Ethical Intelligence Training Program

Insert (CLP) Photograph on Web Page (Align Right)

The Appleton Greene Corporate Training Program (CTP) for Ethical Intelligence is provided by Mr. Opincar Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 36 months; Program orders subject to ongoing availability.

Personal Profile

Mr/Ms Surname is a Certified Learning Provider (CLP) at Appleton Greene and he/she has experience in department 1, department 2 and department 3. He/She has achieved a Qualification 2, Qualification 2 and Qualification 3. He/She has industry experience within the following sectors: industry 1; industry 2; industry 3; industry 4 and industry 5. He/She has had commercial experience within the following countries: Country 1, or more specifically within the following cities: City 1; City 2; City 3; City 4 and City 5. His/Her personal achievements include: personal achievement 1; personal achievement 2; personal achievement 3; personal achievement 4 and personal achievement 5. His/Her service skills incorporate: service skill 1; service skill 2; service skill 3; service skill 4 and service skill 5.

To request further information about Mr. Opincar through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Ethical Intelligence

Organizational culture is a force as fierce as fire. A controlled fire is a force of creation. It can conquer, calm, and create. An uncontrolled fire is a force of destruction. It can damage, disrupt, and destroy. Organizational culture is an all-consuming force. Controlling it creates an environment within which ethical conduct and organizations flourish. It is the “hidden hand” controlling organizations.

When organizational culture is neglected and uncontrolled, it creates an environment within which the survival of the fittest devours all within its path, including the C-Suite and the board of directors. Enron’s infamous “rank and yank” practice exemplified a “burn-it-down” organizational culture. Here are two additional recent examples of the destructive power of organizational cultural fire.

Credit Suisse. “Your honor, I am sorry for what I have done. My terrible mistake will live with me for the rest of my life.” Kareem Serageldin. “You failed in doing what was right, and for this, I have to punish you.” Judge Hellerstein. This exchange occurred between Kareem Serageldin, former Credit Suisse banker, upon hearing his prison sentence for defrauding the bank of $2.7 billion. Unfortunately, this was not the first, nor the last, ethical lapse involving a member of the Credit Suisse organization.

Since 1986, Credit Suisse has had nearly a dozen public ethical crises resulting in multi-billions of dollars of losses, fines, penalties, and significant reputational destruction. Many organizational members, such as Mr. Serageldin or other loosely associated organizational members, have been imprisoned for various crimes. In 2022, the Chairman and CEO resigned because he ignored the COVID quarantine rules he ordered all other organization members to observe. Finally, in March 2023, Credit Suisse failed and was taken over by UBS.

Wells Fargo. Once upon a time, investors, customers, and others regarded Wells Fargo & Co. as an organizational culture gold standard. Its reputation was spotless, and its profitability and return on investment were nearly unparalleled, earning the bank the highly trusted title. Then, a 2013 Los Angeles Times article about certain alleged fraudulent Wells Fargo sales practices led to a nearly overnight fall from grace, from which the bank has not yet recovered, as the nearby chart shows.

Noted former Wells Fargo investor Warren Buffett once commented, “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

Background

The dawning of the 21st century and its cascade of business scandals compelled many to think about doing things differently. The business failures of that time thrust an eight-decade era of rules, regulations, ethics codes, and legislation under the hot lights of public scrutiny. The investing public, employees, suppliers, and other stakeholders were angry and demanded answers, especially from regulators and politicians.

Given the regulatory environment, Enron’s collapse should not have happened. Neither should have HealthSouth, WorldCom, and others. Since the Security and Exchange Commission’s (SEC) founding in 1934, an impressive regulatory regime has evolved to prevent such business failures/scandals and their aftermath. Nonetheless, the carnage happened, especially to those who could least afford it.

The Enron failure, accompanied by Arthur Andersen’s demise, was both dramatic and devastating to a nation still reeling from the 911 disaster and its fallout. The political clamor to “fix the problem” resulted in sweeping legislation that spawned the Sarbanes Oxley Act (SOX) of 2002 and the creation of the Public Company Accounting Oversight Board (PCAOB).

Those two events substantially complicated an already giant regulatory and compliance framework labyrinth. There was great hope that those steps would finally solve the problem of unethical behavior in corporate America.

Now, 20+ years later, there is widespread agreement that SOX and PCAOB have been net positives in holding public accounting firms and their clients accountable for more robust internal controls and improvements in financial reporting.

Yet, during the first ten years after SOX became law, thousands of executives were tried and convicted of the frauds SOX was designed to prevent. And now, we continue seeing business scandals and corporate failures such as Theranos, Nikola, Volkswagen, and others.

During these subsequent 20+ years, many have started asking whether laws, regulations and even lengthy prison sentences work in stemming corporate ethical lapses. Harvey Pitt, former SEC Chief, was once asked that very question by a UK journalist. “Does regulation work?” Pitt’s answer was, “Don’t ask me!”

So, does regulation work?

There is not a yes or no answer to the question. A nuanced answer is that regulation is necessary, but more is needed. Since 1992, however, a parallel initiative to addressing this seemingly intractable problem of organizational ethical lapses, and that initiative is Enterprise Risk Management.

Enterprise Risk Management

Enterprise risk management (ERM) is the culture, capabilities, and practices that organizations integrate with strategy setting and apply when they carry out that strategy to manage risk in creating, preserving, and realizing value. In 1992, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) created and promulgated a framework known as the “Internal Control – Integrated Framework.” The following Framework was intended to help companies, regardless of industry and size, measure the efficacy of their internal controls.

The base of this pyramid model, Control Environment, is organizational culture. The organizational culture is the milieu within which risk assessments, control activities, and monitoring operate. Since the publication of this original model in 1992, COSO has updated and expanded the model three times: in 2004, 2013, and 2017. The DNA view of the current model is as follows:

Throughout the COSO model’s iterations and improvement, organizational culture’s primacy has persisted and is now accompanied by governance. Organizational culture is still the foundation of ERM because organizational governance is a product of and is informed by organizational culture.

Why should you care about this?

The Ethical Culture Imperative

Why is this important? Or why should you care about your organization’s culture? Whether you are a leader, manager, or single contributor, you should prize an ethical culture because such cultures produce more value, reduce enterprise risk, enhance and protect your brand, deliver greater stakeholder engagement, enhance innovation, increase productivity, are more naturally compliant, and are easier to govern.

• Ethical cultures produce more value. During the past several decades, scholars and practitioners have discovered that the single distinguishing characteristic between organizations that positively contribute to society and those that do not is an ethically intelligent (ethical) organizational culture. No matter how it is measured, EVA (economic value added), EPS (earnings per share), cash flow, share price, P/E (price earnings) ratio, return on equity, cost of capital, return on assets, market capitalization, ethical organizational cultures create more value. In a recent 2022 survey of 1,348 North American executives, 92% believed an ethical organizational culture increased firm value.

• Ethical cultures reduce enterprise risk. Every organization faces internal and external risks, and in today’s 24/7/365 volatile, uncertain, complex, and ambiguous business world, risks are everywhere and rising. Whether cyber intrusions, online and offline theft, sexual harassment, organizational wet work and plausible deniability, or aggressive accounting, an ethically intelligent organizational culture is the first and most vital line of defense against such toxic activity. Enterprise risk management experts, practitioners, and scholars alike have experienced and demonstrated that a laser focus on workplace ethics is instrumental in reducing enterprise risk.

