Employee Benefits

Accredited Consulting Service for Mr. Young Accredited Senior Consultant (ASC)

The Appleton Greene Accredited Consultant Service (ACS) for Employee Benefits is provided by Mr. Young and provides clients with four cost-effective and time-effective professional consultant solutions, enabling clients to engage professional support over a sustainable period of time, while being able to manage consultancy costs within a clearly defined monthly budget. All service contracts are for a fixed period of 12 months and are renewable annually by mutual agreement. Services can be upgraded at any time, subject to individual client requirements and consulting service availability. If you would like to place an order for the Appleton Greene Employee Benefits service, please click on either the Bronze, Silver, Gold, or Platinum service boxes below in order to access the respective application forms. If you have any questions or would like further information about this service, please CLICK HERE. A detailed information guide for this service is provided below and you can access this guide by scrolling down and clicking on the tabs beneath the service order application forms.

Client Telephone Conference (CTC)

If you have any questions or if you would like to arrange a Client Telephone Conference (CTC) to discuss this particular Unique Consulting Service Proposition (UCSP) in more detail, please CLICK HERE.

Bronze Client Service

Monthly cost: USD $1,500.00

Time limit: 5 hours per month

Contract period: 12 months

SERVICE FEATURES

Bronze service includes:

01. Email support

02. Telephone support

03. Questions & answers

04. Professional advice

05. Communication management

To apply – CLICK HERE

Silver Client Service

Monthly cost: USD $3,000.00

Time limit: 10 hours per month

Contract period: 12 months

SERVICE FEATURES

Bronze service plus

01. Research analysis

02. Management analysis

03. Performance analysis

04. Business process analysis

05. Training analysis

To apply – CLICK HERE

Gold Client Service

Monthly cost: USD $4,500.00

Time limit: 15 hours per month

Contract period: 12 months

SERVICE FEATURES

Bronze/Silver service plus

01. Management interviews

02. Evaluation and assessment

03. Performance improvement

04. Business process improvement

05. Management training

To apply – CLICK HERE

Consultant Profile

Mr. Young is an approved Senior Consultant at Appleton Greene and he has experience in human resources, management and finance. He has achieved a Master of Public Administration, a Bachelor of Arts in Political Science and is a Certified Employee Benefit Specialist. He has industry experience within the following sectors: Insurance; Consultancy; Banking & Financial Services and Accountancy. He has had commercial experience within the following countries: United States of America, or more specifically within the following cities: San Antonio TX; Austin TX; Houston TX; Dallas-Ft Worth TX and McAllen TX. His personal achievements include: national association gained health benefits; manufacturer improved participant spending accounts; school district automated retirement plan and insurance agency broadened consultancy. His service skills incorporate: employee benefits; benefit TPA; benefit design; benefit compliance and ERISA governance.

To request further information about Mr. Young through Appleton Greene, please CLICK HERE

Executive Summary

Employee Benefits

As health care costs continue to rise and compliance requirements intensify, correctly navigating the complex maze of employee benefits is essential. There is a need for a trusted advisor with experience and who is a degreed/credentialed with knowledge to help companies from small to large design, implement and administer strategic insurance and employee benefits programs to advance business goals and meet employee benefits coverage and retirement needs.

Implementation and managing comprehensive, cost-effective human resource programs will help a company to meet it’s specific business goals. A business should receive timely expert support and personalized service to ensure the selection of a benefits program that will be right for the plan sponsor and its participants.

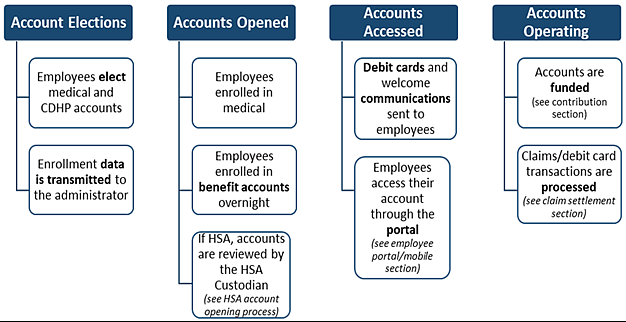

Management of the entire scope of plan design and administration is required to allow for uninterrupted plan coverage for the company’s employee participants. Help with all applications for new coverage should be received, termination procedures from previous carrier to new carrier should be coordinated, and employee communications and administration protocols for new enrolees implemented. The flow chart below illustrates an implementation process for just one employee benefit option of flexible spending accounts.

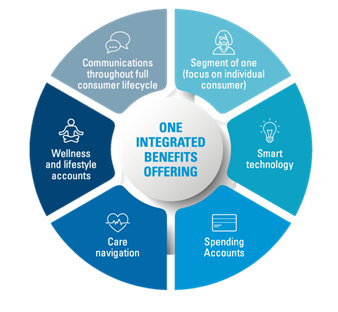

Every solution will be tailored to help each client maintain leadership status as an employer of choice. Expert design and customize comprehensive plans will be achieved that balance the need to control costs while accommodating specific plan requests and unique employee situations through a robust benefit offering. This service should be offered without being focused on a specific product to sell for commissions.

Consulting clients will be provided with customized and comprehensive solutions for employee benefits needs from medical, dental, and disability insurance to profit sharing plans, 401(k), 403(b)/457, pension and actuarial services for complex cash balance or defined benefit plans..

By approaching market benchmarking data employers are provided a standard to compare current benefit programs. Recommendations then should be made to help clients enhance plans while at the same time remaining competitive and reducing overall plan costs.

Valuable benefit trend statistics and surveys are one of the core pieces of information that can be provided to help clients support benefit plan design strategy and decisions.

When the project is completed the following strengths will be realized:

• Every benefit plan offered will have been reviewed, analyzed, and corrected for benefit coverage gaps and overlapping coverages. The goal to develop an employee benefits plan to meet the need for the recruitment and retention of talented and valuable personnel will be met.

• Management will be meeting the fiduciary responsibility to keep the plans compliant with the Employee Retirement Income Security Act (ERISA) and IRS regulations. The plan sponsor and employer will understand how to manage the day-to-day operations of their employee benefit plans.

• Management will have established their confidence that a comprehensive, cost-effective human resource programs are in place to meet a company’s specific business goals and to attract top talent to the company.

• A RFP process will have established and implemented to identify and take into account the various vendors and providers experience and expertise, including the vendors credentials and access to market alternatives. The process will not end with just an award letter. Management will know how to collaborate with the awarded vendors to agree on the price, delivery, processes, payment terms and warranties in the agreement. Vendor agreements will be understood after a thorough review process implemented by management.

• A communication program will have been developed and implemented to communicate the benefits in a manner that the employees and participants can appreciate.

