Growth Strategy – Workshop 2 (Market Opportunity)

The Appleton Greene Corporate Training Program (CTP) for Growth Strategy is provided by Mr. Ardila Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 27 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr Ardila is the co-founder of The Hawksbill Group, a business consulting and investment firm advising medium and large clients in the public and private sectors. Mr. Ardila is also a member of the Board of Directors of Accenture, Goldman Sachs BDCs, Nexa Resources and Ola Electric Mobility. Prior to his current activities, he was Executive Vice President of General Motors and CEO of Latin America from 2010-2016 (March). In his 30-year career with GM, he held several important positions, including country CEO in Ecuador, Colombia, Argentina and Brazil, as well as CFO of Latin America, Africa and the Middle East. He also worked as an investment banker for the Rothschild Group from 1996-1998 and Secretary General at the Ministry of Industry and Trade in Colombia (1983-84).

Mr. Ardila is a graduate of the London School of Economics where he obtained a MSc. Degree in Economics. He has lived in 10 countries and speaks English, Spanish, Portuguese and German.

MOST Analysis

Mission Statement

Simply described, a market opportunity is a gap in the market. Something, someone, or some place that isn’t being serviced by other businesses that you may take advantage of and exploit to expand your company swiftly. However, it is simpler said than done. Everyone is striving for the same spot and searching for that extra, unheard-of thing to put them ahead of the competition. How therefore can you identify a promising market opportunity before your rivals do? And once you have one, how do you go about creating an effective business growth strategy? Four crucial factors come into play when determining a promising market potential for your company: What do consumers want or need? What, more crucially, is your competition NOT doing? How does your product address a specific issue? or strengthen an existing remedy? What is the market like right now? Following the completion of these inquiries, you ought to be in a better position to comprehend your target market, spot product flaws, and ultimately find untapped markets. At the end of the exercise, you also need to understand the profit potential of the opportunity, which normally is arrived at by estimating the gross margin over a period of time.

Objectives

01. Identify Strengths and Weaknesses: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Purchase Situation Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Direct Competition Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Indirect Competition Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Analysis of Complementary Products and Services: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Analysis of other Industries: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Foreign Markets Analysis: departmental SWOT analysis; strategy research & development. 1 Month

08. Environmental Analysis: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

09. Listen to your Customers: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

10. Consumer Segmentation: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Spot Acute Unsolved Problems: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Profit Potential: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Identify Strengths and Weaknesses: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Purchase Situation Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Direct Competition Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Indirect Competition Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Analysis of Complementary Products and Services: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Analysis of other Industries: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Foreign Markets Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Environmental Analysis: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Listen to your Customers: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Consumer Segmentation: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Spot Acute Unsolved Problems: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Profit Potential: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze Identify Strengths and Weaknesses.

02. Create a task on your calendar, to be completed within the next month, to analyze Purchase Situation Analysis.

03. Create a task on your calendar, to be completed within the next month, to analyze Direct Competition Analysis.

04. Create a task on your calendar, to be completed within the next month, to analyze Indirect Competition Analysis.

05. Create a task on your calendar, to be completed within the next month, to analyze Analysis of Complementary Products and Services.

06. Create a task on your calendar, to be completed within the next month, to analyze Analysis of other Industries.

07. Create a task on your calendar, to be completed within the next month, to analyze Foreign Markets Analysis.

08. Create a task on your calendar, to be completed within the next month, to analyze Environmental Analysis.

09. Create a task on your calendar, to be completed within the next month, to analyze Listen to your Customers.

10. Create a task on your calendar, to be completed within the next month, to analyze Consumer Segmentation.

11. Create a task on your calendar, to be completed within the next month, to analyze Spot Acute Unsolved Problems.

12. Create a task on your calendar, to be completed within the next month, to analyze Profit Potential.

Introduction

Every company needs to know who they are, where they fit into the market, and where they’re going. Only 33% of businesses make it past their tenth year after starting out, while only 66% survive their first two years.

What does it thus take to locate the ideal market opportunities and create a development plan that gets you where you want to go?

What is a market opportunity?

Simply described, a market opportunity is a gap in the market. Something, someone, or some place that isn’t being serviced by other businesses that you may take advantage of and exploit to expand your company swiftly.

However, it is simpler said than done. Everyone is striving for the same spot and searching for that extra, unheard-of thing to put them ahead of the competition.

How therefore can you identify a promising market opportunity before your rivals do? And once you have one, how do you go about creating an effective business growth strategy?

How to identify a good market opportunity

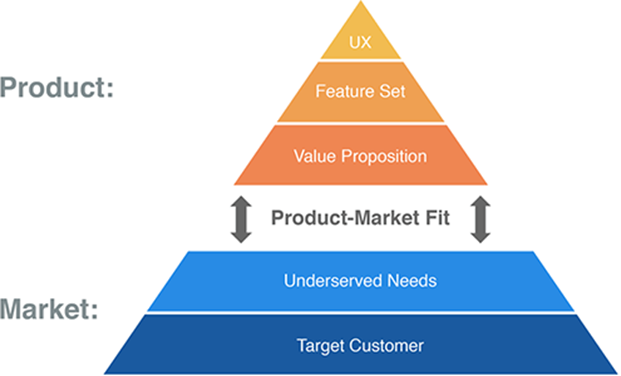

Identifying a good market opportunity for your business boils down to four key areas:

1. What do consumers want/need?

2. What is your competition doing, or more importantly, NOT doing?

3. How can your product solve a particular problem? Or compliment a pre-existing solution?

4. What is the current state of the market?

Following the completion of these inquiries, you ought to be in a better position to comprehend your target market, spot product flaws, and ultimately find untapped markets.

Let’s look at some of the methods you might use to respond to the following four questions.

How to use consumer data analysis to identify market opportunities

The first thing you need to do is figure out who exactly you are selling to. Knowing your audience is essential to assisting you in discovering a new market opportunity, whether you are doing customer surveys, analyzing data from your own website, or using third-party research.

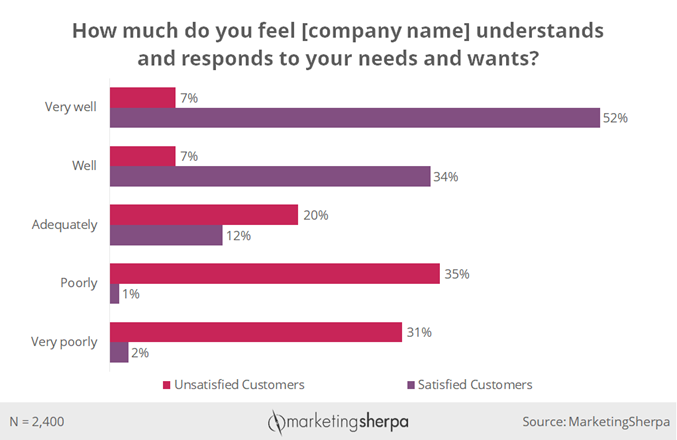

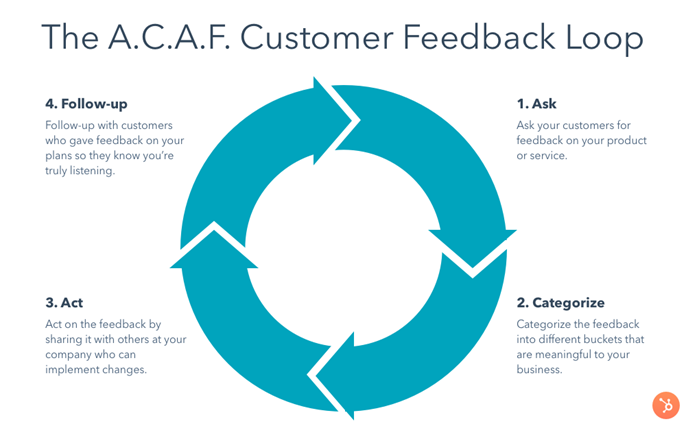

Customer reviews and surveys analysis

Asking your consumers directly is one of the finest methods to find out who they are and what they want from your company. Customer feedback and surveys may provide you with valuable information about every facet of your company, from what clients think of your goods and services to how well your website and customer care department run.

Even though analyzing all of this feedback can be time-consuming, there are tools available to help. Sentiment analysis software can automatically determine the feelings underlying each comment and find recurring patterns in your comments. For instance, you can learn that multiple consumers have brought up a product’s flaw or that they feel your service falls short when it comes to after-sale support.

You may use the information you learn from your reviews and surveys to enhance your offerings, customer service, and brand perception. You must choose what you want to take away from your feedback and how you will apply it moving ahead.