• Ethical cultures enhance and protect your brand. The idea that your culture is your brand has existed for a long time. A brand-enhancing example is Southwest Airlines (LUV) when Herb Kelleher was the CEO. During Kelleher’s tenure, LUV had a free-spirited, happy culture where everyone aspired to have a good time and treat passengers that way. And as a result, LUV’s brand was that of a happy, fun-loving flying experience. After Kelleher died in 2019, the organization’s culture began changing. During the 2022 holiday season, consumers could see the effects of the culture change. LUV’s reputation was seriously degraded because of flight cancellations and employee discontent.

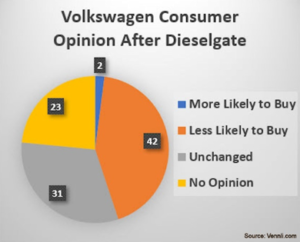

The Volkswagen “Dieselgate” scandal offers an example of culture-driven brand damage. In 2015, information that Volkswagen had created and installed software in its diesel-powered cars that enabled cheating on emissions tests became public. The negative public reaction was almost instant, and the damage to Volkswagen’s brand followed. As depicted in the nearby chart, Volkswagen’s share price declined, and the consumer public’s perception of its brand plunged. Researchers later discovered that Volkswagen’s emissions incident also reduced the general demand for diesel-powered cars.

• Ethical cultures produce greater stakeholder engagement. Organizations do not live in vacuums. According to stakeholder theory (SA), every organization has multiple stakeholders whose perceptions, goodwill, and generosity are keys to organizational success. Also, according to SA, critical stakeholder groups include customers, creditors, employees, investors, regulators, suppliers, and host communities, to name a few.

Whether you accept this broad stakeholder perspective or adhere to a narrower view of your organization’s stakeholders (e.g., only investors and employees), an ethical organizational culture produces positive engagement results. In a recent Employee Relations Law Journal article, Lian and Crowley noted.

With increased visibility into the actions of companies and their leaders through social media and job review websites like Glassdoor and Blind, the need for ethical conduct by leaders has never been more critical. Leaders’ behavior that could once be excused or overlooked can quickly ‘go viral’ and be picked up by leading news services. Companies and their boards can take essential steps to create conditions that help facilitate ethical leadership by top executives.

Employees who have “bought into” your organization’s mission, vision, and values are more productive and innovative than those whose sole motivation is collecting a paycheck.

• Ethical cultures produce more innovation. Innovation is something new or a change made to an existing product/service, idea, or market. Most organizations must innovate or fall into stasis and die. At first glance, the connection between an ethically intelligent (ethical) organizational culture and innovation is unclear. Multiple quantitative and qualitative research studies have shown a positive connection. Ethical cultures produce more innovation. If you stop and think about it, the reasons become apparent. Ethical cultures are more open and transparent, which fosters sharing and unrestricted dialog across the organization. Ethical cultures are more collaborative. People are more likely to trust others in the organization. To encourage innovation in your organization, ensure an ethically intelligent organizational culture.

• Ethical cultures increase productivity. Increased productivity refers to increased process outputs from fixed or reduced process inputs, expressed as a formula: Productivity = Units of Output/Units of Input. In most organizations, the most important input is labor, especially in a knowledge/service business. Employees are key to increased productivity, and organizational culture is crucial to employee behavior. Here is an example

Mary is responsible for maintaining an essential departmental process that management uses to price a range of commodities daily. Mary often needs help to complete the work each day due to cyberloafing, a practice the organizational culture tolerates. Management hires a second person to help Mary. John begins work, and the process is working on a timely basis again. Over time, John picks up the cyberloafing practice because the culture tolerates it. Now, two people are marginally doing the work that could be completed by one person who does not cyberloaf. An ethically intelligent culture would not allow this situation to begin or persist.

Ethical cultures encourage—and demand—employees to do the right thing even when no one is looking. It’s called an R-Squared Cultural Behavior, or right-thinking, right-acting, a behavior modification process this course imparts to its students.

• Ethical cultures are more naturally compliant. For several years, compliance has become an increasingly popular “buzz” word in the corporate lexicon. As the regulatory state has grown, so have the regulations with which organizations must comply. So much so that countless large organizations have hired hundreds of “compliance” professionals to deal with the growing “compliance” burden. Many have established “compliance” departments.

Unlike other organizational governance structures, such as values statements and ethics codes, the compliance mosaic is external and imposed upon existing internal governance authorities, like the board of directors. The board “complies” with the compliance mosaic because they must, which often results in the “compliance” department operating almost as an external entity. It is superimposed on existing governance initiatives, usually at a substantial additional cost.

Ethical organizational cultures, consisting of ethically intelligent organizational members led by ethically intelligent leaders and managers are naturally compliant because right-thinking, right-acting is the required in an R-Squared organizational culture. Therefore, such an organizational culture is naturally compliant because “complying” is the right thing to do.

• Ethical cultures are easier to govern. Since antiquity, when humans began living in communities, leaders have known and understood the critical importance of culture to governing. The Roman Empire (Empire), one of the largest and longest-lived world empires, was no exception. At its zenith, Rome occupied most of the then-known European, Asian, Persian, and North African land masses. From 27 BCE through 180 CE, known as Pax Romana (the Roman peace), the entire Roman Empire enjoyed over two centuries of peace, tranquility, and prosperity. The Romans accomplished this seemingly impossible task through an ambitious program of required Roman acculturation.

The Empire protected its provinces and allowed them a high level of self-governance in exchange for accepting Empire taxation, military occupation, and indigenous culture replacement with Roman cultural norms. One could argue about the ethics of the Empire, but there is no argument that culture enables the effective leadership of organizations of any size. Create ethical organizational cultures led by ethically intelligent leaders and observe the ease with which organizations are governed. This is an important revelation because today, the previously tolerant era of ethically challenged organizational cultures is over.

A Time of Reckoning

After nearly a century of laws, regulations, and professional ethics codes, organizational stakeholders of all stripes have had it with “challenged” organizational cultures. Since 1933, Congress and statehouses have repeatedly reacted to the ethical misbehavior of organizational leaders by conducting investigations and passing legislation, which was accompanied by multiple thousands of pages of new regulations and rules.

The financial scandals at the turn of the 21st century resulted in the Sarbanes-Oxley Act (SOX) that mandated stiff penalties, even extending to executive incarceration. Since the passage of SOX in 2002, thousands of executives have been imprisoned for violating its provisions. Unfortunately, unethical activities have scarcely abated.

Einstein once defined insanity as doing the same thing repeatedly but expecting a different outcome. It is time for a different solution that does not rely on more reporting and enforcement. Stakeholders demand to know what kinds of ethical cultures boards of directors and professional managers create in their organizations.

The era of “we’ll do better next time” is over. Tell that to a Credit Suisse shareholder who lost her retirement because of the bank’s failure. Or assure a mother in East Palestine, Ohio, whose child is deathly ill from chemical toxins dumped into her town by a train derailment that “next time will be different.” There will be no “next time.” Stakeholders are demanding ethical organizational cultures.

