Sales Growth – Workshop 1 (Growth Playbook)

The Appleton Greene Corporate Training Program (CTP) for Sales Growth is provided by Mr. Longstaffe Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr Longstaffe has over 30 years of global experience in Sales, Consulting, and Training. His extensive background is instrumental in enabling him to design and deliver well proven and effective sales training solutions which improve the performance of professional salespeople. His training programs provide an extremely relevant learning experience equipping participants with meaningful and applicable skills that result in their adoption, action and successful results.

Mr Longstaffe is the CEO of a company he founded in 1998. It is a sales consulting firm and training solutions provider. Mr Longstaffe specializes in developing highly effective, practical tools and processes to improve professional selling skills in B2B sales teams. In the Sales Growth Program he has built an entire portfolio of training modules, drawing on his expertise in Consultative Selling, Account Management, Channel Management, Competitive Selling, Negotiations and Tactical Selling Skills.

Mr Longstaffe has worked for large corporations and high-growth start-ups. He has led sales teams, built channel organizations and created highly effective training curricula. Mr Longstaffe also worked with Sir Winston Churchill’s grand-daughter to develop a unique training program based on the leadership principles of Sir Winston Churchill.

Mr Longstaffe has worked with clients across the globe from a wide range of industries including Information Technology, Telecoms, Aerospace, Financial Services and Healthcare. He has extensive experience in international sales, having worked in San Francisco, London and Australia.

Prior to establishing his training business, Mr Longstaffe worked at ODI as Managing Director of their UK operation. ODI was a leading consulting firm in organizational development, corporate alignment, strategy deployment, leadership, quality and customer care programs. There he led the turnaround of the UK operation, re-branding the company and launching their new software-based Alignment Diagnostic tool.

Prior to joining ODI, Mr Longstaffe was a Director of Esprit Consulting Ltd, a sales training company, based in London. He was critical in the expansion of international business and, as Director of Business Development, forged a Strategic Partnership with KPMG. He succeeded in winning significant seven figure training projects with many global IT companies, and he opened new offices in San Francisco. On his return to the UK, he managed the global operations of Esprit with responsibility for the network of Channel Partners both in the UK and Overseas.

Mr Longstaffe began his career in Sales and Management with Jardine Matheson & Co in Hong Kong. Following his graduate training program, he took his first sales role as a new business sales executive in the air cargo subsidiary, Jardine Cargo International. He won the prestigious ‘Freight Forwarder of the Year’ award in his first year in the industry and immediately became the top performing sales executive in the company, a position he maintained until being promoted to Branch Manager. He built the most profitable branch office in the UK and was appointed Regional Sales Manager on the West Coast USA.

Mr Longstaffe has an MA (Hons) and BA (Hons) from Emmanuel College, Cambridge University, UK.

MOST Analysis

Mission Statement

Our mission for the Sales Growth Program is to help you develop the necessary Consultative Selling process and skills to enable you to differentiate yourselves from your competition and to win more business. Your mission is to apply the new process and skills to achieve a lasting change in process and behavior which will enable you and your team to sustain the performance improvement long-term.

Along the way, you will learn new techniques and be introduced to new process tools which are all designed to help you achieve this goal. In this first workshop we will focus on the fundamentals of Consultative Selling, and you will start to develop your own Sales Growth Playbook. You will be adding to this playbook throughout the program so that by the end of the program you have a detailed roadmap to follow and a handbook to help you grow.

In simple terms, our mission here is to help you find new ways to grow more revenue, more profitably.

Objectives

To accomplish our mission for this first workshop, you will need to achieve the following objectives for each of the 12 modules. The specific objective for each modules are as follows, By the end of each of the modules, participants will be able to:

01. Introduction to Consultative Selling – Define what Consultative Selling will mean for you and what changes you will make to your sales process and strategy. ?Time Allocated: 1 Month

02. Getting Involved Early – Determine when you usually get involved in the customer’s buying cycle and develop ideas for getting involved earlier. ?Time Allocated: 1 Month

03. Creating Competitive Differentiation – identify new ideas?Time Allocated: 1 Month

04. Providing Insight – identify ways to provide insight to your customers through new ideas, problem solving and being more consultative.Time Allocated: 1 Month

05. The Sales Growth Playbook – create the framework for your own Playbook based on your goals.Time Allocated: 1 Month

06. Company Overview – determine what is most important in terms of your company overview and what do we need to include: key messages, and your ‘WHY?’Time Allocated: 1 Month

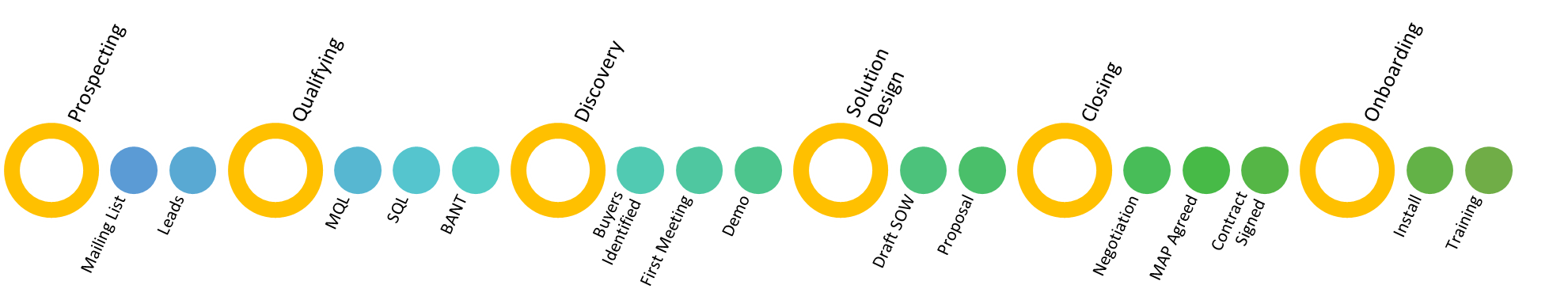

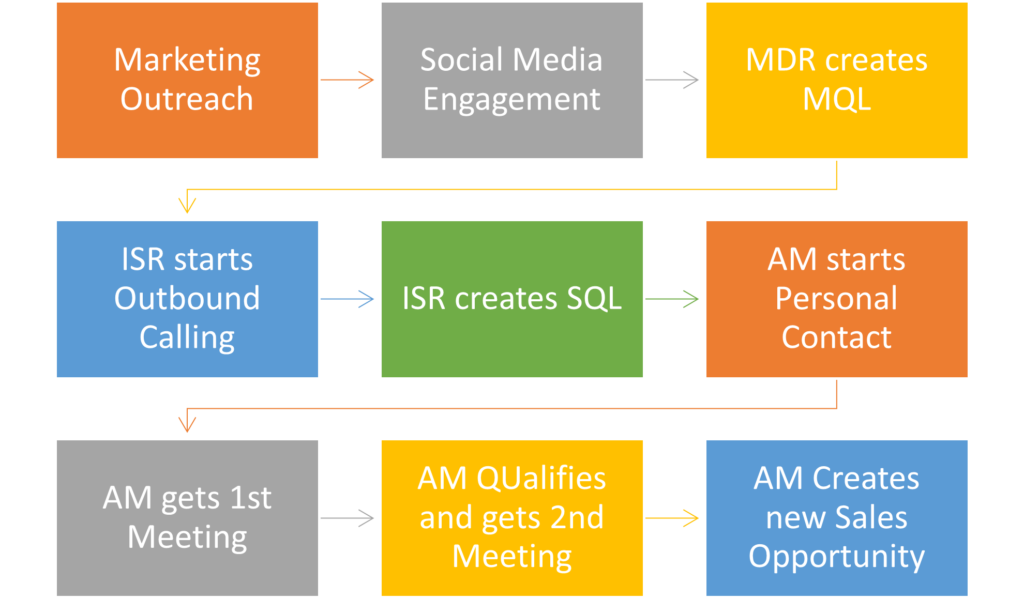

07. Sales Strategy and Process – produce a flow diagram to document your sales process from lead to close, with an outline defining each step. Time Allocated: 1 Month

08. Go-To- Market Strategy – define your strategy and Rules of Engagement for key components like demo’s and proof of concepts.Time Allocated: 1 Month

09. Strategic Sales Plays – define the actions required to implement each of the 3 key strategic sales plays: New, Renew, Expand. Time Allocated: 1 Month

10. Tactical Sales Plays – design a sample structure for a replicable sales play as the basis for adding more later.Time Allocated: 1 Month

11. Key Sales Metrics – agree what are the most important sales metrics, and decide how will you track and measure them.Time Allocated: 1 Month

12. Incentives and Compensation – determine whether the commission structure is effective, decide what else is needed.Time Allocated: 1 Month

Strategies

Throughout the Sales Growth Program we will be employing a consistent development methodology to provide you with the Strategies you need to accomplish the mission and goals for each workshop. This will include your active participation in the workshop combined with the required reading and preparation and a series of integrated exercises. These exercises will include:

• Individual Exercises – to challenge you to find innovate new ways to apply some of the new techniques and ideas to your own real world situation

• Team Exercises – to help you work in small groups to solve problems together and select the best solutions and ways forward to implement the new tools and techniques

• Brainstorming exercises – using whiteboards and flipcharts to share information and ideas in a collaborative team activity

• Written tasks – to help you define and record detailed processes and document a plan for the implementation

• Role-plays – to enable you to practice new ideas and skills in a safe learning environment before you try them for real with customers

• Sharing experiences – to enable everyone to learn from each other and maximize the power of team cooperation

Tasks

In this first workshop you will focus on completing the following tasks at the end of each module and within the 1 month period before the second workshop:

01. Introduction: Define what Consultative Selling means and define specific goals/actions you need to take to enhance your current sales approach. 1 Month.

