Portfolio Optimization – Workshop 1 (Strategic Objectives)

The Appleton Greene Corporate Training Program (CTP) for Portfolio Optimization is provided by Mr. Shankar Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

To be advised.

MOST Analysis

Mission Statement

The foundation of successful portfolio optimization lies in setting clear and measurable strategic objectives. This workshop focuses on defining these objectives in alignment with the organization’s overarching business strategy. Senior management will play a critical role in this phase, ensuring that portfolio goals reflect revenue targets, market share expansion, and profitability improvements. Participants will learn to identify and refine key performance indicators (KPIs) to measure progress toward these objectives. The session also emphasizes the importance of a top-down approach to integrate strategic vision with actionable metrics. By the end of the workshop, participants will have a roadmap for aligning portfolio objectives with company goals, creating a unified direction for portfolio optimization efforts.

Objectives

01. Strategic Planning: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Aligning Objectives with Corporate Vision and Mission: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Top-Down Strategic Planning in Portfolio Design: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Translating Strategy into Measurable KPIs: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Goal Setting Frameworks for Portfolio Optimization: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

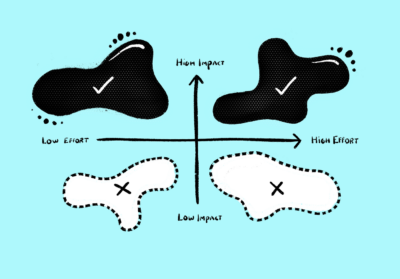

06. Prioritization Techniques for Strategic Goals: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Setting Financial Targets for Portfolio Growth: departmental SWOT analysis; strategy research & development. 1 Month

08. Establishing Market Positioning Goals: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

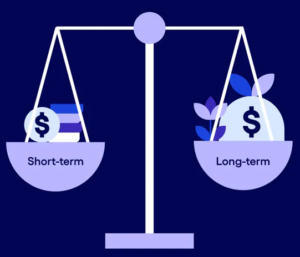

09. Balancing Short-Term Wins with Long-Term Strategy: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

10. Creating a Strategic Roadmap for Portfolios: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Communicating Strategic Objectives Across Teams: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Measuring Strategic Alignment and Portfolio Success: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Strategic Planning: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Aligning Objectives with Corporate Vision and Mission: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Top-Down Strategic Planning in Portfolio Design: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Translating Strategy into Measurable KPIs: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Goal Setting Frameworks for Portfolio Optimization: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Prioritization Techniques for Strategic Goals: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Setting Financial Targets for Portfolio Growth: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Establishing Market Positioning Goals: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Balancing Short-Term Wins with Long-Term Strategy: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Creating a Strategic Roadmap for Portfolios: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Communicating Strategic Objectives Across Teams: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Measuring Strategic Alignment and Portfolio Success: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze Strategic Planning.

02. Create a task on your calendar, to be completed within the next month, to analyze Aligning Objectives with Corporate Vision and Mission.

03. Create a task on your calendar, to be completed within the next month, to analyze Top-Down Strategic Planning in Portfolio Design.

04. Create a task on your calendar, to be completed within the next month, to analyze Translating Strategy into Measurable KPIs.

05. Create a task on your calendar, to be completed within the next month, to analyze Goal Setting Frameworks for Portfolio Optimization.

06. Create a task on your calendar, to be completed within the next month, to analyze Prioritization Techniques for Strategic Goals.

07. Create a task on your calendar, to be completed within the next month, to analyze Setting Financial Targets for Portfolio Growth.

08. Create a task on your calendar, to be completed within the next month, to analyze Establishing Market Positioning Goals.

09. Create a task on your calendar, to be completed within the next month, to analyze Balancing Short-Term Wins with Long-Term Strategy.

10. Create a task on your calendar, to be completed within the next month, to analyze Creating a Strategic Roadmap for Portfolios.

11. Create a task on your calendar, to be completed within the next month, to analyze Communicating Strategic Objectives Across Teams.

12. Create a task on your calendar, to be completed within the next month, to analyze Measuring Strategic Alignment and Portfolio Success.

Introduction

In the complex world of portfolio optimization, success begins not with tools or models, but with clarity. Strategic objectives are the foundation that guide every decision, investment, and trade-off. They define what winning looks like—whether that’s growing revenue, capturing market share, or driving innovation—and translate broad business ambitions into measurable, prioritized action.

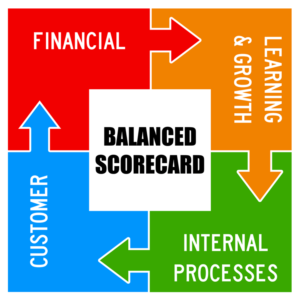

This alignment between portfolio decisions and corporate strategy is not new. Since the mid-20th century, as organizations became more diversified and project-oriented, leaders realized the need for strategic focus. The rise of management thinkers like Peter Drucker and frameworks such as the Balanced Scorecard brought attention to the importance of linking execution with purpose. In the portfolio context, this means using strategic objectives as a filter: which initiatives support growth? Which ones need to pivot—or stop altogether?

Today, with businesses facing heightened competition, constrained resources, and fast-changing markets, aligning portfolios with strategy is not optional—it’s essential. A top-down approach ensures that every investment reflects senior leadership’s vision, and that KPIs are used not just to track progress, but to steer it.

This workshop invites participants to step into that strategic space. You’ll explore how to define meaningful objectives, link them to performance metrics, and create alignment across business units. Most importantly, you’ll leave with a practical roadmap to guide portfolio decisions in service of what matters most to your organization.

The Evolution of Strategic Objectives in Portfolio Management

The concept of strategic objectives within portfolio management has evolved significantly over the past several decades, shaped by shifts in business complexity, globalization, and organizational theory. Originally, portfolio decisions were largely operational—focused on budgeting, timelines, and resource allocation. But as companies grew more complex and faced a broader array of market forces, the need to tie those decisions directly to strategic intent became clear.

The evolution began in earnest during the 1950s and 60s, when business leaders like Peter Drucker emphasized “management by objectives”—the idea that all organizational efforts should be directed toward clearly defined outcomes. This thinking laid the groundwork for later developments in portfolio theory, particularly in large, diversified organizations. As conglomerates became common, leaders needed a way to assess which business units, projects, or investments aligned with overall corporate strategy.

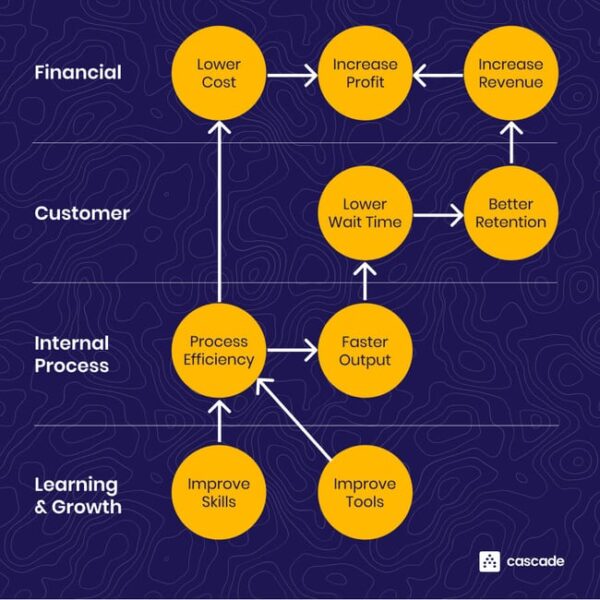

By the 1980s and 90s, strategic management became formalized through frameworks like the Balanced Scorecard (Kaplan & Norton), which introduced a structured way to connect business strategy with measurable performance indicators. Around the same time, project portfolio management (PPM) emerged as a discipline, offering tools and processes to evaluate initiatives not just on feasibility or ROI, but on how well they served strategic goals.

