Financial Management – Workshop 1 (Estimating Capital Requirements)

The Appleton Greene Corporate Training Program (CTP) for Financial Management is provided by Dr. Norman Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Elton Norman is a 21-year United States Army veteran and Bronze Star recipient with over 10 years of financial experience. He possesses a comprehensive background in financial management, cost reduction strategies, and organizational leadership, and has managed assets of $400M. In addition to creating and executing strategies to achieve the financial objectives of various organizations, he has also administered budgets of $500M and ensured costs stayed 15% under-budgeted expectations.

Elton identifies issues and develops financial strategies to deliver more effective stewardship of assets. In one case, he identified opportunities to minimize operational expenses, resulting in a 27% decrease in overhead.

Elton is skilled in motivating and empowering others to surpass performance requirements and develop professionally. His advanced degree in Financial Management and certifications further demonstrate his vast knowledge and dedication to continuing to learn. Elton’s leadership experience enables him to seamlessly fit into a wide variety of organizations and help them grow.

MOST Analysis

Mission Statement

Estimating capital needs such as fixed capital requirements and working capital needs to avoid over-capitalization or under-capitalization.

Objectives

01. Introduction to Capital Estimation: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Types of Capital in Business: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Fixed Capital Requirements: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Working Capital Components: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Forecasting Sales and Expenses: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Cash Flow Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Risk Assessment in Capital Estimation: departmental SWOT analysis; strategy research & development. 1 Month

08. Financial Ratios and Metrics: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

09. Sources of Capital: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

10. Capital Estimation Tools and Software: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Case Studies in Capital Estimation: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Building a Comprehensive Capital Estimation Strategy: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Introduction to Capital Estimation: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Types of Capital in Business: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Fixed Capital Requirements: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Working Capital Components: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Forecasting Sales and Expenses: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Cash Flow Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Risk Assessment in Capital Estimation: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Financial Ratios and Metrics: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Sources of Capital: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Capital Estimation Tools and Software: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Case Studies in Capital Estimation: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Building a Comprehensive Capital Estimation Strategy: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze Introduction to Capital Estimation.

02. Create a task on your calendar, to be completed within the next month, to analyze Types of Capital in Business.

03. Create a task on your calendar, to be completed within the next month, to analyze Fixed Capital Requirements.

04. Create a task on your calendar, to be completed within the next month, to analyze Working Capital Components.

05. Create a task on your calendar, to be completed within the next month, to analyze Forecasting Sales and Expenses.

06. Create a task on your calendar, to be completed within the next month, to analyze Cash Flow Analysis.

07. Create a task on your calendar, to be completed within the next month, to analyze Risk Assessment in Capital Estimation.

08. Create a task on your calendar, to be completed within the next month, to analyze Financial Ratios and Metrics.

09. Create a task on your calendar, to be completed within the next month, to analyze Sources of Capital.

10. Create a task on your calendar, to be completed within the next month, to analyze Capital Estimation Tools and Software.

11. Create a task on your calendar, to be completed within the next month, to analyze Case Studies in Capital Estimation.

12. Create a task on your calendar, to be completed within the next month, to analyze Building a Comprehensive Capital Estimation Strategy.

Introduction

What are capital requirements?

Capital requirements refer to the minimum amount of capital that financial institutions, such as banks and insurance companies, are required to hold as a regulatory safeguard against financial risks. These requirements are set by regulatory authorities to ensure the stability and soundness of the financial system, protect depositors and policyholders, and prevent institutions from becoming insolvent during times of economic stress.

Capital requirements serve as a cushion that institutions can use to absorb losses arising from various risks, including credit risk, market risk, operational risk, and more. Adequate capitalization is vital to ensure that institutions have sufficient financial resources to meet their obligations even in adverse scenarios.

There are different components and methods for calculating capital requirements, including:

1. Basel Accords: The Basel Committee on Banking Supervision has developed international standards for bank capital requirements known as the Basel Accords. These accords, including Basel I, Basel II, and Basel III, provide frameworks for banks to calculate capital requirements based on risk factors associated with their assets and activities.

2. Internal Ratings-Based (IRB) Approach: Under Basel II and subsequent revisions, banks can use their internal risk assessment models to calculate capital requirements for credit risk, taking into account factors such as probability of default, loss given default, and exposure at default.

3. Standardized Approach: An alternative to the IRB approach, the standardized approach provides predefined risk weights for different asset classes and activities. It simplifies capital calculation by categorizing assets into broad risk categories.

4. Risk-Weighted Assets (RWA): Capital requirements are often expressed as a percentage of risk-weighted assets, which are calculated based on the risk profiles of a bank’s assets. Riskier assets receive higher weights, leading to higher required capital.

5. Leverage Ratio: In addition to risk-based capital requirements, regulators often impose leverage ratios, which set a minimum capital threshold as a percentage of a bank’s total exposure. This ensures that a bank maintains a minimum level of capital regardless of the riskiness of its assets.

6. Stress Testing: Regulatory authorities require financial institutions to undergo stress tests that assess their resilience to adverse economic scenarios. The results of stress tests may influence capital requirements.

Capital requirements are a central component of financial regulation aimed at safeguarding the stability of financial institutions and the broader economy. They ensure that institutions have the financial strength to manage risks, absorb losses, and continue to provide essential services even during challenging times.

Where does capital come from?

Capital comes from various sources, both internal and external, and it plays a crucial role in financing business activities, investments, and operations. Here are the primary sources of capital:

1.

Equity Capital:

• Owners and Founders: When a business is established, its founders and initial owners contribute their personal funds or assets to finance the startup.

• Private Investors: Individuals, often referred to as angel investors or venture capitalists, provide funding in exchange for ownership stakes in the company. This is common among startups seeking early-stage investment.

• Public Investors: Companies can raise capital by issuing shares of stock to the public through initial public offerings (IPOs). Public investors who buy these shares become shareholders and provide equity capital.

2.

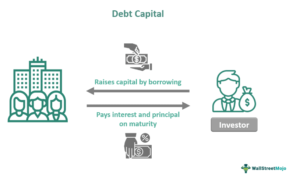

Debt Capital:

• Loans: Companies can borrow money from financial institutions, such as banks, in the form of loans. These loans are repaid over time, along with interest.

• Bonds: Businesses can issue bonds to raise funds from investors. Bonds are debt securities with fixed interest rates and maturity dates. Investors who buy bonds become creditors and are repaid the principal amount along with interest.

• Financial Instruments: Various financial instruments, such as commercial paper and promissory notes, allow companies to borrow money from investors for shorter periods.

3.

Retained Earnings:

• Companies can generate capital from their own profits by retaining a portion of their earnings instead of distributing them as dividends to shareholders. These retained earnings can be reinvested into the business for growth and expansion.

4.

Asset Sales:

• Companies can sell non-essential assets, such as real estate, equipment, or investments, to raise capital. This approach is often used to generate funds quickly.

5.

Government Funding and Grants:

• Governments may offer grants, subsidies, or low-interest loans to support specific industries, research projects, or initiatives. These funds contribute to capital in various sectors.

6.

Crowdfunding:

• Online crowdfunding platforms allow businesses to raise capital from a large number of individual investors. This approach is particularly popular for creative projects, startups, and small businesses.

7.

Partnerships and Joint Ventures:

• Companies can enter partnerships or joint ventures with other firms, sharing resources, expertise, and capital to achieve common objectives.

8.

Venture Capital and Private Equity:

• Venture capital firms and private equity investors provide capital to businesses in exchange for equity stakes. Venture capital is often targeted at startups and early-stage companies, while private equity may target more established businesses.

