Financial Leadership Program

Workshop 1 – Model Overview

The Appleton Greene Corporate Training Program (CTP) for Financial Leadership is provided by Mr. Antongiovanni MBA BA Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr Antongiovanni is a Certified Learning Provider (CLP) at Appleton Greene and he has experience in management, finance and human resources. He has achieved an MBA and BA in Accounting. He has industry experience within the following sectors: manufacturing; logistics; automotive; consumer goods and food & beverage. He has had commercial experience within the following countries: United States of America, or more specifically within the following cities: Chicago IL; Milwaukee WI; Des Moines IA; Indianapolis IN and Madison WI. His personal achievements include: creating a patented multi-layer coating process, inventing a patented workflow automation app, creating a new business unit in Japan, completing a global ERP rollout and creation of a M&A strategy. His service skills incorporate: process improvement; finance strategy; business strategy; operational execution and project management.

MOST Analysis

Mission Statement

The first workshop in this program is designed to create an understanding of the model and make sure the underlying corporate infrastructure is ready to support the Financial Leadership Model. We will achieve this by first working to understand the model. After we have completed an overview of the model, we will work on the four competencies of the model. Next, we will review the four leadership traits. We will review existing business processes and elements of the finance team. This will help us to identify potential issues and help set expectations for the team. Finally, we will review the participants in future workshops, discuss the time commitment and availability of the team participants.

Objectives

01. Understand the financial competency and leadership model.

02. Understand the difference between competencies and leadership traits.

03. Build matrix of competency and leadership expectations specific to the organizational structure and complexity.

04. Review existing business processes related to recruitment, talent evaluation and employee development.

05. Analyze and develop a plan to integrate the model into existing business processes.

06. Calibrate current performance of finance team. (Current)

07. Identify and analyze key personnel and any existing issues. (History)

08. Identify and calibrate expectations on future outlook of the finance team. (Future Outlook)

09. Analyze and determine who should participate in future sessions.

10. Estimate the time commitment for implementation of the process.

Strategies

01. Each participant is to set aside time to study the elements of the workshop content.

02. Participants to set aside time to meet as a team to discuss the competencies and leadership traits.

03. List and group financial team roles. Assign performance criteria for each competency and leadership for each group.

04. Analyze existing business processes related to recruitment, development, and performance evaluation. Determine where integration with the competency and leadership model is necessary.

05. Develop an integration plan including resolving any differences in terminology and expectations for future modules.

06. Participants should meet to discuss the overall performance of the finance team. The team should review each of the competencies and evaluate if this is a strength or weakness in the current organization. The team should also review the financial leadership’s performance against the leadership traits.

07. List key personnel and any existing issues with the current team as it relates to the financial competency and leadership model.

08. Participants should meet to discuss future expectations of the finance team’s performance. These expectations will be used in modules 6 and 11.

09. List the key personnel that will participate in each of the modules.

10. Determine the estimated time commitment for the participants for each module and analyze the current workload to determine feasibility.

Tasks

01. Read through the entire workshop and make notes.

02. Schedule a meeting for the participants to meet and discuss the model within 30 days.

03. Set a deadline within the next 30 days to create a matrix of competency expectations and job level and leadership expectations and job level.

04. Schedule a meeting within the next 30 days for key stakeholders to review existing business processes.

05. Set a deadline in the next 30 days for developing a plan to integrate the financial competency and leadership model into business, including expectations for future modules.

06. Schedule a meeting in the next 30 days to discuss the current performance of the finance team as it relates to the financial competency and leadership model.

07. Set a deadline within the next 30 days to review key personnel and existing issues.

08. Schedule a meeting within the next 30 days to discuss the future expectations of the finance team’s performance.

09. Set a deadline within the next 30 days to create a list of participants for each of the modules.

10. Set a deadline for determining and analyzing the time commitment for each of the participants.

Introduction

Introduction to Financial Leadership

The primary goal of this workshop will be to lay the foundation for implementation of the Financial Leadership Model, review existing corporate infrastructure and plan for participation in future workshops. This workshop should lay the groundwork for future workshops. This workshop will focus internally on the organization and will require participants to engage in open and honest dialogue regarding the performance of the finance function of the company.

There is some preparation work that all participants should complete prior to starting the workshop. The preparation work is detailed in the Preliminary Analysis section. Participants should also read through the Distance Learning section to make sure they establish the proper learning environment. The Tutorial Support section will also provide instructions and details on how to seek support.

Financial Leadership vs Organizational Leadership

It is important to differentiate between financial leadership and organizational leadership. This program will develop the financial leadership skills for the finance team. Organizational leadership is very familiar to all of us. This is the role of the President or CEO of the company. There are many books written on the subject. Organizational leadership is leadership that is necessary to lead the entire organization, to balance the needs of internal and external stakeholders and many other things we see CEOs do.

Financial Leadership is different. The financial leader is not the face of the company and does not have the formal authority of the CEO. Financial leaders need to have the be able to use influence to affect change in an organization. While financial leaders have formal authority, the successful leaders are able to influence others. The ability to use influence to affect change is the key to financial leadership. The Financial Leadership Model will help financial leaders build these skills and the team necessary to build their ability to influence the organization.

Financial Leadership Model

The Financial Leadership Model has two critical components. First, there are competencies that all members of the finance team should have. These skills are necessary for the financial leader to develop on the team in order for their leadership to be effective. The second component is the leadership traits that are necessary for financial leaders to unlock true financial leadership in their organization. These skills will allow the financial leader to adapt to different situations in the business and to become a valued counsel and advocate for the business.

The workshop will introduce the different module components and develop competency matrices for both the Financial Competencies and Leadership Traits. During the workshop we will establish performance criteria for each of the competencies and traits. We will further establish performance criteria for different levels in the organization.

The matrices are a key output for this workshop. The matrices will be further refined and validated as the program progresses. It is important that workshop participants are prepared to discuss current performance of the finance team and expectations based on the model.