Today, strategic objectives are central to portfolio optimization. Organizations don’t just ask can we do this project—they ask should we, based on our long-term goals. Strategic objectives act as a decision filter, helping leadership evaluate competing initiatives in terms of growth potential, risk, and alignment with corporate vision.

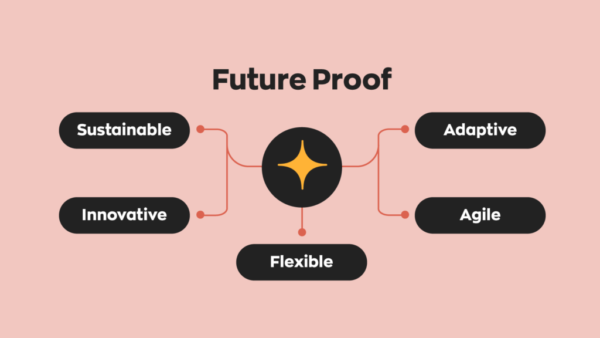

Moreover, the dynamic business environment of the 21st century—characterized by rapid innovation, digital transformation, and stakeholder accountability—has made continuous alignment even more important. Strategic objectives are no longer static declarations; they must be adaptive, data-informed, and constantly reassessed.

In short, the evolution of strategic objectives in portfolio management reflects a broader maturation of organizational thinking. From ad hoc project selection to strategy-led optimization, companies now recognize that the portfolio is not just a collection of activities—it’s the engine of strategy execution. And without clear, evolving strategic objectives, that engine can quickly lose direction.

Why Strategic Alignment is Critical in Today’s Business Environment

In today’s fast-paced, complex business environment, strategic alignment is not just a best practice—it’s a competitive necessity. With limited resources, evolving customer expectations, and increasing market volatility, organizations must ensure that every initiative and investment is directly tied to their strategic goals. Without alignment, even well-executed projects risk delivering minimal value, draining time, money, and attention away from what matters most.

Strategic alignment ensures that all parts of an organization—teams, departments, business units—are moving in the same direction. When portfolio decisions are aligned with the organization’s vision, mission, and long-term goals, it creates clarity, focus, and cohesion. This helps leaders prioritize high-impact initiatives, eliminate duplication, and prevent effort from being spread too thin across disconnected or low-value activities.

In a world shaped by digital transformation, agile development, and constant disruption, the ability to pivot quickly is essential. However, agility without alignment can lead to fragmentation and confusion. Strategic alignment acts as a stabilizing force, ensuring that even as organizations adapt to change, they remain rooted in their core purpose. It empowers teams to make faster, more confident decisions because they understand how their work contributes to the bigger picture.

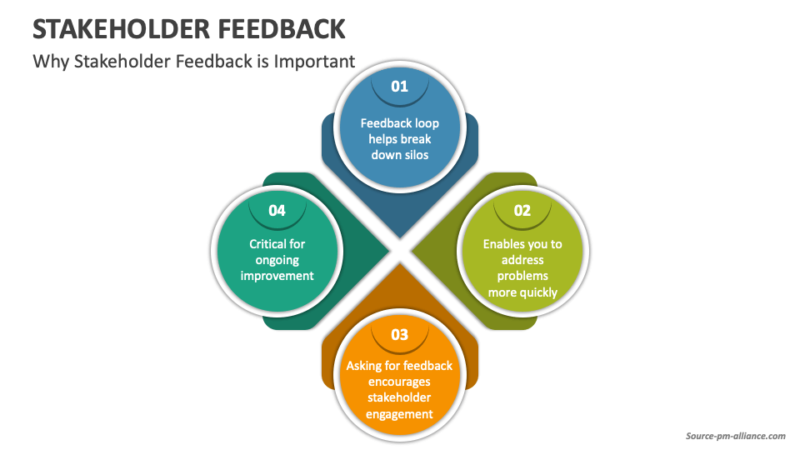

Furthermore, strategic alignment enhances accountability. When goals are clearly defined and widely communicated, performance can be measured more effectively, and teams are more likely to stay engaged. It also strengthens stakeholder confidence—investors, partners, and customers are more likely to trust organizations that demonstrate intentional, focused direction.

One of the biggest challenges in portfolio management is managing competing priorities. Alignment helps resolve this by providing a framework for decision-making. It allows leadership to evaluate initiatives based on their strategic relevance, rather than gut instinct, political pressure, or short-term gain.

Ultimately, strategic alignment is what transforms portfolio management from a tactical function into a strategic capability. It connects everyday execution with enterprise ambition. In today’s environment—where change is constant and resources are finite—organizations that master strategic alignment are better equipped to make smart investments, adapt effectively, and outperform the competition.

The Benefits of Strategic Objectives in Portfolio Optimization

Strategic objectives provide the foundation for focused, effective, and aligned portfolio management. They act as the guiding framework that ensures every initiative, investment, and resource allocation directly supports the organization’s broader mission and goals. Without them, organizations risk making decisions based on short-term pressures, internal politics, or fragmented priorities. When clearly defined and well-communicated, strategic objectives offer a range of tangible and intangible benefits that drive organizational success.

1. Clarity and Focus

One of the most immediate benefits of strategic objectives is the clarity they bring to decision-making. In a world where resources—time, capital, talent—are limited, organizations must make tough choices about where to invest and where to divest. Strategic objectives provide a filter that helps prioritize initiatives based on their alignment with long-term goals. This prevents scattershot efforts and keeps teams focused on what truly matters.

2. Improved Resource Allocation

Strategic objectives help ensure that resources are not just used efficiently, but strategically. Rather than distributing budgets or talent evenly across projects, organizations can direct resources to the initiatives that offer the highest return on strategic value. This leads to better portfolio performance, as high-impact projects are adequately funded and staffed, while low-alignment initiatives are avoided or deprioritized.

3. Enhanced Agility and Responsiveness

In rapidly changing markets, organizations must adapt quickly. Strategic objectives create a stable reference point that helps businesses remain anchored while navigating uncertainty. When new opportunities or risks emerge, leaders can assess them through the lens of existing objectives. This ensures agility is not confused with aimlessness and helps the organization pivot in a focused and intentional way.

4. Strengthened Organizational Alignment

Strategic objectives foster alignment across departments and teams. When everyone understands the organization’s top priorities and how their work contributes to them, collaboration improves. Siloed thinking is reduced, and decision-making becomes more cohesive. This shared direction also enhances morale and engagement—employees are more motivated when they know their efforts are tied to meaningful, strategic outcomes.

5. Better Performance Measurement

Another major benefit is the ability to define success in measurable terms. Strategic objectives are typically linked to key performance indicators (KPIs) or other metrics, allowing organizations to track progress and adjust as needed. This data-driven approach enables smarter decision-making and builds accountability throughout the organization.

6. Stakeholder Confidence

Clear strategic objectives also inspire confidence among external stakeholders—investors, partners, and customers. They signal that the organization is not only visionary but also disciplined in its execution. When stakeholders see a company investing in initiatives that clearly support its strategic direction, trust and credibility are reinforced.