The mission is to receive timely expert support and personalized service to ensure the selection of a benefits program that is right for the plan sponsor and its participants. The goal is designing comprehensive plans that balance the need to control costs while accommodating specific plan requests and unique employee situations through a robust benefit offering. An approach to any project will be with the overall view of the company’s culture and goals of the company that will in the end result as a benefit from the service.

Service Methodology

A systematic process is required to provide clients with timely expert support and personalized service. There is a multiple step process that is required and ordered to provide expert support and personalized service that will ensure the selection of a benefits program that is right for the plan sponsor and its participants.

Step 1 – Benefit Review – This first step has been developed with the objective to review current employee benefit programs and determine if the employee benefit program goals are being met. The goal is to develop an employee benefits plan that will meet the need for the recruitment and retention of talented and valuable personnel. An effective employee benefit program will help a company to maintain leadership status as an employer of choice.

Step 2 – Governance – The objective of governance is to help the prudent employer understand the need to administrator and manage the day-to-day operations of their employee benefit plans, whether the employer appointments a third party plan administrator or administers the plan in house. This step will alleviate and effectively minimizes liability exposure of the plan sponsor.

Step 3 – Plan Design – Benchmarking data is required to provide a standard to compare the benefit programs being implemented. Valuable benefit trend statistics and surveys are one of the core pieces of information needed to help support a specific benefit plan design strategy and decision. The plan design objective is to establish confidence that a comprehensive, cost-effective human resource programs are in place to meet a company’s specific business goals and to attract top talent to the company.

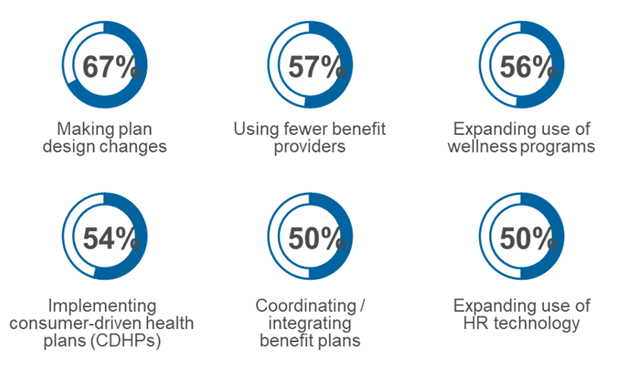

Cost Control Strategies being considered by Employers

Step 4 – RFP Process – Once the first three objectives have been met, and not before, it is time to begin the process of finding the best insurance coverages, asset investment dealers for the retirement plan, the agent of record for the insurance coverages, the financial advisor for the retirement plan/pension plan, and benefit plan administrator/recordkeeper that is available. The RFP process does not end with the final award letter, but then moves to the procurement negotiations. The company will need to collaborate with the awarded vendors to agree on the price, delivery, processes, payment terms and warranties in the agreement.

Step 5 – Communication – Communication of the benefit program is critical for the participants to receive and appreciate. Without a well developed communication program can undermine all of the work in Steps 1-4. When building a communication plan, there are key elements that always should be considered. Topics such as general education on the benefit features to be offered, who is eligible, and what contributions will be required via payroll deduction should be covered to help the participants determine how much coverage is proper for themselves and their family. Also, what supplemental benefits are appropriate under various circumstances and their family needs. Finally, what they will need to save to adequately prepare for retirement. The education should include where to go for investment education to prevent participants just putting money into cash assets during open enrollment.

Service Options

Companies can elect whether they just require Appleton Greene for advice and support with the Bronze Client Service, for research and performance analysis with the Silver Client Service, for facilitating departmental workshops with the Gold Client Service, or for complete process planning, development, implementation, management and review, with the Platinum Client Service. Ultimately, there is a service to suit every situation and every budget and clients can elect to either upgrade or downgrade from one service to another as and when required, providing complete flexibility in order to ensure that the right level of support is available over a sustainable period of time, enabling the organization to compensate for any prescriptive or emergent changes relating to: Customer Service; E-business; Finance; Globalization; Human Resources; Information Technology; Legal; Management; Marketing; or Production.