02. Getting Involved Early: Determine when you usually get involved in the customer’s buying cycle and define ideas for getting involved earlier. 1 Month.

03. Creating Competitive Differentiation: using the 4 sources of differentiation discussed, define a list of actions to improve your competitive differentiation in the eyes of the customer. 1 Month.

04. 1. Providing Insight: Develop ideas for providing insight in sales meetings with current customers and prospects using the 3 types of insight discussed in this module. 1 Month.

05. Sales Growth Playbook: Develop the structure and ‘Table of Contents’ for your own Sales Growth playbook, defining the chapters and identify any external input needed. 1 Month.

06. Company Overview: Define the opening chapter of the playbook with a clearly define company story and value proposition. 1 Month.

07. Sales Strategy and Process: Produce a flow diagram to document your sales process from lead to close, with an outline defining each step. 1 Month.

08. Go-To-Market Strategy: Define your strategy and Rules of Engagement for key components of your strategy such as demo’s and proof of concepts. 1 Month.

09. Strategic Sales Plays: Define the actions required to implement each of the 3 key strategic sales plays: New, Renew, Expand. 1 Month.

10. Tactical Sales Plays: using the sample structure for a replicable sales play, complete at least one replicable tactical sales play. 1 Month.

11. Key Sales Metrics: Define your key metrics, develop a plan for data collection and highlight immediate actions required to make this an effective team metric. 1 Month.

12. Incentives and Compensation: create a 3/6/12 month plan to define what actions you will take in the next year to achieve your personal sales goals. 1 Month.

Introduction

Workshop 1 is designed to set the scene for the entire program. It will provide participants with a strong foundation on which to build their SALES GROWTH skills and processes. The workshop starts by helping participants to understand the critical importance of developing real Consultative Selling techniques which form the bedrock of the whole program.

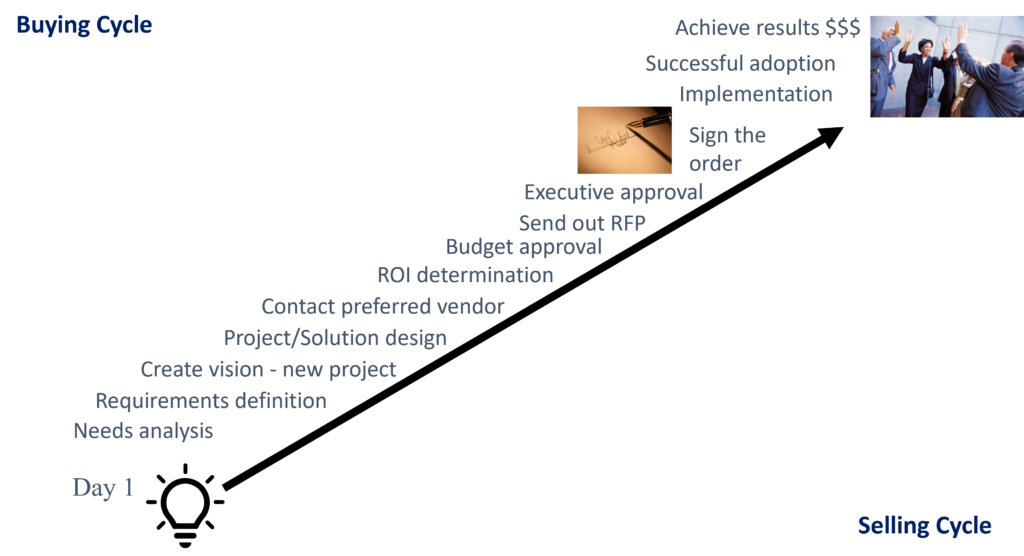

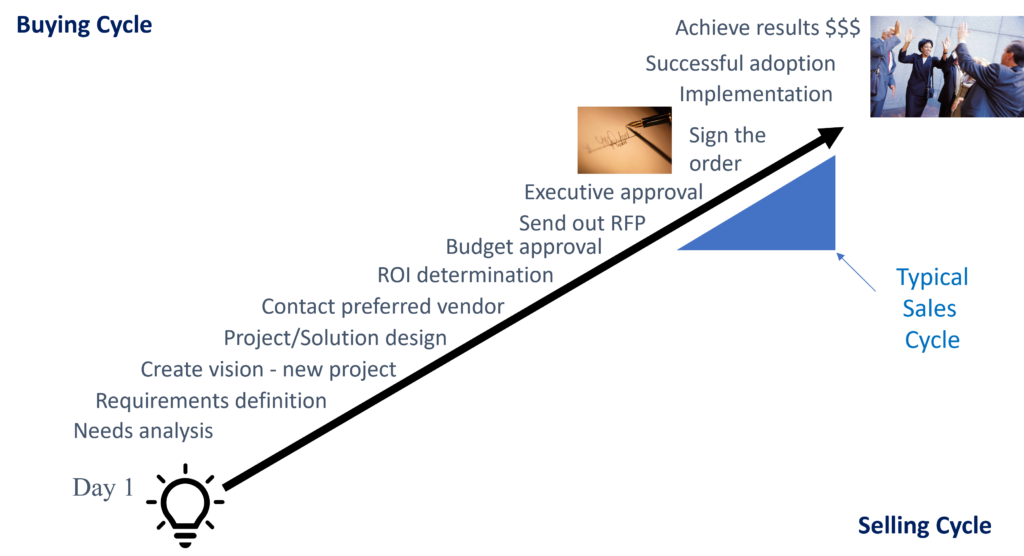

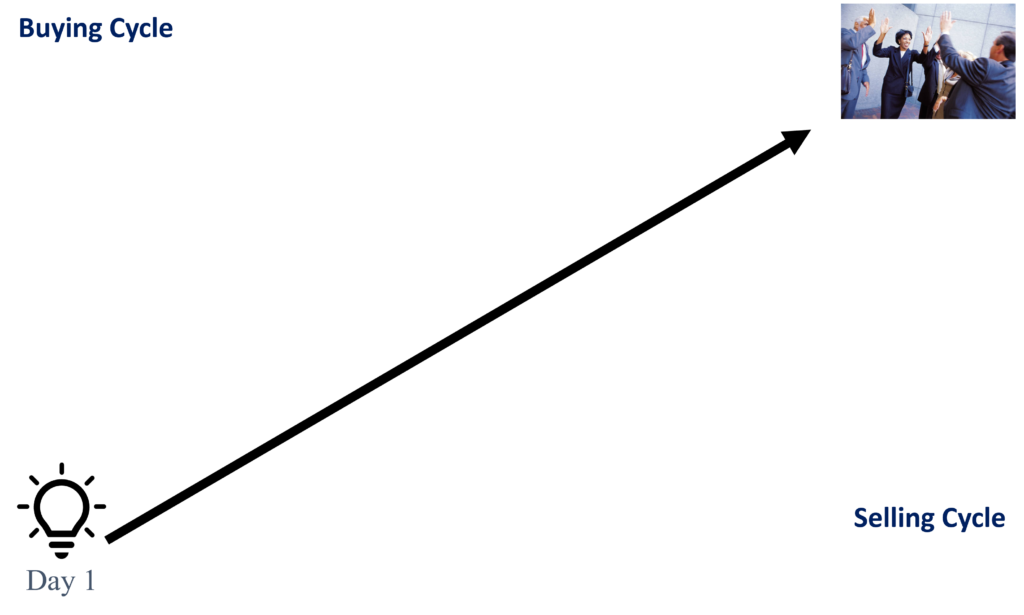

One of the essential tenets of the program is that participants can become more successful by being more effective and more efficient in their sales process. This is possible as a result of, for example, shortening the sales cycle by aligning the sales cycle with the customer buying cycle and making sure that more is achieved in every sales meeting and customer interaction. This process starts by developing more of a focus on the customer and by looking for ways in which the participants can deliver insight and ideas which will differentiate the participants from other salespeople through the way they sell, not just through what they sell.

This first workshop seeks to explain why this approach is necessary and it sheds light on what can be accomplished if sales teams are able to make this transition. The rest of this workshop focuses on the development of a Sales Growth Playbook which participants will use to create their own operating manual for Sales Growth.

Each element of the Sales Growth Playbook is explained in detail. Each module provides new material and challenges existing thinking. It explains what is required and provides examples of how participants can apply these new tools and techniques to their personal sales environment. As participants move through his first workshop they are building a framework for their own Sales Growth Playbook, this then forms the basis of the Work Study which follows the workshop, so that participants will gradually develop a comprehensive Playbook of their own.