What kind of culture exists in your organization? Do you lie to customers? Do you shoot straight with employees? Are your suppliers paid on time, or do you take advantage of them? If you run a railroad, trucking firm, or shipping operation, is safety a priority, or is it the bottom line? Is everyone in the organization living its values?

How do you know? There are not enough surveillance cameras, auditors, or human resource assessments that can answer these questions. As the Romans proved millennia ago, the only way to ensure the correct answer to those questions is by creating and nurturing an ethically intelligent culture where right-thinking and right-acting are the default behaviors.

Course Overview

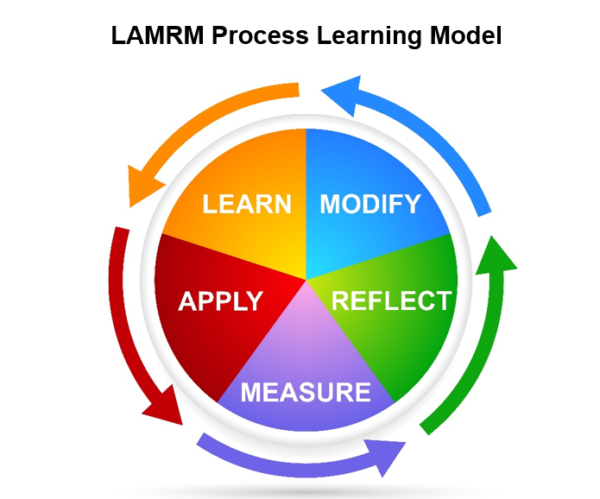

This course teaches you and your organization how to create an ethical culture by learning and applying the principles and practices of ethically intelligent behavior and leadership to cultural transformation. Specifically, this course is an iterative three-year ethical-organizational-culture-transformation process based on the principles and practices of ethical intelligence and adult learning theory, using the following LAMRM process.

The LAMRM process is iterative, meaning it is repeated as many times as necessary for student mastery. The operations within the LAMRM process include:

• LEARN the theoretical content presented within the module

• APPLY the module theory within the student’s professional/personal domain

• MEASURE the results of the application

• REFLECT on theory application considering the outcome(s)

• MODIFY behavior based on the reflection

The learner repeats the iteration as many times as necessary for the student to master and internalize the module content and begin achieving the desired outcomes. Iterations after the first can be synchronous or asynchronous, meaning the learner can repeat the module before moving to the next module or move on and return as desired.

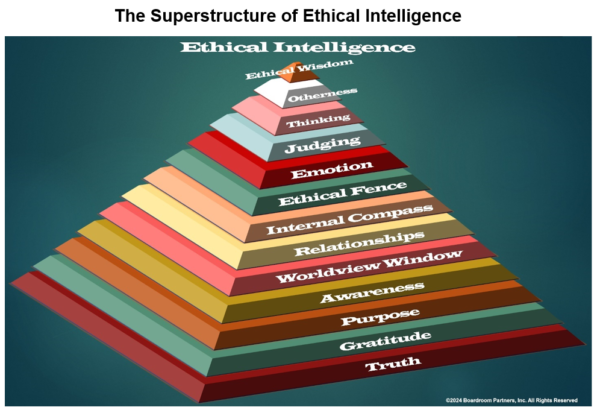

Because of synergy, ethical intelligence is a whole that equals more than the sum of its parts. We break ethical intelligence into 13 parts or levels for simplicity and explanation. Nevertheless, each succeeding tier depends on the previous tier for completion and application. For example, referring to the Superstructure depicted nearby, having an operational, ethical fence or line in the sand depends on an operational internal compass pointing in the direction of rightness or wrongness. Although we cover this superstructure in detail in Module Six, its contents permeate this course. The following is a title summary of the course modules.

Curriculum

Ethical Intelligence – Part 1- Year 1

- Part 1 Month 1 Setting Foundations

- Part 1 Month 2 Ancient Origins of Ethical Intelligence

- Part 1 Month 3 Ethical Intelligence and The Renaissance

- Part 1 Month 4 Postmodernism and Ethical Intelligence

- Part 1 Month 5 Meaning and Sense-Making

- Part 1 Month 6 The Superstructure of Ethical Intelligence

- Part 1 Month 7 Truth Is the Foundation of Ethical Intelligence

- Part 1 Month 8 Gratitude Is the Currency of The Universe

- Part 1 Month 9 Purpose Drives Vision, Mission, and Values

- Part 1 Month 10 Awareness (Heart Sanctuary

- Part 1 Month 11 Worldview Window (Do You See Me?)

- Part 1 Month 12 Primal (Prototype) Relationship

Ethical Intelligence – Part 2- Year 2

- Part 2 Month 1 Tangled Relationship Webs (Including AI)

- Part 2 Month 2 Finding True North and The Internal (Moral) Compass

- Part 2 Month 3 Ethical Fence and Comfort Zone

- Part 2 Month 4 Neuroscience and The Psychology of Emotions

- Part 2 Month 5 Irrationality and Emotional Intelligence

- Part 2 Month 6 Adjudicator and The Sweatbox

- Part 2 Month 7 Ethically Intelligent (Holistic) Thinking

- Part 2 Month 8 Me Versus “You,” A Struggle for Differentiation

- Part 2 Month 9 Possessive Self, Hostile Otherness, Postmodern Ethics

- Part 2 Month 10 Aristotle’s Wisdom and The Beauty of Just Outcomes

- Part 2 Month 11 The Hidden Hand of Culture Encounters Its Termites

- Part 2 Month 12 Caustic Corrosion of Cultural Hypocrisy

Ethical Intelligence – Part 3- Year 3

- Part 3 Month 1 Organizational Wet Work and Plausible Deniability

- Part 3 Month 2 Organizational Omertà and The Coverup

- Part 3 Month 3 Toxic Triangle (Arrogance, Entitlement, Hubris)

- Part 3 Month 4 Shooting Messengers and Blocking Communications

- Part 3 Month 5 Pressure-To-Perform and The Slippery Slope

- Part 3 Month 6 R-Squared Cultural Behavior

- Part 3 Month 7 Great Leaders Are Great Actors

- Part 3 Month 8 The Captivity Cloister and Innocuous Imperial Box

- Part 3 Month 9 Boards of Directors, Agency, and Governance

- Part 3 Month 10 Perceived Hostile Otherness and Lonely Unease

- Part 3 Month 11 The Heart of ESG (Environmental, Social, Governance

- Part 3 Month 12 Module 36: The Future of Leadership Is Gardening

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Ethical Intelligence corporate training program.

Ethical Intelligence – Part 1- Year 1

- Part 1 Month 1 Setting Foundations – Objective: Introduce this training program and, using The Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework as a guide, explore the foundational role ethically intelligent leadership and organizational culture play in managing enterprise risk.

Content Summary

COSO issued the Enterprise Risk Management: Integrating Strategy and Performance Framework (Framework) for managing enterprise risk in 2004 and updated it in 2017. Within the Framework, organizational culture (which flows from ethically intelligent leadership) is cited as the foundation of Enterprise Risk Management (ERM).