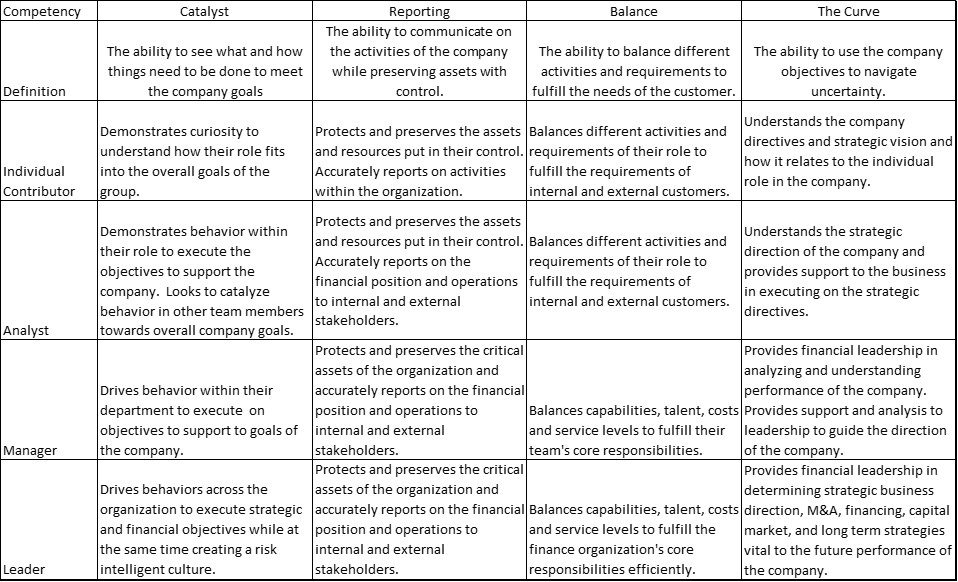

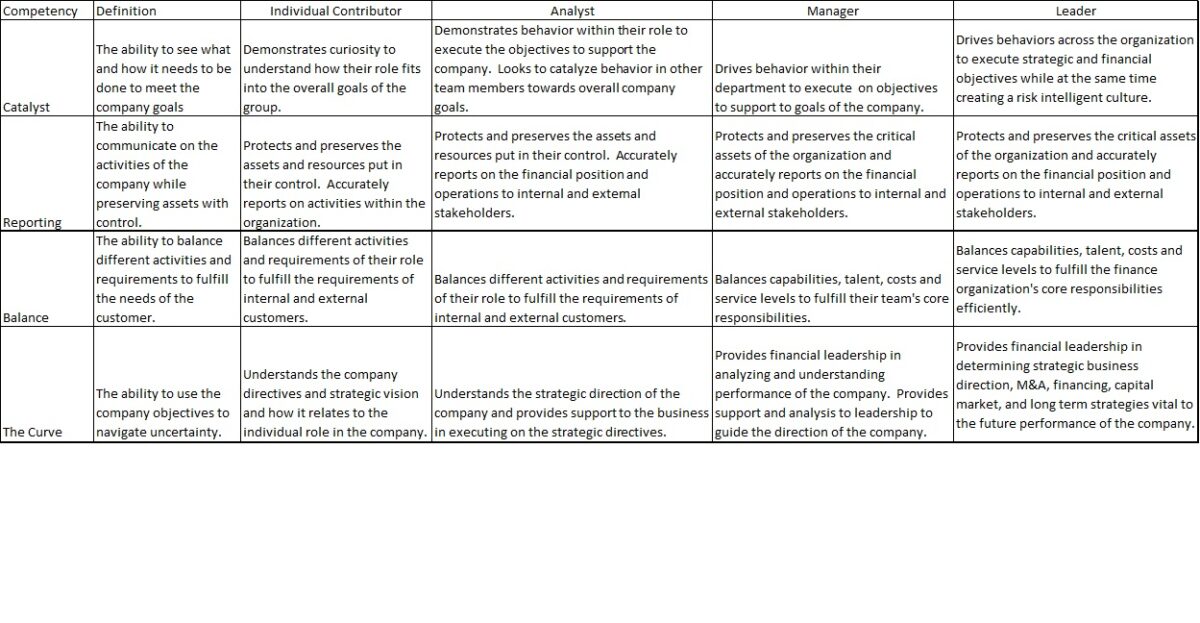

Financial Competencies

Successful leaders need to build successful teams. There are four financial competencies that team members need to demonstrate. The more senior the role in the organization, the more skill that is required in each of these competencies. Catalyst, the first competency is the ability to see what and how things need to be done to meet the company goals is the first of these competencies. The second is Reporting or the communicating on the activities of the company while preserving assets with control. Balance, the third competency is the ability to balance different activities and requirements to fulfill the needs of the customer. The final competency is The Curve. This is the ability to use the company objectives to navigate uncertainty.

It is important to have employees with sufficient levels of the competencies for their role in the organization. When employees do not have the sufficient level of these competencies it will create problems with the team’s performance and will be a distraction for the financial leaders of the company.

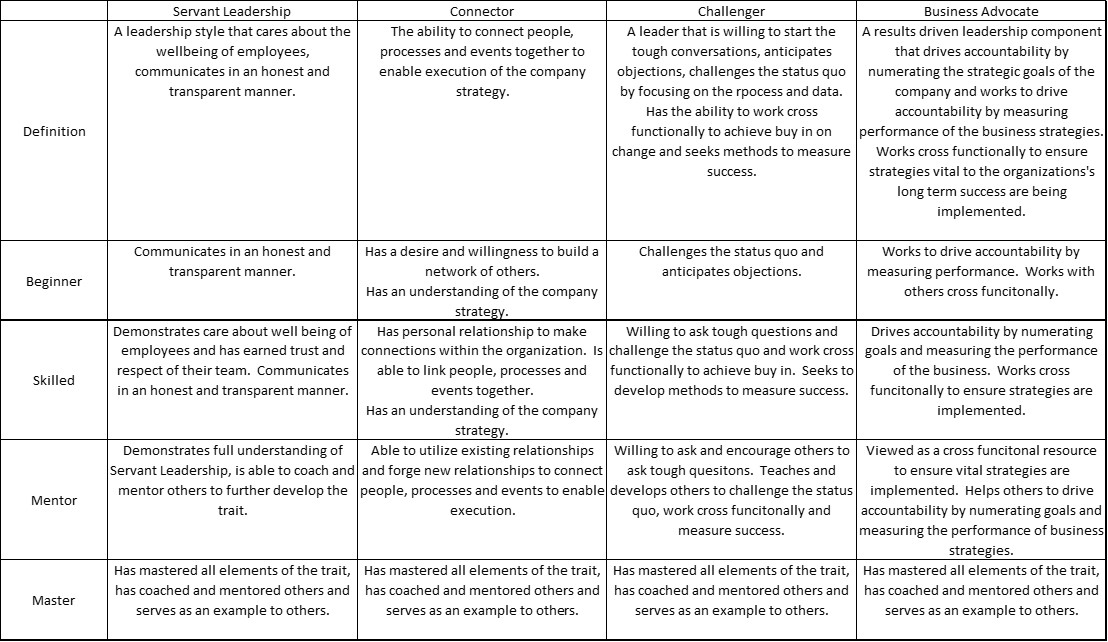

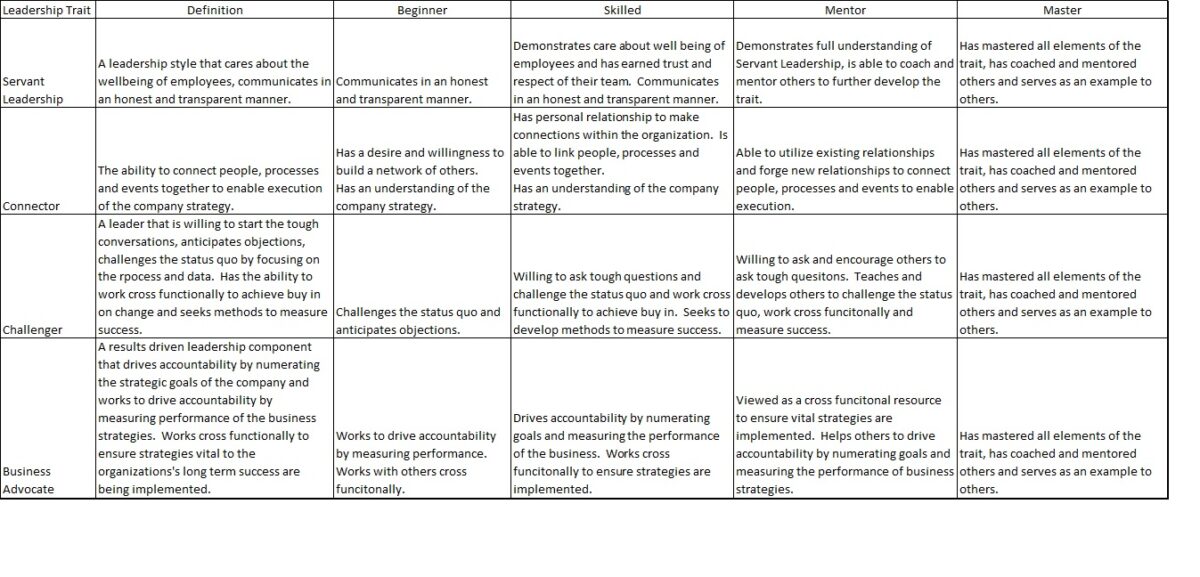

Leadership Traits

Successful financial leaders have the ability to utilize different skills depending on the situation. The Financial Leadership Model will introduce four key leadership traits that all financial leaders need to be able to utilize. The ability to adapt to different situations are key to long term success.

