Women Empowerment – Workshop 4 (Money Mindset)

The Appleton Greene Corporate Training Program (CTP) for Women Empowerment is provided by Ms. Tull Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Ms. Tull is a Certified Learning Provider (CLP) with Appleton Greene. She has over 25 years of experience in coaching, consulting and training CEO’s and executives. She specializes in the areas of personal and professional development and leadership. She is passionate about empowering women in the workplace equipping them with leadership skills and helping them to reveal their unique value, so they can reach their true potential and make a bigger impact. She has industry experience in the following sectors: Technology, Financial Services, Biomedical, Consultancy and Healthcare. She has commercial experience in the following countries: United States, Canada, England, Mexico and Sweden. More specifically within the following cities: Austin, TX; Houston, TX; Dallas, TX; Los Angeles, CA; New York City NY; St. Louis, MS; Virginia Beach, VA; Chicago IL. Her personal achievements include 17 yrs. as Founder/CEO of Silverlining Concepts, LLC where she empowers business owners and leaders to own their value and earn their worth, Certified Money Breakthrough Method Coach, Best-selling Author of a book about owning your value, so you can earn your worth in the workplace, Executive Contributor to Huffington Post, Biz Journals and Brainz Magazine, featured on the Brainz 500 Global list 2021. She also is a co-host on a national TV show- that focuses on bringing more light and positivity to the world. Her service skills include; leadership development, executive coaching, business strategy, sales and marketing strategies, mindset shifting and advanced communications and presentation skills.

MOST Analysis

Mission Statement

Have you ever heard how you do money is how you do everything? Where money is concerned, you are either experiencing contraction (repelling it) or expansion (attracting it). Discover how you can clear your money clutter, so you can earn and save more money. You will obtain clarity, confidence, and freedom when it comes to money. You’ll learn a proven step by step process to allow you to take control of your financial future.

Objectives

1. Money Legacy – Understanding your money story also known as your money legacy, is one of the most important things you can do to improve your financial situation. It’s critical to understand your current relationship with money—what you say about it, how you feel about it, what you believe about it, and how you use it. In this lesson, you will learn actionable steps to bring about positive change for your financial future including creating a new Family Money Legacy.

2. Expansion vs. Contraction – When it comes to money you have either an Abundance Mindset with expansive thoughts of (abundance, peace, freedom) or a Scarcity Mindset with contractive thoughts such as (fear, stress and lack). In this lesson, you learn how contractive thoughts can not only keep you from generating the income and lifestyle you desire but can sabotage your success in all areas of your life.

3. Clear Clutter – Having clutter in our lives can bog us down and create stress and overwhelm in lur lives. Decluttering and getting organized around money is a powerful first step to changing the direction of your money life. In this lesson, you will learn powerful steps to create a clutter free life.

4. Forgive Past – Many of us want to have a bright, shining future: filled with hope and clarity and empowerment when it comes to our financial futures. But something seems to be holding us back. As much as we desire a new future, we simply can’t move forward until we pause, looked into our past, and address the issues that are tying us to it. This course is all about forgiveness – why it’s the answer and exactly how to go about it.

5. Money Breakthrough – Your money mindset influences what you believe you can and cannot do with money, how much money you believe you’re allowed, entitled, and able to earn, how much money you believe you can and should spend, how you use debt, how much money you give away, and your ability to invest confidently and successfully. In this lesson you will lean to shift your money mindset with a money breakthrough that will allow you to instantly up-level your confidence, create a new, empowered money mindset, and feel on fire about the special brilliance you bring to the world.

6. Relationship with Money – We have relationships with almost everything in our environment, including concepts, and yes…even money. In order to be financially successful, it is necessary for you to adopt a new money mindset. This means not only removing blocks, forgiving, shifting your mindset but also creating a new healthy and empowering relationship with money.

7. Need vs Want – When creating a monthly budget, one of the most important steps is to categorize your spending by whether it is a “need” or a “want.” It is also one of the most difficult steps to take because what constitutes a need versus a want varies from person to person. It’s also easy to mistake wants for needs if you’re so used to having them that you can’t imagine life without them. However, as we demonstrate in this lesson, needs, and wants are not the same thing and why it’s critical to understand the distinction between them.

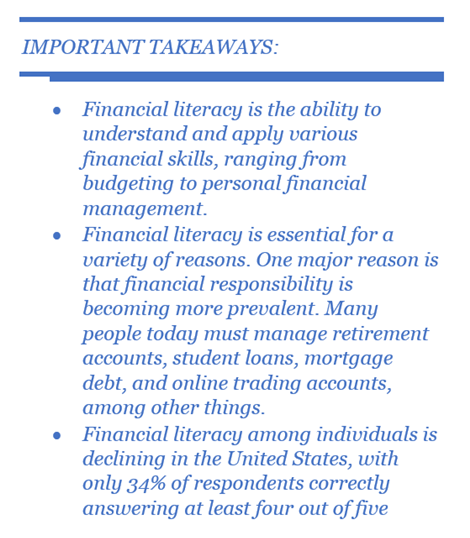

8. Financial Literacy – Many consumers today have a basic understanding of finance. Indeed, a lack of financial knowledge may be one of the reasons why many individuals struggle with saving and investing. Few people are prepared as financial decision-making becomes more complicated. That is why Financial Illiteracy is the #1 crisis in America! Understanding the value of money and how it works can significantly impact our future.

9. Money Management – Your overall wealth has less to do with how much money you make and more to do with learning how to manage your money. Whether you earn $100,000 or $1 million, developing your money management skills can help you achieve financial freedom, retire comfortably, and much more. The good news is that you don’t have to be a math genius or a millionaire to learn about money management. Money management is fundamentally about changing your mindset and developing good habits – habits we will do a deep dive in during this course.

10. Money Goals – It’s important to focus on what you want and create goals when it comes to money. Imagine what it will be like to live debt-free, achieve financial stability, and have the ability to spend your money on the things you value most. When you focus on what you want vs. your current situation it’s far easier to stay motivated and reach your financial goals. During this lesson, we will help you breakthrough your financial glass ceiling determine your freedom number, set your new bold money goal and create your “Money Mantra”.