9.

Bank Lines of Credit:

• Companies can establish lines of credit with banks, allowing them to borrow funds as needed to cover short-term cash flow needs.

10.

Trade Credit:

• Businesses can negotiate credit terms with suppliers, allowing them to receive goods or services and pay for them at a later date. This effectively serves as a form of short-term financing.

These sources of capital provide businesses and institutions with the financial resources necessary to operate, grow, and innovate. Decisions about which sources to use depend on factors such as the company’s stage of development, its financial health, risk tolerance, and the specific funding requirements of its projects or operations.

Why do we estimate capital requirements?

Estimating capital requirements is a crucial practice in finance and business management for several reasons:

1. Financial Planning: Accurate estimation of capital requirements helps businesses plan and allocate their financial resources effectively. It provides insights into how much funding is needed for various projects, initiatives, and operations.

2. Risk Management: Estimating capital needs allows companies to assess potential financial risks and vulnerabilities. Adequate capitalization acts as a buffer against unexpected losses or economic downturns, enhancing a company’s resilience.

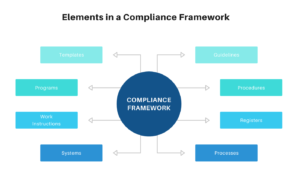

3. Regulatory Compliance: Many industries, especially financial institutions, are subject to regulatory requirements that mandate minimum capital levels. Estimating capital accurately ensures compliance with these regulations and helps maintain financial stability.

4. Investor Confidence: Investors and stakeholders seek assurance that a business is well-capitalized and can handle financial challenges. Transparent and accurate capital estimates contribute to investor confidence.

5. Creditworthiness: Lenders and creditors evaluate a company’s capital position when assessing its creditworthiness. A company with strong capital reserves is considered less risky and more likely to meet its financial obligations.

6. Strategic Decision-Making: Estimating capital requirements aids in informed decision-making regarding expanding operations, entering new markets, or making investments. It provides financial information to evaluate potential returns on investment.

7. Growth and Expansion: Businesses need capital to support growth initiatives, such as acquisitions, research and development, marketing, and expansion into new markets. Estimating capital needs helps secure funds for these endeavors.

8. Optimal Resource Allocation: Accurate capital estimation helps optimize the allocation of financial resources. It ensures that resources are allocated efficiently to generate maximum returns.

9. Liquidity Management: Estimating capital requirements assists businesses in managing liquidity. Having sufficient capital ensures the ability to meet short-term financial obligations without relying on external sources of funding.

10. Solvency: Maintaining an adequate capital position is essential for solvency. Accurate capital estimation prevents a company’s liabilities from exceeding its assets.

11. Stakeholder Communication: Transparent communication of capital estimates and strategies builds trust with stakeholders, including shareholders, employees, customers, and partners.

12. Competitive Advantage: Companies with accurate capital estimation practices are better equipped to make strategic moves and capitalize on opportunities, giving them a competitive edge.

Overall, estimating capital requirements is essential for maintaining financial stability, enabling growth, managing risks, and making well-informed strategic decisions. It’s a fundamental practice that contributes to the viability and success of businesses across various industries.

What are the strengths and limitations of estimating capital requirements?

Estimating capital requirements has both strengths and limitations, which are important to consider when using this practice for financial planning and decision-making. Here’s an overview of the key strengths and limitations:

Strengths:

1. Financial Planning and Budgeting: Estimating capital requirements allows businesses to develop accurate financial plans and budgets, helping them allocate resources effectively and make informed decisions about expenditures.

2. Risk Management: Adequately estimating capital needs provides a buffer against unexpected financial challenges or economic downturns, enhancing a company’s ability to manage risks and maintain stability.

3. Regulatory Compliance: Accurate capital estimation ensures that businesses comply with regulatory requirements, particularly in industries subject to minimum capital standards, such as financial institutions.

4. Investor Confidence: Transparent and accurate capital estimates contribute to investor confidence, reassuring stakeholders that the company is adequately funded and has a plan to address financial needs.

5. Strategic Decision-Making: Estimating capital requirements provides essential information for evaluating potential projects, investments, and growth opportunities. It aids in assessing returns on investment and potential risks.

6. Liquidity Management: Estimating capital helps companies manage their liquidity and ensures they have the resources to meet short-term financial obligations.

Limitations:

1. Uncertainty: Estimating capital requirements involves making projections based on assumptions, and the future is inherently uncertain. Changes in economic conditions, market trends, or business circumstances can impact the accuracy of estimates.

2. Complexity: The factors influencing capital requirements can be complex and multifaceted. Businesses must consider variables such as revenue projections, cost structures, market dynamics, and regulatory changes.

3. Risk of Overestimation or Underestimation: Businesses risk either overestimating their capital needs, leading to unnecessary costs, or underestimating them, which could result in financial instability or inability to meet obligations.

4. Data Quality: Accurate capital estimation relies on accurate and reliable data. Poor data quality can lead to flawed estimates and potentially poor decision-making.

5. Behavioral Factors: Estimating capital requirements might be influenced by behavioral biases, such as optimism bias or pressure to meet specific targets, which can lead to inaccuracies.

6. Changes in Business Strategy: If a company’s strategic goals or operations change, the estimated capital requirements might become obsolete, requiring adjustments and potentially causing disruptions.

7. External Factors: Events beyond a company’s control, such as changes in regulatory policies or unexpected market shocks, can impact capital needs, rendering initial estimates less relevant.

8. Cost of Capital: Different sources of capital (equity, debt, etc.) come with varying costs. Miscalculating these costs can lead to suboptimal financial decisions.

Balancing these strengths and limitations requires careful consideration of the context, the reliability of data and assumptions, and ongoing monitoring and adjustments as circumstances change. Businesses should use capital estimation as a tool but remain prepared to adapt their strategies based on new information and developments.

How do we estimate capital requirements?

Estimating capital requirements involves assessing the amount of capital a company or financial institution needs to support its operations, manage risks, and comply with regulatory standards. The process can vary depending on the type of institution, industry regulations, and the complexity of operations. Here’s a general overview of how capital requirements are estimated:

1. Risk Assessment:

• Identify and analyze the various risks that the institution faces, such as credit risk, market risk, operational risk, and liquidity risk. Understand the potential impact of these risks on the institution’s financial stability.

2. Regulatory Guidelines:

• Understand the regulatory framework governing capital requirements for your industry. This could include international standards like the Basel Accords for banking or specific regulations for insurance companies and other financial entities.

3. Asset Classification:

• Classify the institution’s assets based on risk factors. Assets with higher risk profiles will require more capital to cover potential losses.

4. Risk Measurement Models:

• Depending on the industry and regulations, use appropriate risk measurement models to quantify the potential losses associated with different types of risks. This could involve estimating probabilities of default, loss given default, and other risk-related metrics.

5. Calculation of Risk-Weighted Assets (RWA):

• For banking institutions, calculate risk-weighted assets by multiplying the risk weight of each asset class (as determined by regulations) by the corresponding exposure amount. This calculation reflects the institution’s risk exposure.

6. Determine Required Capital Buffer:

• Based on the institution’s risk profile and regulatory standards, calculate the minimum amount of capital required to cover potential losses. This can involve applying regulatory capital ratios, such as the Basel III minimum common equity tier 1 (CET1) capital ratio.

7. Leverage Ratios (if applicable):

• Some regulations also mandate leverage ratios that set a minimum capital threshold relative to the institution’s total exposure. Calculate this ratio to ensure compliance.

