Technology Company Acquisition – Workshop 1 (Value Chain Inspect)

The Appleton Greene Corporate Training Program (CTP) for Technology Company Acquisition is provided by Mr. Cuatrecasas Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Montthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr. Cuatrecasas is an investment banker, entrepreneur and author. During his career, he has helped hundreds of companies on mergers, acquisitions, capital raisings, company sales, divestitures, restructurings, leveraged buy-outs and a wide variety of strategic issues. He has over 30 years of experience executing strategic deals and delivering proven, actionable strategies for executives to learn how to find the right tech company to acquire and how to do the acquisition in the right way.

He understands from experience that most companies don’t have programs or systematic methodologies ways to “techquify” their operations and advance their strategic positioning. When they do try to acquire or invest in technology companies, competing priorities and inertia get in the way. As a result, most established companies and their ambitious executives go too slow and never unlock their full potential.

His training offers executives a step-by-step approach to all the tricks in the tech company acquisition game, from how to find the right tech start-tech, how to develop the right approach, how to get the lowest possible price and the best terms and do a win-win deal that delivers a 10-100x ROI.

Mr. Cuatrecasas has served as the Founder and CEO of Aquaa Partners, an investment banking firm based in London. Previously he was the Founder and a Partner of Alegro Capital from 2003-2010. Previous to Alegro Capital, Mr. Cuatrecasas was the co-founder and Managing Director of ARC Associates from 1993-2003. (ARC Associates was a leading independent London-based TMT mergers and acquisitions advisory practice with a full range of blue chip and entrepreneurial clients including Sonera, Cable & Wireless, Apax, Marconi, Equant, ICL, KKR, Permira and BT, amongst others). Prior to ARC Associates, Mr. Cuatrecasas was a Senior Associate with Arkwright Capital (ex-Bain & Co. partners), an M&A and Corporate Finance advisory firm in London (1991-1993) and with GE Capital in their LBO and Restructuring Group in New York (1989-1991).

Over the past thirty years, Mr. Cuatrecasas has completed over fifty merger and acquisition transactions around the world worth more than $25 billion dollars and over 70 corporate finance advisory and strategic consultancy assignments.

Mr. Cuatrecasas holds an MBA from Columbia University where he was awarded the Roswell C. McCrea Scholarship and a BA from Wake Forest University. Mr. Cuatrecasas holds dual US and UK citizenship and speaks fluent Spanish. Mr. Cuatrecasas has been quoted in The Washington Post, The Los Angeles Times, US News & World Report, and Forbes. He lives (most of the time) in London with his wife and three children.

MOST Analysis

Mission Statement

In this first and critically important step of the TechquisitionTM method, the company’s senior executive management commits to creating value through finding and investing in or acquiring (or otherwise instigating a joint venture or exclusive partnership with) the right technology (or digital) company. If the CEO and senior management do not believe it is possible to transform the market value of their company via tech company acquisition, then the TechquisitionTM effort will likely fail. The commitment must be in place. A corporate initiative that is begun from a nice-to-have or let’s-see-what-happens position rather than a need-to-have or must-do mindset is doomed to fail. Too many other competing priorities will get in the way. If the board is not supporting, and, in many cases, leading the charge, then it should at least be aware of the inorganic innovation effort and ideally confirm the value-chain inflection points and specifications proposed by management concerning the type of characteristics the ideal target company should have. Assuming a commitment is confirmed, then the company’s senior management should take the time to review and check the board’s decision and specifications to strategically invest in or acquire a technology company. This should include a thorough inspection of the company’s value chain—assess the opportunities and check strategic imperatives against the industry and market trends, the competitive environment, and the company’s positioning, and assess the needed capabilities, the customer demands, and the evolving technological landscape.

Objectives

01. Strategy Desk Audit: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Competitive Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Identify Stakeholder Goals: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Identify Value Chain Inflection Points: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Example Target Companies: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Value Creation Potential Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Availability of Opportunities: departmental SWOT analysis; strategy research & development. 1 Month

08. Proximity to the Core: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

09. Geographic Relevance: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

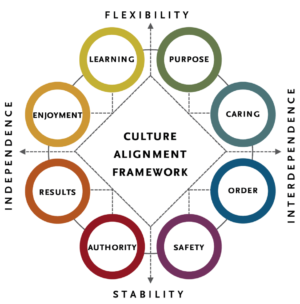

10. Culture Fit: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Assessment of Trade-offs: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Create a Project Schedule: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Strategy Desk Audit: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Competitive Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Identify Stakeholder Goals: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Identify Value Chain Inflection Points: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Example Target Companies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Value Creation Potential Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Availability of Opportunities: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Proximity to the Core: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Geographic Relevance: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Culture Fit: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Assessment of Trade-offs: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Create a Project Schedule: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyse Strategy Desk Audit.

02. Create a task on your calendar, to be completed within the next month, to analyse Competitive Analysis.

03. Create a task on your calendar, to be completed within the next month, to analyse Identify Stakeholder Goals.

04. Create a task on your calendar, to be completed within the next month, to analyse Identify Value Chain Inflection Points.

05. Create a task on your calendar, to be completed within the next month, to analyze Example Target Companies.

06. Create a task on your calendar, to be completed within the next month, to analyse Value Creation Potential Analysis.

07. Create a task on your calendar, to be completed within the next month, to analyse Availability of Opportunities.

08. Create a task on your calendar, to be completed within the next month, to analyse Proximity to the Core.

09. Create a task on your calendar, to be completed within the next month, to analyze Geographic Relevance.

10. Create a task on your calendar, to be completed within the next month, to analyse Culture Fit.

11. Create a task on your calendar, to be completed within the next month, to analyse Assessment of Trade-offs.

12. Create a task on your calendar, to be completed within the next month, to analyse Create a Project Schedule.

Introduction

Technology companies are not just disruptors—they are the future. For legacy companies to remain relevant and competitive, the most effective strategy is to transform themselves into technology-driven organizations. This transformation is often achieved through strategic acquisitions, partnerships, or joint ventures with innovative tech companies that can provide the competitive edge needed to thrive in the digital age. The course is designed to equip senior executives with the knowledge and tools necessary to navigate the complexities of acquiring or investing in the right technology company.

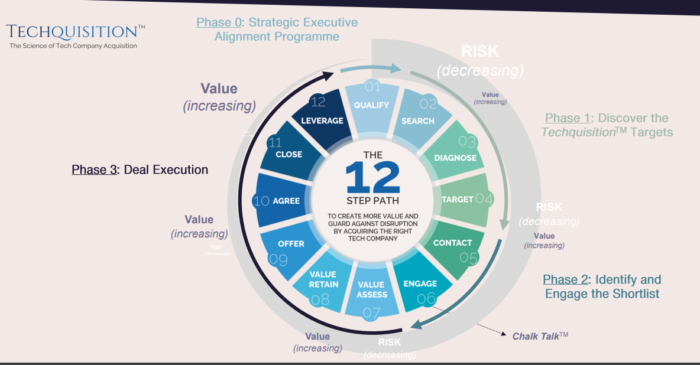

The first module, Value Chain Inspect, is a critical component of the Techquisition™ methodology. It lays the foundation for the entire acquisition process, focusing on ensuring that the company’s senior executive management is aligned in its commitment to creating value through acquisition or strategic partnership. Without this foundational alignment, no subsequent efforts will succeed. The executive team must believe that transforming the market value of their company through technology company acquisition is not only possible but essential for survival and future growth.

The Importance of Commitment

In Part 1, Month 1: Value Chain Inspect, the course emphasizes the importance of total commitment from the company’s senior leadership. This commitment is more than a casual interest in potential opportunities; it must come from a place of necessity, not just curiosity. A common mistake companies make is approaching acquisitions with a “nice-to-have” mindset rather than a “must-do” attitude. When acquisition efforts are seen as optional or exploratory, they often lose momentum as other priorities take over, leading to a failure to capitalize on potential opportunities.

A successful tech company acquisition requires an executive team that not only understands the strategic importance of the acquisition but also drives the process with a sense of urgency and purpose. As outlined in the Techquisition™ methodology, if the board of directors does not fully support or lead the initiative, it at least needs to be aware of the acquisition’s strategic implications and validate the management’s proposed value chain inflection points. The board plays a crucial role in ensuring that the company’s leadership is on the same page regarding the types of characteristics the target technology company should possess.

Value Chain Analysis as a Strategic Imperative

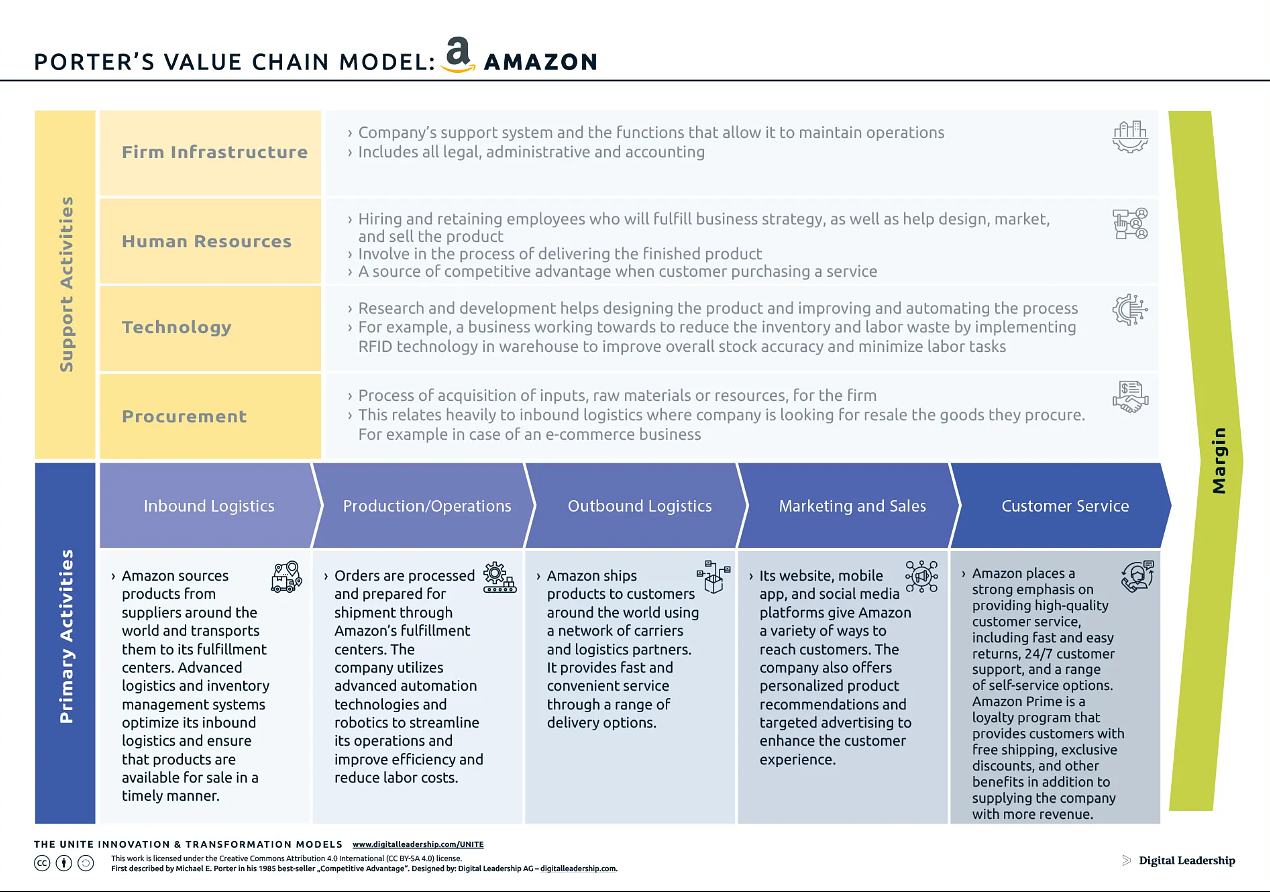

The concept of Value Chain Inspect centers around a thorough analysis of the company’s value chain, which is essential for identifying strategic opportunities and aligning them with market trends and competitive pressures. This process involves inspecting each stage of the company’s value chain to determine where value can be added or enhanced through technological integration.