That Framework guides the integration of the contents of this training program into organizational processes. This module provides a high-level overview of this program, explaining how all the pieces fit together.

Using case studies, original research, and Fortune 1000 executive testimonials, we explore the critical importance of organizational leadership and culture in guiding organizations through the minefields of worldwide enterprise risks created by a volatile, uncertain, complex, and ambiguous (VUCA) business environment.

Learning Outcomes

After completing this module, learners will be able to:

• Explain the COSO Framework and apply the COSO Cube to the learner’s organization’s risk profile, especially in the learner’s area of responsibility.

• Write a brief essay citing three ways this training can enhance the learner’s leadership and organizational contribution.

• Write a brief essay describing the role of organizational culture in enterprise risk management, citing appropriate and authoritative sources.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes are a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership training and mentoring

• Procurement policies and procedures

• Organizational values creation and training

• Financial reporting compliance

- Part 1 Month 2 Ancient Origins of Ethical Intelligence – Objective: Discover the ancient origins of human ethical intelligence and enumerate its nomenclature.

Content Summary

We introduce the ancient origins of human ethical intelligence and its nomenclature and influence. We trace its 5,000-year history, beginning with the first written evidence of human ethical intelligence, chiseled into the great pyramid at Giza, up to the advent of the Renaissance.

This is the first of four modules designed to create a foundational awareness of the ancient origins and the five-millennia evolution of humanity’s traditions and thought processes about ethics and ethical behavior. This background enhances converting “head” knowledge into a “heartfelt” commitment to ethical behavior.

Knowing how society reached these norms of expected ethical conduct transforms sterile rules-based ethics codes into action-producing principles of organizational behavior.

Learning Outcomes

After completing this module, learners will be able to:

• Articulate the ancient origins and WISDOM of human ethical intelligence and cite three ethically intelligent exemplars, explaining their contributions.

• Describe the fundamental nomenclature of human ethical intelligence by relating it to everyday life.

• Write a brief essay relating the intersection of human ethical intelligence with humanity’s spiritual and religious traditions, citing appropriate and authoritative sources.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.After completing this module, learners can apply its content through these processes:

• Leading the organization

• Managing the organization

• Accounting revenue recognition, especially IP firms

• Financial reporting to diverse stakeholders

• Risk management, especially evaluating the length and breadth of supply chain policies and procedures

- Part 1 Month 3 Ethical Intelligence and The Renaissance – Objective: Explore the diminishment of human ethical intelligence and its influence during the Renaissance.

Content Summary

We examine the diminishment of human ethical intelligence during the Renaissance Period. Our examination includes an intimate look at the influence of philosophy, the arts, and emerging scientific thought on the fading importance of human ethical intelligence, which mirrored the waning influence of the Roman Catholic Church and its corrupt casuistry practices.

This is the second of four modules designed to create a foundational awareness of the ancient origins and the five-millennia evolution of humanity’s traditions and thought processes about ethics and ethical behavior. This background enhances converting “head” knowledge into a “heartfelt” commitment to ethical behavior.

Knowing how society reached these norms of expected ethical conduct transforms sterile rules-based ethics codes into action-producing principles of organizational behavior.

Learning Outcomes

After completing this module, learners will be able to:

• Explain the effects of casuistry on the waning influence of human ethical intelligence in the conduct of human affairs.

• Compare and contrast the strands of scientific thought and philosophy of the Renaissance and apply the knowledge to the slow demise of human ethical intelligence as a viable human thought process.

• Write a short essay that articulates the exemplars (at least three) of the Renaissance and the impact each had on human thought, especially the scientific method, citing appropriate and authoritative sources.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Board and C-Suite leadership programs

• Human resources’ adoption and use of psychometric testing

• Revenue accounting and its theoretical underpinnings

• Marketing content creation and placement

• Risk management, applying the COSO framework

- Part 1 Month 4 Postmodernism and Ethical Intelligence – Objective: Describe post-modernistic thought’s debilitating effects on present-day ethical thinking and judging.

Content Summary

We chronicle the fading understanding of human ethical intelligence and its influence on postmodern human society. We identify this lost knowledge’s importance to our understanding of ethics and ETHICAL JUDGING. We analyze the current adherence to rules-based ETHICAL JUDGING processes rather than the holistic, ethically intelligent practice of fairness-of-outcomes ETHICAL JUDGING. We also administer the eQuu® Survey Experience.

This is the third of four modules designed to create a foundational awareness of the ancient origins and the five-millennia evolution of humanity’s traditions and thought processes about ethics and ethical behavior. This background enhances converting “head” knowledge into a “heartfelt” commitment to ethical behavior.

Knowing how society reached these norms of expected ethical conduct transforms sterile rules-based ethics codes into action-producing principles of organizational behavior.

Learning Outcomes

After completing this module, learners will be able to:

• Explain the importance of the human collective unconscious and its relationship and influence on current-day human interactions, specifically the trust deficit between the human self and the other.

• Discuss the impact of science, including quantum mechanics, on our understanding of present-day rules-based ETHICAL JUDGING processes.

• Write a short essay naming three exemplars of the postmodern period and their contributions to our understanding of human ethical intelligence.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Board and C-Suite adoption of rules-based behavioral constructs

• Human resources’ application of “scientific-based” employee evaluations

• Accounting for sales commissions• Truthful internal budgeting protocols

• Risk management, especially horizontal communication stovepipes

- Part 1 Month 5 Meaning and Sense-Making – Objective: Explain how humans construct meaning from perceived reality and then extend the explanation to human sense-making.

Content Summary

We enter the domains of human psychology and neuroscience as we explore the internal human mechanisms for constructing meaning and sense-making. Humans are hardwired to engage in this process. As we consider how humans make meaning, or sense, of life as it unfolds, we discover and discuss a mosaic of factors contributing to the whole of it.

This is the fourth of four modules designed to create a foundational awareness of the ancient origins and the five-millennia evolution of humanity’s traditions and thought processes about ethics and ethical behavior. This background enhances converting “head” knowledge into a “heartfelt” commitment to ethical behavior.

Knowing how society reached these norms of expected ethical conduct transforms sterile rules-based ethics codes into action-producing principles of organizational behavior.

Learning Outcomes

After completing this module, learners will be able to:

• Articulate the science behind human meaning and sense-making and explain the difference between the two.

• Explain the importance of meaning and sense-making to human ethical intelligence, especially considering a more diverse, mobile, and educated society.

• Write a short essay that applies this knowledge to discerning the relationships, identifying stakeholders, and outlining the potential outcomes of an ethical dilemma resolution, citing appropriate and authoritative sources.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Engineering and innovation in new product/service creations

• Human resources’ on/offboarding policies/procedures

• Accounting research and transaction recordation

• Selecting diverse financing sources

• Procurement and DEI outreach initiatives

- Part 1 Month 6 The Superstructure of Ethical Intelligence – Objective: Enumerate the superstructure of ethical intelligence, including its 13 domains, and relate that knowledge to measuring the maturity of ethical intelligence in humans.