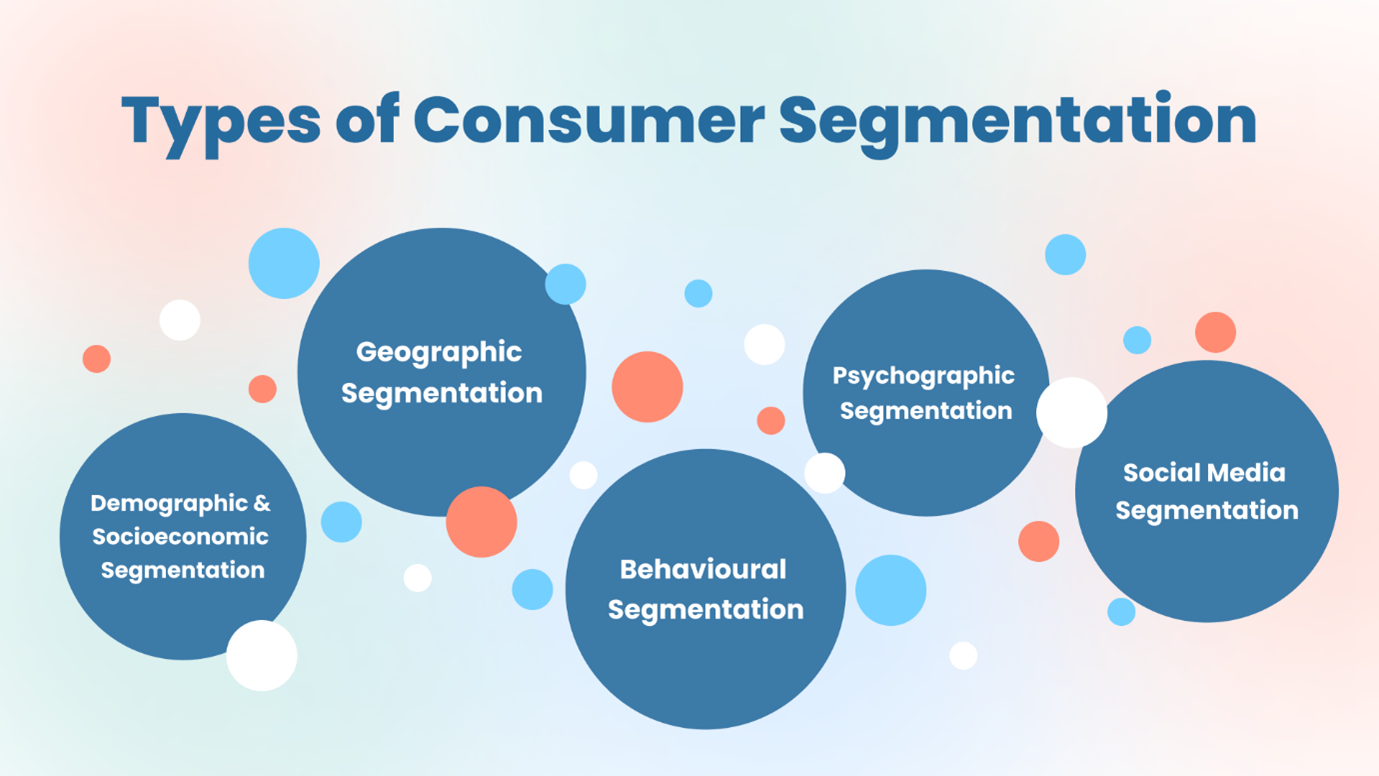

Identifying consumer segments

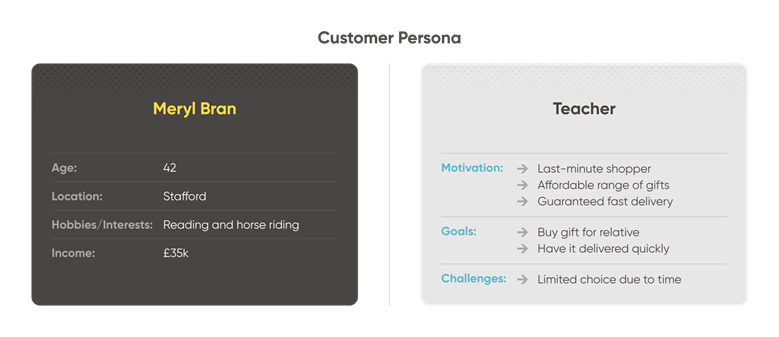

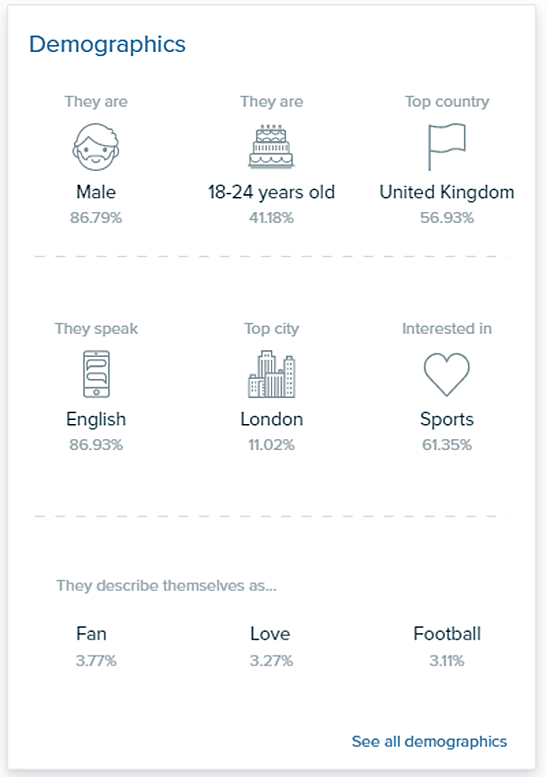

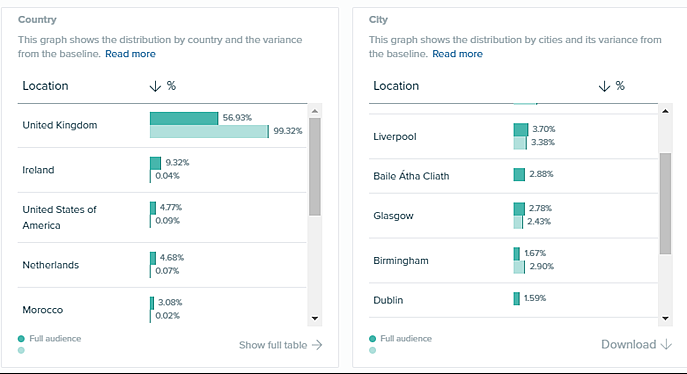

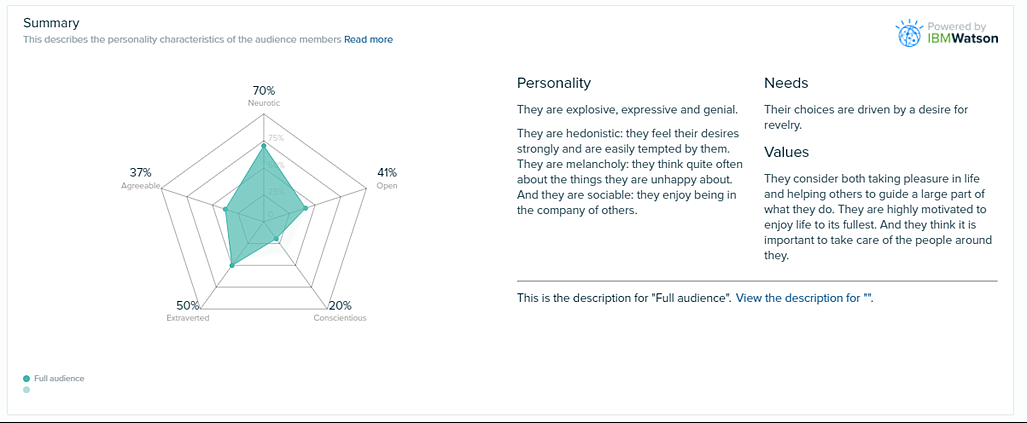

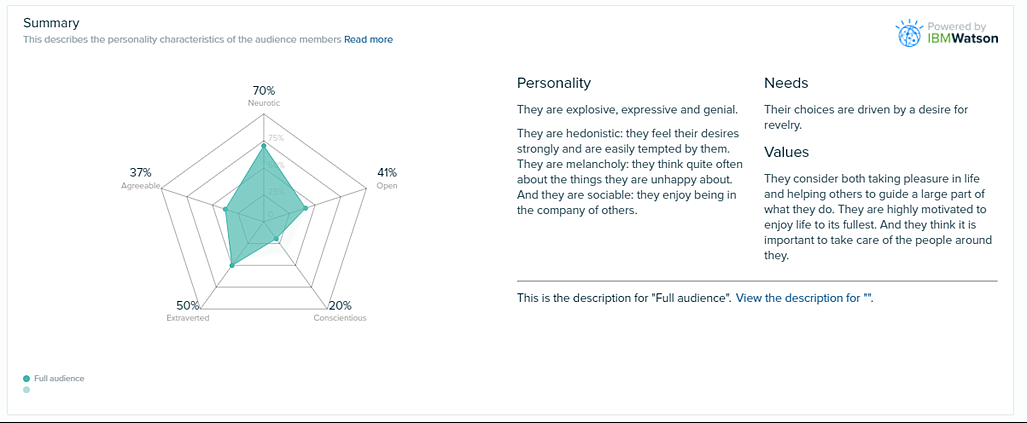

Examine your current audience and divide it into groups according to characteristics you find common. These can be hard demographic variables that can be used to estimate market size, such as age, gender, geography, income, occupation, etc. You may find out why individuals would purchase your items by analyzing “softer” factors like attitudes, lifestyle, and personal values. These factors can affect everything from price to design.

Creating customer personas

After segmenting your audience, you should become a little more specific and create some distinct client profiles. Customer personas are a more thorough breakdown of the many customer types most likely to patronize your company. For instance, a toy store might include personas for parents, children, grandparents, and so on.

If it helps, you can give each of these personalities a name, age, and personality. The more real-looking they are, the simpler it will be to start relating to them on an emotional level. Personas make it simple for everyone in your company to understand the motives, potential pain areas, and ways in which your company may assist your target customer.

Based on actual clients, create each of your personalities. You may go deeper into who has purchased from you in the past and why by using surveys, feedback, and site analytics. In the long run, your business growth strategy will benefit from personas more if they are accurate.

Market opportunity examples across the world: Starbucks

When it comes to illustrating the failures of worldwide expansion, Starbucks has been virtually every expert’s go-to case study. Its failed attempt to dominate the Australian scene resulted in the closure of almost 70% of its outlets.

But another American coffee shop, Gloria Jean’s, did well in Australia.

It was a case of Starbucks not knowing how to make their brand relevant, not knowing how Australians loved their ambiance, and not being able to offer a menu that was palatable to the general populace.

Purchasing pattern analysis

Until you know how frequently and how much a consumer is likely to spend with you, you cannot assess the potential value of a new market opportunity. Your target audience’s frequency, amount, and value of purchases are revealed by their buying behaviors.

Key inquiries to make are:

• When do customers purchase our goods or services?

• When they need it, is it there?

• Where do people make the purchase?

• How are payments made?

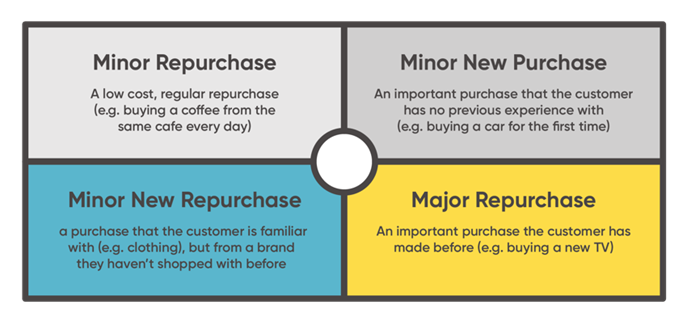

Types of buying pattern

Every consumer purchase falls into one of the following categories:

How to carry out purchasing pattern analysis

Consumers often go through five stages when making any purchase, regardless of the pattern they fall into. It’s crucial to comprehend each of them to determine where and how your company fits in.

1. Problem recognition

When a consumer realizes they either need or want to buy something, this is when it happens. They might require new headphones because their old ones broke, or they might decide to update their existing set of headphones since a new model just came out.

2. Collect information

At this point, buyers start to learn more about the products they might buy from a variety of sources, such as asking for suggestions, reading reviews, speaking with salespeople, clicking on advertisements, and more.

3. Evaluate alternatives

Consumers will have a number of options to pick from in terms of the kind of product or service and the brand or company after doing their research. Consider purchasing headphones as an example. The buyer will need to determine the brand they want to purchase as well as the sort of headphones they want (in-ear, wireless, or over-ear) (Sony, Bose, Beats, etc.).

They will evaluate the benefits, costs, and features of each good or service during this stage of the process in order to make a choice.

4. Final buying decision

Time to make or break! The consumer will now make a final decision regarding the good or service they’re going to acquire, albeit they also have the option of choosing not to do so! If they do decide to move further, they will additionally think about the location, timing, and mode of their intended purchase.

5. Post-purchase evaluation

The last stage is the most crucial if you want to keep your consumers. After making a transaction from you, did your consumer express satisfaction with it? Do they know who to call if they require assistance?

Asking for feedback at this point is a wonderful approach to assess how easy the consumers’ entire purchasing process was for them as well as to uncover any problems with the product or service so you can address them quickly and keep the client satisfied.

2. How to use product analysis to identify market opportunities

Product analysis can take many different shapes, but to put it simply, it is enquiring about and gathering feedback on your product. You can get information from a variety of sources for this, such as focus groups, current customers, and industry or product specialists. Almost any step of the design process is a good time to conduct a product analysis.