8. Stress Testing:

• Conduct stress tests that simulate adverse scenarios to assess the institution’s resilience. Evaluate how much capital would be needed to withstand such scenarios and meet regulatory requirements.

9. Internal Risk Models (if applicable):

• If permitted by regulations, use internal risk models to estimate credit risk, operational risk, and other risk factors. These models may provide a more accurate assessment of capital needs.

10. Capital Planning and Budgeting:

• Based on the estimated capital requirements, develop a capital plan and budget that outlines how the institution will raise and allocate capital to meet regulatory standards and support its strategic goals.

11. Ongoing Monitoring and Adjustments:

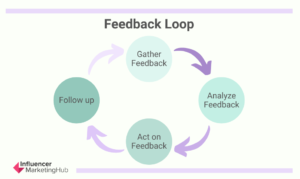

• Capital requirements are not static; they can change due to shifts in the institution’s risk profile, market conditions, or regulatory changes. Continuously monitor and adjust capital estimates as needed.

12. Transparency and Reporting:

• Communicate capital estimates, plans, and compliance with regulators, investors, and other stakeholders as required by regulations and best practices.

The estimation of capital requirements is a complex process that requires careful consideration of various factors, including risk assessment, regulatory guidelines, and the specific circumstances of the institution. It’s essential to involve risk management professionals, financial analysts, and regulatory experts in the process to ensure accuracy and compliance.

What are the key variables and data sources required for accurate estimation?

The accurate estimation of capital requirements relies on various key variables and data sources that provide insights into an institution’s risk profile, financial health, and regulatory obligations. Depending on the industry and the type of risks being assessed, the specific variables and data sources may vary. Here are some key variables and data sources commonly required for accurate estimation of capital:

1. Credit Risk:

• Probability of Default (PD): The likelihood that a borrower will default on its obligations.

• Loss Given Default (LGD): The amount a lender stands to lose if a borrower defaults.

• Exposure at Default (EAD): The amount of exposure an institution has to a borrower at the time of default.

Data Sources for Credit Risk:

• Historical loan performance data.

• Borrower financial statements.

• Credit rating agencies’ data.

• Economic indicators and industry trends.

2. Market Risk:

• Value at Risk (VaR): The potential loss in value of a portfolio due to market movements.

• Volatility: A measure of the variability of asset prices or market indices.

• Correlation: The degree to which asset prices move together.

Data Sources for Market Risk:

• Historical market data (stock prices, interest rates, exchange rates).

• Volatility indices.

• Options pricing data.

3. Operational Risk:

• Loss Data: Historical data on operational losses and incidents.

• Key Risk Indicators (KRIs): Quantitative metrics that indicate the level of operational risk exposure.

Data Sources for Operational Risk:

• Internal loss data.

• External loss data from industry databases.

• Incident reporting systems.

4. Liquidity Risk:

• Cash Flow Projections: Estimates of cash inflows and outflows under various scenarios.

• Stress Testing Scenarios: Simulated adverse scenarios that assess liquidity needs.

Data Sources for Liquidity Risk:

• Historical cash flow data.

• Market and economic data for stress testing scenarios.

• Scenario analysis data.

5. Regulatory Requirements:

• Regulatory Capital Ratios: Minimum capital ratios set by regulators (e.g., Basel III CET1 ratio).

• Leverage Ratios: Minimum capital relative to total exposure (if applicable).

Data Sources for Regulatory Requirements:

• Regulatory guidelines and documents.

• Publicly available regulatory reports and disclosures.

6. Economic and Macroeconomic Data:

• Economic indicators such as GDP growth, inflation rates, and unemployment rates that impact risk factors.

Data Sources for Economic Data:

• Government economic reports.

• Economic research institutions’ publications.

7. Internal Risk Models (if applicable):

• Custom-developed risk models that use institution-specific data to estimate risk parameters.

Data Sources for Internal Risk Models:

• Institution-specific data on loans, transactions, and operations.

• Historical loss data.

8. Scenario Analysis Data:

• Data on hypothetical adverse scenarios used for stress testing.

Data Sources for Scenario Analysis:

• Market data.

• Historical economic data.

• Industry-specific data.

Accurate estimation of capital requirements requires robust and reliable data, as well as sophisticated analytical techniques. It’s essential to have access to historical data, relevant economic indicators, industry benchmarks, and regulatory guidelines. Additionally, data quality and integrity are crucial for ensuring the accuracy and reliability of capital estimates.

Case Study

One notable case of a company successfully estimating capital requirements is Wells Fargo & Company’s implementation of comprehensive stress testing and capital planning practices following the 2008 financial crisis. Wells Fargo, a prominent U.S. financial institution, demonstrated effective capital estimation and management to enhance its resilience.

Case Study: Wells Fargo’s Stress Testing and Capital Planning

Background: Wells Fargo is one of the largest banks in the United States, offering a range of financial services, including banking, mortgage, investments, and more. Like many other financial institutions, Wells Fargo faced significant challenges during the 2008 financial crisis.

Stress Testing and Capital Planning: In the aftermath of the crisis, regulatory authorities increased their focus on stress testing and capital planning to ensure that banks were better equipped to withstand economic shocks. Wells Fargo took several steps to successfully estimate and manage its capital requirements:

1. Enhanced Risk Assessment Models: Wells Fargo developed advanced risk assessment models to estimate potential losses under adverse economic scenarios. These models took into account credit risk, market risk, operational risk, and other factors.

2. Scenario Analysis: The bank conducted comprehensive scenario analyses to simulate various adverse economic conditions, including economic downturns, interest rate changes, and housing market collapses. These scenarios helped the bank assess its resilience to different stress events.

3. Capital Adequacy: Based on the results of stress tests, Wells Fargo estimated the amount of capital needed to maintain adequate financial stability under stress scenarios. This estimation ensured that the bank had a sufficient capital buffer to absorb losses.

4. Regulatory Compliance: Wells Fargo aligned its stress testing and capital planning practices with regulatory requirements, including those outlined by the Federal Reserve as part of the Comprehensive Capital Analysis and Review (CCAR) process.

5. Transparency and Reporting: The bank communicated its stress testing results and capital adequacy to regulators, investors, and the public. Transparency in reporting built confidence in Wells Fargo’s financial health.

Achievements: Wells Fargo’s successful implementation of stress testing and capital planning practices led to several positive outcomes:

1. Enhanced Resilience: The bank’s robust risk assessment and scenario analysis enabled it to identify potential vulnerabilities and take proactive measures to address them, enhancing its resilience to economic shocks.

2. Regulatory Compliance: Wells Fargo consistently passed regulatory stress tests and demonstrated its ability to maintain adequate capital levels, as required by regulatory standards.

3. Investor Confidence: Transparent communication of stress test results and capital planning strategies contributed to investor confidence and market stability.

4. Improved Risk Management: The practices adopted by Wells Fargo improved the bank’s overall risk management capabilities and ensured that potential risks were identified and addressed in a timely manner.

5. Operational Efficiency: Having a well-defined capital planning process allowed the bank to allocate resources more efficiently and make informed decisions about strategic initiatives.

However, it’s important to note that Wells Fargo faced challenges and controversies in subsequent years related to other operational and compliance issues. While the bank’s capital planning practices contributed to its post-crisis recovery, they were only one aspect of its overall risk management and operational efforts.

This case study highlights how Wells Fargo’s successful estimation of capital requirements through stress testing and scenario analysis helped the institution build resilience and maintain financial stability in a dynamic and uncertain environment.