7. Long-Term Value Creation

Ultimately, strategic objectives help organizations move beyond short-term wins and toward sustainable, long-term value creation. They ensure that today’s decisions are paving the way for tomorrow’s growth, competitiveness, and resilience.

In summary, strategic objectives are not just a planning tool—they are a performance driver. They align people, processes, and projects around a common purpose, enabling organizations to make smarter choices, deliver greater impact, and stay focused on what truly drives success.

Case Study: Microsoft’s Strategic Pivot and Portfolio Realignment

In the early 2010s, Microsoft faced growing competitive pressure and technological disruption. With a wide-ranging portfolio that included Windows OS, Office Suite, hardware, gaming, and emerging cloud services, the company appeared to lack cohesive strategic direction. Under then-CEO Steve Ballmer, Microsoft was frequently criticized for being reactive and slow to respond to rapidly changing market conditions, especially in comparison to more agile competitors like Apple, Google, and Amazon.

That changed in 2014 when Satya Nadella took over as CEO. Nadella introduced a bold and unifying strategic vision: to transform Microsoft into a “cloud-first, mobile-first” company. This clear objective served as the cornerstone for an extensive portfolio optimization effort, guiding the company in evaluating, prioritizing, and streamlining its investments and initiatives.

Under this new direction, Microsoft reassessed its entire portfolio. Any product or initiative that did not align with the cloud-mobile strategy was deprioritized or phased out. Significant investments were channeled into Azure, Microsoft’s cloud computing platform, which quickly became a central pillar of the company’s future. At the same time, the company began to shift away from its traditional dependence on the Windows operating system, positioning it as just one element in a broader, integrated ecosystem.

This strategic focus led to several high-profile changes. Microsoft discontinued or scaled back projects that no longer aligned with its objectives, such as its acquisition of Nokia’s phone business and various consumer hardware experiments. Internally, Nadella emphasized cultural change as well—fostering greater collaboration, agility, and innovation while ensuring that the company’s new direction was consistently communicated across all levels.

The results were transformative. Microsoft’s cloud business grew rapidly, making Azure one of the top global cloud platforms. The company regained its status as a technology leader, and by 2021, its market capitalization had soared from roughly $300 billion in 2014 to over $2 trillion. Employees reported a stronger sense of purpose, increased alignment with company goals, and improved cross-functional collaboration.

Microsoft’s story illustrates the power of clearly defined strategic objectives in driving effective portfolio management. By aligning its projects, culture, and resources with a focused vision, the company was able to reorient itself for long-term success. This case highlights how strategic objectives, when applied with discipline and clarity, can be a catalyst for performance, innovation, and sustained growth.

The Role of Senior Leadership in Setting Direction

Senior leadership plays a pivotal role in setting the strategic direction that guides portfolio optimization. Their responsibility extends far beyond approving budgets or greenlighting projects—they are the architects of vision, purpose, and alignment. Without a clear and unified direction from the top, portfolio management can easily become reactive, fragmented, or misaligned with the organization’s long-term objectives.

At its core, strategic direction begins with a deep understanding of the organization’s mission and future ambitions. Senior leaders must translate these ambitions into a set of clear, actionable strategic objectives that inform which initiatives are pursued, which are paused, and which are not worth the investment. This guidance provides a decision-making framework that cascades through every level of the organization.

One of the key contributions senior leadership makes is prioritization. In any business, there are far more potential projects than there are resources to execute them. Leaders must make difficult trade-offs, ensuring that the portfolio reflects not only the current market reality but also the company’s future aspirations. This requires courage, discipline, and a willingness to say “no” to projects that do not serve the bigger picture—even if they seem attractive in the short term.

Beyond decision-making, senior leadership plays a critical role in communication. When executives clearly articulate the rationale behind strategic objectives and portfolio priorities, they create alignment, reduce resistance, and improve cross-functional collaboration. Their visibility and advocacy are crucial in building commitment and fostering a culture where strategic alignment is embedded in everyday choices.

Moreover, leadership sets the tone for performance and accountability. By linking strategic objectives to key performance indicators (KPIs) and regularly reviewing portfolio progress, they reinforce the importance of outcomes over activity. Their engagement ensures that strategy doesn’t live in a PowerPoint deck—it’s actively lived and managed.

In fast-moving environments, leaders also need to be agile, revisiting objectives and direction as circumstances evolve. Strategic direction is not a one-time announcement—it’s an ongoing leadership responsibility.

In summary, senior leadership defines the “why” and “where” of portfolio strategy. Their role is to focus the organization’s energy, inspire confidence, and ensure that resources are aligned with the greatest opportunities for impact and growth. Without this clarity from the top, portfolio optimization is unlikely to succeed.

Creating Organizational Buy-In for Portfolio Objectives

Creating organizational buy-in for portfolio objectives is one of the most critical—and often most overlooked—elements of successful portfolio management. No matter how well-crafted a strategic plan may be, its impact is limited if the people executing it don’t understand, support, or believe in it. Buy-in ensures that the entire organization—not just leadership—moves in the same direction, with a shared sense of purpose and commitment.

The first step toward buy-in is clarity. Strategic objectives must be clearly defined, easily communicated, and directly tied to the organization’s broader goals. Ambiguous or abstract objectives fail to resonate. When people understand why certain initiatives are prioritized and how they connect to the company’s mission, they are more likely to feel ownership over the work. Clear objectives give context to decisions, especially when projects are paused or resources reallocated.

However, clarity alone isn’t enough. Engagement is key. Leaders must involve teams early in the process of defining or refining portfolio objectives. While high-level direction comes from senior leadership, inviting feedback from key stakeholders—across departments and levels—creates space for dialogue and builds trust. People are far more likely to support what they’ve had a hand in shaping. Even if their input doesn’t change the final decisions, the process signals respect, transparency, and collaboration.

Communication also plays a central role. A one-time announcement of new strategic priorities is not sufficient. Continuous messaging through multiple channels—team meetings, internal newsletters, performance dashboards, leadership updates—reinforces alignment and helps keep objectives top of mind. Storytelling can also be powerful: sharing examples of how aligned initiatives have driven impact gives life to the strategy and makes it feel real and achievable.

To foster lasting buy-in, it’s important to show results. Linking portfolio objectives to tangible outcomes and regularly reporting progress builds credibility. When employees see that decisions are producing positive results—such as revenue growth, innovation, customer satisfaction, or efficiency—they’re more likely to stay committed. Recognition is another useful tool; celebrating teams and individuals who contribute meaningfully to strategic goals reinforces desired behaviors and builds momentum.

Resistance is natural, particularly in organizations where change is frequent or past strategies have failed. In these cases, building buy-in also means acknowledging skepticism and creating open channels for concerns. Leaders who listen actively and respond to feedback demonstrate that alignment isn’t about top-down control—it’s about shared success.

Finally, embedding strategic objectives into performance systems (KPIs, OKRs, appraisal processes) ensures that buy-in is not just cultural, but structural. When objectives are reflected in how success is measured and rewarded, they become part of how people operate, not just what they’re told.

In summary, creating organizational buy-in for portfolio objectives is about communication, inclusion, consistency, and credibility. It turns strategic alignment from a leadership ideal into an organizational reality—and lays the groundwork for meaningful, sustained performance across the entire portfolio.

