Portfolio Optimization

The Appleton Greene Corporate Training Program (CTP) for Portfolio Optimization is provided by Mr. Shankar Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

INSERT HERE

To request further information about Mr. Shankar through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Portfolio Optimization

Today, organizations are increasingly looking for strategies to maximize the impact of their investments while minimizing risks. Portfolio optimization is a critical strategic process designed to help companies achieve these goals by efficiently managing assets, projects, products, or business units. It revolves around balancing risk and returns to create an optimal mix that aligns with a company’s financial goals, market opportunities, and strategic vision.

At its core, portfolio optimization focuses on decision-making — determining where to allocate resources for the greatest potential return. It’s not simply about picking the highest-performing assets; it’s about constructing a well-diversified portfolio that considers market conditions, risk tolerance, historical performance, and future growth potential. This holistic approach requires a keen understanding of financial metrics, business strategy, and emerging market trends.

The Rise of AI in Portfolio Optimization

Traditional portfolio management methods often rely heavily on historical data and the intuition of seasoned managers. However, as the volume and complexity of data increase, these conventional approaches are becoming less effective. This is where artificial intelligence (AI) steps in, transforming the landscape of portfolio optimization. By harnessing the power of machine learning algorithms, AI can process massive datasets, identify hidden patterns, and generate predictive insights far beyond human capabilities. This enables organizations to make better-informed decisions and continuously adjust their portfolios in real time, adapting to changing market conditions swiftly and accurately.

AI-powered portfolio optimization also facilitates a data-driven approach, helping businesses to evaluate potential investments more objectively. Predictive analytics, sentiment analysis, and deep learning models provide granular insights that reduce the uncertainty inherent in strategic decision-making. This level of sophistication allows companies to optimize their asset mix dynamically, balancing growth potential and risk exposure with precision.

Diversification: The Key to Minimizing Risk

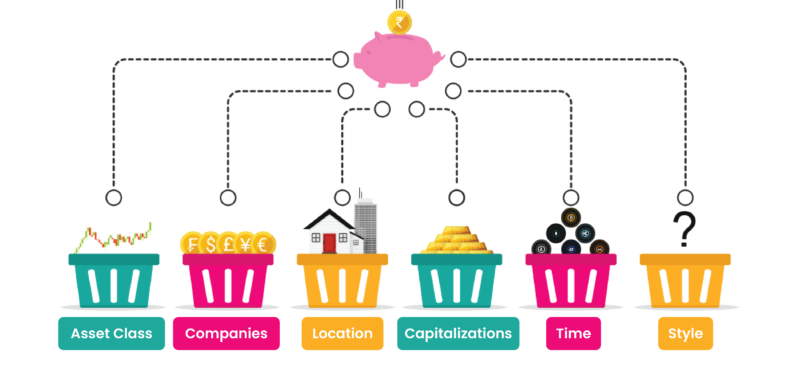

One of the primary principles of portfolio optimization is diversification. By spreading investments across different asset classes, industries, or geographical markets, companies can mitigate the impact of poor performance in any area. This concept, often encapsulated in the phrase “not putting all your eggs in one basket,” reduces the portfolio’s overall volatility and enhances its stability. The goal is to create a portfolio where the combined assets exhibit lower risk than the sum of their risks — an outcome achievable only through strategic diversification.

Balancing Risk and Return

Effective portfolio optimization involves finding the optimal balance between risk and return. High-risk investments may offer the potential for greater returns, but they also come with a higher probability of loss. Conversely, safer investments provide steady but lower returns. The challenge lies in constructing a portfolio that aligns with the organization’s risk tolerance while maximizing expected returns. This often involves utilizing modern portfolio theory (MPT), which provides a framework for selecting a mix of assets that collectively lower risk without sacrificing performance.

Aligning with Corporate Strategy

Portfolio optimization is not a one-size-fits-all approach; it must be tailored to fit the broader corporate strategy and goals. For some organizations, this may mean prioritizing innovation and growth by investing heavily in emerging markets or cutting-edge technologies. Focusing on stability and risk management may lead to more conservative choices for others. The key is alignment — ensuring the portfolio reflects the organization’s strategic priorities and long-term vision.

The Benefits of Portfolio Optimization

Portfolio optimization offers a strategic edge for organizations looking to maximize returns while minimizing risks. A holistic asset management approach provides several key advantages that drive financial performance and align investments with broader corporate objectives.

One of the primary benefits of portfolio optimization is enhanced risk management. Companies can construct a balanced portfolio that aligns with their risk tolerance, allowing them to distribute investments across various asset classes, industries, and markets. This diversified approach helps to reduce the impact of poor performance in any single area, mitigating the effects of market volatility and providing a cushion against unexpected downturns.

Beyond risk reduction, portfolio optimization is designed to maximize returns. By carefully analyzing each asset’s risk-return profile, companies can allocate resources to projects or investments that offer the best potential for growth. This strategic allocation improves overall profitability and ensures that capital is directed towards high-performing assets, increasing the return on investment (ROI).

Another significant advantage of portfolio optimization is using data-driven decision-making. Modern AI-powered tools can analyze vast amounts of data, uncover hidden patterns, and provide predictive insights beyond traditional methods. This enables organizations to make informed, evidence-based choices about their investments. With real-time data and analytics, companies can also continuously monitor and adjust their portfolios, adapting swiftly to market conditions or internal business shifts.

A well-optimized portfolio also benefits from adequate diversification, which reduces overall risk by spreading investments across a wide range of assets. This reduces the portfolio’s volatility and helps create a more stable performance over time. By including assets that have low correlations with each other, businesses can lower the likelihood of simultaneous downturns across the portfolio.

Aligning investment decisions with broader strategic objectives is another core benefit of portfolio optimization. Companies can tailor their portfolios to support their long-term goals, whether they prioritize growth, innovation, or stability. By focusing on assets that best fit their strategic vision, organizations ensure that every investment contributes to the overall corporate mission and maximizes the use of available resources.

Portfolio optimization also improves transparency and accountability. With a systematic approach to evaluating assets and transparent performance metrics, stakeholders understand the decision-making process more deeply. This clarity enhances governance, making it easier for companies to manage their investments prudently and in accordance with corporate policies.

Finally, portfolio optimization offers greater strategic flexibility. The ability to regularly evaluate and rebalance the portfolio allows organizations to pivot quickly in response to market changes, capitalize on new opportunities, and minimize risks. Scenario analysis and predictive models help businesses prepare for various possible market conditions, making them more resilient and better equipped to handle uncertainty.

Overall, portfolio optimization provides a robust framework for managing investments effectively. It enhances risk management, maximizes returns, and ensures alignment with corporate goals. By integrating advanced analytics and AI, companies can make smarter, data-driven decisions that boost financial performance and offer a significant competitive advantage in a dynamic business environment.