11. Action and Accountability – Every person in the world wants a comfortable life, smooth relationships, and enough money to live comfortably, have their own house, car, and enough money to enjoy their yearly or monthly vacations. But just having a dream, plan, or vision for your work isn’t enough. To have this kind of life, the most important thing that is required is action. In order to get your desired outcome, you must take action. This lesson is all about learning what actionable steps to take to create the life and financial future that you want.

12. Money Power – Money is a metaphor for your self-worth. If you are not making the money that you desire somewhere in your life you are giving your power away. We’ve all felt as if we were at the mercy of what happened to us. However, just because you believe you are powerless does not imply that you are. When you feel powerless, it’s usually because you’ve chosen (consciously or unconsciously) to give away your power to others. The great news is that you can do something about it. In this lesson we will go through a powerful process to help you re-claim your power in your life and with money.

Strategies

1. Learn and implement the steps to create a new Family Money Legacy.

2. Method to move out of contraction and into expansion when it comes to money.

3. Discover strategies to eliminate clutter in your life and access the 10 steps to de-clutter your finances.

4. Learn a “letting go” tool and create a forgiveness letter.

5. Adopt a new mindset with the 8-step process to improve your money mindset and method to create your own money breakthrough.

6. Learn 5 powerful ways to creating an empowered relationship with money and process to create a sacred relationship with money.

7. Learn the 5 levels of Maslow’s Hierarchy of Needs and develop a strategy to discern wants from needs.

8. Identify 7 reasons why financial literacy is important to your financial success.

9. 10 simple ways to successfully manage your money.

10. Identify your freedom number, create money goals and a new “Money Mantra.”

11. Discover how to prioritize money in your life with the 7 financial priorities, learn powerful action and accountability steps as well as create a money vision board.

12. Learn the 7 Money Archetypes, 10 ways we give our money power away and a step-by-step process to re-claim it.

Tasks

1. Go through the Study Guide and Distance Learning lessons first and make notes.

2. Identify the key relationships that need to be managed to ensure project success.

3. Determine needs, critical drivers, concerns, and interests for each relationship.

4. Ensure that these relationships are built and maintained on a regular basis, by soliciting ideas, comments, and assessing value.

5. Schedule a meeting for the participants to meet and discuss the workshop within 30 days.

6. Participants to share expectations and feedback during the workshop.

7. Set a deadline for determining and analyzing the time commitment for each of the participants.

8. Participants to demonstrate personal presence, get feedback, and make a plan for further development.

9. Participants to experience the challenges of change and apply learnings to the philosophy of leading change.

10. Participants are to complete each exercise fully, actively participate in all of the group exercises and be willing to discuss the process and results with the group.

11. Participants to complete their project by identifying and implementing changes discussed throughout the workshop.

12. Participants to review resources for inspiration and identify at least one new tool for adoption from the provided list.

Introduction

Material wealth and financial success provide more freedom and comfort in life, as well as less stress and hardship. Many of us want to make more money and believe we have a greater potential for wealth than we do now. We may even have a good idea of how to make money, but something is still holding us back. If you don’t feel like you’ve reached your full potential for success, perhaps a change in your money mindset is in order. We can’t change our life if we’re worried about money, and we can’t be happy if you’re constantly stressed about money. Chances are, that you have something to share that offers great value or that can make a difference. If you’re worried about or conflicted around money, you won’t be able to get your gifts or talents out into the world.

This workshop – on Money Mindset dives in deep to uncover where this FEAR around money comes from and how you can shift it and begin to feel empowered when it comes to making and managing money.

With a better understanding of your money mindset, you can begin to take action to change it and transform your relationship with money.

What exactly is Money Mindset?

A money mindset is your distinct and individual set of core beliefs about money and how it functions in the world.

It is your monetary attitude. Your money mindset influences what you believe you can and cannot do with money, how much money you believe you’re allowed, entitled, and able to earn, how much money you believe you can and should spend, how you use debt, how much money you give away, and your ability to invest confidently and successfully.

Your attitude toward people, rich and poor, is influenced by your money mindset. Do you think rich people are evil, mean, materialistic, and greedy, and thus you don’t want to be like them? Do you believe that poor people are noble and virtuous, the salt of the earth – and that it is therefore preferable to be like them?

Another indicator of your money mindset is how you handle yourself in financial conversations: do you feel vulnerable and intimidated, or confident and in control? Are you comfortable asking questions – either yes because you feel safe doing so, or no because you’re shy and embarrassed? Do you have an unspoken belief that money is a man’s world and that women should not be concerned with it?

What’s fascinating about our money mindset is that it resides in our unconscious mind. And it can lie dormant for a long time. However, by becoming an astute observer of your thoughts, feelings, bodily reactions, and interactions with money, you gain awareness of your current set point and the ability to shift your mindset.

History of Money Mindset

Many of our core beliefs about money are formed in childhood as a result of observing and internalizing money messages from our parents, friends, community, and other caregivers. Our parents, in particular.

Little children absorb everything they come into contact with. We paid close attention to how the adults closest to us dealt with money and life – did your parents fight about money, or were they cool and collected when family finances were discussed?

Why is it Important?

Understanding your money mindset and where it came from can aid in its transformation. Just as you would enter your coordinates into a navigator before embarking on a journey, you should be aware of and comprehend your current financial beliefs.

Knowing where you started helps you realize how far you’ve come as you shift your mindset. It’s like looking at the map and realizing you’ve already traveled 200 miles. The difference with money is that it is a once-in-a-lifetime journey. We never arrive at our destination. We’re just getting started. The journey is the destination.

How to Change Your Money Mindset.

Awareness is the first step toward changing your money mindset. Pay attention to your money-related thoughts, behaviors, and actions. Your feelings will be influenced by your financial thoughts. And your emotions influence your behavior.

For example, if you believe money is a scarce commodity, you will be stressed and anxious. You may lash out at family members for their financial frivolity, carelessness, or money mistakes. You are not likely to be generous, and you may even hoard money and material possessions.

We either have expansive thoughts about money (abundance, joy, peace) or contractive thoughts such as (lack, scarcity, or fear).

