Flow of Funds – Workshop 1 (Understanding Credit Policies)

The Appleton Greene Corporate Training Program (CTP) for Flow of Funds is provided by Ms. Grisby Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Ms. Grisby is dedicated to helping businesses optimize their financial and operational processes through innovative accounts receivable management solutions. Her company, specializes in providing a comprehensive range of services, including medical billing, corporate training, accounting, and consulting. These offerings are designed to empower organizations to achieve financial stability, reduce risk, and foster stronger customer relationships.

With over a decade of experience in commercial accounts receivable management, commercial credit management, process optimization, and SOP creation, Ms. Grisby brings a wealth of expertise to her work. Her proficiency lies in designing and implementing strategies that enhance cash flow, reduce outstanding debt, and ensure businesses maintain a healthy financial outlook.

A key strength of Ms. Grisby is her ability to collaborate with clients and tailor solutions to meet their unique needs. Whether developing customized training programs, improving financial reporting systems, or resolving complex billing issues, she consistently delivers measurable results. By combining industry best practices with innovative approaches, Ms. Grisby helps businesses streamline operations and achieve sustainable growth.

Ms. Grisby is an active member of the American Academy of Revenue Cycle Consultants (AARCC) and the National Association of Credit Managers, demonstrating her commitment to industry leadership and maintaining the highest standards of professionalism and integrity.

Her professional achievements include:

• Leading and managing high-performing teams to achieve organizational goals at a well-known medical device company.

• Designing and implementing process improvements that increase efficiency and reduce costs.

• Creating comprehensive SOPs to ensure consistency and compliance across operations.

• Developing financial reports that provide actionable insights for decision-making with a leading medical organization.

• Resolving complex accounts receivable and billing issues with innovative solutions for Fortune 500 companies.

• Driving successful KPIs that align with business objectives and enhance performance for leading organizations.

Ms. Grisby believes that effective cash flow management is the cornerstone of business success. She views each client partnership as an opportunity to make a meaningful impact, helping organizations unlock their full potential. Her company is not just a service provider but a strategic partner invested in client success.

Her commitment to continuous learning and innovation enables her to stay ahead in a constantly evolving industry. By adopting new technologies, refining her skills, and exploring forward-thinking solutions, Ms. Grisby consistently delivers exceptional outcomes.

Outside of her professional endeavors, Ms. Grisby actively networks with other professionals, attends industry events, and shares her expertise through workshops and training sessions. She thrives on connecting with like-minded individuals passionate about driving success and creating value.

Ms. Grisby is a results-driven leader dedicated to helping organizations streamline accounts receivable management, improve operational efficiency, and achieve financial excellence.

MOST Analysis

Mission Statement

A comprehensive understanding of a company’s credit policies and procedures is essential for effectively managing accounts receivable. Credit policies define the terms and conditions under which credit is extended to customers, helping to minimize financial risks while fostering strong customer relationships. Clear knowledge of these policies ensures consistency in decision-making, aids in evaluating creditworthiness, and facilitates timely collections. Adherence to established procedures also helps maintain cash flow stability and mitigate bad debt. By aligning credit management practices with company goals, managers can ensure efficient accounts receivable operations while supporting broader financial objectives.

Objectives

01. The Foundations of Credit Policies: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. The Relationship Between Credit Policies and Economic Growth: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. The Role of Credit Policies in Economic Stability: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Credit Risk Assessment and Management: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Globalization and Cross-Border Credit Policies: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Digital Transformation and Credit: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Regulation and Compliance in Credit Policies: departmental SWOT analysis; strategy research & development. 1 Month

08. Credit Policies During Economic Crises: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

09. Consumer Credit Policies and Behavior: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

10. Corporate Credit Policies and Investment: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Sustainable Credit Policies and ESG Goals: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Future Trends in Credit Policies: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. The Foundations of Credit Policies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. The Relationship Between Credit Policies and Economic Growth: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. The Role of Credit Policies in Economic Stability: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Credit Risk Assessment and Management: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Globalization and Cross-Border Credit Policies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Digital Transformation and Credit: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Regulation and Compliance in Credit Policies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Credit Policies During Economic Crises: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Consumer Credit Policies and Behavior: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Corporate Credit Policies and Investment: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Sustainable Credit Policies and ESG Goals: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Future Trends in Credit Policies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze The Foundations of Credit Policies.

02. Create a task on your calendar, to be completed within the next month, to analyze The Relationship Between Credit Policies and Economic Growth.

03. Create a task on your calendar, to be completed within the next month, to analyze The Role of Credit Policies in Economic Stability.

04. Create a task on your calendar, to be completed within the next month, to analyze Credit Risk Assessment and Management.

05. Create a task on your calendar, to be completed within the next month, to analyze Globalization and Cross-Border Credit Policies.

06. Create a task on your calendar, to be completed within the next month, to analyze Digital Transformation and Credit.

07. Create a task on your calendar, to be completed within the next month, to analyze Regulation and Compliance in Credit Policies.

08. Create a task on your calendar, to be completed within the next month, to analyze Credit Policies During Economic Crises.

09. Create a task on your calendar, to be completed within the next month, to analyze Consumer Credit Policies and Behavior.

10. Create a task on your calendar, to be completed within the next month, to analyze Corporate Credit Policies and Investment.

11. Create a task on your calendar, to be completed within the next month, to analyze Sustainable Credit Policies and ESG Goals.

12. Create a task on your calendar, to be completed within the next month, to analyze Future Trends in Credit Policies.

Introduction

Managing accounts receivable is a critical function in any organization, as it directly impacts cash flow, financial stability, and overall operational success. At the heart of effective accounts receivable management lie the company’s credit policies and procedures. These foundational elements establish the terms under which credit is extended to customers, guiding organizations in balancing the need to drive sales with the imperative to minimize financial risks. By fostering clear and consistent practices, companies can protect themselves against the adverse effects of bad debts while simultaneously nurturing strong, trust-based customer relationships.

This introduction explores the importance of understanding and implementing credit policies and procedures, delving into their historical context, key components, and role in modern financial management. It highlights how these practices have evolved alongside business and economic changes, emphasizing their significance in ensuring sustainable growth and resilience.

Historical Evolution of Credit Policies

The concept of extending credit has existed for centuries, dating back to ancient trade practices when merchants granted credit to trusted customers to encourage trade. In the Roman Empire, credit arrangements were formalized through legal contracts, and similar systems emerged in medieval Europe, where merchants used credit to finance voyages or large-scale trades. These early systems relied heavily on trust and personal relationships, with little formal regulation.

The Industrial Revolution marked a turning point in the development of credit policies. As businesses grew larger and more complex, the volume and scale of credit transactions increased significantly. Manufacturers and wholesalers began extending credit to retailers to stimulate sales and secure market share. To manage these growing risks, companies started establishing standardized credit terms and conditions.

In the 20th century, the rise of corporate finance and banking systems brought further sophistication to credit management. Financial institutions developed frameworks for assessing creditworthiness, and businesses began employing dedicated credit managers to oversee receivables. Credit bureaus emerged to provide reliable credit information, further professionalizing the process. By the late 20th century, advancements in technology allowed for automated credit scoring, enabling more precise and data-driven decisions.

Today, credit policies and procedures are integral to a company’s financial strategy. They are designed not only to protect the business from losses but also to align with broader organizational goals, such as enhancing customer satisfaction and supporting long-term growth.

Case Study: The Evolution of Credit Policies in Retail: Walmart’s Practices

Walmart, a global retail leader, provides a compelling example of how credit policies have evolved to align with modern business strategies, enhance customer satisfaction, and maintain financial efficiency. From its early reliance on supplier trade credit to its current sophisticated credit systems, Walmart’s practices illustrate the transformation of credit management over time.

In its formative years, Walmart leveraged simple trade credit arrangements with suppliers, allowing deferred payments for inventory while maintaining cash flow for operations. This practice mirrored the industrial-era approach, where manufacturers and retailers used credit to facilitate sales and expand market reach. As Walmart grew into a retail giant, its credit policies became more structured and strategic, reflecting broader advancements in credit management.

Today, Walmart negotiates favorable credit terms with suppliers, often securing extended payment periods to optimize liquidity and operational efficiency. These arrangements underscore the role of credit policies in balancing immediate cash flow needs with long-term financial stability. On the customer side, Walmart offers branded credit products such as the Walmart Rewards Card and the Capital One Walmart Mastercard. These cards empower customers with purchasing flexibility and incentivize loyalty through rewards programs tied to in-store and online shopping.