Common Methodologies in Portfolio Optimization

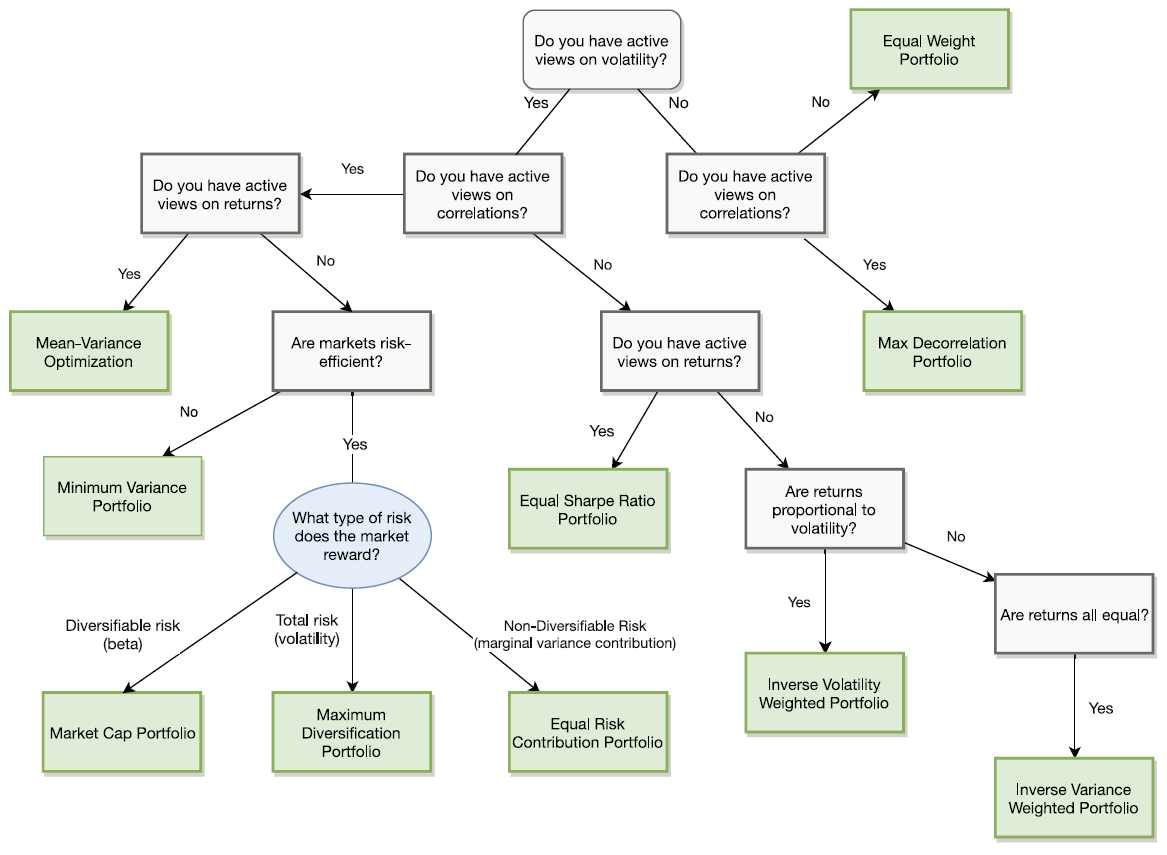

The field of portfolio optimization has evolved significantly over time, resulting in the development of several well-established methodologies. Each approach offers unique advantages and caters to different investment objectives, risk tolerances, and market conditions. By leveraging these methodologies, businesses and investors can construct portfolios that maximize returns, minimize risk, and align with strategic goals. Below, we delve into some of the most widely used portfolio optimization methodologies, including the Modern Portfolio Theory (MPT), the Black-Litterman model, mean-variance optimization, and risk parity.

Modern Portfolio Theory (MPT)

Modern Portfolio Theory (MPT), developed by Harry Markowitz in the 1950s, is one of the foundational frameworks in portfolio optimization. It introduced the concept of creating a diversified portfolio that balances risk and return, providing a systematic way to make investment decisions based on quantitative analysis. The fundamental principle behind MPT is that investors can achieve a higher expected return by diversifying their investments across various assets with different risk profiles and performance characteristics.

MPT relies heavily on statistical measures like variance (which measures the dispersion of asset returns) and covariance (which assesses the correlation between the returns of two assets). By analyzing the covariance between different assets, MPT aims to construct a portfolio where the combined risk is lower than the sum of individual asset risks. This is achieved through diversification, where assets with low or negative correlations are selected to reduce overall portfolio volatility.

The efficient frontier, a core concept of MPT, represents the set of optimal portfolios that offer the highest expected return for a given level of risk. Investors can use the efficient frontier to identify portfolios that align with their risk tolerance, maximizing the return potential without taking on unnecessary risk. Despite its popularity, MPT has some limitations, including its reliance on historical data, which may not always predict future market behavior.

Black-Litterman Model

The Black-Litterman model, introduced by Fischer Black and Robert Litterman in the 1990s, is an advanced methodology that addresses some of the challenges associated with Modern Portfolio Theory. One of the primary criticisms of MPT is its heavy dependence on historical data for estimating expected returns, which can lead to unrealistic or unstable portfolio allocations. The Black-Litterman model overcomes this issue by combining market equilibrium data with investor views, creating a more balanced and robust framework for portfolio optimization.

In the Black-Litterman model, market equilibrium data reflects the implied returns of the market based on observed asset prices and their relative risks. This data is then adjusted using investor views, which are subjective opinions about the expected performance of specific assets. By blending these two sources of information, the model generates a more reliable estimate of expected returns, reducing estimation errors and providing a smoother path to optimal asset allocation.

The flexibility of the Black-Litterman model makes it particularly useful for institutional investors and portfolio managers who want to incorporate their unique market insights while maintaining a solid foundation in objective market data. This approach results in more stable and realistic portfolio allocations, improving overall decision-making.

Mean-Variance Optimization

Mean-variance optimization is another fundamental portfolio optimization methodology closely related to Modern Portfolio Theory. It involves selecting a portfolio that maximizes the expected return for a given risk level or minimizes risk for a given level of expected return. The process uses expected returns (mean) and risk (variance) as the primary inputs, balancing these factors to construct the optimal portfolio.

The main advantage of mean-variance optimization is its simplicity and ease of implementation. It provides a straightforward mathematical framework for selecting assets based on risk-return characteristics. However, like MPT, this method has limitations, particularly its sensitivity to the accuracy of input data. Small changes in expected returns or variances can lead to significant shifts in the optimal portfolio composition, making it prone to estimation errors.

Despite these challenges, mean-variance optimization remains widely used, particularly when combined with other models or enhanced by robust statistical methods to improve data reliability. It is often employed as a baseline strategy in quantitative portfolio management, serving as a foundation for more sophisticated optimization approaches.

Risk Parity

Risk parity is a more recent approach to portfolio optimization that has gained popularity, especially among institutional investors. Unlike traditional methods that focus primarily on expected returns, risk parity emphasizes equalizing the risk contribution of each asset in the portfolio. The idea is that a well-diversified portfolio should include a variety of assets and balance the risk exposure across those assets rather than concentrating risk in a single asset class.

In a typical risk parity strategy, the portfolio is constructed so that each asset class (e.g., equities, bonds, commodities) contributes equally to the overall portfolio risk. This often leads to higher allocations in lower-risk assets, such as bonds, and lower allocations in higher-risk assets, like equities. The objective is to create a more resilient portfolio that can perform well across different market environments, reducing the potential for significant losses during periods of high volatility.

Risk parity is particularly effective in scenarios where traditional asset allocation methods might fail due to changes in market dynamics. Focusing on risk distribution rather than return maximization offers a way to achieve more stable, lower-volatility returns. It benefits long-term investors seeking to maintain a balanced portfolio without making frequent adjustments based on shifting market predictions.

The methodologies used in portfolio optimization range from traditional, statistically driven models like Modern Portfolio Theory and mean-variance optimization to more advanced, flexible approaches like the Black-Litterman model and risk parity. Each of these methodologies has strengths and is suited to different investment objectives and market conditions. By understanding and applying these techniques, investors and organizations can construct well-diversified, resilient portfolios that effectively balance risk and return, aligning with their financial goals and broader strategic vision.

Top 10 Pain Points Addressed by Portfolio Optimization

Inefficient Resource Allocation

Organizations often need help allocating capital effectively across projects, products, or investments. With a strategic approach, resources may be well-spent on low-performing or non-strategic initiatives. Portfolio optimization helps ensure that capital is directed towards the highest-value opportunities.

High-Risk Exposure

Many companies need help managing the risk associated with their portfolios. Concentrating investments in a few high-risk projects can lead to significant financial losses if market conditions shift. Portfolio optimization provides a framework for diversification, reducing risk exposure, and protecting against volatility.

Lack of Clear Performance Metrics

Without clear metrics and KPIs, organizations find it difficult to evaluate the success of individual projects or assets. This lack of visibility can lead to poor decision-making and underperformance. Portfolio optimization establishes consistent performance benchmarks, enabling better assessment and tracking of investment outcomes.