Most often we have made any financial mistakes that we wish we could undo. It’s perfectly normal! We’re all guilty of it. It’s a part of our financial education and maturation. Furthermore, neither our parents nor our school systems taught us anything about proper money management. As a result, we learned through osmosis and trial and error. It is essential to forgive ourselves for our financial blunders. Allow ourselves to let go of the past and let go of any feelings of shame, guilt, or stress.

It takes time, focus and a structured process to change your money mindset. It’s time to get started if you want to have a more joyful, abundant, and confident relationship with your money. The journey is the destination. Let’s begin your money mindset shift journey.

Executive Summary

It’s a common misconception that money and spirituality are incompatible: if you’re a kind giving person or spiritual in anyway, you shouldn’t want money or people who want money are materialistic and greedy.

However, this way of thinking is extremely detrimental to our success. In fact, this couldn’t be further from the truth: money does not inherently breed greed and materialism. Money and spirituality, go very well together and can bring abundance into our lives. We will have a difficult time creating financial abundance in this lifetime if we feel (even slightly) that money is bad.

That is why having a money mindset that is based on expansive thoughts (abundance and peace) and reflects prosperity is necessary to obtain our financial goals.

The Money Mindset workshop will provide a focused structure and process to shift our money mindset and teaches money skills which will allow us to become confident when it comes to making and managing money.

There are 12 courses (or focus areas) in the Money Mindset Workshop.

Here they are:

1. Money Legacy – Understanding your money story also known as your money legacy, is one of the most important things you can do to improve your financial situation. It’s critical to understand your current relationship with money—what you say about it, how you feel about it, what you believe about it, and how you use it. In this lesson, you will learn actionable steps to bring about positive change for your financial future including creating a new Family Money Legacy.

2. Expansion vs. Contraction – When it comes to money you have either an Abundance Mindset with expansive thoughts of (abundance, peace, freedom) or a Scarcity Mindset with contractive thoughts such as (fear, stress and lack). In this lesson, you learn how contractive thoughts can not only keep you from generating the income and lifestyle you desire but can sabotage your success in all areas of your life.

3. Clear Clutter – Having clutter in our lives can bog us down and create stress and overwhelm in lur lives. Decluttering and getting organized around money is a powerful first step to changing the direction of your money life. In this lesson, you will learn powerful steps to create a clutter free life.

4. Forgive Past – Many of us want to have a bright, shining future: filled with hope and clarity and empowerment when it comes to our financial futures. But something seems to be holding us back. As much as we desire a new future, we simply can’t move forward until we pause, looked into our past, and address the issues that are tying us to it. This course is all about forgiveness – why it’s the answer and exactly how to go about it.

5. Money Breakthrough – Your money mindset influences what you believe you can and cannot do with money, how much money you believe you’re allowed, entitled, and able to earn, how much money you believe you can and should spend, how you use debt, how much money you give away, and your ability to invest confidently and successfully. In this lesson you will lean to shift your money mindset with a money breakthrough that will allow you to instantly up-level your confidence, create a new, empowered money mindset, and feel on fire about the special brilliance you bring to the world.

6. Relationship with Money – We have relationships with almost everything in our environment, including concepts, and yes…even money. In order to be financially successful, it is necessary for you to adopt a new money mindset. This means not only removing blocks, forgiving, shifting your mindset but also creating a new healthy and empowering relationship with money.

7. Need vs Want – When creating a monthly budget, one of the most important steps is to categorize your spending by whether it is a “need” or a “want.” It is also one of the most difficult steps to take because what constitutes a need versus a want varies from person to person. It’s also easy to mistake wants for needs if you’re so used to having them that you can’t imagine life without them. However, as we demonstrate in this lesson, needs, and wants are not the same thing and why it’s critical to understand the distinction between them.

8. Financial Literacy – Many consumers today have a basic understanding of finance. Indeed, a lack of financial knowledge may be one of the reasons why many individuals struggle with saving and investing. Few people are prepared as financial decision-making becomes more complicated. That is why Financial Illiteracy is the #1 crisis in America! Understanding the value of money and how it works can significantly impact our future.

9. Money Management – Your overall wealth has less to do with how much money you make and more to do with learning how to manage your money. Whether you earn $100,000 or $1 million, developing your money management skills can help you achieve financial freedom, retire comfortably, and much more. The good news is that you don’t have to be a math genius or a millionaire to learn about money management. Money management is fundamentally about changing your mindset and developing good habits – habits we will do a deep dive in during this course.

10. Money Goals – It’s important to focus on what you want and create goals when it comes to money. Imagine what it will be like to live debt-free, achieve financial stability, and have the ability to spend your money on the things you value most. When you focus on what you want vs. your current situation it’s far easier to stay motivated and reach your financial goals. During this lesson, we will help you breakthrough your financial glass ceiling, determine your freedom number, set your new bold money goal and create your “Money Mantra”.

11. Action and Accountability – Every person in the world wants a comfortable life, smooth relationships, and enough money to live comfortably, have their own house, car, and enough money to enjoy their yearly or monthly vacations. But just having a dream, plan, or vision for your work isn’t enough. To have this kind of life, the most important thing that is required is action. In order to get your desired outcome, you must take action. This lesson is all about learning what actionable steps to take to create the life and financial future that you want.

12. Money Power – Money is a metaphor for your self-worth. If you are not making the money that you desire somewhere in your life you are giving your power away. We’ve all felt as if we were at the mercy of what happened to us. However, just because you believe you are powerless does not imply that you are. When you feel powerless, it’s usually because you’ve chosen (consciously or unconsciously) to give away your power to others. The great news is that you can do something about it. In this lesson we will go through a powerful process to help you re-claim your power in your life and with money.

Impact for Positive Change

At the conclusion of each workshop, we will focus our collective attention on how you, as a leader, will put what we’ve learned into practice in your business. Impact for positive change means putting what you’ve learned into practice and taking action to make a significant difference. That starts with a strong desire to change and reflection on what you’re going to do differently. It’s also crucial to consider how you’ll involve people in your organization in the discussion about what you’ve learnt and make requests for what you need from them in order to succeed. Not only will your formal team be involved, but so will your cross-functional colleagues. How will you be collaborating to ensure all the women in your company have everything they need to succeed?