The Sales Growth Playbook starts at the high-level and then develops into Strategic Sales Plays and Tactical Sales Plays. Each of their new approaches is explained and participants will construct their own sales-plays which can be applied to improve their own sales success.

Towards the end of the first workshop, we turn our attention to Sales Metrics and Incentives. Participants are encouraged to consider new metrics which will enable them to track their progress in Consultative Selling throughout the program. The workshop concludes with a discussion on incentives and compensation to help determine whether the company has in place the right metrics, incentives and compensation structure to reward the type of behavior change which the teams are aiming to achieve.

Armed with an in-depth understanding of what a consultative approach really means, and equipped with a new Playbook to guide them, participants are ready to embrace change and motivated to build the new consultative selling techniques which are covered in detail in the subsequent workshops in the program.

Executive Summary

Chapter 1: Introduction to Consultative Selling

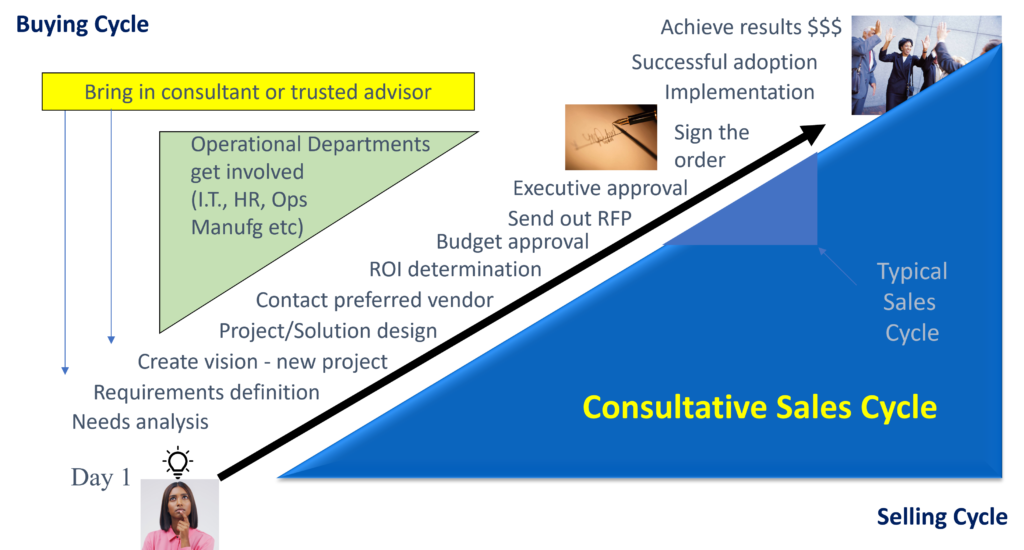

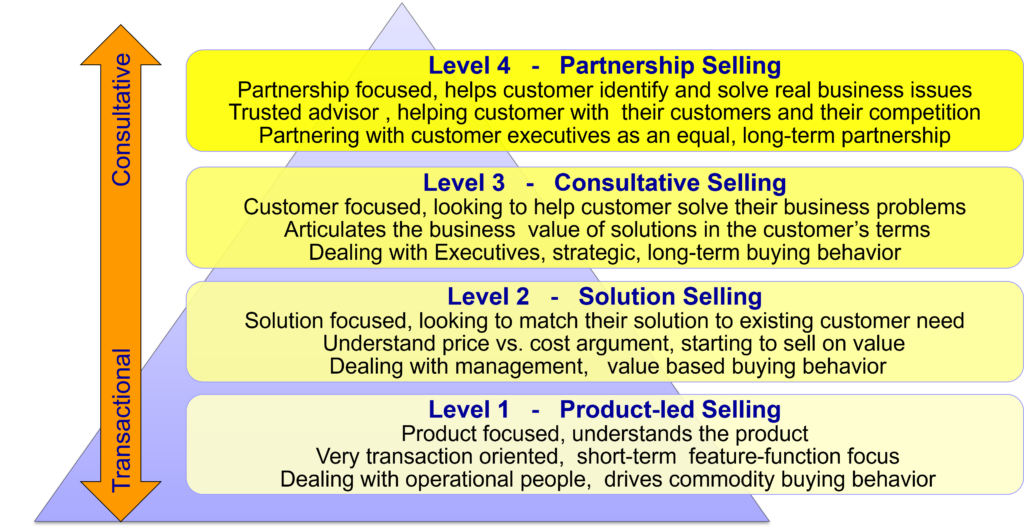

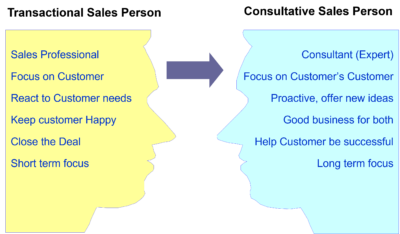

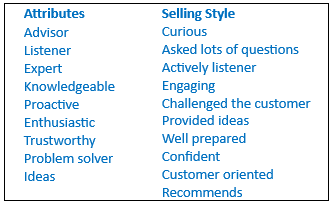

As the introduction to the Sales Growth program this Chapter will provide the foundation for the development of your Consultative Selling Skills and Process which will enable you to differentiate yourselves from your competition. For many salespeople, educated in a more basic, customer needs-based approach, this represents a major challenge. A traditional, ‘needs-based’ sales process assumes that the customer already knows what they need. The role of the salesperson is then simply to provide a solution to those needs. However, in that environment, salespeople can add very little value to the customer’s buying process. In fact, current research suggests that most customers have already undertaken 54% of their buying journey before they even contact a salesperson. At that point they believe they already know what they need and increasingly they are looking for a friction-less buying process, often one which can be conducted online, and does not include a salesperson at all.