Difficulty Aligning Investments with Strategic Goals

Organizations often need help to align their investments with long-term strategic objectives. This misalignment can result in wasted resources and missed opportunities. Portfolio optimization helps ensure investments support the broader corporate strategy and drive growth.

Inability to Adapt to Market Changes

Market dynamics are constantly shifting, and businesses that need help to adapt quickly risk losing their competitive edge. A rigid portfolio that isn’t regularly evaluated and adjusted may perform poorly in changing conditions. Portfolio optimization offers a dynamic, flexible approach, allowing companies to pivot and rebalance their assets based on real-time data.

Overwhelming Volume of Data

Managing large datasets and extracting actionable insights is a common pain point for organizations. The volume and complexity of data make it difficult to analyze performance and predict future trends accurately. Portfolio optimization, especially AI-powered, can sift through massive data sets, providing predictive insights and enabling data-driven decisions.

Ineffective Risk Management

Poor risk management can lead to significant financial losses and organizational instability. Traditional methods may fail to identify potential risks or forecast their impact accurately. Portfolio optimization uses advanced analytics and modeling to assess risk comprehensively, enabling proactive mitigation strategies.

Underperforming Assets or Projects

Many organizations hold on to underperforming assets or projects for too long, draining resources and lowering overall returns. Portfolio optimization helps identify these laggards quickly, providing data-driven insights to support decisions about reallocating or divesting resources.

Lack of Strategic Diversification

Companies that don’t diversify their investments effectively can suffer from higher volatility and increased risk. Relying too heavily on a single market or asset class can leave a portfolio vulnerable to downturns. Portfolio optimization emphasizes diversification, helping build a more resilient mix of investments to weather market fluctuations.

Inconsistent Decision-Making Processes

In many organizations, investment decisions are based on intuition or incomplete information, leading to inconsistent outcomes. Portfolio optimization provides a structured, objective framework for decision-making, reducing reliance on gut feelings and helping ensure that choices are backed by data and aligned with strategic priorities.

In addressing these pain points, portfolio optimization empowers organizations to allocate resources wisely, manage risks effectively, and make informed, strategic decisions that enhance overall performance and long-term value.

Conclusion

In an increasingly complex and dynamic business environment, the need for a strategic approach to managing assets and investments has never been greater. Portfolio optimization emerges as a critical solution, allowing companies to maximize the impact of their investments while minimizing risk exposure. By leveraging advanced analytics and artificial intelligence, businesses can now evaluate vast amounts of data, uncover predictive insights, and make informed, data-driven decisions that align with their broader strategic goals.

The benefits of portfolio optimization extend beyond enhanced risk management and improved returns. It enables organizations to allocate resources efficiently, diversify their investments, and maintain a balanced mix of assets that can withstand market fluctuations. Additionally, portfolio optimization’s structured, objective framework fosters transparency, accountability, and better governance, allowing companies to continuously monitor and adapt their portfolios to shifting market dynamics.

Addressing common pain points such as inefficient resource allocation, underperforming assets, and inconsistent decision-making, portfolio optimization equips businesses with the tools needed to navigate uncertainty and seize growth opportunities. It aligns investment decisions with long-term strategic objectives, supports proactive risk management, and offers the flexibility to pivot quickly in response to emerging trends.

Our Portfolio Optimization program offers a powerful strategy that empowers organizations to manage their investments more effectively, enhancing financial performance and driving sustainable growth. By embracing our holistic approach, businesses can gain a significant competitive advantage, ensuring their portfolios are resilient and primed to capitalize on future opportunities in a rapidly evolving marketplace.

Case Study

Apple Inc., the tech giant that makes the ubiquitous iPhone, has a product portfolio that consists of the iPhone, iPad, MacBook range of laptops, Apple Watch smartwatches, accessories such as air pods and air tags, Beats range of audio accessories, and services such as Apple TV, Apple Music, and Apple Arcade.

Market Segmentation and Competition

Apple’s product portfolio management depends heavily on its strong product development, superior customer experience, and ability to build an ecosystem that combines its products and services. Apple focuses on the premium market segment, with its products and services priced significantly above the market average. While competition offers cheaper products with similar or sometimes better features, Apple’s products retain their premium positioning based on cutting-edge design and best-in-class user experience.

Portfolio Analysis: BCG Matrix

The BCG Growth-Share Matrix analysis of Apple’s offerings gives us the following insights.

Star:

Despite slowing growth, the iPhone continues to be the star of the product portfolio, bringing in $200+ billion in revenue annually and a significant 35% profit margin. However, as the market for iPhones slows down, it will soon move to the cash cow quadrant.

Cash Cows:

The iPad commands nearly 40% of the tablet market, and despite sluggish growth, it continues to be profitable.

Question Mark:

The Apple Watch is a fast-growing product that is dominating the wearables space. The wearables, home, and accessories category now accounts for 10% of Apple’s sales, and Apple expects the Apple Watch’s sales to grow in the coming years.

Similarly, services were the fastest-growing category in Apple’s portfolio and are expected to generate revenues of $100 billion next fiscal year. The profit margins are also the highest in the portfolio, at 70%+. Given Apple’s stated goals of moving away from the iPhone and developing the services market, Apple will continue to invest in this segment.

Dogs:

There is a general trend of moving away from laptops, and Apple’s MacBook range declined by 27% in FY 2023. While margins remain steady, Apple expects this segment to shrink. Similarly, given the shrinking demand, Apple discontinued the production of its iPod range.

Based on the above, Apple will continue focusing on its iPhone range as it moves to a cash cow, wearables, and services, with services expected to contribute significantly more to the overall product mix.

Curriculum

Portfolio Optimization – Part 1- Year 1

- Part 1 Month 1 Strategic Objectives

- Part 1 Month 2 Market Segmentation

- Part 1 Month 3 Competitive Benchmarking

- Part 1 Month 4 Customer Insights

- Part 1 Month 5 Product Analysis

- Part 1 Month 6 Portfolio Mapping

- Part 1 Month 7 Revenue Allocation

- Part 1 Month 8 Product Roadmap

- Part 1 Month 9 Monitoring and Feedback

- Part 1 Month 10 Roles and Responsibilities

- Part 1 Month 11 Cross-functional Collaboration

- Part 1 Month 12 Managing Risk

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Portfolio Optimization corporate training program.

Portfolio Optimization – Part 1- Year 1

- Part 1 Month 1 Strategic Objectives – The foundation of successful portfolio optimization lies in setting clear and measurable strategic objectives. This workshop focuses on defining these objectives in alignment with the organization’s overarching business strategy. Senior management will play a critical role in this phase, ensuring that portfolio goals reflect revenue targets, market share expansion, and profitability improvements. Participants will learn to identify and refine key performance indicators (KPIs) to measure progress toward these objectives. The session also emphasizes the importance of a top-down approach to integrate strategic vision with actionable metrics. By the end of the workshop, participants will have a roadmap for aligning portfolio objectives with company goals, creating a unified direction for portfolio optimization efforts.

- Part 1 Month 2 Market Segmentation – Effective portfolio management begins with understanding the market. This workshop delves into the process of market segmentation, equipping participants with tools and strategies to identify and target distinct customer groups. By categorizing markets based on demographics, behaviors, and preferences, organizations can reduce risk and increase their ability to capture market share. Participants will explore methods to match products with the right customer segments while optimizing distribution channels. The session also covers techniques for prioritizing market opportunities and tailoring products to meet specific needs. By the end, attendees will have a clear framework for reducing risk through precise market targeting and segmentation.

- Part 1 Month 3 Competitive Benchmarking – Understanding the competition is essential for staying ahead in any market. This workshop introduces participants to competitive benchmarking techniques, including the creation of a comprehensive benchmark matrix. Participants will analyze competitor products, pricing strategies, distribution channels, and market positioning to evaluate their own portfolio. They will learn to identify gaps and opportunities while understanding how their products compare to others in the market. This session emphasizes the strategic value of benchmarking in positioning products for success and informs decision-making for future portfolio adjustments. Attendees will leave with actionable insights to enhance competitiveness.