Curriculum

Women Empowerment – Workshop 4 – Money Mindset

- Money Legacy

- Expansion vs Contraction

- Clear Clutter

- Forgive Past

- Money Breakthrough

- Relationship with Money

- Need vs. Want

- Financial Literacy

- Money Management

- Money Goals

- Action and Accountability

- Money Power

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Women Empowerment corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family know when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they don’t! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change, is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast

As a guide, the Appleton Greene Program Title corporate training program should take 12-18 months to complete, depending upon your availability and current commitments. The reason why there is such a variance in time estimates is because every student is an individual, with differing productivity levels and different commitments. These differentiations are then exaggerated by the fact that this is a distance-learning program, which incorporates the practical integration of academic theory as an as a part of the training program. Consequently all of the project studies are real, which means that important decisions and compromises need to be made. You will want to get things right and will need to be patient with your expectations in order to ensure that they are. We would always recommend that you are prudent with your own task and time forecasts, but you still need to develop them and have a clear indication of what are realistic expectations in your case. With reference to your time planning: consider the time that you can realistically dedicate towards study with the program every week; calculate how long it should take you to complete the program, using the guidelines featured here; then break the program down into logical modules and allocate a suitable proportion of time to each of them, these will be your milestones; you can create a time plan by using a spreadsheet on your computer, or a personal organizer such as MS Outlook, you could also use a financial forecasting software; break your time forecasts down into manageable chunks of time, the more specific you can be, the more productive and accurate your time management will be; finally, use formulas where possible to do your time calculations for you, because this will help later on when your forecasts need to change in line with actual performance. With reference to your task planning: refer to your list of tasks that need to be undertaken in order to achieve your program objectives; with reference to your time plan, calculate when each task should be implemented; remember that you are not estimating when your objectives will be achieved, but when you will need to focus upon implementing the corresponding tasks; you also need to ensure that each task is implemented in conjunction with the associated training modules which are relevant; then break each single task down into a list of specific to do’s, say approximately ten to do’s for each task and enter these into your study plan; once again you could use MS Outlook to incorporate both your time and task planning and this could constitute your study plan; you could also use a project management software like MS Project. You should now have a clear and realistic forecast detailing when you can expect to be able to do something about undertaking the tasks to achieve your program objectives.

Performance management

It is one thing to develop your study forecast, it is quite another to monitor your progress. Ultimately it is less important whether you achieve your original study forecast and more important that you update it so that it constantly remains realistic in line with your performance. As you begin to work through the program, you will begin to have more of an idea about your own personal performance and productivity levels as a distance-learner. Once you have completed your first study module, you should re-evaluate your study forecast for both time and tasks, so that they reflect your actual performance level achieved. In order to achieve this you must first time yourself while training by using an alarm clock. Set the alarm for hourly intervals and make a note of how far you have come within that time. You can then make a note of your actual performance on your study plan and then compare your performance against your forecast. Then consider the reasons that have contributed towards your performance level, whether they are positive or negative and make a considered adjustment to your future forecasts as a result. Given time, you should start achieving your forecasts regularly.

With reference to time management: time yourself while you are studying and make a note of the actual time taken in your study plan; consider your successes with time-efficiency and the reasons for the success in each case and take this into consideration when reviewing future time planning; consider your failures with time-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future time planning; re-evaluate your study forecast in relation to time planning for the remainder of your training program to ensure that you continue to be realistic about your time expectations. You need to be consistent with your time management, otherwise you will never complete your studies. This will either be because you are not contributing enough time to your studies, or you will become less efficient with the time that you do allocate to your studies. Remember, if you are not in control of your studies, they can just become yet another cause of stress for you.

With reference to your task management: time yourself while you are studying and make a note of the actual tasks that you have undertaken in your study plan; consider your successes with task-efficiency and the reasons for the success in each case; take this into consideration when reviewing future task planning; consider your failures with task-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future task planning; re-evaluate your study forecast in relation to task planning for the remainder of your training program to ensure that you continue to be realistic about your task expectations. You need to be consistent with your task management, otherwise you will never know whether you are achieving your program objectives or not.

Keeping in touch

You will have access to qualified and experienced professors and tutors who are responsible for providing tutorial support for your particular training program. So don’t be shy about letting them know how you are getting on. We keep electronic records of all tutorial support emails so that professors and tutors can review previous correspondence before considering an individual response. It also means that there is a record of all communications between you and your professors and tutors and this helps to avoid any unnecessary duplication, misunderstanding, or misinterpretation. If you have a problem relating to the program, share it with them via email. It is likely that they have come across the same problem before and are usually able to make helpful suggestions and steer you in the right direction. To learn more about when and how to use tutorial support, please refer to the Tutorial Support section of this student information guide. This will help you to ensure that you are making the most of tutorial support that is available to you and will ultimately contribute towards your success and enjoyment with your training program.

Work colleagues and family

You should certainly discuss your program study progress with your colleagues, friends and your family. Appleton Greene training programs are very practical. They require you to seek information from other people, to plan, develop and implement processes with other people and to achieve feedback from other people in relation to viability and productivity. You will therefore have plenty of opportunities to test your ideas and enlist the views of others. People tend to be sympathetic towards distance-learners, so don’t bottle it all up in yourself. Get out there and share it! It is also likely that your family and colleagues are going to benefit from your labors with the program, so they are likely to be much more interested in being involved than you might think. Be bold about delegating work to those who might benefit themselves. This is a great way to achieve understanding and commitment from people who you may later rely upon for process implementation. Share your experiences with your friends and family.

Making it relevant

The key to successful learning is to make it relevant to your own individual circumstances. At all times you should be trying to make bridges between the content of the program and your own situation. Whether you achieve this through quiet reflection or through interactive discussion with your colleagues, client partners or your family, remember that it is the most important and rewarding aspect of translating your studies into real self-improvement. You should be clear about how you want the program to benefit you. This involves setting clear study objectives in relation to the content of the course in terms of understanding, concepts, completing research or reviewing activities and relating the content of the modules to your own situation. Your objectives may understandably change as you work through the program, in which case you should enter the revised objectives on your study plan so that you have a permanent reminder of what you are trying to achieve, when and why.

Distance-learning check-list

Prepare your study environment, your study tools and rules.

Undertake detailed self-assessment in terms of your ability as a learner.

Create a format for your study plan.