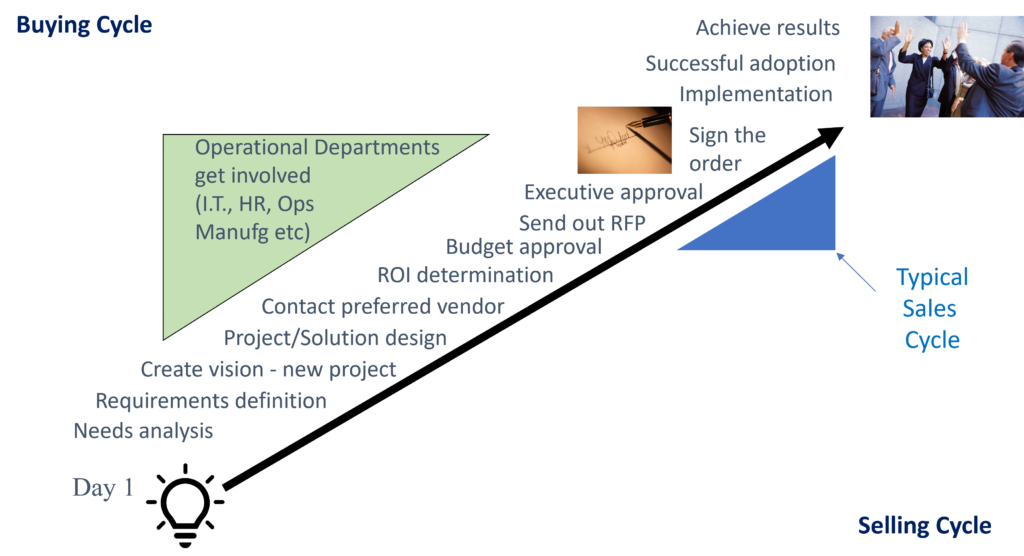

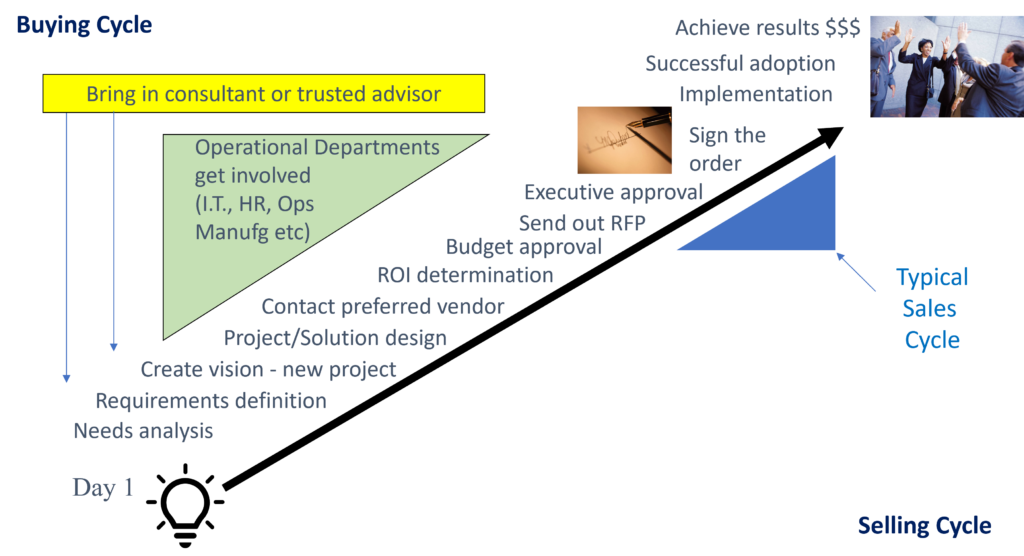

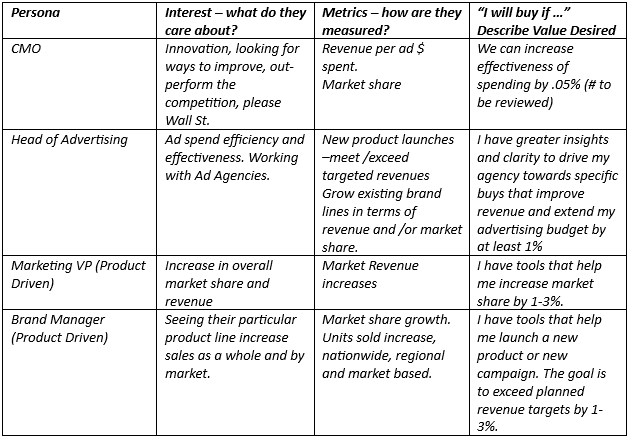

A more consultative sales approach requires salespeople to get involved earlier in the buying cycle. This means developing trust with many people in the customer team, challenging them a little, helping them by providing the insight and ideas they need in order to win against their competitors. In this first Chapter we explore in more detail the characteristics of this consultative approach and what differentiates this from a traditional, product-led sales approach.

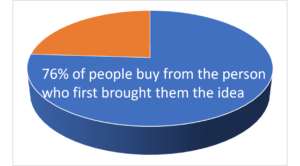

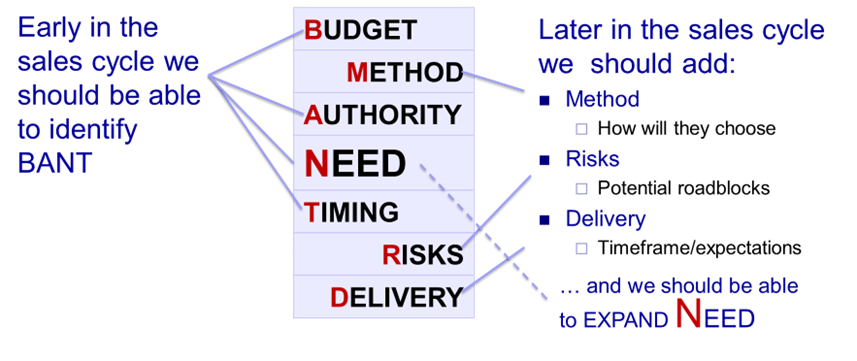

Chapter 2: Getting Involved Early

As we learned in the first Chapter, getting involved earlier in the customer buying process is a key success factor for salespeople to be effective in a consultative sales approach. The importance of this was validated in recent research by Gartner that showed that 76% of customers choose the buy from the company that first brought them the idea. Knowing this is an essential building block for your consultative selling methodology. It means you need to get involved much earlier in the buying cycle than most salespeople think. Doing this is not easy. It requires some fundamental changes in sales technique and sales process. A key part of this new strategy is to identify the parts of the customer organization where the buying cycle is actually initiated. Where is the idea born? This is usually outside the traditional target audience of the product-led salesperson. How will you identify where to start? How will you develop the credibility to be able to approach these new buyers? This Chapter focuses on what you need to do to start developing these new skills.

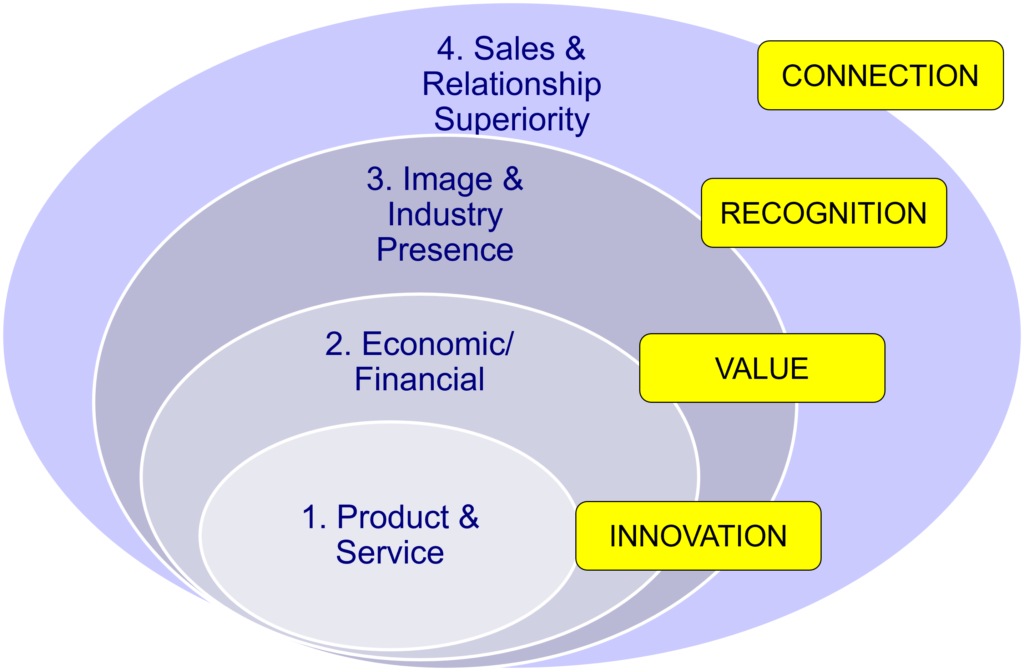

Chapter 3: Creating Competitive Differentiation

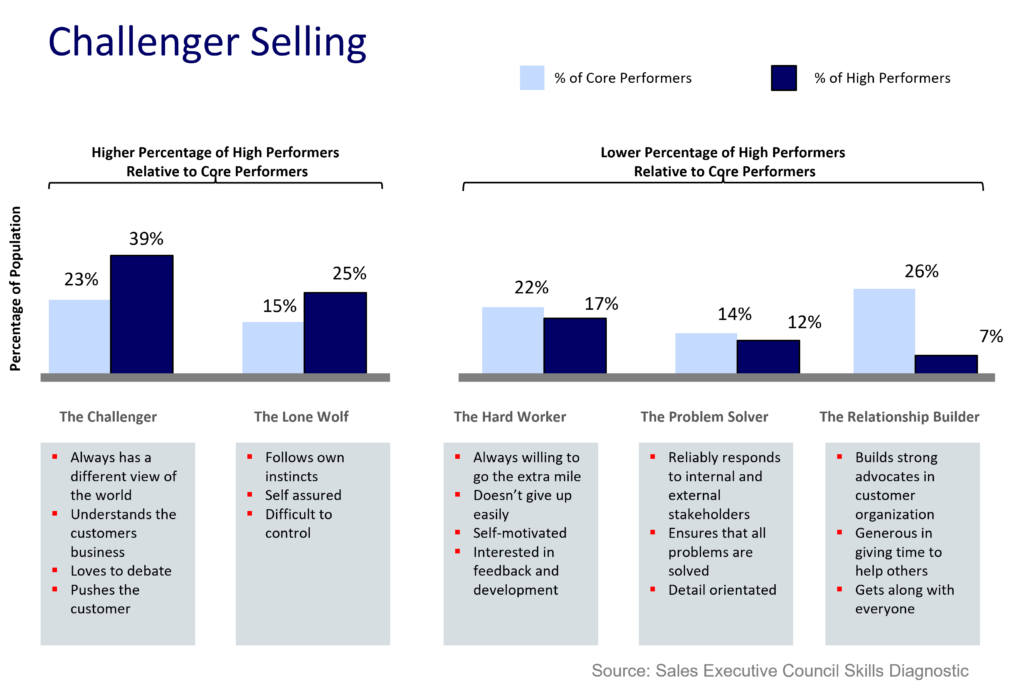

Much of this Sales Growth program, and the very essence of consultative selling, relates to the fact that salespeople need to start differentiating themselves from other salespeople, not through the products they sell, but through the WAY they sell. In other words, the salespeople themselves are the key differentiator.

This chapter explores the sources of competitive differentiation and looks at the way in which salespeople can influence them. It deals with the fact that some of these factors are outside the sales teams’ control, but there are things that individual professionals can do to make a difference.

In a highly competitive marketplace where customers have many valid potential suppliers to choose from, this personal, professional, differentiation can make all the difference.