- Part 1 Month 4 Customer Insights – Customer insights are the cornerstone of a successful portfolio strategy. This workshop guides participants in gathering and analyzing customer data through methods such as surveys, interviews, focus groups, and digital tools like social listening and web analytics. Emphasis is placed on integrating both quantitative data and qualitative feedback into the insights process. Attendees will learn how to identify emerging customer needs and preferences, translating them into actionable portfolio strategies. This session also highlights the importance of maintaining an ongoing feedback loop to adapt products and strategies to changing customer dynamics. By the end, participants will have a structured approach to leveraging customer insights for portfolio success.

- Part 1 Month 5 Product Analysis – A thorough product analysis is critical for understanding performance and potential. This workshop focuses on creating a financial dashboard to monitor key metrics such as sales, profit, margins, and growth rates. Participants will learn to categorize products based on revenue growth and profitability, enabling them to identify high-performing assets and underperforming areas. The session also explores methods for evaluating product lifecycle stages and aligning them with strategic goals. By the end, attendees will have the tools to develop data-driven strategies that maximize the value of their portfolio.

- Part 1 Month 6 Portfolio Mapping – Portfolio mapping is a powerful tool for visualizing and analyzing portfolio performance. This workshop introduces participants to frameworks such as the BCG Matrix, GE/McKinsey Matrix, and Ansoff Matrix, tailored to their industry and organizational needs. Participants will learn to map products based on criteria like market share, growth potential, and maturity. The session emphasizes the importance of using portfolio maps to identify gaps, prioritize investments, and make informed decisions about product development, retention, or retirement. Attendees will leave with a clear understanding of how to apply mapping techniques to optimize portfolio performance.

- Part 1 Month 7 Revenue Allocation – Allocating revenue effectively is essential for achieving portfolio objectives. This workshop focuses on translating portfolio mapping outcomes into actionable revenue strategies. Participants will learn to allocate resources based on product goals, such as growth, maintaining market share, or discontinuation. Additionally, the session covers budgeting for innovation, ensuring funds are reserved for developing and launching new products to address market gaps. By the end, attendees will have a clear framework for strategic revenue allocation that balances immediate needs with long-term growth.

- Part 1 Month 8 Product Roadmap – A well-structured product roadmap is vital for tracking progress and addressing challenges. This workshop guides participants in creating detailed roadmaps that outline timelines, milestones, and potential issues for each product. Participants will explore best practices for using roadmaps as tools to align product performance with high-level portfolio goals. The session also emphasizes the importance of regularly updating roadmaps to reflect changing market conditions and organizational priorities. By the end, attendees will have the skills to develop dynamic roadmaps that drive portfolio success.

- Part 1 Month 9 Monitoring and Feedback – Continuous monitoring and feedback are key to maintaining portfolio alignment with strategic objectives. This workshop introduces participants to setting up and tracking key performance indicators (KPIs) such as market share, growth rates, and customer satisfaction scores. Attendees will learn to interpret performance data and use it to identify trends, opportunities, and areas for improvement. The session also covers the importance of feedback loops in adapting to changes in the market. By the end, participants will have a robust framework for ongoing portfolio evaluation.

- Part 1 Month 10 Roles and Responsibilities – A clear governance structure is essential for effective portfolio management. This workshop focuses on defining roles, responsibilities, and decision-making processes within the portfolio management team. Participants will explore frameworks for assigning tasks, establishing accountability, and streamlining decision-making. The session emphasizes the importance of transparency and collaboration in governance. By the end, attendees will have a detailed structure for managing their portfolio with clarity and efficiency.

- Part 1 Month 11 Cross-functional Collaboration – Portfolio success depends on alignment across key business functions. This workshop highlights the importance of integrating portfolio goals with marketing, sales, and finance. Participants will learn to develop communication frameworks that facilitate information sharing and collaboration. The session also explores strategies for addressing cross-functional challenges and ensuring all departments work toward common objectives. By the end, attendees will have a comprehensive approach to fostering collaboration and driving portfolio success.

- Part 1 Month 12 Managing Risk – Effective risk management is essential for sustaining portfolio performance. This workshop focuses on identifying, analyzing, and prioritizing risks using data and feedback from monitoring systems. Participants will learn to develop strategies for mitigating risks and responding proactively to potential threats. The session also emphasizes the importance of continuous risk monitoring to adapt to changing conditions. By the end, attendees will have a robust risk management framework to support long-term portfolio success.

Methodology

Portfolio Optimization

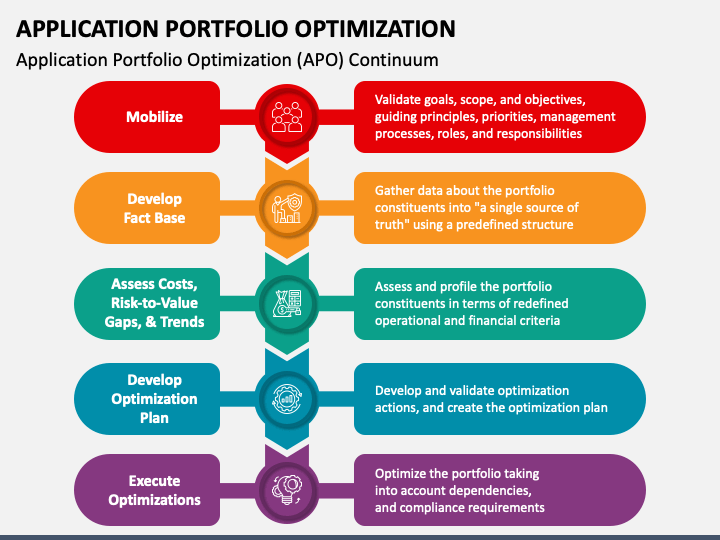

In the realm of business and financial strategy, portfolio optimization is a disciplined methodology that enables organizations to manage their mix of assets, projects, or investments effectively. The primary goal is to maximize returns while minimizing risk, ensuring that resources are allocated in a manner that aligns with both short-term objectives and long-term strategic goals. The process involves a careful blend of quantitative analysis, risk assessment, and strategic planning, providing a robust framework for making informed decisions about where and how to invest.

Portfolio optimization integrates financial theories and practical tools, often leveraging data analytics and artificial intelligence (AI) to gain deeper insights and make predictions. By utilizing advanced models and techniques, businesses can create an optimal portfolio that balances risk and reward, aligns with corporate strategy, and adapts dynamically to changing market conditions. Below, we explore the core components of portfolio optimization methodology through crucial business processes, common approaches, standard practices, and the diverse methods employed.

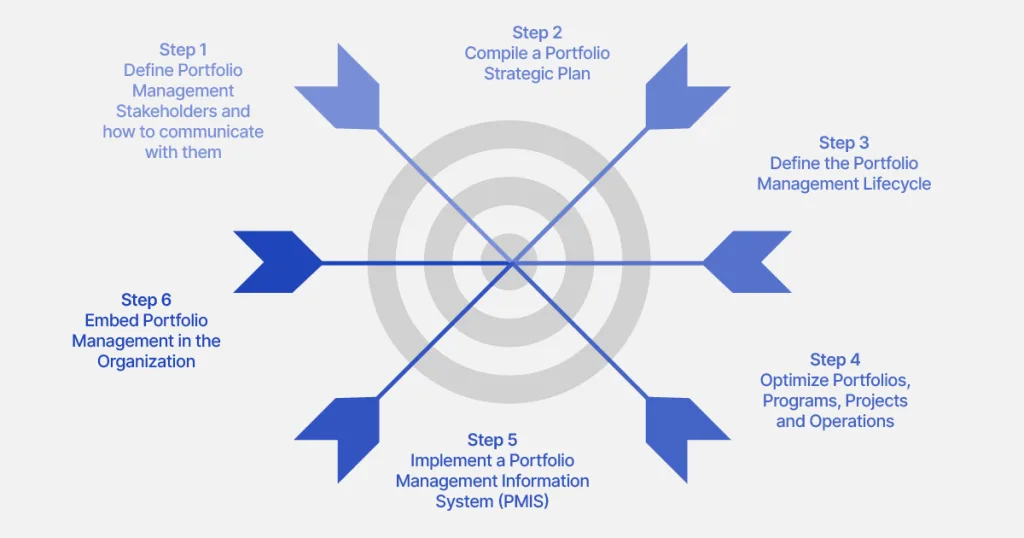

Key Business Processes in Portfolio Optimization

Portfolio optimization is a strategic process that requires a systematic approach to managing and improving a collection of assets, projects, or investments. The success of this methodology relies on the execution of several critical business processes, each of which plays a distinct role in supporting informed decision-making and optimal resource allocation. These processes include data gathering and analysis, evaluation of risk and return, portfolio construction, and continuous monitoring and rebalancing.