The first of these traits is Servant Leadership, the ability to demonstrate care about the wellbeing of employees and the ability to communicate in an honest and transparent manner. The second leadership trait is Connector, the ability to connect people, processes, and events to enable execution of strategy. Challenger or the willingness to have tough conversations and challenge the status quo is the third trait in the model. The final trait is Business Advocate, results driven leadership that drives accountability, numerates strategic goals and measure performance of business strategies.

In this workshop we will focus on defining the leadership traits and the level of mastery for different levels in the organization. In later workshops we will discuss more about each individual trait and how the different traits work together. The traits are not different buckets to jump from one to another, rather they are linked and should be thought of as how much of each ingredient is necessary in a given situation.

Data Gathering

During the workshop we will be reviewing several existing internal processes and the individuals that make up the finance team. It is important to gather the data discussed in the Preliminary Analysis so the workshop can work with complete data. Please refer to this section on the specifics and recommendations for gathering data for the workshop. It will be helpful for the participants to share in the data and to have a method for shared access.

Participant Considerations

Participant Preparation

The workshop is designed to start with the model and begin the process of understanding the model prior to implementation. It is recommended that all participants review the Study Guide, Tutorial Support and Preliminary Analysis prior to the start of the workshop. The Study Guide help each participant prepare for the program and will provide tips to help your success. The Tutorial Support section will provide show you how to request support during the program. The Preliminary Analysis will discuss things the participants should do to prepare prior to the workshop.

The preparation discussed in the Preliminary Analysis does not involve any research. However, the participants should spend time preparing for the Workshop. As discussed in the Preliminary Analysis, participants should spend time gathering the data required, reviewing key internal processes and spending time reflecting on the current performance of the team.

The participants should also spend time reflecting on their own performance as leaders. During the workshop, participants will be discussing the performance of the team. It is important for participants to prepare themselves for this activity by preparing themselves to give and receive feedback. It is important to keep focused on the feedback is meant to improve the performance of the finance team. It is critical that participants ask questions and challenge assumptions during the process.

Guidelines on Feedback

As participants prepare for the workshop, they should keep in mind the three guidelines on feedback that are discussed in the Preliminary Analysis. There is a human element of feedback that needs to be acknowledged. Feedback can be as difficult to give as to received, and participants in the program should remember that it may be as uncomfortable for the person providing the feedback as it is to receive.

It is recommended to establish three ground rules. First, focus on outcomes and not intent or character of the individual. If you present the feedback based on the outcome obtained, the focus will be on the results and not on the person. This is easily done with statements that are structured based on observations, results or facts followed by the perceived consequence. For example, when you come to the meeting late, Tom, it makes me feel that you do not respect my time. In this example, there is nothing that is personally attacking Tom. It is about the fact that he is late, and the consequence is the meeting organizer feels disrespected.

The second guideline is respect. Everyone needs to be respectful of each other. When you focus on the outcome it is difficult to be disrespectful of the person you are giving feedback to. The focus shifts to the outcome. If you assume that Tom does not intend to disrespect the meeting organizer, there is a mutual problem to solve. For individuals accepting feedback showing mutual respect to the person providing the feedback is also required. This means no interrupting or attempting to rationalize your thought process. It is okay to ask questions to seek clarification or to ask for help.

The final guideline is to be truthful. Many times, professional environments people feel the need to soften feedback so to not look ‘mean’ or to allow the other party to save face. This is not that time. There is nothing meaner than not telling someone the truth when they have asked for the truth. If you are hesitating on providing feedback because you feel it might be perceived as mean, ask yourself what is meaner saying something or allowing the situation to continue. Do not confuse being mean for uncomfortable.

Participants should also make sure they understand the rule of quickness. If someone violates the rules or acts in a manner that is not consistent with providing good feedback, they need to be called out quickly. If the team allows poor behavior to go unchecked the rules will not be followed. Please follow the guideline of being truthful. Do not fall into the mean perception trap. It is far ‘meaner’ to allow the poor behavior to continue.

Team / Organization Dynamics

This module will require the participants to meet and discuss the performance criteria for the financial competencies and leadership traits. It will be important for the team to effectively communicate and discuss these issues as a team. Creating the right environment for an open and honest discussion is necessary to for the participants to successful discuss the criteria and build the matrices required.

Prior to any meeting or the workshop, the participants should agree to complete any preparation necessary and be ready to participate. Additionally, two rules need to be agreed upon prior to the meeting. First, unless otherwise noted the conversations and discussions in the room should be considered confidential and do not leave the room. Second, all ideas in the room are equal and are not dependent on any individual’s status in the organization.

During the team discussions all participants should abide by three rules. First, the Platinum Rule. Treat others as you want to be treated. Second, the ‘No Jerk Rule’. A jerk will say what they wish, without regard for others. This does not mean you cannot offer criticism. When tough issues arise, your communication should come from a genuine concern for others or the team. This eliminates the ‘jerk’ component. Finally, the Quickness Rule also applies here. Participants should be quick to call out violations or the rules or poor behavior.

Matrix Development

Matrix as a tool

During the workshop, the participants will develop a Competency Matrix and a separate Leadership Matrix. Each matrix will have the different competencies or leadership traits along one axis and different levels of skill along the other axis. The participants will need to determine the different organizational levels within the finance team. The performance expectations or mastery of a skill will be different for an individual contributor than it will be for a high-level executive.

The matrices will be powerful tools for your organization. The matrices will help in the evaluation of existing employees, will help evaluate new employees and employees being considered for new roles. Additionally, the matrices will aid in the communication to others in the organization performance criteria and expectations for members of the finance team. This will create transparency and accountability.

Participants should not worry about getting the matrices perfect during the workshop. The matrices developed as part of this workshop will be working drafts that will be improved and honed over the rest of the program.