Evaluating your existing products using consumer feedback

Finding and analyzing customer reviews of items is a terrific approach to receive insightful feedback on both new and existing products. Sentiment analysis tools can highlight the positive and negative aspects of your product so you can quickly see what is working well and what needs to be improved.

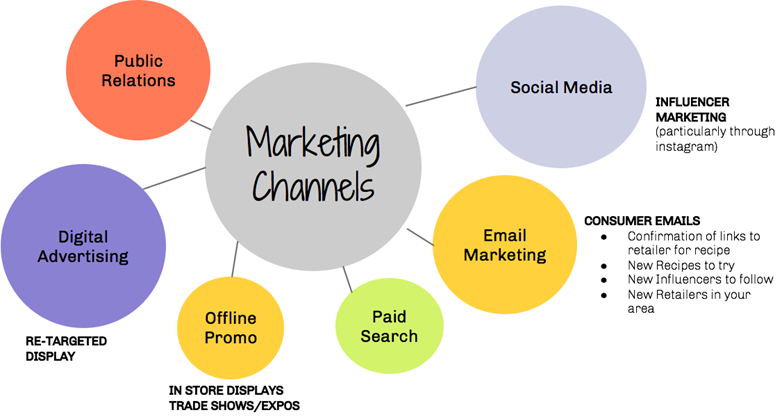

When you know which products are popular with your customers and are receiving positive reviews, you can choose to concentrate on expanding the lines of these products, or you can switch up your marketing strategy by emphasizing the aspects of your products that your target market finds most appealing.

Evaluating complimentary or new product launches

You should be watching not just your own items but also those of others. Your growth strategy will be greatly influenced by how well items that complement your own perform. You must stay current with current trends in order to comprehend how these complementary items might impact you.

For example, if you make printers, you should monitor paper sales because more and more companies are putting a premium on sustainability. If you see a dip, you’ll need to either come up with a different plan of action or modify your growth approach.

But it’s vital to keep in mind that it’s not just passively monitoring how other people fare. Building connections and collaborating with like-minded companies might actually help your clients and open up new market prospects.

Market opportunity examples across the world: Ikea

The culture of the area is another element that has a significant impact on how people perceive products.

Ikea is renowned for its ready-to-assemble furniture and DIY philosophy. But in India, people are accustomed to having their furniture constructed. Indians of the middle and upper classes rarely own power tools, much less utilize them, or read manuals with complex graphics.

Ikea has however made progress in figuring out what the target market wants, changing everything from the type of wood used in the furniture to the Indianized Swedish meatballs offered on the menu.

It’s too soon to predict if Ikea will succeed in the subcontinent, but it surely helps to conduct accurate fieldwork the first time.

A business would be well to consider expanding to another area, especially if the market it serves is starting to become saturated. Untapped markets can present a variety of new prospects, potential clients, and business lessons.

3. How to use competitor analysis to identify market opportunity

The following phase in creating a successful growth strategy is comprehending your competition. There are several approaches, but the main thing you want to attempt and unearth are the primary advantages and disadvantages of each of your competitors. Then, use what you’ve discovered to influence the course of your firm.

Many new firms overlook competitor analysis, yet doing so will help you create good offensive and defensive plans, as well as forewarn you of any prospective possibilities or threats as early as feasible.

Competitor benchmarking

In order to compare your performance to that of your primary competitors, competitor benchmarking makes use of a variety of metrics. With anything you’re comparing, whether it’s market share, sales, or even your Net Promoter Score, you may be as general or particular as you wish. This is your chance to assess your performance in detail and determine the potential location of your next market opportunity.

How to choose competitors to benchmark against

Keep your attention on the task at hand and resist the urge to simply put everyone’s name in the hat. If you want to understand how you can improve right away, the main players in your field if you have higher growth aspirations, or even those who are playing catch up if you want to prevent being caught off guard in the future, you can opt to look at your direct competitors.

How do you choose what to benchmark

Where do you begin when there is so much to look at? Consider your company’s goals and the KPIs that will be most helpful in achieving your growth objectives. If you’re still hesitant, you can start in a few of the following places:

• Financial results (revenue, profit, year-on-year growth, etc.)

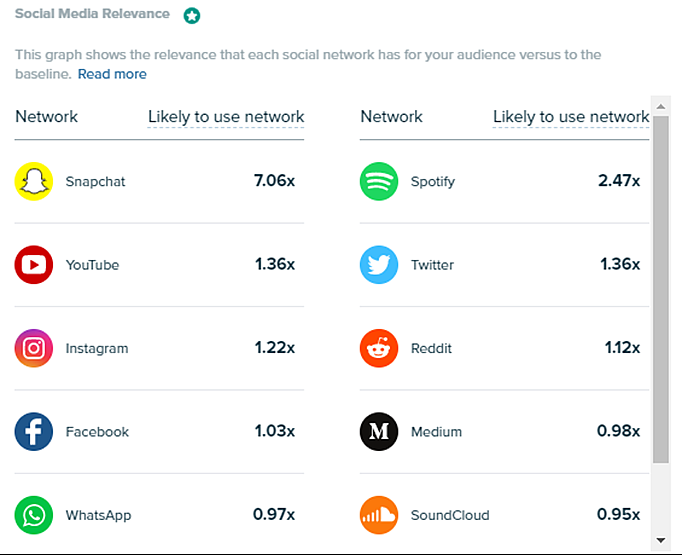

• Marketing stats (brand recognition, social following, engagement rates, etc.)

• Sales numbers

• Customer service statistics (customer relationship, action and efficiency, response times, etc.)

• Customer experience metrics (Customer Satisfaction Score, Net Promoter Score, Customer Effort Score etc.)

Industry benchmarking

Establishing your existing standing in the business you have chosen is also crucial. You can get a better understanding of where you stand in the market and identify new growth possibilities by comparing your business processes to “best practice” approaches and your performance to industry standards.

How to choose what to benchmark

It’s not always the simplest information to obtain, but if you look carefully, you can find a lot of data that you can use as a benchmark. Brand awareness, for example, could be difficult to measure precisely, but site traffic, Net Promoter Score, and social engagement are all quantifiable if you know where to look.

Here are a few metrics you may start monitoring to better understand how you’re doing in comparison to industry standards:

• Average order value

• Net promoter score

• Site traffic

• Average revenue per customer

• Social engagement

• PPC cost and rankings

• Feedback response rates

What to do if you’re looking to enter a new industry

Benchmarking won’t do if your business growth strategy calls for entering a new sector of the market. To more accurately assess the market opportunity available, you’ll want to learn as much as you can about your new industry.

Before starting your new business, there are a few things you should learn more about, such as:

• Market size

• Market share

• Growth rates

• Brand positioning of competitors

• Pricing and sales rates

4. How to use market analysis to identify market opportunity

Understanding the market, or the elements of the business environment, that may have an impact on the course your organization is taking, is the last piece of the puzzle. There are many external events that could possibly disrupt or even increase your odds of success, including political decisions like Brexit, legal changes like GDPR, and broader economic changes.

It might be challenging to keep up with everything that is happening, but it is critical that you do so in order to make more informed decisions for your company.

The following are a few things you should pay particular attention to:

• Technological developments

• Government regulations

• Geopolitical shifts

• Economic indicators

• Trade policies

• Social and cultural changes

Although much of this research will involve some fieldwork, using customer feedback can help you immediately gauge how seriously your consumers take these concerns.

Customers can be questioned about how these concerns might effect them in surveys, which gives you a wealth of viewpoints and more knowledge to assist inform your strategy for dealing with any potential roadblocks.

How to develop the right growth strategy for your brand

You’ll need a business growth strategy that enables you to capitalize now that you’ve finished a thorough analysis of the market and located the opportunities.

Because they never stop moving forward, companies like Apple, Netflix, and Amazon are able to maintain their growth. Their growth plan is adjusted as a result of their listening to and learning from the marketplaces and, most crucially, their consumers.

It all comes down to creating a reliable brand with lasting appeal. Creating a brand identity and a growth strategy that aims for constant and flexible expansion is crucial. Sure, there are some fast wins that could give you a few additional leads in the near term.

Ultimately, each firm is unique, so what works for one company might not work for you. If you’re still unsure about where to start, let’s look at a few possibilities.

Improve the reputation of your company

How is your brand viewed by consumers? Have you earned a good or bad reputation? Do you even have a reputation for your brand given how well-known it is? There is always space for improvement, regardless of how positive, negative, or neutral your reputation is, and doing so could greatly accelerate your progress.

To begin with, you must ascertain the reputation of your brand, which may be done by starting a client feedback collection process. Reviews and polls are a great place to start, but you can also utilize social listening techniques to find out what customers are saying about your business even though they might be reluctant to say it to your face.

You can leverage any favorable comments you receive to enhance the reputation of your brand. You can utilize them to influence any upcoming marketing initiatives, share them on social media, and include them into your PPC advertising. For instance, if your research reveals that your customers adore your eco-friendly packaging, your upcoming campaign might emphasize just how green your business is!

It’s also important to think about if you’re taking any actions that can damage your reputation. For instance, if you ignore or respond poorly to negative comments, it will harm your relationship with your clients.

Market opportunity examples across the world: Netflix

Over the years, Netflix has filled a variety of market voids. The business started out by mailing out DVD rentals for a monthly charge in 1997. The business had a DVD rental website in 1998 that was in competition with Blockbuster Video, which had physical storefronts.

One of the first profitable online DVD rental businesses, the business had more than a million clients by 2003. When the company launched its streaming service, it had 10 million subscribers by 2009, and Blockbuster declared bankruptcy the following year. As of 2022, Netflix has 200 million subscribers worldwide and is available in 190 countries.

Employee engagement

Your employees are the face of your company, so whether you know it or not, if they’re unhappy, they’ll be talking poorly about it. This may have a long-term negative effect on your reputation and stunt the development of your brand.

Additionally, it can make your initiatives unsuccessful, as was the case with Starbucks’ recent transgender acceptance campaign. Unfortunately, the campaign became viral for all the wrong reasons because the brand values portrayed in the video advertisement didn’t align with how many transgender employees felt.

It is simple to determine where your brand is succeeding and failing from the viewpoint of your employees. Your staff members can voice any complaints, express what they enjoy about their positions, and participate in the development and success of the company by participating in regular anonymous employee engagement surveys.

Even if you won’t be able to accommodate every employee’s request, you still need to demonstrate that you value their input, even if it’s not always favorable.

Focus on customer experience

Isn’t it time you stopped thinking about selling items and started focusing on selling experiences since firms who excel at their customer experience generate 5.7 times more income than the competition?

The economy of experiences is flourishing. 72% of millennials decide to spend their hard-earned money on experiences rather than actual things when making purchases. Due in part to technology, but also to changing consumer behavior that places a premium on shared experiences and the convenience of using smartphones for socializing, sharing, and shopping.

You must first understand what makes your customers tick if you want your firm to benefit from it. However, receiving feedback from your consumers before you start developing a new customer experience-focused growth plan will help you learn a lot about what you’re doing properly and, more crucially, what might be missing from your existing offering. Start building individualized brand experiences that are based on what your clients are telling you they genuinely want by utilizing his insight! removing the uncertainty and providing you an edge over the competitors.