Case Study

A notable case study of a company that failed to successfully estimate capital requirements is the collapse of Lehman Brothers during the 2008 financial crisis. Lehman Brothers’ inability to accurately estimate its capital needs and manage its risks played a significant role in its downfall.

Case Study: Lehman Brothers and Capital Estimation Failure

Background: Lehman Brothers was a global financial services firm with a significant presence in investment banking and financial markets. The company faced financial challenges related to its exposure to mortgage-backed securities and other complex financial products as the 2008 financial crisis unfolded.

Estimation Failure and Contributing Factors:

1. Risk Mismanagement: Lehman Brothers heavily invested in mortgage-backed securities and other complex financial products tied to the U.S. housing market. The company’s risk management practices failed to adequately account for the inherent risks associated with these assets, including the potential for massive defaults and losses.

2. Underestimation of Capital Needs: Lehman Brothers’ estimation of capital requirements proved inadequate to cover the losses incurred from the deteriorating value of its mortgage-related assets. The company had not set aside sufficient capital reserves to weather the crisis.

3. Lack of Transparency: Lehman Brothers’ lack of transparency regarding its exposure to risky assets and its reliance on short-term financing further eroded market confidence. This lack of transparency made it difficult for investors and counterparties to accurately assess the company’s financial health.

4. Complex Financial Structures: The use of complex financial structures, such as off-balance-sheet entities and repurchase agreements (repos), contributed to the confusion surrounding Lehman Brothers’ true financial condition. These structures made it challenging to assess the company’s leverage and risk exposure accurately.

5. Market Panic: As concerns grew about Lehman Brothers’ solvency and capital adequacy, market panic intensified. The inability of the company to provide clear and reassuring information exacerbated the panic and led to a loss of confidence in its ability to survive the crisis.

Consequences: Lehman Brothers filed for bankruptcy on September 15, 2008, in what remains one of the largest bankruptcy filings in U.S. history. The collapse had far-reaching consequences for global financial markets and played a pivotal role in intensifying the severity of the 2008 financial crisis.

The case of Lehman Brothers illustrates the critical importance of accurately estimating capital requirements and effectively managing risks within financial institutions. The failure to do so can have catastrophic consequences not only for the institution itself but also for the broader financial system. It led to widespread regulatory reforms, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, aimed at enhancing risk management practices, improving transparency, and preventing similar crises in the future.

Case Study

One case study of a company successfully estimating capital requirements is BBVA (Banco Bilbao Vizcaya Argentaria), a Spanish multinational financial services company. BBVA’s implementation of innovative capital management strategies, particularly during the 2008 financial crisis, is often cited as an example of effective capital estimation and risk management.

Case Study: BBVA’s Capital Management during the 2008 Financial Crisis

Background: BBVA is a prominent global financial institution with a presence in more than 30 countries. It offers a wide range of financial services, including retail banking, corporate banking, investment banking, and asset management.

Effective Capital Management Strategies:

1. Risk Management Culture: BBVA cultivated a strong risk management culture throughout the organization. This included a robust risk governance framework, risk committees, and regular assessments of risk exposure.

2. Early Recognition of Risks: Prior to the 2008 financial crisis, BBVA’s risk management practices allowed it to identify the emerging risks associated with the subprime mortgage market and securitization. This early recognition enabled the bank to take proactive measures.

3. Capital Allocation: BBVA proactively allocated capital to areas that presented better risk-adjusted returns. This approach helped the bank optimize its capital deployment and enhance profitability.

4. Stress Testing and Scenario Analysis: BBVA conducted comprehensive stress tests and scenario analyses to assess its resilience to adverse economic conditions. The bank estimated potential losses and capital needs under various stress scenarios.

5. Mitigation Strategies: Based on stress test results, BBVA implemented risk mitigation strategies, including reducing exposure to riskier assets, enhancing risk controls, and adjusting its business strategy.

6. Transparency and Communication: BBVA maintained transparent communication with regulators, investors, and stakeholders about its risk exposure, capital position, and risk management practices.

Achievements: BBVA’s effective capital management strategies during the 2008 financial crisis yielded several positive outcomes:

1. Resilience During Crisis: BBVA was relatively well-prepared to weather the impact of the financial crisis compared to many of its peers. The bank’s proactive risk management practices allowed it to mitigate potential losses.

2. Solvency and Stability: The bank’s strong capital position and risk management efforts contributed to its stability and solvency during a period of heightened market uncertainty.

3. Market Confidence: BBVA’s transparent communication and risk mitigation measures helped maintain market confidence in the bank’s financial health.

4. Operational Continuity: BBVA’s capital management practices ensured the continuation of essential services to customers and partners, even in a challenging economic environment.

While BBVA’s approach to capital management during the 2008 financial crisis was generally successful, it’s important to note that no institution is entirely immune to challenges. BBVA, like other financial institutions, faced its share of difficulties and had to adapt its strategies over time. Nevertheless, the case of BBVA underscores the importance of proactive risk management, stress testing, and effective capital allocation in maintaining financial stability during times of crisis.

Executive Summary

Chapter 1: Introduction to Capital Estimation

Capital estimation is a fundamental aspect of financial planning and decision-making for businesses, organizations, and projects of all sizes and industries. At its core, capital estimation is the process of forecasting and determining the financial resources needed to initiate, develop, and sustain ventures effectively. Whether it’s launching a new product, expanding operations, constructing infrastructure, or embarking on innovative projects, estimating capital requirements is a critical precursor to success.

The significance of capital estimation lies in its ability to provide clarity and structure to financial decision-making. It offers a strategic roadmap for securing the necessary funds, allocating resources efficiently, and managing financial risks. Accurate capital estimation ensures that a project or business has the financial means to achieve its objectives and deliver value to stakeholders.

Capital estimation encompasses a wide range of considerations, from understanding the nature of the project to evaluating market dynamics, industry trends, and technological advancements. It involves a careful analysis of various factors, including costs, revenue projections, cash flow, and risk mitigation strategies. These elements are intertwined and interdependent, making capital estimation both a science and an art, requiring a combination of quantitative analysis and qualitative judgment.

To estimate capital requirements effectively, one must distinguish between different types of capital needs. These include fixed capital, working capital, and growth capital. Fixed capital represents the funds required for long-term assets like land, buildings, equipment, and machinery. Working capital addresses short-term operational expenses, including inventory, accounts receivable, and accounts payable. Growth capital pertains to resources needed to expand business operations, enter new markets, or launch new products or services. Understanding the specific type of capital required is essential for crafting a tailored estimation strategy.

The process of capital estimation typically involves several key steps. It begins with project planning, where the scope, objectives, and resource needs are defined. Cost estimation follows, wherein costs are meticulously broken down into various categories, including direct and indirect costs. Financial modeling, aided by advanced tools and software, enables the creation of projections, scenario analyses, and financial evaluations. Risk assessment is an integral part of the process, as it involves identifying potential risks, estimating their impact on capital requirements, and developing contingencies to mitigate them. Lastly, capital estimation requires a thorough evaluation of financing strategies, considering sources such as equity, debt, internal funds, and external investments.

Central to capital estimation is the collection and analysis of relevant data. Accurate and up-to-date data is essential for making informed decisions. Data sources may include historical financial records, market research, industry benchmarks, inflation rates, interest rates, and economic forecasts. A robust data-driven approach enhances the precision of capital estimation and supports sound financial management.

The significance of accurate capital estimation cannot be overstated. It underpins effective financial planning, minimizes the risk of underfunding or overcommitting resources, and enhances strategic decision-making. Accurate capital estimation is particularly crucial in today’s dynamic and competitive business landscape, where agility and resource optimization are key determinants of success.