Walmart’s customer credit options are supported by advanced data-driven processes. Creditworthiness assessments leverage partnerships with credit bureaus and automated systems, ensuring responsible lending practices. Competitive interest rates and flexible repayment terms make these credit products appealing to a diverse consumer base, aligning with Walmart’s goal of fostering customer loyalty.

The integration of technology into Walmart’s credit management practices further enhances efficiency. Automated systems streamline credit approvals and receivables management, reducing financial risk and operational complexity. Real-time credit scoring tools enable swift approvals while minimizing the potential for defaults, showcasing the company’s commitment to innovation and financial discipline.

Walmart’s credit policies also align with its broader strategic objectives, such as improving inventory turnover, enhancing customer loyalty, and maximizing cash flow. By balancing risk management with customer-focused initiatives, Walmart has created a credit framework that supports its global operations and long-term growth.

This case demonstrates how modern businesses, like Walmart, have transitioned from traditional credit practices to sophisticated, technology-driven systems that are integral to their financial strategy. These practices highlight the critical role of credit policies in maintaining financial stability, fostering loyalty, and driving sustainable business success.

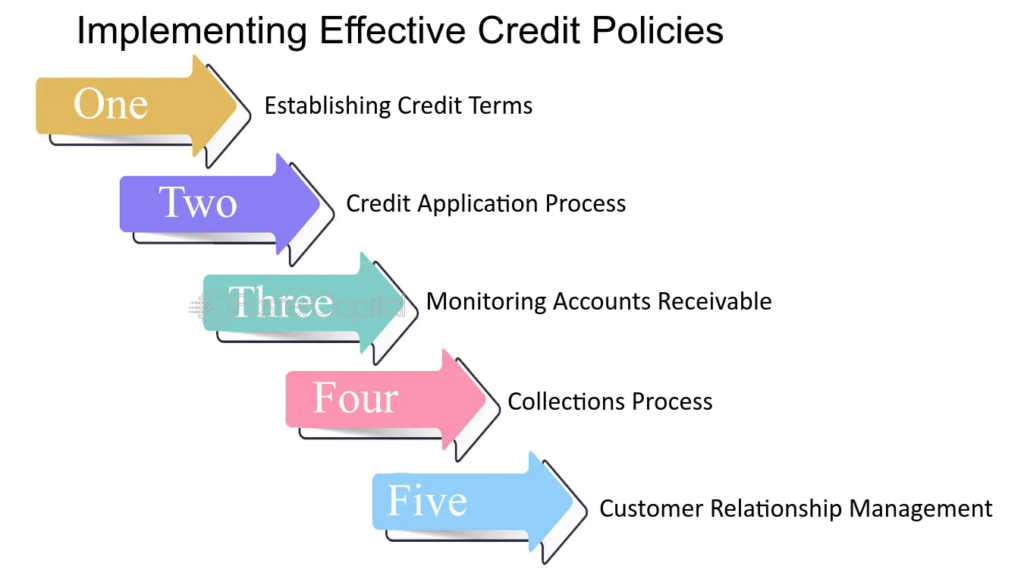

Key Components of Credit Policies

A well-crafted credit policy outlines the principles and guidelines for extending credit to customers. While these policies vary across industries and organizations, they typically address several core areas:

1. Credit Terms: These define the payment conditions under which credit is extended, including payment due dates, discounts for early payments, and penalties for late payments. Clear and fair terms help set expectations for customers and reduce disputes.

2. Credit Limits: Establishing credit limits for individual customers or accounts is essential for managing risk. Limits are often based on the customer’s creditworthiness, financial health, and payment history.

3. Creditworthiness Assessment: Evaluating a customer’s ability and willingness to pay is a cornerstone of credit management. Companies use a mix of financial data, credit scores, trade references, and historical behavior to make informed decisions.

4. Collections Process: Effective procedures for collecting overdue payments are crucial to maintaining cash flow. Policies should specify the steps for follow-up, escalation, and potential legal action in case of non-payment.

5. Risk Mitigation Measures: This includes mechanisms like requiring deposits, securing guarantees, or purchasing credit insurance to protect against potential losses.

6. Compliance and Ethical Standards: Credit policies must comply with relevant laws and regulations, such as anti-discrimination laws and consumer protection statutes. They should also align with the company’s ethical values.

Benefits of Adhering to Credit Policies

Adhering to well-defined credit policies and procedures is not just a best practice; it is a cornerstone of sound financial management and operational efficiency. These policies serve as a blueprint for managing credit and collections effectively, enabling organizations to mitigate risks while supporting broader business objectives. The following are expanded benefits of adhering to credit policies:

Minimizing Financial Risk

Clear credit policies help safeguard a company’s financial health by reducing the risk of bad debts and payment defaults. By rigorously evaluating customers’ creditworthiness through a combination of financial analysis, credit scores, and historical payment data, businesses can make informed decisions about whom to extend credit to and under what terms. Additionally, credit policies often include safeguards such as setting credit limits, requiring collateral, or implementing payment milestones, which act as buffers against potential losses. This proactive approach not only prevents revenue leakage but also protects the company’s reputation and stakeholder confidence.

Ensuring Consistency

Inconsistent credit practices can lead to confusion, inefficiencies, and even disputes, both internally and with customers. Standardized credit policies and procedures ensure that all credit-related decisions are made uniformly across the organization. This consistency minimizes subjectivity and reduces the potential for favoritism, bias, or human error in the credit approval process. It also enables employees to act with confidence, knowing they are following a structured framework that aligns with the company’s risk appetite and business goals. Consistency fosters a professional and disciplined approach to credit management, which is essential for maintaining financial stability.

Enhancing Customer Relationships

Strong customer relationships are built on trust and transparency, and clear credit policies play a crucial role in establishing both. When customers understand the terms and conditions of credit upfront, it sets the stage for open and honest communication. Transparent credit practices convey professionalism and fairness, demonstrating that the company values its customers while maintaining its own financial discipline. Furthermore, adhering to credit policies ensures that customers are treated equitably, which can enhance loyalty and encourage repeat business. A customer who feels respected and trusted is more likely to prioritize payments and maintain a positive relationship with the company.

Supporting Cash Flow Stability

Cash flow is the lifeblood of any business, and effective credit management is a key driver of cash flow stability. Clear credit policies ensure that receivables are collected in a timely manner, providing the liquidity needed to meet operational expenses, invest in growth initiatives, and weather economic uncertainties. Policies that encourage prompt payments—such as offering discounts for early payment or enforcing penalties for late payments—help improve cash conversion cycles. Timely collections also reduce the need for external financing, which can be costly, and ensure that the company remains solvent even in challenging times.

Facilitating Strategic Alignment

Credit policies are most effective when they align with the company’s broader strategic objectives. For example, a business looking to expand its market share may choose to offer more flexible credit terms to attract new customers, while one focused on preserving cash flow may tighten credit limits. Well-defined policies provide a structured framework for balancing these priorities, ensuring that credit decisions support the organization’s overall goals. Strategic alignment also fosters better collaboration between departments, such as sales and finance, as both teams work toward common objectives guided by the credit policy.

Improving Operational Efficiency

By providing clear guidelines and procedures, credit policies streamline the credit approval and collections processes. Employees spend less time debating individual cases or resolving disputes, as decisions are guided by predefined criteria. Automation tools, which are often integrated with credit policies, can further enhance efficiency by automating credit checks, generating invoices, and tracking payments. This operational efficiency not only saves time and resources but also enables staff to focus on more strategic activities, such as identifying opportunities for customer growth or optimizing the credit-to-cash cycle.

Strengthening Governance and Compliance

Adhering to credit policies ensures that the organization remains compliant with applicable laws and regulations, such as anti-discrimination laws, fair credit practices, and industry-specific standards. This compliance reduces the risk of legal disputes and penalties, protecting the company from reputational damage. Additionally, strong governance practices demonstrate to investors, regulators, and other stakeholders that the organization is committed to ethical and responsible financial management.

Reducing Administrative Burden

Standardized policies reduce the administrative burden associated with managing accounts receivable by eliminating ambiguity in the credit approval and collections process. Employees no longer need to create ad hoc solutions for each situation, as the policy provides clear guidance on handling various scenarios, from approving credit applications to dealing with overdue accounts. This consistency simplifies training for new employees and reduces the time spent on repetitive administrative tasks.