Product development

Even though you already have some excellent goods under your belt, you still need to have a product development strategy in place if you want to stay ahead of the competition. You must be able to stand out in a crowded market, and distinctive goods and services are a wonderful method to achieve this. In addition to helping you keep your current consumers, fresh product advancements can draw in new ones.

To create a successful product development plan, you must first understand the needs of your target market. Consider:

• What your customers need

• What needs to be improved

• What your competitors are doing

Engaging your customers in your strategy is one of the finest methods to learn this information. To get input for improving your product offering, create surveys, read reviews, organize focus groups, and execute beta tests on new items. This will not only guarantee that you are producing goods that consumers value, but it will also strengthen your relationship with your current clientele because they will feel invested in the expansion and success of your business. If you want to expand your business, you need to check both of these boxes: this can assist increase customer loyalty and draw in new clients.

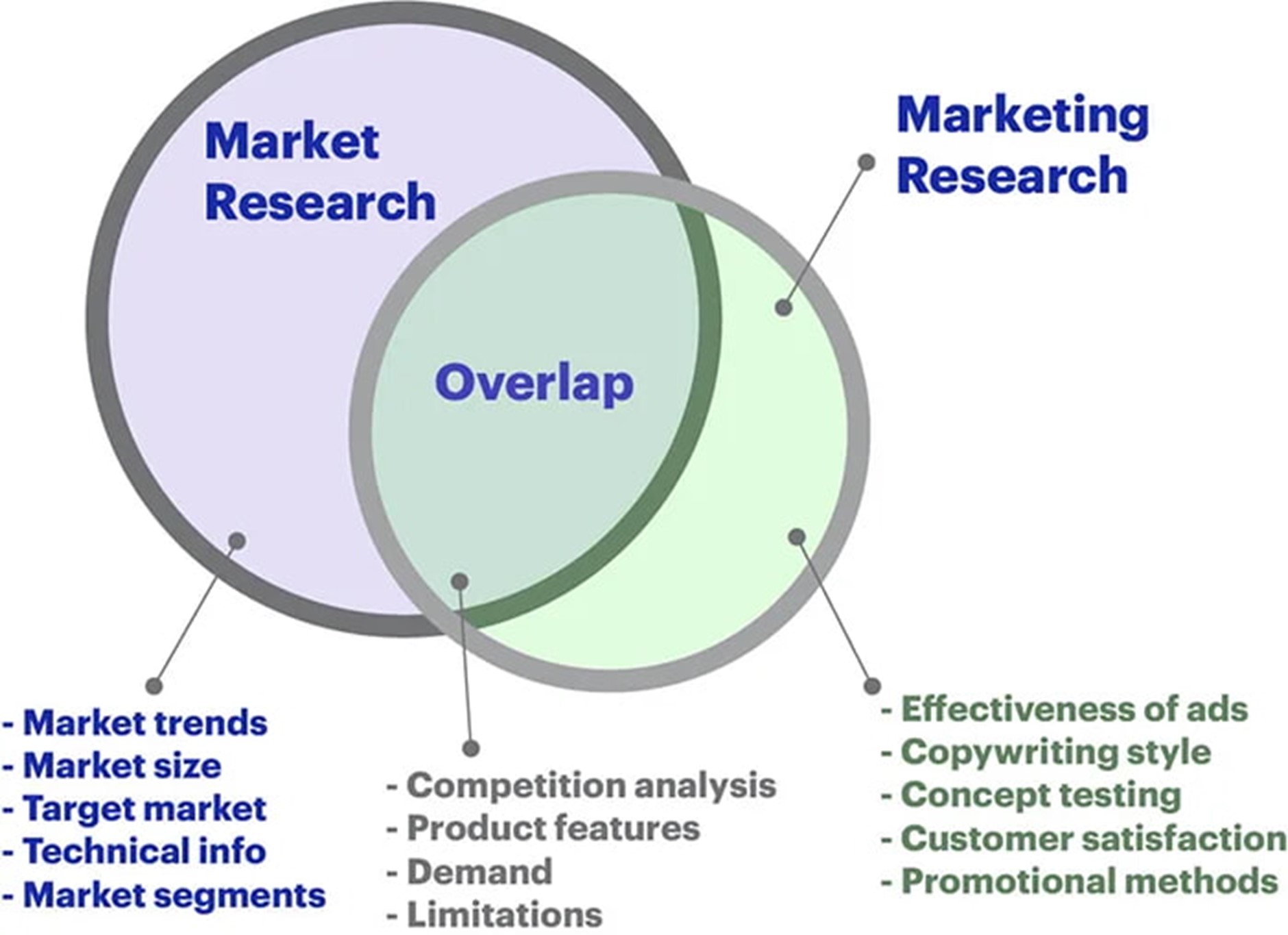

What is the difference between market research and market opportunity analysis?

Consider that you are in charge of putting up an ice cream counter in a shopping center. How would you approach the whole thing?

Finding the counter’s placement would be the first step. Would it take place inside the mall or outside? What flavors would you then be providing to everyone else? What would you charge for your goods, in the end?

When doing your market research, you would start by asking questions like these. You would need to draw on data that you either currently have on hand or obtain through market intelligence from multiple sources in order to respond to these inquiries.

After setting up your ice cream kiosk, you start thinking about how to expand your company. Could you perhaps raise the cost of each flavor? Maybe you could come up with some new combos or bargains. Perhaps you could collaborate with a different well-known brand to release a new flavor? These are only a few instances of market prospects that might enable your company to reach new heights of development.

Given that there are many overlaps between market research and market opportunity, it is simple to become confused between the two.

Market research provides information on which market opportunities are worthwhile, which makes it simple to recognize the difference.

With their rapid fluctuations, markets may be sensitive things. It can feel hazardous to try something new or ambitious for your business.

However, seizing market opportunities shouldn’t require making a big bet. When done well, market research can eliminate ambiguity on multiple levels.

Market opportunity examples across the world: Whole Foods

Whole Foods fills the market void created by consumers’ desire for a central location to buy natural, organic, and nutritious food goods. Only a few natural food supermarkets existed in the United States in 1980, when the first Whole Foods Market opened in Texas.

The business spread all over Texas and the southern United States by 1984. The business began acquiring additional natural food stores on the West Coast and in the Northeast during the 1990s. Amazon.com bought Whole Foods in 2017, and it will be its property as of 2022.

Executive Summary

Chapter 1: Identify Strengths and Weaknesses

Even companies that appear to have it all together and be in the lead might have both strengths and disadvantages. Even while it is crucial for each firm to recognize its advantages and disadvantages, not all companies take the time to do so. People frequently find it simple to recognize their strengths, but it can be more difficult to acknowledge their flaws. However, that is precisely what every company ought to be doing!

Every company should focus on identifying its strengths and shortcomings for a variety of reasons. To begin with, once you are aware of your company’s advantages, you can utilize that knowledge to narrow your attention to those advantages, use those advantages to create a game-changing product, and ultimately expand your company. Knowing your shortcomings gives you the opportunity to make changes for the better and possibly enhance current items. Because you will be addressing it and perhaps resolving something that could be perceived as a threat to your organization, that shift can aid in the growth of your enterprise.

Here are several tips for determining your business’s strengths and weaknesses:

• Analyze. In order to identify the advantages and disadvantages of your company, analysis is crucial. You should be truthful when doing this. Again, admitting to our shortcomings can be challenging, but doing so is necessary if we want to make progress. After reviewing your prices in relation to the market using a pricing analysis report, you could occasionally need to make these price changes. In other instances, they could result from an ignorance of your target audience as a whole. Without evaluating everything and being sincere with yourself, changes cannot occur.

• Compile a list. Make a note of all the areas where the company, in your opinion, demonstrates its strengths and flaws on a piece of paper. If you’re being sincere, there’s a strong probability that you can recognize many of those places on your own. It may not have occurred to you previously, but once you do, it won’t be difficult to identify some areas for concern and those in which your company thrives.

• Consult others. Consider including others in the discussion if you are having trouble determining the company’s strengths and drawbacks. Ask your loved ones, your coworkers, and perhaps even your customers what they think. Create a survey for your consumers to complete if you’re going to ask them for feedback on your products or services, as well as any areas where you think your business may improve. A competitive pricing analysis company might be used as an example to analyze what is happening with your company’s price schedule and how it compares to market values. You can grow and change for the better with the help of the knowledge you gain from something like this.

• Take note of complaints. Does your business keep track of the consumer complaints it gets? If not, begin developing a procedure and a policy to do so. This is a fantastic technique to discover more about your company’s weaknesses. Since you will notice patterns in the complaints, the information you obtain will assist you in identifying weak points. Changes should be made using this information, especially if a certain policy, item, or service is frequently the subject of criticism.

• Make improvements. As you compile all of this data, you’ll discover your strengths and shortcomings. The details regarding your deficiencies are possibly the most crucial and should be addressed. Avoid overextending yourself by attempting to complete them all at once. Instead, concentrate on two or three areas of weakness at once. You can then set a target and establish a plan to take care of those before moving on to others. If changes can be made right away, fantastic. However, if they are the kind that will accept longer-term fixes, don’t worry. Things will eventually get better if you start making changes and attempt to enhance your weaknesses.

You may do this with your employees as well as as a firm as a whole. Ask them to honestly assess their assets and liabilities. Once they have, look into what may be done to fix the flaws. Perhaps making a few adjustments to your responsibilities will make your business more effective. Making such improvements allows for time savings and aids in the company’s future expansion.

Finding your strengths may be thrilling and joyful. However, having to examine the flaws in your business or workforce is never fun. But doing it is something that is crucial. This is especially important if you want to deal with dangers, support your company’s goals, and keep one step ahead of the competition. Set a goal to perform this exercise once a year or more, as new deficiencies could develop over time. By doing this, you can make sure issues are resolved and your business keeps running smoothly.

Make sure to seek assistance from a firm that performs a competitive price research and to look at your clientele as well. Make sure you are aware of your strategies for increasing the viability of your company.

Chapter 2: Purchase Situation Analysis

Any company decision should come after conducting a situation analysis. Planning for a new market opportunity or launching any new endeavor should start with this phase.

In this course manual, we’ll explain what a purchasing situation analysis is and walk you through how to conduct one to help you comprehend the idea better.

What is a Situation Analysis?

Prior to a new marketing initiative or project, it is essentially the process of critically examining the internal and external variables that affect a firm.

It gives you the information you need to see the opportunities and problems that are now facing your business, service, or product. The development of a strategy to advance from your current marketing scenario to your desired situation is aided by this.

Importance:

• Helps define the nature and scope of a problem

• Helps identify the current strategies and activities in place to overcome the problem

• Helps understand the opinions and experiences of stakeholders

• Helps give a comprehensive view of the current situation of the organization

• Helps detect the gaps between the current state and desired state

• Provides information necessary to create a plan to get to reach the goals

• Helps identify the best courses of action to take during the project

• Helps make sure that efforts and actions are not repeated and wasted unnecessarily

Steps to Conduct A Situation Analysis

By completing them, you will be able to get a thorough understanding of the conditions surrounding your organization.

Conduct a Customer Analysis

Investigate your target market in depth to learn about its demographics, geographic location, trends, interests, issues, etc. You may correctly organize the information using a client profile.