This introduction sets the stage for a comprehensive exploration of capital estimation. Throughout the following discussions, we will delve into the intricacies of estimating capital requirements, the variables and data sources crucial for precision, the effects of estimating cash flow, the role of risk analysis, the financial measures and ratios used in evaluation, and the various sources of capital available to businesses and projects. Additionally, we will draw insights from real-world case studies of companies that have successfully estimated capital to achieve their ambitious goals. Through this exploration, we will gain a profound understanding of the art and science of capital estimation, a skill vital for navigating the complexities of modern finance and achieving sustainable growth.

Chapter 2: Types of Capital in Business

Capital is the lifeblood of any business. It represents the financial resources that a company requires to operate, grow, and succeed in the marketplace. In the realm of business, capital can take on several forms, each serving a distinct purpose and function. Understanding these types of capital is essential for effective financial management and strategic decision-making.

1. Fixed Capital: Fixed capital, also known as “long-term capital,” refers to the funds invested in a business’s long-term assets. These assets are not meant for immediate sale but are utilized in the production process and provide lasting value. Fixed capital includes investments in land, buildings, machinery, equipment, vehicles, and infrastructure. These assets are typically critical to a company’s operations and are expected to generate revenue over an extended period. Estimating the capital required for fixed assets is crucial for business planning, as it often represents a substantial portion of a company’s total investment.

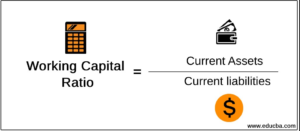

2. Working Capital: Working capital represents the funds a business needs to cover its day-to-day operational expenses and short-term financial obligations. It’s the capital required to manage the company’s current assets (e.g., cash, accounts receivable, inventory) and current liabilities (e.g., accounts payable, short-term debt). Working capital ensures that a business can meet its short-term obligations, pay suppliers, maintain inventory, and manage cash flow effectively. Estimating working capital requirements is essential for sustaining smooth business operations and avoiding liquidity problems.

3. Growth Capital: Growth capital is the financial resources a company requires to expand its operations, enter new markets, invest in research and development, or launch new products or services. It’s often used for strategic initiatives that aim to drive the company’s growth and increase its market share. Growth capital can be used to fund activities such as marketing campaigns, mergers and acquisitions, product development, and geographical expansion. Accurate estimation of growth capital is vital for seizing growth opportunities and staying competitive in the marketplace.

4. Equity Capital: Equity capital represents the ownership stake in a business held by its shareholders. It’s the value of the company’s assets minus its liabilities, and it reflects the residual interest in the business after all debts and obligations have been settled. Equity capital can be raised through the sale of company shares, making it a critical source of funding for many businesses, particularly startups. Equity investors, such as shareholders and venture capitalists, provide capital in exchange for ownership or equity in the company. Estimating equity capital requirements involves assessing the company’s valuation, investor expectations, and the need for equity financing to support growth and operations.

5. Debt Capital: Debt capital refers to the funds a company raises by borrowing money from external sources, such as banks, financial institutions, or bondholders. It involves the issuance of debt instruments like loans, bonds, or promissory notes, which the company agrees to repay with interest over a specified period. Debt capital is often used to finance major projects, acquisitions, or expansions. Estimating debt capital requirements entails evaluating the company’s ability to service its debt, including interest payments and principal repayments, within its cash flow constraints.

6. Human Capital: While not a traditional form of financial capital, human capital represents the skills, knowledge, experience, and expertise of a company’s employees. It is a valuable asset that drives innovation, productivity, and competitive advantage. Estimating the capital required for recruiting, training, and retaining skilled employees is essential for nurturing a talented workforce that can contribute to a company’s success.

In summary, capital is a multifaceted concept in business, encompassing fixed capital for long-term assets, working capital for day-to-day operations, growth capital for expansion, equity capital for ownership, debt capital for borrowing, and human capital for the skills and expertise of the workforce. Accurate estimation of each type of capital requirement is integral to effective financial management and strategic planning, ensuring that a company has the necessary resources to thrive in a dynamic and competitive business environment.

Chapter 3: Fixed Capital Requirements

In the intricate landscape of business finance, Fixed Capital Requirements emerge as a linchpin, supporting the creation and sustenance of long-lasting assets and infrastructure. These assets, often termed “fixed assets” or “long-term capital,” are the backbone of a business, enabling it to operate efficiently, compete effectively, and thrive in a dynamic marketplace. Understanding Fixed Capital Requirements is paramount for businesses embarking on projects, expanding their operations, or making strategic investments.

Fixed Capital Requirements encompass the financial resources allocated to acquire and maintain assets and infrastructure with long-term utility. Unlike assets intended for immediate sale or liquidation, these assets serve as the bedrock upon which a business’s core operations and revenue generation rely. Fixed capital plays a pivotal role in defining a company’s operational capacity, competitiveness, and innovative capabilities.

This category encompasses a diverse array of assets that constitute the fabric of a business’s operational landscape. It includes land and real estate, serving as the foundation for physical locations, such as manufacturing facilities, offices, warehouses, and retail outlets. Buildings and infrastructure form essential components, providing facilities for various business functions, and investment in infrastructure, such as roads, bridges, and utilities. Heavy machinery, manufacturing equipment, specialized tools, and vehicles are integral for production processes, while furniture, fixtures, and equipment enhance the functionality of workspaces. Additionally, investments in technology, software systems, IT infrastructure, and research and development facilities contribute to a company’s operational capabilities.

Estimating Fixed Capital Requirements is a critical step in project planning and business strategy. Numerous factors influence the determination of these requirements, including the project’s scale and complexity, industry-specific demands, market dynamics, technological advancements, regulatory compliance, economic conditions, and ongoing maintenance and repair costs.

Fixed capital investments are foundational to a company’s operational capabilities and competitive edge. They facilitate capacity expansion, improve efficiency and productivity through modern machinery and technology, enhance a company’s competitive edge by responding to market changes, and ensure long-term sustainability and resilience in the face of economic challenges.

However, managing and optimizing fixed capital assets come with challenges. Fixed assets typically depreciate over time, impacting financial statements and tax considerations. Rapid technological advancements may render assets obsolete, necessitating reinvestment in newer equipment. Routine maintenance and repair costs must be budgeted to ensure assets remain operational and efficient. Striking a balance between investing in fixed assets and allocating resources to working capital, growth initiatives, and debt service is a constant consideration for businesses.

In conclusion, Fixed Capital Requirements serve as the cornerstone of a business’s operational capabilities, competitiveness, and long-term sustainability. They encompass a diverse range of assets critical for business functions, from land and machinery to technology and infrastructure. Accurate estimation and effective management of fixed capital are imperative for supporting growth, maintaining competitiveness, and ensuring long-term viability. Recognizing the components, factors, and role of fixed capital in business is essential for sound financial planning and strategic decision-making in the dynamic landscape of modern commerce.

Chapter 4: Working Capital Components

Working capital, often regarded as the lifeblood of a business, represents the financial resources available for day-to-day operations and short-term financial obligations. It serves as a vital indicator of a company’s liquidity, operational efficiency, and ability to meet its short-term liabilities. Understanding the components of working capital is essential for managing cash flow, ensuring smooth operations, and making informed financial decisions.

1.

Current Assets:

Current assets are the first pillar of working capital and consist of assets that are expected to be converted into cash or used up within one year. Key components include:

• Cash and Cash Equivalents: This includes actual cash on hand and highly liquid investments, such as money market funds or Treasury bills. Cash is the most liquid asset, readily available for meeting short-term obligations.