Chapter 4: Providing Insight

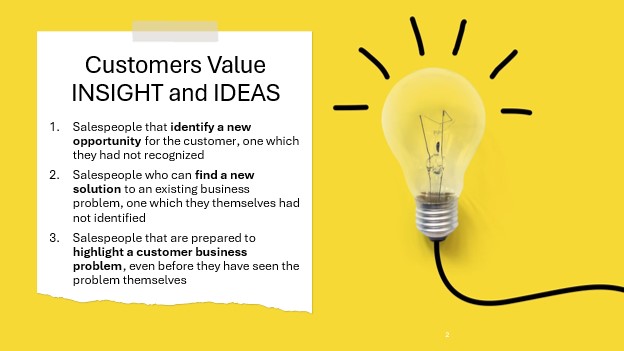

Developing credibility with new buyers requires a different approach. The very essence of a consultative approach is that the salesperson focuses on the customer rather than on their own product. Of course, they must have the basic product knowledge, but that is a foundational requirement, not a differentiator in the eyes of the customer. Research identifies that there were 3 reasons why managers and executives in a customer organization would agree to meet with a salesperson – and wanting to learn about their products and services was not one of them! The key is that customers are looking for insight and ideas. In other words, if they want to learn about your products and services, they can simply look at your website. When they meet with a salesperson, they want to learn something new. Something they do not know already and something that they are not likely to learn from your competition.

So, the first reason they would meet with a salesperson is if they felt the salesperson could provide some new insight or ideas regarding new business opportunities for their business. This means that salespeople need to apply a forward-looking insight to consider the customer’s customer. i.e. to look beyond the immediate customer and think of ways in which that customer can improve what they do for their customers.

The second reason why a customer will meet with a salesperson is if they believe the salesperson can help them to find new solutions to an existing business problem. This requires that the salesperson has sufficient knowledge and understanding of the customer’s business, and the industry in which they operate, to be able to offer insight and ideas which go beyond what the customer might themselves have already considered. Again, if they have already thought of the solution, the salesperson is not adding any value, the customer has already identified their pain and the likely solution. They want to hear from salespeople who can provide insight by suggesting new ideas and offering different types of solution.

Consultative salespeople can do this because they have industry knowledge and insight, they develop experience and expertise in a particular industry, and they see many different companies in that industry providing them with a unique perspective which the customer themselves might lack.

The third, and more challenging reason why a customer will meet with a salesperson is if they feel that the salesperson has the potential to become a true trusted advisor. This is someone who can offer insight and ideas about their business by helping the customer to avoid potential future problems and roadblocks. Consultative salespeople can do this because they are experts in their field. The value they provide goes far beyond their products and services and lies in providing their customers which an ability to beat their competitors by being better prepared for change and being better equipped to capitalize on new opportunities.

Another factor that goes hand-in-hand with this approach is that customers only want to meet with salespeople who they believe can get things done within their own organization. This means that they need to see the salesperson as an effective virtual team leader, marshalling the resources of their company, as and when needed, to help the customer accomplish their goals.

Chapter 5: The Sales Growth Playbook

Having developed a foundational understanding of consultative selling, this Chapter will help you develop your new ‘Sales Growth Playbook’. This will include what needs to be done to include all the key stakeholders who will need to support the changes in the process and new process implementation for the sales teams. You are basically building a roadmap for change. You will add to this Sales growth Playbook throughout the course.

A Sales Growth Playbook becomes the handbook which sales teams use every day for help, advice and counsel on what they need to do to become more consultative. You will decide what specific chapters you think should be included in your Playbook and use the framework to create a Sales Growth Playbook which exactly suits your company and your industry. The following workshops will address specific sections that should be in every playbook. If your company already has a playbook this is an opportunity to re-open it, dust it off, and see if it is still valid, and to identify what updates might be needed to ensure that your Sales Growth Playbook aligns with the strategy to become a truly consultative sales organization.

Chapter 6: Company Overview

The Sales Growth Playbook should start with a comprehensive overview of your company. Imagine trying to explain what your company does to people in a number of scenarios: How would you explain it to a sibling or a friend? How would you explain it to a stranger that you meet at a cocktail party or on a plane? How would you explain it a new contact at an existing customer, or to a senior executive in a new prospect?

This chapter seeks to get to the essence of your new consultative positioning statement. In a later workshop we will do a deeper dive into specific value propositions, but the chapter seeks to help you get grounded in the new messaging. We also explore whether you can articulate the company “WHY?” Using Simon Sinek’s simple structure, we will help you articulate the ‘WHY?’.

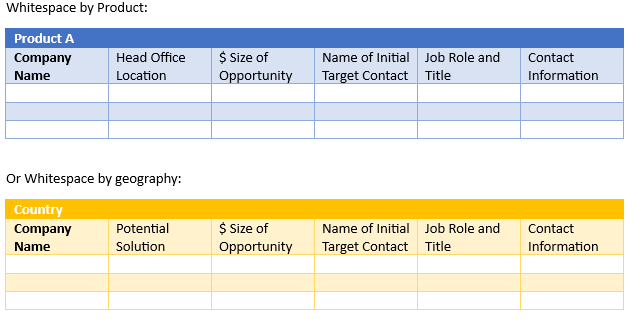

Chapter 7: Sales Strategy and Process

Effective sales teams follow a consistent strategy and have clearly defined processes for every part of their sales campaigns. This chapter looks at the basics of what is required and will produce the building blocks for how these processes will be developed and fine-tuned in later workshops. You will map out your current sales strategy and create flow-charts to describe the process. You will look for ways to improve these and determine whether or not you need different ‘plays’ for different types of sale. How does the process for a customer renewal differ from a sale to a new prospect? What is the sale-play for a cold-calling prospect differ from an opportunity for Expansion? These sales plays will define how the sales teams interacts with other parts of the customer-facing teams and will include inputs required from other departments such as Marketing, Customer Success and Service/Support.

Chapter 8: Go-To-Market Strategy

To what extent is your marketing strategy aligned with your new sales strategy? Is your organization still focused on selling products which will engender a commodity-based buying behavior? What needs to change? This chapter will focus on making sure that the sales teams have all the tools and support they need in order to make their move to a more consultative sales approach successful.

You will analyze your current solution-set and identify those products and services that align with the goal of providing real insight and ideas to the customer. We will review sales messaging and identify any changes in messaging which might be needed by other parts of the organization in order to better represent the consultative nature of the sales team. We will identify your best sellers in terms of products and why. We will also look to the future to include the strategy needed to lay the groundwork for new products which are coming in the future and ensure we are introducing these as insightful solutions to real customer needs, rather than simply ‘flashy’ new objects which create excitement but have a short shelf-life in terms of real competitive differentiation.

Chapter 9: Strategic Sales Plays

As you know, your Sales Growth Playbook is going to become your handbook for how to grow your sales revenue. Within the handbook, this section will focus on the Strategic Sales Plays which will help you to direct your efforts. The next section deals with more tactical plays. You can think of the two being slightly different but still closely related.

Strategic Sales plays are the major plans than will address the key fields of play in which you are going to operate. These are typically referred to as LAND, EXPAND and RENEW. The concept is that initially you have a strategy to break-in to a new account. This is your LAND strategy. When successful you will have won some business with this customer, but perhaps there is more to win later. The next Strategic Play is therefore to EXPAND your initial business to develop a higher revenue stream. This might be achieved by selling to other divisions or to new geographic areas. Having Landed and Expanded, your next strategic play is to RENEW the business that you have already won and therefore you have a Strategic Play which is focused on renewal and recommitment from the customer.

For some business this Renewal may be in the form of a 1-3 year contract renewal. For others it may be that the customer will only ‘renew’ so to speak, when they re-purchase a similar or upgraded product or solution in the future. For some businesses, the strategic play for renew is focused on securing a service contract at the end of a warranty period.

Chapter 10: Tactical Sales Plays

Tactical sales plays are more specific than Strategic plays. You will typically only have a handful of Strategic Plays, but you are likely to build dozens of these more tactical plays. If you think about this from a sporting perspective, you might have an Offence and Defence (Strategic) Play but within each of these you will have many different tactical plays based on where you are in the field and what the competition is doing.

Furthermore, your strategic plays, being more high-level, can be similar for different types of customer and the same across multiple geographies. Whereas your tactical plays are more likely to vary for each market and each product-line. You will build your sales plays to be specific to the producsta dn solutions that you are selling. You will add to them over time and these will be more likely to adapt and porph with time.

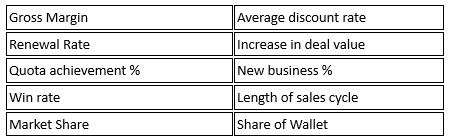

Chapter 11: Key Sales Metrics

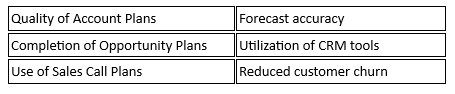

How will you know whether you have been successful in implementing the new ideas from this Sales Growth Program? What will be your success measures? What are the KPI’s or CSF’s? The process starts by thinking about key metrics and measures that can help you ‘move the needle’ in terms of higher sales revenue. We will focus on defining key sales goals: beyond simply sales revenue. It takes time to make significant changes in behavior and even longer for those changes to bear fruit in terms of increased revenue.  Of course, increased revenue and higher profitability are the ultimate goals but using these measures to track our growth toward the future is like driving by looking in the rear-view mirror. They tell us what has happened in the past, but they are lagging indicators. We want to identify some ‘leading indicators’ that can give us a better indication that we are on the right track.