Executive Summary

Chapter 1: Strategic Planning

Strategic planning is the foundation of effective portfolio optimization. It ensures that all initiatives and investments are aligned with both external opportunities and internal capabilities. In a rapidly changing and competitive environment, organizations must continuously reassess how market forces, industry trends, and internal strengths shape their strategic direction.

This lesson emphasizes that strategic objectives are not formed in isolation. They are developed through a deep understanding of the external environment, competitive landscape, and the organization’s internal readiness. By doing so, organizations can move from vague vision statements to actionable portfolio objectives that guide investment decisions and operational focus.

Understanding external market forces is the first critical component. Tools like PESTEL and Porter’s Five Forces help analyze political, economic, technological, and competitive shifts that influence strategic planning. This external awareness enables organizations to anticipate disruption, identify emerging opportunities, and shape portfolio priorities that are externally viable.

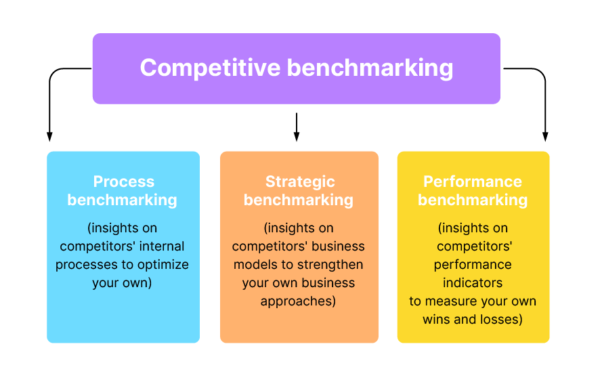

Next, competitive analysis provides insight into how the organization stacks up against rivals. Using SWOT, benchmarking, and competitor audits, organizations can identify threats to their position and areas for differentiation. This informs smarter investment decisions and prevents portfolios from becoming reactive or redundant.

Strategic planning also requires a clear view of internal capabilities and resource readiness. A capability audit helps assess organizational strengths and constraints—from talent and systems to culture and capacity. Evaluating resource availability and alignment ensures that portfolio objectives are achievable, not just aspirational.

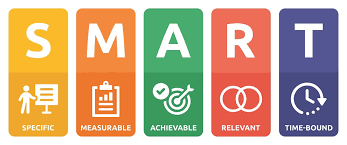

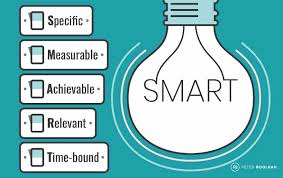

The final step is translating strategic vision into clear portfolio objectives. This involves breaking down high-level vision into strategic themes, then defining SMART objectives with measurable outcomes. Every initiative in the portfolio should link back to one or more of these objectives. Prioritization and stakeholder alignment are essential, as is the development of KPIs to track progress and adapt as conditions evolve.

When organizations integrate external insights, competitive positioning, internal capabilities, and clear strategic objectives, they create a powerful roadmap for portfolio optimization. This approach ensures that strategy is not just planned, but executed with purpose, focus, and agility.

Chapter 2: Aligning Objectives with Corporate Vision and Mission

Strategic portfolio optimization requires more than identifying high-value projects—it demands deep alignment with the organization’s core purpose. This lesson explores how corporate vision, mission, and core values form the foundation for setting meaningful and coherent portfolio objectives. Without this alignment, even well-executed initiatives can feel disconnected or conflict with the organization’s long-term aspirations.

The vision articulates the future the organization is striving to create, serving as an aspirational compass. The mission describes the organization’s current role, offering clarity about what it does, for whom, and how. Core values are the ethical and cultural principles that guide how objectives are pursued. Together, these elements shape strategy, define priorities, and set behavioral expectations.

Translating purpose into portfolio-level objectives ensures strategic intent becomes actionable. This involves identifying key strategic themes—broad focus areas tied to purpose—and converting them into SMART (Specific, Measurable, Achievable, Relevant, Time-bound) objectives. These objectives then guide project selection, prioritization, and measurement.

Embedding core values into portfolio governance ensures that decisions reflect the organization’s identity and not just performance metrics. Values such as transparency, collaboration, or sustainability should be considered alongside financial and operational criteria when evaluating initiatives. Governance bodies should be equipped to assess alignment with both strategy and values.

Embedding core values into portfolio governance ensures that decisions reflect the organization’s identity and not just performance metrics. Values such as transparency, collaboration, or sustainability should be considered alongside financial and operational criteria when evaluating initiatives. Governance bodies should be equipped to assess alignment with both strategy and values.

This alignment process also supports stakeholder engagement and adaptability. Translating purpose into objectives is most effective when it involves diverse perspectives from across the organization. It also requires continuous monitoring and adjustment as market dynamics and strategic priorities evolve.

Ultimately, this lesson emphasizes that aligning portfolio objectives with vision, mission, and values is not a one-time exercise. It is a leadership discipline that connects high-level purpose with day-to-day decisions. When purpose is embedded in the portfolio, organizations operate with greater clarity, consistency, and integrity—ensuring that every initiative contributes meaningfully to the future they aim to build.

Chapter 3: Top-Down Strategic Planning in Portfolio Design

This chapter explores how top-down strategic planning plays a foundational role in effective portfolio design and organizational alignment. Rather than treating portfolio management as a collection of disconnected projects, this approach emphasizes executive leadership, strategic clarity, and structured decision-making to ensure every initiative is working toward shared enterprise goals.

Participants will first explore the role of executive leadership in portfolio planning. Senior leaders are responsible for setting the strategic direction, articulating key priorities, and ensuring that resources—such as funding, talent, and time—are allocated to initiatives that reflect long-term ambitions. They provide the vision and cohesion needed to move beyond departmental agendas and foster coordinated execution across the organization.

The chapter then introduces the process of translating corporate strategy into portfolio criteria. This involves breaking down high-level strategies into tangible evaluation filters, such as customer impact, innovation potential, or alignment with strategic themes. These criteria provide a consistent framework for selecting and prioritizing projects based on value, feasibility, and relevance.

Next, the chapter explores how top-down planning can drive cross-functional alignment. By cascading strategic objectives throughout the organization, leadership ensures that different departments and business units are working in harmony—not competition. Well-designed governance structures and shared KPIs help reinforce this alignment and prevent fragmentation.

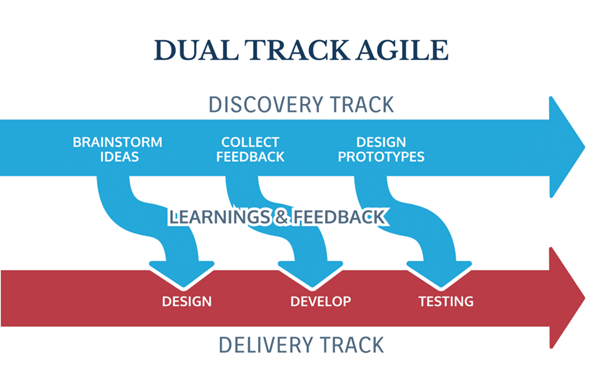

However, top-down planning does not mean silencing the organization’s creative potential. Participants will also examine how to balance executive direction with bottom-up innovation. While the executive team provides strategic guardrails, it’s often frontline teams who spot new opportunities or emerging challenges first. The chapter provides guidance on fostering innovation pipelines, dual-track governance, and feedback loops that keep strategy dynamic and responsive to change.

By the end of this chapter, participants will understand how to design portfolios that are both strategically sound and operationally agile. They will be equipped with tools to connect enterprise-level goals with day-to-day execution, ensure alignment across departments, and create space for innovative thinking from all levels of the organization.