Content Summary

Using the Ethical Intelligence Pyramid, we provide a broad perspective of the ethical intelligence structure. In that overview, we discuss its domains—TRUTH, GRATITUDE, PURPOSE, AWARENESS, WORLDVIEW WINDOW, RELATIONSHIPS, INTERNAL COMPASS, ETHICAL FENCE, EMOTION, SWEAT (ETHICAL JUDGING), ETHICALLY INTELLIGENT THINKING, OTHERNESS (self/other interactions) and WISDOM.

This module is all about building superstructure. We define ethical intelligence as the intellectual capacity and framework for judging matters of equity in relationships. We assert that decision-making and judging don’t refer to the same phenomenon. We introduce the human Self as the self-aware, thinking you. The Other is all else. Finally, we review and explain the silver-level results report from the eQuu® Survey Experience.

Learning Outcomes

After completing this module, learners will be able to:

• Describe and explain the interrelationships of the 13 domains of human ethical intelligence.

• Differentiate between a person’s ethical intelligence maturity score and that person’s ethical conduct.

• Write a short essay describing the meaning of the personal ethical intelligence maturity score they earned from taking the eQuu® Survey Experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership, creating and leading the strategic success elements

• Human resources’ psychometric test use and measurements

• Accounting, managing external auditors

• Procurement, specifically contract management

• Risk management, especially supply chain length, and ethics

THIRTEEN TIERS OF ETHICAL INTELLIGENCE

The next thirteen modules involve a deep dive into the ethical intelligence superstructure. We consider each tier of the superstructure and how it contributes to the holism of human ethical intelligence.

- Part 1 Month 7 Truth Is the Foundation of Ethical Intelligence – Objective: Compare and contrast the TRUTH concept and its meaning through the ages and why TRUTH forms the foundation of human ethical intelligence.

Content Summary

We introduce the concept of TRUTH as it has been understood through the ages, stressing the lack of societal agreement on a universal definition of TRUTH. We examine TRUTH and lying through multiple lenses—scholarly, cultural, and practical. We introduce such leading scholars as Aldert Vnj, Warren Shibles, Sissela Bok, Linda Coleman, Paul Kay, and Joseph Kupfer.

We compile the multiple definitions of Truth into an ethically intelligent Truth definition. Using that definition, we explore how truth-telling organizational cultures endure, thrive, and create long-lasting value for all stakeholders.

Using case studies and Fortune 1000 executive testimonials, we explore the abiding “truth” that neither ethically intelligent leaders nor ethically intelligent organizational cultures lie at any time for any reason.

Learning Outcomes

After completing this module, learners will be able to:

• Write a short essay expressing the learner’s understanding of TRUTH and lying and contrast that understanding with the seven definitions presented in this module.

• Articulate why truth-telling is the foundation of human ethical intelligence, citing appropriate and authoritative sources.

• Write a short essay describing an incident in the learner’s, or an associate’s, professional career wherein lying resulted in organizational losses. Describe the aftermath, if appropriate.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Marketing content creation and venue placement

• Sales generation and tracking, customer relationship management

• Accounting for revenues, including shipments and sales commissions

• Financial planning and forecasting, especially model creation, and testing

• Procurement, supply chain sourcing, and slave labor certifications

- Part 1 Month 8 Gratitude Is the Currency of The Universe – Objective: Discover the concept of GRATITUDE and thanksgiving as it has been understood throughout the ages and explain its importance to creating an ethically intelligent life and organizational culture.

Content Summary

GRATITUDE is the currency of the universe. It is one of the human virtues nearly universally accepted and applauded throughout the world’s societies. Grateful organization members are the core of an ethically intelligent organizational culture. Grateful people are more joyful, welcoming, helpful and complain less. Team members thankful for belonging to the organization are more engaged and productive.

We introduce the spectrum of GRATITUDE understanding through the lenses of psychology, social sciences, and spirituality. We present the interrelationships of GRATITUDE and the other domains of human ethical intelligence. Using case studies and Fortune 1000 executive testimonials, we explore why GRATITUDE is an essential component of an ethically intelligent leader/manager and critical in creating an ethically intelligent organizational culture.

Learning Outcomes

After completing this module, learners will be able to:

• Compare and contrast the spectrum of GRATITUDE understanding and the learner’s understanding and practice of GRATITUDE.

• Articulate why GRATITUDE is the currency of the universe and its importance to human ethical intelligence, citing appropriate and authoritative sources.

• Write a short essay describing a professional experience wherein the learner or an associate neglected expressions of GRATITUDE and what was learned from the experience

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Human resources’ employee retention and engagement initiatives

• Leadership training and mentoring

• Management training, mentoring, and promotion initiatives

• Cross-cultural expressions of gratitude in foreign operations

• Risk management, foreign operatives’ use of baksheesh

- Part 1 Month 9 Purpose Drives Vision, Mission, and Values – Objective: Explore the imperatives of discovering life and organizational PURPOSE and how that knowledge and understanding drive the vision, mission, values, and value creation.

Content Summary

PURPOSE is the reason something or someone exists. It is often called the “why” of something or someone. Once humans understand the “why” of their lives, many other aspects of life assume greater meaning.

When we comprehend the “why” of an organization, its vision, mission, and values come into focus, we integrate PURPOSE knowledge into the other domains of human ethical intelligence and demonstrate the synergy generated by such integration.

Using case studies and Fortune 1000 executive testimonials, we explore the power of emotionally embracing your PURPOSE. Emotions drive our lives. Purposeful emotions become passions.

Passions enable us to scale great heights and realize our dreams, which is the mark of greatness in people and organizations.

Learning Outcomes

After completing this module, learners will be able to:

• Meaningfully explore and clarify their life PURPOSE.

• Define the “why” of their organizations and compare and contrast their interpretation of their vision, mission, and values statements to the actual published organizational vision, mission, and values.

• Write a short essay about their revelations about their life’s PURPOSE OR COMPARE AND CONTRAST THEIR ORGANIZATION’S VISION, MISSION, AND VALUE pronouncements to their products from this module.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership strategy creation through vision, mission, and values understanding

• Human resources’ psychometric assessments

• Innovation and creative product/service initiatives

• Financial management and Economic Value Added (EVA) applications

• Marketing content creation clarity campaigns

- Part 1 Month 10 Awareness (Heart Sanctuary) – Objective: Explore the psychological and neurological underpinnings of human AWARENESS and its dependence on a properly constituted human HEART SANCTUARY.

Content Summary

The HEART SANCTUARY is a psychological, neurological, mystical, or spiritual structure where the human Self retreats for respite from the world. It’s our sacred, safe place where only we can enter. We have complete control of this space. It’s where we recharge and adjust our perspectives of the outside world.

Many names have called this sacrosanct place throughout the millennia. The philosopher John Locke called this place our sphere of “personal jurisdiction.” The philosopher Adam Smith referred to it as the “inner man.” Augustine referred to the HEART SANCTUARY as the “secret place.”

Our exploration of the HEART SANCTUARY includes an introduction to Jung’s concept of the collective unconscious and its role in creating general human AWARENESS. We explain the importance of general, situational, and personal AWARENESS to the functioning of our ethical intelligence.