Of course, increased revenue and higher profitability are the ultimate goals but using these measures to track our growth toward the future is like driving by looking in the rear-view mirror. They tell us what has happened in the past, but they are lagging indicators. We want to identify some ‘leading indicators’ that can give us a better indication that we are on the right track.

You will develop some new measures for yourselves. These might include things like shorter sales cycles, closing higher value deals, winning more repeat business, expanding sales territories, launching new products, selling high and wide within large accounts, developing an effective ‘land and expand’ strategy or breaking into new accounts. The output from this project study is a Sales Growth Playbook which will guide you on your sales development journey.

Chapter 12: Incentives and Compensation

There is an old adage that says “What you measure, is what you get”. This is never more true than when you consider the way in which salespeople are measured and compensated. In sales, this translates to “salespeople sell what they are paid to sell”. Therefore, getting the sales compensation element right is critical to any effective change management process aimed at successfully helping a sales organization to make the transition from being a product-focused sales team to being more consultative. For example, there is no point in asking, or telling, sales teams to sell larger deals and to be more consultative, and then continue to pay them to make small, transactional sales at a commodity level. This chapter seeks to analyze what is really motivating the salespeople and how you can adapt the compensation plan to support the changes in sales behavior that you are trying to make. In this final Chapter in the initial workshop, we will focus on fine-tuning your sales compensation and sales incentives to encourage the sales behavior that you want to see.

Curriculum

Sales Growth – Workshop 1– Growth Playbook

- Introduction to Consultative Selling

- Getting Involved Early

- Creating Competitive Differentiation

- Providing Insight

- The Sales Growth Playbook

- Company Overview

- Sales Strategy and Process

- Go-To-Market Strategy

- Strategic Sales Plays

- Tactical Sales Plays

- Key Sales Metrics

- Incentives and Compensation

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Sales Growth corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family know when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they don’t! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change, is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast

As a guide, the Appleton Greene Sales Growth corporate training program should take 12-18 months to complete, depending upon your availability and current commitments. The reason why there is such a variance in time estimates is because every student is an individual, with differing productivity levels and different commitments. These differentiations are then exaggerated by the fact that this is a distance-learning program, which incorporates the practical integration of academic theory as an as a part of the training program. Consequently all of the project studies are real, which means that important decisions and compromises need to be made. You will want to get things right and will need to be patient with your expectations in order to ensure that they are. We would always recommend that you are prudent with your own task and time forecasts, but you still need to develop them and have a clear indication of what are realistic expectations in your case. With reference to your time planning: consider the time that you can realistically dedicate towards study with the program every week; calculate how long it should take you to complete the program, using the guidelines featured here; then break the program down into logical modules and allocate a suitable proportion of time to each of them, these will be your milestones; you can create a time plan by using a spreadsheet on your computer, or a personal organizer such as MS Outlook, you could also use a financial forecasting software; break your time forecasts down into manageable chunks of time, the more specific you can be, the more productive and accurate your time management will be; finally, use formulas where possible to do your time calculations for you, because this will help later on when your forecasts need to change in line with actual performance. With reference to your task planning: refer to your list of tasks that need to be undertaken in order to achieve your program objectives; with reference to your time plan, calculate when each task should be implemented; remember that you are not estimating when your objectives will be achieved, but when you will need to focus upon implementing the corresponding tasks; you also need to ensure that each task is implemented in conjunction with the associated training modules which are relevant; then break each single task down into a list of specific to do’s, say approximately ten to do’s for each task and enter these into your study plan; once again you could use MS Outlook to incorporate both your time and task planning and this could constitute your study plan; you could also use a project management software like MS Project. You should now have a clear and realistic forecast detailing when you can expect to be able to do something about undertaking the tasks to achieve your program objectives.

Performance management

It is one thing to develop your study forecast, it is quite another to monitor your progress. Ultimately it is less important whether you achieve your original study forecast and more important that you update it so that it constantly remains realistic in line with your performance. As you begin to work through the program, you will begin to have more of an idea about your own personal performance and productivity levels as a distance-learner. Once you have completed your first study module, you should re-evaluate your study forecast for both time and tasks, so that they reflect your actual performance level achieved. In order to achieve this you must first time yourself while training by using an alarm clock. Set the alarm for hourly intervals and make a note of how far you have come within that time. You can then make a note of your actual performance on your study plan and then compare your performance against your forecast. Then consider the reasons that have contributed towards your performance level, whether they are positive or negative and make a considered adjustment to your future forecasts as a result. Given time, you should start achieving your forecasts regularly.

With reference to time management: time yourself while you are studying and make a note of the actual time taken in your study plan; consider your successes with time-efficiency and the reasons for the success in each case and take this into consideration when reviewing future time planning; consider your failures with time-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future time planning; re-evaluate your study forecast in relation to time planning for the remainder of your training program to ensure that you continue to be realistic about your time expectations. You need to be consistent with your time management, otherwise you will never complete your studies. This will either be because you are not contributing enough time to your studies, or you will become less efficient with the time that you do allocate to your studies. Remember, if you are not in control of your studies, they can just become yet another cause of stress for you.

With reference to your task management: time yourself while you are studying and make a note of the actual tasks that you have undertaken in your study plan; consider your successes with task-efficiency and the reasons for the success in each case; take this into consideration when reviewing future task planning; consider your failures with task-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future task planning; re-evaluate your study forecast in relation to task planning for the remainder of your training program to ensure that you continue to be realistic about your task expectations. You need to be consistent with your task management, otherwise you will never know whether you are achieving your program objectives or not.

Keeping in touch

You will have access to qualified and experienced professors and tutors who are responsible for providing tutorial support for your particular training program. So don’t be shy about letting them know how you are getting on. We keep electronic records of all tutorial support emails so that professors and tutors can review previous correspondence before considering an individual response. It also means that there is a record of all communications between you and your professors and tutors and this helps to avoid any unnecessary duplication, misunderstanding, or misinterpretation. If you have a problem relating to the program, share it with them via email. It is likely that they have come across the same problem before and are usually able to make helpful suggestions and steer you in the right direction. To learn more about when and how to use tutorial support, please refer to the Tutorial Support section of this student information guide. This will help you to ensure that you are making the most of tutorial support that is available to you and will ultimately contribute towards your success and enjoyment with your training program.

Work colleagues and family

You should certainly discuss your program study progress with your colleagues, friends and your family. Appleton Greene training programs are very practical. They require you to seek information from other people, to plan, develop and implement processes with other people and to achieve feedback from other people in relation to viability and productivity. You will therefore have plenty of opportunities to test your ideas and enlist the views of others. People tend to be sympathetic towards distance-learners, so don’t bottle it all up in yourself. Get out there and share it! It is also likely that your family and colleagues are going to benefit from your labors with the program, so they are likely to be much more interested in being involved than you might think. Be bold about delegating work to those who might benefit themselves. This is a great way to achieve understanding and commitment from people who you may later rely upon for process implementation. Share your experiences with your friends and family.

Making it relevant

The key to successful learning is to make it relevant to your own individual circumstances. At all times you should be trying to make bridges between the content of the program and your own situation. Whether you achieve this through quiet reflection or through interactive discussion with your colleagues, client partners or your family, remember that it is the most important and rewarding aspect of translating your studies into real self-improvement. You should be clear about how you want the program to benefit you. This involves setting clear study objectives in relation to the content of the course in terms of understanding, concepts, completing research or reviewing activities and relating the content of the modules to your own situation. Your objectives may understandably change as you work through the program, in which case you should enter the revised objectives on your study plan so that you have a permanent reminder of what you are trying to achieve, when and why.

Distance-learning check-list

Prepare your study environment, your study tools and rules.

Undertake detailed self-assessment in terms of your ability as a learner.

Create a format for your study plan.

Consider your study objectives and tasks.

Create a study forecast.

Assess your study performance.

Re-evaluate your study forecast.

Be consistent when managing your study plan.

Use your Appleton Greene Certified Learning Provider (CLP) for tutorial support.

Make sure you keep in touch with those around you.

Tutorial Support

Programs

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. They are implemented over a sustainable period of time and professional support is consistently provided by qualified learning providers and specialist consultants.

Support available

You will have a designated Certified Learning Provider (CLP) and an Accredited Consultant and we encourage you to communicate with them as much as possible. In all cases tutorial support is provided online because we can then keep a record of all communications to ensure that tutorial support remains consistent. You would also be forwarding your work to the tutorial support unit for evaluation and assessment. You will receive individual feedback on all of the work that you undertake on a one-to-one basis, together with specific recommendations for anything that may need to be changed in order to achieve a pass with merit or a pass with distinction and you then have as many opportunities as you may need to re-submit project studies until they meet with the required standard. Consequently the only reason that you should really fail (CLP) is if you do not do the work. It makes no difference to us whether a student takes 12 months or 18 months to complete the program, what matters is that in all cases the same quality standard will have been achieved.