Service Mission

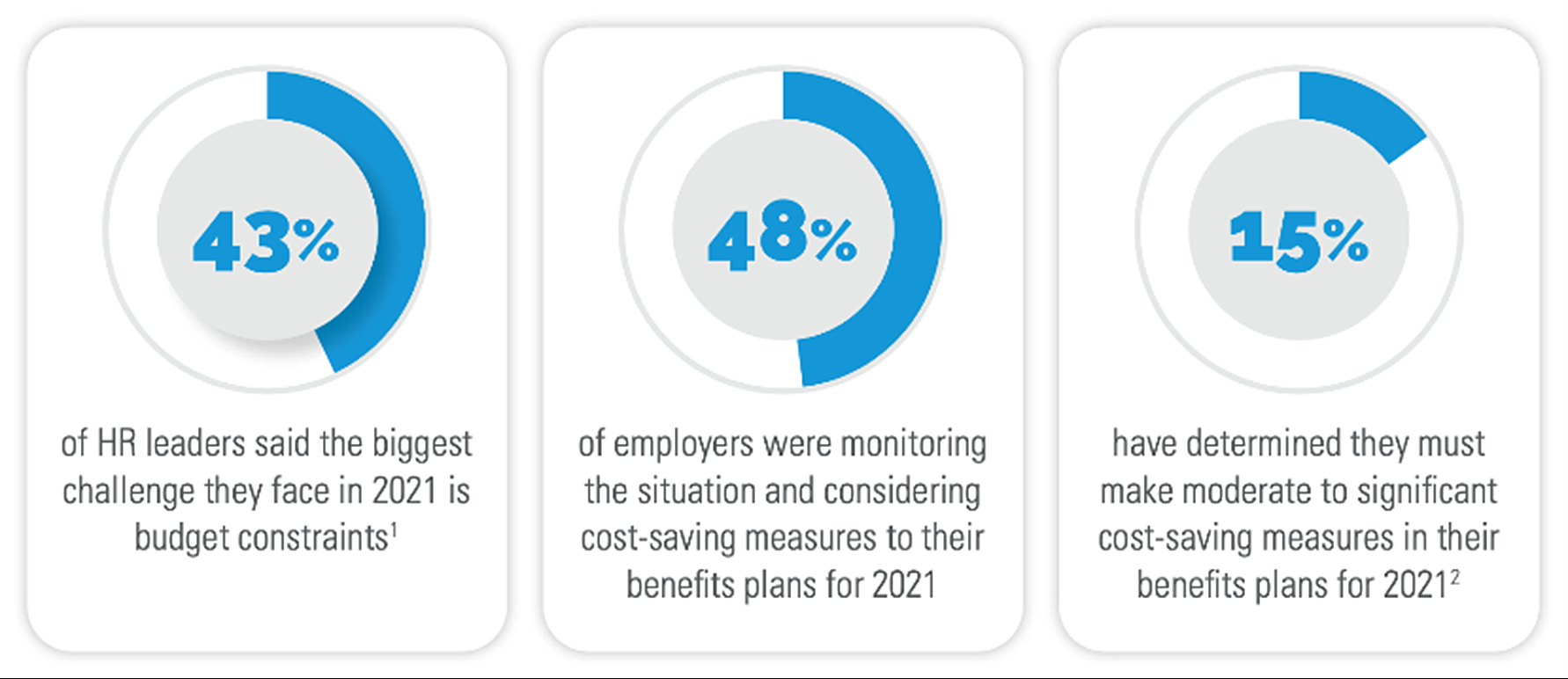

An effective employee benefit program will help you maintain leadership status as an employer of choice. The service mission is to development and implement an effective plan(s) and a program appreciated by the employee participants of the program, while being a success for the employer. A foremost goal is to develop a strategic insurance and employee benefits programs to advance business goals and meet employee benefits coverage and retirement needs. Solutions that are tailored to help each client maintain leadership status as an employer of choice. In a recent survey 43% of HR leaders said the biggest challenge they face is budget restraints. With the rapid pace of inflation this challenge will only increase in the near foreseeable future. Additionally, 48% of employers were monitoring the situation and considering cost-saving measures to their benefits plans. 15% of employers have determined they must make moderate to significant cost-saving measures in their benefits plans in the near future.

The mission is to develop expert program designs and customized comprehensive plans that balance the need to control costs while accommodating specific plan requests and unique employee situations through a robust benefit offering. If the process and steps outlined within followed these goals will be met and the benefit program will be a success for the employer and appreciated by the employee participants.

Service Objectives

- Benefits Review

As health care costs continue to rise and compliance requirements intensify exponentially, correctly navigating the complex maze of employee benefits is essential. The heart and soul of any business is its people. When a company’s employees lose their focus on their tasks due to concern for their/or their family’s health and welfare, they are less likely to properly apply their skills to produce and deliver products and services of the company. That in turn will cause the business performance to be not as competitive and satisfactory. In the end, customer satisfaction will be harmed due to quality and delivery issues.Employee benefits are a crucial factor in the recruitment and retention of talented and valuable personnel. A strategic blend of expertise, creative solutions, and extensive resources are needed to enable a company to successfully implement competitive employee benefits programs that meet employee expectations and needs as well as business and financial goals. When employees no longer worry about their health and welfare and that of their families, they will in turn deliver products and services that meet the delivery requirements that satisfy the company’s customers.

Every employee benefits solutions must be tailored to maintain the company’s leadership status as an employer of choice. Otherwise the company’s team will be second choice in the marketplace. Expert design and customized comprehensive plans are needed to balance the need to control costs while accommodating specific plan and unique employee situations through a robust benefit offering.

In addition the company works with plan participants to ensure they maximize their benefits and that optimize results. Educational enrollment meetings with customized collateral help employees understand the coverage that is available, which enables them to make better decisions for themselves and their families.

The goal is to develop an employee benefits plan that will meet the need for the recruitment and retention of talented and valuable personnel. An effective employee benefit program will help a company to maintain leadership status as an employer of choice. The first objective is to review current employee benefit programs and determine if the employee benefit program goals are being met.

- Governance

Business owners understand the relationship and reasons for partnering with an Attorney, CPA and Financial Advisor. These partnerships allow the business owner to focus on their line of business while leaving legal, accounting and financial concerns in the hands of their advisors. Even with this suite of professionals the business owner still maintains sole fiduciary liability overseeing the administration, plan management and decisions of their employee benefit plans. With the current federal and state enforcement climate, an employer has a need to ensure they reduce corporate and personal liability for fiduciary responsibilities. A prudent business owner should see the need to align themselves with a strategic plan to obtain proper governance of their employee benefit plans.Whether large or small, employers that provide employee benefit plans to their employees have a fiduciary responsibility to keep the plans compliant with the Employee Retirement Income Security Act (ERISA). Most Plan Sponsors (employers), as well as plan committees, human resource professionals, officers and directors are aware of this fiduciary responsibility. What is unclear to most, about their fiduciary role, is their own personal liability to restore any losses to the plan if the basic standards of conduct set forth by ERISA are not followed.

There is a need for employers to partner with the expertise to manage the oversight of the daily plan operations as well as take on some of the fiduciary liability enabling the business owner to focus on their company and its future.

Why?

• They lack the time and expertise to ensure that all of the administrative functions for the retirement plan are carried out correctly

• Most employers operate with lean in-house staff and need to be confident that the plan is being administered correctly

• Employers need to minimize fiduciary liability exposure which can be exorbitant

• Most employers with staff do not have the ERISA expertise needed to administer plans

• Employers who have newer employees working on the plan are still learning about ERISA requirements

Beyond ERISA governance, there are other agencies that have regulations and laws that require attention. The Internal Revenue Service, Department of Health and Human Services, HHS Office of Civil Rights, and state insurance agencies have reporting requirements along with state regulations that all need to be complied with daily and annually. The Affordable Care Act has another set of complex rules that must be required with, including reporting. For example, a penalty of $2,750 (for 2022) per full-time employee minus the first 30 will be incurred if the employer fails to offer minimum essential coverage to 95 percent of its full-time employees and their dependents, and any full-time employee obtains coverage on the exchange.

The objective of governance is to help the prudent employer understand the need to administrator and manage the day-to-day operations of their employee benefit plans, whether the employer appointments a third-party plan administrator or administers the plan in house. This step will alleviate and effectively minimizes liability exposure of the plan sponsor.