Developing Competency Matrix

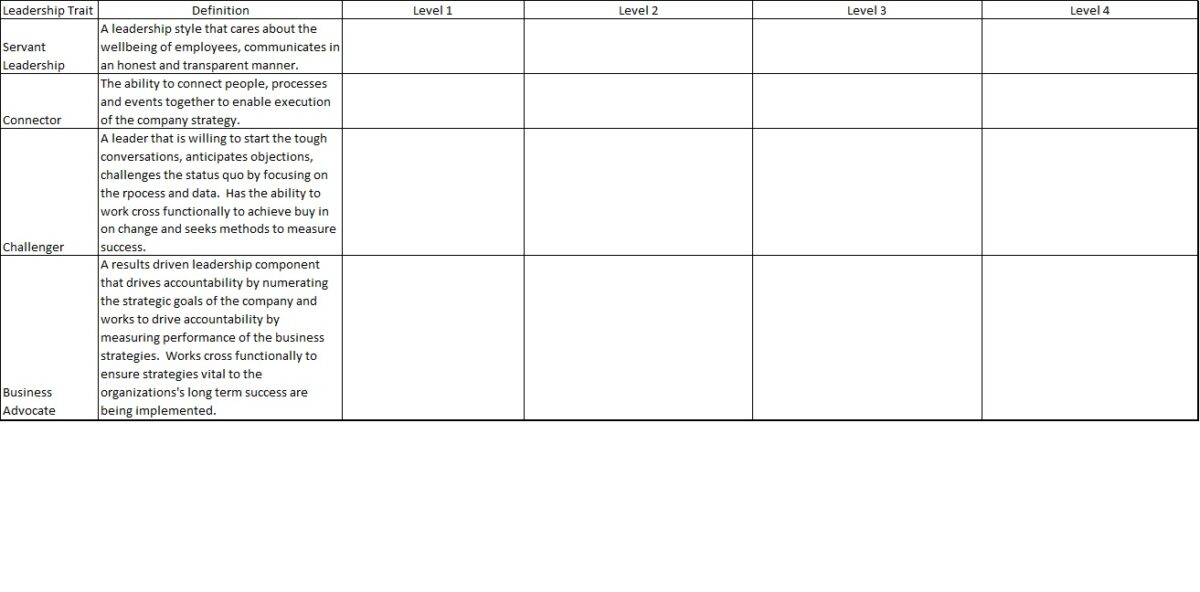

First, we will develop a competency matrix based on the 4 financial competencies: Catalyst, Reporting, Balance and The Curve. The participants in the workshop will need to determine the different levels of competency in the organization. One axis of the matrix will be the four competencies and the other axis will be different competency levels required in the organization. Please see example below.

Once you have established different performance levels, you need to provide a description of the performance required at that level. Participants should keep in mind that this will be a public document that will be shared with all employees on the finance team.

Understanding and Testing the Competency Matrix

Once a draft of the competency matrix is finished, it is important to verify that all the participants have a solid understanding of the matrix and the differences in the performance levels for each competency. During the workshop, the different participants will be asked to explain the matrix to other participants. This will help validate the understanding of the participant explaining the matrix and to make sure both participants are aligned on their understanding of the matrix.

Once the participants are comfortable with the matrix, they can start the validation process. The participants should select a small group of employees and determine if they can identify which level of performance is required for each employee and then compare each employee’s performance to the appropriate standard. The group should also validate a recent group of job candidates that were interviewed. After these exercises are complete the workshop participants should identify any possible issues or items that were not clear in the process. This will be used to further refine the matrix.

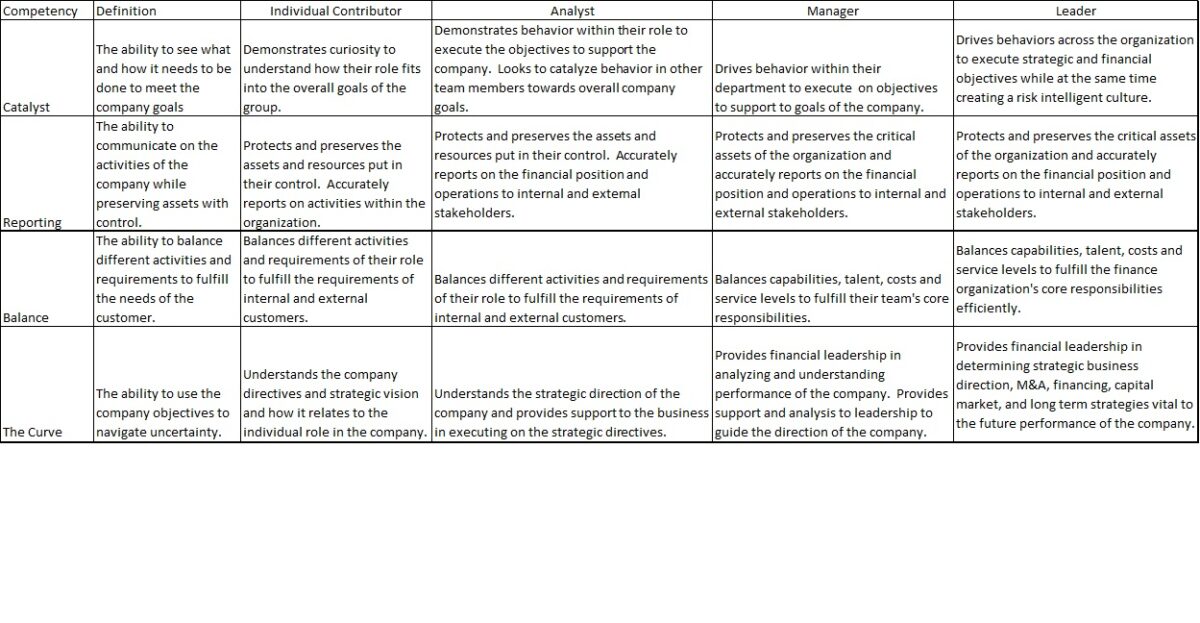

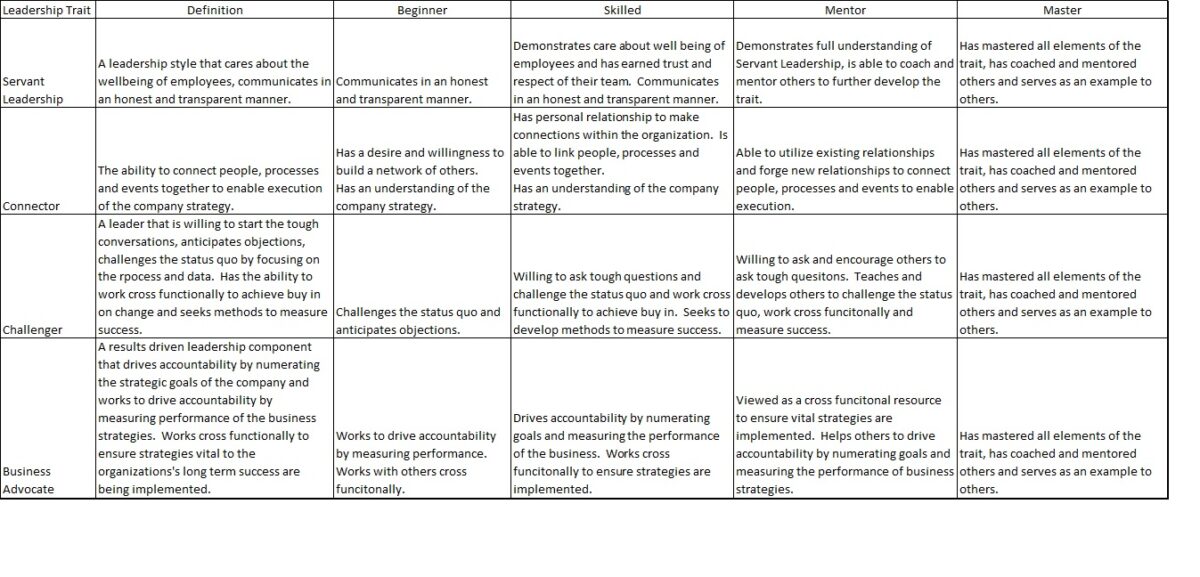

Developing the Leadership Matrix

Building the Leadership Matrix will be similar to the Competency Matrix. The matrix will have the 4 leadership traits on one axis and the four leadership traits: Servant Leadership, Connector, Challenger, and Business Advocate. The other axis will show different levels of skill for each trait. Please see the example below:

The leadership traits are different from the competencies. The competencies are specific skills that are separate from each other. The leadership traits are related and are something that financial leaders need to learn how to mix into the appropriate portions. For example, it is difficult to be a Business Advocate if you are unskilled at being a Connector or Challenger. Furthermore, when acting as a Challenger, if you cannot demonstrate Servant Leadership, your message may not be well received.