• Accounts Receivable: Accounts receivable represent funds owed to the company by customers for goods or services delivered on credit. Efficient management of accounts receivable is crucial to converting them into cash promptly.

• Inventory: Inventory includes the goods and materials held by a company for production or sale. Effective inventory management ensures a balance between having enough stock to meet customer demand and avoiding overstocking, which ties up capital.

• Prepaid Expenses: Prepaid expenses are advance payments made for future expenses. Examples include prepaid insurance premiums or prepaid rent. These represent future benefits that can be utilized as needed.

2.

Current Liabilities:

Current liabilities form the second side of the working capital equation and encompass obligations that must be settled within one year. Key components include:

• Accounts Payable: Accounts payable are amounts owed by the company to suppliers and creditors for goods or services received on credit. Managing accounts payable effectively allows a company to maintain good supplier relationships and optimize cash flow.

• Short-Term Debt: Short-term debt includes loans, credit lines, and other borrowings that must be repaid within one year. It’s a source of capital but also represents a financial obligation.

• Accrued Liabilities: Accrued liabilities are expenses that have been incurred but not yet paid. Examples include wages and salaries payable, interest payable, and taxes payable.

• Unearned Revenue: Unearned revenue represents payments received from customers for products or services not yet delivered. It’s a liability until the company fulfils its obligations.

Working capital is calculated as the difference between current assets and current liabilities. A positive working capital indicates that a company has more assets available than liabilities due within the next year, providing a cushion for short-term financial needs. Conversely, a negative working capital suggests potential liquidity issues.

Effective management of working capital involves optimizing the components mentioned above. Strategies may include:

• Accounts Receivable Management: Promptly collecting outstanding receivables to accelerate cash inflow.

• Inventory Control: Maintaining an optimal level of inventory to avoid overstocking or stockouts.

• Accounts Payable Management: Negotiating favorable payment terms with suppliers while adhering to due dates.

• Short-Term Debt Management: Carefully considering the cost and timing of short-term borrowings.

Proper management of working capital is essential for the financial health and stability of a business. It ensures that a company can meet its day-to-day obligations, invest in growth opportunities, and weather unexpected financial challenges. A well-balanced working capital position reflects operational efficiency and provides the flexibility to seize strategic initiatives.

In conclusion, the components of working capital are the linchpin of a company’s financial stability and operational efficiency. Current assets, including cash, accounts receivable, inventory, and prepaid expenses, provide the resources to meet short-term financial needs, while current liabilities, such as accounts payable, short-term debt, accrued liabilities, and unearned revenue, represent the obligations that must be fulfilled. Effective management of these components is critical for ensuring smooth business operations, maintaining liquidity, and making informed financial decisions. Working capital is the heartbeat of a business, and understanding its components is essential for navigating the complexities of modern commerce.

Chapter 5: Forecasting Sales and Expenses

Forecasting sales and expenses is a pivotal element in the realm of capital management and financial planning for businesses. It serves as the compass guiding a company’s resource allocation, strategic decision-making, and overall financial health. In this dynamic landscape, where the allocation of capital can make or break a business, accurate sales and expense predictions are paramount.

Forecasting Sales:

Sales forecasting is the art and science of predicting a company’s future revenue. It involves estimating the volume of products or services that a business is expected to sell over a specific period, typically a fiscal year or quarter. Accurate sales forecasts are essential for several reasons:

1. Resource Allocation: Sales forecasts inform decisions regarding production, inventory levels, and staffing. Overestimating sales can lead to overproduction and excess inventory, tying up capital. Underestimating sales can result in missed opportunities and customer dissatisfaction.

2. Financial Planning: Sales forecasts are fundamental in financial planning, as they provide insights into expected revenue streams. They help businesses set budgets, plan for working capital needs, and evaluate their ability to meet financial obligations.

3. Growth Strategies: Sales forecasts play a crucial role in growth strategies. They aid in identifying growth opportunities, market trends, and customer demand. With accurate forecasts, companies can make informed decisions about expanding product lines or entering new markets.

4. Investor Confidence: Investors and stakeholders rely on sales forecasts to assess a company’s growth potential and financial viability. Consistently meeting or exceeding sales projections can enhance investor confidence.

5. Marketing and Sales Strategy: Sales forecasts guide marketing and sales strategies. They help determine pricing, promotional activities, and sales targets. Adjustments can be made based on actual performance compared to forecasts.

To forecast sales effectively, businesses typically consider historical sales data, market trends, customer behavior, competitive analysis, and economic indicators. Advanced data analytics and machine learning models are increasingly used to refine sales predictions.

Forecasting Expenses:

Expense forecasting complements sales forecasting by estimating the costs and expenditures a business is likely to incur. This encompasses various expense categories, including operating expenses, cost of goods sold (COGS), capital expenditures, and overhead costs. Expense forecasting serves several critical functions:

1. Budgeting: Expense forecasts form the basis for creating budgets. They help businesses allocate resources to various departments and initiatives while ensuring that spending remains in line with revenue expectations.

2. Cost Control: By predicting expenses, businesses can identify cost-saving opportunities and areas where expenditures need to be managed more effectively.

3. Capital Planning: Capital expenditures, such as investments in fixed assets or technology, are integral to business growth. Expense forecasts guide capital allocation decisions by providing insights into the timing and magnitude of these investments.

4. Cash Flow Management: Expense forecasts are vital for cash flow management. They help businesses anticipate cash needs for paying suppliers, servicing debt, and covering operating expenses.

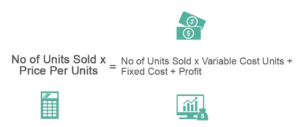

5. Profitability Analysis: Expense forecasts enable companies to analyze the relationship between costs and revenue. This analysis helps identify the break-even point and assess the overall profitability of products, services, or projects.

Expense forecasting relies on historical expense data, budgetary projections, industry benchmarks, and future plans. It helps businesses anticipate variable costs, such as labor, materials, and overhead, as well as fixed costs, such as rent, insurance, and depreciation.

The Capital Connection:

Sales and expense forecasts are intricately linked to capital management. Accurate sales predictions guide decisions about how much capital is needed to support growth, while expense forecasts ensure that capital is used efficiently. The alignment of these forecasts helps in:

1. Capital Allocation: Matching capital to expected sales and expenses ensures that a business has the necessary funds to operate, invest, and grow. This alignment helps prevent undercapitalization or overcapitalization.

2. Risk Mitigation: Forecasting sales and expenses allows businesses to identify potential cash flow gaps and take proactive measures, such as securing additional financing or adjusting expenses, to mitigate financial risks.

3. Optimizing Capital Structure: By aligning capital needs with sales and expenses, companies can make informed decisions about the mix of equity and debt financing that best supports their financial goals.

In conclusion, forecasting sales and expenses is a linchpin in capital management and financial planning. Accurate sales predictions guide resource allocation and growth strategies, while expense forecasts ensure efficient capital utilization. The harmonious connection between sales, expenses, and capital is central to a company’s ability to navigate the complex terrain of modern business and achieve financial stability and success.

Chapter 6: Cash Flow Analysis

Cash flow analysis is a critical component of capital management and financial planning for businesses. It provides a dynamic perspective on a company’s financial health by tracking the movement of cash in and out of the business over a specific period, typically a month, quarter, or fiscal year. Cash flow analysis is intimately linked to capital as it offers insights into a company’s ability to generate, manage, and allocate cash resources effectively.