- Plan Design

The process of developing and implementing a comprehensive, cost-effective employee benefits program begins with a review of all programs currently in place at the company. This includes not only employer sponsored and paid for plans, but also all workplace voluntary benefit plans often associated with a Section 125 Cafeteria Plan. Then a review of what governance is required regarding those programs that have been identified in the benefit review. Once objectives 1 & 2 are completed, the project should quickly advance to a revised and comprehensive plan design of the employee benefits being offered or to be offered. Just reviewing the benefit plans and the governance of the program is important, but failure to revise based on the reviews will not accomplish the end goal. To be a well-designed benefit program the plan needs to be a customized and comprehensive solution for the employer’s culture and demographics. Many employee benefit programs are a hodgepodge of insurance coverages that have been incrementally implemented over the years. Due to past years decisions, insurance coverages can conflict with each other or even duplicate each other. Employees can end up buying via payroll deduction duplicate policies that are expensive and high-cost insurance coverages that are neither useful or needed. As health care costs continue to rise and compliance requirements intensify, correctly navigating the complex maze of employee benefits is essential to implement a high-quality employee benefit program. This includes both employer sponsored plans, but also voluntary benefits. There is a need for not only education, credentials, and expertise, but also experience to manage the entire scope of plan implementation and ongoing plan administration. Experience along expertise will enhance for uninterrupted plan coverage that benefit the participants and does not a frustrate employees with a hodgepodge insurance and employee benefits plan. Wise benchmarking/best practices implementation of an employee benefit program is required to eliminate high-cost high commission products with the best available products in the market that will provide quality coverage at the lowest possible expense for the employer and the employees.Benchmarking data is required to provide a standard to compare the benefit programs being implemented. Valuable benefit trend statistics and surveys are one of the core pieces of information needed to help support a specific benefit plan design strategy and decision. These surveys and statistics provide benchmark data from leading consulting organizations around the country.

The plan design objective is to establish confidence that a comprehensive, cost-effective human resource programs are in place to meet a company’s specific business goals and to attract top talent to the company.

- RFP Process

Once the first three objectives have been met it is time to begin the process of finding the best insurance coverages, asset investment dealers for the retirement plan, the agent of record for the insurance coverages, the financial advisor for the retirement plan/pension plan, and benefit plan administrator/recordkeeper that is available. The Request For Proposal (RFP) process should include not only both health and welfare products, but also retirement plan/pension plan administrative services, recordkeeping services, actuarial services, and associated investment products. This process will take careful consideration, time, and can be complex if done properly. Picking the best vendor for each benefit plan element is a critical process, following best practices and stringent due diligence in the process. Failure to carefully evaluate the vendors and players can carry serious consequences in both civil and government enforcement.What is the RFP process? It is the development of a formal questionnaire that will be sent to prospective vendors of the benefit programs chosen in the plan design. The process should be systematic and objective in order to find the best vendors for the plan. The company, or plan sponsor, is a fiduciary of the employee benefit plan and is obligated to the participants and their beneficiaries to find the best possible products available. It is what is known as the “prudent man rule”. The RFP process should take into account the broker’s experience and expertise, including the person’s credentials and access to market alternatives. For example, some brokers and financial advisors are limited to specific insurance carriers or investment providers. Insurance brokers and financial advisors are motivated to sometimes use particular favored companies because of earning sizeable bonuses, exotic company trips and conventions, or other incentives, impacting their recommendations at the expense of the plan sponsor and the plan’s participants. Commission rates are often significantly different from company to company for the same coverage. Higher commission rates almost always will drive up the cost of the insurance coverage or asset charges in the retirement plan investments.

The RFP process does not end with the final award letter, but then moves to the procurement negotiations. The company will need to collaborate with the awarded vendors to agree on the price, delivery, processes, payment terms and warranties in the agreement. With employee benefit plans there will be several contracts that need to be reviewed and agreed upon. For example, there can be gotchas within a stop loss health insurance contract that can be very costly if not identified and negotiated before the start of the plan year. If the vendor will not agree, then the award letter should be rescinded, and the next vendor contacted to continue the process.

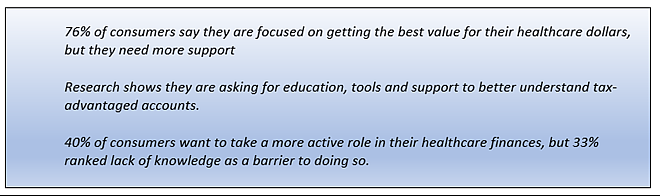

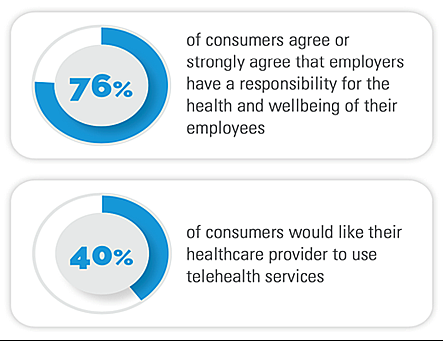

- Communications

Are you confident your employees understand their employee benefits and which are optional and those that are employer provided? Do they grasp how pre-tax accounts (Health Savings Accounts, Health Reimbursement Arrangements, or Flexible Savings Accounts) will benefit them? The differences of any voluntary and ancillary benefits being offered? The differences between retirement plan or pension plan options, including 401(k), 403(b), 457, Profit Sharing, Cash Balance, or Defined Benefit can help them save money and gain control over their financial future? If some or all of these benefits are offered, employees will become confused and overcome by all of the options, failing to appreciate the value of the employee benefit program being offered.Communication of the benefit program is critical for the participants to receive and appreciate. When building a communication plan, there are key elements that always should be considered. For example, a focus on keeping it simple is important. It is important to use jargon-free language for clear communication. The summary of benefits offered should be kept short and digestible. Employees lose interest quickly in the complex world of making sense of their benefit options. Always use real-world examples. Employees will need help understanding their benefits in a way that resonates with their situation and culture. Tools and quizzes can help employees evaluate their personal needs. There are numerous tools and platforms to accomplish this task at open enrollment and throughout the year. Find and use various types of media. Interactive tools, videos and graphics to help deliver an understandable message across the spectrum of employees to deliver the message to different types of learners. Some participants will need visual educational tools vs. just words on a page or brochure.

By providing educational resources that touch on the important topics can help your employees feel more prepared for making important decisions during open enrollment. Topics such as general education on the benefit features to be offered, who is eligible, and what contributions will be required via payroll deduction should be covered to help the participants determine how much coverage is proper for themselves and their family. Also, what supplemental benefits are appropriate under various circumstances and their family needs. Finally, what they will need to save to adequately prepare for retirement. The education should include where to go for investment education to prevent participants just putting money into cash assets during open enrollment.

Internal emails have become standard communication within companies small to large. A good email campaign includes sending one email per week in the weeks leading up to open enrollment. The emails should provide a basic educational information that can be sent in advance of any specific plan design decisions have been nailed down.

This last objective is often overlooked when employee benefit plans are implemented. Only basic information is provided or what is required by the regulations. Even though summary plan descriptions required by the Department of Labor can outline the benefit plans, by themselves they do not provide what the employee needs in order to make wise decisions. Most of the time employees will not even read a SPD.