Learning Outcomes

After completing this module, learners will be able to:

• Describe the differences between general, situational, and personal AWARENESS and why it is essential to understand them.

• Create a word or aspirational picture of the appearance of or conditions within their personal HEART SANCTUARY.

• Write a short essay describing a professional experience wherein the learner’s, or an associate’s, general, situational, or personal AWARENESS produced a positive or negative outcome and what the learner gleaned from the experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leader and follower human relations

• Manager and subordinate human relations

• Human resources offboarding policies and procedures

• C-Suite and executive perquisites and compensation

• Human resources employee counseling resource provision

- Part 1 Month 11 Worldview Window (Do You See Me?) – Objective: Explore the concept of the WORLDVIEW WINDOW and how it affects how we perceive and interpret reality, especially how we treat people of insignificance.

Content Summary

The WORLDVIEW WINDOW is a psychological, neurological, mystical, or spiritual structure through which the Self (you) views the Other (everyone else) during ETHICAL JUDGING. It is the lens through which we see the world and evaluate fairness within RELATIONSHIPS. It is a metaphor for an actual window.

Our Worldview Window provides a crystal-clear view of reality when we’re born. As infants and children, we openly welcome the world through this window. Only later in life does our Worldview Window become clouded by our acquired biases and lived experiences.

We explore our Worldview Window’s role in constructing our AWARENESS, building healthy relationships, and our ability to discern a complex web of stakeholder relationships within an ethical dilemma. We integrate this knowledge into a mosaic explaining our diversity, equity, and inclusion views.

Learning Outcomes

After completing this module, learners will be able to:

• Discern and describe the learner’s worldview and how it influences their evaluation of fairness within relationships.

• Articulate how the learner’s worldview (primarily related to insignificance or the insignificant) might cloud or close their WORLDVIEW WINDOW.

• Write a short evaluation of how the learner’s organization’s WORLDVIEW WINDOW affects its diversity, equity, and inclusion initiatives.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Board, C-Suite, and executive diversity initiatives

• Human resources’ diversity, equity, and inclusion programs

• Marketing content creation and media selection

• Neurodiversity initiatives and psychometric assessments

• Sales associate selection policies and screening criteria

- Part 1 Month 12 Primal (Prototype) Relationship – Objective: Explore the PRIMAL RELATIONSHIP and understand how it is the prototype of all other relationships and its hidden and pervasive life-long influence on ETHICAL JUDGING.

Content Summary

Relationships begin at birth. The special bond between the biological mother or other maternal figure (mother) and child is the purest form of relationship. Within it, there are no doubts, barriers, or pretenses. There’s only love and unlimited trust. The child knows the mother, and the mother knows the child. That mother-figure connection is central to our existence as humans. It’s the most basic connection we share, one to the other.

The PRIMAL RELATIONSHIP is the essential connection between the Self and the Other. It has existed since the beginning. It’s the model of all relationships. The PRIMAL RELATIONSHIP is ageless and necessary. Its pristine condition includes love, trust, empathy, caring, respect, sympathy, compassion, altruism, and intimacy. But it simultaneously births love and hate. It’s often contradictory. We deeply dive into this construction and its implications for human ethical intelligence.

Learning Outcomes

After completing this module, learners will be able to:

• Critically articulate and evaluate the learner’s experience within their (mother-figure) relationship.

• Dispassionately apply the learner’s newly found knowledge of their PRIMAL RELATIONSHIP to their adult relationships.

• Write a short essay describing a personal or professional relationship experience wherein the subterranean influences of the PRIMAL RELATIONSHIP produced unexpected outcomes and what was learned from the experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Relationships with leaders, managers, and co-workers

• Human resources’ provision of counseling benefits

• Human resources and employee engagement initiatives

• Financial engineering: stock buybacks versus employee raises

• Horizontal communications protocols

Ethical Intelligence – Part 2- Year 2

- Part 2 Month 1 Tangled Relationship Webs (Including AI) – Objective: Explain the TANGLED RELATIONSHIP WEB construct and its importance in resolving ethical dilemmas because our human ethical intelligence manifests within our RELATIONSHIPS.

Content Summary

Ethical dilemmas always occur within TANGLED RELATIONSHIP WEBS. In most ethical dilemmas, there is a complex and diffuse web of relationships involving many interrelated stakeholders, which we must understand to render just ethical judgments. This module integrates all the human ethical intelligence domains discussed in this course into an emerging whole.

We demonstrate how TRUTH, GRATITUDE, PURPOSE, AWARENESS, and WORLDVIEW WINDOW flow into a mosaic of compelling factors that drive our relationship behavior. We introduce complexity science and artificial intelligence concepts and apply them to evaluate our TANGLED RELATIONSHIP WEBS.

We show that we need to unpack or unwind the tangle and discern the interconnections of the web to recognize all appropriate stakeholders and, thus, render just ethical judgments.

Learning Outcomes

After completing this module, learners will be able to:

• Explain the TANGLED RELATIONSHIP WEBS construct and its importance in justly resolving ethical dilemmas.

• Articulate the human ethical intelligence domain interactions by sampling real-world scenarios.

• Write a short essay describing a professional, ethical dilemma experience wherein the outcome was unclear because the TANGLED RELATIONSHIP WEBS were not correctly deconstructed, and interconnections understood.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Divestments, facility closures, facility relocations

• Human resources’ reduction in force policies

• Accounting earnings per share calculations

• Financial and regulatory reporting practices

• Supply chain management operations and audits

- Part 2 Month 2 Finding True North and The Internal (Moral) Compass – Objective: Explore the origins and current societal status of the human Internal Compass mental construct.

Content Summary

Most of us believe in some form of an internal human compass. It’s sometimes called the moral compass, moral core, or personal ethics compass. The INTERNAL COMPASS refers to a psychological, neurological, mystical, or spiritual structure that contains a metaphorical internal human—cognitive, psychological, moral, or ethical compass—used for ETHICAL JUDGING.

Regardless of how we visualize our INTERNAL COMPASS or its location within our human person, its functioning is driven by the core values and principles we’ve accumulated over a lifetime. Our core values and principles may have been rationally learned and internalized, but our emotions activate them.

In this module, we explore the deep interactions occurring within the human psyche as we evaluate the rightness or wrongness of behavior. We illustrate the compass working within real-world ethical dilemmas using case studies, executive testimonials, and current research.

Learning Outcomes

After completing this module, learners will be able to:

• Enumerate the historical origins of the human INTERNAL COMPASS construct and its current positioning within the modern human psyche.

• Critically examine the learner’s personal INTERNAL COMPASS and understand its source, contents, and viability.

• Recall a personal or professional experience where their INTERNAL COMPASS did not provide a clear ETHICAL JUDGING pathway and write a short essay about the experience and any lessons learned.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership and management training and mentor programs

• Human resources recruitment advertising strategies

• Accounting for complex transactions

• Financing tool usage, especially public disclosures

• Risk management, specifically related to compliance

- Part 2 Month 3 Ethical Fence and Comfort Zone – Objective: Explain the origin, nature, and importance of the metaphorical ETHICAL FENCE (the line in the sand) and the ETHICAL COMFORT ZONE preceding it.