Data Gathering and Analysis

The initial phase of portfolio optimization is a comprehensive data-gathering and analysis process. This foundational step collects detailed information about the organization’s assets, projects, and investments from various sources, including historical performance records, financial statements, market trends, economic indicators, and competitor analysis. By leveraging internal and external data, companies can build a robust dataset that captures a complete picture of their current portfolio, laying the groundwork for informed decision-making.

The focus here is not only on gathering data but also on ensuring its quality and accuracy. Inaccurate or incomplete data can lead to flawed analysis and suboptimal decisions. With the rise of advanced analytics and AI, businesses can efficiently process large volumes of data, identifying trends, correlations, and patterns that may not be immediately evident. The insights derived from this analysis provide a strong foundation for assessing the existing portfolio’s strengths and weaknesses, highlighting areas for potential improvement.

Evaluation of Risk and Return

Once the data is collected and analyzed, the following critical process involves evaluating each asset or project’s risk and return profile within the portfolio. This step is crucial because it determines how each investment contributes to the portfolio’s performance. The evaluation process considers several factors, including historical performance, market volatility, economic outlook, and the specific risk characteristics of each asset.

Key metrics used in this evaluation include expected return, standard deviation, beta (systematic risk), and correlation coefficients, which help assess how assets move about each other. The goal is to quantify the potential risk and return for each investment, creating a clear picture of the portfolio’s overall risk profile. By understanding these dynamics, businesses can identify which assets offer the best balance of risk and reward, guiding strategic decision-making.

Portfolio optimization often utilizes predictive analytics and scenario analysis to forecast future market conditions and assess how changes in the economic landscape might impact the portfolio. By modeling different scenarios, organizations can better prepare for potential risks and make more informed choices about which assets to hold, adjust, or divest, thereby enhancing the effectiveness of their portfolio optimization strategy.

Portfolio Construction

With a clear understanding of individual assets’ risk and return profiles, the next step is portfolio construction. This process involves selecting the right mix of assets based on the organization’s strategic objectives, risk tolerance, and investment horizon. The goal is to create a diversified portfolio that optimizes the balance between risk and return, aligning with the company’s financial goals.

Portfolio construction often incorporates asset allocation strategies, dividing investments across asset classes such as equities, fixed income, real estate, and alternative investments. A well-diversified portfolio minimizes unsystematic risk (the risk specific to individual assets) by spreading investments across assets with low or negative correlations.

Modern portfolio theory (MPT) and other quantitative methods, such as mean-variance optimization, are commonly used in this phase to determine the optimal asset mix. These models aim to construct a portfolio that offers the highest possible expected return for a given level of risk. Additionally, businesses may factor in qualitative considerations, such as industry trends, regulatory changes, and alignment with environmental, social, and governance (ESG) criteria.

Continuous Monitoring and Rebalancing

Portfolio optimization is not a one-time event but an ongoing process that requires continuous monitoring and rebalancing. This step involves regularly assessing the portfolio’s performance against key performance indicators (KPIs) and benchmarks. Real-time data and advanced analytics play a crucial role here, enabling organizations to continuously track asset performance and market conditions, allowing for adaptability to changing market conditions.

The need for rebalancing arises when market movements cause the portfolio’s asset allocation to drift away from its target mix. For example, if equity markets outperform, the portfolio may become more weighted toward equities, increasing overall risk. Rebalancing involves adjusting the asset allocation to its optimal state, typically by buying or selling assets to maintain the desired risk-return profile.

This process also allows organizations to capitalize on new opportunities and address emerging risks. For instance, if economic indicators suggest a potential downturn, companies might reduce exposure to high-risk assets and increase allocations to safer, more stable investments. By staying agile and responsive to market changes, businesses can better protect their portfolios and enhance long-term performance.

The critical business processes in portfolio optimization — data gathering and analysis, evaluation of risk and return, portfolio construction, and continuous monitoring and rebalancing — provide a comprehensive framework for managing investments strategically. These processes enable organizations to make informed decisions, optimize resource allocation, and adapt effectively to evolving market conditions.

Standard Processes in Portfolio Optimization

Portfolio optimization follows a structured, step-by-step approach designed to analyze, evaluate, and refine a collection of assets, projects, or investments. These standard processes provide a systematic framework for decision-making and are essential for creating and maintaining a portfolio that aligns with the organization’s financial goals and risk tolerance. The core processes include portfolio assessment, risk evaluation, asset allocation, and rebalancing. Let’s explore each of these in more detail.

Portfolio Assessment

The first step in the portfolio optimization process is a thorough portfolio assessment, which involves reviewing the current assets, their performance, and overall portfolio composition. This assessment is critical as it provides a baseline understanding of the existing portfolio’s strengths, weaknesses, and areas for improvement. The process typically begins with gathering detailed data on each asset, including historical performance, current valuations, revenue contributions, and risk characteristics.

During the assessment phase, analysts evaluate the portfolio’s diversification, examining whether the assets are spread across different industries, asset classes, and geographical regions. This helps identify any areas of concentration that might expose the portfolio to heightened risk. Additionally, key performance metrics such as return on investment (ROI), Sharpe ratio, and alpha (excess return relative to a benchmark) are used to gauge the effectiveness of the portfolio’s current strategy.

This initial analysis sets the stage for deeper evaluation, allowing the organization to pinpoint underperforming assets or projects that may need reallocation or divested. The outcome of the portfolio assessment is a comprehensive snapshot of the portfolio’s current state, providing valuable insights for the next steps in the optimization process.

Risk Evaluation

After the portfolio assessment, the following crucial process is risk evaluation. This step involves analyzing the risk profile of the portfolio and each asset to identify potential vulnerabilities. Practical risk evaluation requires qualitative and quantitative tools, enabling a comprehensive understanding of the factors that could impact portfolio performance.

One of the most commonly used tools in risk evaluation is Value at Risk (VaR), which estimates the maximum potential loss over a specific period at a given confidence level. VaR helps organizations understand the extent of possible losses under normal market conditions, providing a clear metric for assessing overall portfolio risk. However, stress testing is also employed since VaR may not capture extreme market events. Stress testing involves simulating adverse scenarios, such as economic recessions or market crashes, to evaluate how the portfolio would perform under unfavorable conditions.

In addition to VaR and stress testing, organizations may use sensitivity analysis, which examines how changes in key variables (e.g., interest rates, exchange rates, inflation) could affect asset performance. This holistic approach to risk evaluation helps businesses prepare for various market dynamics, enhancing their ability to mitigate potential threats and make informed adjustments.

Asset Allocation

Once the risks are thoroughly assessed, the process moves on to asset allocation, a critical component of portfolio optimization that determines how resources are distributed across different asset classes or projects. The primary goal of asset allocation is to build a diversified portfolio that maximizes return potential while aligning with the organization’s risk tolerance and strategic priorities.

Asset allocation strategies vary widely. They range from strategic asset allocation, which sets long-term targets based on expected returns and risk levels, to tactical asset allocation, where short-term adjustments are made to capitalize on market opportunities. The process involves selecting the optimal mix of assets, such as equities, fixed income, real estate, and alternative investments, based on their risk-return profiles and correlation.