Achievements

Society of Professional Asset Managers and Recordkeepers (SPARK)

SPARK is widely considered one of the most effective advocacy organizations in the country for the retirement plan industry. As the singular voice for the industry on issues of policy, regulation and privacy, SPARK brings together leaders from all core business areas and disciplines – CIOs and senior IT leaders, legal and compliance, audit and risk, operations, CMOs and public relations, sales, service and business development – unlike other trade groups representing a single piece. SPARK developed the best practices for data points for IRS Section 403(b) retirement plans and the associated information sharing required by the IRS regulations. Mr. Young serviced on the committee responsible for this task.

National Pest Management Association (NPMA)

The National Pest Management Association (NPMA), a non-profit organization with nearly 5,000 members from around the world, was established in 1933 to support the pest management industry’s commitment to the protection of public health, food and property. Mr. Young developed an employee benefit package of insurance coverages to help the NPMA members provide health insurance and other coverages to their employees. NPMA members are typically very small mom and pop businesses with less than 10 employees. The members hurdle was finding affordable health insurance and other benefits to retain their employees. This was developed and implemented via an online portal.

Pharr San Juan Alamo Consolidated Independent School District (PSJA)

PSJA is a major school district in The Valley of Texas. PSJA caters to a 32,000-student body and employees over 5000 employees. PSJA needed a solution of providing a health insurance program to the substitute teachers who are not contract employees without impacting the primary health plan. Mr. presented an health insurance arrangement (HRA) that would not create a discriminatory plan.

Industries

This service is primarily available to the following industry sectors:

Insurance

Within the group insurance benefits industry there has been abuse by insurance companies and financial advisors for decades. The motivation has often been to sell high commission products that harm rather than benefit the participants of the plan. The Employee Retirement Income Security Act was written to protect participants of employee benefit plans from this practice and other abuses within the industry. ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty; and, if a defined benefit plan is terminated, guarantees payment of certain benefits through a federally chartered corporation, known as the ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty; and, if a defined benefit plan is terminated, guarantees payment of certain benefits through a federally chartered corporation, known as the Pension Benefit Guaranty Corporation (PBGC).

Unfortunately, ERISA does not cover plans established or maintained by governmental entities and churches for their employees. Abuse continues in these circumstances, though the IRS is attempting to correct the abuses sponsored by these employers.

More and more insurance agents, agencies, brokers and financial advisors with integrity are moving to correct this problem by a more professional approach. The use of governance officers, investment committees, and third party administrators are being used. ERISA 3(16) compliance services are now common in the private sector where a third party takes on the role as the named fiduciary for the employer.

The courts have also moved in specific cases to discipline insurance representatives and FAs, or the employers sponsoring benefit plans both in the private sector and within governments and churches not covered by ERISA. For example, a few years ago the College Life Insurance Company of America and other plaintiffs settled a class action suit brought by a Laredo schoolteacher. The settlement was for $10,875,000 for a class of 130,000 policy holders who had been sold misleading “tax-sheltered life” plans inside their 403b plans, largely because no agency or school district did anything to protect the teachers.

In the private sector, the DOL has been aggressively auditing plans to weed out the bad players in the industry. These audits often result in employers being fined or even plans being disqualified as tax exempt plans.

The industry is improving but there is a long way to go to bring the industry to the place that commission sales no longer drive the decisions about plan design and operation.

Consultancy

Consultancy

As the country recovers from the shutdowns and isolation of the COVID19 pandemic the use of remote employees and consultants remains strong. The world of business and employment has likely changed for the foreseeable future or permanently due to the pandemic. Companies must recognize this change and adapt to it efficiently. Many business owners and executives recognize this but struggle with how to effectively make the changes and improvements necessary to adapt to the workforce. Tapping into a pool of available employees with the right expertise, time or ability to focus on the tasks required to operate the company properly and aggressively is becoming increasingly a major challenge. Employees no longer have the loyalty to remain engaged and committed to the company when so many options exist via remote employment. The loss of talent has risen to a major challenge in this environment.

Enter the use of consultants that can help companies enhance business systems, improve efficiencies and reduce costs. A quote from the past in a Fortune Magazine stated, “The consultants whose job it is to bring in business for the consulting company usually haven’t done any real work for so long that they’ve lost the ability to execute. Instead, they hydroplane, jumping across the water, working many assignments at a time without ever getting their feet wet in any of them and adding value to none.” Most CEOs are generalist and know their limitations as a result. Thus, they see the need to bring outside expertise to complete their need to address issues facing the organization they are managing. On the other hand, consultants are often overdeveloped in one skill strategy, organizational design, or technology that can appear appealing to the CEO. The consultant must approach any project with the overall culture and goals of the company he is working to benefit with his service. As well, the CEO should be buying results, not just the apparent skills of a consultant. The goal of any consulting project is to not only identify the problems, but to find the solutions to better the organization. Within the employee benefit and insurance industry this demand is increasing exponentially as employers attempt to implement improved governance, fiduciary responsibilities, and lower cost and improved health care coverage for their employees. The most cost-effective way to accomplish the above is usually through the use of outside experts who have the credentials, experience, and expertise in the insurance benefit industry. There are many gotchas within the federal and state regulations that can cost the employer large sums of money and time. An ERISA benefits attorney once stated that if he had the opportunity to audit any employee benefit plan he would find more than one failure to comply with the regulations. The consulting industry provides professional advice in a variety of specialized fields, including management, IT, human resources, environmental regulations and real estate, among many others. Within the employee benefit industry, employers are rapidly inviting in consults to help with the complex tasks of managing their employee benefits.

Non-Profit & Charities

Due to the COVID19 pandemic, inflation pressures, and increased federal and state regulations, non-profits and charities are struggling to survive a perfect storm for their organizations. In addition, the world of the non-profit, like in business, employment has likely changed for the foreseeable future or permanently due to the pandemic. With the experience operating a business for 35 years, as well as President of non-profit and Treasurer of a K-12 private non profit school in Peru, it has been observed the employment climate both in the US and abroad has changed and is becoming more challenging across all sectors. Non-profits and charities must recognize this change and adapt to it efficiently in order to survive. Experience with a non-profit association of non-profit employers also revealed the many challenges unique to the non-profit world. Such as finding insurance companies willing to insure at a reasonable rate the small team associated with most non-profits. Sponsoring and funding a retirement plan is also challenging for the non-profit due to complexities of the regulations of retirement plans such as IRS Section 403(b)s, 457s, and 401(a) plans. Add to this Nonqualified Compensation Plans, and the Executive Director (ED) has a full plate on the table that often is too much to deal with for the ED. Often the ED has to wear many hats, one which has to do with managing employees and their compensation/benefits programs. The ED does not have the luxury to hire a HR director that has been trained in this regard. Therein lies the benefit of outside expertise that understands and who has experienced the challenges of operating a non-profit.