Content Summary

The ETHICAL FENCE structure has its roots in antiquity. Socrates had spoken of an irresistible pull that distinguished right from wrong, supposing it a protective barrier preventing the ethically intelligent person from making an inappropriate ethical judgment. The ETHICAL FENCE or ethical line in the sand refers to a metaphorical boundary separating right from wrong. The human INTERNAL COMPASS establishes the position and power of that line.

The area preceding that line is the ETHICAL COMFORT ZONE, a place from which the ethically intelligent do not stray. Ethically intelligent people know precisely where the line is, and metaphorical warning signals appear when they are “crowding” the line.

Using case studies, Fortune 1000 executive testimonials, and original research in this module, we critically examine the ETHICAL FENCE and its modern viability.

Learning Outcomes

After completing this module, learners will be able to:

• Articulate the ETHICAL FENCE and ETHICAL COMFORT ZONE concepts and their application within real-world circumstances.

• Critically examine the learner’s ETHICAL FENCE, or line in the sand, and explain its strength and the PRECEDING ETHICAL COMFORT ZONE.

• Write a short essay about a professional experience wherein their ETHICAL COMFORT ZONE failed to protect them from questionable behavior and what they learned from the experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Management of work-from-home policies and procedures

• Human resources’ psychometric testing implementations

• Accounting fixed asset recordation

• Financial engineering in EVA and NPV calculations/presentations

• C-Suite and executive compensation, especially contingent compensation

- Part 2 Month 4 Neuroscience and The Psychology of Emotions – Objective: Explore the power of the most ancient portion of the human brain, the limbic system, explain its role in human emotions and couple that learning with ETHICAL JUDGING.

Content Summary

Whenever we make an ethical judgment, our emotions are an enormous silent partner sitting next to us on the judgment seat. Emotions permeate every ethical judgment we make. We examine the limbic system and its related neurological structures to understand the human Emotion mechanism from a neurological and psychological perspective.

We explore the enormous hidden power our limbic and hormonal systems exercise over our human reasoning processes by examining philosopher David Hume’s admonition, “In the face of passion, reason is impotent.” We then combine that knowledge with practical considerations and integrate everything into an assessable and actionable package.

Learning Outcomes

After completing this module, learners will be able to:

• Articulate the primary psychological and neurological structures of human emotions and how those structures operate under ETHICAL JUDGING conditions.

• Explain the importance of hormones, emotions, and emotional states in ETHICAL JUDGING, especially when incorporating situational risk factors.

• Recall a time when the learner was making an ethical judgment in the heat of the moment, and the outcome was not an optimal resolution (i.e., a line was crossed) of the ethical dilemma. If appropriate, write a paragraph about what the learner gleaned from the experience, focusing on the emotional aftermath.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership training and mentorship practices

• Human resources counseling and outreach programs

• Accounting for revenues and sales professionals’ commissions

• Marketing content creation and media selection protocols

• Cross-cultural inclusion and diversity training

- Part 2 Month 5 Irrationality and Emotional Intelligence – Objective: Discover the nature of emotional intelligence and its role in Ethical Judging and executive leadership.

Content Summary

We continue our exploration of the hidden critical role emotions play in ETHICAL JUDGING by examining germinal and current research into rational people engaging in predictably irrational behavior. We continue our exploration of irrational behavior with the story of Captain van Zanten, a man celebrated for calm, logical, and reasoned judgments. Using our newly acquired understanding of the power of the human limbic system, we segue into emotional intelligence.

Emotional intelligence is the ability to perceive, control, and evaluate emotions in oneself and others. Daniel Goleman pioneered this idea in 1995, and the concept is now an accepted area of interest and study in management and leadership.

Mature emotional intelligence is a “must have” for fair and just Ethical Judging.

Learning Outcomes

After completing this module, learners will be able to:

• Define the core principles of emotional intelligence and its effects on human behavior within relationships.

• Critically examine the learner’s personal emotional intelligence maturity based on current measure standards.

• Write a short essay describing a professional experience wherein they, or an associate, applied the tenets of emotional intelligence, describing the outcome and what was learned from the experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• C-Suite and executive compensation, primarily contingent compensation

• Engineering and innovation processes focusing on “fear of failure”

• Accounting error management and accountability

• Finance planning and forecasting, focusing on the ROYAL FAMILY OF FIVE FEARS

• Nepotism policies and reporting practices

• Staff fraternization and sexual harassment strategies

- Part 2 Month 6 Adjudicator and The Sweatbox – Objective: Explore the inner workings of human ETHICAL JUDGING via the metaphor of the ancient SWEATBOX updated to postmodern conditions.

Content Summary

The concept of a SWEATBOX reaches worldwide and is used in many cultures. SWEATBOXES can be found in many dissimilar cultures, such as Scandinavia, Africa, and South America. SWEATBOXes are also part of ancient Native American traditions. The SWEATBOX is a metaphor we all understand.

What happens within the human psyche (the HEART SANCTUARY) during ETHICAL JUDGING sessions needs to be better understood. We use the ancient SWEATBOX metaphor to dive deeply into the neurological processes occurring during ETHICAL JUDGING experiences. We explore the idea that your normally calm HEART SANCTUARY becomes the hot and steamy environment of the SWEATBOX.

Using Harry Truman’s decision to use the atomic bomb to end WWII as a case study, we introduce the ADJUDICATOR, who is simultaneously the judge, jury, prosecutor, and defendant during an ETHICAL JUDGING session. The case study integrates several ethical intelligence domains.

Learning Outcomes

After completing this module, learners will be able to:

• Explain that ETHICAL JUDGING is not rational by comparing the limbic and cerebrum neurological elements and their respective roles in ETHICAL JUDGING.

• Describe the learner’s emotions and judgment about Truman’s use of the atomic bomb to end WWII, including their argument’s pros and cons.

Write a short essay wherein the learner or an associate describes an ETHICAL JUDGING experience that was more EMOTION than reason and how they dealt with the aftermath, if any. Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Management processes concerning stakeholder relationships

• Human resources sexual harassment case investigation and reporting

• Accounting engineering and earnings-per-share calculation practices

• Financial engineering and executive compensation

- Part 2 Month 7 Ethically Intelligent (Holistic) Thinking – Objective: Explore the concept of ETHICALLY INTELLIGENT THINKING (holistic thinking), defined as understanding a mosaic of circumstances, stakeholders, and emotions and, from that chaos, exercising fair judgment in compromise.

Content Summary

ETHICALLY INTELLIGENT THINKING (also called CEO thinking) is observing a three-dimensional set of dots (elements of sensory input), discerning a pattern, and connecting that pattern into a meaningful order. We explore recent findings from neuroscience as we consider the waning ideas of the right versus left brain or upper versus lower brain while relating these concepts to how we think.

We demonstrate the critical importance of ETHICALLY INTELLIGENCE within the ETHICAL JUDGING context. The capacity for ETHICALLY INTELLIGENT THINKING ENABLES the assessment of the contextual elements surrounding an ethical dilemma, leading to a fully informed ethical judgment. Using examples from great world leaders, we examine the complex structure of ETHICALLY INTELLIGENT and its application within emotionally charged circumstances.