Enabling Data-Driven Decision Making

Comprehensive credit policies often include mechanisms for tracking and analyzing credit performance metrics, such as average collection periods, delinquency rates, and bad debt ratios. These metrics provide valuable insights into customer behavior and the effectiveness of the company’s credit practices. By adhering to policies that incorporate regular monitoring and reporting, organizations can identify trends, adjust strategies, and make data-driven decisions that improve overall financial performance.

Promoting Long-Term Sustainability

Ultimately, adhering to credit policies contributes to the long-term sustainability of the organization. By protecting cash flow, minimizing risks, and fostering strong customer relationships, these policies create a stable financial foundation for future growth. Moreover, they ensure that the company can adapt to changing market conditions and economic challenges without compromising its financial health.

The benefits of adhering to well-defined credit policies and procedures extend far beyond risk mitigation. They provide a structured approach to managing accounts receivable, ensuring consistency, enhancing customer relationships, and supporting broader strategic objectives. By fostering cash flow stability, improving operational efficiency, and promoting compliance, these policies serve as a vital tool for achieving both short-term success and long-term sustainability. Businesses that invest in robust credit management practices position themselves not only to weather financial challenges but also to thrive in competitive and dynamic markets.

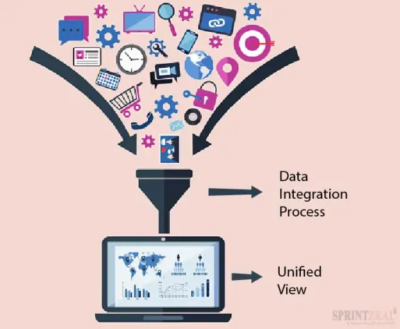

Modern Trends in Credit Policies and Procedures

The dynamic nature of today’s business landscape, marked by rapid technological advancements, shifting consumer behaviors, and increasing regulatory demands, has significantly transformed credit management. Modern credit policies and procedures have evolved to incorporate innovative tools and address emerging challenges, ensuring businesses remain competitive while aligning with broader economic and societal trends. These advancements have made credit management more efficient, accurate, and responsive to the needs of businesses and their customers.

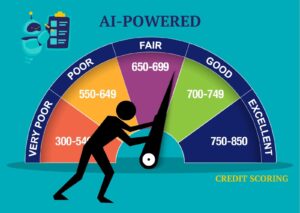

One of the most impactful changes is the adoption of automated credit scoring systems powered by artificial intelligence (AI) and machine learning (ML). These systems can analyze vast datasets from diverse sources, such as transaction histories, market trends, and even social signals, to predict creditworthiness with remarkable precision. Unlike traditional methods that relied on limited data points, automated credit scoring offers dynamic models that adapt to evolving customer behaviors and economic conditions. This shift has enabled businesses to make more informed credit decisions, mitigating risks while identifying opportunities for growth.

Customer Relationship Management (CRM) systems have also become a cornerstone of modern credit management. By integrating credit policies with CRM platforms, organizations ensure seamless collaboration between sales, finance, and operations. These systems provide real-time insights into credit limits, payment histories, and customer behavior, allowing for more strategic decision-making. Automation within CRM tools further streamlines processes such as invoicing, payment tracking, and dispute resolution, enhancing efficiency and supporting broader organizational goals.

Another significant trend is the incorporation of environmental, social, and governance (ESG) considerations into credit policies. Businesses are increasingly aligning credit decisions with sustainability goals by prioritizing customers and partners who demonstrate ethical practices, environmental stewardship, and strong governance. For example, companies may offer preferential credit terms to partners with green certifications or sustainable operations. This integration of ESG factors not only supports long-term sustainability but also reinforces a commitment to responsible business practices, enhancing reputation and stakeholder trust.

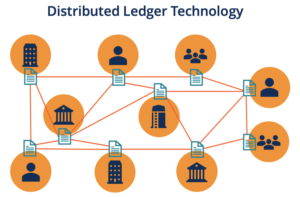

The rise of digital payment ecosystems, including real-time payments and blockchain-based solutions, is reshaping how businesses approach credit management. Real-time payments allow instant fund transfers, reducing late payments and improving cash flow. Blockchain technology adds a layer of transparency and traceability to transactions, making it easier to monitor payment histories and assess creditworthiness. Meanwhile, the adoption of digital currencies presents both opportunities and challenges, requiring businesses to adapt their credit policies to address currency volatility and cross-border transactions.

Data security and privacy have also become central to credit management in the digital era. As organizations collect and analyze increasing amounts of data to evaluate creditworthiness, they must implement robust measures to protect sensitive customer information. Credit policies now include encryption standards, compliance with privacy regulations such as GDPR and CCPA, and transparent communication with customers about data usage. These measures not only safeguard information but also build trust and enhance the company’s reputation for ethical practices.

The use of AI and automation in collections processes is another game-changer in modern credit management. AI-driven tools can identify delinquent accounts early, recommend tailored follow-up actions, and automate communications with customers. Predictive analytics help businesses prioritize high-risk accounts and develop customized payment plans for customers facing financial difficulties. These innovations improve collection rates, reduce recovery times, and maintain positive customer relationships, striking a balance between financial goals and customer satisfaction.

Lastly, the ability to offer personalized credit solutions has become a competitive advantage. Leveraging data analytics, businesses can tailor credit terms and payment plans to individual customer needs. For example, dynamic credit terms that adjust based on purchasing patterns or personalized payment plans for customers experiencing financial challenges foster loyalty and trust. This level of customization not only enhances customer relationships but also ensures the company’s credit practices remain flexible and responsive to changing circumstances.

The trends shaping modern credit policies and procedures reflect the transformative impact of technology, sustainability, and changing market dynamics. From automated credit scoring and CRM integration to ESG considerations and the adoption of real-time payments, these developments are reshaping how organizations approach credit management. By embracing these innovations, businesses can enhance efficiency, reduce risks, and align their practices with financial and ethical objectives, ensuring long-term success in a rapidly evolving world.

Conclusion

A comprehensive understanding of credit policies and procedures is essential for managing accounts receivable effectively. From their historical roots in early trade to their modern iterations driven by technology and globalization, credit practices have evolved to meet the demands of an increasingly complex business environment. By adhering to well-defined policies, organizations can minimize financial risks, maintain stable cash flows, and build lasting customer relationships. In an era of rapid change, the ability to adapt and innovate in credit management is more critical than ever, ensuring that businesses remain resilient and competitive in the face of new challenges.

Executive Summary

Chapter 1: The Foundations of Credit Policies

Credit policies are fundamental to effective financial management, guiding how businesses extend, manage, and collect credit. These policies balance the need to drive growth through credit sales with minimizing financial risks. By clearly defining the criteria for evaluating creditworthiness, setting credit limits, and establishing terms and conditions, businesses can make informed decisions, maintain cash flow stability, and reduce the likelihood of bad debts.

Key Components of Credit Policies

1. Defining Creditworthiness:

Creditworthiness assesses a customer’s ability and willingness to meet financial obligations. This involves analyzing financial history, including payment records, outstanding debts, and financial ratios such as debt-to-income and liquidity. Credit scores from agencies provide a standardized measure of reliability, while trade references offer qualitative insights into payment practices. External factors, such as economic conditions and industry trends, also influence creditworthiness. Tools like AI-powered automated credit scoring systems and integrated data sources enhance the accuracy and efficiency of these evaluations. Continuous monitoring ensures that credit decisions remain aligned with evolving customer behavior and financial conditions.

2. Setting Credit Limits:

Credit limits define the maximum credit a business is willing to extend, balancing sales growth with risk management. Factors influencing credit limits include the customer’s financial health, transaction history, order size and frequency, and strategic business goals. Modern practices incorporate dynamic credit limits, which adjust based on real-time factors like payment behavior. Regular monitoring and automated systems ensure limits are revised appropriately, protecting businesses from overexposure while enabling flexibility in credit offerings.

3. Establishing Terms and Conditions:

Clear terms and conditions define the rules of credit agreements, ensuring transparency and enforceability. Key elements include payment terms (e.g., net 30), early payment discounts, penalties for late payments, credit application requirements, dispute resolution procedures, and default and recovery measures. Customization for different customer segments and the use of technology, such as automated invoicing and payment tracking, improve efficiency and compliance. Legal adherence ensures ethical practices and builds customer trust.

The three components—creditworthiness, credit limits, and terms and conditions—are interconnected, forming a cohesive framework for credit management. Thoughtfully designed and integrated, these policies enable businesses to minimize risks, protect cash flow, and align credit practices with strategic objectives, ensuring long-term growth and resilience in a competitive market.