Diversification is a crucial principle in asset allocation, as it helps reduce unsystematic risk (the risk specific to individual assets). By including a range of assets with low or negative correlations, the portfolio’s overall volatility can be minimized. This process often leverages advanced techniques, such as mean-variance optimization and factor-based analysis, to refine asset selection and ensure that the portfolio can effectively achieve its objectives.

Rebalancing

The final standard process in portfolio optimization is rebalancing, a dynamic practice to maintain the desired asset mix and risk profile over time. Rebalancing involves periodically reviewing and adjusting the portfolio to align with the organization’s investment goals and strategic vision.

Market fluctuations and asset performance can cause the portfolio’s actual allocation to drift from its target mix. For example, if stocks outperform bonds, the portfolio may become more heavily weighted toward equities, increasing its overall risk exposure. Rebalancing addresses this issue by selling overweight assets and buying underweight assets, bringing the portfolio back to its optimal allocation.

There are several approaches to rebalancing, including calendar-based rebalancing, where adjustments are made at regular intervals (e.g., quarterly or annually), and threshold-based rebalancing, where changes are triggered when asset allocations deviate beyond a predetermined threshold (e.g., 5% from the target allocation). The choice of approach depends on the organization’s preferences, market conditions, and cost considerations.

Rebalancing is essential for long-term portfolio health, as it helps investors stay disciplined, avoid emotional decision-making, and maintain a consistent risk-return profile. Organizations can respond effectively to market changes by systematically adjusting the asset mix, capitalizing on new opportunities, and protecting against potential losses.

The standard processes in portfolio optimization — portfolio assessment, risk evaluation, asset allocation, and rebalancing — provide a comprehensive framework for managing investments strategically. Each step is designed to build a deeper understanding of the portfolio, enhance risk management, and optimize asset distribution, ensuring that the portfolio remains aligned with corporate goals and adapts effectively to market dynamics. This structured approach enables organizations to make informed, data-driven decisions that drive better financial outcomes and support sustainable growth.

Diverse Methodologies Employed in Portfolio Optimization

Portfolio optimization has evolved from its roots in traditional financial theories to include various sophisticated and data-driven methodologies. These diverse approaches allow organizations to tailor their portfolio strategies based on specific investment objectives, risk profiles, and market conditions. By combining quantitative analysis, macroeconomic insights, artificial intelligence, and multi-objective frameworks, modern portfolio optimization offers a comprehensive toolkit for enhancing performance and managing risk. Below, we explore vital methodologies that play a pivotal role in contemporary portfolio optimization, including quantitative methods, factor-based optimization, AI-driven approaches, and multi-objective optimization.

Quantitative Methods: Monte Carlo Simulations and Beyond

Quantitative methods form the backbone of many portfolio optimization strategies, providing a rigorous, data-driven framework for predicting asset performance and assessing risk. One of the most widely used quantitative techniques is the Monte Carlo simulation, which employs statistical modeling to generate a range of possible outcomes for a portfolio based on historical data and probabilistic scenarios.

Monte Carlo simulations involve creating thousands of random samples of potential market conditions and projecting how the portfolio might perform under each scenario. This process helps investors understand the probability distribution of returns and identify potential risks, such as extreme losses. By exploring a wide range of possible future states, Monte Carlo simulations provide a robust tool for stress testing and risk assessment, allowing organizations to make more informed decisions about asset allocation and risk management.

Beyond Monte Carlo simulations, other quantitative methods, such as optimization algorithms (e.g., genetic algorithms and linear programming), are used to solve complex optimization problems, particularly when dealing with large datasets or multi-asset portfolios. These methods offer a way to explore different asset combinations and identify the optimal mix that meets the investor’s risk-return criteria.

Factor-Based Optimization

Factor-based optimization is a methodology that considers the underlying macroeconomic factors and other drivers that influence asset returns. Unlike traditional methods that focus primarily on historical performance and asset-specific characteristics, factor-based optimization examines broader factors, such as interest rates, inflation, economic growth, and geopolitical events, that can significantly impact asset performance.

This approach uses a factor model to identify the key variables that drive returns across different asset classes. Common factors include value, momentum, quality, size, and volatility. By analyzing these factors, investors can build a portfolio designed to perform well under varying economic scenarios rather than relying solely on historical correlations.

Factor-based optimization offers several advantages, including better diversification and more precise risk management. By selecting assets influenced by different factors, investors can reduce the likelihood of simultaneous declines across the portfolio. Additionally, this methodology allows for dynamic adjustments, as changes in economic conditions may alter the impact of specific factors on asset returns. For example, a factor model might shift the portfolio away from interest-rate-sensitive assets like bonds in a rising interest-rate environment.

AI-Driven Approaches

Integrating artificial intelligence (AI) in portfolio optimization has revolutionized how investors analyze data and make decisions. AI-driven methodologies leverage machine learning algorithms and advanced analytics to process vast amounts of financial data, uncovering patterns and insights that traditional analysis might miss. These tools can dynamically adjust the portfolio based on real-time data and predictive analytics, making them well-suited for today’s fast-paced and volatile markets.

Machine learning models, such as neural networks and random forests, can identify complex, non-linear relationships between variables that affect asset performance. For example, AI can detect subtle correlations between macroeconomic indicators, market sentiment, and asset prices, enabling more accurate predictions of future returns. Sentiment analysis, a subset of AI, analyzes data from news articles, social media, and financial reports to gauge investor sentiment and predict market movements.

One key benefit of AI-driven approaches is their ability to adapt and learn over time. As new data becomes available, machine learning models update their predictions, allowing for continuous optimization of the portfolio. This adaptability helps investors respond quickly to changes in market conditions, capitalizing on emerging opportunities and mitigating risks. However, AI methodologies also require robust data governance and model validation to ensure that the predictions are reliable and free from biases.

Multi-Objective Optimization

Multi-objective optimization is a methodology that addresses the complexity of balancing multiple, often conflicting, goals in portfolio management. Unlike single-objective approaches that focus solely on maximizing returns or minimizing risk, multi-objective optimization considers a broader set of criteria, such as maximizing returns, minimizing risk, and achieving sustainability targets like ESG (Environmental, Social, and Governance) compliance.

This methodology uses advanced optimization techniques like Pareto analysis to find solutions representing the best trade-offs between competing objectives. The Pareto frontier is a concept where each point on the curve represents a portfolio configuration that cannot be improved in one objective (e.g., return) without worsening another (e.g., risk). This approach helps investors decide based on their priorities and constraints, offering a tailored solution that aligns with the organization’s values and goals.

For example, a company with a solid commitment to sustainability might prioritize ESG factors in its portfolio, even if it means accepting slightly lower returns. Multi-objective optimization provides the flexibility to incorporate these preferences, balancing financial performance with ethical considerations. This is particularly relevant in today’s investment landscape, with growing interest in sustainable investing and socially responsible portfolios.

The methodologies employed in portfolio optimization range from traditional quantitative approaches like Monte Carlo simulations and factor-based models to advanced, data-driven techniques such as AI-driven analysis and multi-objective optimization. Each methodology offers unique advantages, allowing investors to build diversified, resilient portfolios tailored to their needs and objectives. By combining these diverse approaches, organizations can enhance their decision-making capabilities, optimize asset allocation, and navigate the complexities of modern financial markets more effectively.

Portfolio optimization is a comprehensive, data-driven methodology that integrates various business processes, standardized practices, and advanced techniques to achieve optimal asset management. By employing diverse methodologies tailored to specific needs, businesses can enhance their decision-making capabilities, effectively manage risk, and drive better financial performance.

Industries

This service is primarily available to the following industry sectors:

Insurance

The insurance industry is a crucial component of the global financial system, providing products and services that help individuals and businesses manage risks. At its core, insurance is a contract (policy) between an insurer and a policyholder where the insurer agrees to compensate the policyholder for specific losses or damages in exchange for a premium. The industry is broadly categorized into two main sectors: life and health insurance and property and casualty insurance.

Life insurance focuses on policies that pay out a lump sum to beneficiaries upon the insured’s death. It is a financial safety net for families, covering expenses such as debts, mortgages, and funeral costs. Additionally, life insurance products often include investment components, such as whole life or universal life policies, which build cash value over time.