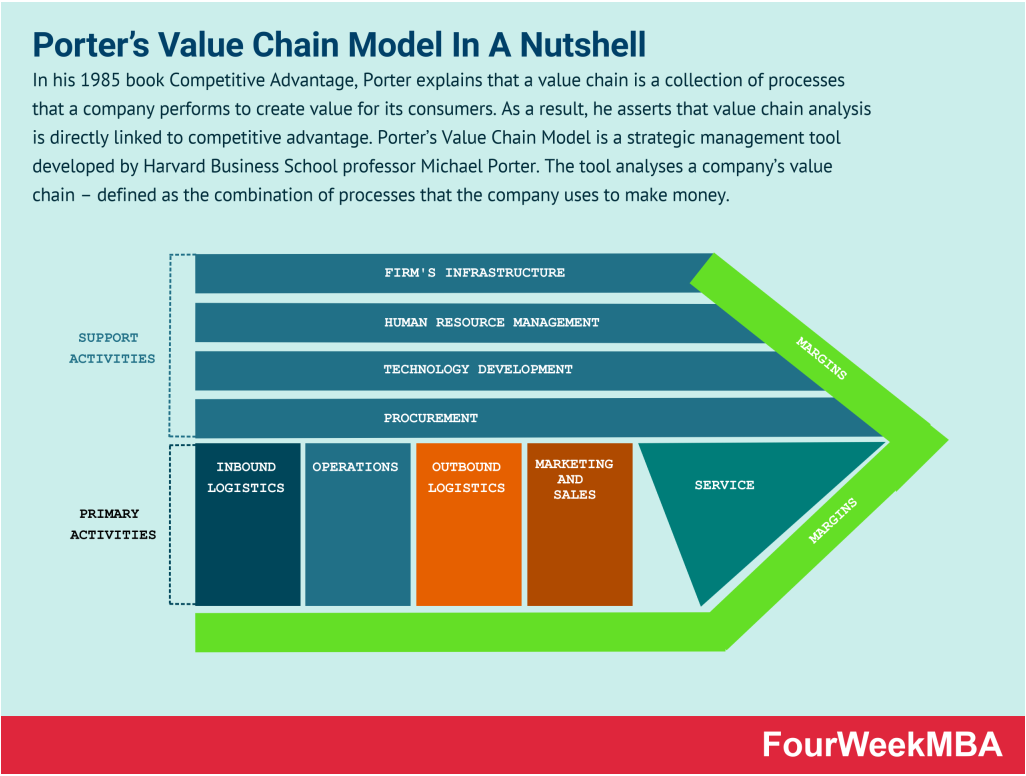

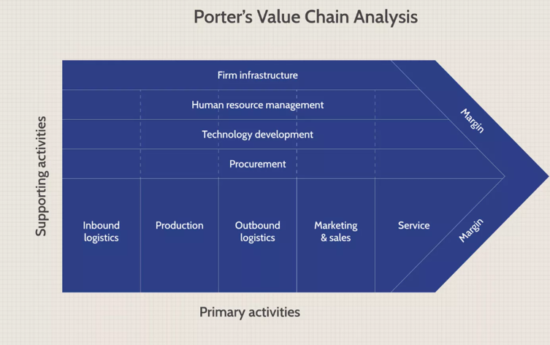

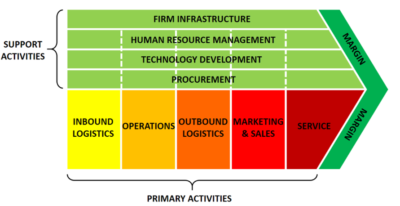

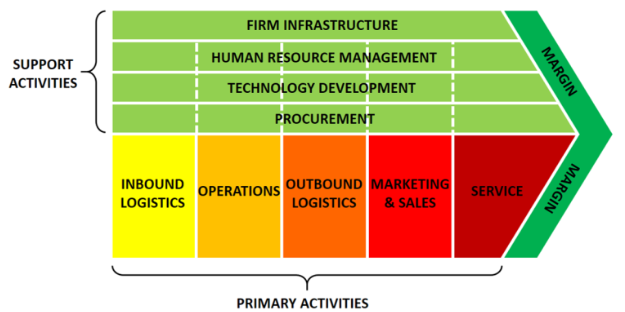

The value chain, a concept popularized by Michael Porter, breaks down a company’s activities into strategically relevant pieces to understand where and how value is created and delivered to customers. In the context of technology company acquisitions, the goal is to identify value chain inflection points—specific areas where integrating new technologies or digital capabilities could significantly boost efficiency, enhance customer satisfaction, or open up new revenue streams.

In this phase, senior management must assess various strategic imperatives, such as:

• Industry and Market Trends: Analyzing how technological advancements are disrupting their industry and how they can harness these trends for growth.

• Competitive Environment: Understanding how competitors are leveraging technology and where the company stands in relation to them.

• Company Positioning: Identifying where the company currently fits within the industry landscape and how technology acquisition could redefine its position.

• Customer Demands: Evaluating evolving customer expectations, particularly in terms of digital solutions, and how acquiring a tech company can help meet these demands.

• Technological Landscape: Assessing the current and emerging technologies and their relevance to the company’s core operations and growth strategy.

Each of these factors plays a crucial role in shaping the company’s acquisition strategy and ensuring that any potential acquisition aligns with long-term business goals. The inspection of the value chain will ultimately reveal the gaps that a technology company can fill, the inefficiencies that digital solutions can resolve, and the competitive advantages that a successful acquisition can offer.

The Role of Executive Alignment

At the heart of the Value Chain Inspect process is the alignment of senior executive management. In this first phase of the Techquisition™ process, executives must be united in their understanding of the company’s goals, challenges, and the opportunities presented by technology acquisitions. This alignment is critical because an acquisition effort that lacks unity among leadership will struggle to maintain focus and direction.

The course underscores that management should not view this as a one-time analysis but rather as an ongoing conversation. Leadership teams must frequently revisit and refine their understanding of the value chain and how it intersects with technology trends. The commitment to a tech acquisition is not just a financial or operational decision—it requires a shift in mindset, one that views technology as the key to unlocking the company’s future potential.

This alignment extends beyond just internal management; it must also include the board of directors and other key stakeholders. Everyone involved must recognize that a successful tech acquisition can fundamentally transform the business. The commitment to this transformation cannot be half-hearted. In fact, if the board and management are not aligned in their vision and intent, the Techquisition™ effort is likely to falter.

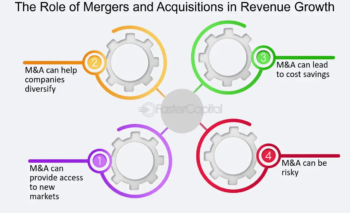

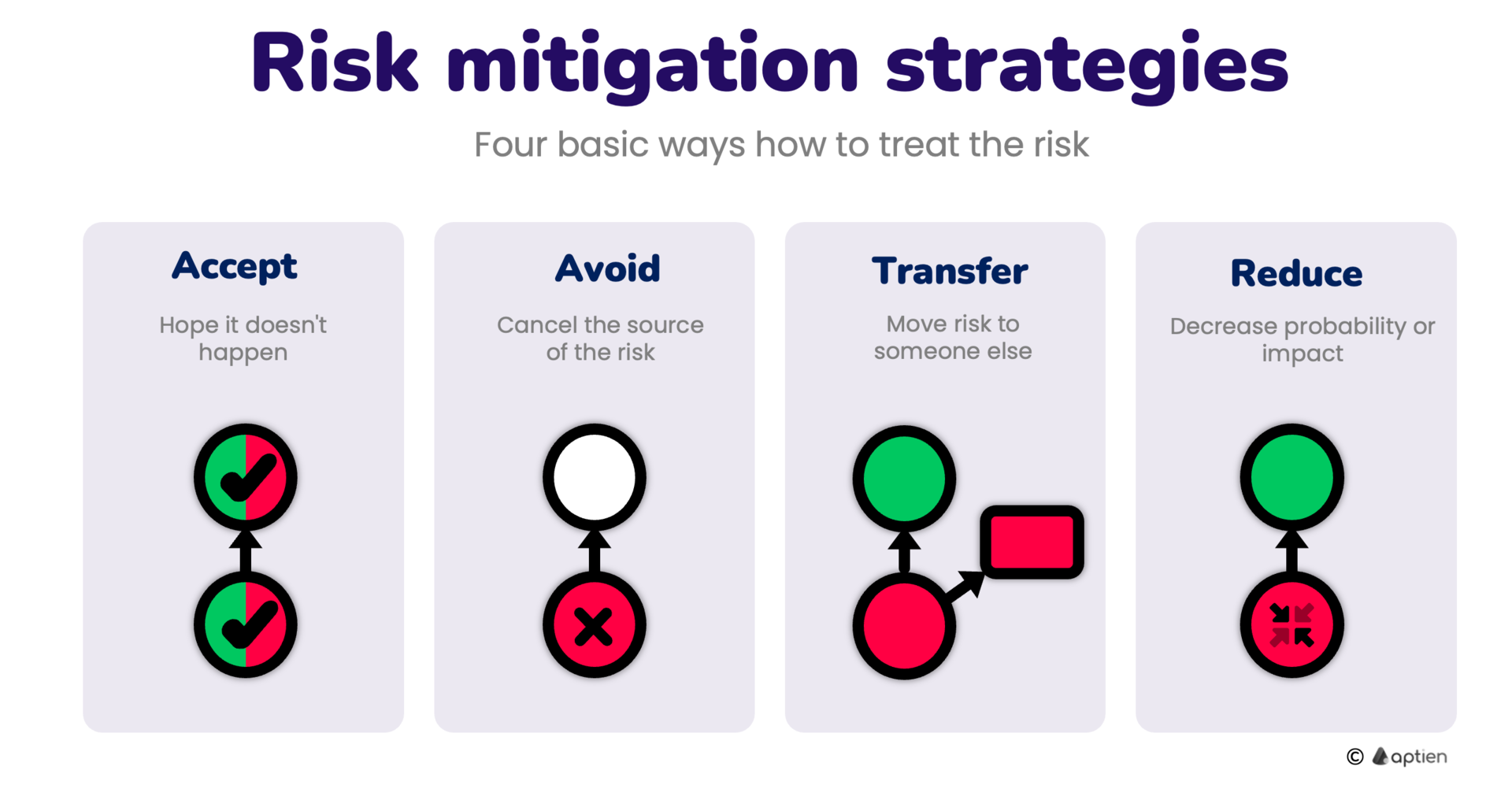

The Role of Risk and Opportunity in Value Chain Inspect

Another key element in the Value Chain Inspect phase is the management of risk. Every acquisition carries inherent risks—financial, operational, cultural, and strategic. During this phase, executives are trained to conduct a thorough risk analysis of the acquisition process, ensuring that potential risks are identified early and mitigation strategies are put in place. This is particularly important when acquiring technology companies, as these companies often operate in fast-moving, unpredictable markets where technological advancements and customer expectations can shift rapidly.