You may identify market trends, customer behavior, and demands and devise efficient methods to effectively reach them with the aid of a thorough customer study.

Take a look at the Product and Distribution Situation

Consider how well your current goods and services can meet the demands of your clients.

If you have distributors, you should also assess them in terms of distribution channels, distributor demands, distributor types, distributor sizes, as well as the numerous advantages enjoyed by both the distributors and the business.

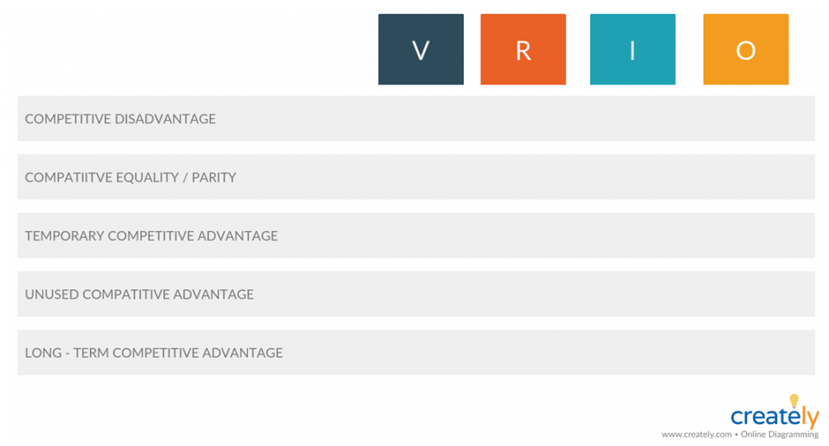

Analyze the Competitive Advantage

You must identify your main competitors, their product positioning, and their strengths and shortcomings in order to ascertain your competitive advantage.

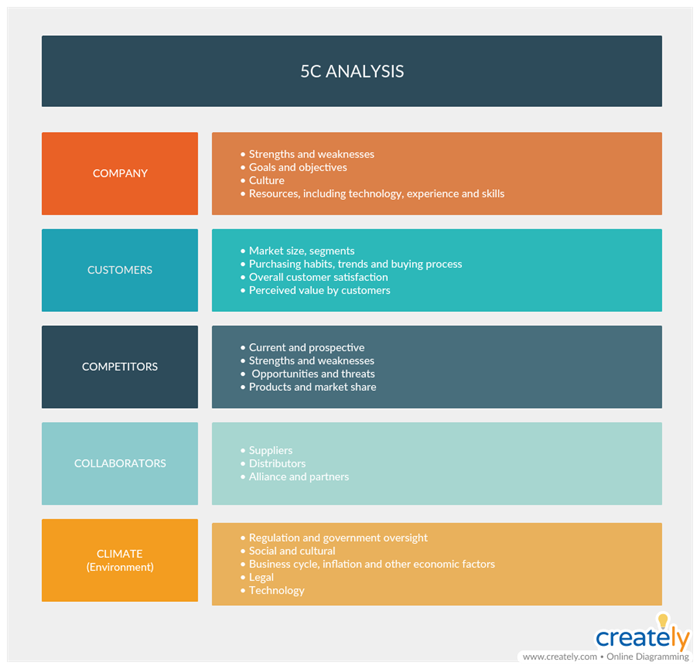

Here’s how to use some useful graphic tools to conduct an efficient analysis of your competitors.

Assess Your Environment

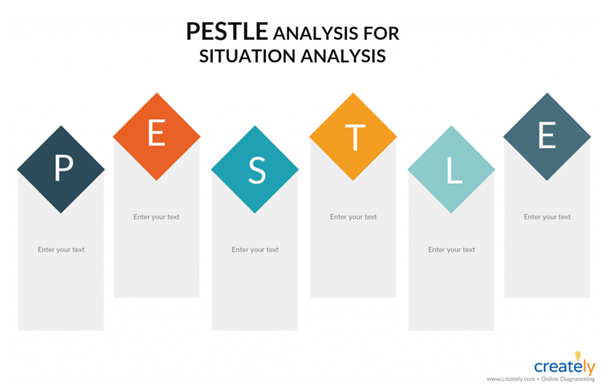

Examine how your organization’s performance may be impacted by both internal and external influences, including economic and political trends, personnel abilities, and the availability of resources.

Both the SWOT analysis and the PESTLE analysis are effective methods for doing an environmental scan.

After doing a thorough environmental scan, you will be able to pinpoint the opportunities and difficulties presented by recent developments.

Chapter 3: Direct Competition Analysis

What is direct and indirect competition in business?

Competition is not limited to athletics. It is something that exists in a variety of disciplines, including business, economics, psychology, and biology. In spite of the fact that the term itself may have a bad connotation (e.g., win-lose, zero-sum game), it is actually a crucial component for everyone, especially your business. Long-term improvements to your products, services, and client connections are made as a result of increased motivation and innovation.

Henry Ford once said:

“Competition whose motive is merely to compete, to drive some other fellow out, never carries very far. The competitor to be feared is one who never bothers about you at all, but goes on making his own business better all the time.”

Understand your competition, whether they are direct or indirect, regardless of whether your business is just getting off the ground or is well established. Why? Any company that might dissuade a potential client from picking you is one of your competitors. What company wouldn’t want to contend for that?

Understand your competitors

As corny as it may sound, competition is a given regardless of the goods or services you provide. For this reason, it’s essential to know what the other major players in the field are doing in order to retain your current clientele and advance. Google research is one of the cheapest, simplest, and quickest ways to find out more about your competition. To assist you understand what they’re all about, you can find client endorsements, reviews, opinionated blog articles, and other illuminating stuff online.

Pro tip: Perform a competitive analysis to keep a more detailed eye on your competitors. It’s crucial to conduct this extensive research in order to understand where your company fits into the market environment, even though it’s not a one-time project. This entails contrasting the pricing points, advantages, disadvantages, and characteristics of competing goods and services with those of your own.

Identifying the three major categories of competition—direct, indirect, and secondary competitors—is a vital component of mapping your competitors. Here, it’s crucial to be familiar with various company models in order to create a mental map while strategizing and guarantee that you have that “it” element in your market.

Direct competition

When two or more businesses fight for the same market by providing the same good or service, this is referred to as direct competition.

There are lots of typical instances of this. One is the competition between McDonald’s and Burger King; more particular, the Big Mac and the Whopper are fierce competitors. Apple’s iPhone and Samsung’s Galaxy is another illustration.

It’s not always easy to tell who your competitors are and who they aren’t. So, to assist you in locating direct competition, here are two straightforward methods:

• Customer feedback: Your clients undoubtedly have a few additional factors in mind before choosing you as their preferred brand. When you gather customer feedback, you can start to comprehend their preferences with the aid of your help desk software. Ask current clients which businesses they were considering. Ask prospective clients which companies they are thinking about in order to tailor and center your pitch on their requirements.

• Online communities: Boy, do people love to express their opinions on social media. Nowadays, the best places to go for advice are brands’ social media profiles and discussion boards on websites like Tumblr, Quora, and Reddit.

Secondary competition

When two or more companies provide a separate high-end or low-end version of your product or service to a similar market, this is known as secondary competition.

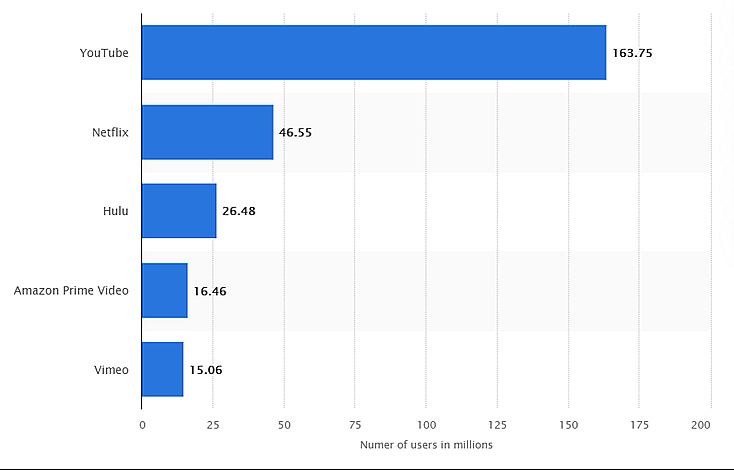

The following are a few instances of secondary rivals. Both Gap and Gucci, which are retail companies, aim to appeal to middle-class consumers who value practicality over luxury. Then there are websites that let you stream videos for free, but frequently at the expense of quality, such as Netflix and YouTube. With the first, you must pay a monthly charge to access premium content.

It frequently happens that launching a business is accompanied by a tornado of emotions. But you soon come to the realization that there are a lot of things you’ll need to do to put yourself on the proper road, including hiring smart staff members and developing an effective social media marketing plan.

Initially, you support customers through your personal Gmail account. However, when you develop and grow, you might find that it’s not scaleable. The next stage is to upgrade to “help desk software,” which comes with a full complement of features to expedite and manage your customer assistance. As a result, a ticketing system and your single Gmail mailbox are viewed as supplementary competitors.