Chapter 2: The Relationship Between Credit Policies and Economic Growth

Credit policies are fundamental to economic development, serving as a bridge between financial institutions and the broader economy. These policies define the terms under which credit is extended to individuals and businesses, directly influencing access to capital—a key driver of economic activity. By enabling investment, innovation, and consumer spending, well-designed credit policies stimulate growth, while poorly constructed or imbalanced policies can hinder it.

Capital Allocation

Credit policies shape how financial resources are distributed across industries, determining which sectors receive funding and driving economic growth. In real estate, accessible mortgages fuel housing construction and ownership, benefiting related industries. In manufacturing, favorable policies support investments in equipment and technology, enhancing productivity and competitiveness. The technology sector, reliant on risk-tolerant policies, thrives with access to venture capital for innovation and expansion. Targeted credit policies can also address regional disparities, promoting inclusive growth and balanced development.

Small Business Growth

Small and medium-sized enterprises (SMEs) depend heavily on accessible credit to overcome resource constraints, expand operations, and drive innovation. Favorable credit policies enable SMEs to invest in technology, workforce development, and market expansion, contributing to job creation and economic resilience. Conversely, restrictive credit policies can stifle entrepreneurship and limit the economic contributions of SMEs. Modern credit practices increasingly leverage technology, such as AI-driven credit scoring, to address challenges in assessing SME creditworthiness and managing risk.

Consumer Spending

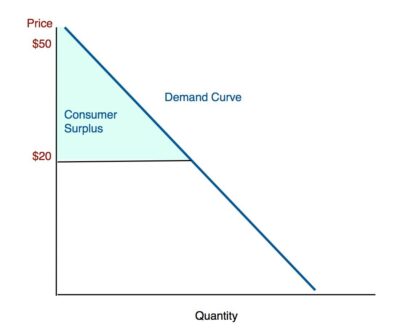

Credit policies governing personal loans, mortgages, and credit cards significantly influence consumer spending, which accounts for a major share of economic demand. Accessible credit drives household consumption, benefiting industries like retail, real estate, and services. However, overly lenient policies risk excessive consumer debt, while restrictive ones suppress spending and slow growth.

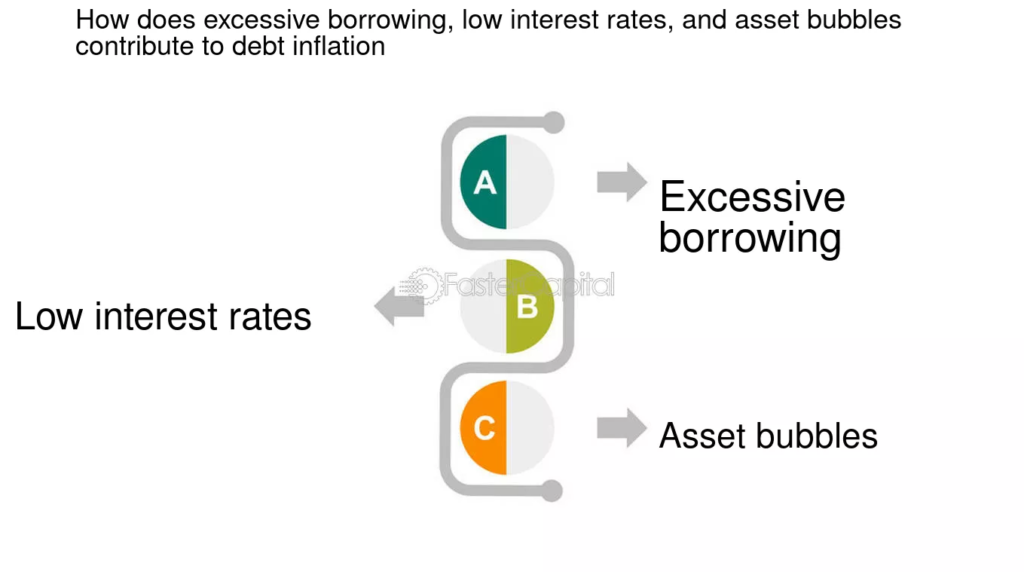

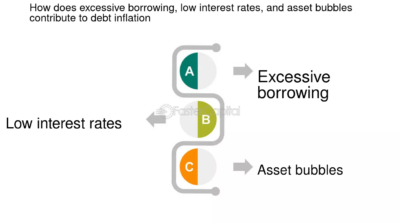

Risks of Imbalance

Imbalanced credit policies—whether overly lenient or excessively restrictive—pose significant risks. Lenient policies can lead to economic bubbles and financial instability, while restrictive ones may cause credit crunches, suppressing investment and consumption. Balanced policies are crucial for fostering sustainable growth and managing economic risks.

Optimizing Credit Policies

To promote sustainable growth, credit policies should balance risk management with accessibility. Leveraging technology, promoting financial inclusion, and aligning with environmental, social, and governance (ESG) principles are key strategies for creating policies that support innovation, inclusion, and economic stability.

In conclusion, credit policies are vital tools for driving economic activity, and their thoughtful design ensures long-term prosperity and resilience.

Chapter 3: The Role of Credit Policies in Economic Stability

Credit policies are essential tools for maintaining economic stability by regulating credit flow, managing liquidity, promoting sustainable growth, and minimizing financial risks. Central banks, financial institutions, and policymakers utilize these policies to foster economic activity while ensuring financial discipline. Their effective implementation can help economies withstand shocks such as recessions, inflation, and financial crises.

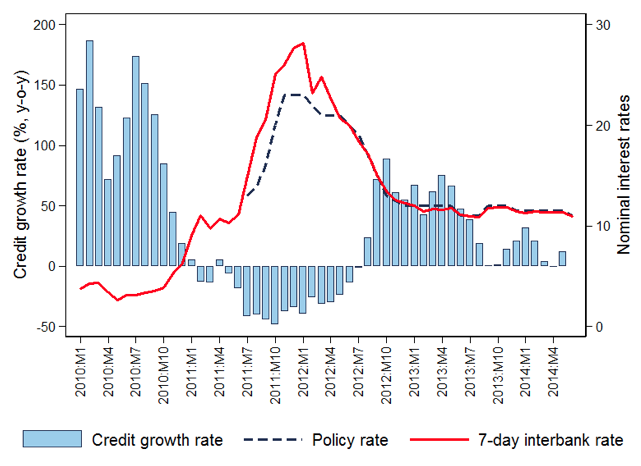

Managing Liquidity

Credit policies play a vital role in liquidity management, ensuring a stable money supply that supports economic activity. Central banks regulate liquidity through tools such as interest rates, reserve requirements, and open market operations. By adjusting these tools, they influence borrowing and lending behaviors, either stimulating economic activity during downturns or curbing excessive borrowing during periods of expansion. Financial institutions complement these efforts by evaluating borrower creditworthiness and adjusting lending terms to balance credit availability and risk.

Promoting Sustainable Growth

Sustainable economic growth depends on credit policies that guide financial resources toward productive sectors while ensuring equitable access to credit. These policies support investments in manufacturing, technology, and infrastructure, fostering innovation and job creation. They also align with broader sustainability goals by incentivizing green investments and promoting financial inclusion for underserved populations. This ensures that economic growth is balanced, inclusive, and environmentally responsible.

Balancing Growth with Risk Management

Effective credit policies must balance fostering growth with mitigating risks. Overly lenient policies can lead to asset bubbles, excessive borrowing, and financial crises, while overly restrictive policies may stifle growth and innovation. Strategies such as rigorous risk assessments, encouraging responsible borrowing, and implementing dynamic policy adjustments enable policymakers to maintain this balance. By promoting financial literacy and leveraging advanced data analytics, these policies reduce default risks and ensure credit remains a tool for empowerment rather than instability.

Mitigating Risks

Credit policies help minimize risks associated with nonperforming loans (NPLs), speculative investments, and economic bubbles. Proactive measures like early detection of delinquent accounts, efficient debt resolution mechanisms, and technology-driven risk monitoring systems enhance resilience in the financial system. Dynamic credit policies that adapt to economic conditions ensure that credit flows remain aligned with evolving market realities.

In conclusion, credit policies are indispensable for promoting economic stability. By managing liquidity, fostering sustainable growth, balancing risks, and leveraging technology, they safeguard financial systems and support long-term economic resilience. These measures ensure that credit serves as a catalyst for development rather than a source of systemic vulnerabilities.