However, the course also emphasizes the importance of viewing risk in balance with opportunity. While it is essential to mitigate risk, the primary focus should always remain on the opportunity to create exponential value through the acquisition. Technology acquisitions, when done correctly, can transform a company’s value chain in ways that far outweigh the potential risks.

For example, the acquisition of Jet.com by Walmart in 2016 is a case in point. Walmart, a legacy retailer, recognized the opportunity to transform its business through digital innovation. The acquisition of Jet.com, though initially seen as risky due to the company’s financial losses, ultimately resulted in a massive increase in Walmart’s market value, demonstrating the potential for value chain transformation through strategic tech acquisition.

Avoiding Common Pitfalls: The Role of Mindset in Value Chain Inspect

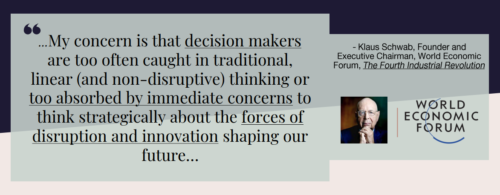

A critical aspect of the Value Chain Inspect phase is the mindset shift required for successful tech company acquisition. The training emphasizes that the executive team must go beyond traditional business thinking and embrace a mindset of innovation and agility. Legacy companies often struggle with the fear of disruption, but this fear can paralyze them from taking the necessary steps toward transformation. The course encourages executives to see disruption not as a threat but as an opportunity to drive exponential value creation.

One of the common pitfalls that companies face in this phase is confirmation bias—believing that the solutions to their problems lie within their existing strategies or previous experiences. The Value Chain Inspect module trains executives to challenge their assumptions, to look beyond what they already know, and to remain open to new ideas and perspectives. This is particularly important when selecting potential acquisition targets, as the right tech company may not always fit the traditional mold of what the company has acquired in the past.

Another pitfall is the tendency to rush through the value chain inspection process, eager to move on to the more tangible aspects of acquisition. However, this phase is crucial for laying the groundwork for a successful acquisition. Skipping or underestimating the importance of this step can lead to misaligned objectives, poor strategic fit, and ultimately, acquisition failure.

Conclusion: Laying the Foundation for Techquisition™ Success

The Value Chain Inspect module is the foundation upon which the rest of the Techquisition™ process is built. It is where senior executives align their vision, commitment, and strategies to ensure that the company’s acquisition efforts are driven by a clear understanding of where value can be created and how technology can transform the business.

This phase is not just about identifying acquisition targets—it’s about inspecting and understanding the company’s entire value chain and determining where technology can make the most impact. It’s about aligning leadership on the strategic importance of the acquisition and ensuring that the commitment is strong enough to overcome the inevitable challenges that will arise.

By the end of this module, individuals will have a deeper understanding of how to analyze their company’s value chain, how to identify the key opportunities for technological integration, and how to align their leadership team behind a unified vision for the future. With this foundation in place, the company will be well-positioned to move into the next phases of the Techquisition™ process—engaging with potential acquisition targets and executing successful deals that drive exponential value transformation.

The Value Chain Inspect module thus serves as the critical first step in a company’s journey to becoming a forward-thinking, technology-driven industry leader in an era of rapid technological advancement.

Case Study: Walmart’s Acquisition of Jet.com

In 2016, Walmart made a bold move by acquiring Jet.com, a loss-making e-commerce startup, for $3.3 billion. At the time, many industry analysts questioned the wisdom of this acquisition, given that Jet.com was relatively new, and its business model was not yet profitable. However, Walmart’s leadership saw this acquisition as a critical step in transforming its value chain and competing with Amazon in the growing online retail market.

Before the acquisition, Walmart was struggling to make significant inroads in e-commerce, despite being one of the largest retailers in the world. Its value chain was optimized for traditional brick-and-mortar retail, with an extensive network of physical stores and supply chain infrastructure that did not fully capitalize on the growing shift towards online shopping. Walmart needed to pivot its business model to incorporate digital solutions and online capabilities in order to remain competitive and stay relevant to evolving customer demands.

Jet.com, on the other hand, was an e-commerce platform designed with innovative technology to optimize pricing, delivery, and customer engagement in the online shopping space. The platform used a unique pricing algorithm that offered customers discounts based on their purchasing behavior and the cost-efficiency of the delivery method. This kind of technology was precisely what Walmart needed to enhance its value chain and expand its presence in the digital marketplace.

Walmart’s acquisition of Jet.com marked a significant shift in its e-commerce strategy and had a transformative impact on its value chain. By integrating Jet.com’s technology and talent into its operations, Walmart was able to quickly scale its online business, enhance its customer experience, and create synergies between its physical stores and its e-commerce platform.

The acquisition provided Walmart with several key benefits:

1. E-commerce Expertise and Technology: Jet.com brought a team of e-commerce experts, including its founder Marc Lore, who became the head of Walmart’s U.S. e-commerce operations. The acquisition allowed Walmart to leverage Jet.com’s advanced technology, pricing algorithms, and digital infrastructure, which were crucial for improving its online shopping capabilities.

2. Logistics and Supply Chain Optimization: Walmart’s existing supply chain was heavily focused on serving its physical stores. The integration of Jet.com’s logistics expertise allowed Walmart to optimize its distribution network for online orders, improving delivery times and reducing costs.

3. Customer Experience: Jet.com’s focus on customer-centric innovation helped Walmart improve its online user experience. The platform’s unique pricing model and efficient delivery system allowed Walmart to offer more competitive prices and faster shipping, enhancing its appeal to digital consumers.

4. Cultural Shift and Digital Transformation: Perhaps the most significant impact of the acquisition was the cultural shift within Walmart. The deal signaled a strong commitment from Walmart’s leadership to embrace digital transformation and compete with technology giants like Amazon. It catalyzed a broader transformation within Walmart, encouraging the company to invest more heavily in technology and innovation.

The results of the Jet.com acquisition were dramatic. Within just 16 months of the acquisition, Walmart increased its market value by $60 billion—a staggering 15.8x return on its $3.3 billion investment in Jet.com. The acquisition also helped Walmart establish itself as a formidable player in the e-commerce space, allowing it to effectively compete with Amazon and other digital retailers.

Additionally, the acquisition paved the way for Walmart’s later strategic investments, including its acquisition of a controlling stake in Flipkart, one of India’s largest e-commerce platforms, for $16 billion in 2018. The success of the Jet.com deal gave Walmart the confidence and expertise to pursue even larger and more ambitious tech acquisitions, further transforming its value chain and positioning it as a leader in global e-commerce.

The Walmart-Jet.com case study offers several valuable lessons for the Value Chain Inspect phase of the Techquisition™ process:

1. Commitment to Digital Transformation: Walmart’s leadership was fully committed to transforming its business through technology. Without this commitment, the acquisition would likely have failed. Walmart recognized the critical need to enhance its value chain through digital capabilities and took bold steps to achieve this goal.

2. Strategic Fit: The acquisition of Jet.com was not just about buying a company—it was about integrating technology and talent that could transform Walmart’s value chain. This strategic fit was crucial for the success of the acquisition, as it allowed Walmart to leverage Jet.com’s strengths in areas where it was previously weak.

3. Cultural Alignment: Walmart’s ability to integrate Jet.com’s culture of innovation into its broader organization was essential for achieving long-term success. The acquisition helped shift Walmart’s mindset towards embracing digital transformation and thinking like a technology company.

4. Value Chain Transformation: By acquiring Jet.com, Walmart was able to transform its value chain in ways that would have been difficult, if not impossible, to achieve organically. The acquisition allowed Walmart to optimize its logistics, improve its customer experience, and enhance its competitive position in the e-commerce market.

This case study serves as a powerful example of how a well-executed technology acquisition can transform a company’s value chain, create exponential value, and position the company for long-term success in the digital age. It reinforces the importance of the Value Chain Inspect phase in ensuring that an acquisition is aligned with the company’s strategic goals and that the leadership team is fully committed to driving value through technology integration.

Case Study: Microsoft’s Acquisition of LinkedIn

In 2016, Microsoft made headlines with its $26.2 billion acquisition of LinkedIn, the largest acquisition in Microsoft’s history. At first glance, the deal raised questions among industry experts. Microsoft, a software and cloud computing giant, seemed to be venturing outside its core business by acquiring LinkedIn, a professional networking platform. However, this acquisition was far more strategic than it initially appeared, especially when viewed through the lens of value chain enhancement.

Prior to the acquisition, LinkedIn had already established itself as the leading professional networking site, with over 400 million users globally. It had created a unique value chain centered around professional connections, job listings, and content sharing. However, LinkedIn’s potential for deeper integration with enterprise software and productivity tools was untapped. Microsoft saw this potential as an opportunity to integrate LinkedIn’s network with its own suite of enterprise services, particularly Office 365 and Dynamics, which could significantly enhance Microsoft’s value chain in areas like cloud computing, professional services, and artificial intelligence.

Microsoft’s acquisition of LinkedIn was strategically aligned with its goal of becoming a leading provider of cloud-based services and enterprise solutions. By integrating LinkedIn’s vast network of professionals with its own enterprise products, Microsoft aimed to create a more comprehensive platform that offered greater value to business customers. The synergies between LinkedIn and Microsoft’s value chain became immediately apparent in several key areas:

1. Professional Networking and Productivity: By integrating LinkedIn with Microsoft’s Office 365 suite, Microsoft was able to enhance its core productivity tools (such as Word, Excel, and Outlook) with LinkedIn’s professional networking capabilities. For example, the integration allowed users to access LinkedIn profiles directly within Microsoft Office applications, providing richer context for collaboration and communication with colleagues, clients, and partners.