Support Process

Please forward all of your future emails to the designated (CLP) Tutorial Support Unit email address that has been provided and please do not duplicate or copy your emails to other AGC email accounts as this will just cause unnecessary administration. Please note that emails are always answered as quickly as possible but you will need to allow a period of up to 20 business days for responses to general tutorial support emails during busy periods, because emails are answered strictly within the order in which they are received. You will also need to allow a period of up to 30 business days for the evaluation and assessment of project studies. This does not include weekends or public holidays. Please therefore kindly allow for this within your time planning. All communications are managed online via email because it enables tutorial service support managers to review other communications which have been received before responding and it ensures that there is a copy of all communications retained on file for future reference. All communications will be stored within your personal (CLP) study file here at Appleton Greene throughout your designated study period. If you need any assistance or clarification at any time, please do not hesitate to contact us by forwarding an email and remember that we are here to help. If you have any questions, please list and number your questions succinctly and you can then be sure of receiving specific answers to each and every query.

Time Management

It takes approximately 1 Year to complete the Sales Growth corporate training program, incorporating 12 x 6-hour monthly workshops. Each student will also need to contribute approximately 4 hours per week over 1 Year of their personal time. Students can study from home or work at their own pace and are responsible for managing their own study plan. There are no formal examinations and students are evaluated and assessed based upon their project study submissions, together with the quality of their internal analysis and supporting documents. They can contribute more time towards study when they have the time to do so and can contribute less time when they are busy. All students tend to be in full time employment while studying and the Sales Growth program is purposely designed to accommodate this, so there is plenty of flexibility in terms of time management. It makes no difference to us at Appleton Greene, whether individuals take 12-18 months to complete this program. What matters is that in all cases the same standard of quality will have been achieved with the standard and bespoke programs that have been developed.

Distance Learning Guide

The distance learning guide should be your first port of call when starting your training program. It will help you when you are planning how and when to study, how to create the right environment and how to establish the right frame of mind. If you can lay the foundations properly during the planning stage, then it will contribute to your enjoyment and productivity while training later. The guide helps to change your lifestyle in order to accommodate time for study and to cultivate good study habits. It helps you to chart your progress so that you can measure your performance and achieve your goals. It explains the tools that you will need for study and how to make them work. It also explains how to translate academic theory into practical reality. Spend some time now working through your distance learning guide and make sure that you have firm foundations in place so that you can make the most of your distance learning program. There is no requirement for you to attend training workshops or classes at Appleton Greene offices. The entire program is undertaken online, program course manuals and project studies are administered via the Appleton Greene web site and via email, so you are able to study at your own pace and in the comfort of your own home or office as long as you have a computer and access to the internet.

How To Study

The how to study guide provides students with a clear understanding of the Appleton Greene facilitation via distance learning training methods and enables students to obtain a clear overview of the training program content. It enables students to understand the step-by-step training methods used by Appleton Greene and how course manuals are integrated with project studies. It explains the research and development that is required and the need to provide evidence and references to support your statements. It also enables students to understand precisely what will be required of them in order to achieve a pass with merit and a pass with distinction for individual project studies and provides useful guidance on how to be innovative and creative when developing your Unique Program Proposition (UPP).

Tutorial Support

Tutorial support for the Appleton Greene Sales Growth corporate training program is provided online either through the Appleton Greene Client Support Portal (CSP), or via email. All tutorial support requests are facilitated by a designated Program Administration Manager (PAM). They are responsible for deciding which professor or tutor is the most appropriate option relating to the support required and then the tutorial support request is forwarded onto them. Once the professor or tutor has completed the tutorial support request and answered any questions that have been asked, this communication is then returned to the student via email by the designated Program Administration Manager (PAM). This enables all tutorial support, between students, professors and tutors, to be facilitated by the designated Program Administration Manager (PAM) efficiently and securely through the email account. You will therefore need to allow a period of up to 20 business days for responses to general support queries and up to 30 business days for the evaluation and assessment of project studies, because all tutorial support requests are answered strictly within the order in which they are received. This does not include weekends or public holidays. Consequently you need to put some thought into the management of your tutorial support procedure in order to ensure that your study plan is feasible and to obtain the maximum possible benefit from tutorial support during your period of study. Please retain copies of your tutorial support emails for future reference. Please ensure that ALL of your tutorial support emails are set out using the format as suggested within your guide to tutorial support. Your tutorial support emails need to be referenced clearly to the specific part of the course manual or project study which you are working on at any given time. You also need to list and number any questions that you would like to ask, up to a maximum of five questions within each tutorial support email. Remember the more specific you can be with your questions the more specific your answers will be too and this will help you to avoid any unnecessary misunderstanding, misinterpretation, or duplication. The guide to tutorial support is intended to help you to understand how and when to use support in order to ensure that you get the most out of your training program. Appleton Greene training programs are designed to enable you to do things for yourself. They provide you with a structure or a framework and we use tutorial support to facilitate students while they practically implement what they learn. In other words, we are enabling students to do things for themselves. The benefits of distance learning via facilitation are considerable and are much more sustainable in the long-term than traditional short-term knowledge sharing programs. Consequently you should learn how and when to use tutorial support so that you can maximize the benefits from your learning experience with Appleton Greene. This guide describes the purpose of each training function and how to use them and how to use tutorial support in relation to each aspect of the training program. It also provides useful tips and guidance with regard to best practice.

Tutorial Support Tips

Students are often unsure about how and when to use tutorial support with Appleton Greene. This Tip List will help you to understand more about how to achieve the most from using tutorial support. Refer to it regularly to ensure that you are continuing to use the service properly. Tutorial support is critical to the success of your training experience, but it is important to understand when and how to use it in order to maximize the benefit that you receive. It is no coincidence that those students who succeed are those that learn how to be positive, proactive and productive when using tutorial support.

Be positive and friendly with your tutorial support emails

Remember that if you forward an email to the tutorial support unit, you are dealing with real people. “Do unto others as you would expect others to do unto you”. If you are positive, complimentary and generally friendly in your emails, you will generate a similar response in return. This will be more enjoyable, productive and rewarding for you in the long-term.

Think about the impression that you want to create

Every time that you communicate, you create an impression, which can be either positive or negative, so put some thought into the impression that you want to create. Remember that copies of all tutorial support emails are stored electronically and tutors will always refer to prior correspondence before responding to any current emails. Over a period of time, a general opinion will be arrived at in relation to your character, attitude and ability. Try to manage your own frustrations, mood swings and temperament professionally, without involving the tutorial support team. Demonstrating frustration or a lack of patience is a weakness and will be interpreted as such. The good thing about communicating in writing, is that you will have the time to consider your content carefully, you can review it and proof-read it before sending your email to Appleton Greene and this should help you to communicate more professionally, consistently and to avoid any unnecessary knee-jerk reactions to individual situations as and when they may arise. Please also remember that the CLP Tutorial Support Unit will not just be responsible for evaluating and assessing the quality of your work, they will also be responsible for providing recommendations to other learning providers and to client contacts within the Appleton Greene global client network, so do be in control of your own emotions and try to create a good impression.

Remember that quality is preferred to quantity

Please remember that when you send an email to the tutorial support team, you are not using Twitter or Text Messaging. Try not to forward an email every time that you have a thought. This will not prove to be productive either for you or for the tutorial support team. Take time to prepare your communications properly, as if you were writing a professional letter to a business colleague and make a list of queries that you are likely to have and then incorporate them within one email, say once every month, so that the tutorial support team can understand more about context, application and your methodology for study. Get yourself into a consistent routine with your tutorial support requests and use the tutorial support template provided with ALL of your emails. The (CLP) Tutorial Support Unit will not spoon-feed you with information. They need to be able to evaluate and assess your tutorial support requests carefully and professionally.

Be specific about your questions in order to receive specific answers

Try not to write essays by thinking as you are writing tutorial support emails. The tutorial support unit can be unclear about what in fact you are asking, or what you are looking to achieve. Be specific about asking questions that you want answers to. Number your questions. You will then receive specific answers to each and every question. This is the main purpose of tutorial support via email.

Keep a record of your tutorial support emails

It is important that you keep a record of all tutorial support emails that are forwarded to you. You can then refer to them when necessary and it avoids any unnecessary duplication, misunderstanding, or misinterpretation.

Individual training workshops or telephone support

Please be advised that Appleton Greene does not provide separate or individual tutorial support meetings, workshops, or provide telephone support for individual students. Appleton Greene is an equal opportunities learning and service provider and we are therefore understandably bound to treat all students equally. We cannot therefore broker special financial or study arrangements with individual students regardless of the circumstances. All tutorial support is provided online and this enables Appleton Greene to keep a record of all communications between students, professors and tutors on file for future reference, in accordance with our quality management procedure and your terms and conditions of enrolment. All tutorial support is provided online via email because it enables us to have time to consider support content carefully, it ensures that you receive a considered and detailed response to your queries. You can number questions that you would like to ask, which relate to things that you do not understand or where clarification may be required. You can then be sure of receiving specific answers to each individual query. You will also then have a record of these communications and of all tutorial support, which has been provided to you. This makes tutorial support administration more productive by avoiding any unnecessary duplication, misunderstanding, or misinterpretation.