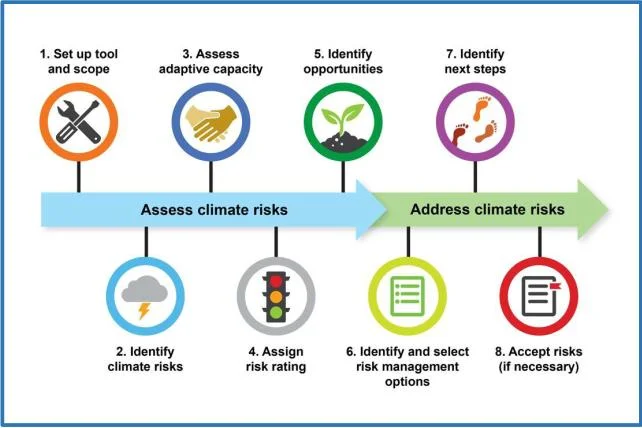

Chapter 4: Credit Risk Assessment and Management

Credit risk assessment and management are essential for maintaining financial stability and the sustainability of credit markets. Credit risk arises when borrowers fail to meet their financial obligations, posing potential losses for lenders. Effective credit risk management involves identifying, assessing, and mitigating risks to safeguard lenders’ financial health and ensure responsible borrowing practices.

Understanding Credit Risk

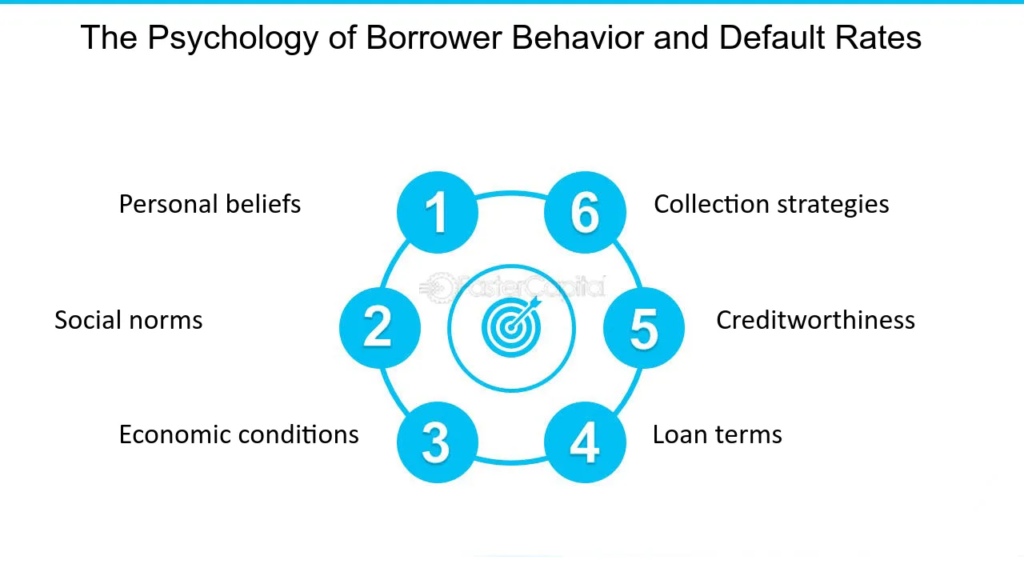

Credit risk manifests in various forms, including default risk (when borrowers fail to repay loans), concentration risk (excessive exposure to a single borrower or sector), and systemic risk (credit issues spreading across the financial system). Factors like borrower behavior, economic conditions, and market trends significantly influence credit risk, necessitating regular monitoring and analysis.

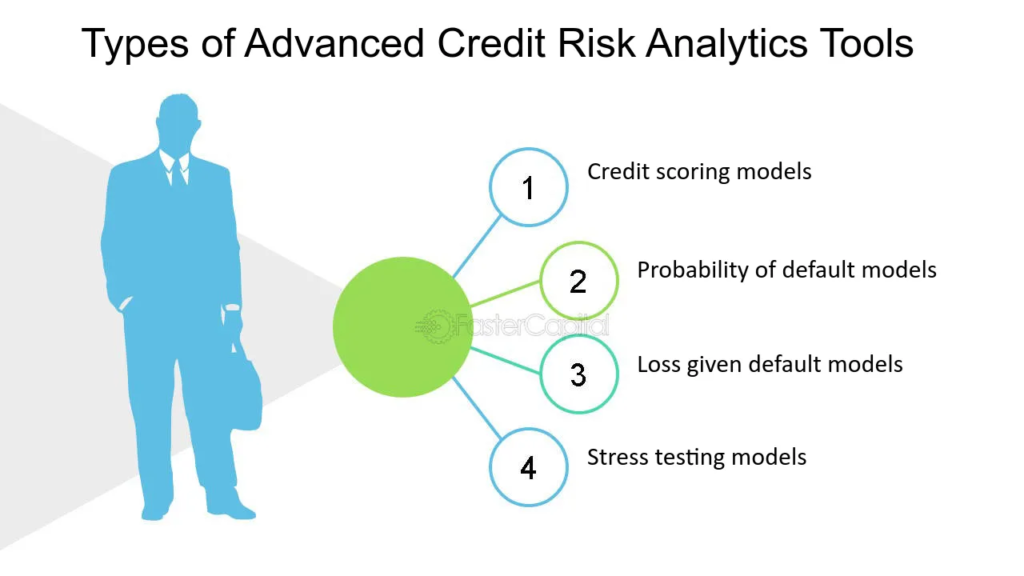

Credit Risk Assessment Tools

Traditional tools like credit scoring and financial ratio analysis evaluate borrowers’ creditworthiness based on factors like payment history, debt-to-income ratios, and liquidity. Advanced technologies, such as AI and machine learning, enhance risk assessments by analyzing vast datasets and identifying patterns that traditional methods might miss. The integration of alternative data, such as utility payments and mobile transactions, expands access to credit for underserved populations, improving inclusivity and decision-making accuracy.

Mitigating Credit Risk

Lenders employ various strategies to mitigate credit risk:

1. Diversification: Spreading credit exposure across borrowers, industries, and regions minimizes the impact of localized downturns or defaults.

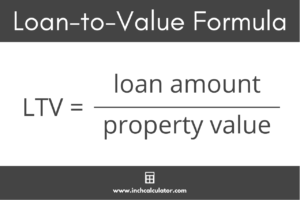

2. Collateral Requirements: Securing loans with assets like real estate or inventory provides a safety net for lenders in case of default. Loan-to-value (LTV) ratios and ongoing collateral monitoring ensure adequate coverage.

3. Loan Covenants: Contractual agreements impose financial discipline on borrowers, such as maintaining liquidity or limiting additional debt.

4. Stress Testing and Scenario Analysis: These tools simulate adverse economic scenarios, such as recessions, to evaluate portfolio resilience and guide proactive measures like tightening lending standards or diversifying portfolios.

Role of Technology in Risk Mitigation

Technological advancements, including AI, blockchain, and real-time monitoring systems, enhance credit risk management by providing precise, scalable, and transparent assessments. These tools enable early detection of potential defaults and improve overall risk mitigation.

In conclusion, robust credit risk assessment and management are essential for protecting lenders, fostering responsible borrowing, and ensuring financial system stability. By employing diverse strategies and leveraging technology, lenders can minimize risks, maintain operational resilience, and support sustainable economic growth.

Chapter 5: Globalization and Cross-Border Credit Policies

Globalization has redefined the global financial landscape, creating complex networks of international trade and cross-border financial flows. These interconnected systems influence credit policies, requiring adaptation to manage risks like currency fluctuations, regulatory divergences, and geopolitical uncertainties. At the same time, globalization provides opportunities to diversify credit portfolios, foster innovation, and enable financial inclusion.

International trade is a major driver of cross-border credit policies, shaping how credit is extended and managed. Trade agreements lower barriers to commerce, facilitating instruments like letters of credit and trade insurance, which reduce payment risks. Regional trade blocs, such as the EU and NAFTA, enhance financial integration through common credit standards. Export credit agencies further support international trade by mitigating risks for exporters.

Financial globalization has expanded credit access by enabling institutions to lend beyond domestic markets, fostering competition that reduces interest rates. However, it introduces challenges like currency risks, which require hedging strategies, and susceptibility to global economic shocks, as seen during the 2008 financial crisis. These dynamics demand robust risk management in cross-border credit.

Trade imbalances significantly affect credit risk. Surplus economies like China and Germany extend credit to deficit nations, promoting liquidity but increasing exposure to high-debt markets. Conversely, deficit economies face higher borrowing risks. Policymakers often respond with measures such as tariffs or currency devaluations, influencing creditworthiness and repayment dynamics.