2. Sales and Marketing: Microsoft’s Dynamics CRM (customer relationship management) system gained significant advantages from LinkedIn’s Sales Navigator tool, which helps sales professionals identify and target leads more effectively. The integration of LinkedIn’s data into Microsoft’s CRM solution allowed businesses to leverage LinkedIn’s extensive professional data for more personalized and effective sales and marketing campaigns. This transformed how businesses approached lead generation and client engagement.

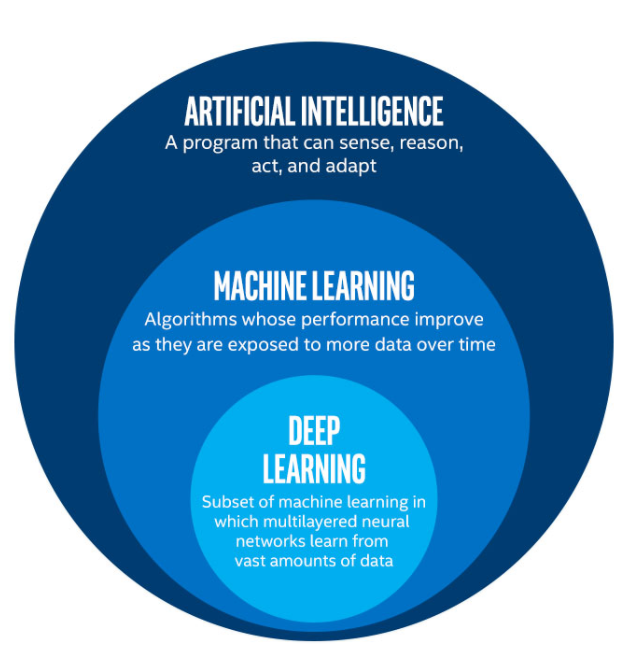

3. Artificial Intelligence and Machine Learning: The acquisition also allowed Microsoft to incorporate LinkedIn’s data into its broader artificial intelligence and machine learning initiatives. By combining LinkedIn’s data with Microsoft’s cloud-based AI platform, Microsoft could develop more intelligent solutions for recruitment, employee engagement, and business analytics. This added significant value to its cloud computing services, allowing enterprise customers to tap into deeper insights and predictive analytics based on LinkedIn’s professional network.

4. Learning and Development: LinkedIn’s acquisition of Lynda.com, an online learning platform, prior to the Microsoft deal provided an additional layer of value. Through LinkedIn Learning, Microsoft was able to offer integrated learning and development tools within its productivity suite. This created an opportunity for organizations to not only manage their workforce but also to train and upskill employees through LinkedIn Learning directly within Microsoft’s enterprise ecosystem.

A key element of the success of Microsoft’s acquisition of LinkedIn was the cultural alignment between the two companies. Both organizations shared a vision of empowering professionals to be more productive and successful. Under the leadership of Microsoft’s CEO, Satya Nadella, the company embraced a forward-thinking culture that prioritized cloud-based solutions, data-driven decision-making, and a people-first approach to technology. LinkedIn’s mission to connect the world’s professionals and help them be more productive complemented Microsoft’s broader goals.

This alignment was crucial in ensuring a smooth integration and maintaining LinkedIn’s brand identity and autonomy. Nadella made it clear from the start that LinkedIn would retain its own culture and continue to operate independently, with its CEO, Jeff Weiner, reporting directly to Nadella. This approach helped preserve LinkedIn’s innovative spirit while still capitalizing on the synergies with Microsoft’s products and services.

Since the acquisition, Microsoft and LinkedIn have seen significant success, with clear value creation across both businesses:

1. Revenue Growth: LinkedIn’s revenue grew substantially following the acquisition, with Microsoft’s resources and support helping to accelerate LinkedIn’s product development and market penetration. LinkedIn’s user base has also grown, surpassing 900 million members globally by 2023.

2. Product Integration: Microsoft successfully integrated LinkedIn’s capabilities into its Office 365 and Dynamics 365 platforms. The integration of LinkedIn’s professional data into Microsoft’s CRM tools has enhanced its ability to offer personalized business solutions, making Dynamics 365 a more competitive alternative to Salesforce and other CRM providers.

3. Enterprise Solutions: Microsoft has developed new enterprise solutions leveraging LinkedIn’s data and AI technologies. For example, it introduced Microsoft Relationship Sales, a product that combines LinkedIn Sales Navigator and Dynamics 365 to help sales teams build stronger relationships with clients by using data-driven insights.

4. Cloud and AI Expansion: LinkedIn’s rich professional data has become a valuable asset for Microsoft’s AI initiatives. By incorporating LinkedIn’s data into Microsoft’s Azure cloud platform, the company has been able to create more advanced machine learning models for business applications, from recruitment to sales.

5. Learning and Development Growth: LinkedIn Learning, integrated into Microsoft’s enterprise platforms, has seen tremendous growth as companies increasingly focus on upskilling and reskilling their employees in the digital age. This integration has allowed Microsoft to offer a full-stack solution for companies looking to enhance productivity, talent development, and retention.

Microsoft’s acquisition of LinkedIn offers several key lessons for companies entering the Value Chain Inspect phase of the Techquisition™ process:

1. Strategic Synergies: The acquisition was successful because it created synergies across both Microsoft and LinkedIn’s value chains. LinkedIn’s professional network and data integrated seamlessly with Microsoft’s enterprise software solutions, enhancing the value proposition of both companies. This case demonstrates the importance of identifying areas within the value chain where an acquisition can create complementary value.

2. Cultural Alignment and Autonomy: Microsoft’s decision to allow LinkedIn to operate independently while still benefiting from Microsoft’s resources was a key factor in the success of the acquisition. Cultural fit and clear communication between the two leadership teams ensured that LinkedIn could maintain its unique identity while contributing to Microsoft’s broader strategic goals.

3. Technology Integration: One of the most important aspects of the acquisition was Microsoft’s ability to integrate LinkedIn’s data and technologies into its existing products. This integration unlocked new capabilities, such as improved AI and machine learning solutions, that significantly enhanced Microsoft’s enterprise offerings.

4. Long-Term Vision: The acquisition was not just about immediate gains, but about long-term strategic positioning. Microsoft recognized that owning LinkedIn’s vast professional network would be a valuable asset for its future growth in cloud services, AI, and enterprise solutions. This long-term vision helped Microsoft continue to innovate and expand its value chain in the years following the acquisition.

The Microsoft-LinkedIn case study serves as a powerful example of how a strategic technology acquisition can transform a company’s value chain and create new opportunities for growth. By acquiring LinkedIn, Microsoft not only enhanced its product offerings but also positioned itself as a leader in enterprise solutions, AI, and professional networking.

This case highlights the importance of value chain analysis in the Value Chain Inspect phase of the Techquisition™ process. It demonstrates how identifying strategic synergies, ensuring cultural fit, and integrating new technologies into existing systems can lead to exponential value creation. For companies looking to drive digital transformation through tech acquisition, the Microsoft-LinkedIn acquisition is a model for success in the era of cloud computing, AI, and digital networking.

Executive Summary

Chapter 1: Strategy Desk Audit

The Strategy Desk Audit is the first critical step in understanding a company’s existing strategy and key objectives by reviewing publicly available and internal documentation. This audit provides a foundational view of where the company currently stands in relation to its strategic priorities and value chain. Conducting this thorough review is essential for determining how aligned the company’s present strategy is with its broader goals, especially when considering acquisitions or other significant business initiatives.

At the heart of the Strategy Desk Audit is the understanding that any corporate initiative must be based on solid research and a clear “must-do” mindset rather than a vague interest or exploratory endeavor. Without this commitment, competing priorities often derail such efforts. Therefore, the audit aims to establish the company’s current trajectory by evaluating its publicly disclosed information and internal reports, thus identifying the key drivers of value within its operations.

Review of Reports

The audit begins with a detailed review of the company’s publicly available information. This includes essential documents such as annual reports, 10-K and 10-Q filings, investor presentations, and transcripts from earnings calls. These sources provide insights into the company’s performance, strategic priorities, and market positioning. Supplementary materials, such as product brochures, analyst research reports, fact sheets, and the company’s website, also offer valuable context.

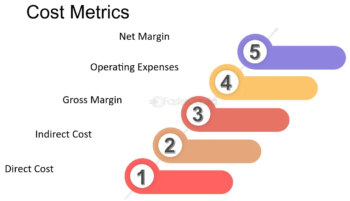

From these documents, key financial indicators, such as the company’s primary revenue sources and their trends, are examined. This analysis helps highlight critical areas of focus within the company’s value chain, such as product lines that are experiencing rapid growth or segments where cost structures are affecting margins. For instance, examining gross margins can reveal where opportunities for value creation may lie, especially if margins are under pressure, suggesting areas in the value chain that require optimization.

Equally important is identifying anomalies in the company’s strategy. For example, if the company claims to prioritize employee investment but has consistently reduced spending on management training, this could indicate misalignment between stated objectives and actual resource allocation. Such discrepancies provide insights into potential weaknesses or contradictions within the value chain.

Review of Strategic Objectives

The Strategy Desk Audit also involves understanding the company’s short-term and long-term strategic objectives. Short-term objectives are crucial for addressing immediate operational challenges and achieving quick wins in efficiency and revenue growth. These objectives are often outlined in strategic planning documents, internal communications, and performance metrics.

Executives can use various internal communication channels, like newsletters, KPI reports, and strategic planning sessions, to gain a deeper understanding of these short-term goals. Cross-functional collaboration and scenario planning also play a vital role in aligning different teams toward common short-term objectives, ensuring that the company is responsive to both internal and external market pressures.

On the other hand, long-term objectives provide a broader vision of where the company aims to be in the future. These goals are critical for sustained growth and often focus on innovation, market positioning, and large-scale resource allocation. Long-term objectives can typically be found in CEO reports and annual statements, where the company’s overarching mission and future aspirations are articulated.