The participants will need to establish the different performance levels for each trait. Generally, there should be at least three performance levels and no more than six. Different roles can then be assigned different performance levels for the different traits. Using the chart above, the requirement for a seasoned financial executive might be to have ‘Master’ level in three of the four traits and ‘Mentor’ in the other. For someone looking to enter a management role, having the ‘Beginner’ level for all 4 traits may be a requirement.

The matrix will provide a tool to show employees interested in development areas where they can pursue developing skills to further their career. It can also be useful as a recruitment tool and to help with selection of employees for promotion.

Understanding and Testing the Leadership Matrix

Once a draft of the Leadership Matrix is finished, demonstrating that the participants are aligned and understand the matrix is critical. Similar to what is done with the Competency Matrix, we will have participants in the workshop explain the matrix to other participants. This will help to validate the participants understanding of the Leadership Matrix and make sure participants are aligned.

Once the participants are comfortable with the matrix, they should do a quick validation of the matrix. The participants should select a small group of employees and determine if they can identify which level of performance is required for each employee and then compare each employee’s performance to the appropriate standard. The group should also validate a recent group of job candidates that were interviewed. After these exercises are complete the workshop participants should identify any possible issues or items that were not clear in the process. This will be used to further refine the matrix.

Calibration Process

Introduction to Calibration

Calibration is an intentional process where different participants compare their individual assessments of the performance of an employee. The purpose of the calibration process is to make sure the participants in the evaluation looking at employees with the same set of facts, data, and expectations. The purpose of the calibration exercises is to reach agreement.

Agreement on facts, data, and expectations. It is not a democratic voting process, nor is it an exercise in consensus building.

During this workshop there will be a small calibration exercise to test the matrices that are developed. Additionally, participants should prepare for larger calibration exercises as Financial Leadership Model is further tested, and employees are evaluated using the model.

Preparing for Calibration

The key to successful calibration is preparation. Participants should prepare for calibration of an employee by making sure they can cite examples on the performance of the employee and can properly characterize their relationship with the employee. Providing examples and details on an employee’s performance compared to the matrix helps to remove subjectivity and personal conflicts from the conversation. This feedback can then be used to explain why a rating was giving to the employee. The relationship that you as a participant in the workshop has with the employee being rated is something you should also reflect on. When you manage someone directly, you will have a different viewpoint from someone that is a peer or an internal customer.

Successful calibration will have viewpoints from different perspectives. Typically, peers see things that managers and others do not see. This can be helpful insight into the performance regarding one of the competencies or leadership traits. Many times, in my career it has taken me longer to notice something about an employee that worked directly for me, when it was very obvious to the others on the team. Internal customer perspective is also helpful, after all it is important to understand your customer’s perspective. I have been surprised many times when someone outside of the finance team has commented on the performance of my team.

Resolving conflicts

During your calibration conversations there may be conflict while discussing the performance of the team and individual members. All participants should keep in mind that conflict is not a symptom of something being wrong, it is actually a sign that you are having open, honest conversations. This is good. Conflict will lead to conversations to get an honest assessment on where your teams are in comparison to the competency and leadership matrices. The key is to keep the conflict healthy and constructive. In order to keep the conversation constructive and healthy, the conversation should focus on results and include specific details.

The purpose of the calibration exercise is to get an agreement. Agreement is not consensus. If there is conflict that cannot be resolved with conversation and discussion based on facts and details, the solution is to gather more data. If the agreement is to gather more data, the agreement should include what and how much data to be gathered and a deadline for coming back to continue the discussion.

Validation

Validation is an ongoing process and necessary to strengthen the matrices. Consistently validating the matrices against success and failure allows for continual improvement in the matrices and to build confidence in the Financial Leadership Model. It is important to build confidence by showing how the Leadership Model and the matrices are helping the organization to be more successful. It is equally important to understand situations where thing did not go well.

Validation of matrices against existing processes

One of the first validations that should be done is to look at your existing processes. The competency and leadership matrices should be validated against your performance management, recruitment, talent development and promotion selection processes. A recent success and a recent failure should be looked at for each of the processes.

When evaluating your existing processes to the matrix several questions should be asked. When comparing successes, you should ask: Does the matrix agree with what are considered successes? If the matrix does not agree, what is driving the success? Is this something that needs to be incorporated into one of the matrices? Is it possible the matrix could be pointing to a longer-term issue that has not become apparent?

When evaluating a recent failure, different questions will be raised. Among the questions that should be asked are: Could the matrix have helped in avoiding or provided an indication of the potential risk? Is the reason for failure due to something the matrices were not intended to help you evaluate? Do you feel the matrices need to be updated as a result of what happened?

Validation of matrices against high and low performing employees

The competency and leadership matrices should also be validated against your employee performance. When evaluating high performing employees, do the employees meet the standards in the matrices? If they do not meet the standards, ask if they are really high performing employees or merely the best in the group.

For employees with lower performance, compare them to the matrix standards. Do they meet the standards? Is there performance related to other issues? Are they really low performing or just the lowest in a high performing group?

What to do after validation?

As the matrices are validated, it is important to consider if a change or refinement to the matrices is needed. Once the matrices have been communicated, changes will need to be communicated and explained to the team.

The matrices should not be updated to reflect current employee performance, but to expected performance. If the team is not meeting the standards created in the matrices it will become necessary to adjust the team. Competency and leadership adjustments will be addressed in future modules.

Executive Summary

Financial Leadership – Role of Finance

The role of finance has been evolving for decades. The days of finance keeping accurate books and monitoring transactions for compliance is only part of the expectation. Companies expect financial leaders to understand complex issues, communicate with key stakeholders and help to drive the business towards its strategic goals. The average tenure of a CFO has dropped from five to three years in the last five years.

There are many reasons the average tenure for the CFO is shrinking. Many organizations have started to view that a change in strategy, necessitates a change in the CFO. The thought process is that there are types of CFO’s and if you are in a growth stage you need a ‘growth’ financial leader. If you need to reduce costs and improve operating performance, you need the financial leader for that situation. If you have technical accounting issues, there is a financial leader for that situation too. This movement towards type casting financial leaders is helping organizations with their challenges.

One of the common reasons for the reduction in CFO tenure has been the lowering average tenure for CEOs. The average tenure of a CFO is about the same as the average CEO. While on the surface it may make sense that a new CEO will want to have their CFO on the team, this is not necessarily the best option. If you were a new CEO, would you really want to replace the person that understands the business processes, will provide analysis and decision support? If the CEO decides to replace his financial leader, he / she will have to search and onboard a new financial leader. During this time, the financial function in the company will be at a reduced capacity. The company will either have no financial leader, an interim financial leader, or an obvious situation where the financial leader will be replaced. All of this can cause chaos and delay the CEO from implementing changes or from having the appropriate financial counsel during the transitional period.

Impact of a Leadership Change:

This chaos cascades through the organization, primarily through the finance team. Employees will fall into one of three groups. The panic group will begin looking for employment and may start to disengage from the business. This can be dangerous in many aspects. First it could lead to a loss of talent since typically the first employees to leave in a crisis and uncertainty are the best employees. There is also the risk of one or two key people leaving to start a stampede for the door. A concentration of turnover in finance can have an impact on overall company morale. When there is a concentration of turnover in finance, it is a red flag to the rest of the company. Do these employees know something I do not? Is the financial outlook not positive? The CEO / Business Leader will need to help manage situation, it is improbable that an interim leader or a leader that is considered to be their way out of the organization.

The second group is the optimistic group is the opposite of the first group. This group will either consider change positive or have an optimistic view on the company. While this group will still be engaged but the challenge is to keep them that way during the transition. If the transition is not handled well, you may find employees leaving this group and looking to leave.