The rise of global supply chains adds complexity to credit policies, necessitating extended credit terms and tailored risk strategies. Multijurisdictional operations introduce risks such as legal disputes and geopolitical instability. Innovations like supplier financing and blockchain technology improve transparency, streamline processes, and mitigate these risks.

International organizations like the IMF and Basel Committee work to harmonize credit regulations, fostering stability and reducing systemic risks. However, regulatory divergence persists due to differences in national priorities, creating inconsistencies that complicate cross-border credit.

Technologies like blockchain, AI, and digital platforms enhance transparency, reduce costs, and streamline international lending processes. These tools empower financial institutions to manage risks effectively while fostering inclusion.

Globalization has transformed credit policies, balancing growth opportunities with the imperative to manage risks. Continued collaboration, innovation, and adaptive strategies are essential to sustaining global financial stability.

Chapter 6: Digital Transformation and Credit

Digital transformation has revolutionized credit management through technologies such as digital payment systems, artificial intelligence (AI), and blockchain. These advancements enhance efficiency, transparency, and inclusivity while addressing challenges in traditional credit processes. By streamlining operations and expanding credit access to underserved populations, digital innovations are reshaping the financial ecosystem.

Digital payment systems facilitate real-time transactions, improving credit repayment processes and reducing defaults. Borrowers can automate recurring payments, ensuring timely repayments while minimizing administrative burdens for lenders. These systems provide real-time updates, increasing transparency and reducing errors or disputes. Additionally, predictive analytics embedded in payment platforms helps identify borrowers at risk of default, allowing lenders to offer preemptive interventions. For lenders, accelerated fund flows improve liquidity, enabling efficient loan disbursement and reinvestment.

AI, powered by machine learning (ML) and predictive analytics, has transformed credit scoring and risk assessment. Traditional models often exclude underserved populations due to limited data. AI-driven systems address this by analyzing diverse data sources, such as utility payments and transaction histories, to evaluate creditworthiness. These tools improve risk management by identifying potential defaults early, enabling lenders to adjust terms or offer financial counseling. AI’s efficiency also reduces operational costs, enhances fraud detection, and allows for highly customized credit solutions.

Blockchain technology introduces transparency and trust through its secure, decentralized ledger system. It eliminates intermediaries by providing tamper-proof transaction records accessible to all parties. Smart contracts, integrated with blockchain, automate credit agreements by executing predefined terms automatically, such as loan disbursements or penalties for missed payments. These innovations streamline credit processes, reduce inefficiencies, and lower costs, particularly in cross-border lending. Blockchain also improves collateral management by enabling swift asset transfers in case of defaults.

Despite its benefits, digital transformation presents challenges such as cybersecurity threats, data privacy concerns, and regulatory uncertainties. AI systems must address issues like algorithmic bias and overreliance on automation, while blockchain faces scalability and regulatory barriers. Collaboration among financial institutions, technology providers, and regulators is critical to overcoming these hurdles.

Digital transformation has redefined credit management, offering faster, more accurate, and inclusive solutions. As these technologies evolve, they promise to further enhance credit policies and risk management, fostering a more efficient and equitable financial ecosystem.

Chapter 7: Regulation and Compliance in Credit Policies

Regulation and compliance are foundational elements of credit policy frameworks, ensuring stability, transparency, and trust in financial systems. By establishing guidelines and monitoring adherence, these mechanisms protect stakeholders, mitigate systemic risks, and uphold ethical practices in lending and credit management. They play a pivotal role in maintaining financial stability and fostering economic resilience.

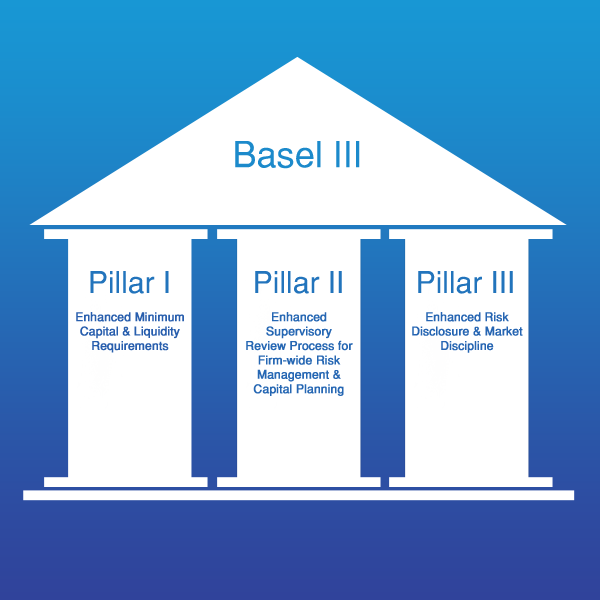

Frameworks like Basel III shape credit policies by setting standards for capital adequacy, liquidity management, and risk assessment. For example, Basel III introduced measures such as the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) to ensure financial institutions can withstand economic shocks. These regulations promote prudent lending practices, mitigate overleveraging, and enhance the resilience of financial systems, reducing the likelihood of crises.

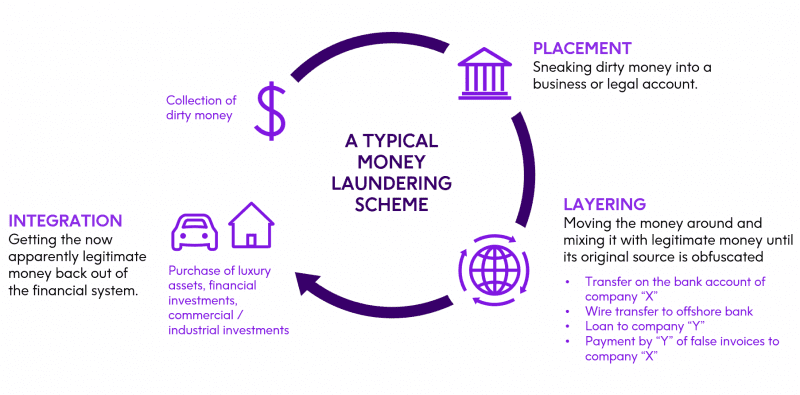

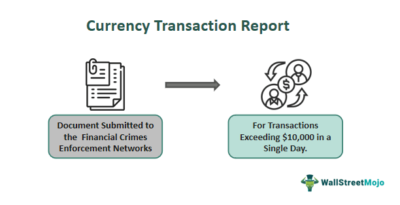

Compliance involves adhering to critical areas such as anti-money laundering (AML), know-your-customer (KYC), and data protection laws. AML regulations combat financial crimes by requiring institutions to monitor transactions and report suspicious activities, while KYC ensures the transparency and legitimacy of client identities. Data protection laws, like GDPR, safeguard customer information, enhancing trust and minimizing reputational risks for financial institutions.

Regulation and compliance foster trust through transparent and fair credit practices. By mandating clear disclosures of credit terms and ensuring non-discriminatory access to credit, they promote equity and customer confidence. Compliance with data privacy laws further strengthens this trust, assuring customers that their sensitive information is secure.

These frameworks also contribute to economic resilience by addressing systemic risks. Measures such as capital adequacy requirements and stress testing ensure financial institutions maintain sufficient buffers to navigate economic downturns. Additionally, regulations targeting financial crimes protect the integrity of markets, safeguarding them from destabilizing activities like money laundering or fraud.

As globalization, digitization, and economic shifts redefine financial systems, regulation and compliance must evolve. Institutions and regulators face challenges such as navigating complex international regulations, leveraging advanced technologies for compliance, and addressing emerging risks like cybersecurity threats. Collaborative efforts between financial institutions, regulators, and technology providers will be critical for maintaining robust and adaptive regulatory frameworks.

In summary, regulation and compliance are essential for maintaining trust, stability, and ethical practices in credit systems. They ensure financial institutions operate responsibly, support economic growth, and contribute to the long-term sustainability of global financial ecosystems.

Chapter 8: Credit Policies During Economic Crises

Economic crises, such as the 2008 global financial crisis and the COVID-19 pandemic, highlight the critical role of credit policies in stabilizing economies, supporting businesses, and fostering recovery. These policies, implemented by governments, central banks, and financial institutions, address liquidity challenges, prevent defaults, and mitigate systemic risks during financial downturns.