Tutorial Support Email Format

You should use this tutorial support format if you need to request clarification or assistance while studying with your training program. Please note that ALL of your tutorial support request emails should use the same format. You should therefore set up a standard email template, which you can then use as and when you need to. Emails that are forwarded to Appleton Greene, which do not use the following format, may be rejected and returned to you by the (CLP) Program Administration Manager. A detailed response will then be forwarded to you via email usually within 20 business days of receipt for general support queries and 30 business days for the evaluation and assessment of project studies. This does not include weekends or public holidays. Your tutorial support request, together with the corresponding TSU reply, will then be saved and stored within your electronic TSU file at Appleton Greene for future reference.

Subject line of your email

Please insert: Appleton Greene (CLP) Tutorial Support Request: (Your Full Name) (Date), within the subject line of your email.

Main body of your email

Please insert:

1. Appleton Greene Certified Learning Provider (CLP) Tutorial Support Request

2. Your Full Name

3. Date of TS request

4. Preferred email address

5. Backup email address

6. Course manual page name or number (reference)

7. Project study page name or number (reference)

Subject of enquiry

Please insert a maximum of 50 words (please be succinct)

Briefly outline the subject matter of your inquiry, or what your questions relate to.

Question 1

Maximum of 50 words (please be succinct)

Maximum of 50 words (please be succinct)

Question 3

Maximum of 50 words (please be succinct)

Question 4

Maximum of 50 words (please be succinct)

Question 5

Maximum of 50 words (please be succinct)

Please note that a maximum of 5 questions is permitted with each individual tutorial support request email.

Procedure

* List the questions that you want to ask first, then re-arrange them in order of priority. Make sure that you reference them, where necessary, to the course manuals or project studies.

* Make sure that you are specific about your questions and number them. Try to plan the content within your emails to make sure that it is relevant.

* Make sure that your tutorial support emails are set out correctly, using the Tutorial Support Email Format provided here.

* Save a copy of your email and incorporate the date sent after the subject title. Keep your tutorial support emails within the same file and in date order for easy reference.

* Allow up to 20 business days for a response to general tutorial support emails and up to 30 business days for the evaluation and assessment of project studies, because detailed individual responses will be made in all cases and tutorial support emails are answered strictly within the order in which they are received.

* Emails can and do get lost. So if you have not received a reply within the appropriate time, forward another copy or a reminder to the tutorial support unit to be sure that it has been received but do not forward reminders unless the appropriate time has elapsed.

* When you receive a reply, save it immediately featuring the date of receipt after the subject heading for easy reference. In most cases the tutorial support unit replies to your questions individually, so you will have a record of the questions that you asked as well as the answers offered. With project studies however, separate emails are usually forwarded by the tutorial support unit, so do keep a record of your own original emails as well.

* Remember to be positive and friendly in your emails. You are dealing with real people who will respond to the same things that you respond to.

* Try not to repeat questions that have already been asked in previous emails. If this happens the tutorial support unit will probably just refer you to the appropriate answers that have already been provided within previous emails.

* If you lose your tutorial support email records you can write to Appleton Greene to receive a copy of your tutorial support file, but a separate administration charge may be levied for this service.

How To Study

Your Certified Learning Provider (CLP) and Accredited Consultant can help you to plan a task list for getting started so that you can be clear about your direction and your priorities in relation to your training program. It is also a good way to introduce yourself to the tutorial support team.

Planning your study environment

Your study conditions are of great importance and will have a direct effect on how much you enjoy your training program. Consider how much space you will have, whether it is comfortable and private and whether you are likely to be disturbed. The study tools and facilities at your disposal are also important to the success of your distance-learning experience. Your tutorial support unit can help with useful tips and guidance, regardless of your starting position. It is important to get this right before you start working on your training program.

Planning your program objectives

It is important that you have a clear list of study objectives, in order of priority, before you start working on your training program. Your tutorial support unit can offer assistance here to ensure that your study objectives have been afforded due consideration and priority.

Planning how and when to study

Distance-learners are freed from the necessity of attending regular classes, since they can study in their own way, at their own pace and for their own purposes. This approach is designed to let you study efficiently away from the traditional classroom environment. It is important however, that you plan how and when to study, so that you are making the most of your natural attributes, strengths and opportunities. Your tutorial support unit can offer assistance and useful tips to ensure that you are playing to your strengths.

Planning your study tasks

You should have a clear understanding of the study tasks that you should be undertaking and the priority associated with each task. These tasks should also be integrated with your program objectives. The distance learning guide and the guide to tutorial support for students should help you here, but if you need any clarification or assistance, please contact your tutorial support unit.

Planning your time

You will need to allocate specific times during your calendar when you intend to study if you are to have a realistic chance of completing your program on time. You are responsible for planning and managing your own study time, so it is important that you are successful with this. Your tutorial support unit can help you with this if your time plan is not working.

Keeping in touch

Consistency is the key here. If you communicate too frequently in short bursts, or too infrequently with no pattern, then your management ability with your studies will be questioned, both by you and by your tutorial support unit. It is obvious when a student is in control and when one is not and this will depend how able you are at sticking with your study plan. Inconsistency invariably leads to in-completion.

Charting your progress

Your tutorial support team can help you to chart your own study progress. Refer to your distance learning guide for further details.

Making it work

To succeed, all that you will need to do is apply yourself to undertaking your training program and interpreting it correctly. Success or failure lies in your hands and your hands alone, so be sure that you have a strategy for making it work. Your Certified Learning Provider (CLP) and Accredited Consultant can guide you through the process of program planning, development and implementation.

Reading methods

Interpretation is often unique to the individual but it can be improved and even quantified by implementing consistent interpretation methods. Interpretation can be affected by outside interference such as family members, TV, or the Internet, or simply by other thoughts which are demanding priority in our minds. One thing that can improve our productivity is using recognized reading methods. This helps us to focus and to be more structured when reading information for reasons of importance, rather than relaxation.

Speed reading

When reading through course manuals for the first time, subconsciously set your reading speed to be just fast enough that you cannot dwell on individual words or tables. With practice, you should be able to read an A4 sheet of paper in one minute. You will not achieve much in the way of a detailed understanding, but your brain will retain a useful overview. This overview will be important later on and will enable you to keep individual issues in perspective with a more generic picture because speed reading appeals to the memory part of the brain. Do not worry about what you do or do not remember at this stage.

Content reading

Once you have speed read everything, you can then start work in earnest. You now need to read a particular section of your course manual thoroughly, by making detailed notes while you read. This process is called Content Reading and it will help to consolidate your understanding and interpretation of the information that has been provided.

Making structured notes on the course manuals

When you are content reading, you should be making detailed notes, which are both structured and informative. Make these notes in a MS Word document on your computer, because you can then amend and update these as and when you deem it to be necessary. List your notes under three headings: 1. Interpretation – 2. Questions – 3. Tasks. The purpose of the 1st section is to clarify your interpretation by writing it down. The purpose of the 2nd section is to list any questions that the issue raises for you. The purpose of the 3rd section is to list any tasks that you should undertake as a result. Anyone who has graduated with a business-related degree should already be familiar with this process.

Organizing structured notes separately

You should then transfer your notes to a separate study notebook, preferably one that enables easy referencing, such as a MS Word Document, a MS Excel Spreadsheet, a MS Access Database, or a personal organizer on your cell phone. Transferring your notes allows you to have the opportunity of cross-checking and verifying them, which assists considerably with understanding and interpretation. You will also find that the better you are at doing this, the more chance you will have of ensuring that you achieve your study objectives.

Question your understanding

Do challenge your understanding. Explain things to yourself in your own words by writing things down.

Clarifying your understanding

If you are at all unsure, forward an email to your tutorial support unit and they will help to clarify your understanding.

Question your interpretation

Do challenge your interpretation. Qualify your interpretation by writing it down.

Clarifying your interpretation

If you are at all unsure, forward an email to your tutorial support unit and they will help to clarify your interpretation.

Qualification Requirements

The student will need to successfully complete the project study and all of the exercises relating to the Sales Growth corporate training program, achieving a pass with merit or distinction in each case, in order to qualify as an Accredited Sales Growth Specialist (APTS). All monthly workshops need to be tried and tested within your company. These project studies can be completed in your own time and at your own pace and in the comfort of your own home or office. There are no formal examinations, assessment is based upon the successful completion of the project studies. They are called project studies because, unlike case studies, these projects are not theoretical, they incorporate real program processes that need to be properly researched and developed. The project studies assist us in measuring your understanding and interpretation of the training program and enable us to assess qualification merits. All of the project studies are based entirely upon the content within the training program and they enable you to integrate what you have learnt into your corporate training practice.

Sales Growth – Grading Contribution

Project Study – Grading Contribution

Customer Service – 10%

E-business – 05%

Finance – 10%

Globalization – 10%

Human Resources – 10%

Information Technology – 10%

Legal – 05%

Management – 10%

Marketing – 10%

Production – 10%

Education – 05%

Logistics – 05%

TOTAL GRADING – 100%

Qualification grades

A mark of 90% = Pass with Distinction.

A mark of 75% = Pass with Merit.

A mark of less than 75% = Fail.