The third group take a wait and see approach. This is the typical group of fence sitters, waiting for more information or to see what happens. The leadership during the transition needs to make sure that employees in this group stay in this group. It is unlikely they will join the optimistic group until a new financial leader is in place. The company will also need to watch out for the development of toxic employees. These employees can be found in either the panic group or the wait and see group. By toxic, I mean that they are actively working against the company’s leadership and are working to taint other employees’ perceptions of the company and the changes being made.

Consequences:

There are several consequences of this process. The CEO will be distracted from their responsibilities by having to pay closer attention to the financial team. The new financial leader will have to immediately work to stabilize the existing team. The financial leader will also face pressure to quickly build the team which can lead to poor hiring decisions. The key to success for any new CFO is having an effective team that allows the CFO the opportunity to address the issues they were hired for.

What happens if when the new financial leader has different expectations and demonstrates different behavior because the company decided to hire a different CFO ‘type’? The chaos will continue. There may be the appearance of smooth, calm surface like a slow flowing river. However, there will be many currents under the surface. Employees will be scrambling to understand changes that have become explicit while trying to read the tea leaves to predict what new expectations and changes may happen.

New leadership will shuffle the employees in the three groups. The biggest risk for the new financial leader and the company will be employees that are positive on the change will take a wait and see approach. It is unlikely that an employee that has turned negative on the company prospects will revert and become positive. The new leader will need to find ways to get employees that are taking the wait and see approach to move towards feeling positive and secure about the prospect of the new financial leader.

Leadership change in the financial function can be necessary but changing a financial leader because there is a new CEO, or the company strategy has changed can be cause unnecessary disruption.

Financial Leadership

Is it possible for a financial leader to develop skills that allow for them to adapt and change to new business leaders and shifts in the company strategy? There are ways for financial leaders to learn to pivot their style in different situations. Financial leaders can also build great teams to help them in times of crisis and turmoil. After all it is in the best interests of the organization to have a financial leader that can change as the business environment changes. In the case of a new business leader, it would make sense for that leader to want to have someone that will be able to help them understand and improve the business they are leading.

First the financial leader needs to learn to vary their style based on the business circumstances. The differences in style are not separate personas to operate from. The Financial Leadership Program will teach financial leaders four different leadership traits and how to use them in different circumstances. Developing an understanding of the traits will allow the financial leader to turn them up or down as the situation presents itself.

Company’s do not want to change so the leader can pivot to the situation. This is great news for leaders that can develop these skills and the necessary team. Why lose time and possibly add chaos to the situation.

Leadership Traits

There are 4 leadership traits that all financial leaders need to be able to utilize. Servant Leadership, the ability to demonstrate care about the wellbeing of employees and the ability to communicate in an honest and transparent manner. Connector, the ability to connect people, processes, and events to enable execution of strategy. Challenger or the willingness to have tough conversations and challenge the status quo. Business Advocate, results driven leadership that drives accountability, numerates strategic goals and measure performance of business strategies. These traits are not different buckets to jump from to another, rather they are linked and should be thought of as how much of each ingredient is necessary. After all, if you are measuring the performance of the business and are unwilling to have a difficult conversation or cannot have the conversation without sounding like a jerk your leadership will not have the impact you are hoping for.

Financial leadership is different from the leadership from the CEO. The financial leader is there to increase the likelihood of success for the organization. When a financial leader brings harnesses these four traits the likelihood of organization success is greatly enhanced.

Financial Competencies

The most dynamic financial leader cannot be successful if the team supporting them is not success and built for long term success. There are four competencies that financial employees need to demonstrate. The more senior the role in the organization, the more skill that is required in each of these competencies. Catalyst, the ability to see what and how it needs to be done to meet the company goals is the first of these competencies. The second is Reporting or the communicating on the activities of the company while preserving assets with control. Balance is the ability to balance different activities and requirements to fulfill the needs of the customer. The Curve is the ability to use the company objectives to navigate uncertainty.

It is critical to employees to have sufficient level of the competency for their role in the organization. The accounts payable processor’s competency level should not be the same as the accounts payable manager. When an employee does not have a sufficient level of the competency, it creates problems in the team’s performance and is a distraction for the financial leader.

It is critical to determine the appropriate level of mastery for each of the competencies and to assess your team based on the expected performance against each competency. If an employee is lacking in the competency there are three causes for this issue. First, the employee may not have developed the necessary competency. The second cause is the leadership is preventing the employee from demonstrating this competency adequately. The final cause could be an element of the company’s culture. Typically, the cultural element causing the issue is an unwritten organizational rule of behavioral norm. While assessing each employee’s performance it is important to understand what may be causing the issue so the appropriate actions can be taken. Financial leaders need to make sure these competencies are used in the recruitment process of new employees.

Building the team

In today’s business environment it is critical for CFOs and other financial leaders to have the right team behind them. Having a team with the right financial competencies is a good first step in the process. The real opportunity comes when you add the right kinds of leaders to the team with the competencies. It is necessary to have leaders in the finance function have the 4 leadership traits. The key is to identify the level of mastery that is necessary for the different levels of leadership on your team. The accounts receivable supervisor will have a different skill level than a financial executive reporting to the CFO.

It is important the set expectations regarding the skill level required in the 4 leadership traits. Setting the expectations will allow the financial leader to properly assess the managerial structure and see where improvements need to be made. Constant assessment will also all the financial leader to review and see how much progress has been made. Being open and transparent with the expectations provides a tool for employees looking for development. An employee interested in advancement will be able to assess their skills in each of the leadership traits and work to develop the skills that are necessary.

The financial leader also needs to make sure the competencies and leadership traits are integrated into the recruitment process. While employees should be screened and evaluated based on their skills related to the company standards, the company can also use the performance standards to show how a financial employee can develop in the company. This will aid in getting the right candidates in the process but also in providing a key insight into the company’s development process.

Financial Leadership – Team

As a financial leader imagine a future where you have the right people in place to do the day-to-day work and the managerial structure in place to lead the team. This will allow you to focus on the strategic elements of what is required of the financial leader. Most financial leaders struggle to get to this future because they do not take the time to build the right team, with the right skills. They spend too much of their time covering the team’s weaknesses instead of addressing the underlying cause. Many CFOs and financial leaders complain about the amount that is on their plate, but how many when challenged actually have the right things on their plate. Properly assessing your current team and building that team with competencies and leadership solves this issue.

From the employee perspective, most employees look for the opportunity to work for a company that allows people to do the job they were hired to do. People want to be told why the work is necessary. Being told what to do without understand the why element is frustrating. The why is the strategy and mission of the company. This cannot be implemented properly without proper financial leadership. The financial leader needs to focus on the leading and not getting too involved in the minor details that should not require their attention.

Leaders

When you create strong leaders on your team, it will improve your effectiveness in many ways. Implementation of the Financial Leadership Program will help you to have more capable leaders on your team. The clearest improvement will be that you will be able to delegate more tasks to your team and to the leaders on the team. This will allow you to continue to develop the leadership traits of the team and allow you to focus on the activities that require your attention. Too many leaders think of delegation as a way to push activities to your team the delegator doesn’t want to do. The real power of delegation happens when you delegate a task to someone because you recognize their ability to get the job done. When employees realize that you delegate to the employees you trust, it will become something employees want instead of the boss just buried me in busy work.

Under the proper leadership you will notice other changes in your team once you have started delegating properly. Employees will take initiative to take things off your plate. You may even notice that employees will come to you with a problem and a solution. Offering the solution shows the leadership traits are encouraging communication and employees have the competency to see beyond their immediate concerns. Overall, this will reduce turnover and lead to higher satisfaction on the team.