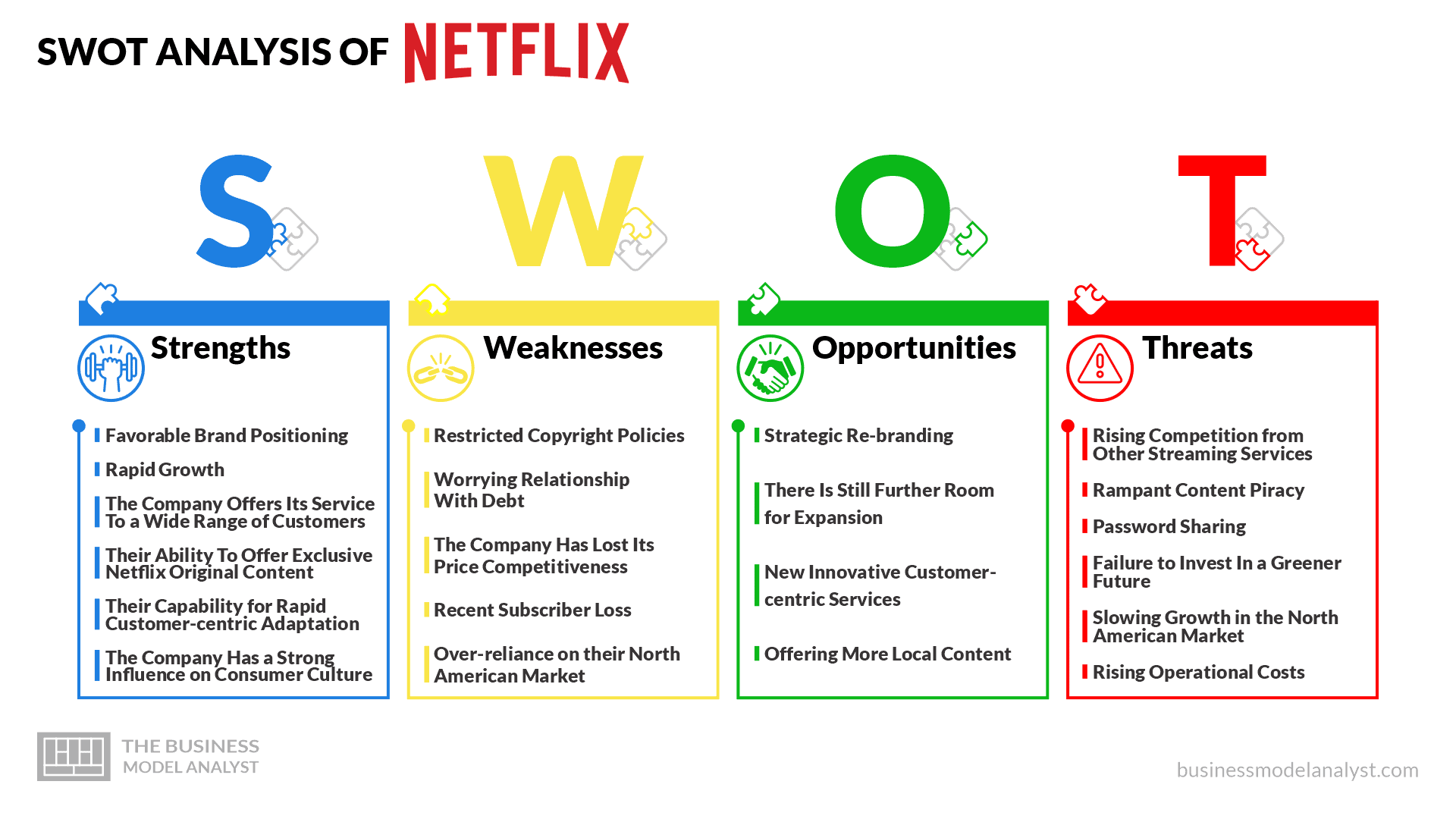

SWOT Analysis

The final component of the Strategy Desk Audit is the preparation of a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis. This analysis offers a holistic view of the company’s internal capabilities and external challenges, informing future strategic decisions. By identifying core competencies, potential vulnerabilities, and emerging opportunities, the SWOT analysis provides actionable insights into how the company can strengthen its value chain and allocate resources more efficiently.

Understanding external threats, such as new competitors, technological disruptions, or changing regulations, helps in creating a proactive strategy to mitigate risks. Internally, recognizing both strengths and weaknesses allows the company to capitalize on areas of success while addressing inefficiencies in the value chain.

Initial Value Chain Inspection

By compiling and analyzing documentation from various departments—such as finance, operations, marketing, and supply chain management—the company can gain an initial understanding of its value chain. This includes identifying how different segments of the company contribute to revenue generation and cost structures, as well as spotting areas where efficiency improvements, resource allocation, or strategic investments could make the most impact.

The Strategy Desk Audit provides a comprehensive overview of a company’s current strategy, allowing for an informed approach to optimizing the value chain. This step ensures that strategic initiatives are grounded in a thorough understanding of both internal capabilities and external market dynamics, setting the foundation for successful future endeavors like acquisitions or partnerships.

Chapter 2: Competitive Analysis

In the Competitive Analysis phase of the Value Chain Inspect process, the focus is on identifying and understanding the key competitive threats facing each major component of a company’s value chain. A thorough analysis of these threats is crucial for maintaining a competitive edge in the market. Competition can arise from a variety of sources, including existing competitors, emerging upstart companies, and even disruptive innovations such as free or low-cost technological solutions like Google search or AI-powered tools.

This stage of analysis aims to determine where the greatest risks and opportunities lie, providing a strategic foundation for future decision-making regarding acquisitions, partnerships, or internal innovations. Understanding the competitive landscape allows the company to better position itself within the industry and proactively address any potential disruptions to its value chain.

Identifying Competitive Threats

Competitive threats can manifest in several forms, depending on the segment of the value chain in question. For example, in the “product sourcing” part of the value chain, competitors might innovate through better sourcing strategies, introducing cost-effective alternatives or superior products. Starbucks, for instance, might face direct competition from companies like Peet’s Coffee or Costa Coffee, which could innovate by using different types of coffee beans or by adopting more sustainable or efficient sourcing methods. Such innovations can directly impact the quality and cost structure of Starbucks’ operations, thereby threatening its market position.

Beyond direct competitors, companies can face indirect threats from adjacent industries or upstart companies offering alternative solutions. In the coffee industry, for instance, the rise of home-brewing devices like Nespresso, Keurig, or De’Longhi poses a significant challenge to traditional coffee retailers. These products offer consumers a convenient, cost-effective way to enjoy premium coffee at home, reducing the need for them to visit coffee shops. Similarly, emerging brands like L’Or, with innovative approaches to coffee production and distribution, present additional challenges.

Other threats can arise from technology or new platforms that provide low-cost or even free solutions, such as Google search or ChatGPT. These technologies, though not always direct competitors, can disrupt various aspects of a company’s value chain by offering alternatives that shift consumer behavior. For example, AI tools can change how customers search for or purchase products, thereby impacting companies in retail, services, or manufacturing.

Porter’s Five Forces for Competitive Analysis

Porter’s Five Forces is an essential framework for conducting a Competitive Analysis during the Value Chain Inspect phase. It helps companies systematically evaluate the competitive pressures they face in their market environment. This framework breaks down competition into five key areas:

1. Threat of New Entrants: New companies entering the market can pose significant threats, especially if they introduce disruptive innovations or technologies. In many industries, upstart tech companies can enter with new business models or solutions that attract customers away from traditional players. By analyzing barriers to entry and the likelihood of new competitors, a company can assess how vulnerable it is to disruption.

2. Bargaining Power of Suppliers: The influence suppliers have over a company’s value chain can significantly impact operational costs and product quality. If key suppliers innovate or change their pricing strategies, this can directly affect a company’s cost structure and ability to compete. A company must assess whether its suppliers hold a strong position and how shifts in the supplier landscape could influence its competitiveness.

3. Bargaining Power of Buyers: Customers increasingly expect higher value for lower costs, which can force companies to innovate or lower prices to retain market share. Analyzing buyer power allows companies to understand how sensitive their customers are to price changes or alternative solutions, which is particularly relevant when new, lower-cost technologies like AI tools enter the market.

4. Threat of Substitutes: Substitute products or services are often a major source of competition. For instance, Starbucks competes not just with other coffee shops but also with home coffee machines like Nespresso and Keurig. Identifying these substitutes and understanding their appeal helps companies anticipate changes in consumer behavior and adapt their value chain accordingly.

5. Industry Rivalry: The intensity of competition between existing players can vary significantly by industry. High rivalry often forces companies to continuously innovate and reduce costs to maintain their market position. By analyzing the level of competition, a company can better understand how aggressive its strategic moves need to be in order to stay ahead.

The Competitive Analysis is a vital component of the Value Chain Inspect process. It helps companies identify not only direct competitors but also the broader landscape of threats and opportunities that could impact each part of the value chain. Whether the competition comes from existing players, new entrants, technological innovations, or substitutes, a clear understanding of these dynamics allows companies to proactively adjust their strategies.

Porter’s Five Forces framework provides a structured approach to this analysis, helping companies assess their competitive position and make informed decisions about resource allocation, product development, and potential acquisitions. By recognizing and addressing competitive threats early on, companies can safeguard their value chains and position themselves for long-term success.

Chapter 3: Identify Stakeholder Goals

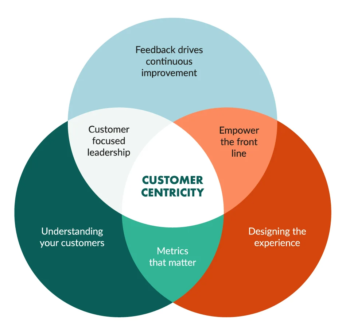

In the Identify Stakeholder Goals phase of the Value Chain Inspect process, the primary objective is to understand how the various components of a company’s value chain align with the expectations and objectives of its key stakeholders. A company’s stakeholders can include shareholders, employees, customers, suppliers, regulators, and the broader community. Each of these groups has distinct goals and interests, and the company must ensure that the operations within each part of the value chain are aligned with these expectations.

By identifying and addressing stakeholder goals, a company can ensure more efficient operations, foster innovation, mitigate risks, improve sustainability, and enhance stakeholder communication. These efforts contribute to long-term success by aligning the company’s activities with the diverse interests of those who have a vested interest in its success.

Aligning Value Chain Operations with Stakeholder Expectations

Each segment of a company’s value chain, whether it involves sourcing, production, distribution, marketing, or customer service, must be aligned with the expectations of various stakeholders. For example, shareholders typically prioritize financial returns, which are driven by operational efficiency, profitability, and growth. In this context, aligning the company’s production processes with stakeholder goals might involve streamlining operations to reduce costs or enhancing product quality to drive revenue growth.

Employees, on the other hand, may focus on job security, career development, and a positive work environment. Aligning value chain activities with employee expectations could involve investing in training and development programs or implementing technologies that enhance productivity without jeopardizing job satisfaction.

Similarly, customers expect high-quality products and services at reasonable prices. Ensuring that the value chain meets these expectations might involve improving supply chain management to ensure timely delivery of products or leveraging innovation to offer better products at competitive prices.