Understanding Cash Flow Analysis:

Cash flow analysis involves examining the sources and uses of cash within a business. It categorizes cash flows into three primary components:

Operating Cash Flow (OCF): OCF represents the cash generated or consumed by a company’s core operations. It encompasses revenue from sales, collections from customers, and payments to suppliers, employees, and other operating expenses. A positive OCF indicates that a company’s core business operations are generating cash.

Investing Cash Flow (ICF): ICF tracks cash flows related to investments in assets such as property, equipment, and securities. It includes expenditures for capital projects, asset acquisitions, and proceeds from asset sales. A negative ICF implies capital expenditures, while a positive ICF may result from asset sales or investments.

Financing Cash Flow (FCF): FCF captures cash flows related to financing activities, including borrowing, repaying debt, issuing or repurchasing shares, and paying dividends. Positive FCF indicates that the business is raising more capital than it’s using for financing activities, while negative FCF suggests capital outflows.

The Significance of Cash Flow Analysis:

Cash flow analysis holds immense significance in capital management for several reasons:

Capital Availability: It provides insights into the company’s ability to access capital when needed. Positive cash flow suggests that the company has cash reserves available for investment or expansion, reducing the reliance on external financing.

Liquidity Assessment: Cash flow analysis assesses the company’s liquidity position. Maintaining sufficient liquidity ensures that the business can meet its short-term financial obligations and unexpected expenses without resorting to costly borrowing.

Risk Mitigation: By tracking cash flows, a business can identify potential cash flow gaps or periods of strain. This early warning system allows for proactive measures such as securing credit lines or adjusting spending to mitigate financial risks.

Investor Confidence: Investors and stakeholders closely scrutinize cash flow statements to gauge a company’s financial health and its ability to generate consistent cash flows. Positive cash flows often instil investor confidence.

Cash Flow and Capital Allocation:

Effective capital allocation hinges on cash flow analysis. Businesses use cash flow insights to make informed decisions about deploying capital in various ways:

Capital Expenditures: Positive cash flow can fund capital expenditures, such as investments in fixed assets, technology upgrades, or research and development, without relying heavily on debt financing.

Debt Management: Monitoring cash flow helps businesses assess their ability to service debt. Healthy cash flows ensure timely debt payments, maintaining the company’s creditworthiness.

Dividends and Share Buybacks: Positive cash flows enable businesses to distribute capital to shareholders through dividends or share repurchases, enhancing shareholder value.

Working Capital Management: Cash flow analysis aids in optimizing working capital by ensuring sufficient cash reserves to cover operating expenses, payables, and other short-term obligations.

Challenges in Cash Flow Analysis:

While cash flow analysis is invaluable, it comes with challenges:

Timing: Timing discrepancies between cash inflows and outflows can lead to cash flow volatility. For instance, recognizing revenue before collecting payments can impact cash flow.

Non-Cash Items: Certain accounting items, like depreciation and amortization, affect income statements but don’t impact cash flows. Adjusting for such non-cash items is critical for accurate analysis.

Seasonality: Businesses with seasonal sales patterns may experience fluctuations in cash flows, requiring careful management to maintain liquidity.

In conclusion, cash flow analysis is an indispensable tool in capital management and financial planning. It offers a real-time view of a company’s cash position, liquidity, and financial health. Understanding and leveraging cash flow insights enable businesses to make informed capital allocation decisions, manage debt effectively, and maintain financial stability. Ultimately, a well-executed cash flow analysis plays a pivotal role in a company’s ability to navigate the complexities of modern business and optimize its capital utilization.

Chapter 7: Risk Assessment in Capital Estimation

In the intricate landscape of capital estimation, risk assessment emerges as a pivotal process, wielding significant influence over a company’s financial health and strategic decision-making. Capital estimation is not merely about calculating the financial resources required for various projects and initiatives; it’s about recognizing and mitigating the inherent risks that can jeopardize the successful execution of those endeavors. In essence, risk assessment in capital estimation is the compass that guides businesses through the turbulent seas of uncertainty, ensuring that they make informed and prudent financial decisions.

Identifying and Categorizing Risks:

The first step in risk assessment is identifying and categorizing the diverse array of risks that can impact capital estimation. These risks can be broadly categorized into several key areas:

1. Market Risks: These encompass factors such as shifts in customer demand, changes in market conditions, competitive pressures, and evolving industry trends. Market risks can significantly affect revenue projections and the feasibility of capital-intensive projects.

2. Operational Risks: Operational risks arise from internal processes, systems, and management. These include supply chain disruptions, operational inefficiencies, and human errors that can lead to cost overruns or project delays.

3. Financial Risks: Financial risks encompass fluctuations in interest rates, currency exchange rates, and the cost of capital. Changes in these variables can impact financing costs and the overall affordability of capital investments.

4. Regulatory and Compliance Risks: Businesses must navigate a complex web of regulations and compliance requirements that can change over time. Failure to comply with these regulations can lead to legal consequences and unexpected expenses.

5. Technological Risks: In an era of rapid technological advancements, businesses face the risk of technology obsolescence. Investing in outdated technology can lead to wasted capital and a competitive disadvantage.

6. Environmental and Sustainability Risks: Increasingly, environmental and sustainability concerns are becoming significant factors in capital estimation. Failure to account for these risks can result in reputational damage and regulatory penalties.

Quantifying and Assessing Risks:

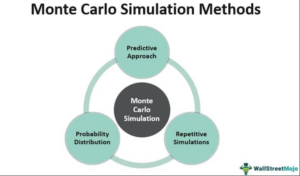

Once risks are identified, the next step is quantifying and assessing their potential impact. This involves assigning probabilities to each risk event and estimating the financial consequences should they occur. Methods such as sensitivity analysis, Monte Carlo simulations, and scenario planning are employed to gauge the range of possible outcomes under different risk scenarios.

Risk Mitigation and Management:

Risk assessment in capital estimation is not merely a theoretical exercise; it’s a proactive effort to mitigate and manage risks effectively. Businesses employ several strategies to address potential risks:

1. Diversification: Spreading capital investments across different projects, industries, or geographic regions can help mitigate the impact of adverse events in any single area.

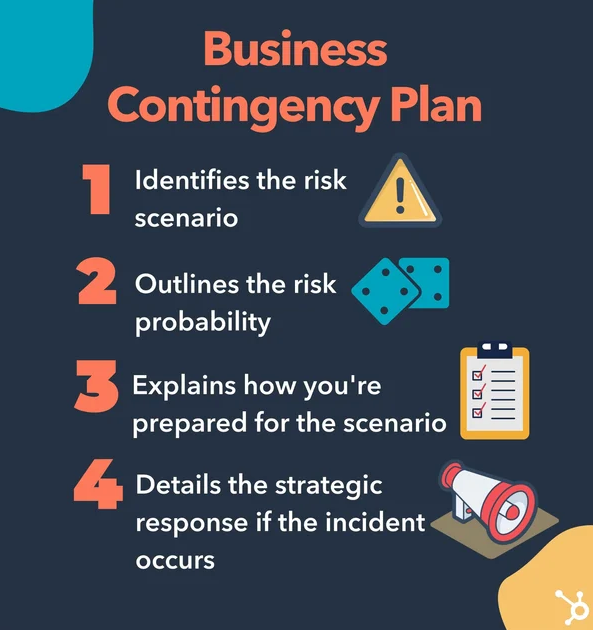

2. Contingency Planning: Developing contingency plans for identified risks enables businesses to respond swiftly should those risks materialize. These plans can include financial reserves, alternate suppliers, or crisis response protocols.

3. Hedging Strategies: Hedging against financial risks, such as currency fluctuations or interest rate changes, can protect the company’s financial stability.