Learning Outcomes

After completing this module, learners will be able to:

• Examine an ethical dilemma—discern and list the web of embedded relationships, stakeholders, issues, and emotions and propose a fair outcome.

• Consider a public ethical scandal and defend the learners’ perceived fairness outcome.

• Write a short essay wherein the learner describes a professional, ethical dilemma they resolved unsatisfactorily, citing an approach that may have been more appropriate and the reasons.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Strategic planning and values creation

• Innovation and change management

• Accounting for complex transaction practices

• C-Suite and executive compensation structures

• Supply chain creation, management, and auditing.

- Part 2 Month 8 Me Versus “You,” A Struggle for Differentiation –Objective: Describe human selfhood and OTHERNESS and trace their slow separation and differentiation from antiquity to the present estrangement and open hostility.

Content Summary

The Self is the self-aware, thinking you. The Other is all else. The Other may be an individual, a group, or an organization, such as a competitor or governmental agency. OTHERNESS is all that is not you.

Given the vast expanse of time humans have occupied this planet, human individuality, or the Self, is a relatively new idea. In the beginning, there was no me, only us. Emerging and differentiating the Self from the Other has been an ongoing struggle. We chronicle the tortuous journey from antiquity to the present.

We weave AWARENESS, WORLDVIEW WINDOW, and RELATIONSHIPS (especially the Primal Relationship) into a holistic structure that provides a knowledge gestalt inclusive of the human Self and the increasingly distant Other. Using exemplars and case studies, we apply our emerging expertise to quicken our passage to WISDOM.

Learning Outcomes

After completing this module, learners will be able to:

• Articulate the nature of human Selfhood and its long history and relationship to the Other or OTHERNESS.

• Explain the critical importance of the Self and Other dichotomies and their role in ETHICAL JUDGING.

• Write a short essay describing a professional relationship experience wherein the Other was marginalized in favor of the Self, resulting in unfair outcomes. Share the aftermath, if appropriate.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership training and mentoring

• Human resources departments psychometric testing regimes

• Procurement ethics training practices

• Corporate giving program management

• ESG, especially the social implications

- Part 2 Month 9 Possessive Self, Hostile Otherness, Postmodern Ethics – Objective: Explore the postmodern Possessive Self, its ever-distant relationship with the Other, and the pathways through which this estrangement flows and corrupts ETHICAL JUDGING.

Content Summary

During the 20th century, the battle between the Self and the Other reached its conclusion with the emergence and dominance of the Possessive Self, which was, and still is, wary of the specter of the Hostile Other. We explore how this corrosive competition between these two sociological and psychological forces has corrupted culture and ETHICAL JUDGING in the 21st century.

Post-modernism, as it appeared in the 1970s, is often linked with the philosophical movement called Poststructuralism (also called Deconstruction), in which philosophers such as Jacques Derrida proposed that structures within a culture were artificial and could be deconstructed to perform analysis. Postmodernism has been characterized as “anything goes.” We examine this attitude and its impact on ethics and ETHICAL JUDGING.

Learning Outcomes

After completing this module, learners will be able to:

• Enumerate the origins and societal influences of the 21st-century Possessive Self and the Hostile Other, including human actors like Marx, Spencer, and Sumner.

• Explain the contribution of the Possessive Self and the Hostile Other to the 21st century 24/7 VUCA (volatile, uncertain, complex, ambiguous) business climate.

• Write a short essay describing and explaining the outcome of a professional encounter with either a Possessive Self or Hostile Other figure, complete with an emotional introspection and discussion of the aftermath.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Ethics and regulatory compliance

• Management training programs, especially concerning DEI

• Investor (stakeholder) relationship practices

• Third-party litigation management and control

• ESG and rating agency interactions

- Part 2 Month 10 Aristotle’s Wisdom and The Beauty of Just Outcomes – Objective: Explore the ancient ideas that wisdom, discernment, and aesthetics are woven into a tapestry that drives the just outcomes of ethically intelligent behavior.

Content Summary

Plato said that good was beautiful. Aristotle noted that ethical behavior has contained within it an inherent beauty. Freidrich Schiller, a German philosopher agreeing with Plato and Aristotle, concluded that humanity could not behave ethically through the powers of reason alone. Schiller thought that aesthetics enabled humans to discern where right fades to wrong.

We explore WISDOM and its essential element—discernment. Discernment is often defined as “choosing wisely.” This limited definition dramatically diminishes a complex, beautiful, and necessary human ability. Discernment is essential, however, to the concept of “doing the right thing,” which is R-SQUARED BEHAVIOR.

Aristotle and Augustine believed an ethically intelligent person possessed a finely tuned discernment that not only distinguished parts from wholes but also comprehended that the beauty of the whole is often more than the sum of its parts. We use this standard to evaluate justice within ethical dilemma resolutions.

Learning Outcomes

After completing this module, learners will be able to:

• Explain how the synergistic relationships among WISDOM, discernment, and aesthetics produce a whole greater than the sum of the individual elements.

• Compare and contrast the ethical intelligence of Dietrich Bonhoeffer to Martin Luther King, Jr.

• Write an essay describing a professional experience wherein the learner’s discernment failed to comprehend all aspects of a situation but, in the end, was a valuable learning experience.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.

After completing this module, learners can apply its content through these processes:

• Leadership, specifically mentoring programs.

• Human Resources, rules-based employee discipline structures.

• Management training programs

• DEI (diversity, equity, inclusion) practices

- Part 2 Month 11 The Hidden Hand of Culture Encounters Its Termites – Objective: Discover the fierce fire of organizational culture and its capacity to burn an organization to the ground or cleanse it from cultural dysfunction.

Content Summary

The philosopher and economist Adam Smith gave us the idea of the “invisible hand” of economics: pursuing your self-interest to serve the greater good of the economy and society. In the case of the HIDDEN HAND OF CULTURE, the greater good is served when there is a healthy and righteous culture. The opposite case is also possible. A corrupt culture will corrupt all who are part of it.

Culture will change you, or you can change it, and you’d better know the difference. In this module, we teach discerning that difference. We describe organizational culture as a gestalt and, through case studies and the lived experiences of Fortune 1000 executives, demonstrate its culture-altering potency.

This organizational culture overview module prepares learners to discover, evaluate, and exterminate the organizational culture dysfunctions (termites) encountered and studied in modules 24, 25, 26, 27, 28, and 29.

Learning Outcomes

After completing this module, learners will be able to:

• Define and discuss THE HIDDEN HAND OF CULTURE, INCLUDING ITS COMPONENTS—VALUES, MYTHS, ARTIFACTS, and traditions.

• Articulate the hidden forces at work in any organizational culture, either changing it for the better or positioning it for failure. Analyze the learner’s organizational culture, look for its effects, and enumerate them.

• Write a short essay describing a professional experience within a “troubled” organizational culture and how they reacted to that experience, including the outcome(s) if appropriate.

Implicated Organization Processes

Ethics and ETHICALLY INTELLIGENT THINKING must permeate every organizational process and should infuse behavior at all levels of the organization. The following higher-order (core) processes represent a suggested starting point.