Consider your study objectives and tasks.

Create a study forecast.

Assess your study performance.

Re-evaluate your study forecast.

Be consistent when managing your study plan.

Use your Appleton Greene Certified Learning Provider (CLP) for tutorial support.

Make sure you keep in touch with those around you.

Tutorial Support

Programs

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. They are implemented over a sustainable period of time and professional support is consistently provided by qualified learning providers and specialist consultants.

Support available

You will have a designated Certified Learning Provider (CLP) and an Accredited Consultant and we encourage you to communicate with them as much as possible. In all cases tutorial support is provided online because we can then keep a record of all communications to ensure that tutorial support remains consistent. You would also be forwarding your work to the tutorial support unit for evaluation and assessment. You will receive individual feedback on all of the work that you undertake on a one-to-one basis, together with specific recommendations for anything that may need to be changed in order to achieve a pass with merit or a pass with distinction and you then have as many opportunities as you may need to re-submit project studies until they meet with the required standard. Consequently the only reason that you should really fail (CLP) is if you do not do the work. It makes no difference to us whether a student takes 12 months or 18 months to complete the program, what matters is that in all cases the same quality standard will have been achieved.

Support Process

Please forward all of your future emails to the designated (CLP) Tutorial Support Unit email address that has been provided and please do not duplicate or copy your emails to other AGC email accounts as this will just cause unnecessary administration. Please note that emails are always answered as quickly as possible but you will need to allow a period of up to 20 business days for responses to general tutorial support emails during busy periods, because emails are answered strictly within the order in which they are received. You will also need to allow a period of up to 30 business days for the evaluation and assessment of project studies. This does not include weekends or public holidays. Please therefore kindly allow for this within your time planning. All communications are managed online via email because it enables tutorial service support managers to review other communications which have been received before responding and it ensures that there is a copy of all communications retained on file for future reference. All communications will be stored within your personal (CLP) study file here at Appleton Greene throughout your designated study period. If you need any assistance or clarification at any time, please do not hesitate to contact us by forwarding an email and remember that we are here to help. If you have any questions, please list and number your questions succinctly and you can then be sure of receiving specific answers to each and every query.

Time Management

It takes approximately 1 Year to complete the Women Empowerment corporate training program, incorporating 12 x 6-hour monthly workshops. Each student will also need to contribute approximately 4 hours per week over 1 Year of their personal time. Students can study from home or work at their own pace and are responsible for managing their own study plan. There are no formal examinations and students are evaluated and assessed based upon their project study submissions, together with the quality of their internal analysis and supporting documents. They can contribute more time towards study when they have the time to do so and can contribute less time when they are busy. All students tend to be in full time employment while studying and the Women Empowerment program is purposely designed to accommodate this, so there is plenty of flexibility in terms of time management. It makes no difference to us at Appleton Greene, whether individuals take 12-18 months to complete this program. What matters is that in all cases the same standard of quality will have been achieved with the standard and bespoke programs that have been developed.

Distance Learning Guide

The distance learning guide should be your first port of call when starting your training program. It will help you when you are planning how and when to study, how to create the right environment and how to establish the right frame of mind. If you can lay the foundations properly during the planning stage, then it will contribute to your enjoyment and productivity while training later. The guide helps to change your lifestyle in order to accommodate time for study and to cultivate good study habits. It helps you to chart your progress so that you can measure your performance and achieve your goals. It explains the tools that you will need for study and how to make them work. It also explains how to translate academic theory into practical reality. Spend some time now working through your distance learning guide and make sure that you have firm foundations in place so that you can make the most of your distance learning program. There is no requirement for you to attend training workshops or classes at Appleton Greene offices. The entire program is undertaken online, program course manuals and project studies are administered via the Appleton Greene web site and via email, so you are able to study at your own pace and in the comfort of your own home or office as long as you have a computer and access to the internet.

How To Study

The how to study guide provides students with a clear understanding of the Appleton Greene facilitation via distance learning training methods and enables students to obtain a clear overview of the training program content. It enables students to understand the step-by-step training methods used by Appleton Greene and how course manuals are integrated with project studies. It explains the research and development that is required and the need to provide evidence and references to support your statements. It also enables students to understand precisely what will be required of them in order to achieve a pass with merit and a pass with distinction for individual project studies and provides useful guidance on how to be innovative and creative when developing your Unique Program Proposition (UPP).

Tutorial Support

Tutorial support for the Appleton Greene Women Empowerment corporate training program is provided online either through the Appleton Greene Client Support Portal (CSP), or via email. All tutorial support requests are facilitated by a designated Program Administration Manager (PAM). They are responsible for deciding which professor or tutor is the most appropriate option relating to the support required and then the tutorial support request is forwarded onto them. Once the professor or tutor has completed the tutorial support request and answered any questions that have been asked, this communication is then returned to the student via email by the designated Program Administration Manager (PAM). This enables all tutorial support, between students, professors and tutors, to be facilitated by the designated Program Administration Manager (PAM) efficiently and securely through the email account. You will therefore need to allow a period of up to 20 business days for responses to general support queries and up to 30 business days for the evaluation and assessment of project studies, because all tutorial support requests are answered strictly within the order in which they are received. This does not include weekends or public holidays. Consequently you need to put some thought into the management of your tutorial support procedure in order to ensure that your study plan is feasible and to obtain the maximum possible benefit from tutorial support during your period of study. Please retain copies of your tutorial support emails for future reference. Please ensure that ALL of your tutorial support emails are set out using the format as suggested within your guide to tutorial support. Your tutorial support emails need to be referenced clearly to the specific part of the course manual or project study which you are working on at any given time. You also need to list and number any questions that you would like to ask, up to a maximum of five questions within each tutorial support email. Remember the more specific you can be with your questions the more specific your answers will be too and this will help you to avoid any unnecessary misunderstanding, misinterpretation, or duplication. The guide to tutorial support is intended to help you to understand how and when to use support in order to ensure that you get the most out of your training program. Appleton Greene training programs are designed to enable you to do things for yourself. They provide you with a structure or a framework and we use tutorial support to facilitate students while they practically implement what they learn. In other words, we are enabling students to do things for themselves. The benefits of distance learning via facilitation are considerable and are much more sustainable in the long-term than traditional short-term knowledge sharing programs. Consequently you should learn how and when to use tutorial support so that you can maximize the benefits from your learning experience with Appleton Greene. This guide describes the purpose of each training function and how to use them and how to use tutorial support in relation to each aspect of the training program. It also provides useful tips and guidance with regard to best practice.