Having the right leaders on your team will also augment your skills and make you better. A strong group of leaders will complement each other. If you miss on an issue and you have a strong team, they will help you to realize the issue quickly and solve it. Weak teams will tell you what you want to hear. Sometimes messages need to be communicated from more than one person. People will look for validation of the message. If your team has the right leadership traits, the message will be validated.

Conversations

After you have completed the Financial Leadership Program, you will notice a change in the conversations you have with others in the organization. There will be a shift from conversations and interactions happening due to obligation to a desire to have the finance team involved in the conversation. This is a subtle, but powerful shift in behavior. Many times, finance and financial leaders are involved in discussions because it is a requirement. Someone from finance will need to perform analysis, approve a budget, etc. When finance is no longer viewed as the number crunching, compliance experts they will be invited to the discussion as someone that can add value.

As you find yourself pulled into more discussions it will become critical to have the right team behind you. This will require you to delegate more and to be able to rely more on your team. The team will also benefit from finance being viewed as a key business partner and not the compliance team that makes business difficult.

Counsel

As the company and others react to the positive changes coming from your implementation of the Financial Leadership Program, you will be sought after for counsel as a trusted advisor. Your peers will come to you as a sounding board to talk through issues. They will not come seeking approval but will be looking for guidance and help on issues. The CEO or business leader will confide more in you. There is a difference between being told factually information that should be given to finance and having a real conversation where the leader of the business explains their thoughts and is expecting your opinion.

You may also find that you become known outside of your organization. It is not uncommon for financial leaders to be sought after by customers and others in the industry.

Curriculum

Financial Leadership – Workshop 1 – Model Overview

- Introduction to the Financial Leadership Model

- The 4 Competencies

- Competency Matrix

- Competency Calibration

- Preparation for Competency Assessment

- The 4 Leadership Traits

- Leadership Matrix

- Leadership Calibration

- Preparation for Leadership Assessment

- Existing Infrastructure Review

- Integration of Model

- Participant Training / Resources

Distance Learning

Financial Leadership

Introduction

Welcome to Appleton Greene and thank you for enrolling in the Financial Leadership corporate training programs. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So, we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family knows when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner, and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning, we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they do not! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met, and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly, if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast

As a guide, the Appleton Greene Financial Leadership program should take 6-12 months to complete, depending upon your availability and current commitments. The reason why there is such a variance in time estimates is because every student is an individual, with differing productivity levels and different commitments. These differentiations are then exaggerated by the fact that this is a distance-learning program, which incorporates the practical integration of academic theory as an as a part of the training program. Consequently, all the project studies are real, which means that important decisions and compromises need to be made. You will want to get things right and will need to be patient with your expectations in order to ensure that they are. We would always recommend that you are prudent with your own task and time forecasts, but you still need to develop them and have a clear indication of what are realistic expectations in your case.

With reference to your time planning: consider the time that you can realistically dedicate towards study with the program every week; calculate how long it should take you to complete the program, using the guidelines featured here; then break the program down into logical modules and allocate a suitable proportion of time to each of them, these will be your milestones; you can create a time plan by using a spreadsheet on your computer, or a personal organizer such as MS Outlook, you could also use a financial forecasting software; break your time forecasts down into manageable chunks of time, the more specific you can be, the more productive and accurate your time management will be; finally, use formulas where possible to do your time calculations for you, because this will help later on when your forecasts need to change in line with actual performance.

With reference to your task planning: refer to your list of tasks that need to be undertaken in order to achieve your program objectives; with reference to your time plan, calculate when each task should be implemented; remember that you are not estimating when your objectives will be achieved, but when you will need to focus upon implementing the corresponding tasks; you also need to ensure that each task is implemented in conjunction with the associated training modules which are relevant; then break each single task down into a list of specific to do’s, say approximately ten to do’s for each task and enter these into your study plan; once again you could use MS Outlook to incorporate both your time and task planning and this could constitute your study plan; you could also use a project management software like MS Project. You should now have a clear and realistic forecast detailing when you can expect to be able to do something about undertaking the tasks to achieve your program objectives.

Performance management

It is one thing to develop your study forecast, it is quite another to monitor your progress. Ultimately it is less important whether you achieve your original study forecast and more important that you update it so that it constantly remains realistic in line with your performance. As you begin to work through the program, you will begin to have more of an idea about your own personal performance and productivity levels as a distance-learner. Once you have completed your first study module, you should re-evaluate your study forecast for both time and tasks, so that they reflect your actual performance level achieved. In order to achieve this, you must first time yourself while training by using an alarm clock. Set the alarm for hourly intervals and make a note of how far you have come within that time. You can then make a note of your actual performance on your study plan and then compare your performance against your forecast. Then consider the reasons that have contributed towards your performance level, whether they are positive or negative and make a considered adjustment to your future forecasts as a result. Given time, you should start achieving your forecasts regularly.

With reference to time management: time yourself while you are studying and make a note of the actual time taken in your study plan; consider your successes with time-efficiency and the reasons for the success in each case and take this into consideration when reviewing future time planning; consider your failures with time-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future time planning; re-evaluate your study forecast in relation to time planning for the remainder of your training program to ensure that you continue to be realistic about your time expectations. You need to be consistent with your time management, otherwise you will never complete your studies. This will either be because you are not contributing enough time to your studies, or you will become less efficient with the time that you do allocate to your studies. Remember, if you are not in control of your studies, they can just become yet another cause of stress for you.

With reference to your task management: time yourself while you are studying and make a note of the actual tasks that you have undertaken in your study plan; consider your successes with task-efficiency and the reasons for the success in each case; take this into consideration when reviewing future task planning; consider your failures with task-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future task planning; re-evaluate your study forecast in relation to task planning for the remainder of your training program to ensure that you continue to be realistic about your task expectations. You need to be consistent with your task management, otherwise you will never know whether you are achieving your program objectives or not.

Keeping in touch

You will have access to qualified and experienced professors and tutors who are responsible for providing tutorial support for your particular training program. So, do not be shy about letting them know how you are getting on. We keep electronic records of all tutorial support emails so that professors and tutors can review previous correspondence before considering an individual response. It also means that there is a record of all communications between you and your professors and tutors and this helps to avoid any unnecessary duplication, misunderstanding, or misinterpretation. If you have a problem relating to the program, share it with them via email. It is likely that they have come across the same problem before and are usually able to make helpful suggestions and steer you in the right direction. To learn more about when and how to use tutorial support, please refer to the Tutorial Support section of this student information guide. This will help you to ensure that you are making the most of tutorial support that is available to you and will ultimately contribute towards your success and enjoyment with your training program.

Other students and clients

It is our corporate policy not to contact existing students or clients unless it is concerning their own personal studies or client activity. It is therefore prohibited for students to forward any unsolicited communications to other students or clients in an attempt to obtain unauthorized support or assistance of any kind and this would effectively place you in breach of your terms and conditions of enrollment with Appleton Greene. Formal complaints received from other students about unsolicited communications may therefore result in your program being terminated. The policy is there to protect existing students and clients from what would be a constant deluge of inquiries from other students undertaking training programs and prevents students from using other students for motivational and tutorial support while undertaking programs. The Appleton Greene Tutorial Support Unit is there for this purpose and they are authorized and contracted to provide this service to you. Other students and clients are not. However, we do understand that it is useful for you to be able to see what other students think about your program and it is also useful to see what clients think about the various Certified Learning Providers that have been employed by them too. It is for this reason that we publish our testimonials from students and clients online and we would encourage you to take time to peruse through these when you have time to do so.