Driving Efficiency and Innovation

Stakeholders also expect companies to drive efficiency and innovation, particularly in highly competitive industries. Innovation within the value chain can manifest in various forms, such as improving production processes, adopting new technologies, or enhancing customer service. Companies that actively seek to innovate are more likely to meet or exceed stakeholder expectations, as innovation often leads to improved products, lower costs, and better customer experiences.

Efficiency is equally critical, as it ensures that the company can operate at optimal cost levels while maintaining or improving quality. This is particularly important for stakeholders such as shareholders, who are often concerned with profit margins and long-term financial sustainability. By optimizing operational efficiency, companies can enhance their competitiveness and ability to generate value for stakeholders.

Mitigating Risks

Another key aspect of aligning value chain operations with stakeholder goals is the mitigation of risks. Stakeholders are often concerned with various risks, ranging from financial to reputational, operational, and regulatory risks. For example, shareholders might be worried about financial risks associated with fluctuating markets, while regulators are concerned with compliance and the company’s adherence to industry standards.

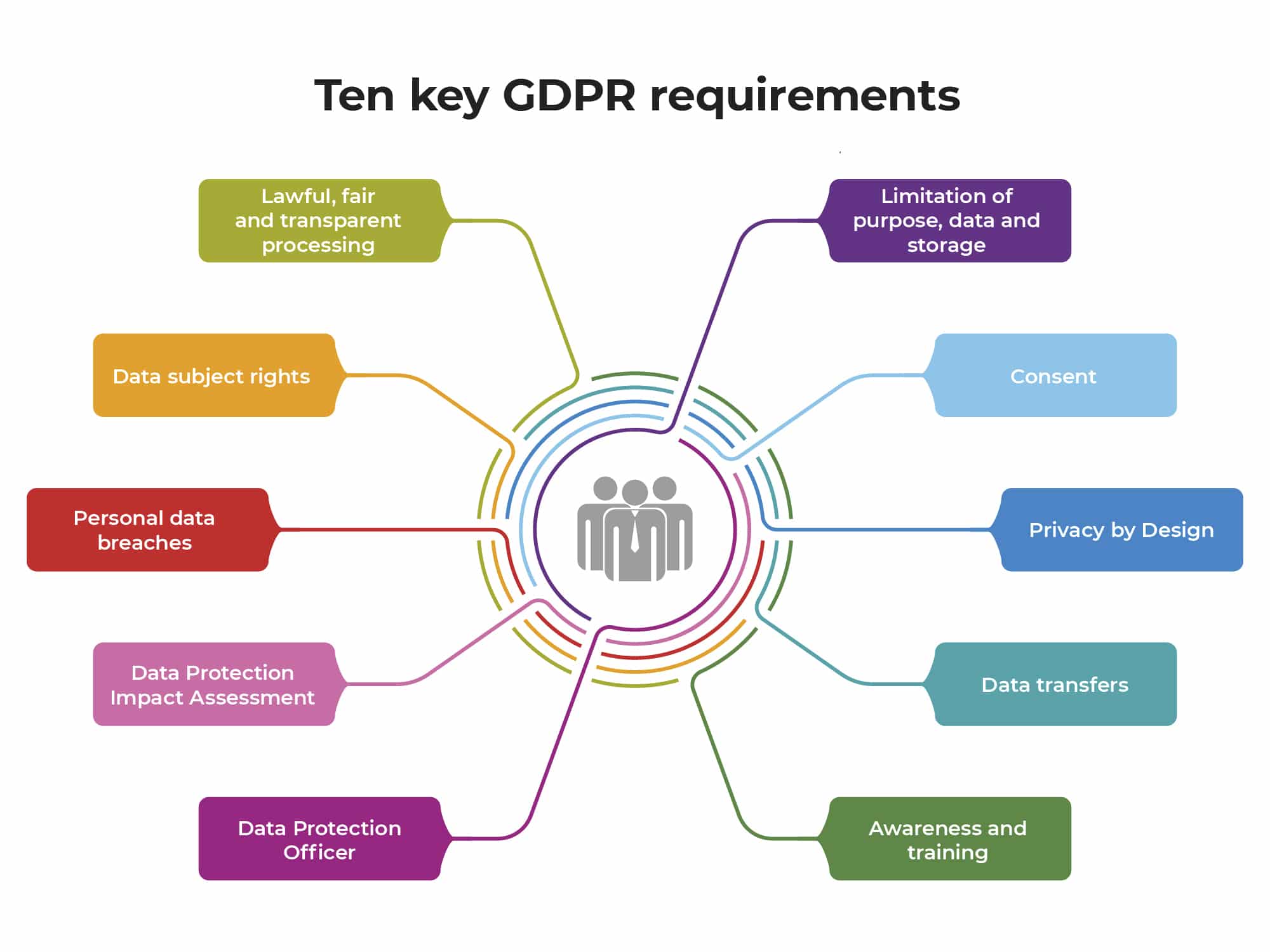

Companies must proactively identify potential risks in their value chain and implement strategies to mitigate them. This could involve diversifying suppliers to reduce dependency on any single source, implementing robust cybersecurity measures to protect against data breaches, or ensuring compliance with environmental regulations to avoid legal penalties. By addressing these risks, companies can provide stakeholders with the confidence that their interests are being protected.

Ensuring Sustainability

Sustainability is an increasingly important goal for many stakeholders, particularly as environmental concerns continue to grow. Customers, investors, and even regulators are now expecting companies to adopt sustainable practices in their value chain, from sourcing materials responsibly to minimizing waste and reducing carbon emissions. For example, a company’s procurement processes might need to focus on using renewable resources or ensuring that its suppliers adhere to fair labor practices.

Aligning the value chain with sustainability goals not only meets stakeholder expectations but also enhances the company’s reputation and market position. Companies that are perceived as socially and environmentally responsible are often more attractive to investors, customers, and employees.

Improving Stakeholder Communication and Engagement

Effective communication and engagement with stakeholders are critical for improving decision-making and ensuring that the company’s strategies are aligned with stakeholder goals. Companies must establish clear communication channels to regularly inform stakeholders about their progress, challenges, and initiatives related to the value chain.

For example, shareholders require transparency regarding the company’s financial performance and strategic decisions, while employees may need updates on operational changes that affect their roles. Customers benefit from clear communication about product availability, pricing, and quality improvements. Improving engagement with stakeholders through these communication efforts fosters trust, enables more effective decision-making, and ensures that stakeholder interests are considered in the company’s overall strategy.

The Identify Stakeholder Goals phase is essential for ensuring that a company’s value chain aligns with the diverse expectations of its stakeholders. By focusing on operational efficiency, innovation, risk mitigation, sustainability, and communication, companies can create value for all stakeholders and strengthen their long-term strategic position. This alignment is critical for building trust, driving performance, and ensuring that the company remains competitive and adaptable in an ever-changing business environment.

Chapter 4: Identify Value Chain Inflection Points

In the Identify Value Chain Inflection Points phase of the Value Chain Inspect process, the focus is on recognizing the critical moments or places within the company’s operations where significant changes or decisions can have a dramatic impact on performance, competitive advantage, or overall value creation. These inflection points represent pivotal opportunities or risks within the value chain, and understanding them is crucial for maintaining or enhancing a company’s competitive edge in the market.

Identifying these points allows a company to make strategic adjustments that can lead to substantial gains or, conversely, help mitigate potential losses. By analyzing key activities, external factors like technological advancements and regulatory changes, and internal shifts within the organization, companies can better navigate these crucial moments and capitalize on them for long-term success.

Key Activities and Processes

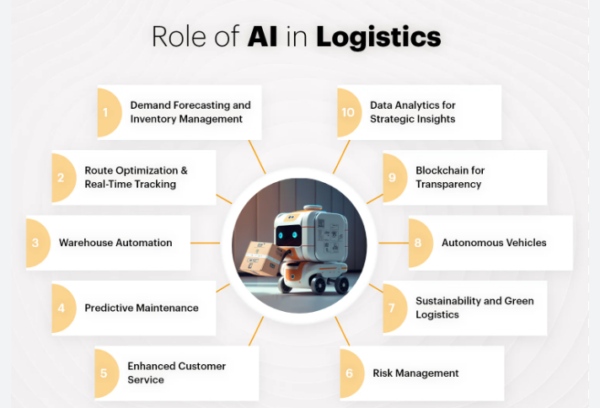

A common source of inflection points lies within the company’s core activities and processes, such as supply chain management, production, distribution, marketing and sales, and customer service. These activities form the foundation of the company’s value chain, and any significant change in how they are managed can either strengthen or weaken the company’s market position.

For instance, if a company identifies inefficiencies in its supply chain management and implements new strategies to optimize sourcing or logistics, it can drastically improve operational efficiency, reduce costs, and enhance product delivery times. Conversely, if a competitor enhances its customer service operations by leveraging new technology or streamlining communication channels, the company may face a critical need to adapt or risk losing market share. By regularly evaluating these core processes, companies can identify inflection points where adjustments will yield the greatest benefit.

Technological Advancements

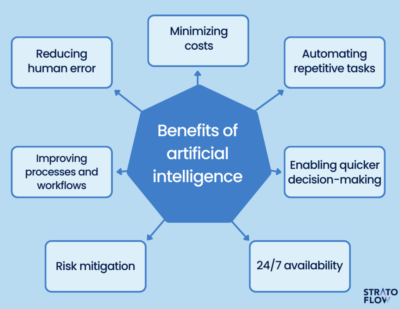

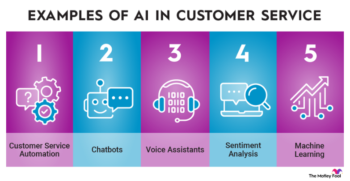

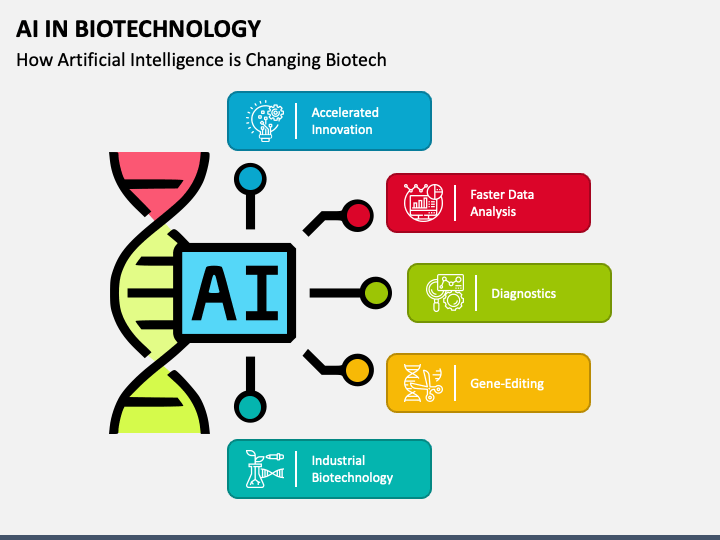

Technological advancements often serve as major inflection points in a company’s value chain. When new technologies are introduced, they can render existing processes obsolete or create new opportunities for value creation. For example, the rise of artificial intelligence (AI) and automation has had a profound impact on industries ranging from manufacturing to customer service. AI-powered tools can streamline operations, improve decision-making, and offer personalized customer experiences, which were not possible with traditional methods.