The 2008 global financial crisis was a turning point for credit policies, exposing vulnerabilities in risk management and regulatory oversight. Rooted in credit mismanagement, excessive subprime lending, and the overuse of complex financial instruments, the crisis led to widespread defaults and systemic instability. In response, policymakers implemented measures like the Troubled Asset Relief Program (TARP), quantitative easing, and bank bailouts to restore liquidity, stabilize credit markets, and prevent financial collapse. The crisis underscored the importance of robust credit risk assessments, enhanced regulatory frameworks, and systemic stability measures to mitigate future risks.

Similarly, the COVID-19 pandemic prompted swift and unprecedented credit policy interventions to address economic disruptions. Measures included loan moratoriums, targeted credit programs, and government-backed schemes to support businesses and households. For example, the U.S. Paycheck Protection Program (PPP) provided forgivable loans to small businesses, while central banks worldwide implemented interest rate cuts and asset purchase programs to maintain liquidity. These interventions prevented widespread defaults, stabilized credit markets, and supported vulnerable sectors, such as healthcare and retail. However, challenges like unequal access to funding and administrative bottlenecks highlighted the need for better-targeted and efficiently implemented credit policies.

Small and medium enterprises (SMEs) were particularly reliant on emergency credit policies during these crises. Credit guarantees and relief programs provided essential liquidity, helping SMEs maintain operations and retain employees. However, barriers such as complex application processes, unequal access in underserved areas, and risk aversion among lenders limited the reach of these measures. Addressing these challenges through streamlined processes, broader outreach, and post-crisis support is essential for ensuring long-term SME resilience and growth.

Both crises emphasized the importance of proactive and adaptive credit policies in managing systemic risks and fostering recovery. They highlighted the need for collaboration among governments, financial institutions, and central banks to implement effective interventions. Moving forward, lessons from these events can guide the development of resilient credit systems that balance immediate relief with long-term economic stability.

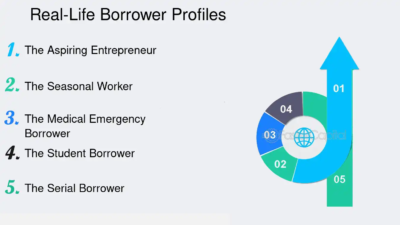

Chapter 9: Consumer Credit Policies and Behavior

Consumer credit policies play a pivotal role in shaping individual financial behavior and economic stability. These policies, governed by financial institutions and regulatory frameworks, define how consumers access credit, the costs associated with borrowing, and the repayment terms. Key components include credit scores, interest rates, and lending terms, which collectively influence borrowing decisions and financial well-being.

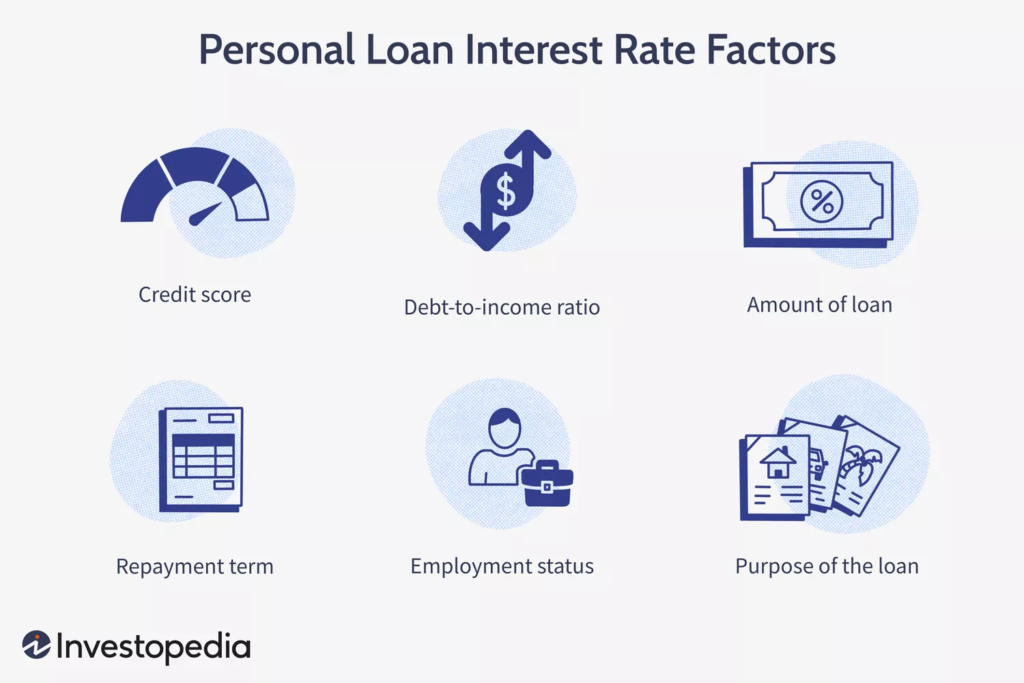

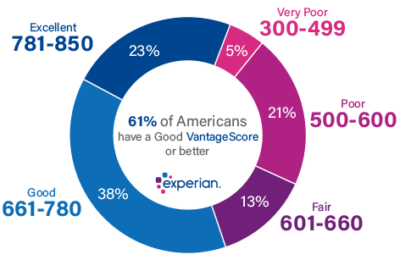

Credit Scores are fundamental to consumer lending, serving as a measure of creditworthiness. Derived from credit reports, scores assess factors like payment history, credit utilization, and credit mix. A high credit score increases access to loans, lowers interest rates, and enhances borrowing limits, while a low score may lead to higher costs and stricter terms. Credit scores incentivize financial discipline by rewarding timely payments and responsible credit use.

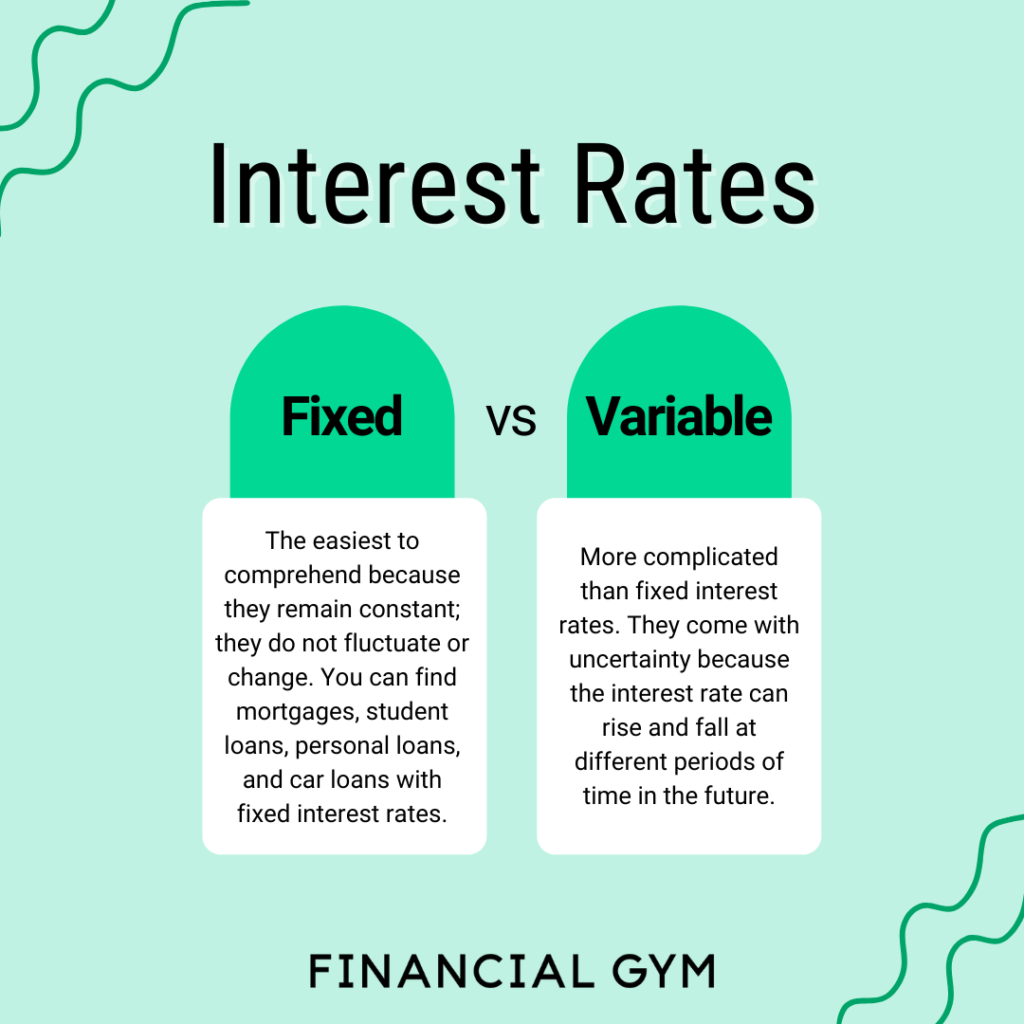

Interest Rates represent the cost of borrowing and significantly impact consumer decisions. Determined by macroeconomic factors, such as central bank policies and inflation, as well as borrower-specific characteristics like credit scores, interest rates influence the affordability of loans. Consumers often choose between fixed rates, which provide stability, and variable rates, which offer flexibility but come with potential risks tied to market fluctuations.