Chapter 4: Translating Strategy into Measurable KPIs

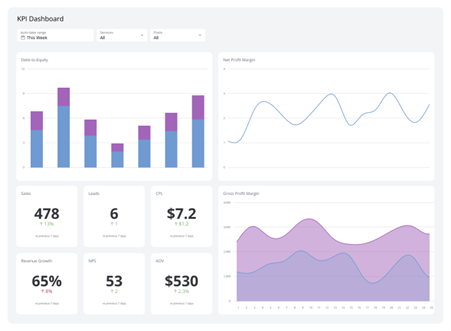

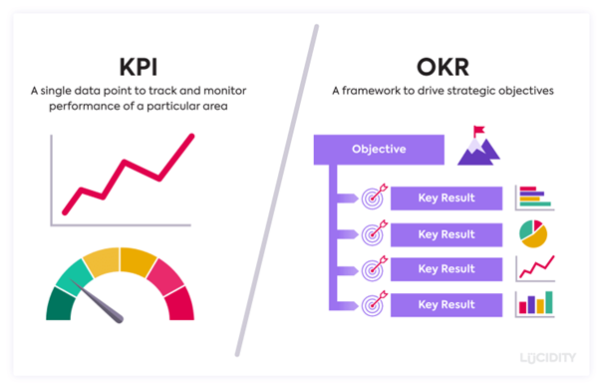

This chapter explores how to translate high-level strategic goals into clear, measurable Key Performance Indicators (KPIs) that guide decision-making, track progress, and drive accountability across a portfolio. While strategies provide direction, it’s KPIs that make those strategies operational—turning vision into results through data-driven insights.

Participants will first learn what makes a KPI both strategic and actionable. Not all metrics are useful—strong KPIs must be clearly linked to strategic objectives and provide insight that enables corrective action. They must be measurable, meaningful, and limited in number to keep focus on what matters most.

Next, the chapter explains how to link KPIs to portfolio-level objectives. Through relevant examples and mapping techniques, participants will explore how to create a direct line between strategic goals (e.g., improving customer experience or driving innovation) and quantifiable indicators that reflect progress. This alignment ensures that every initiative in the portfolio supports the broader mission and can be tracked meaningfully.

The lesson then introduces the importance of balancing leading and lagging indicators. Leading indicators offer early signals to help teams adjust before problems escalate, while lagging indicators validate whether strategic goals have been achieved. A balanced mix helps organizations remain both forward-looking and results-driven.

The lesson then introduces the importance of balancing leading and lagging indicators. Leading indicators offer early signals to help teams adjust before problems escalate, while lagging indicators validate whether strategic goals have been achieved. A balanced mix helps organizations remain both forward-looking and results-driven.

Participants will also discover how to design a strategic KPI dashboard—a powerful visualization tool that consolidates real-time performance data for decision-makers. The chapter covers key design principles such as aligning metrics to strategy, using visual clarity, automating data feeds, and enabling drill-down analysis. A well-crafted dashboard improves visibility, accelerates decision-making, and enhances alignment across teams.

Finally, the chapter highlights how KPIs should be used for ongoing review and course correction. Regular performance check-ins help identify issues early, prevent strategic drift, and ensure that all parts of the organization remain focused and responsive. KPIs become more than measurements—they become a feedback loop that fuels continuous improvement.

In summary, this chapter equips participants with the tools and frameworks needed to move from strategic aspiration to measurable action. By building a strong KPI framework, organizations can track what matters, adapt with agility, and deliver results that truly support long-term goals.

Chapter 5: Goal Setting Frameworks for Portfolio Optimization

Effective goal setting is essential for turning strategic intent into focused execution—especially in the complex world of portfolio management, where multiple initiatives must be aligned, tracked, and delivered across functions. This chapter introduces participants to three powerful and widely used frameworks—SMART goals, OKRs (Objectives and Key Results), and Hoshin Kanri—and explores how each can be applied to optimize portfolios and enhance performance.

The chapter begins with SMART goals, a simple and highly practical model for defining clear, specific, and measurable objectives. SMART goals are especially useful at the project or task level, helping teams stay focused and accountable. Their strength lies in breaking down abstract ambitions into achievable, time-bound actions that can be tracked and evaluated with ease.

Next, we explore OKRs, a goal-setting system designed to foster strategic alignment and agility. OKRs help organizations focus on what matters most by pairing inspirational objectives with measurable outcomes. They are ideal for dynamic, fast-moving environments and support cross-functional collaboration. Used correctly, OKRs drive clarity, prioritization, and alignment across teams and departments.

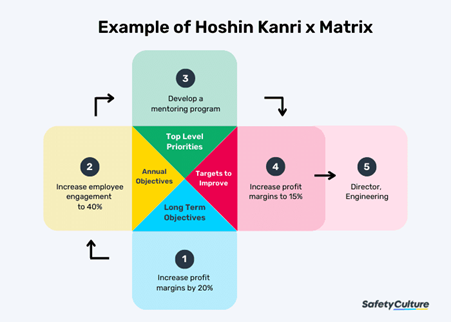

The chapter then introduces Hoshin Kanri, a more comprehensive strategy deployment framework used to bridge long-term vision with daily execution. Through tools like the X-Matrix, the catchball process, and A3 reports, Hoshin Kanri aligns organizational goals from the top down and ensures buy-in through two-way communication. It is particularly effective in large or complex organizations seeking strategic discipline, cultural alignment, and continuous improvement.

Participants will also explore how these frameworks differ, when to use each one, and how they can be blended for even greater impact. A dedicated section on integrating these frameworks into portfolio governance illustrates how strategic goals can be used to assess, prioritize, and review initiatives consistently across the organization.

By the end of this chapter, participants will be equipped with a clear understanding of how to structure goals, choose the right framework for their needs, and embed those goals into portfolio processes. This alignment ensures that every initiative contributes meaningfully to the organization’s strategic direction.

Chapter 6: Prioritization Techniques for Strategic Goals

Strategic clarity is vital in portfolio management, but knowing what to act on first is what truly drives impact. With limited time, resources, and capacity, organizations must make intentional choices about which goals and initiatives to pursue. This chapter equips participants with practical, proven techniques to help prioritize effectively—ensuring the right work gets the right attention at the right time.