4. Robust Due Diligence: Thorough due diligence in project selection and vendor assessment can help identify and mitigate operational and market risks.

5. Environmental and Social Impact Assessments: Conducting comprehensive assessments of a project’s environmental and social impact can address sustainability risks and ensure compliance with regulations.

6. Insurance: Transferring certain risks through insurance coverage can provide financial protection in the event of unexpected events.

Regular Monitoring and Adjustment:

Risk assessment is not a one-time activity; it’s an ongoing process. Businesses must continuously monitor the risks associated with their capital investments and adjust their strategies as circumstances evolve. Regular risk assessments provide an opportunity to identify emerging risks, adjust risk mitigation measures, and optimize capital allocation.

In conclusion, risk assessment in capital estimation is a cornerstone of informed decision-making in the business world. It is the process of recognizing, quantifying, and managing the diverse array of risks that can impact capital-intensive projects and investments. By categorizing risks, assessing their potential impact, and implementing effective risk mitigation strategies, businesses can navigate the uncertain terrain of capital allocation with greater confidence and resilience. In today’s rapidly changing business environment, mastering the art of risk assessment is essential for safeguarding financial stability and achieving long-term success.

>hr/>

Chapter 8: Financial Ratios and Metrics

In the realm of capital estimation, financial ratios and metrics emerge as indispensable tools for assessing a company’s financial health, performance, and stability. These quantitative measures provide crucial insights into a business’s ability to manage capital efficiently, meet its financial obligations, and make informed decisions about capital allocation. Financial ratios and metrics act as the compass that guides businesses through the complex landscape of capital estimation, helping them chart a course towards sustainable growth and financial success.

Liquidity Ratios:

Liquidity ratios are among the first metrics examined during capital estimation, as they provide insights into a company’s short-term financial viability. Key liquidity ratios include the Current Ratio and the Quick Ratio. The Current Ratio compares a company’s current assets to its current liabilities, indicating its ability to cover short-term obligations. The Quick Ratio, also known as the Acid-Test Ratio, focuses on a company’s most liquid assets (excluding inventory) and provides a more conservative measure of liquidity. These ratios are critical for ensuring that a business has the necessary working capital to meet its short-term financial commitments, a fundamental consideration in capital estimation.

Profitability Ratios:

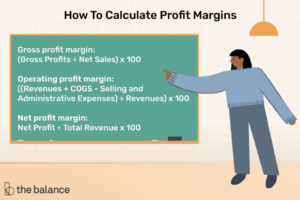

Profitability ratios are central to understanding a company’s ability to generate returns on capital investments. Key profitability ratios include the Net Profit Margin, Return on Assets (ROA), and Return on Equity (ROE). The Net Profit Margin measures the percentage of each dollar of revenue that translates into profit, providing insights into cost management and pricing strategies. ROA assesses a company’s efficiency in generating profits from its assets, while ROE evaluates how effectively it leverages shareholder equity to generate returns. These ratios are critical in determining the attractiveness of capital investments and the potential for sustainable profitability.

Debt and Leverage Ratios:

Debt and leverage ratios are paramount in assessing a company’s capital structure and financial risk. Notable ratios in this category include the Debt-to-Equity Ratio, the Interest Coverage Ratio, and the Debt Service Coverage Ratio. The Debt-to-Equity Ratio measures the proportion of debt financing relative to equity, indicating the company’s reliance on external borrowing. The Interest Coverage Ratio assesses the company’s ability to service its debt obligations by comparing earnings before interest and taxes (EBIT) to interest expenses. The Debt Service Coverage Ratio focuses on the ability to meet both principal and interest payments from operating cash flow. These ratios are essential in determining a company’s capacity to manage debt and its potential vulnerability to financial distress, factors that significantly impact capital estimation.

Efficiency Ratios:

Efficiency ratios offer insights into a company’s operational effectiveness and capital utilization. Key metrics in this category include the Asset Turnover Ratio and the Inventory Turnover Ratio. The Asset Turnover Ratio measures how efficiently a company utilizes its assets to generate sales, highlighting the effectiveness of capital allocation. The Inventory Turnover Ratio assesses the speed at which a company sells and replaces its inventory, impacting working capital requirements and capital efficiency. These ratios are integral in optimizing capital allocation by identifying areas where assets can be better deployed or where capital investments may be warranted to improve operational efficiency.

Valuation Ratios:

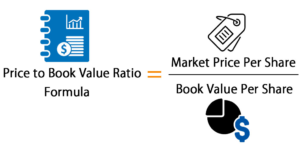

Valuation ratios provide a perspective on a company’s market value relative to its financial performance. The Price-to-Earnings (P/E) Ratio and the Price-to-Book (P/B) Ratio are prominent metrics in this category. The P/E Ratio compares a company’s stock price to its earnings per share (EPS), indicating the market’s perception of future growth and profitability. The P/B Ratio relates a company’s stock price to its book value per share, providing insights into its valuation relative to its net assets. These ratios are instrumental in capital estimation by helping businesses assess whether their stock is undervalued or overvalued, influencing decisions related to capital raising or share repurchases.

In conclusion, financial ratios and metrics play a paramount role in capital estimation by offering quantitative insights into a company’s financial health, performance, and stability. These ratios span various dimensions, from liquidity and profitability to debt management, operational efficiency, and market valuation. Leveraging these metrics allows businesses to make informed decisions about capital allocation, manage financial risk, and navigate the intricate landscape of capital estimation with greater precision and confidence. In the dynamic world of modern business, mastering the art of financial ratio analysis is an essential skill for steering a course toward sustainable growth and long-term financial success.

Chapter 9: Sources of Capital

Capital, often referred to as the lifeblood of a business, is the financial foundation upon which companies build, expand, and innovate. Access to capital is essential for various aspects of business operations, from daily functioning to strategic investments. Businesses rely on a variety of sources to acquire the necessary capital to meet their financial needs and drive growth. These sources of capital can be broadly categorized into two primary categories: internal and external sources.

Internal Sources of Capital:

1. Retained Earnings: Retained earnings represent the accumulated profits that a company has not distributed to shareholders as dividends. These earnings are reinvested into the business, providing a consistent source of internal capital for expansion, research and development, and debt reduction.

2. Depreciation Reserves: Depreciation is a non-cash expense that reduces the book value of assets over time. While it doesn’t impact cash flows directly, businesses can set aside depreciation reserves, creating an internal source of capital to replace or upgrade assets when needed.

3. Working Capital Optimization: Efficient working capital management, including reducing excess inventory, extending accounts payable, and accelerating accounts receivable collection, can free up cash within the business for other purposes.

4. Asset Sales: Selling underutilized or non-core assets, such as real estate, equipment, or investments, can generate capital for strategic initiatives or debt reduction.

External Sources of Capital:

1. Equity Financing:

• Common Stock: Companies can raise capital by issuing common stock to investors. Common stockholders have ownership rights and may receive dividends and voting privileges.

• Preferred Stock: Preferred stock offers investors a higher claim on assets and earnings than common stock but typically lacks voting rights. Businesses issue preferred stock to attract investors seeking stable dividends.

• Venture Capital: Startups and high-growth companies often seek venture capital funding. Venture capitalists invest in exchange for equity and actively support business growth.

• Initial Public Offering (IPO): Going public through an IPO allows companies to raise significant capital by selling shares to the public for the first time. This provides liquidity to existing shareholders and access to a broader investor base.

2. Debt Financing:

• Bank Loans: Traditional bank loans provide a common source of debt capital. These loans vary in terms, interest rates, and collateral requirements.