If a company fails to embrace technological advancements while its competitors do, it risks falling behind in terms of efficiency and innovation. On the other hand, identifying the right technological inflection points can lead to substantial competitive advantages, such as cost savings, improved product quality, or enhanced customer satisfaction.

Regulatory Changes

Changes in laws or regulations can also create inflection points within a company’s value chain, forcing companies to adapt quickly to stay compliant. For example, a new environmental regulation that mandates reduced carbon emissions could require companies to adjust their production processes, invest in cleaner technologies, or shift sourcing strategies to meet the new standards.

Failure to comply with regulatory changes could result in fines, penalties, or reputational damage, making these inflection points critical for maintaining operational continuity. Conversely, companies that anticipate and adapt to regulatory changes early may gain a competitive advantage by positioning themselves as industry leaders in compliance and sustainability.

Market Dynamics

The competitive landscape is always evolving, and changes in market dynamics—such as the entry of new competitors, shifts in consumer demand, or mergers and acquisitions—can create significant inflection points. For example, a company may face pressure if a new entrant introduces an innovative product at a lower price point, forcing the incumbent to reevaluate its pricing strategy or product differentiation.

Similarly, shifts in consumer preferences, such as a growing demand for eco-friendly products, can prompt companies to rethink their value chain strategies. In these cases, identifying and responding to market dynamics early can prevent loss of market share and allow the company to capitalize on emerging trends.

Internal Organizational Changes

Significant internal changes within the company can also act as value chain inflection points. Leadership transitions, mergers, acquisitions, or shifts in company culture often have ripple effects throughout the organization. For example, a change in leadership might lead to a new strategic direction, impacting everything from production priorities to marketing strategies.

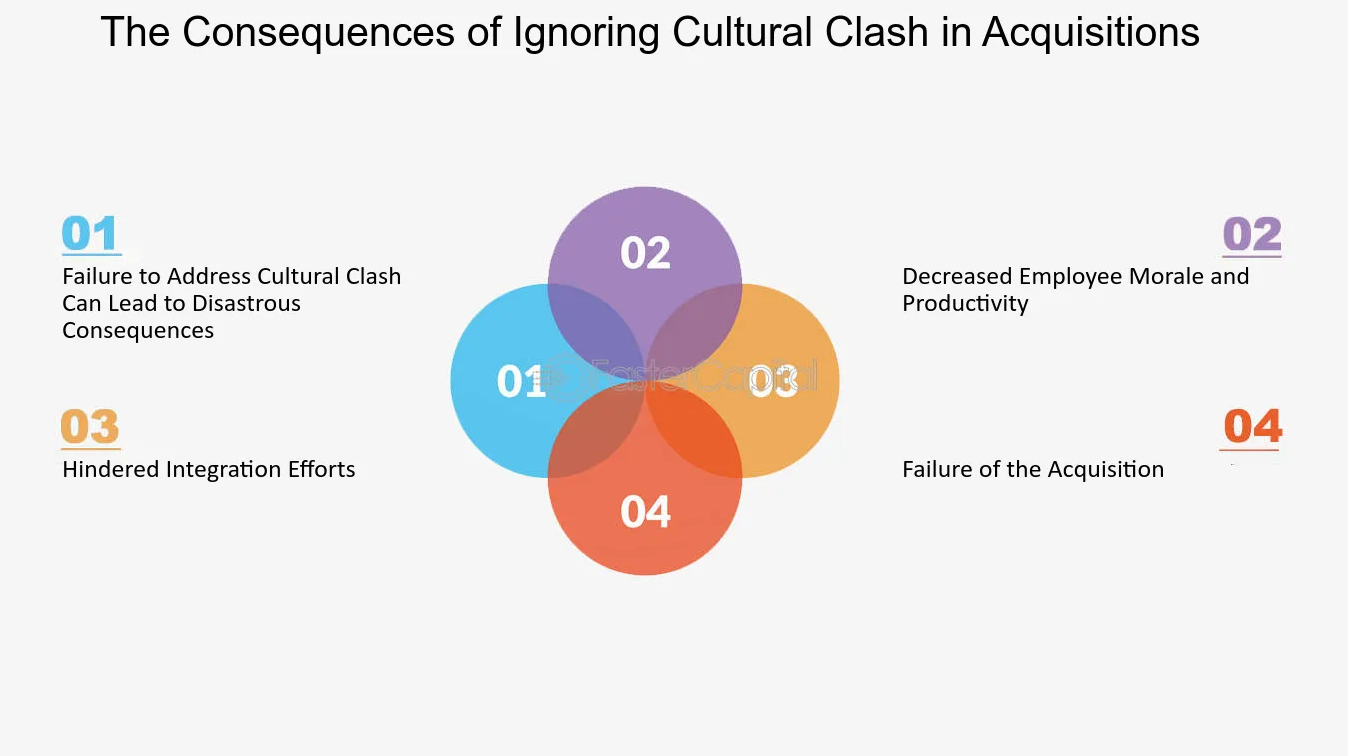

Similarly, mergers or acquisitions can introduce new capabilities, technologies, or markets, which can be pivotal in reshaping the value chain. However, these internal changes can also introduce risks, such as misalignment of goals or cultural clashes, making it essential to identify these inflection points and manage them carefully to ensure smooth transitions.

Economic Factors

Finally, macro-economic factors such as inflation, recession, or shifts in global trade policies can create inflection points that significantly affect the value chain. For example, rising inflation may increase production costs, forcing companies to adjust pricing strategies or explore cost-saving measures in their supply chain.

Global economic trends, such as changes in trade policies or tariffs, can disrupt sourcing and distribution networks, particularly for companies that rely on international suppliers. Identifying these economic inflection points allows companies to make proactive adjustments, such as diversifying supply chains or hedging against currency risks, to protect their value chain from potential disruptions.

In the Identify Value Chain Inflection Points phase, companies gain a strategic advantage by recognizing critical moments where changes or decisions can have a significant impact on their performance and competitive standing. Whether these inflection points are driven by internal processes, technological innovations, regulatory shifts, market dynamics, organizational changes, or macro-economic factors, identifying them early allows companies to respond effectively. This proactive approach helps companies mitigate risks, seize opportunities, and ensure their value chain remains resilient and capable of delivering long-term success.

Chapter 5: Example Target Companies

In the Example Target Companies phase of the Value Chain Inspect process, the objective is to identify and describe potential technology companies that could serve as interesting targets for acquisition or partnership. These example companies should align with various components of the acquiring company’s value chain, offering opportunities for improvement, innovation, or competitive advantage. While these companies are identified purely as examples, they provide valuable insights into the types of businesses that could add strategic value across different parts of the value chain.

The process of identifying these example companies is relatively straightforward. It can be done through basic online searches or by using specialized databases. The key is to apply the insights gathered from earlier phases—such as the company’s strategic goals, competitive landscape, stakeholder objectives, and value chain inflection points—to refine search parameters. These parameters help in narrowing down the list to companies that could bring significant benefits to the acquiring company’s operations.

Identifying Potential Target Companies

To find example target companies, the process begins with establishing relevant search parameters based on the insights from earlier stages of the Value Chain Inspect phase. These parameters may include specific technologies, industries, or business models that align with the acquiring company’s value chain needs. For example, if the goal is to enhance supply chain management, the search could focus on tech companies specializing in logistics optimization, blockchain solutions for supply chain transparency, or AI-powered demand forecasting tools.

Additionally, databases like Crunchbase, CB Insights, or PitchBook can be used to filter companies based on size, revenue growth, technological capabilities, or market positioning. These tools provide detailed insights into company financials, technology focus, and market trends, allowing for a more targeted search of potential acquisition or partnership candidates.

Example 1: A Logistics Optimization Company

One example target company could be a logistics optimization startup that offers AI-driven solutions for managing complex supply chains. For a company that relies heavily on efficient product distribution, such as a retail or manufacturing business, this type of technology could transform its logistics operations. The company might offer predictive analytics, real-time tracking, and automated decision-making tools to optimize inventory management and reduce transportation costs.

For the acquiring company’s value chain, this logistics optimization technology would improve the distribution and supply chain management segments. By streamlining these processes, the company could reduce operational expenses, improve delivery times, and enhance customer satisfaction—all of which would contribute to better financial performance and a stronger competitive position in the market.

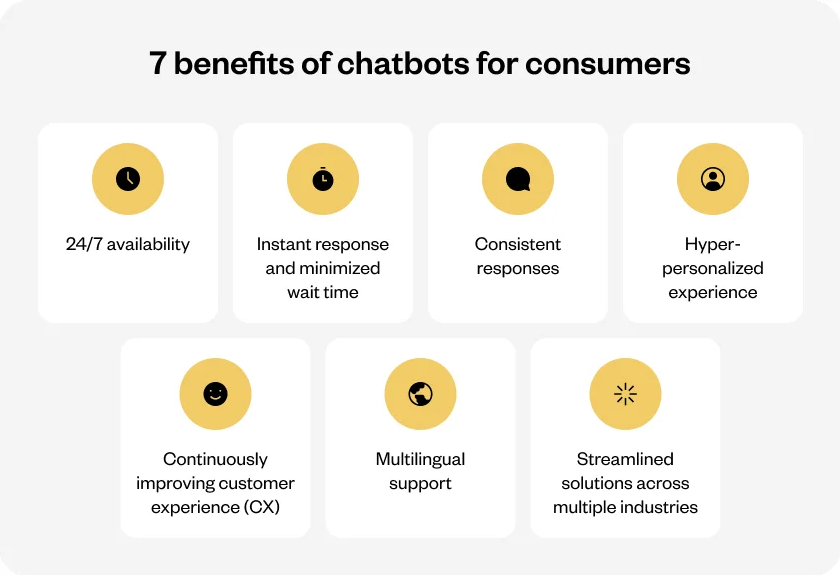

Example 2: A Customer Service AI Platform

Another potential target could be a tech company specializing in AI-powered customer service solutions. With AI chatbots and automated customer support tools, such a company could help businesses provide faster, more personalized service while reducing the need for large customer service teams.

For a company looking to improve its customer service operations, acquiring or partnering with a business like this could dramatically reduce response times, improve customer engagement, and provide valuable data insights into customer behavior. This type of technology integration would also enhance efficiency and lower costs, making it a valuable addition to the value chain. By automating routine inquiries, the acquiring company’s human support staff could focus on more complex issues, improving overall service quality.

Example 3: A Sustainable Packaging Innovator

Sustainability is increasingly becoming a key concern for many companies, and a company specializing in sustainable packaging solutions could be an attractive target. Such a company might focus on developing biodegradable, recyclable, or reusable packaging materials, which can help businesses meet regulatory requirements and align with consumer demand for environmentally friendly products.

For a company operating in industries like food and beverage, cosmetics, or e-commerce, where packaging is a critical part of the production and distribution processes, acquiring a sustainable packaging innovator could significantly enhance their environmental impact and brand reputation. Integrating sustainable materials into the supply chain would not only reduce the company’s carbon footprint but also improve relationships with eco-conscious customers and regulators.

Example 4: A Cloud-Based Collaboration Platform

A fourth example target company could be a cloud-based collaboration platform that enhances communication and project management across teams, especially in large, global organizations. With features like real-time collaboration, file sharing, and integrated communication tools, this platform could streamline workflows and improve efficiency across various departments.

For a company focused on enhancing internal communication and organizational efficiency, this type of technology could transform how teams work together, especially in remote or hybrid work environments. The integration of a powerful collaboration platform could reduce project turnaround times, minimize errors, and improve overall productivity, thus positively impacting the company’s operational efficiency and competitive advantage.

The Example Target Companies phase of the Value Chain Inspect process helps identify potential tech companies that align with specific needs in the acquiring company’s value chain. By focusing on areas such as logistics optimization, customer service, sustainability, and internal collaboration, the company can identify valuable opportunities for innovation, efficiency, and competitive differentiation.

These example companies serve as a guide for what to look for when considering acquisitions or partnerships, offering strategic solutions to enhance value chain performance. The process of finding these companies involves using targeted search parameters informed by earlier analysis, ensuring that the chosen targets align with the company’s broader goals and strategic initiatives.

Chapter 6: Value Creation Potential Analysis

The Value Creation Potential Analysis phase of the Value Chain Inspect process focuses on assessing how a technology company acquisition could generate shareholder value across different parts of the acquiring company’s value chain. The objective is to identify which segments of the value chain—such as sourcing, research and development (R&D), production, distribution, marketing, or customer service—present the greatest opportunities for value creation. This high-level assessment allows companies to prioritize areas where an acquisition could yield the most significant returns, thereby enhancing overall competitive advantage and long-term growth.

The analysis measures potential value creation by evaluating how a tech acquisition could impact key parameters in each area of the value chain, including enhancing competitive advantage, cost efficiency, revenue growth, and strategic positioning.

Enhancing Competitive Advantage

A tech acquisition can significantly boost a company’s competitive advantage by providing access to new capabilities, technologies, or processes that competitors may not have. For instance, acquiring a tech company with advanced AI algorithms or automation tools could enhance the production or distribution processes, allowing the acquiring company to deliver products faster and more efficiently. By securing such advantages early, companies can outperform competitors, gain market share, and position themselves as leaders in their industry.

In this context, the most fertile ground for value creation might be areas of the value chain where competition is most intense, such as R&D or product innovation, where cutting-edge technology could provide a distinctive edge.

Cost Efficiency

One of the most immediate benefits of acquiring a tech company is the potential for cost efficiency. For example, if a tech company specializes in supply chain optimization or automation technologies, integrating these tools into the sourcing or production segments of the value chain could lead to significant cost savings. Automated processes could reduce labor costs, increase productivity, and minimize waste, directly contributing to higher profit margins.

Evaluating the value creation potential in this area involves assessing which part of the value chain is currently facing high operational costs and where technology could streamline processes. Areas like sourcing and production often present substantial opportunities for cost reduction through automation, better procurement strategies, and improved logistics.

Revenue Growth

Acquisitions can also drive revenue growth by expanding product offerings, improving customer service, or opening new markets. For example, acquiring a tech company with expertise in digital marketing or e-commerce could transform the acquiring company’s marketing and sales efforts. New technologies could enable better targeting of customer segments, optimize advertising strategies, and personalize customer experiences, all of which contribute to increased sales.

Identifying value creation potential in this area requires an understanding of how a tech acquisition could tap into new revenue streams or enhance existing ones. For many companies, value creation opportunities will be found in the customer experience and marketing segments of the value chain, where technology can help boost brand visibility and customer engagement.

Strategic Positioning

Strategic positioning involves aligning a company’s strengths with emerging market trends and consumer demands. Acquiring a tech company with expertise in a rapidly growing sector can elevate the acquiring company’s position within the industry. For example, a company that acquires a tech firm focused on AI or green technologies could improve its strategic positioning by entering a fast-growing market and addressing critical issues like sustainability or digital transformation.

The value creation potential here often lies in the company’s long-term strategy, where the acquisition helps solidify the company’s place in an evolving marketplace and positions it for sustained growth.

Technological Synergy

A tech company acquisition can also create value through technological synergy. This occurs when the acquiring company can integrate the acquired company’s technology into its existing operations to improve efficiency, innovation, and scalability. For example, acquiring a cloud computing startup could provide better data management capabilities across the value chain, from production to distribution and customer service.

The key is identifying where technology integration will have the most impact, often in the R&D or IT functions, where technological upgrades can drive operational improvements across the entire company.

Flexibility and Agility

In an increasingly fast-paced and competitive business environment, flexibility and agility are critical for responding to market changes. Acquiring a tech company that enables greater agility—whether through cloud solutions, automation, or data analytics—can empower the acquiring company to quickly adapt to new trends or challenges. Flexibility can enhance production and distribution processes by enabling companies to scale operations efficiently or pivot to meet changing customer demands.

The value creation potential in this area often comes from improvements in logistics, supply chain management, or customer service, where agility is most critical for staying ahead of competitors.

Risk Mitigation

Acquisitions can also mitigate risks by strengthening a company’s position in areas like cybersecurity, regulatory compliance, or operational reliability. For example, acquiring a tech company with expertise in cybersecurity can help protect the company from data breaches or fraud, which could otherwise have significant financial and reputational consequences.

In this case, the value creation potential lies in risk management strategies within the value chain, where an acquisition could shore up vulnerabilities or provide solutions to potential threats.

Talent Acquisition

One of the often-overlooked benefits of a tech acquisition is the ability to acquire top talent. The tech industry is highly competitive, and having access to a team of experienced engineers, developers, or data scientists can provide a significant advantage. These talented individuals can drive innovation in R&D, product development, and even customer service, helping the acquiring company stay at the forefront of technological advances.

Customer Experience Improvement

Improving the customer experience is a major driver of value creation. Acquiring a tech company with expertise in user experience (UX), digital platforms, or AI-driven customer service tools can dramatically improve how customers interact with the company’s products and services. This leads to increased customer satisfaction, loyalty, and ultimately, revenue growth.

Long-Term Strategic Alignment

Finally, value creation potential can be found in aligning the tech acquisition with the company’s long-term strategic goals. Acquisitions that support a company’s vision for future growth, whether through market expansion, technological leadership, or operational efficiency, create lasting value and position the company for sustained success.

The Value Creation Potential Analysis phase focuses on identifying areas of the value chain where a tech acquisition can have the greatest impact. By assessing factors such as competitive advantage, cost efficiency, revenue growth, and strategic positioning, companies can determine which segments of their value chain are most fertile for creating shareholder value and achieving long-term success.

Chapter 7: Availability of Opportunities

The Availability of Opportunities phase of the Value Chain Inspect process focuses on understanding the theoretical number of opportunities available for acquiring or investing in a technology company across different segments of the value chain. This assessment is crucial because it helps determine the likelihood of finding suitable target companies for acquisition or partnership in later phases of the acquisition process. The core idea is that, in general, the greater the pool of available companies, the higher the probability of finding a target that aligns well with the acquiring company’s strategic goals.

For each part of the value chain—whether it be sourcing, R&D, production, distribution, marketing, or customer service—the availability of target companies can vary widely. In some areas, there may be only a few thousand potential target companies, while in other areas, there could be tens of thousands or even over 100,000 possible companies to consider. This variation in availability directly impacts the approach to the acquisition process and the level of strategic planning required to identify and evaluate the best opportunities.

Evaluating Opportunities by Value Chain Segment

The first step in assessing the availability of opportunities is understanding how each segment of the value chain presents different levels of opportunity for acquisitions or investments. For example, the R&D and technology development segments may have a particularly large pool of tech startups, innovation hubs, and specialized companies. These companies focus on areas like artificial intelligence, machine learning, automation, and data analytics, making this segment fertile ground for identifying innovative partners or acquisition targets that could drive technological advancements for the acquiring company.

In contrast, segments such as production or sourcing may have fewer available opportunities due to the more specialized nature of these operations. Tech companies focused on revolutionizing production processes through advanced manufacturing technologies or enhancing sourcing through supply chain innovations may be fewer in number. Nevertheless, companies in these areas often have a significant impact on cost efficiency, operational improvements, and competitive advantage, making them valuable targets despite the smaller pool of options.

Quantifying Opportunities: Large vs. Small Pools

The availability of opportunities in a particular segment of the value chain can be classified broadly into “large” and “small” pools based on the number of potential target companies.

In large pools, such as those associated with digital marketing, e-commerce, or customer service platforms, there may be tens of thousands of tech companies. The rise of digital platforms and technologies has resulted in an abundance of companies focusing on improving customer experiences, optimizing digital marketing strategies, or enhancing sales processes through AI-driven analytics and automation. The sheer number of companies in these spaces increases the probability of finding an ideal target, offering a range of options for acquisitions or partnerships that can lead to revenue growth, better customer engagement, and enhanced competitive positioning.

On the other hand, small pools are more likely to be found in specialized areas such as production, sourcing, or logistics optimization. In these segments, the availability of technology-driven companies might be more limited. However, the fewer available opportunities do not necessarily equate to lower value. In fact, these specialized companies often provide high-impact solutions, such as advanced manufacturing technologies or supply chain transparency tools, which can significantly improve operational efficiency and lower costs. In such cases, although the number of potential targets may be limited, the strategic benefits of acquiring a company with the right technological capabilities can be substantial.

Benefits of a Larger Pool of Opportunities

When there is a large pool of available opportunities in a particular value chain segment, it generally increases the chances of finding a company that aligns closely with the acquiring company’s strategic needs. The larger the number of target companies, the more options there are for evaluating fit based on factors such as technology alignment, company culture, financial health, and strategic goals.

Moreover, a larger pool of target companies enables greater flexibility in the negotiation process. With more options available, the acquiring company can afford to be selective and ensure that the chosen target meets all of its criteria. It also creates a more competitive environment among potential targets, which can lead to better deal terms or partnership opportunities.

For instance, in the digital transformation segment of the value chain, where technologies like cloud computing, AI, and big data analytics are widespread, there are countless opportunities for acquisitions. The abundance of companies in this space allows an acquiring company to focus on finding the perfect technological fit, whether it’s a company that excels in data management, cybersecurity, or customer experience optimization.

Challenges of a Smaller Pool of Opportunities