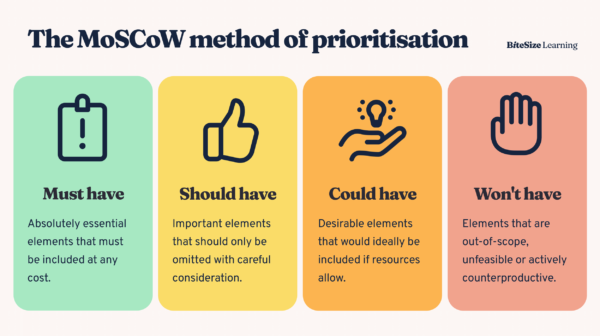

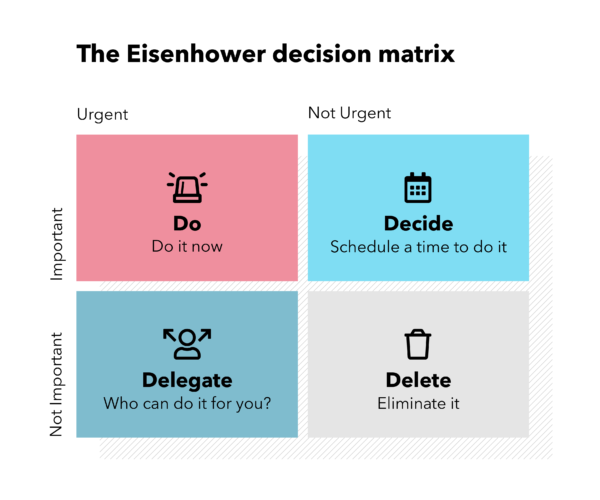

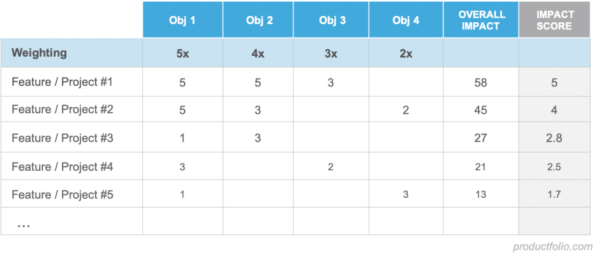

Participants will explore three core prioritization frameworks: the MoSCoW Method, the Eisenhower Matrix, and Weighted Scoring Models. Each method offers a different lens to evaluate initiatives based on value, urgency, feasibility, and strategic alignment.

The MoSCoW Method helps categorize initiatives into four buckets: Must Have, Should Have, Could Have, and Won’t Have (this time). It clarifies necessity versus desirability, making it easier to focus on what’s essential while managing stakeholder expectations and avoiding scope creep.

The Eisenhower Matrix supports better time and effort allocation by distinguishing between urgency and importance. It helps organizations step out of reactive mode and invest in long-term value—reducing distractions and reinforcing strategic discipline.

Weighted Scoring Models bring data and objectivity to prioritization. By assigning weights to criteria like ROI, customer impact, and risk, teams can score and compare initiatives more transparently and defensibly—especially when navigating competing interests across departments.

Weighted Scoring Models bring data and objectivity to prioritization. By assigning weights to criteria like ROI, customer impact, and risk, teams can score and compare initiatives more transparently and defensibly—especially when navigating competing interests across departments.

Beyond the tools themselves, the chapter also emphasizes how to facilitate prioritization workshops that engage stakeholders, build consensus, and ensure shared ownership of strategic decisions. Through structured discussion and collaborative evaluation, these workshops help align perspectives and foster commitment to chosen priorities.

Finally, the lesson tackles common pitfalls such as bias and overload. Without guardrails, prioritization can be skewed by politics, recency bias, or overcommitment. Participants will learn strategies to counteract these risks—like setting clear decision criteria, limiting active initiatives, and creating space for ongoing review and course correction.

By the end of this chapter, participants will be able to apply tailored prioritization techniques, engage cross-functional teams in structured decision-making, and create a focused, high-impact portfolio that advances the organization’s strategic goals.

Chapter 7: Setting Financial Targets for Portfolio Growth

Financial targets are a cornerstone of strategic portfolio management. This chapter explores how aligning revenue, profitability, and cost-efficiency goals with organizational strategy ensures that portfolios deliver not only strategic value but measurable business impact. Financial discipline transforms portfolios from collections of initiatives into engines of sustainable growth.

Participants will first learn how to establish revenue and profitability targets that align with strategic objectives. These targets ensure that initiatives are not only strategic in nature but also financially justified. Through a mix of top-down vision and bottom-up validation, organizations can set ambitious yet achievable goals that reflect both market opportunity and operational capacity.

The chapter then moves into cost management and ROI forecasting, emphasizing the importance of budgeting, cost tracking, and value estimation in portfolio planning. Participants will explore key financial tools—including ROI, payback period, and NPV—to evaluate initiatives against expected returns and resource requirements. Accurate forecasting helps prioritize investments and avoid overcommitting to low-impact projects.

A key theme is the challenge of balancing long-term investments with short-term financial goals. Strategic portfolios must sustain current performance while building future capability. This section provides practical guidance on setting financial guardrails and allocation ratios to ensure a healthy mix of quick wins and long-term bets.

Participants will also learn about financial KPIs that monitor portfolio health, such as ROI, budget variance, payback period, and profit margins. These metrics help track progress, identify underperformance, and support timely course correction. Financial KPIs are essential for transparency, accountability, and data-driven governance.

Throughout, the chapter emphasizes the importance of collaboration between strategy, finance, and delivery teams. Financial targets are most effective when they are co-created, clearly communicated, and consistently reviewed. By the end of this session, participants will be equipped to integrate financial rigor into every stage of portfolio management—ensuring that each initiative is not only strategically aligned but financially sound.

Chapter 8: Establishing Market Positioning Goals

This chapter focuses on the strategic importance of establishing market positioning goals within portfolio management. Market positioning defines how an organization wants to be perceived in its industry—whether as a low-cost leader, innovation pioneer, or premium brand—and it plays a critical role in shaping investment decisions, customer engagement, and long-term growth.

Participants will first explore how to define market share goals and competitive benchmarks, setting clear, quantifiable targets that align with strategic intent. These goals provide a basis for measuring performance and understanding where the organization stands relative to competitors. Benchmarking helps ensure goals are grounded in external realities rather than internal assumptions.

The chapter also delves into positioning through differentiation and unique value propositions (UVPs). Participants will learn how to identify what makes their offerings distinct, how to articulate this value clearly, and how to align projects with UVPs that resonate with target audiences. Strong differentiation drives customer preference, price resilience, and brand loyalty.

Next, the chapter addresses brand visibility and customer perception. These intangible assets are vital to long-term success, and participants will learn how to set strategic objectives around awareness, recognition, and sentiment. Metrics such as share of voice, brand recall, and NPS (Net Promoter Score) are explored as tools to monitor progress and fine-tune messaging.

Next, the chapter addresses brand visibility and customer perception. These intangible assets are vital to long-term success, and participants will learn how to set strategic objectives around awareness, recognition, and sentiment. Metrics such as share of voice, brand recall, and NPS (Net Promoter Score) are explored as tools to monitor progress and fine-tune messaging.

Importantly, participants will examine how to align portfolio initiatives with competitive strategy, ensuring that projects are not only innovative or efficient but also strategically differentiated. Whether pursuing cost leadership, innovation, or customer intimacy, portfolio decisions should reinforce the company’s competitive edge.

Throughout the lesson, emphasis is placed on integrating these goals into portfolio governance. Participants will learn how to evaluate initiatives based on their ability to enhance market position, and how to avoid “strategic drift” by regularly validating the relevance and impact of each project.

By the end of this chapter, participants will understand how to craft and integrate market positioning objectives into portfolio strategy—ensuring every initiative contributes to building visibility, relevance, and competitive advantage in a dynamic market landscape.

Chapter 9: Balancing Short-Term Wins with Long-Term Strategy

Strategic portfolio management isn’t just about getting things done—it’s about making sure the right things are done, at the right time, to support both current performance and future success. This chapter explores how to strike a balance between tactical goals (short-term, execution-focused wins) and strategic goals (long-term, vision-aligned transformations) within a portfolio. It shows how this balance is essential for keeping organizations responsive to immediate demands while building momentum toward enduring impact.

Participants will begin by learning how to distinguish between tactical and strategic goals in the portfolio context. Tactical goals focus on immediate performance and responsiveness, such as improving a process or launching a campaign. Strategic goals, on the other hand, guide long-term change—such as entering new markets, transforming customer experiences, or leading in innovation. Both are essential, and this session highlights how confusing the two can lead to poor prioritization and diluted results.

The chapter then introduces tools like time horizon planning and layered portfolio design, which help segment initiatives based on when their value will be realized. By intentionally structuring the portfolio across short-, medium-, and long-term horizons, leaders can manage resource allocation, maintain organizational momentum, and ensure a steady pipeline of value creation.

To support long-term investments in a dynamic environment, the lesson also covers scenario planning as a technique to future-proof strategic bets. By stress-testing initiatives against multiple possible futures, organizations can identify resilient “no-regret” moves and adapt to emerging risks or opportunities.

The chapter emphasizes the importance of linking tactical initiatives to strategic goals, ensuring that near-term efforts meaningfully contribute to long-term outcomes. It also explores governance practices for managing each type of goal, including dual KPI structures, time-based review cycles, and differentiated evaluation criteria.

By the end of the chapter, participants will understand how to design and manage a portfolio that addresses both present needs and future ambitions. They will gain techniques for aligning stakeholders, sequencing initiatives, and maintaining strategic focus—even in fast-changing environments. The goal is not to choose between short-term and long-term—but to intentionally blend them, creating a portfolio that delivers impact now while shaping sustainable advantage for the future.

Chapter 10: Creating a Strategic Roadmap for Portfolios

A strategic roadmap is the connective tissue between vision and execution in portfolio management. While high-level goals set the direction, it’s the roadmap that lays out how those goals will be achieved—step by step, phase by phase. This chapter explores how to create and manage strategic roadmaps that guide execution across complex portfolios, helping organizations turn strategy into coordinated, measurable action.

Participants will first learn how to translate strategic goals into executable milestones, breaking down long-term ambitions into specific, time-bound deliverables that can be assigned and tracked. This ensures progress is tangible and helps maintain alignment across teams and functions.

The roadmap design process also involves mapping dependencies, phasing, and sequencing. By understanding how initiatives relate to one another, identifying critical paths, and ordering work appropriately, portfolio leaders can avoid bottlenecks, manage risk, and ensure initiatives build on each other in a logical, efficient flow.

Equally important is assigning clear ownership and accountability. A strategic roadmap only works when someone is responsible for driving each piece forward. Participants will explore how to assign initiative owners, establish executive sponsorship, and use tools like RACI matrices to clarify roles and decision rights.

Equally important is assigning clear ownership and accountability. A strategic roadmap only works when someone is responsible for driving each piece forward. Participants will explore how to assign initiative owners, establish executive sponsorship, and use tools like RACI matrices to clarify roles and decision rights.

The chapter then covers how to integrate the roadmap with performance tracking tools. Participants will discover how platforms like Jira, Smartsheet, or Power BI can link milestones with KPIs—turning the roadmap from a static plan into a living dashboard that supports ongoing performance management, transparency, and responsiveness.

Throughout the chapter, emphasis is placed on using the roadmap not just as a timeline, but as a strategic alignment and communication tool. By linking initiatives to strategic goals, visualizing interdependencies, and tracking outcomes in real time, roadmaps become essential to guiding the portfolio through uncertainty and change.

By the end of this session, participants will be equipped to build and maintain strategic roadmaps that are clear, actionable, and adaptable—ensuring their portfolio stays on track, delivers measurable value, and brings strategy to life.

Chapter 11: Communicating Strategic Objectives Across Teams

Clear, consistent communication is the linchpin of successful strategy execution. This chapter focuses on how to effectively cascade strategic objectives throughout the organization—ensuring that all teams, from leadership to frontline staff, understand what needs to be done, why it matters, and how their work contributes to the bigger picture.

Participants will first explore how to translate strategic goals into team-relevant language. Broad objectives like “accelerate digital transformation” or “lead in sustainability” must be broken down into practical terms that make sense to each function—so that marketing, operations, HR, and finance can all connect their daily work to organizational priorities. This translation builds ownership, motivation, and clarity at the team level.

The session then looks at structured communication channels as a vehicle for cascading objectives. From leadership town halls to departmental planning and digital platforms like dashboards or OKR tools, organizations need a layered, consistent approach to messaging. Participants will learn how to embed strategic conversations into regular business rhythms—like team meetings, performance reviews, and check-ins—to keep strategy alive and actionable.

To support engagement and memory, the chapter emphasizes the role of visual frameworks and storytelling. Strategy maps, scorecards, and roadmaps help people visualize priorities, while storytelling adds context and emotion—making strategy more relatable and inspiring action. Leaders are encouraged to use both visuals and narratives to reinforce key messages consistently.

Another key focus is identifying and addressing misalignment. When different teams interpret the same objectives differently—or pursue conflicting initiatives—strategic execution suffers. Participants will learn techniques for diagnosing disconnects, creating shared goals, and building cross-functional understanding. Tools like joint KPIs, integrated roadmaps, and collaborative planning sessions can help teams row in the same direction.

Finally, the chapter explores how to sustain alignment over time, especially in dynamic environments. Regular feedback loops, shared communication rituals, and leadership modeling ensure that alignment is not a one-time event but an ongoing process of clarification and coordination.

By the end of this chapter, participants will be equipped to turn strategic objectives into shared language, direction, and momentum. They’ll understand how to align diverse teams through thoughtful communication, and how to reinforce strategy at every level of the organization—making it not just understood, but embedded in daily action.

Chapter 12: Measuring Strategic Alignment and Portfolio Success

This final chapter focuses on one of the most critical—and often overlooked—aspects of strategic portfolio management: measuring whether portfolio activities are delivering real strategic value. While planning and execution are vital, it is ongoing evaluation that confirms whether initiatives are aligned, impactful, and worth continuing. Without structured measurement, organizations risk misallocating resources, drifting from their strategic goals, or missing opportunities to course-correct in time.

Participants will begin by exploring how to define clear success criteria for strategic alignment. This includes translating high-level objectives into measurable outcomes at every level of the organization—enterprise, portfolio, and project. Success criteria must be specific, relevant, and adaptable over time to reflect evolving strategies and market realities.

The chapter then moves into establishing review cadences and feedback loops, which allow for timely portfolio oversight and iterative learning. Whether through monthly updates, quarterly strategic reviews, or annual resets, structured reviews ensure the portfolio remains dynamic and aligned. These sessions must be supported by effective dashboards, stakeholder input, and mechanisms for translating insights into action.

Participants will also learn how to identify and course-correct misaligned or underperforming initiatives. This involves using performance data, stakeholder feedback, and governance forums to evaluate strategic fit and take timely action—whether that means realigning, re-scoping, or retiring initiatives. These decisions are essential to preserving value and ensuring the portfolio remains focused and effective.

Participants will also learn how to identify and course-correct misaligned or underperforming initiatives. This involves using performance data, stakeholder feedback, and governance forums to evaluate strategic fit and take timely action—whether that means realigning, re-scoping, or retiring initiatives. These decisions are essential to preserving value and ensuring the portfolio remains focused and effective.

Finally, the chapter emphasizes the importance of embedding continuous learning into portfolio measurement. Rather than simply tracking outputs, high-performing portfolios use lessons learned to drive improvement. Retrospectives, documented insights, and shared feedback loops foster a culture where teams learn from each other and evolve their practices. Psychological safety, leadership support, and technology tools are key enablers of this learning culture.