Lending Terms and Conditions outline the repayment framework for borrowed funds. These include repayment schedules, grace periods, and penalties, tailored to individual financial profiles. Flexible terms, such as graduated payments or deferred repayment plans, accommodate diverse borrower needs, while penalties discourage delinquency. Effective lending terms strike a balance between affordability for consumers and risk management for lenders.

Consumer credit policies shape borrowing behavior, encouraging responsible financial practices through incentives and disincentives. They also affect broader economic trends, influencing consumer spending, saving habits, and overall financial inclusion. However, challenges like systemic inequalities in access to credit and the risk of predatory practices necessitate robust oversight and transparent processes.

In conclusion, consumer credit policies are instrumental in fostering financial stability and inclusivity. By balancing borrower needs with lender interests, these policies enable sustainable credit ecosystems, support economic growth, and promote responsible financial behavior among consumers.

Chapter 10: Corporate Credit Policies and Investment

The integration of corporate credit policies into a business’s financial strategy is instrumental in determining its ability to borrow, invest, and grow. These policies establish the framework for borrowing, influencing terms such as credit limits, interest rates, collateral requirements, and repayment schedules. By setting these parameters, credit policies shape how businesses allocate financial resources and plan for strategic investments, fostering long-term stability and growth.

Key components of corporate credit policies—such as risk assessment criteria, credit ratings, and repayment terms—are crucial for evaluating a company’s financial health and creditworthiness. These elements not only guide internal financial decisions but also affect external perceptions, as lenders, investors, and alternative financiers assess businesses based on these frameworks. As a result, robust credit policies enable businesses to secure favorable borrowing terms, fund innovation, and maintain financial resilience.

The influence of credit policies extends to borrowing decisions, impacting how and where companies secure funding. Traditional financial institutions and bond markets evaluate borrowers based on established credit policies, determining their access to capital and the cost of debt. In parallel, the rise of alternative lenders offers businesses additional financing options, particularly for those with non-traditional credit needs. Balancing these opportunities requires companies to weigh the advantages of leveraging debt against potential risks, ensuring financial stability while pursuing strategic objectives.

Investment strategies are also heavily shaped by corporate credit policies, as these frameworks determine the availability and cost of capital for R&D, infrastructure development, and market expansion. Favorable credit conditions allow businesses to undertake large-scale projects and innovate, while restrictive policies may constrain their ability to allocate capital effectively. The alignment of credit policies with strategic goals is crucial for optimizing resource allocation and achieving sustainable growth.

This discussion explores the role of corporate credit policies in borrowing and investment decisions, highlighting their impact on financial stability, strategic planning, and market competitiveness. It underscores the importance of adaptive and well-designed credit policies in navigating economic challenges and unlocking growth potential.

Chapter 11: Sustainable Credit Policies and ESG Goals

The global financial landscape is transforming as credit policies increasingly align with Environmental, Social, and Governance (ESG) goals. This shift emphasizes the role of the financial sector in promoting sustainable development, addressing climate change, and fostering responsible lending practices. By integrating ESG criteria, financial institutions are incentivizing businesses to adopt sustainable practices while mitigating long-term risks associated with environmental degradation, social inequality, and governance shortcomings.

Integration of ESG Criteria

ESG factors are reshaping traditional credit assessments by broadening evaluations to include environmental impact, social responsibility, and governance structures. Companies demonstrating strong ESG performance benefit from favorable loan terms and expanded credit access. Instruments such as sustainability-linked loans (SLLs) and green loans are tailored to align financial incentives with sustainability targets, encouraging businesses to meet environmental and social benchmarks.

Incorporating ESG criteria also enhances risk management. Businesses failing to address ESG issues face growing risks, including regulatory penalties, reputational damage, and operational disruptions. Lenders mitigate exposure to these risks by evaluating factors such as a borrower’s carbon footprint, labor practices, and governance structures. This proactive approach strengthens portfolio resilience and aligns with long-term financial stability goals.

Green Bonds and Sustainability-Linked Loans

Green bonds and SLLs are innovative financial tools that drive investment in sustainable projects. Green bonds fund initiatives like renewable energy and conservation, while SLLs incentivize borrowers to achieve ESG performance targets by linking loan terms to sustainability outcomes. These instruments mobilize private capital for public benefit, supporting the transition to a low-carbon economy and achieving global sustainability goals.

Both instruments encourage accountability through rigorous reporting standards and transparency. They also help industries transition to greener practices by providing tailored financing options, fostering corporate responsibility, and addressing the United Nations Sustainable Development Goals (SDGs).

Challenges and Opportunities

Despite their benefits, integrating ESG into credit policies faces challenges, including inconsistent data standards, greenwashing risks, and high implementation costs. Initiatives such as the Green Bond Principles and Sustainability-Linked Loan Principles are addressing these gaps by establishing guidelines and ensuring market integrity.

As markets mature and policies evolve, ESG integration, green bonds, and SLLs will play an increasingly significant role in advancing sustainability. These tools not only drive financial innovation but also address pressing global challenges, ensuring that the financial sector remains a key enabler of sustainable development.

Chapter 12: Future Trends in Credit Policies

Credit policies are undergoing a transformation to address emerging global challenges such as technological advancements, climate change, and geopolitical risks. These evolving dynamics are reshaping traditional frameworks, pushing financial institutions to integrate innovative solutions and adapt to new realities. The future of credit management lies in leveraging technological innovations, aligning with sustainability goals, and building resilience against geopolitical uncertainties.

Technological advancements like artificial intelligence (AI), machine learning (ML), blockchain, and digital platforms are revolutionizing credit processes. AI and ML automate credit scoring and enhance risk assessments by analyzing large datasets, including nontraditional metrics like mobile transactions and social media behavior. Blockchain offers a secure, transparent ledger system, improving trust and reducing fraud, while smart contracts automate credit agreements, reducing inefficiencies. Digital platforms like M-Pesa and Tala expand access to underserved populations, fostering financial inclusion and enabling small businesses and individuals in remote areas to secure credit.

The integration of environmental, social, and governance (ESG) criteria into credit policies reflects the growing importance of green finance and sustainability. Financial institutions are aligning credit decisions with climate goals by promoting green bonds, sustainable lending practices, and climate-resilient frameworks. ESG criteria incentivize businesses to adopt sustainable practices, while green bonds finance environmentally beneficial projects. Sustainability-linked loans and climate risk modeling further demonstrate the shift toward credit policies that prioritize long-term environmental resilience and responsible investments.

Geopolitical risks, including trade wars, sanctions, and regional instability, pose significant challenges to global credit markets. These risks disrupt trade, increase default probabilities, and strain financial systems. Adaptive credit policies focus on diversification, enhanced risk assessments, and collaboration with governments and international organizations to maintain stability. For instance, the sanctions on Russia following the annexation of Crimea in 2014 highlighted the need for resilient credit systems and innovative responses to geopolitical disruptions.

In conclusion, the future of credit policies is defined by technological innovation, sustainable practices, and adaptability to global risks. By integrating these elements, financial institutions can enhance efficiency, inclusivity, and resilience. The evolving credit landscape underscores the importance of collaboration among governments, regulators, and financial institutions to navigate emerging challenges and create a stable, forward-looking financial ecosystem.

Curriculum

Flow of Funds – Workshop 1 – Understanding Credit Policies

- The Foundations of Credit Policies

- The Relationship Between Credit Policies and Economic Growth

- The Role of Credit Policies in Economic Stability

- Credit Risk Assessment and Management

- Globalization and Cross-Border Credit Policies

- Digital Transformation and Credit

- Regulation and Compliance in Credit Policies

- Credit Policies During Economic Crises

- Consumer Credit Policies and Behavior

- Corporate Credit Policies and Investment

- Sustainable Credit Policies and ESG Goals

- Future Trends in Credit Policies

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Flow of Funds corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family know when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they don’t! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change, is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast