Technology Company Acquisition

The Appleton Greene Corporate Training Program (CTP) for Technology Company Acquisition is provided by Mr. Cuatrecasas MBA BA Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

Mr. Cuatrecasas is an investment banker, entrepreneur and author. During his career, he has helped hundreds of companies on mergers, acquisitions, capital raisings, company sales, divestitures, restructurings, leveraged buy-outs and a wide variety of strategic issues. He has over 30 years of experience executing strategic deals and delivering proven, actionable strategies for executives to learn how to find the right tech company to acquire and how to do the acquisition in the right way.

He understands from experience that most companies don’t have programs or systematic methodologies ways to “techquify” their operations and advance their strategic positioning. When they do try to acquire or invest in technology companies, competing priorities and inertia get in the way. As a result, most established companies and their ambitious executives go too slow and never unlock their full potential.

His training offers executives a step-by-step approach to all the tricks in the tech company acquisition game, from how to find the right tech start-tech, how to develop the right approach, how to get the lowest possible price and the best terms and do a win-win deal that delivers a 10-100x ROI.

Mr. Cuatrecasas has served as the Founder and CEO of Aquaa Partners, an investment banking firm based in London. Previously he was the Founder and a Partner of Alegro Capital from 2003-2010. Previous to Alegro Capital, Mr. Cuatrecasas was the co-founder and Managing Director of ARC Associates from 1993-2003. (ARC Associates was a leading independent London-based TMT mergers and acquisitions advisory practice with a full range of blue chip and entrepreneurial clients including Sonera, Cable & Wireless, Apax, Marconi, Equant, ICL, KKR, Permira and BT, amongst others). Prior to ARC Associates, Mr. Cuatrecasas was a Senior Associate with Arkwright Capital (ex-Bain & Co. partners), an M&A and Corporate Finance advisory firm in London (1991-1993) and with GE Capital in their LBO and Restructuring Group in New York (1989-1991).

Over the past thirty years, Mr. Cuatrecasas has completed over fifty merger and acquisition transactions around the world worth more than $25 billion dollars and over 70 corporate finance advisory and strategic consultancy assignments.

Mr. Cuatrecasas holds an MBA from Columbia University where he was awarded the Roswell C. McCrea Scholarship and a BA from Wake Forest University. Mr. Cuatrecasas holds dual US and UK citizenship and speaks fluent Spanish. Mr. Cuatrecasas has been quoted in The Washington Post, The Los Angeles Times, US News & World Report, and Forbes. He lives (most of the time) in London with his wife and three children.

To request further information about Mr. Cuatrecasas through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Technology Company Acquisition

Companies today are faced with challenges from every corner, but perhaps the greatest challenge emerging is from technology and artificial intelligence (AI). When it comes to AI, executives can choose to do nothing, assuming the threat is still premature, or they can take action to reap full advantage now of AI as it evolves.

Mark Cuban summed up this challenge well when he said “AI is going to change everything, but it’s going to be a partnership between humans and AI, not a competition.”

Klaus Schwab, Chairman of the World Economic Forum, is concerned decision makers are too focused on the short-term:

This corporate training on tech company acquisition is for executives either who are feeling trapped by “immediate concerns” or who are thinking strategically about the future. Both are yearning for their problems to go away. Both can solve their problems by learning more about how to thrive in the new world of technology and AI. This training is for those executives who want the “magic wand” they can wave to thrive in this new world, but only for those who also understand that earning the right to this “wand” requires time, effort, training and discipline.

As company profits come under more and more pressure, and as AI and automation become more commonplace, job losses will only increase. Traditional companies are already struggling to recruit the best and the brightest, and then after they’re hired to not lose them to technology companies. To recruit and keep the best people today, and to maintain and grow profits, these companies need a new way of operating. They need to become technology companies themselves.

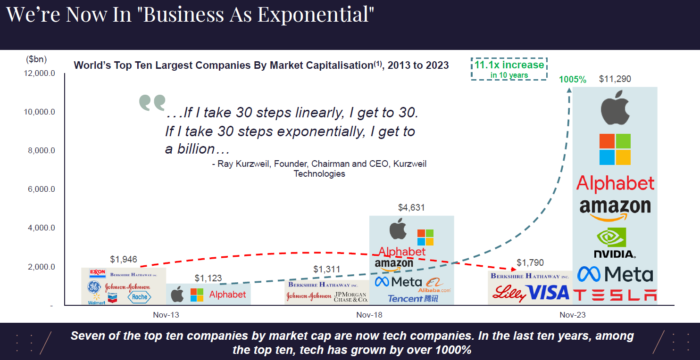

The majority of industry market value today rests in, and from now on will always rest in technology companies. The best thing a company can do therefore to protect its future is to become a technology company.

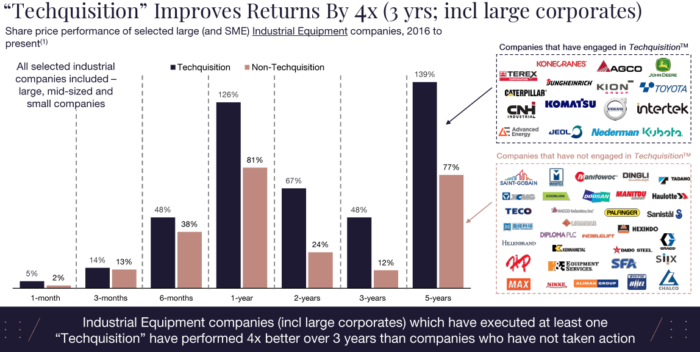

The best way to become a technology company is not just by hiring top software engineers, data scientists and technology consultants. They are expensive and very hard to find and you will lose most of them soon enough anyway. Rather, a traditional company becomes a technology company by partnering with technology companies, including most importantly by investing in them and acquiring them.

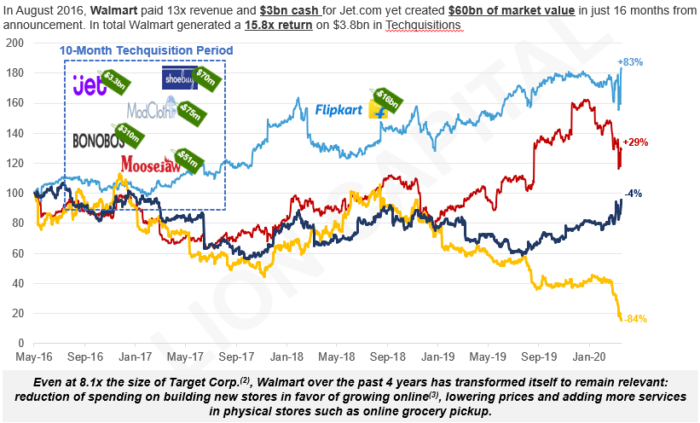

To truly move the needle on stakeholder value you will need to acquire technology companies. In 2016, Walmart saved its legacy and transformed its future when it acquired loss-making Jet.com for $3.3 billion. As a result of this deal, Walmart increased its market value by $60 billion in just 16 months, generating a 15.8x return on its investment in Jet. A few years later, Walmart went on to acquire control of Flipkart in India for $16 billion, a deal that would have been unthinkable had Walmart not succeeded and bent company culture with Jet.com.

Acquiring the right technology company can give you a 10x “turbo boost” in achieving industry leadership and maintaining it. However, you have to do it the right way.

This tech company acquisition training program offers that right way. It offers you a revolutionary approach to transforming legacy companies into forward-thinking industry leaders through the strategic investment in and acquisition of tech company disruptors.

The program also incorporates the implementation of a tangible process within your organization that enables key stakeholders to be more proactive about the way they do this internally.

The training allows executives of established companies to master each of 12 phases so they can discover innovative acquisition strategies and mindset shifts to future-proof their bottom line in the era of AI and exponential technology advances.

Every day we read about new exponential technologies – ChatGPT, self-driving electric vehicles, robots, virtual reality, drones, cloud computing, deepfakes, cultured meat and fish, quantum computing, brain-computer interfaces, cybersecurity, self-flying taxis, CRISPR, crypto and Web 3.0, photonics, hyperloop – the list goes on. These technologies are disrupting the entire value chain – from production to consumption – of most industries around the world. And it is growing, faster and faster. This disruption is allowing for new competitors to emerge, but it is also allowing the opportunity to acquire new customers, and more cheaply, as well as to find new suppliers. Indeed, the only limit to growth and transformation today is one’s own imagination, combined with one’s capability to execute, which is heavily influenced by awareness, education and training.

The new technologies emerging today are undoubtedly creating an abundance of opportunity for established companies who are willing to embrace rapid change without sacrificing their core goals. But to take advantage of the these opportunities in AI and digital and technology, companies need to know what is the right thing to do, and what is the right way to do it.

Case Study

In 2015, Walmart began to be seriously threatened by Amazon. Amazon, an e-commerce machine, had expanded well beyond books into all forms of retail while Walmart was still struggling to grow its own e-commerce business. Walmart’s operating earnings were in decline during this period while Amazon was growing at a tremendous pace. Walmart’s earnings before interest and tax (EBIT) declined by 5 percent between the first nine months of fiscal year (FY) 2015 and the first nine months of FY 2016. Meanwhile, Amazon’s gross profits grew by nearly 38 percent during the same period.

Walmart’s decline in operating performance compared to Amazon’s performance was reflected in the two companies’ share prices. From January 5, 2015, to August 1, 2016, a period in which the S&P 500 index rose by 6.8 percent, Walmart’s share price declined by 17.5 percent while Amazon’s share price rose by 160 percent. In the race to dominate the US retail market, upstart Amazon was racing ahead while stalwart Walmart was in decline.

Walmart could have chosen to do nothing or tried on its own to “fix” its broken e-commerce operation. Instead, Walmart chose to adapt via acquiring a tech company. It decided to evolve into a technology company rather than be forced into oblivion. In August 2016, Walmart made a bold move – it agreed to acquire a loss-making, online, e-commerce start-up, Jet.com, for approximately $3 billion in cash and $300 million in shares, which represented thirteen times Jet.com’s historical revenue, or 20x higher than Walmart’s own revenue multiple of 0.5x. To a relatively uninformed outside observer, this might seem like an expensive, unwarranted, and even dangerous price to pay.

However, the acquisition of Jet.com helped Walmart raise its game to another level, and it went on to acquire another four digital companies in the twelve months after agreeing to acquire Jet.

A mere sixteen months after the deal, Walmart’s market value had increased by $66 billion (approximately 30 percent), from $223 billion in August 2016 to $288 billion in December 2017, which represented an approximate 18x return on investment for Walmart’s shareholders.

Then, in May 2018, Walmart agreed to acquire 77 percent of Indian digital e-commerce company Flipkart for $16 billion, an acquisition that Walmart probably could not have even contemplated before it acquired Jet.com.

In 2016, Walmart was filing patents for “smart” shopping carts, and by 2018, the company was filing patents for in-store drone assistance, blockchain-powered delivery-truck fleets, and virtual reality shopping. By October 2018, Walmart’s chief executive officer Doug McMillon said, at Walmart’s annual investor gathering, “We’re changing. We’re adapting. We continue to transform.”

As “expensive” as the Jet.com acquisition was perceived to be at the time, it has proven to be transformational for Walmart. It has helped shape Walmart into an extremely innovative company. and demonstrates the difference between executing a genuine digital transformation versus the more common and usually ineffective quest for “optimization.” It is a shining example for all traditional companies to emulate. Walmart, that giant old bricks-and-mortar small-town conservative US retailer, by executing the acquisition of a technology company has actually become a technology company itself.

More encompassing than “how-to” training, this tech company acquisition training program strengthens the executive mindset. It was designed for ambitious corporate executives who are eager to implement the future-focused actions vital to survive and thrive today.

Benefits

With this training you can expect to identify, seize and execute smart strategic investments and acquisitions to radically improve your company’s positioning.

In this training you will discover:

• The keys to turning your business into a fully modernized contender

• How the right acquisitions not only protect your market position, but transform your share price

• The levers of value creation required to multiply established corporations’ market value

• The methodology and tactical ploys to acquire tech companies with little risk

• Important factors in bringing technological talent into your culture without breaking it, and much, much more

This training offers unparalleled insights into how you can maintain your company’s success in a disruptive market climate.

Results

Completing the 12 phases of the tech company acquisition training can deliver an acquisition (or a strategic investment, joint venture, or exclusive partnership) that can completely transform your company, protecting profits, keeping and growing jobs and creating shareholder value for many years to come.

When executed properly, the right technology-company acquisition can convert a traditional company from a “disruptee” to a “disruptor,” which can be exciting and extremely rewarding for all involved, from management and staff to customers, suppliers, and shareholders: the company’s entire ecosystem.

Curriculum

Technology Company Acquisition – Part 1 – Year 1

- Part 1 Month 1 Value Chain Inspect

- Part 1 Month 2 Search & Identify

- Part 1 Month 3 Diagnose

- Part 1 Month 4 Target

- Part 1 Month 5 Contact

- Part 1 Month 6 Engage

- Part 1 Month 7 Value Assess

- Part 1 Month 8 Value Retain

- Part 1 Month 9 Offer

- Part 1 Month 10 Agree

- Part 1 Month 11 Confirm and Close

- Part 1 Month 12 Leverage

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Technology Company Acquisition corporate training program.

Technology Company Acquisition – Part 1 – Year 1

- Part 1 Month 1 Value Chain Inspect – In this first and critically important step of the TechquisitionTM method, the company’s senior executive management commits to creating value through finding and investing in or acquiring (or otherwise instigating a joint venture or exclusive partnership with) the right technology (or digital) company. If the CEO and senior management do not believe it is possible to transform the market value of their company via tech company acquisition, then the TechquisitionTM effort will likely fail. The commitment must be in place. A corporate initiative that is begun from a nice-to-have or let’s-see-what-happens position rather than a need-to-have or must-do mindset is doomed to fail. Too many other competing priorities will get in the way. If the board is not supporting, and, in many cases, leading the charge, then it should at least be aware of the inorganic innovation effort and ideally confirm the value-chain inflection points and specifications proposed by management concerning the type of characteristics the ideal target company should have. Assuming a commitment is confirmed, then the company’s senior management should take the time to review and check the board’s decision and specifications to strategically invest in or acquire a technology company. This should include a thorough inspection of the company’s value chain—assess the opportunities and check strategic imperatives against the industry and market trends, the competitive environment, and the company’s positioning, and assess the needed capabilities, the customer demands, and the evolving technological landscape.

- Part 1 Month 2 Search & Identify – Properly searching for the right target company is perhaps the most important phase of all, and among the most difficult. It should start as soon as the company has committed to a clear path forward, established the specifications, and assigned roles and responsibilities for achieving a successful result. The company should undertake a comprehensive global search—even if it means assessing all three hundred thousand technology companies—to identify all available targets that fit the specifications. While in its core business a company might be more concerned with geographic location, in the technology industry location does not matter so much; instead, focus on the full package of value, which includes the value of the team, the IP, the know-how, and the target’s skills and capabilities. To find this value, leave no stone unturned. This is the scarce value that delivers the 10x to 100x strategic return on investment—it is worth spending serious time, money, and effort to find it. Assume nothing when you search, since making assumptions can cause you to miss what you are looking for. Having scouts scattered everywhere might be a good idea for core business acquisitions, but it’s a bad idea when shopping for a technology company. The search should be a deliberate, disciplined effort, centrally coordinated and carefully managed so as to avoid mixed messaging. Having the wrong message leaked by a scout to a potential target can create problems in the later phases of the process. Saving nickels and dimes in this phase can cost a company millions in the end, particularly if the wrong company is acquired. The perfect fit is usually out there, and it is worth doing everything possible to find it. Winning Aspiration defines the purpose of your enterprise, its guiding mission and aspiration, in strategic terms. The first choice of the strategic choice cascade is winning aspirations. Here we ask, “what is our winning aspiration.” Strategically, our winning aspiration defines our purpose. Aspirations are a view of the future. Qualified with “winning,” it is the ideal future that we strive to achieve. Unless you deliberately set out to win, it is impossible to do so. A business that only wants to participate rather than succeed will invariably fall short of making the difficult decisions and large investments necessary to succeed. Aspirations that are too modest rather than lofty are much more harmful. Most businesses fail because they have low expectations.

- Part 1 Month 3 Diagnose – After a thorough and rigorous search, it’s time to carefully study the results. When it comes to analysis, you should review the target candidates against a long list of criteria, including company size, profitability, growth, geography, competitive positioning, quality of product or solution, protected IP, scalability of the IP, potential fit (strategic and operational), management team, likely valuation range, and shareholder dynamics. It is advisable not to assume too much or eliminate companies too early. Until you start speaking with the priority target companies, you don’t know the whole picture or the real story. Most company financial data reported in databases is old, and so it represents a fuzzy approximation of a distant past. Probably 80 percent to 90 percent of all websites and product videos are outdated and reveal little of the information that you actually need to be able to make proper judgments and decisions. Additionally, the target company’s product-development road map can matter more than its current product offering. However, understanding this road map is a challenge and requires time and often expert know-how.

- Part 1 Month 4 Target – After having analyzed the long list of potential target companies, you now need to perform a more detailed review to create a short list of companies that you will want to engage. This means that you should not only assess the traditional pros and cons of the target companies on the long list but also ask probing questions (internally and with your advisers) about each candidate, such as “What makes this target company special? What makes it special for us? Why? How well does it fit into our ecosystem?” If you are not sure of the answers, you must get the answers—you should not proceed to the next phase until you have the intel you need. Once you are satisfied, rank and prioritize the target companies and create a short list of the most appropriate companies to contact in the next phase. Typically, you will want to narrow your list down to a maximum of thirty target companies to contact in the next phase; otherwise it can become unmanageable.

- Part 1 Month 5 Contact – Contacting the selected target companies is a delicate and important step. The initial contact should ideally be made by an agent or adviser on a no-names basis (in which the acquiring company is unidentified). This provides an opportunity to collect vital information that can be used both in assessing the target company as well as in setting up a more formal approach in the next phase. Usually, a founder will open up more to an agent than they will when they are talking directly with a prospective strategic partner, at least in the first few calls or meetings. Out of a short list of thirty target companies, you will typically end up with three to eight companies that are worth a formal approach in the next phase. For these short-listed target companies, communications must be handled delicately. The goal of these initial calls is to get the answers to your most important questions, which can only be answered by the target’s founder(s) and management on a one-on-one basis. There are about fifty different questions we typically ask the target’s CEO, founder(s), or primary shareholder, and they can include the following: Why did you (and your co-founder) decide to set up your company? What frustration or problem did you set out to solve? How did you intend to change the world or make the world a better place? How do you see your progress so far? What frustrates you the most now? What really gets you down? Do you like hiring people and managing them? Do you like firing them? Do you like raising capital? How about managing outside investors and VCs? What do you ultimately want to do with this company one day? IPO? Strategic sale? When do you think that will be? Who would you want to sell this company to one day and why? How important is money to you? What is your dream? What would really get you excited? Getting the answers to these questions allows you to (a) create the final short list of companies that could be right for you and (b) craft and compose a unique type of presentation called the ChalkTalk, which we find is particularly effective with getting the final short-listed target companies interested and engaged. (This is to be discussed in detail in the next phase.) In summary, if this phase is executed properly, then after completing the initial calls, you should have whittled your list down to three to eight companies that you want to seriously engage with as you move into the next phase.

- Part 1 Month 6 Engage – The Engage phase is when you first establish direct contact with the target company’s senior management (assuming that you employed an agent to ask the critical questions in the previous phase). Your first direct contact with a short-listed company is extremely important; you never get a second chance to make a first impression. This first impression should be made using a world-class ChalkTalk presentation designed to convince your target that you are the best partner for them even if they are not looking for a partner. The goal of the ChalkTalk presentation is to articulate your vision and explain why you are so interested in the target company. It should inspire and compel the decision makers, both at the target company and your own company, to action. The script focuses on the target company and describes why the acquirer and the target should and could leverage the best of each other. The presentation is not meant to be a sales pitch. Your perspective as a prospective acquirer, strategic investor, or joint-venture partner must be entirely genuine, and the presented vision must be seen as authentic by both the target company’s staff and the acquirer’s staff. The script should be based on what is special and unique about the target company (which you’ll have ascertained during the earlier Diagnose and Target phases and from your agent’s initial call(s) with the target in the Contact phase), and it should incorporate your own vision and strategic thinking as it relates to the target company, your company, and your industry (and perhaps even other related industries). In effect, the ChalkTalk is a similar idea to Amazon’s “Working Backward” approach, which is based on the drafting of a future press release announcing an as-of-yet unfinished product: The press release itself is a gut-check for whether or not the product is worth building. If the team is not excited about reading it, then the document needs to be revised, or perhaps the idea should be revisited altogether. As the team begins development, the press release serves as a guide for the team to reflect on and compare with what is being built.” In a similar way, if the ChalkTalk is prepared (and later presented) properly, it should inspire and form the anchor from which shareholder value will be created. The script should be powerful enough to convince the target that you are the one and only strategic partner for it and dissuade the target from believing that any other company could be as valuable a partner or represent as attractive a future as you do. If you do this well, you will have helped to stave off any competitive threats. While working in this phase and on the script, it’s important to take the time to leverage your network to contact the right people in the target company’s ecosystem—not only to gain additional intel for the script but also to sense check that the articulation of the ChalkTalk will work before you deliver it. Overall, the goal of the Engage phase is to achieve two outcomes: First, establish a fundamental emotional bond or connection with the founders, owners, or management of the target company. You will have studied the target company, probably over several months, and admired them. You’ll want to demonstrate your genuine interest in and concern for the target company. If executed properly, this step helps to lay the groundwork for a successful transaction and working relationship later on. Such relationship building also helps make the target company feel motivated to do a deal with you. Second, you will have set in the target’s subconscious mind an anchor on the price and terms of a potential deal that is more realistic than perhaps the price that would have been agreed on in the target’s last funding round; you will have focused on the target (and not on yourself) and on the bigger plan for your shared win-win “world domination.” Given the deeply considered approach you will have taken with the target—which is, at its core, a genuine approach rather than an opportunistic or tactical one (which is an extremely important and often overlooked distinction!)—you are far more likely to successfully craft a credible joint business plan for the “new” business, as well as structure more creative terms and agree on a price. If the initial talks are successful, then in the follow-up phase, you can ask for NDAs to be signed and you can obtain additional information on the target company that you consider to be especially important. You don’t want to ask for too much information at this point (no one likes to be prematurely overburdened with data collection) but not too little either. As a general point, as you begin to engage with the short-listed companies, you will start to spend serious time and money on the project. This is one reason why the first phase—Qualify and Commit—is so important. You want to make sure that your organization goes into the Engage phase clear on what you want and why you want it. As I have described, you have to be committed and disciplined in how you engage with the selected targets. The Engage phase is when the real culture check begins: you’ll begin a deeper and broader dialogue with the target company’s management team, founders, or shareholders to get a feel for who they are and what they truly value. The target company’s values are very, very important. This is the phase when you can begin to identify the target’s key staff (a category that, by the way, doesn’t necessarily include the CEO) as early as possible and build relationships with them. Ideally, your most senior executives, including those who are running divisions with their own P&Ls (rather than only staff executives), should lead the discussions with the target. The initial meetings can be relatively informal (they’ll tend to become more formal as the process moves on) and present good opportunities to start crafting specific agenda, particularly for the meetings with the key staff of the target company, as the discipline of agenda setting helps prepare for the formal meetings to come. As you build relationships with your priority target company, it’s best if you continue to engage with several companies from the short list. It might turn out that your priority choice is unavailable for a deal or that they choose another strategic partner despite your best efforts. Sometimes, no matter what you do, even after increasing the offer price and enhancing the terms, you still cannot get your priority choice, at which point you turn to the other targets on your short list to see if you can get what you need through one of them. Presuming that the Engage phase progresses well, the next step is to determine whether or not you will proceed to make an offer to complete some form of transaction with the target company. Before you make such a determination, be sure to get as far as you can in preparing a joint business plan for the target’s business that includes any synergies and contributions your company could make, whether you are acquiring, investing, or doing a joint venture or exclusive strategic partnership. This joint business plan will become the basis for measuring the value that both the target company and your own company can gain from the transaction. Your company’s board will judge the business plan as it contemplates approving the deal. The board might also hold you accountable for executing the plan, so get the plan right! Once you’ve constructed a joint business plan, you will also need to prepare a valuation of the target company. This valuation work should use traditional valuation methodologies—comparable transactions, comparable trading companies, discounted cash flow, etc.—as well as non-traditional means of assessing a company’s value, including the company’s IP and its talent assets.

- Part 1 Month 7 Value Assess – When it comes to M&A, beauty is in the eye of the beholder—therefore, it is vital that you thoroughly analyze the strategic fit of the target company with your organization, including all potential synergies as well as points of conflict. This strategic analysis establishes the value of the target more than any other factor. The joint business plan described above will be very helpful in assessing this strategic value. Ideally, you want to construct a valuation of the target based on two scenarios: (a) on a standalone basis and (b) based on your company owning all or part of the target company, which includes the synergy value. This comparison can provide insight and perspective that will prove invaluable when you are in the Offer and Agree phases, during which you’ll need all the leverage and creativity you can find! The Value Assess phase is also the perfect time to review the pros and cons of completing a transaction with the target company versus not completing a transaction. Make sure to include a formal risk analysis identifying risk-mitigation actions. As you value assess the target company, you will inevitably start to consider the price you would be willing to pay (although it is still too early to formalize any concrete ideas on price, deal structure, or terms—too many factors can still change).

- Part 1 Month 8 Value Retain – Once you have a clear picture of the target company’s value, turn your focus toward understanding how you will retain the target’s value after the acquisition or strategic investment is complete. You must start this process now, before you make a formal offer. Many acquirers make the mistake of focusing on the value they can get rather than the value they will be able to retain. Retaining value (via a “bleed-free” acquisition) means keeping the target’s human talent as well as its IP, whether it is “integrated” or not. You have paid for them, so you must keep them. Ensuring that the target company doesn’t bleed what made it great once ownership changes often boils down to getting the incentives right—for all parties—and then properly managing expectations. This is one reason why, ideally before you construct and present your offer, it is vital to perform deep psychometric testing of the managers and staff members at the target company who are likely to influence the success or failure of the deal as well as the outcomes after. Merely interviewing team members and checking references is not enough! The testing should include an assessment of the cognitive, affective, and conative parts of the mind as well as specialist tests to assess how the interviewee feels about the prospect of the deal going through (assuming they are in the know). This testing can be the most important pre-diligence task of all. It is an opportunity to find out who in the target company team is “in” and who is “out.” The results from this testing alone might prevent you from making an offer at all. While most vendors insist that psychometric testing is done only after terms have been agreed on—i.e., when the deal is in the exclusivity period and when the testing is a condition of closing—my strong advice is to do it before an offer is even made, because the intelligence you will gain is a fundamental indicator of the value of the deal. It will affect the price you are willing to pay, the deal structure you are willing to consider, and the terms that you are prepared to offer. If you meet resistance, certainly do everything possible to ensure the testing is done before you sign the definitive documentation that comes later in the Agree and Close phases. Presuming the testing goes well, you’ll be getting ready to prepare an offer. But wait: check again and again that there’s enough of a culture fit, even if the target company would be kept completely separate from the parent business. Often in this Value Retain phase, the decision is made on the basis that if there is no culture fit, then there is no deal. With technology companies, culture can be everything—culture can make or break value. This is one of the reasons why so many senior executives at large traditional companies fear the thought of acquiring a technology company: the start-up culture may just feel too foreign to them. Beyond assessing culture fit, you should qualify and confirm four additional key success factors to achieve a bleed-free acquisition: (a) Can the target’s key talent be retained, and if so, how can it be retained? (b) Can full ownership of the target’s IP be secured, and can the IP rights be protected? And how much does it matter? (c) Will the target’s customers genuinely be happy with this acquisition? Why? Specifically, what is it about the business combination that will cause the target’s customers to be happy? What do we (the acquirer or investor) need to do to make that happen? (d) Will our customers genuinely be happy with this acquisition? Why and specifically how will they be happy? Even if the acquisition or strategic investment relates to a back end or middle part of the value chain such as production, raw-materials sourcing, or logistics, it will still have an important impact on customers, and this impact must be articulated. After completing this phase, you should have enough information and understanding to either prepare an offer and go for a deal with gusto or withdraw. Alternatively, you could put the talks on ice for a while.

- Part 1 Month 9 Offer – If you’ve made it to this point and are ready to make an offer for the target company, you’ve probably already put in three to nine months of serious effort and considerable investment. If it means you’re about to acquire or invest in the right company, then this effort is absolutely worth it. When preparing the offer you will present to the target company, be sure to lead with a thorough articulation of what originally inspired you to approach the target—i.e., go back to the ChalkTalk script that you used in the Engage phase, and use it again in the Offer phase to explain why are you so interested in, excited about, and inspired by the target company and all the amazing value-creating possibilities that will arise from combining the two businesses. Describe what you see as possible for the target, as well as for your own company, and explain what has maintained your interest in the target since you started talking. Many acquirers and strategic investors forget the critical importance of restating the original why when they get to the offer phase, and instead they focus on the technical aspects, such as price, terms, conditions, and timing. But a heartfelt articulation of the why is critically important—it will increase the probability of success, both near term and long term. The articulation of the original why is what helps seal the deal; it can have a major impact on how the decision makers at the target company reflect on the deal. Additionally, your words here can be referred to in discussions post-completion and be used to hold you to account in the future, which really matters to the target. In many cases, the target company will still be run by its founders; they are not only selling their precious shares to you—they are selling their baby. Founders or not, the decision makers are human, and humans are emotional beings. Humans tend to make decisions with their hearts and justify them with their heads, so make sure the emotion you express in your offer (yes, in your offer) is real, and make sure it counts. During this Offer phase, recognize that scarce, fast-growing, innovative companies can attract a crowd and can be snapped up relatively quickly by other bidders, especially after the target has had a strong bite from a keenly interested prospective strategic partner (i.e., you). This means you are unlikely to win hearts and minds with a lowball offer, despite the emotional connections or bonds you may have established already. Warren Buffett commented that “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” If you come in too low on price, you risk insulting the founders, losing your carefully cultivated relationship and the deal itself. Paying a fair price is essential when you are dealing with the best technology companies, which, if you have properly executed phases one through eight of the TechquisitionTM process, you are. If you don’t present fair terms (and present them in the right way), you could very well lose the deal. Technology companies like to be bought, not sold. However, once they have received the first bite, many of them are happy to use it as a bait to see if other prospective buyers will come, even if you have already established a positive and close relationship. In situations like this, when the target company is a rare and scarce asset, you must put your best foot forward and be ready to offer the most attractive terms you possibly can. This is really the key point—if the incentives are not properly set, for all parties, then the deal may be too risky to go through with. One reason for all the deliberate and careful planning and execution thus far is so you can preempt competitive bidding. You’re not talking with average companies; you’re talking with the best, and the best are always in demand. Not only do you want to feel inspired by the target, but you need to be inspiring to them. The target company’s management should be interested enough in you at this stage that they do not want to contact any other competitive bidders. They should know that you are the one—but it is up to you to achieve that. Beyond this, be sure to lead from the front and communicate early and often so you do not have any nasty surprises regarding the arrival of competition. Finally, during the Offer phase, make sure to verify that your supporting in-house team members and external advisers are onboard. Proper preparation for these final phases is important, and your team need to be on your side while you are preparing your offer, not later. Your advisers may include financial, strategy and due-diligence, talent-assessment, legal, accounting, commercial, tax, insurance, executive-compensation, and PR advisers. Once you have constructed your offer, which should contain the key elements of the ChalkTalk, as well as the facts (including the price, structure, terms, and timing), the next step is to present the offer properly. Be ready to negotiate the terms of the offer. Ideally, you should present your offer to the target company during an in-person, face-to-face meeting with the target’s management or board members. Try to include the largest shareholders if possible. This is an extremely important and potentially value-transformative deal for your company. Don’t just send your offer via email. Think of presenting it as a full stadium pitch that compels and inspires; don’t opt for a stale letter of intent or term-sheet document. If, despite your efforts, your offer can’t be made during an in-person meeting with the target company, then present the offer via video conference and plan a meeting (which you can call a “discussion” rather than a “negotiation”) regardless of the target company’s response to the offer. You have made it this far—through nine demanding and disciplined phases—so it is important to keep communicating with the target company, even if they are not yet convinced. There is almost always more than one way to complete a deal that, strategically, is “meant” to be done. In these discussion meetings, ensure above all that you first seek to understand whatever you might not yet have understood from previous discussions. Then, once you really, truly understand the target company’s motivations and you know that they know that you understand, it’s time to ensure that your own motivations have been understood. This is very important for a win-win deal. It can take time. Part of ensuring the target company understands you is to impart as much “pre-suasion” as possible before you enter detailed discussions. Agents can help here.

- Part 1 Month 10 Agree – Presuming you’ve had enough interest to enter detailed discussions, your next objective should be to come to an agreement. If, after you’ve presented your offer, the target company is still talking to you and asking you questions, you have a chance of reaching an agreement. The key is to keep talking and get closer to them; try to achieve the best understanding you can of what they really care about. The ball is usually in your court throughout the process, even after you have made the offer and pursued them. Remember, tech companies like to be bought, not sold. Even if you have presented the best ChalkTalk story in the world and the best offer they could hope for, they need to feel wooed. They want to know how badly you want them and why, because they are selling their baby to you. Even if they are only selling a minority stake, many tech companies still feel like they are “selling out.” Some target companies, after you present your offer, will not say no, but neither will they say yes. They will just go quiet or say maybe; perhaps they’ve been distracted by their own business, perhaps they don’t know what to do, or perhaps they just need to digest the information you’ve presented. Don’t give up on them; check in (politely!) early and often. At the same time, you should be pursuing your second, third, and fourth choices selected during the Contact phase. Once a target is engaging with you on your offer—i.e., they’re asking questions, sending emails to confirm, or even responding by saying, “Thanks, but that’s not going to work for us”—then it’s time to put your negotiation hard hat on. Everyone seems to have their own theory of best practices when it comes to negotiation, as I do, but that’s a topic for another book. The two most important things to understand about negotiations with technology companies are (a) the deal must be a win-win deal, or it will likely fail, and (b) negotiation of an acquisition or strategic investment is all about agreeing to the entire package of value and terms, not just the price. Price is just one of many terms, and there are many others that can be equally as important, at least to the target company and its shareholders. The most important terms of these agreements are the ones that relate to incentives. Companies are made up of people, and people will usually act exactly as they are incentivized to act—or, at least, that is what you should expect and plan for. If the management team of the target company doesn’t get excited about their incentives in making the deal a huge win-win for everyone, then the deal probably won’t be a success. Similarly, if the proper incentives are not in place for the acquirer’s own team to nurture the target company and help bring alive the dream synergies that have been discussed, then the deal is less likely to be a success. Often acquirers (and their advisers) are not aware of the perverse behavioral incentives (from the acquirer’s point of view) that they are constructing for the target company’s management (and their own middle management!) after an acquisition or investment. Wells Fargo’s CEO, Tim Sloan, made clear the negative impact of the incentive mismanagement that caused the biggest banking scandal of 2016 when he said, “We had an incentive plan in our retail banking group that drove inappropriate behavior.” Because the incentives are so important to both sides during this Agree phase, you should be discussing the people at both companies and how they will mix (or not) after closing, even if the target company is not going to be integrated with the parent. The psychometric testing you did earlier will help considerably during these discussions, since you will have a much greater knowledge and understanding of the target’s team. These discussions are a natural follow-up from the joint business planning that you will have done earlier in the process and can often help bridge gaps on terms that emerge in the negotiations. After agreeing on terms, typically via a letter of intent or heads of terms containing an exclusivity period, you are well on your way to closing a deal.

- Part 1 Month 11 Confirm and Close – As instructed by the ancient Russian proverb that President Ronald Reagan used on multiple occasions, you must “trust, but verify.” With terms negotiated and a formal agreement in hand, you are just a few steps away from closing, so you can begin to move from the transaction to maximum value transformation. After you have agreed on terms, you will have a period of several months of exclusivity in which to complete confirmatory due diligence and document the final agreements. You are now checking and confirming everything to ensure you have a deal that is as risk free as possible. This procedure is a good indicator of how you should operate and manage expectations going forward—communicate early and often. When in doubt, communicate!

- Part 1 Month 12 Leverage – The deal is finally closed; however, this doesn’t mean the job is complete. In fact, as you already know, it is just getting started. Properly executing the post-acquisition action plan is critical to remaining bleed-free and creating transformational shareholder value. During the critical first one hundred days, your focus should be on executing the integration of the acquired company (if, that is, you’re going to integrate rather than keep the target separate). You should continually work on understanding how to best lever your core operations via the target company. This includes acclimatizing the target’s people to your culture to create a cohesive (and more efficient) new team. Even if the target is to remain a separate operating subsidiary, there will still be some people-mixing and integration. It’s vital that you and your team think this step through and form a plan ahead of time (ideally starting no later than the Agree phase) so that you can have the proper post-completion supporting mechanisms in place. One smart move may be to hire a post-completion or post-merger integration (PMI) consultant, particularly one with a strong competency in people and culture and significant experience in technology-company acquisitions, even if you are not going to integrate the target company. You could argue against such a hire by saying, “We have executed the first eleven phases to precision, so why do we need a PMI consultant?” And you would be right! The entire point of the TechquisitionTM process is to produce a result based on zero defects and little risk with enormous upside. However, it is always good to have insurance, and insurance is effectively what PMI consults represent. Working with selected staff on your team as well as the acquired company’s key staff, a PMI consultant can bring a fresh perspective to help illuminate blind spots and ensure the magic happens as quickly as possible. In summary, successfully completing the twelve phases of the TechquisitionTM methodology can deliver an acquisition (or a strategic investment, joint venture, or exclusive partnership) that can completely transform your company, protecting and creating shareholder value for many years to come. When executed properly, the right technology-company acquisition can convert a traditional company from a “disruptee” to a “disruptor,” which can be exciting and extremely rewarding for all involved, from management and staff to customers, suppliers, and shareholders: the company’s entire ecosystem.

Methodology

Technology Company Acquisition

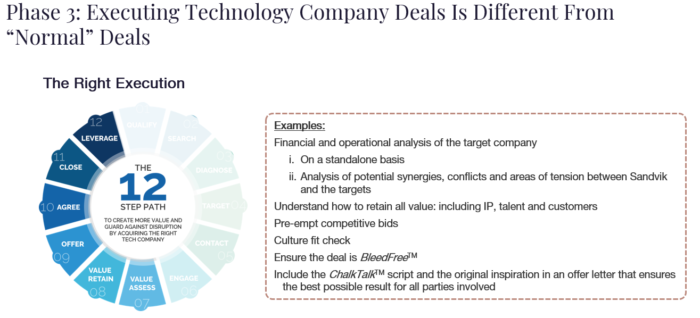

The Tech Company Acquisition program is delivered in 12 steps over three phases. The first phase involves learning how to get clarity and alignment amount the management to arriving at the right short list of target companies. The second phase involves learning how to contact the right people in these companies, in the right way, as well as how to engage with them to secure their interest in you. The third and final phase involves learning how to value the target company properly, make an offer, agree terms, close the transaction and manage the transition and an action plan over the first 100 days.

It’s important to understand that while the methodology of this training is mostly about learning the technical skills of tech company acquisition and how to implement them, it is also about learning how to shift your mindset to be able to achieve a value transformation. You have to believe you can achieve the ultimate goal, while simultaneously applying the holistic aim to eliminate risk through every single step of the deal-making process. The training provides a detailed prescription for the best (and fastest) ways to avoid disruption of your company or division from threats – competitors or otherwise – and create exponential value transformation based on acquiring (or investing in) the right technology companies in the right way.

The first phase of the tech company acquisition methodology, called “Strategy Alignment and Definitive Decision,” involves learning how to determine the top three challenges to the company or division that might be specific, urgent, pervasive, expensive, relevant and/or recognisable. Decide date, participants and format, include forming the key questions. Then there is an exercise that encompasses how to discuss the company’s or division’s existing strategy and approach to innovation and strategic investments and acquisitions, as they impact the company’s or division’s value chain. There are also discussions around the company’s appetite for risk / reward, and existing competitive threats and “Blue Ocean” opportunities. Following this, the program’s participants will learn how to determine the key value chain inflection points, as well as how to “interview” other executives in the company and even competitors.

This work then continues to learning how to find and confirm the right 10-50 target tech companies to invest in or acquire from a universe of over 100,000 potential companies, including “out-of-the-box” (e.g. EnergyTech for Banking, AutoTech for Manufacturing) and learning how to leverage whatever internal or external network of relationships that exist. Importantly, in this phase the program participants learn how confirmation bias and false assumptions that the company may have made in previous “search” projects should be tested.

The training in the second phase, called “Engage,” is focused on learning on how to contact and engage with the short list of target tech companies. The emphasis in this phase is first on learning how to get the vital information and company intelligence that allows you to better assess companies as well as properly set up a more formal in future steps. Training is offered on how to delicately ask certain key questions of the target company management, such as “how did you intend to change the world? What frustrates you the most now? Do you like hiring people and managing them? Do you like raising capital? What is your revenue and profit?” etc.

You will learn how to create the final shortlist of companies that could be right for you as well as craft and compose a unique type of presentation – the ChalkTalkTM – that can be used when moving to the next step of formally engaging with the final list of target tech companies.

The third and final phase of tech company acquisition, called “Execute,” involves learning and applying the science or technical skills, as well as the “art”, of tech company acquisition.

This third phase starts with learning how to value a tech company, including its IP and talent assets, as well as properly assessing the pros and cons of a transaction, such as analysis of the strategic fit, a formal risk analysis identifying risk mitigation actions, beginning to consider the price range you would be willing to pay for the target tech company and the different possible deal structures.

Next you will learn how retain value in a tech company, including its IP and talent, to achieve a “bleed-free” acquisition. The training includes, for example, reviewing how to approach your customers in advance and ask them “would you genuinely be happy with an acquisition like this?” and also the target company’s customers and asking specifically what is it about the business combination that would cause the target’s customers to be happy or not? The training will also address how to manage psychometric testing and discovering how important this can be to a successful transaction.

The training then covers the details of how and when to make an offer on price and terms, how to negotiate and how to build and articulate a strategic business plan in a business combination. The human elements are covered here as much as the technical elements. Then there is training on how to achieve a win-win deal, and how to ensure that it remains a win-win even after the deal is closed. Moving on from the steps of terms being agreed, the training includes how to manage confirmatory due diligence and how to negotiate the final definitive documentation, including how to deal with the “unknown unknowns” that often come up in the latter stages of a transaction. The training includes often forgotten elements such as how to communicate during the negotiation and due diligence process as well as how to manage expectations. Finally we address how to properly execute the post-acquisition action plan in a way to remain “bleed-free” after the acquisition (which most companies are fearful of) and remain on the path to creating transformational stakeholder value.

Industries

This service is primarily available to the following industry sectors:

Manufacturing

The manufacturing industry has transformed profoundly over the past twenty years. This change has been driven by a convergence of technological advancements, global economic shifts, sustainability imperatives, and evolving consumer demands, leading even to the re-thinking of fundamental production and supply chains that were previously taken for granted. At the same time, the next 20 years are full with fear as well as excitement – technological innovation is advancing exponentially while sustainability becomes more of a corporate imperative – leading to an altered industrial landscape.

The evolution of manufacturing over the past 20 to 30 years has been affected significantly by the advent and proliferation of automation and robotics. The surge in automated systems and AI-driven technologies has revolutionized production processes and optimized company operations, helping to deliver greater efficiencies, precision, and scalability while streamlining operating costs. Factories equipped with robotic systems have redefined workflows, supporting a key synergy between human expertise and machine precision. These redefined workflows have altered the nature of work in manufacturing.

Moreover, the emergence and integration of advanced manufacturing technologies, notably additive manufacturing (3D printing), nanotechnology, and sophisticated materials science, have unlocked new realms of possibility. These innovations have led to more intricate designs, more rapid prototyping, and customizable production, offering manufacturers unprecedented flexibility and agility in meeting evolving consumer preferences.

Globalization in the past 20 years has also promoted a proliferation of global supply chains, expanding the reach and accessibility of markets but also exposing gaps and vulnerabilities in systems. Events such as the COVID-19 pandemic brought to life for so many companies the fragility of the interconnected supply networks, prompting a reevaluation of supply chain strategies. The quest for resilience and adaptability in supply chains has gained traction, with a potential shift towards localized or diversified supply networks to mitigate risks posed by global disruptions.

While not necessarily self-imposed by companies, typically given the economic trade-offs, sustainability has nevertheless emerged as a major concern in driving change across the manufacturing sector. Environmental consciousness has spurred a movement toward sustainable practices and manufacturers are carefully assessing eco-friendly materials for products, as well as actively embracing energy-efficient processes and waste reduction initiatives. The goal among manufacturers has generally been to minimize their environmental footprint while adhering to evolving regulatory standards and consumer expectations.

However, far more impactful transformation is likely to unfold over the next 20 years in the manufacturing sector. The use of artificial intelligence (AI) and AI integration are already exploding in a variety of applications, heralding an era of very sophisticated robotics, AI-driven decision-making, and the widespread adoption of digital twin technology. This predictive simulation will revolutionize operations, enabling precise predictive analytics, optimizing production, and minimizing downtime.

Despite the fact that most manufacturers have normalized their supply chains since the COVID-19 pandemic ended, supply chain resilience will remain a pivotal focus area, necessitating a delicate review of trade-offs when choosing between globalization and localization. Manufacturers will have to continue to leverage technology in reconfiguring their supply chains to strengthen resilience while maintaining cost-effectiveness and flexibility. This will lead to an inevitable reimagination of supply chain dynamics, with adaptability and responsiveness being key factors in mitigating future disruptions.

Sustainability will continue to be a driving force of decisions and resource allocation in the manufacturing sector, with an intensified commitment to circular economy principles, renewable energy integration, and the reduction of carbon footprints across the manufacturing value chain and lifecycle. Sustainable practices enhanced by technology will support alignment with environmental imperatives and also serve as a catalyst for innovation and competitive differentiation in the market, particularly given the consumer awareness of the sustainability theme.

Moreover, a shift toward personalized and customized manufacturing is anticipated. Advancements in technology will enable a move away from traditional mass production, facilitating personalized products at scale. This trend, fueled by consumer preferences for unique, tailor-made products, will redefine manufacturing processes and business models, catering to individualized needs efficiently and effectively.

Human-machine collaboration will evolve and eventually explore in applications, emphasizing the augmentation of human capabilities with technological advancements. This collaboration should enhance workplace safety in manufacturing, as well as improve productivity and innovation. If managed properly by companies then manufacturing workforces should feel empowered to adapt to evolving technologies seamlessly.

With all the advances in technology, it can be easy to forget how the dependency of manufacturing operations can lead to fragility from cyberattacks and hacking. Cybersecurity will become increasingly critical across the manufacturing sector. With ubiquitous connectivity and almost complete reliance on digital systems, robust cybersecurity measures will be imperative to safeguard sensitive data, protect intellectual property, and ensure uninterrupted operations in manufacturing. In addition, the integration of biotechnology into manufacturing processes is poised to revolutionize material production and product development. Leveraging biological systems for sustainable manufacturing practices and innovative product designs will drive a paradigm shift in the industry.

In conclusion, the manufacturing industry over the past two decades has experienced remarkable transformations driven by technological innovations, globalization, sustainability imperatives, and evolving consumer preferences. Looking ahead, the industry is poised for radical transformations, marked by artificial intelligence, intensified technological integration, sustainability commitments, supply chain resilience, personalized manufacturing, human-machine collaboration, cybersecurity emphasis, and biotechnology integration. Navigating these exponentially advancing changes will require adaptability, innovation, and a proactive approach to avoid mistakes while embracing the opportunities presented by the ever-evolving manufacturing landscape.

Food & Beverage

Over the past 20 to 30 years the food and beverage industry has witnessed a transformation based on profound shifts in consumer behaviors, technological advancements, and a growing emphasis on sustainability.

Consumer preferences have evolved into a vast variety of personalized products, with a myriad of flavors and nutritional options, based on nuances of health-centric demands and ethical considerations. The demand for healthier alternatives has soared, with organic produce, non-GMO options, and plant-based alternatives taking center stage. For instance, Beyond Meat and Impossible Foods revolutionized the meat industry by offering plant-based meat alternatives that closely mimic the taste and texture of traditional meat, appealing to both vegetarians and flexitarians. However, the complications in their products led to consumer backlash not long after the products were promoted widely into the market.

Technology has been the driving force for personalization, both in terms of how the food or beverage product is made and supplied, but also how it is distributed and sold to the consumer, Digital platforms – both B2B and B2C – have proliferated in all geographies around the world. Furthermore, the cadence of innovation has been relentless, and has resonated through every aspect of the industry. Automation and AI have streamlined processes from farm to fork, optimizing production efficiency and supply chain management. Amazon’s acquisition of Whole Foods, for example, promised to transform the grocery landscape by merging e-commerce prowess with brick-and-mortar convenience, altering consumer expectations and shopping experiences.

Sustainability has also been a driving force of the change witnesses. Environmental concerns have compelled businesses to adopt sustainable practices, including not using certain materials like plastic in the end product. Nestlé’s commitment to achieve net-zero emissions by 2050 and Walmart’s Project Gigaton aiming to reduce greenhouse gas emissions across their supply chain are examples of corporate initiatives in this realm. The drive to reduce plastic waste has seen companies like Coca-Cola and PepsiCo pledging to use more recycled materials in their packaging.

Going forward, health and wellness are likely to continue to be key drivers of innovation and change in the food and beverage industry. Ultra-processed foods (UPFs) are becoming an increasing concern for schools as well as other institutions and families. The industry will need to innovate to eliminate the high amount of food processing as the consumers of food become more and more awars of the dangers of ultra-processing.

The health-oriented innovation will depend on major advances in biotechnology, particularly synthetic biology, and in nutritional science. Personalized nutrition will force a new movement, exemplified by companies like Habit, which analyzes customers’ DNA to provide personalized nutrition recommendations. Functional foods and nutraceuticals will comprise a symphony of products addressing specific health concerns.

Technology will become more and more an enabler of progress in the industry, across the entire value chain. AI integration will accelerate personalization and efficiency, revolutionizing how consumers interact with food. Smart packaging, exemplified by companies like Evigence Sensors, will conduct real-time monitoring of food freshness, ensuring food safety and reducing waste. 3D printing will revolutionize food customization, with initiatives like Barilla’s 3D pasta printer offering personalized pasta shapes.

The future of the food and beverage industry will be harmonized by an even deeper commitment to sustainability over time, fostering a circular economy. Innovations in regenerative agriculture, exemplified by companies like Patagonia Provisions promoting regenerative farming practices, will flourish. Circular supply chains, as showcased by Loop’s reusable packaging platform, will play a central role in minimizing waste and promoting resource efficiency.

The main trends in the food and beverage industry that will unfold over the next five to ten years include cultured or “lab-grown” meat, dairy and fish (of all varieties), plant-based protein and fat including beverages), direct-to-consumer distribution (including incumbents acquiring D2C startups and applying their advanced logistical infrastructure to existing product lines), sugar reduction technologies, pop-up retail, delivery by drone, blockchain-based supply chains and payment systems, beauty-boosting foods, restaurant robots and in-store robots, IoT-connected packaging, automated micro-fulfillment centers and ghost kitchens, personalized food products augmented by AI and 3D printing, e-commerce optimized packaging, upcycling, food waste reduction, meal kits and wellness-focused branding.

Even kitchens all over the world will over time blend diverse cultural influences into a gastronomic tapestry. Consumer demand for authenticity and unique experiences will like drive the popularity of all types of fusion cuisine, including even those offered by McDonald’s spin-off, CosMc’s.

The food and beverage industry has seen monumental change in the past 20 years, however it is now poised for more innovation and growth than ever before. Companies operating in the food and beverage ecosystem will need to harmonize their strategies with evolving trends—fostering innovation, embracing sustainability, leveraging technology, and managing the changing consumer preferences. By seizing on the opportunity for progress, companies can design their own success, resonating with the desires and needs of today’s and tomorrow’s consumers.

Consumer Goods

The consumer goods industry has been transformed in the past two decades by technological advancements, shifting consumer behaviors, globalization, and an amplified focus on sustainability. Executives concerned with how to remain nimble when designing and implementing strategic decisions in such a dynamic environment can decipher current and future trends by assessing the underlying causes and effects of innovation and change.

The digital revolution of the past 20 years has disrupted the consumer goods industry and reshaped consumer expectations, behavior and interactions. For example, over the last decade, global e-commerce sales have surged, exceeding $5 trillion in 2022. Amazon, the pioneer in online retail, witnessed a meteoric rise, with its net sales exceeding $385 billion in 2020, constantly solidifying its dominance in the industry.

The influence of millennials and Gen Z consumers is pronounced and growing. Studies indicate that 73% of millennials and Gen Z consumers are willing to pay extra for sustainable offerings. Brands like Patagonia and TOMS, aligning their values with social causes, have seen significant success, with Patagonia’s revenue reaching $1.5 billion in 2022, evidencing the potency of purpose-driven strategies.

Factors such as globalization and supply chain dynamics in the consumer goods industry was highlighted by the COVID-19 pandemic, which revealed vulnerabilities in global supply chains. According to a survey by McKinsey, 73% of supply chain executives experienced supply chain disruptions during the pandemic. As a result, most businesses have been reevaluating their strategies and planning to increase resilience by diversifying sourcing and manufacturing locations.

Looking ahead to the future, the industry is facing the era of technological convergence, in which technology truly integrates across consumer goods verticals. As an example of this convergence, the global IoT market size is projected to reach $1.6 trillion by 2025, facilitating interconnectedness and data-driven decision-making. Another example is AI-driven predictive maintenance, which can reduce machine downtime by up to 50%, showing its potential to enhance operational efficiency.

Data analytics will allow for continued growth in the consumer goods industry as the right, high quality data can produce valuable insights. Asking the right questions with the right data permits companies to gain a much more clear view of the different ways consumers make decisions. Data scientists can discover fascinating behavior patterns from large amounts of data that they collect, using past behaviors to predict future expectations. The more technology we use around more digitized consumer products, the more that behavior can be predicted. Companies that have quality consumer behavior data make better decisions on project offerings, marketing initiatives and distribution options. This is a significant undertaking, as spending on data and analytics reached $274 billion in 2022, according to recent Statista findings.

Supported by new technologies, personalization strategies are excepted to soar, driven by data analytics and AI capabilities. Accenture reports that 91% of consumers are more likely to shop with brands that provide relevant offers and recommendations. Consumer goods companies implementing personalization have seen sales uplifts of ca 10%, showcasing its efficacy in enhancing customer engagement.

Automation and Cobots – or collaborative robots – are having a major impact on the consumer goods business. Cobots are cheaper, lighter and more versatile than ordinary robots and they physically interact with humans, usually in shared workspaces. They can significantly increase productivity levels, working alongside people, taking on monotonous, repetitive tasks, which reduces human error and can free up capacity for higher-value tasks. By 2025, cobots are expected to account for nearly 35% of all industrial robots and achieved a market value of nearly $10 billion, according to Loup Ventures.

Sustainability in consumer goods products has already become a non-negotiable imperative for brands. Nielsen’s research indicates that 73% of consumers are willing to change their consumption habits to reduce their environmental impact. Brands committing to sustainability, like Unilever, have experienced growth (Unilever’s Sustainable Living Brands grew 69% faster than the rest of the business in 2018).

The changing demographics and evolving lifestyles will continue shape market demands. The global middle class is projected to grow to over 5 billion by 2030, fueling demand for higher-quality consumer goods. Additionally, the aging population, estimated to reach 1.5 billion by 2050, will drive the demand for healthcare and wellness products. Ethical practices also will resonate deeply with consumers. A survey by IBM found that 70% of consumers are willing to pay a premium for brands that are transparent about their business practices. Furthermore, companies embracing ethical sourcing and transparency experience increased brand loyalty and trust, contributing to sustainable growth.

Business executives equipped with the right statistics and insights can manage nimble strategies that adapt to the evolving consumer landscapes, particularly by embracing technology. By harmonizing with these future trends and leveraging the insights from data analytics, consumer goods companies can discover new ways to innovate and grow to remain ahead of the competition.

Insurance

The concept of insurance, as a way of mitigating risk and providing financial protection against unforeseen events, dates back to ancient civilizations and societies where forms of risk-sharing were practiced. Early civilizations such as Babylonian, Chinese, and Greek cultures had informal arrangements resembling insurance. For instance, ancient Babylonians had agreements where traders would distribute goods among various ships to reduce the risk of losing everything if one vessel sank. Similarly, Chinese merchants pooled resources to protect against losses due to theft or damage during transportation. In ancient Greece, mutual aid societies called “benevolent societies” provided financial assistance to members during times of need, resembling today’s insurance principles.

During the Middle Ages and the Renaissance, insurance took more structured forms. Marine insurance emerged in maritime hubs like Genoa and Venice. Merchants and shipowners gathered in coffeehouses and established contracts to distribute risks associated with shipping cargoes across distant lands. This led to the development of Lloyd’s of London, a prominent institution in the insurance world, which originated as a coffeehouse where marine insurance was conducted.

The Great Fire of London in 1666 prompted the creation of fire insurance. Companies began offering policies to protect against property losses due to fire, marking a significant expansion in the types of insurance available. As industrialization progressed from 1760 to 1840, there was a growing need for insurance covering various risks associated with factories, machinery, and workers’ well-being. Life insurance gained prominence during this period, providing financial security to families in the event of a breadwinner’s death.

In the 20th century new types of coverage were introduced, such as health insurance and automobile insurance, addressed the changing needs of society. Government regulations also played a crucial role in shaping the insurance landscape, ensuring solvency and consumer protection.

In today’s modern era, technological advancements have significantly impacted the industry. Insurtech, the integration of technology with insurance, has revolutionized operations. Over the last 20 years, the industry has embraced digitalization to enhance operational efficiency, improve customer experiences, and streamline processes. Insurtech innovations, including AI-driven analytics, IoT-enabled risk assessment, and automation in claims processing, have redefined traditional practices.