By the end of this chapter, participants will understand how to use measurement not just as a reporting tool, but as a strategic capability. They’ll be equipped with frameworks to assess alignment, tools to visualize performance, and practices that transform data into decisions. Most importantly, they’ll recognize that measuring portfolio success is an ongoing, adaptive process—one that helps organizations remain focused, resilient, and aligned with their most important goals.

This chapter provides the tools to ensure that your strategy doesn’t just look good on paper—it lives, evolves, and delivers measurable impact across your organization.

Curriculum

Portfolio Optimization – Workshop 1 – Strategic Objectives

- Strategic Planning

- Aligning Objectives with Corporate Vision and Mission

- Top-Down Strategic Planning in Portfolio Design

- Translating Strategy into Measurable KPIs

- Goal Setting Frameworks for Portfolio Optimization

- Prioritization Techniques for Strategic Goals

- Setting Financial Targets for Portfolio Growth

- Establishing Market Positioning Goals

- Balancing Short-Term Wins with Long-Term Strategy

- Creating a Strategic Roadmap for Portfolios

- Communicating Strategic Objectives Across Teams

- Measuring Strategic Alignment and Portfolio Success

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Portfolio Optimization corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family know when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they don’t! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change, is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast

As a guide, the Appleton Greene Portfolio Optimization corporate training program should take 12-18 months to complete, depending upon your availability and current commitments. The reason why there is such a variance in time estimates is because every student is an individual, with differing productivity levels and different commitments. These differentiations are then exaggerated by the fact that this is a distance-learning program, which incorporates the practical integration of academic theory as an as a part of the training program. Consequently all of the project studies are real, which means that important decisions and compromises need to be made. You will want to get things right and will need to be patient with your expectations in order to ensure that they are. We would always recommend that you are prudent with your own task and time forecasts, but you still need to develop them and have a clear indication of what are realistic expectations in your case. With reference to your time planning: consider the time that you can realistically dedicate towards study with the program every week; calculate how long it should take you to complete the program, using the guidelines featured here; then break the program down into logical modules and allocate a suitable proportion of time to each of them, these will be your milestones; you can create a time plan by using a spreadsheet on your computer, or a personal organizer such as MS Outlook, you could also use a financial forecasting software; break your time forecasts down into manageable chunks of time, the more specific you can be, the more productive and accurate your time management will be; finally, use formulas where possible to do your time calculations for you, because this will help later on when your forecasts need to change in line with actual performance. With reference to your task planning: refer to your list of tasks that need to be undertaken in order to achieve your program objectives; with reference to your time plan, calculate when each task should be implemented; remember that you are not estimating when your objectives will be achieved, but when you will need to focus upon implementing the corresponding tasks; you also need to ensure that each task is implemented in conjunction with the associated training modules which are relevant; then break each single task down into a list of specific to do’s, say approximately ten to do’s for each task and enter these into your study plan; once again you could use MS Outlook to incorporate both your time and task planning and this could constitute your study plan; you could also use a project management software like MS Project. You should now have a clear and realistic forecast detailing when you can expect to be able to do something about undertaking the tasks to achieve your program objectives.

Performance management

It is one thing to develop your study forecast, it is quite another to monitor your progress. Ultimately it is less important whether you achieve your original study forecast and more important that you update it so that it constantly remains realistic in line with your performance. As you begin to work through the program, you will begin to have more of an idea about your own personal performance and productivity levels as a distance-learner. Once you have completed your first study module, you should re-evaluate your study forecast for both time and tasks, so that they reflect your actual performance level achieved. In order to achieve this you must first time yourself while training by using an alarm clock. Set the alarm for hourly intervals and make a note of how far you have come within that time. You can then make a note of your actual performance on your study plan and then compare your performance against your forecast. Then consider the reasons that have contributed towards your performance level, whether they are positive or negative and make a considered adjustment to your future forecasts as a result. Given time, you should start achieving your forecasts regularly.

With reference to time management: time yourself while you are studying and make a note of the actual time taken in your study plan; consider your successes with time-efficiency and the reasons for the success in each case and take this into consideration when reviewing future time planning; consider your failures with time-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future time planning; re-evaluate your study forecast in relation to time planning for the remainder of your training program to ensure that you continue to be realistic about your time expectations. You need to be consistent with your time management, otherwise you will never complete your studies. This will either be because you are not contributing enough time to your studies, or you will become less efficient with the time that you do allocate to your studies. Remember, if you are not in control of your studies, they can just become yet another cause of stress for you.

With reference to your task management: time yourself while you are studying and make a note of the actual tasks that you have undertaken in your study plan; consider your successes with task-efficiency and the reasons for the success in each case; take this into consideration when reviewing future task planning; consider your failures with task-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future task planning; re-evaluate your study forecast in relation to task planning for the remainder of your training program to ensure that you continue to be realistic about your task expectations. You need to be consistent with your task management, otherwise you will never know whether you are achieving your program objectives or not.

Keeping in touch

You will have access to qualified and experienced professors and tutors who are responsible for providing tutorial support for your particular training program. So don’t be shy about letting them know how you are getting on. We keep electronic records of all tutorial support emails so that professors and tutors can review previous correspondence before considering an individual response. It also means that there is a record of all communications between you and your professors and tutors and this helps to avoid any unnecessary duplication, misunderstanding, or misinterpretation. If you have a problem relating to the program, share it with them via email. It is likely that they have come across the same problem before and are usually able to make helpful suggestions and steer you in the right direction. To learn more about when and how to use tutorial support, please refer to the Tutorial Support section of this student information guide. This will help you to ensure that you are making the most of tutorial support that is available to you and will ultimately contribute towards your success and enjoyment with your training program.

Work colleagues and family

You should certainly discuss your program study progress with your colleagues, friends and your family. Appleton Greene training programs are very practical. They require you to seek information from other people, to plan, develop and implement processes with other people and to achieve feedback from other people in relation to viability and productivity. You will therefore have plenty of opportunities to test your ideas and enlist the views of others. People tend to be sympathetic towards distance-learners, so don’t bottle it all up in yourself. Get out there and share it! It is also likely that your family and colleagues are going to benefit from your labors with the program, so they are likely to be much more interested in being involved than you might think. Be bold about delegating work to those who might benefit themselves. This is a great way to achieve understanding and commitment from people who you may later rely upon for process implementation. Share your experiences with your friends and family.

Making it relevant

The key to successful learning is to make it relevant to your own individual circumstances. At all times you should be trying to make bridges between the content of the program and your own situation. Whether you achieve this through quiet reflection or through interactive discussion with your colleagues, client partners or your family, remember that it is the most important and rewarding aspect of translating your studies into real self-improvement. You should be clear about how you want the program to benefit you. This involves setting clear study objectives in relation to the content of the course in terms of understanding, concepts, completing research or reviewing activities and relating the content of the modules to your own situation. Your objectives may understandably change as you work through the program, in which case you should enter the revised objectives on your study plan so that you have a permanent reminder of what you are trying to achieve, when and why.

Distance-learning check-list

Prepare your study environment, your study tools and rules.

Undertake detailed self-assessment in terms of your ability as a learner.

Create a format for your study plan.

Consider your study objectives and tasks.

Create a study forecast.

Assess your study performance.

Re-evaluate your study forecast.

Be consistent when managing your study plan.

Use your Appleton Greene Certified Learning Provider (CLP) for tutorial support.

Make sure you keep in touch with those around you.

Tutorial Support

Programs