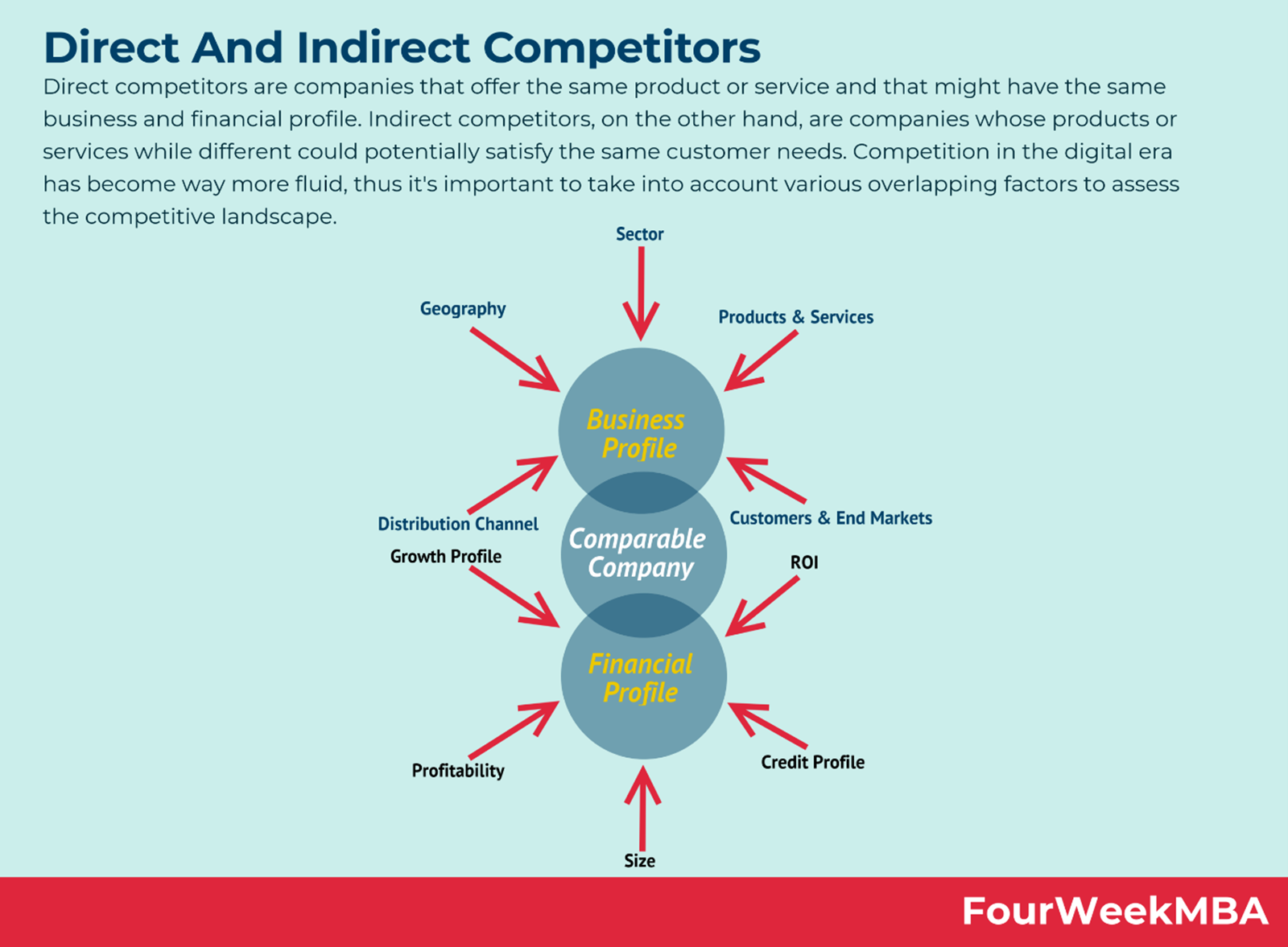

Chapter 4: Indirect Competition Analysis

When two companies target the same market and audience, try to meet the same requirements, and offer different products, this is known as indirect rivalry. Because they offer various remedies for the same problems faced by customers, indirect competitors frequently steal away a sizable portion of a company’s potential customers.

Direct Competition vs Indirect Competition

Some junior marketers may design brand strategies without considering indirect competitors, concentrating primarily on the direct ones. To obtain a complete picture of the market environment, it is essential to take into account a range of goods and services. Below, we contrast direct and indirect rivalry and outline their unique differences.

When two businesses compete directly, they are providing the same goods to the same market. Although the brands, promotions, values, and marketing methods of the companies differ, their products are comparable. Additionally, direct competitors operate in the same market, such as coffee shops in a single city or luxury automobile manufacturers who sell the majority of their developments in Europe.

Businesses that target the same market and consumer segments while producing distinct items are said to be engaged in indirect competition. For instance, cookies and chocolate are both sweets that can be substituted for one another, making them indirect rivals. This idea is more expansive because there are so many alternatives available. For instance, watching different movies and cartoons, going out to dine or the theater, shopping at the mall, and even traveling are all ways to pass the time and can compete with one another.

Even if it could be difficult to consider every possible substitute, you can easily identify the most obvious ones by doing keyword research and researching related subjects. We also provide examples of indirect competition in other markets to assist you better comprehend this idea.

Indirect Competition Examples

You can find a clear strategy and significant competitive advantages by identifying and evaluating your company’s indirect competitors. Study some of the instances of indirect competition below to help with your analysis.

1. Domino’s Pizza vs. McDonald’s. These businesses cater to customers who want to eat quickly and sell fast cuisine. They operate globally and use very identical price guidelines. Additionally similar are their marketing and branding. Domino’s serves pizza, whereas McDonald’s sells burgers and fries, therefore we can say that they are indirect rivals.

2. Marvel comics vs Netflix movies. These two businesses face off in the teen and adult entertainment market. They both have a large following and work all around the world. Netflix movies can be replaced by Marvel comics, and vice versa, even if these two companies don’t directly compete with one another.

3. Targeting vs collaborating with influencers. We can state that these two advertising strategies are in direct competition with one another. The same markets and audiences can be reached utilizing influencer marketing or targeted advertising. Selling goods from the advertised brand is the objective as well. These techniques, however, differ and each has unique characteristics. We advise integrating them to improve the outcomes of your marketing activities.

Here are two effective techniques for identifying indirect competitors:

• Keyword research: Depending on the effectiveness of your SEO efforts, both Google and Bing search engines provide websites a chance to rank on the first page of SERPs (search engine results pages) for particular keywords. While it may seem strange that businesses compete for this real estate in the rankings, it really is no joke. The majority of your prospective consumers use specific keywords in their searches to locate the best answer.

Pro tip: Use Google Keyword Planner to determine how frequently people search for these terms. A more sophisticated SEO tool that can analyze keywords and other SEO data for any website or URL is SEMrush. Your chances of obtaining a high position in the SERPs of both of these search engines will increase with the use of these tactics.

• Creating material that is SEO-friendly: Many of your indirect rivals are producing genuine content (such as blog posts and landing pages) that is closely relevant to your good or service. Every page contains keywords, a seemingly simple yet incredibly effective method of boosting your visibility on Google. Indirect competitors include any companies, bloggers, or magazines that write on subjects related to your brand.

In the end, most of us deal with indirect rivalry on a daily basis. Will a salad or burger satisfy my hunger during lunch? or “Will I chose to take an Uber or drive my car to work?” Customers just need to choose once, which gives organizations a particularly strong opportunity to analyze and comprehend the thinking behind these choices.

Know thyself

A crucial marketing tactic for defining the steps your business takes to gain a competitive edge is competitive brand positioning. Given the concept’s many ramifications, it is both potent and difficult to comprehend. Philip Kolter and Kevin Lane Keller define this phrase as follows in their book Marketing Management:

“The act of designing the company’s offering and image to occupy a distinctive place in the minds of the target market.”

Simply said, it’s how your business sets itself apart from competitors and how your brand influences consumer perception.

You’ll be able to identify your rivals, analyze your strengths, and determine how to best position your brand to win the market through thorough market research. Create a statement that describes your brand’s identity to start.

You don’t have to come up with this yourself. Denise Lee Yohn, a specialist in brand leadership, offers a straightforward formula and some exploratory questions for each variable:

For ‘X,’ we are the ‘A’ who does ‘B’ because ‘C’

• ‘X’ = target audience: Who could be interested in your product or service? What makes them unique? Why are your offerings important for them?

• ‘A’ = brand position in the market: What is your brand’s position in the market? How do your existing and potential customers perceive your product or service?

• ‘B’ = the ‘it’ factor: What makes your brand different? Why should your target audience value you and not others?

• ‘C’ = show results: What proof do you have that shows you can deliver?

Chapter 5: Analysis of Complimentary Goods and Services

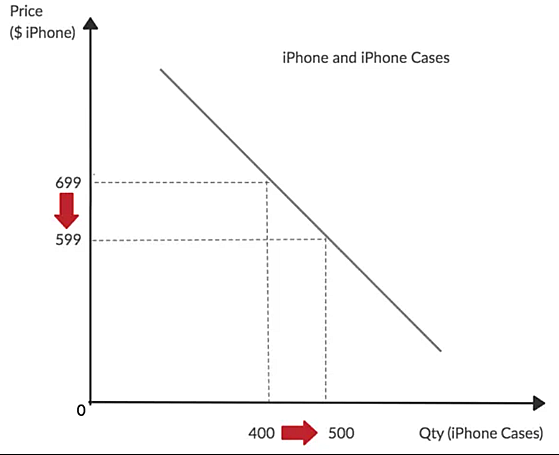

The part that complementary items play in the value creation equation is one aspect that could affect a company’s capacity to reap revenues from its goods and services.

The pricing and demand of these “complements,” as they are also known, are linked since they are goods that are utilized in conjunction with or as a result of using your goods or services.

Complements are a significant, yet frequently ignored, factor that we included in the Porter’s Five Forces model because they must be carefully considered while developing your company’s business plan.

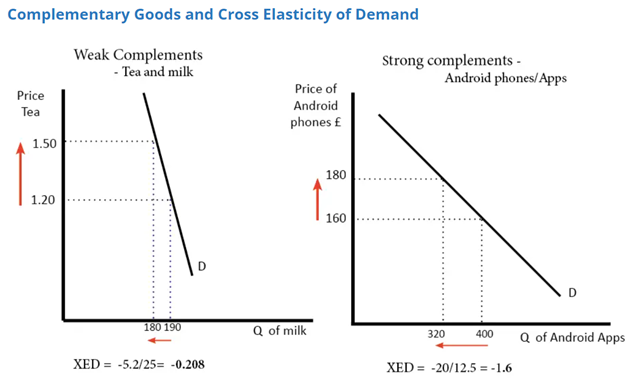

According to economists, two items or products are complementary if a change in one’s price causes the demand for the other to shift in the opposite way.

For instance, if DVD movie prices decrease, there will be a greater demand for DVD players, and if ink cartridge prices decrease, there will be a greater need for printers.

However, the contrary is also true: if the cost of DVD movies increases, the demand for DVD players decreases, and if the cost of ink cartridges increases, the demand for printers decreases.

Complements can be crucial to your ability to regularly and successfully generate income as a result of this relationship.

For instance, if the complement is exclusive and one-of-a-kind, its dealer may be able to restrict your capacity to sell your goods.

In other words, the complement would limit the demand that YOU are able to meet by not being accessible to all of your “possible” clients.

Consider a company that produces coffee pods that are exclusive to a certain kind of brewing equipment from a separate company.

The machine manufacturer has sway over the capsule vendor because it decides where and to whom the brewers are sold and because it also grants the manufacturing licenses, which has an impact on how profitable the capsule producers can be.

This is taking place in the video game industry, where the developers of the PlayStation, Xbox, Nintendo, and other consoles set game prices and receive a share of the sales.

As a result, the strategy of the console manufacturers restricts the earnings that game developers can hope for.

You must pay close attention to how much the complementary solution is required to utilize your product and how easily available it is to YOUR target customers whenever you are marketing a product that depends on a complementary solution in any way.

If your customers require a complement to utilize your product, you must incorporate guarantees into your business strategy to prevent giving the complement’s creators influence over your revenues.

Understanding Supply Vs. Demand

The interaction between suppliers and consumers of a resource is the subject of the theory known as the law of supply and demand. The concept explains the relationship between a commodity or product’s price and consumers’ willingness to buy or sell it.

When prices rise, people frequently supply more while demanding less, and when prices fall, the opposite occurs. The law of supply and the law of demand are the two distinct “laws” upon which the concept is based. Together, the two laws determine the actual market price and the quantity of commodities on the market.

Demand

The rule of demand states that, given all other factors remain constant, fewer individuals will desire a thing the more expensive it is.

In other words, the quantity asked increases in proportion to the price. Because the opportunity cost of buying a good increases as its price rises, consumers buy less of something at a higher price.

Supply

How many units are sold for a specific price is shown by the law of supply. The slope of the supply connection is growing, in contradiction to the law of demand. This shows that as the price increases, the quantity given will increase as well.

The prospective cost of each new unit rises significantly from the standpoint of the seller. Because the higher selling price balances the higher opportunity cost of each additional unit sold, producers offer more at a higher price.

Chapter 6: Analysis of other industries

Many companies utilize industry analysis as a technique to evaluate the market. Market analysts and business owners utilize it to determine how the industry dynamics for the particular industry researched function. The analyst can gain a strong understanding of what is happening in the industry with the use of industry analysis. Consider it a sophisticated method of “getting the lay of the land.”