Health insurance covers medical expenses incurred by the insured due to illness, injury, or other health-related issues. This segment includes individual policies, employer-provided group health insurance, and government programs like Medicare and Medicaid in the United States. Health insurers face challenges related to rising healthcare costs, regulatory changes, and the need for better patient outcomes, driving innovation in this sector.

Property and casualty (P&C) insurance encompasses a wide array of policies that protect against property damage (like homes and cars) and liability risks (such as lawsuits). This segment includes auto, homeowners, and commercial insurance for businesses. P&C insurance is essential for safeguarding assets against natural disasters, accidents, theft, and other unforeseen events.

Commercial insurance within P&C also covers specialized areas like professional liability (e.g., malpractice insurance for doctors), workers’ compensation, and business interruption insurance, which helps businesses recover from events that disrupt operations.

The insurance market consists of various players, including insurers, reinsurers, brokers, and agents. Insurers are the companies that underwrite policies and assume the risk. Reinsurers, such as Swiss Re and Munich Re, provide insurance to insurers, helping them spread risk and manage exposure to large claims. Brokers and agents, on the other hand, act as intermediaries between the insurers and the insured, assisting clients in finding the most suitable policies and ensuring that the policyholder’s interests are represented.

A core function of the insurance industry is underwriting, which involves assessing the risk associated with insuring a person, property, or business. Underwriters analyze data and use actuarial models to determine the likelihood of a claim and set premiums accordingly. This meticulous process is the backbone of the industry, ensuring effective risk management and accurate underwriting, which are essential for insurance companies’ profitability and sustainability.

The insurance industry faces numerous challenges, including regulatory compliance, economic volatility, and changing customer expectations. Climate change has become a significant concern, as natural disasters’ increasing frequency and severity lead to higher claims, particularly in the P&C segment.

Digital transformation is reshaping the industry, with InsurTech (insurance technology) startups driving innovation. These companies use artificial intelligence, big data, and blockchain to streamline processes, enhance customer experiences, and improve risk assessment. For instance, artificial intelligence is used to automate underwriting processes, big data is leveraged to personalize insurance products, and blockchain is employed to secure and streamline claims processing. These technological advancements are revolutionizing the insurance industry, making it more efficient and customer-centric.

The insurance industry is heavily regulated to ensure insurers’ solvency and protect policyholders. Regulatory frameworks vary by country but typically focus on capital requirements, pricing, and consumer protection. In the U.S., for example, insurance is regulated at the state level, with each state having its own insurance department responsible for overseeing insurers’ operations and ensuring compliance with state laws. In the European Union, the Solvency II directive establishes risk management standards and is enforced by the European Insurance and Occupational Pensions Authority (EIOPA).

The insurance industry is pivotal in providing financial protection, promoting stability, and enabling economic growth. It plays a crucial role in the economy, providing a safety net for individuals and businesses and facilitating investment and risk-taking. Despite challenges like evolving risks and regulatory pressures, the industry continues to adapt, leveraging technology and innovation to meet the changing needs of consumers and businesses.

Pharmaceuticals

The pharmaceutical industry is a significant sector within the global healthcare ecosystem, focused on the research, development, manufacturing, and distribution of drugs and medications. Its primary goal is to discover and deliver therapeutic solutions that prevent, treat, or cure diseases, improving the quality of life and extending life expectancy for millions of people.

The pharmaceutical industry is vast and complex, comprising branded (innovative) pharmaceuticals and generic drugs. Branded pharmaceutical companies focus on research and development (R&D) to create new, innovative medicines. These companies invest heavily in clinical trials, which are required to prove the efficacy and safety of new drugs before they can receive regulatory approval. On the other hand, generic drug manufacturers produce versions of branded medicines once the original patents expire, making affordable medication available to a broader population.

Key players in the industry include large multinational corporations known as Big Pharma (e.g., Pfizer, Johnson & Johnson, Merck), mid-sized biotech firms focusing on specialized treatments, and smaller niche companies specializing in generics or specific therapeutic areas.

A complex, multi-phase process of drug development drives the pharmaceutical industry. This process typically begins with preclinical research, where potential compounds are tested in laboratories and on animals to evaluate their safety and biological activity. If promising results are obtained, the drug moves to clinical trials, which are conducted in three phases:

• Phase I tests the drug’s safety on a small group of healthy volunteers.

• Phase II assesses the drug’s efficacy and side effects on a larger group of patients with the targeted condition.

• Phase III involves large-scale testing on diverse patient populations to confirm effectiveness, monitor side effects, and compare the new drug to standard treatments.

If successful, the drug manufacturer submits a New Drug Application (NDA) to regulatory bodies like the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) for approval. Once approved, the drug can be marketed and sold.

The pharmaceutical industry is one of the most heavily regulated sectors globally due to its impact on public health. Regulatory bodies enforce stringent guidelines on drug approval, manufacturing practices, and marketing to ensure safety, efficacy, and quality. The FDA oversees this process in the United States, while the EMA does so in Europe.

The industry also faces intellectual property (IP) regulations, particularly patents. Pharmaceutical patents typically last 20 years, giving companies exclusive rights to market their drugs during this period. This exclusivity allows companies to recoup the high costs associated with R&D and sparks debates about drug pricing and access to affordable medications.

The pharmaceutical industry faces significant challenges, including high R&D costs, regulatory hurdles, and increasing competition from generic drug makers. The average price of bringing a new drug to market is estimated to exceed $1 billion, with only a fraction of compounds making it through the entire process. Additionally, the industry grapples with drug pricing controversies, as rising medication costs have sparked debates over the balance between innovation and affordability.

Emerging trends are reshaping the industry landscape, particularly the rise of biopharmaceuticals, including biologics and biosimilars derived from living cells rather than chemical synthesis. Personalized medicine and gene therapies, which offer targeted treatments based on a patient’s genetic makeup, are also gaining traction.

Digital transformation and artificial intelligence (AI) integration accelerate drug discovery, optimize clinical trials, and improve patient outcomes. AI can analyze vast datasets to identify potential drug candidates, streamline R&D processes, and enhance decision-making in clinical trials.

The pharmaceutical industry is vital to global health, driving advancements in medicine and improving patient care. Despite the high costs and complex regulations, ongoing innovations and emerging technologies continue to push the boundaries of what is possible, offering new hope for treating and curing a wide range of diseases.

Healthcare

The healthcare industry is a vast and dynamic sector encompassing a wide range of services, products, and systems aimed at maintaining and improving health. It is one of the largest and fastest-growing industries globally, driven by factors such as aging populations, advances in medical technology, rising patient expectations, and an increasing focus on preventive care and wellness. The healthcare industry includes various components, such as healthcare providers, pharmaceuticals, medical devices, health insurance, and health technology.

At the heart of the healthcare industry are the dedicated healthcare providers. These include hospitals, clinics, primary care physicians, specialists, and allied health professionals like nurses, therapists, and technicians. They are the ones who deliver direct patient care, from diagnosing and treating illnesses to providing preventive services like vaccinations and health screenings. The diversity of these providers, from small community facilities to large academic medical centers, ensures that every patient’s needs are met.

Primary care providers serve as patients’ first point of contact, handling routine health issues and coordinating referrals to specialists when needed. The shift toward value-based care, a model that focuses on the quality and outcomes of care rather than the volume of services provided, has changed the healthcare landscape. This model emphasizes patient satisfaction, health outcomes, and cost-efficiency, encouraging providers to deliver high-quality care that meets patients’ needs.

The pharmaceutical segment of healthcare is responsible for developing, producing, and distributing medications to treat, prevent, or cure diseases. It includes branded, generic, and over-the-counter (OTC) drugs. The pharmaceutical industry invests heavily in research and development (R&D) to bring innovative treatments to market, such as life-saving drugs and personalized medicines.

Medical devices are products for diagnosing, treating, or monitoring health conditions. They range from simple tools like thermometers and blood pressure cuffs to complex technologies such as MRI machines, pacemakers, and surgical robots. The industry also includes medical supplies like bandages and surgical instruments critical for patient care.