Tutorial Support Tips

Students are often unsure about how and when to use tutorial support with Appleton Greene. This Tip List will help you to understand more about how to achieve the most from using tutorial support. Refer to it regularly to ensure that you are continuing to use the service properly. Tutorial support is critical to the success of your training experience, but it is important to understand when and how to use it in order to maximize the benefit that you receive. It is no coincidence that those students who succeed are those that learn how to be positive, proactive and productive when using tutorial support.

Be positive and friendly with your tutorial support emails

Remember that if you forward an email to the tutorial support unit, you are dealing with real people. “Do unto others as you would expect others to do unto you”. If you are positive, complimentary and generally friendly in your emails, you will generate a similar response in return. This will be more enjoyable, productive and rewarding for you in the long-term.

Think about the impression that you want to create

Every time that you communicate, you create an impression, which can be either positive or negative, so put some thought into the impression that you want to create. Remember that copies of all tutorial support emails are stored electronically and tutors will always refer to prior correspondence before responding to any current emails. Over a period of time, a general opinion will be arrived at in relation to your character, attitude and ability. Try to manage your own frustrations, mood swings and temperament professionally, without involving the tutorial support team. Demonstrating frustration or a lack of patience is a weakness and will be interpreted as such. The good thing about communicating in writing, is that you will have the time to consider your content carefully, you can review it and proof-read it before sending your email to Appleton Greene and this should help you to communicate more professionally, consistently and to avoid any unnecessary knee-jerk reactions to individual situations as and when they may arise. Please also remember that the CLP Tutorial Support Unit will not just be responsible for evaluating and assessing the quality of your work, they will also be responsible for providing recommendations to other learning providers and to client contacts within the Appleton Greene global client network, so do be in control of your own emotions and try to create a good impression.

Remember that quality is preferred to quantity

Please remember that when you send an email to the tutorial support team, you are not using Twitter or Text Messaging. Try not to forward an email every time that you have a thought. This will not prove to be productive either for you or for the tutorial support team. Take time to prepare your communications properly, as if you were writing a professional letter to a business colleague and make a list of queries that you are likely to have and then incorporate them within one email, say once every month, so that the tutorial support team can understand more about context, application and your methodology for study. Get yourself into a consistent routine with your tutorial support requests and use the tutorial support template provided with ALL of your emails. The (CLP) Tutorial Support Unit will not spoon-feed you with information. They need to be able to evaluate and assess your tutorial support requests carefully and professionally.

Be specific about your questions in order to receive specific answers

Try not to write essays by thinking as you are writing tutorial support emails. The tutorial support unit can be unclear about what in fact you are asking, or what you are looking to achieve. Be specific about asking questions that you want answers to. Number your questions. You will then receive specific answers to each and every question. This is the main purpose of tutorial support via email.

Keep a record of your tutorial support emails

It is important that you keep a record of all tutorial support emails that are forwarded to you. You can then refer to them when necessary and it avoids any unnecessary duplication, misunderstanding, or misinterpretation.

Individual training workshops or telephone support

Please be advised that Appleton Greene does not provide separate or individual tutorial support meetings, workshops, or provide telephone support for individual students. Appleton Greene is an equal opportunities learning and service provider and we are therefore understandably bound to treat all students equally. We cannot therefore broker special financial or study arrangements with individual students regardless of the circumstances. All tutorial support is provided online and this enables Appleton Greene to keep a record of all communications between students, professors and tutors on file for future reference, in accordance with our quality management procedure and your terms and conditions of enrolment. All tutorial support is provided online via email because it enables us to have time to consider support content carefully, it ensures that you receive a considered and detailed response to your queries. You can number questions that you would like to ask, which relate to things that you do not understand or where clarification may be required. You can then be sure of receiving specific answers to each individual query. You will also then have a record of these communications and of all tutorial support, which has been provided to you. This makes tutorial support administration more productive by avoiding any unnecessary duplication, misunderstanding, or misinterpretation.

Tutorial Support Email Format

You should use this tutorial support format if you need to request clarification or assistance while studying with your training program. Please note that ALL of your tutorial support request emails should use the same format. You should therefore set up a standard email template, which you can then use as and when you need to. Emails that are forwarded to Appleton Greene, which do not use the following format, may be rejected and returned to you by the (CLP) Program Administration Manager. A detailed response will then be forwarded to you via email usually within 20 business days of receipt for general support queries and 30 business days for the evaluation and assessment of project studies. This does not include weekends or public holidays. Your tutorial support request, together with the corresponding TSU reply, will then be saved and stored within your electronic TSU file at Appleton Greene for future reference.

Subject line of your email

Please insert: Appleton Greene (CLP) Tutorial Support Request: (Your Full Name) (Date), within the subject line of your email.

Main body of your email

Please insert:

1. Appleton Greene Certified Learning Provider (CLP) Tutorial Support Request

2. Your Full Name

3. Date of TS request

4. Preferred email address

5. Backup email address

6. Course manual page name or number (reference)

7. Project study page name or number (reference)

Subject of enquiry

Please insert a maximum of 50 words (please be succinct)

Briefly outline the subject matter of your inquiry, or what your questions relate to.

Question 1

Maximum of 50 words (please be succinct)

Maximum of 50 words (please be succinct)

Question 3

Maximum of 50 words (please be succinct)

Question 4

Maximum of 50 words (please be succinct)

Question 5

Maximum of 50 words (please be succinct)

Please note that a maximum of 5 questions is permitted with each individual tutorial support request email.

Procedure

* List the questions that you want to ask first, then re-arrange them in order of priority. Make sure that you reference them, where necessary, to the course manuals or project studies.

* Make sure that you are specific about your questions and number them. Try to plan the content within your emails to make sure that it is relevant.

* Make sure that your tutorial support emails are set out correctly, using the Tutorial Support Email Format provided here.

* Save a copy of your email and incorporate the date sent after the subject title. Keep your tutorial support emails within the same file and in date order for easy reference.