Also, the donor pool is declining as the inflation and loss of assets due to market changes. Many Americans no longer have the resources to donate to the non-profits as in previous years. As a result non-profits as employers must improve their operations of employee benefit plans. As any employer, a non-profit has to recruit and retain talented employees in order to be better than other non-profits pulling support from often the same donor pool. In addition, examples of leader excess and wasteful spending has the spotlight on non-profits and charities that has led to regulation attempts at the state and federal level and the birth of agencies dedicated to grading charities on administrative expenses, spending and results. Because non-profits are spending other people’s money in the form of donations, they are exposed to increased scrutiny on matters of donor data protection, employee salaries, budgeting, marketing, spending and performance.

Locations

This service is primarily available within the following locations:

San Antonio, Texas – United States

San Antonio has a diversified economy, ranking 4th among Texas metropolitan areas and 38th in the United States. San Antonio’s economy is focused primarily within military, health care, government civil service, financial services, oil and gas and tourism sectors. Within the past twenty years, San Antonio has become a significant location for American-based call centers and has added a significant manufacturing sector centered around automobiles. San Antonio is home to six Fortune 500 companies: Valero Energy Corp, Tesoro Corp, USAA, Clear Channel Communications, NuStar Energy and CST Brands, Inc. H-E-B, the 19th largest private company in the United States is also headquartered in San Antonio. Other companies headquartered in San Antonio are: Bill Miller Bar-B-Q Enterprises, Carenet Healthcare Services, Eye Care Centers of America, Frost Bank, Harte-Hanks, Kinetic Concepts, NewTek, Rackspace, Taco Cabana and Whataburger. Other large companies that operate regional headquarters in the city include: Nationwide Mutual Insurance Company, Kohl’s, Allstate, Chase Bank, Philips, Wells Fargo, Toyota, Medtronic, Sysco, Caterpillar Inc., AT&T, West Corporation, Citigroup, Boeing, QVC, and Lockheed Martin.

San Antonio is in the I-35 corridor. The I-35 Corridor includes the cities of San Antonio, New Braunfels, San Marcos and Austin. Within the next 10 years the theses cities will merge into one mega metro area similar to the Dallas-Ft Worth metro area. Projections are by 2030 there will be 6 to 7 million people in the metro area and near nine million by 2050. San Antonio is currently the seventh-largest city in the nation with Austin ranked at number 11. In the last year, the two cities ranked second and third, respectively, for year-over-year population growth.

Austin, Texas – United States

Austin is considered to be a major center for high tech. Thousands of graduates each year from the engineering and computer science programs at the University of Texas at Austin provide a steady source of employees that help to fuel Austin’s technology and defense industry sectors. The region’s rapid growth has led Forbes to rank the Austin metropolitan area number one among all big cities for jobs. Austin’s largest employers include the Austin Independent School District, the City of Austin, Dell, the U.S. Federal Government, Freescale Semiconductor (spun off from Motorola in 2004), IBM, St. David’s Healthcare Partnership, Seton Family of Hospitals, the State of Texas, the Texas State University, Tesla, and the University of Texas at Austin. Tesla recently built a “Gigafactory” in Austin covering 2500 acres with over 10 million square feet of factory floor. Projections the factory will eventually employ over 10,000 workers. Other high-tech companies with operations in Austin include 3M, Amazon, Apple, Hewlett-Packard, Google, Qualcomm, Inc., AMD, Applied Materials, Cirrus Logic, ARM Holdings, Cisco Systems, Electronic Arts, Flextronics, Facebook, eBay/PayPal, Bioware, Blizzard Entertainment, Hoover’s, Intel Corporation, National Instruments, Rackspace, RetailMeNot, Rooster Teeth, Spansion, Buffalo Technology, Silicon Laboratories, Xerox, Oracle, Hostgator, Samsung Group, HomeAway, and United Devices.

Austin is in the I-35 corridor. The I-35 Corridor includes the cities of San Antonio, New Braunfels, San Marcos and Austin. Within the next 10 years the theses cities will merge into one mega metro area similar to the Dallas-Ft Worth metro area. Projections are by 2030 there will be 6 to 7 million people in the metro area and near nine million by 2050. San Antonio is currently the seventh-largest city in the nation with Austin ranked at number 11. In the last year, the two cities ranked second and third, respectively, for year-over-year population growth.

Houston, Texas – United States

Houston is recognized worldwide for its energy industry, particularly for oil and natural gas, as well as for biomedical research and aeronautics. Renewable energy sources, wind and solar, are also growing economic bases in Houston. The ship channel is also a large part of Houston’s economic base. Because of these strengths, Houston is designated as a global city by the Globalization and World Cities Study Group and Network. The Houston area is the top U.S. market for exports, surpassing New York City, according to data released by the U.S. Department of Commerce’s International Trade Administration. Petroleum products, chemicals, and oil and gas extraction equipment accounted for approximately two-thirds of the metropolitan area’s exports last year. The top three destinations for exports were Mexico, Canada, and Brazil.

Houston has had numerous nicknames over the years including, the “Bayou City”, “Space City”, “H-Town”, and “the 713”. In the 2000 census there were 1,953,631 people in 717,945 households, including 457,330 families, in the city. The median household income was $36,616 and the median family income was $40,443. Males had a median income of $32,084 versus $27,371 for females. The per capita income for the city was $20,101. Nineteen percent of the population and 16% of families were below the poverty line. The age distribution was 27.5% under the age of 18, 11.2% from 18 to 24, 33.8% from 25 to 44, 19.1% from 45 to 64, and 8.4% 65 or older. The median age was 31 years.

Dallas – Ft. Worth, Texas – United States

The Dallas-Fort Worth Metroplex has one of the largest concentrations of corporate headquarters for publicly traded companies in the United States. The city of Dallas has 12 Fortune 500 companies and the DFW region as a whole has 20. Comerica Bank and AT&T located their headquarters in Dallas. Irving is home to four Fortune 500 companies of its own, including ExxonMobil, the most profitable company in the world and the second largest by revenue, Kimberly-Clark, Fluor (engineering), and Commercial Metals. Additional companies headquartered in the Metroplex include Southwest Airlines, American Airlines, RadioShack, Neiman Marcus, 7-Eleven, Brinker International, AMS Pictures, id Software, ENSCO Offshore Drilling, Mary Kay Cosmetics, Chuck E. Cheese’s, Zales and Fossil. Corporate headquarters in the northern suburb of Plano include HP Enterprise Services, Frito Lay, Dr Pepper Snapple Group, and JCPenney. Many of these companies – and others throughout the DFW metroplex – comprise the Dallas Regional Chamber.