Health insurance plays a crucial role in the healthcare ecosystem, providing financial protection for individuals against the high costs of medical care. Insurers offer various plans covering hospital stays, surgeries, prescription drugs, and preventive care. In the United States, health insurance includes private insurance, employer-sponsored plans, and government programs like Medicare and Medicaid. In other countries, government-funded universal healthcare systems often provide coverage for all citizens.

Health insurance companies work with providers to negotiate payment rates and establish care networks, influencing access, quality, and costs of healthcare services. The industry faces challenges related to rising healthcare costs, regulatory changes, and the need to balance affordability with comprehensive coverage.

The adoption of health technology is revolutionizing the healthcare industry, ushering in a new era of efficiency, improved patient outcomes, and enhanced patient experience. Technologies like electronic health records (EHRs), telemedicine, artificial intelligence (AI), and wearable devices are reshaping the way care is delivered. EHRs facilitate better data sharing and patient management, while telemedicine is expanding access to care, particularly in remote areas. The future of healthcare is bright with these technological advancements.

AI is used to analyze medical imaging, predict patient outcomes, and support drug discovery. Wearable devices like fitness trackers and smartwatches monitor vital signs in real time, empowering patients to take a more active role in managing their health.

The healthcare industry faces significant challenges, including rising costs, regulatory complexities, workforce shortages, and healthcare access disparities. However, these challenges also present substantial opportunities for growth and innovation. For instance, the shift toward preventive care and the rise of personalized medicine are driving innovation in the industry. Moreover, the integration of digital health solutions is improving healthcare access and quality. By addressing these challenges and seizing these opportunities, the healthcare industry can continue to evolve and improve.

The healthcare industry is a vital and complex ecosystem that impacts every aspect of human life. It constantly evolves, driven by technological advancements, demographic changes, and the increasing demand for better, more accessible care. While challenges such as cost containment and regulatory hurdles persist, ongoing innovation and a focus on patient-centered care continue to shape the future of healthcare, promising improved outcomes and a higher quality of life for individuals worldwide.

Medical Technology

The medical technology (MedTech) industry is a dynamic and rapidly evolving sector focused on developing and manufacturing devices, tools, and equipment that improve patient care and enhance disease diagnosis, treatment, and prevention. The MedTech industry is critical to modern healthcare, from simple instruments like syringes and stethoscopes to advanced technologies such as robotic surgical systems and artificial intelligence (AI)-powered diagnostics.

Medical technology encompasses various products, broadly categorized into diagnostic, therapeutic, and monitoring equipment. Diagnostic devices include imaging systems like MRI and CT scanners, in vitro diagnostic (IVD) tests for blood analysis, and wearables that monitor vital signs. Therapeutic devices are used in treatment and include pacemakers, insulin pumps, and surgical tools. Monitoring equipment, such as remote patient monitoring (RPM) systems, helps healthcare providers track patient health in real-time, improving the management of chronic conditions.

As key players in the MedTech industry, you, the healthcare professionals, medical technology students, and industry stakeholders are integral to its success. Large multinational corporations like Medtronic, Johnson & Johnson, Siemens Healthineers, and smaller, specialized startups focused on niche innovations operate in a highly regulated environment to ensure medical devices’ safety, efficacy, and quality.

Innovation is the cornerstone of the MedTech industry, with companies investing heavily in research and development (R&D) to create new and improved devices. The industry is currently witnessing several transformative trends that are reshaping the future of healthcare, inspiring hope and optimism:

Wearable Technology: Devices like smartwatches, fitness trackers, and implantable sensors are revolutionizing patient monitoring. They enable continuous tracking of vital signs and early detection of health issues. These devices provide real-time data that can be shared with healthcare providers, empowering patients to manage their health proactively.

• Artificial Intelligence (AI) and Machine Learning (ML): AI is increasingly used in diagnostic imaging, where algorithms can analyze X-rays, MRIs, and other scans faster and more accurately than human radiologists. AI also aids in predictive analytics, helping to identify at-risk patients and recommend personalized treatment plans.

• Robotic Surgery: Robotic-assisted surgical systems, like the da Vinci Surgical System, allow for minimally invasive procedures, offering greater precision, shorter recovery times, and reduced risks of complications. Robotics are also expanding into areas like rehabilitation, where robotic exoskeletons assist patients in regaining mobility.

• 3D Printing: This technology is transforming MedTech by enabling the custom production of medical devices, such as prosthetics, implants, and even tissue scaffolds. 3D printing allows rapid prototyping, personalized medical solutions, and reduced manufacturing costs.

The MedTech industry is subject to strict regulations to ensure patient safety and product quality. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive testing and clinical trials before a new medical device can be approved for market entry. The process includes preclinical testing, clinical trials, and post-market surveillance to monitor safety and effectiveness.

The regulatory landscape is also adapting to innovations, such as AI-powered devices and software-as-a-medical-device (SaMD), requiring updated frameworks to address unique challenges related to data security, patient privacy, and algorithm transparency.

The MedTech industry faces challenges such as regulatory compliance, high R&D costs, and the need for robust data privacy measures, particularly as devices become more interconnected through the Internet of Medical Things (IoMT). There is also pressure to reduce costs and improve accessibility, especially in developing markets.

However, significant opportunities exist, driven by aging populations, increasing prevalence of chronic diseases, and a growing focus on personalized medicine and home-based care. The COVID-19 pandemic accelerated demand for digital health solutions, including telemedicine and remote monitoring, highlighting the industry’s role in shaping the future of healthcare.

The MedTech industry is a vital, innovative sector that enhances patient care and drives advancements in healthcare. With ongoing technological progress and a focus on personalized, data-driven solutions, MedTech is well-positioned to play a central role in addressing global healthcare challenges and improving patient outcomes. Despite regulatory and economic hurdles, the industry’s commitment to innovation continues to transform the landscape of modern medicine.

Manufacturing

The manufacturing industry, a cornerstone of the global economy, transforms raw materials into finished goods through various processes, machinery, and labor. It encompasses multiple sectors, including automotive, electronics, aerospace, chemicals, pharmaceuticals, food and beverage, and textiles. As one of the largest sectors, manufacturing not only drives economic growth and creates jobs but also significantly contributes to trade and innovation. This role in economic development should inspire pride in all of us.

Manufacturing is typically categorized into two main segments: discrete and process. Discrete manufacturing produces distinct items using assembly lines and individual parts, such as cars, appliances, and electronics. Process manufacturing, however, involves creating products that cannot be easily disassembled, such as chemicals, food, and beverages, using formulas and recipes.

The industry has undergone a significant evolution from traditional manual labor and assembly lines to highly automated processes driven by cutting-edge technologies. Today, manufacturing incorporates advanced robotics, artificial intelligence (AI), and industrial Internet of Things (IIoT) technologies, making production more efficient, flexible, and scalable.

The manufacturing industry is undergoing a transformation driven by several key trends:

• Industry 4.0 and Smart Manufacturing: Industry 4.0, the fourth industrial revolution, refers to integrating digital technologies such as IoT, AI, and big data analytics into manufacturing processes. This shift enables intelligent factories, where machines are interconnected and communicate in real time, allowing for predictive maintenance, monitoring, and enhanced decision-making.

• Automation and Robotics: Automation has become a fundamental aspect of modern manufacturing, with robotics playing a pivotal role in assembly lines, material handling, and quality control. Advanced robotics and collaborative robots (cobots) work alongside human workers, increasing productivity while reducing the risk of human error.

• Additive Manufacturing (3D Printing): 3D printing revolutionizes production by allowing manufacturers to create complex, custom parts quickly and cost-effectively. This technology is precious for prototyping, reducing lead times, and enabling mass customization.

• There is a growing emphasis on sustainability and green manufacturing in the industry, driven by regulatory requirements and consumer demand for environmentally friendly products. Manufacturers are investing in energy-efficient technologies, waste reduction strategies, and sustainable sourcing of raw materials to reduce their carbon footprint and promote circular economy principles.