* Allow up to 20 business days for a response to general tutorial support emails and up to 30 business days for the evaluation and assessment of project studies, because detailed individual responses will be made in all cases and tutorial support emails are answered strictly within the order in which they are received.

* Emails can and do get lost. So if you have not received a reply within the appropriate time, forward another copy or a reminder to the tutorial support unit to be sure that it has been received but do not forward reminders unless the appropriate time has elapsed.

* When you receive a reply, save it immediately featuring the date of receipt after the subject heading for easy reference. In most cases the tutorial support unit replies to your questions individually, so you will have a record of the questions that you asked as well as the answers offered. With project studies however, separate emails are usually forwarded by the tutorial support unit, so do keep a record of your own original emails as well.

* Remember to be positive and friendly in your emails. You are dealing with real people who will respond to the same things that you respond to.

* Try not to repeat questions that have already been asked in previous emails. If this happens the tutorial support unit will probably just refer you to the appropriate answers that have already been provided within previous emails.

* If you lose your tutorial support email records you can write to Appleton Greene to receive a copy of your tutorial support file, but a separate administration charge may be levied for this service.

How To Study

Your Certified Learning Provider (CLP) and Accredited Consultant can help you to plan a task list for getting started so that you can be clear about your direction and your priorities in relation to your training program. It is also a good way to introduce yourself to the tutorial support team.

Planning your study environment

Your study conditions are of great importance and will have a direct effect on how much you enjoy your training program. Consider how much space you will have, whether it is comfortable and private and whether you are likely to be disturbed. The study tools and facilities at your disposal are also important to the success of your distance-learning experience. Your tutorial support unit can help with useful tips and guidance, regardless of your starting position. It is important to get this right before you start working on your training program.

Planning your program objectives

It is important that you have a clear list of study objectives, in order of priority, before you start working on your training program. Your tutorial support unit can offer assistance here to ensure that your study objectives have been afforded due consideration and priority.

Planning how and when to study

Distance-learners are freed from the necessity of attending regular classes, since they can study in their own way, at their own pace and for their own purposes. This approach is designed to let you study efficiently away from the traditional classroom environment. It is important however, that you plan how and when to study, so that you are making the most of your natural attributes, strengths and opportunities. Your tutorial support unit can offer assistance and useful tips to ensure that you are playing to your strengths.

Planning your study tasks

You should have a clear understanding of the study tasks that you should be undertaking and the priority associated with each task. These tasks should also be integrated with your program objectives. The distance learning guide and the guide to tutorial support for students should help you here, but if you need any clarification or assistance, please contact your tutorial support unit.

Planning your time

You will need to allocate specific times during your calendar when you intend to study if you are to have a realistic chance of completing your program on time. You are responsible for planning and managing your own study time, so it is important that you are successful with this. Your tutorial support unit can help you with this if your time plan is not working.

Keeping in touch

Consistency is the key here. If you communicate too frequently in short bursts, or too infrequently with no pattern, then your management ability with your studies will be questioned, both by you and by your tutorial support unit. It is obvious when a student is in control and when one is not and this will depend how able you are at sticking with your study plan. Inconsistency invariably leads to in-completion.

Charting your progress

Your tutorial support team can help you to chart your own study progress. Refer to your distance learning guide for further details.

Making it work

To succeed, all that you will need to do is apply yourself to undertaking your training program and interpreting it correctly. Success or failure lies in your hands and your hands alone, so be sure that you have a strategy for making it work. Your Certified Learning Provider (CLP) and Accredited Consultant can guide you through the process of program planning, development and implementation.

Reading methods

Interpretation is often unique to the individual but it can be improved and even quantified by implementing consistent interpretation methods. Interpretation can be affected by outside interference such as family members, TV, or the Internet, or simply by other thoughts which are demanding priority in our minds. One thing that can improve our productivity is using recognized reading methods. This helps us to focus and to be more structured when reading information for reasons of importance, rather than relaxation.

Speed reading

When reading through course manuals for the first time, subconsciously set your reading speed to be just fast enough that you cannot dwell on individual words or tables. With practice, you should be able to read an A4 sheet of paper in one minute. You will not achieve much in the way of a detailed understanding, but your brain will retain a useful overview. This overview will be important later on and will enable you to keep individual issues in perspective with a more generic picture because speed reading appeals to the memory part of the brain. Do not worry about what you do or do not remember at this stage.

Content reading

Once you have speed read everything, you can then start work in earnest. You now need to read a particular section of your course manual thoroughly, by making detailed notes while you read. This process is called Content Reading and it will help to consolidate your understanding and interpretation of the information that has been provided.

Making structured notes on the course manuals

When you are content reading, you should be making detailed notes, which are both structured and informative. Make these notes in a MS Word document on your computer, because you can then amend and update these as and when you deem it to be necessary. List your notes under three headings: 1. Interpretation – 2. Questions – 3. Tasks. The purpose of the 1st section is to clarify your interpretation by writing it down. The purpose of the 2nd section is to list any questions that the issue raises for you. The purpose of the 3rd section is to list any tasks that you should undertake as a result. Anyone who has graduated with a business-related degree should already be familiar with this process.

Organizing structured notes separately

You should then transfer your notes to a separate study notebook, preferably one that enables easy referencing, such as a MS Word Document, a MS Excel Spreadsheet, a MS Access Database, or a personal organizer on your cell phone. Transferring your notes allows you to have the opportunity of cross-checking and verifying them, which assists considerably with understanding and interpretation. You will also find that the better you are at doing this, the more chance you will have of ensuring that you achieve your study objectives.

Question your understanding

Do challenge your understanding. Explain things to yourself in your own words by writing things down.

Clarifying your understanding

If you are at all unsure, forward an email to your tutorial support unit and they will help to clarify your understanding.

Question your interpretation

Do challenge your interpretation. Qualify your interpretation by writing it down.

Clarifying your interpretation

If you are at all unsure, forward an email to your tutorial support unit and they will help to clarify your interpretation.