When it comes to business, industry analysis entails evaluating factors like industry competition, the interaction of supply and demand, how the industry compares to other, emerging industries that offer competition, the industry’s likely future, particularly in light of technological developments, how credit operates in the industry, and the precise magnitude of the impact that external factors have on the industry.

Industry analysis has numerous benefits. You can use industry research as an entrepreneur trying to establish yourself in the market of your choosing to determine where you are in relation to other market participants. When planning for the future of your company in the context of the development of your industry, you may utilize industry research to your advantage to spot possibilities and risks in your immediate surroundings. Understanding how you stack up against your rivals and utilizing that knowledge to your maximum advantage are the only ways to succeed in any cutthroat market.

What Does Industry Analysis Aim to Achieve?

It is impossible to overstate the value of industry analysis for marketing ability. For your firm to succeed, industry analysis and the related skills are vitally essential since they will provide you a deep awareness of the environment in which you are working. But there are several aspects to this importance that can each be examined in more detail.

Industry Analysis Can Be Used to Predict Performance

The performance of the industry as a whole is one of the best predictors of how well your organization will succeed in a certain sector. If the industry is doing well, then your business, assuming you run it well enough, is likely to do well inside that sector. You can determine the changes that industry is likely to experience by being able to predict the changes that are likely to occur in that sector. For instance, manufacturers of goods that need fuel to generate them will benefit from higher profit margins if the price of fuel falls significantly. Predicting such changes will enable your company to respond strategically while working on initiatives pertaining to your industry.

Industry Analysis and Positioning of a Business

If you comprehend how the market functions, you will be better equipped to position yourself in the market throughout the planning stage of your firm. For instance, you will be better able to determine how you may set yourself apart from the competition if you are aware of the kind of things being sold in the market as well as how saturated the industry is.

Analyzing the industry to find threats and opportunities

You will be able to recognize a wide range of dangers and opportunities when you do an industry study. Opportunities are phenomena that would promote the growth of your firm, whereas threats are phenomena that would prevent it.

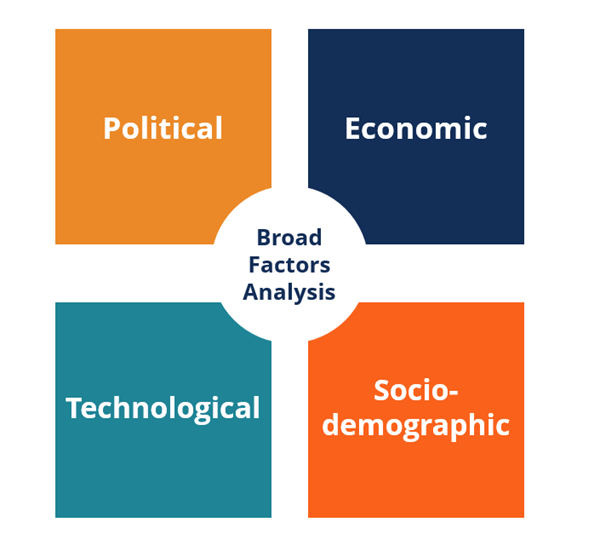

What Types of Industry Analyses Are There?

There are three main ways in which you can perform industry analysis. These are:

1. The Competitive Forces Model, also known as Porter’s 5 Forces.

2. The Broad Factors Analysis, also known as PEST Analysis.

3. SWOT Analysis.

Chapter 7: Foreign markets analysis

Market research is a crucial task for businesses of all sizes. It’s essential to conduct as much research as you can over a wide range of topics before entering a new local market or category to make sure you’re as ready as you can be to launch a successful entry with the least amount of risk.

Market research is still crucial when entering a foreign market. In fact, it can be much more crucial because the stakes are bigger and you’ll be dealing with completely different market circumstances.

This article will discuss why businesses need to conduct international market research, how it often differs from domestic market research, and some of the primary motivations for doing so.

What is international market research?

The term “international market research” is used to refer generally to all pre-entry market research and preparation. International market research, in contrast to domestic market research, is concentrated on a foreign market, which frequently has completely different cultures, economic conditions, and consumer behaviors.

International market research involves a variety of techniques and phases. Although the specific tactics and procedures are frequently the same as those used in domestic market research, your overall strategy probably won’t be the same.

What are the objectives of international marketing research?

Before launching a product or service in a new international market, you can learn about it by conducting international market research. Understanding your target audience, identifying potential obstacles, becoming familiar with your competition, and everything else that will increase your chances of success and prevent unpleasant surprises are the major goals.

What distinguishes domestic market research from that conducted abroad?

Between local and international market research, there are a number of significant differences. The following are some significant variations:

You’re entering a market with social and cultural differences

International market research is far more difficult in many respects than domestic market research because of the frequently enormous contrasts between your home country and your target country.

The challenges are frequently the same as the reasons why you need to conduct the study in the first place: you want to learn as much as you can about a place and culture that may be very different from your own.

For researchers, the disparities between nations might provide numerous difficulties. One-on-one interviews, for instance, are a research technique that excels in western nations like the US and the UK but fails miserably in other regions of the world where it is viewed with scepticism.

There may be more restrictions around research

International marketplaces have legal variations in addition to cultural and social ones. Even while you may be quite familiar with domestic law—particularly as it relates to market research—the situation abroad might be very different.

You will therefore need to be familiar with a completely new set of regulations in order to refrain from breaking them and getting into trouble with the law. One such is the TCPA, which outlaws using an automated dialing system to call a cellphone in the USA.

Before starting any investigation, it is essential to undertake legal research and consult with attorneys in your target market because of the various legal requirements. Being on the wrong side of the law could have disastrous consequences.

It requires much more investment

You can frequently conduct market research on your own turf for a reasonable price. But expenses can soon soar if the same research is conducted abroad. When you’re conducting business in a foreign country with individuals who speak a different language, seemingly straightforward tasks like selecting interview locations, conducting phone interviews, and gathering candidates for interviews can become immensely more challenging.

To assist you in doing these chores, you could find that you need to hire a small army of local employees. Even more distressing, poorer nations with less extensive internet access don’t respond nearly as well to the less expensive market research techniques like email and online surveys.

Chapter 8: Environmental analysis

What is environmental analysis?

A strategic method for determining all internal and external aspects that might have an impact on a company’s success is environmental analysis. While external components reflect potential and threats, internal components show a company’s advantages and disadvantages. Outside of the company, this exists.

Environmental analysis takes trends and major elements into account. For instance, interest rates and how they could impact a business. These evaluations can aid companies in becoming more appealing to customers.

What advantages can environmental analysis offer?

Environmental assessments assist businesses in identifying potential repercussions. That might present a risk or a chance. They can anticipate changes in their environment thanks to this.

Environmental scanning has a number of benefits, such as the following:

Assisting in the accomplishment of company objectives, threat detection, and response strategy development, future prediction, threat recognition, and increased organizational effectiveness.

Understanding the external local, national, or international variables that might effect your small business requires first creating a marketing environmental analysis. Although most of these elements are beyond your direct control, you can still modify your business and marketing plan to maximize the benefits and minimize any potential risks. The most typical approach to doing one of these reviews is a PESTLE analysis.

Example of an Environmental Analysis

Consider Mr. X, an analyst at the financial services company ABC Pvt. Ltd. Mr. X performs an environmental analysis in response to recent changes in the banking sector. Mr. X decides to do a PESTLE analysis because the finance sector is driven by technological improvements.

Mr. X takes into account the political, economic, social, technological, legal, and environmental elements in this analysis. He pays more attention to the technical details, though. He contrasts the technological developments taking place in other businesses operating in the same sector.

The findings demonstrate new developments in technically sound services. It explains how effective chatbots for financial services can boost a company’s profitability. Mr. X plans to create a powerful chatbot because ABC Pvt. Ltd. does not currently have one. The analysis’s recommended course of action is to increase their after-sales support through technological advancements. After that is finished, the company sees a 15% increase in revenue and profitability. The analysis is therefore regarded successful.

Chapter 9: Listen to Your Customers

All day long, our ears pick up sound. Colleagues are using the printer, filling their coffee cups to the brim, and typing on keyboards. We frequently ignore these background noises and carry on with our task in isolation.

What about the opinions of our coworkers, managers, and clients? Do we still act in the same manner toward them? It’s quite easy; since your customers are the ones who buy your products, they can tell you which products are lacking in the marketplace.

One of the most crucial abilities you may have in business is the ability to listen, especially if you manage a team or work in a customer-facing position.

Your clients are the ones that bring in the money for your company, therefore it makes a difference whether you pay attention to them or not if they decide to buy from you in the first place. Without customers, your business cannot function, and if you don’t take the time to understand their needs, you won’t have any customers either. This will then provide you the opportunity to create a good or service that no one else has yet imagined, therefore meeting a market need.

Why you Should Listen to Your Customers

The conversations you have with your potential or current consumers should be two-way; you want them to listen to you as you explain all the ways your product or service will benefit them, but you also need to lend them your ear.

It’s in your best advantage to acknowledge that your consumers are also people with needs to be acknowledged and understood.

Here are some benefits of listening rather than talking in case you’re still unsure;

Your Customers Know What They Want

You can never be completely certain that you understand what a consumer wants until you pay attention to their pain areas, regardless of how much market research you conduct.

Your presumptions about the features, price range, and even the product they want could be wholly incorrect. Be cautious and pay attention to what your client requests.

You’d be insane not to use the information they give you so you can provide the greatest product for their needs, as 59 percent of customers claim that personalisation influences their purchasing decisions.

This procedure should continue as you deepen your connection with them and adjust as their demands alter, ultimately boosting sales and client loyalty.

You Don’t Have to Be Alone to Have Useful Insights

Even while you may believe that your goods or services, sales strategy, and customer support are top-notch, your customers’ perspectives may be very different.

To finally improve the client experience, you can redefine your offering, the way you sell, and your customer care techniques by soliciting consumer input through customer reviews and your CRM software.

The suggestions they offer you are probably going to help you both keep their business and draw in new clients.

The Customer is Always Right

It’s simple to forget that even while clients are looking to you for a good or service, they still have the final say in the purchase.

It’s challenging to pretend to listen. Customers are the first to realize when you are not paying attention since they are aware of it when you are.

The philosophy of “the customer is always right” should not be overlooked; not only do your prospects have money to spend, but they also have the option to work with your rival instead of you.

It’s Not Me, It’s You…

Don’t undervalue your rivals; both new and returning clients might easily visit a different website in place of using and purchasing your goods or services.

When clients have so many options available to them, fully understanding their needs may make a huge impact. They will be more willing to conduct business with you if you demonstrate that you value their opinions and make adjustments as a result.

There are several customer-focused software options available that can assist you in reminding your clients of the benefits of doing business with you. They are more likely to remain and develop into a devoted clientele when they experience this sense of ease.

Chapter 10: Consumer Segmentation

The most efficient customer engagement is made possible by accurate consumer segmentation.