Major companies based in Fort Worth include American Airlines Group (and subsidiaries American Airlines and Envoy), the John Peter Smith Hospital, Pier 1 Imports, RadioShack, the BNSF Railway, Gallus Cycles, and Lockheed Martin. Fort Worth-Arlington is ranked No. 15 on Forbes’ list of the Best Places for Business and Careers. Tourism is an important contributor to the local economy. Items and goods produced: aircraft, communication equipment, electronic equipment, machinery, refrigeration equipment, containers, clothing, food products, pharmaceuticals, computers, clothing, grain and leather.

There were 7,637,387 people in the metro area of Dallas-Ft. Worth. The median income for a household in the MSA was $48,062, and the median income for a family was $55,263.

McAllen, Texas – United States

McAllen is part of the Lower Rio Grande Valley, known as the “The Valley” in Texas. It consists of the Brownsville, Harlingen, Weslaco, Pharr, McAllen, Edinburg, Mission, San Juan, and Rio Grande City metropolitan areas in the United States and the Matamoros, Río Bravo, and Reynosa metropolitan areas in Mexico. A large seasonal influx occurs of “winter Texans” — Texans who come down from the north for the winter and then go back up north before summer arrives.

There is an estimated population of the Rio Grande Valley at 1,368,723. The average ethnic population is over 90% Hispanic. The Valley is rapidly growing and will become a major metropolitan area in the State of Texas.

The economy of The Valley is dependent upon agribusiness and tourism. Cotton, grapefruit, sorghum, maize, and sugarcane are its leading crops, and the region is the center of citrus production and the most important area of vegetable production in the State of Texas. The Valley is becoming a major medical center for South Texas and the region. The Valley has benefited economically from the development of maquiladoras. These industrial plants were first initiated by the Mexican government in the 1960s to encourage economic development on the border, and have become tremendously attractive to a variety of corporations as low-wage assembly and manufacturing centers. Finally, SpaceX has built a major space port near Brownsville, Texas that is gaining international attention.

Employers

This service’s current clients or employers include:

The National Pest Management Association (NPMA)

The National Pest Management Association (NPMA), a non-profit organization with nearly 5,000 members from around the world, was established in 1933 to support the pest management industry’s commitment to the protection of public health, food and property. This commitment is reflected both in the continuing education of pest management professionals and the dissemination of timely information to homeowners and businesses. NPMA supports members in being professional, knowledgeable, and profitable through education, industry leadership, public policy advocacy, and growth of the market.

NPMA exists to positively impact the businesses and livelihoods of those in the pest management community each and every day. Headquartered in Fairfax, Va., just outside of Washington, D.C., the association today is guided by the vision of knowledgeable industry professionals who serve on NPMA’s Board of Directors.

The organization’s professional staff addresses the technical, governmental, educational, business, and networking needs of its members. NPMA supports members in being professional, knowledgeable, and profitable through education, industry leadership, public policy advocacy, and growth of the market. To help meet this mission NPMA endorses or runs many great initiatives that help keep our industry moving forward. To keep these self-sufficient causes thriving, we ask you to join, support, or donate today.

NPMA works every day to elevate the pest management profession by offering world-class education and certification programs designed to create a well-trained workforce, developing best practices and offering timely, informative technical resources, providing a unified voice for the pest management industry to promote a positive regulatory and legislative climate, connecting members to unparalleled networking opportunities, and promoting a positive public image and building awareness of the pest management industry.

Kaneka

Kaneka

Through the technological innovation such as digital transformation (DX) and “data-ism,” our society and business environment are being transformed at speed that exceeds what most people have imagined. Environmental awareness is rising worldwide, and initiatives to realize a sustainable society in areas such as energy, resources, and food problem are accelerating on a global scale, dramatically expanding the domains in which chemistry can make a contribution. Conventional and obsolete materials and solutions are being left behind and getting less competitive. As the world shifts rapidly from the Old Economy to the New Economy, materializing discontinuous growth is the key for companies to survive by speeding up the innovation and social implementation of new businesses. In the New Economy, companies must propose and provide solutions to crucial social issues by anticipating the future society needs and changes, not merely solving the existing problems.

Kaneka practices ESG management in an effort to achieve the goal of “Wellness- First Management” by making the world healthy. We’ve identified Environment and Energy, Food, and Wellness as three areas in which the world faces crises, and we will reform our portfolio accordingly through investing to drive R&D and create new businesses. Based on our key strengths: “highly competitive technological and global development capabilities to create innovative products continuously”, we will solve social issues by identifying future social needs and proposing solutions.

We’re committed to pursuing the situation in which each and every employee is mentally and physically healthy, and our corporate activities and attitudes are sound. What is important for top management is to discern and commit a vision of what a society should be, improve corporate attitude, and realize corporate governance in response as necessary.

Under the new medium-term management plan that began in April 2020, we’ll continue the transformation of R&D into R&B (Research & Business) that we initiated last year and create major new businesses by delivering solutions to social issues. We’ll also put into practice the “Human Driven Company” concept, which serves as the backbone of our management philosophy, by pursuing the Kaneka 1on1 workshop for facilitating personal growth through work.

Kaneka Texas Corporation (KTC): Founded in 1982 as a wholly owned subsidiary of Kaneka Corporation, the plant is located southeast of Houston in the Bayport Industry District at 6161 Underwood Road, Pasadena, TX. KTC started manufacturing operations in 1984 making impact modifier, Kane Ace B, for the plastic industry. Major additions to this plant occurred in 1987 and 1993, making it the largest modifier plant in the world.

In 1990 production of polyimide film began at this site. In 2008 KTC began manufacture of CPVC resin and in 2009 the MS Polymer facility began producing the first liquid polymer products at this site.

Kaneka Nutrients L.P.: Since 2006 KNL has been manufacturing an array of unique nutritional ingredients for the supplement and food & beverages industries. Kaneka is the largest manufacturer of CoQ10 in the world, and the only company that manufactures CoQ10 in the U.S. since 1997. It is the primary brand of CoQ10 used in FDA-approved National Institutes of Health-funded clinical trials, and has been used in the vast majority of all other clinical trials over the past 30 years. The facility is located at 6250 Underwood Rd., Pasadena, TX.

Killeen ISD, Killeen, Texas (KISD)

KISD proudly serves the central Texas communities of Killeen, Fort Hood, Harker Heights, and Nolanville. The Killeen Independent School District is committed to providing excellent educational opportunities to ensure all students served are able to reach their maximum learning potential.

Students within KISD attend 31 elementary schools, 11 middle schools, 5 high schools, 3 special campuses, a state-of-the-art Career Center, and an Early College High School serving approximately 45,000+ students. KISD is the 4th most diverse district in Texas and the 24th largest district in Texas.