Qualification Requirements

The student will need to successfully complete the project study and all of the exercises relating to the Women Empowerment corporate training program, achieving a pass with merit or distinction in each case, in order to qualify as an Accredited Women Empowerment Specialist (AWES). All monthly workshops need to be tried and tested within your company. These project studies can be completed in your own time and at your own pace and in the comfort of your own home or office. There are no formal examinations, assessment is based upon the successful completion of the project studies. They are called project studies because, unlike case studies, these projects are not theoretical, they incorporate real program processes that need to be properly researched and developed. The project studies assist us in measuring your understanding and interpretation of the training program and enable us to assess qualification merits. All of the project studies are based entirely upon the content within the training program and they enable you to integrate what you have learnt into your corporate training practice.

Women Empowerment – Grading Contribution

Project Study – Grading Contribution

Customer Service – 10%

E-business – 05%

Finance – 10%

Globalization – 10%

Human Resources – 10%

Information Technology – 10%

Legal – 05%

Management – 10%

Marketing – 10%

Production – 10%

Education – 05%

Logistics – 05%

TOTAL GRADING – 100%

Qualification grades

A mark of 90% = Pass with Distinction.

A mark of 75% = Pass with Merit.

A mark of less than 75% = Fail.

If you fail to achieve a mark of 75% with a project study, you will receive detailed feedback from the Certified Learning Provider (CLP) and/or Accredited Consultant, together with a list of tasks which you will need to complete, in order to ensure that your project study meets with the minimum quality standard that is required by Appleton Greene. You can then re-submit your project study for further evaluation and assessment. Indeed you can re-submit as many drafts of your project studies as you need to, until such a time as they eventually meet with the required standard by Appleton Greene, so you need not worry about this, it is all part of the learning process.

When marking project studies, Appleton Greene is looking for sufficient evidence of the following:

Pass with merit

A satisfactory level of program understanding

A satisfactory level of program interpretation

A satisfactory level of project study content presentation

A satisfactory level of Unique Program Proposition (UPP) quality

A satisfactory level of the practical integration of academic theory

Pass with distinction

An exceptional level of program understanding

An exceptional level of program interpretation

An exceptional level of project study content presentation

An exceptional level of Unique Program Proposition (UPP) quality

An exceptional level of the practical integration of academic theory

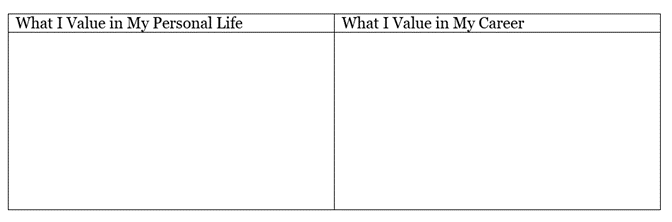

Preliminary Analysis

Empowering female employees at your company is critical for fostering a positive work environment as well as organizational development and growth. It is critical to assist these women in clarifying their core values and defining their priorities in order to develop an empowered mindset. This will necessitate significant changes in the company’s culture, systems, and processes. As a result of this empowerment process, transformation is encouraged. A supportive infrastructure, which also serves as an efficient and strategic business foundation, enables positive change.

Opportunity for Change

As women continue to advance their careers and take on more leadership roles, they must have an empowered mindset, which includes having a healthy and abundant money mindset.

The Women Empowerment Leadership Program is a method of accelerating women’s professional development at work. Women have made significant strides in the workplace, but there is no doubt that they continue to face challenges in climbing the corporate ladder. This program provides the necessary support and tools to ensure that these women have everything they need to succeed. This will in turn benefit the overall growth and profitability of the company.

Workshop 4- Money Mindset continues to focus on developing a success mindset which the first step (and the most significant) step in the Women Empowerment Transformation Process.

Preparing for the Workshop

Participants are encouraged to continue to show up with an open mind and be ready for a transformation from the inside out. Once again, there will be a lot of mindset work that involves being open to change.

Be sure to assess your organizations current stance on mindset development this will be helpful before you start making significant changes to its structure.

Take a look at your current processes and infrastructure.

Participants should also ensure that they are familiar with the major people-related processes of the company. All participants should be familiar with the processes of performance management, recruitment, talent assessment, and talent development. The workshop’s goal is not to change these processes, but rather to supplement them with the 5 Step Women’s Empowerment Business Transformation Process (Mindset Shift, Leadership Development, Personal Presence, Advanced Communications Skills and Creating and Implementing an Action Plan) to improve their effectiveness. Participants compile a list of their most recent successes and failures in each of these processes. The list will be useful later on when discussing how to integrate the process into the existing model.

It may be advantageous to the participants if these processes are also examined from the perspective of the employees. One or two of the participants should meet with a few key employees to discuss the success of the processes. The effectiveness of these processes, rather than the method itself, should be the focal point of these discussions. When discussing the efficacy of the process, it is critical to consider the outcomes from the perspective of the people it is supposed to help. Ineffective processes, regardless of their efficiency, fail to meet the expectations of the customer. The Women’s Empowerment Business Transformation Process will be able to fill in the gaps discovered by identifying flaws in these procedures.

The fourth workshop in our Women Empowerment Program – Money Mindset continues to work on developing a positive shift in our mindset.

How this will be achieved, is by implementation of the following strategies:

1. Learn and implement the steps to create a new Family Money Legacy.

2. Method to move out of contraction and into expansion when it comes to money.

3. Discover strategies to eliminate clutter in your life and access the 10 steps to de-clutter your finances.

4. Learn a “letting go” tool and create a forgiveness letter.

5. Adopt a new mindset with the 8-step process to improve your money mindset and method to create your own money breakthrough.

6. Learn 5 powerful ways to creating an empowered relationship with money and process to create a sacred relationship with money.

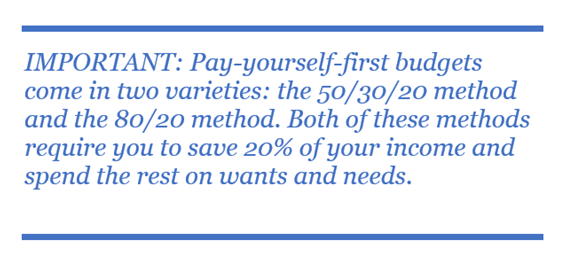

7. Learn the 5 levels of Maslow’s Hierarchy of Needs and develop a strategy to discern wants from needs.