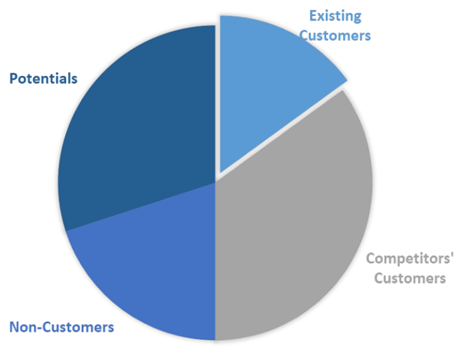

What is Customer Segmentation?

The practice of segmenting a company’s customers into groups that demonstrate similarities among customers in each group is known as customer segmentation. In order to optimize each customer’s value to the company, it is important to select how to interact with each category of customers.

What is customer segmentation analysis?

The method used to find insights that characterize particular client segments is known as customer segmentation analysis. This method is used by marketers and brands to decide which promotions, deals, or items to use when speaking with particular target audiences.

A retail firm might, for instance, construct a segment of prior consumers who haven’t made a purchase or browsed the eCommerce site in the last 30 days in order to figure out how to reactivate lapsed customers. Then, it might examine that group to learn more about the kinds of things these customers have previously purchased, their penchant for discounts, and other factors. The marketing team can use this data to decide which campaign to develop to reactivate these lapsed clients.

Analyzing a segment’s expected Future Value, average order value, loyalty tier distribution, and other factors can help a business assess the value of specific segments.

Why is customer segmentation important?

Marketing professionals may be able to reach each consumer in the most efficient method with the help of customer segmentation. A customer segmentation analysis enables marketers to distinguish distinct groups of customers with a high degree of precision based on demographic, behavioral, and other factors using the vast quantity of data about customers (and potential customers) that is accessible.

It is essential to know in advance how any specific marketing action will affect the client because the marketer’s objective is often to maximize the value (revenue and/or profit) from each customer. Such “activity-centric” consumer segmentation should ideally place more emphasis on the long-term customer lifetime value (CLV) impact of a marketing action than on its immediate worth. As a result, it’s essential to segment or group customers based on their CLV.

CLV-Focused Customer Segmentation

Naturally, it is always simpler to make assumptions and utilize “gut instincts” to set the rules that would categorize customers into logical categories, such as those who purchased a specific product or service, originated from a specific source, or resided in a specific place. These broad classifications, meanwhile, rarely produce the desired outcomes.

It goes without saying that certain clients will spend more money with a business than others. The top clients will spend a lot over a long period of time. Good clients will either spend a lot in a short amount of time or modestly over a lengthy period of time. Others will refrain from making large purchases or from remaining too long.

In order to address each group (or individual) in a way that will most likely maximize that future, or lifetime, worth, the proper way to segment consumers is based on forecasts of their total future value to the business.

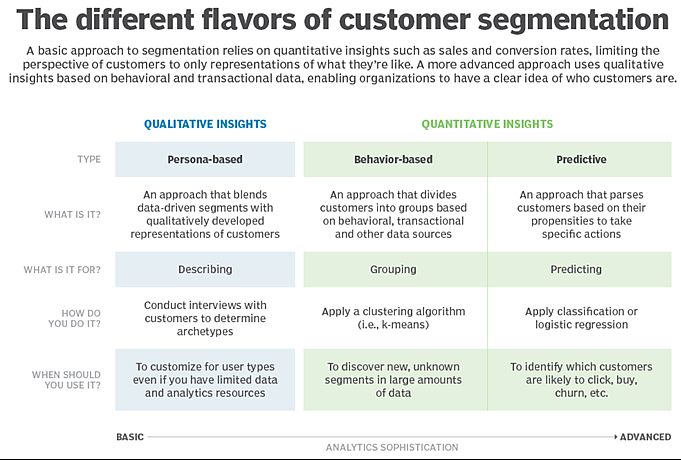

Approaches to Segment Customers

You must choose the method you’ll take to establish your client segments after determining the ideal categories and attributes to employ as a foundation. Rule-based segmentation and cluster-based segmentation are the two most used methods for dividing clients into different groups.

Setting thresholds to determine which category a customer belongs to is the main goal of rule-based segmentation. The strategy divides clients into groups based on a set of guidelines. The rule-based segmentation approach is a straightforward method for grouping clients into groups, but it necessitates that you choose the qualities each time. By taking a look at how many clients are in each group, you can more easily keep an eye on trends. The rule-based segmentation strategy involves a lot of work to keep segments updated if consumer behaviors change because it is challenging to add new qualities.

Cluster-based segmentation determines the optimum way to segment clients so that the segments are as equal as feasible rather than dividing them by thresholds. It illustrates the connections between data points so that client segments can be created. These groups are produced via cluster-based segmentation using the K-means method. Using the cluster-based segmentation approach, you can discover new patterns in your data and generate groups you were unaware of. Additionally, it can group clients based on a variety of factors. Cluster-based segmentation offers greater segmentation capabilities with minimal upkeep, but it is challenging to implement without a skilled data scientist.

Chapter 11: Spot Acute Unsolved Problems

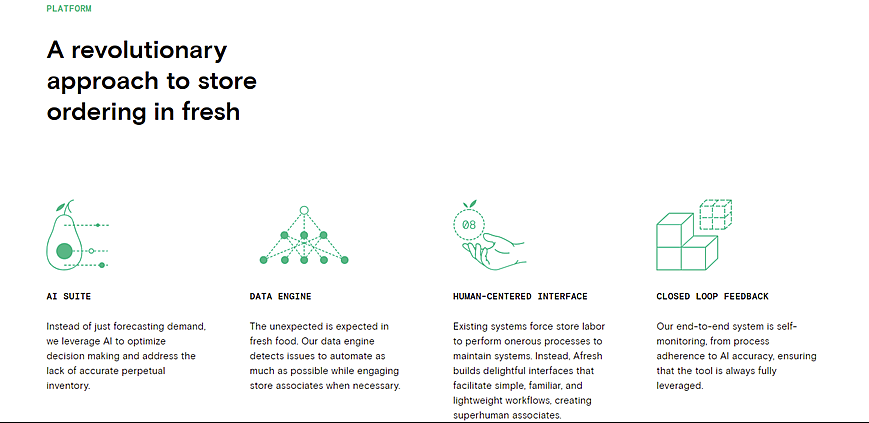

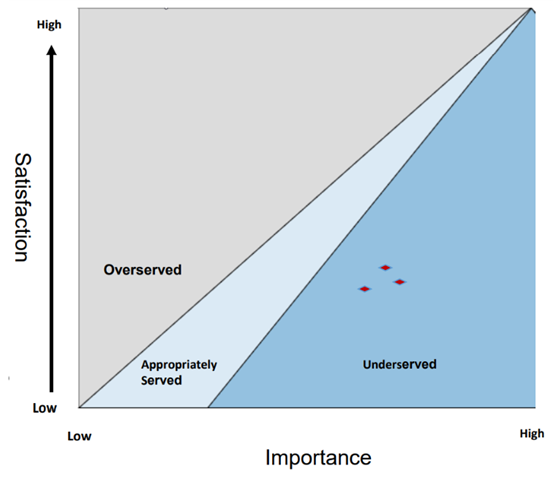

Finding a niche is one thing, but you will have a better chance of dominating a particular market if you can identify a niche with unresolved issues. It partly has to do with conducting the right study. Look at the market on which you should concentrate. You can succeed if you identify the markets that need a particular type of solution and the rivals you can outperform. You might find a definite lack of order, for instance, if you look at the healthcare or home care industries.

Particularly when it comes to technology, there is a glaring lack of forward movement in the home care sector. The absence of effective technology may mask a lack of organization. But at this point, anyone running a home care business may use software to boost their competitiveness. Additionally, it is important to consider markets where identical services and goods are already available.

Deciding which market problems to solve for your target market

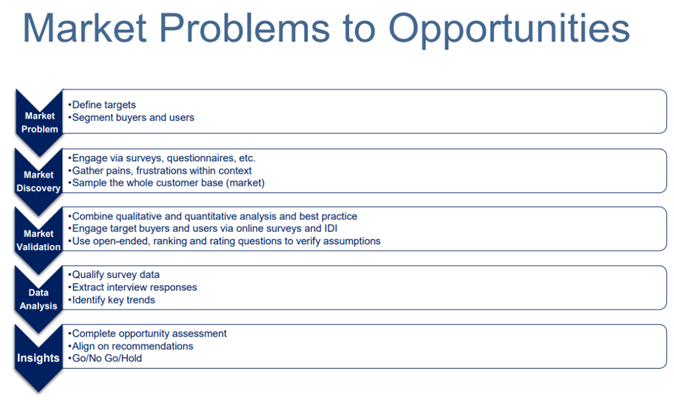

Identifying market problems

The following step is to identify their common difficulties, commonly referred to as market challenges, after you have conducted interviews with potential customers and examined the results. Although the issues facing your target market may be expressed in a variety of ways, the statistics may show consistent tendencies. Search for recurring themes or characteristics in all of the interviews.

Market issues are issues that your target market has publicly or covertly. This might be used to describe current inefficiencies, cumbersome workflows, or subpar solutions. The secret to identifying a market issue is to pay attention to complaints or “if only” statements that come up during interviews.

Market problems: Example

If you owned a company that sold gardening supplies, you would speak with gardeners to determine any issues that arise at work. Paper yard bags not remaining open during gardening could be a problem.

Even though the interviewees may have stated, “I need a better paper bag,” the issue with the market is that the bag won’t stay open. The most crucial part of this activity is identifying the issue, which is that the paper bag won’t remain open. You can choose to remedy this problem in a variety of ways, such as by using a different material or putting a paper bag ring.

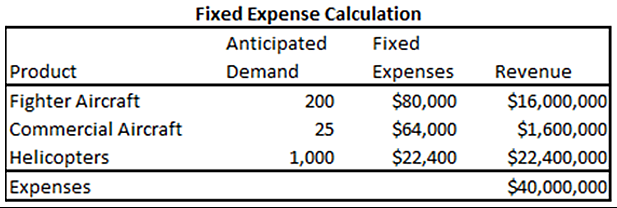

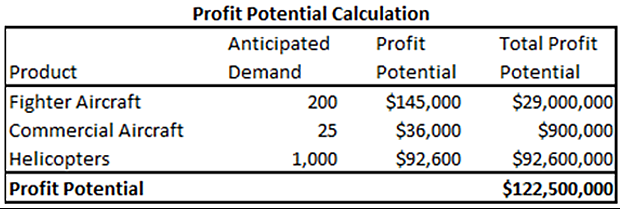

Chapter 12: Profit Potential

In order to boost profits, enter new markets.

If you are unable to expand inside your current market, you may be able to enhance sales and profitability by entering new markets. However, you shouldn’t rush into choosing to expand.

There are risks involved in both expanding into an existing market and releasing a new product. Those hazards must be properly taken into account when estimating market profitability.

What is market profitability?

Market profitability considers the monetary aspects that influence your capacity to generate earnings. These include:

• The level of interest in your product

• The ability of customers, buyers or suppliers in the market to influence your business

• Barriers to entry, such as government restrictions or limited distribution

• The potential of substitute products to affect the demand for your goods

• Competition and rivalry in the market

You might wish to consider other strategies for increasing your margins if your market study reveals weak market profitability. You can utilize a variety of strategic planning methods to aid in your market study.

Market research’s importance