The Killeen Independent School District employs a phenomenal team of approximately 6,100+ individuals dedicated to working together as a well-orchestrated team to ensure facilities are inviting; campuses are safe and orderly; curricula remains rigorous, innovative, and challenging; and extra-curricular activities provide avenues for students to become well-rounded individuals. These collective efforts result in KISD graduates who are equipped with the skills necessary to be successful young adults.

Since 2011, Killeen ISD has earned a Superior rating from the Texas Education Agency for the school district’s careful and efficient use of the taxpayers’ money. KISD has also earned a Transparency Star from the Texas Comptroller of Public Accounts. This program recognizes local governments across Texas that are striving to meet a high standard for financial transparency online.

The Killeen Independent School District recognizes the importance of responding to the needs of our students and families and we welcome feedback and suggestions, as we believe this is an important part of the continuous improvement process.

Americanized Benefits

Americanized Benefits

Americanized Benefit Consultants is an employee benefits brokerage and consulting firm. We are committed to designing and implementing customized benefit solutions that meet immediate employee benefit needs and achieve long-term goals for company productivity and profitability.

We are focused on evaluating the specific needs of our clients, educating them about innovative health and welfare plans and equipping businesses to offer employee benefits that will enhance their ability to attract, retain and increase the efficiency of their workforce.

With our investment in technology and in relationships, we strive to serve as an extension of your human resources department. Our team of skilled and experienced professionals will help you alleviate the drudgery of many tedious, but critically important HR functions. With ABC, the complicated will become routine. At the same time, our superior service will exceed your expectations.

Since we are an independent, privately held employee benefits firm, we are not subject to stockholder demands or constrained by layers of cumbersome corporate bureaucracy. Your needs come first.

As a full-service employee benefits brokerage and consulting firm, Americanized Benefit Consultants is focused on delivering the very best healthcare, human resources and wellness solutions to each client based on their strategic goals and company values. Successful companies know that to attract and retain top employees they must offer quality benefits. At Americanized Benefit Consultants we deliver proven and profitable employee benefit plans that will improve our clients’ bottom line. Americanized Benefit Consultants acts as an extension of your Human Resources Department to make sure your employee benefits are working as designed. Americanized Benefits is value driven, customer focused, relationship oriented, offer value added extras, and specialize in customized benefit solutions.

Service Benefits

Human Resources

- Benefits defined

- Regulations understanding

- Improved benefits

- Cost efficiencies

- Better governance

- Better communications

- Increased participation

- Better vendors

- Improved recruitment

- Improved retention

Management

- Enhanced recordkeeping

- Prudent administration

- Improved accountancy

- Proactive management

- Improved oversight

- Improved technology

- ACA Compliance

- Health Advocacy

- ERISA Compliance

- Plan audits

Finance

- Asset management

- Competitive Plans

- Participant disclosures

- Due Diligence

- Planning tools

- Calculators

- Investment options

- Risk tolerance

- Preferred arrangements

- Loans distributions

Bronze Service

Time limit: 5 hours per month

Contract period: 12 months

Bronze service includes:

01. Email support

02. Telephone support

03. Questions & answers

04. Professional advice

05. Communication management

SERVICE DESCRIPTION

The Bronze Client Service (BCS) for Employee Benefits provides clients with an entry level option and enables client contacts to become personally acquainted with Mr. Young over a sustainable period of time. We suggest that clients allocate up to a maximum of 5 Key Employees for this service. Your Key Employees can then contact the consultant via email, whenever they feel that they need specific advice or support in relation to the consultant’s specialist subject. The consultant will also be proactive about opening and maintaining communications with your Key Employees. Your Key Employees can list and number any questions that they would like to ask and they will then receive specific answers to each and every query that they may have. Your Key Employees can then retain these communications on file for future reference. General support inquiries will usually receive replies within 48 hours, but please allow a period of up to 10 business days during busy periods. The Bronze Client Service (BCS) enables your Key Employees to get to know their designated Appleton Greene consultant and to benefit from the consultant’s specialist skills, knowledge and experience.

Silver Service

Time limit: 10 hours per month

Contract period: 12 months

Bronze service plus

01. Research analysis

02. Management analysis

03. Performance analysis

04. Business process analysis

05. Training analysis

SERVICE DESCRIPTION

The Silver Client Service (SCS) for Employee Benefits provides more time for research and development. If you require Mr. Young to undertake research on your behalf, or on behalf of your Key Employees, then this would understandably require more time and the Silver Client Service (SCS) accommodates this. For example, you may want your consultant to undertake some research into your management, performance, business, or training processes, with a view towards providing an independent analysis and recommendations for improvement. If any research and development, or business analysis is required, then the Silver Client Service (SCS) is for you.

Gold Service

Time limit: 15 hours per month

Contract period: 12 months

Bronze/Silver service plus

01. Management interviews

02. Evaluation and assessment

03. Performance improvement

04. Business process improvement

05. Management training

SERVICE DESCRIPTION

The Gold Client Service (GCS) for Employee Benefits is intended for more detailed evaluation and assessment, that may require your Key Employees to have monthly meetings or interviews with Mr. Young These meetings and interviews can be conducted over the telephone, Skype, or by video conference if required. The consultant can also attend your business premises, an Appleton Greene office, or another mutually beneficial location, but please note that clients are responsible for the costs of any disbursements separately, including travel and accommodation. This service enables you to integrate the specific skills, knowledge and experience of your designated consultant into your Key Employee management team. The Gold Client Service (GCS) can also incorporate training workshops, business presentations and external meetings with customers, suppliers, associations, or any other business-related stakeholders.

Platinum Service

Time limit: 20 hours per month

Contract period: 12 months

Bronze/Silver/Gold service plus

01. Project planning

02. Project development

03. Project implementation

04. Project management

05. Project review

SERVICE DESCRIPTION

The Platinum Client Service (PCS) for Employee Benefits is our flagship service and will be required if you need Mr. Young to facilitate the planning, development, implementation, management, or review of a particular project relating to his specialist subject, which would obviously require more time and dedication. This service enables you to reserve up to 12.5% of the consultant’s working month and provides a more hands-on service as and when required. If you need more time than this, then this can always be arranged, subject of course to the consultant’s ongoing availability. The benefit of having an external consultant involved in projects is they provide an independent perspective and are not influenced by internal politics, day-to-day responsibilities, or personal career interest. They provide objectivity, specific knowledge, skills and experience and will be entirely focused upon the tasks at hand. The Platinum Client Service (PCS) will provide your organization with a valuable resource as and when you need it.