Work colleagues and family

You should certainly discuss your program study progress with your colleagues, client partners and your family. Appleton Greene training programs are very practical. They require you to seek information from other people, to plan, develop and implement processes with other people and to achieve feedback from other people in relation to viability and productivity. You will therefore have plenty of opportunities to test your ideas and enlist the views of others. People tend to be sympathetic towards distance-learners, so do not bottle it all up in yourself. Get out there and share it! It is also likely that your family and colleagues are going to benefit from your labors with the program, so they are likely to be much more interested in being involved than you might think. Be bold about delegating work to those who might benefit themselves. This is a great way to achieve understanding and commitment from people who you may later rely upon for process implementation. Share your experiences with your friends and family.

Making it relevant

The key to successful learning is to make it relevant to your own individual circumstances. At all times you should be trying to make bridges between the content of the program and your own situation. Whether you achieve this through quiet reflection or through interactive discussion with your colleagues, client partners or your family, remember that it is the most important and rewarding aspect of translating your studies into real self-improvement. You should be clear about how you want the program to benefit you. This involves setting clear study objectives in relation to the content of the course in terms of understanding, concepts, completing research or reviewing activities and relating the content of the modules to your own situation. Your objectives may understandably change as you work through the program, in which case you should enter the revised objectives on your study plan so that you have a permanent reminder of what you are trying to achieve, when and why.

Distance-learning checklist

Prepare your study environment, your study tools, and rules.

Undertake detailed self-assessment in terms of your ability as a learner.

Create a format for your study plan.

Consider your study objectives and tasks.

Create a study forecast.

Assess your study performance.

Re-evaluate your study forecast.

Be consistent when managing your study plan.

Use the authorized Appleton Greene Tutorial Support Unit for tutorial support, not other students, or clients.

Make sure you keep in touch with those around you.

Tutorial Support

Financial Leadership

Programs

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing, and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally, and they are all unique in that they individually focus upon a specific business function. They are implemented over a sustainable period of time and professional support is consistently provided by qualified learning providers and specialist consultants.

Support Available

You will have an Appleton Greene Certified Learning Provider (CLP) and an Accredited Consultant, and we encourage you to communicate with them as much as possible. In all cases tutorial support is provided online because we can then keep a record of all communications to ensure that tutorial support remains consistent. You would also be forwarding your work to the tutorial support unit for evaluation and assessment. You will receive individual feedback on all of the work that you undertake on a one-to-one basis, together with specific recommendations for anything that may need to be changed in order to achieve a pass with merit or a pass with distinction and you then have as many opportunities as you may need to re-submit project studies until they meet with the required standard. Consequently, the only reason that you should really fail (CLP) is if you do not do the work. It makes no difference to us whether a student takes 6 months or 18 months to complete the program, what matters is that in all cases the same quality standard will have been achieved.

Support Process

Please forward all of your future emails to the designated (CLP) Tutorial Support Unit email address that has been provided and please do not duplicate or copy your emails to other AGC email accounts as this will just cause unnecessary administration. Please note that emails are always answered as quickly as possible, but you will need to allow a period of up to 20 business days for responses to general tutorial support emails during busy periods, because emails are answered strictly within the order in which they are received. You will also need to allow a period of up to 30 business days for the evaluation and assessment of project studies. This does not include weekends or public holidays. Please therefore kindly allow for this within your time planning. All communications are managed online via email because it enables tutorial service support managers to review other communications which have been received before responding and it ensures that there is a copy of all communications retained on file for future reference. All communications will be stored within your personal (CLP) study file here at Appleton Greene throughout your designated study period. If you need any assistance or clarification at any time, please do not hesitate to contact us by forwarding an email and remember that we are here to help. If you have any questions, please list and number your questions succinctly and you can then be sure of receiving specific answers to each and every query.

Time Management

It takes approximately 12 months to complete the Financial Leadership corporate training program, incorporating 12, 6-hour workshops. Each student will also need to contribute approximately 4 hours weekly of their personal time. Students can study from home or work at their own pace and are responsible for managing their own study plan. There are no formal examinations and students are evaluated and assessed based on their project study submissions, together with the quality of their internal analysis and supporting documents. They can contribute more time towards study when they have the opportunity to do so and can contribute less when they are busy. The Financial Leadership program is designed to accommodate this, so there is plenty of flexibility in terms of time management. It makes no difference to us at Appleton Greene, whether individuals take 6 months or 18 months to complete the program. What matters is that in all cases the same standard of quality will have been achieved with the standard and bespoke programs that have been developed.

Distance Learning Guide

The distance learning guide should be your first port of call when starting your training program. It will help you when you are planning how and when to study, how to create the right environment and how to establish the right frame of mind. If you can lay the foundations properly during the planning stage, then it will contribute to your enjoyment and productivity while training later. The guide helps to adjust your lifestyle in order to accommodate time for study and to cultivate good study habits. It helps you to chart your progress so that you can measure your performance and achieve your goals. It explains the tools that you will need for study and how to make them work. It also explains how to translate academic theory into practical reality. Spend some time now working through your distance learning guide and make sure that you have firm foundations in place so that you can make the most of your distance learning program. There is no requirement for you to attend training workshops or classes at Appleton Greene offices. The entire program is undertaken online, program course manuals and project studies are administered via the Appleton Greene web site and via email, so you are able to study at your own pace and in the comfort of your own home or office as long as you have a computer and access to the internet.

How To Study>

The how to study guide provides students with a clear understanding of the Appleton Greene facilitation via distance learning training methods and enables students to obtain a clear overview of the training program content. It enables students to understand the step-by-step training methods used by Appleton Greene and how course manuals are integrated with project studies. It explains the research and development that is required and the need to provide evidence and references to support your statements. It also enables students to understand precisely what will be required of them in order to achieve a pass with merit and a pass with distinction for individual project studies and provides useful guidance on how to be innovative and creative.

Tutorial Support

Tutorial support for the Financial Leadership program is provided online either through the Appleton Greene web site, or via email. All tutorial support requests are facilitated by a designated Program Administration Manager (PAM). They are responsible for deciding which professor or tutor is the most appropriate option relating to the support required and then the tutorial support request is forwarded onto them. Once the professor or tutor has completed the tutorial support request and answered any questions that have been asked, this communication is then returned to the student via email by the designated Program Administration Manager (PAM). This enables all tutorial support, between students, professors, and tutors, to be facilitated by the designated Program Administration Manager (PAM) efficiently and securely through the email account. You will therefore need to allow a period of up to 20 business days for responses to general support queries and up to 30 business days for the evaluation and assessment of project studies, because all tutorial support requests are answered strictly within the order in which they are received. This does not include weekends or public holidays. Consequently, you need to put some thought into the management of your tutorial support procedure in order to ensure that your study plan is feasible and to obtain the maximum possible benefit from tutorial support during your period of study. Please retain copies of your tutorial support emails for future reference. Please ensure that ALL of your tutorial support emails are set out using the format as suggested within your guide to tutorial support. Your tutorial support emails need to be referenced clearly to the specific part of the course manual or project study which you are working on at any given time. You also need to list and number any questions that you would like to ask, up to a maximum of five questions within each tutorial support email. Remember the more specific you can be with your questions the more specific your answers will be, and this will help you to avoid any unnecessary misunderstanding, misinterpretation, or duplication. The guide to tutorial support is intended to help you to understand how and when to use support in order to ensure that you get the most out of your training program. Appleton Greene training programs are designed to enable you to do things for yourself. They provide you with a structure or a framework and we use tutorial support to facilitate students while they practically implement what they learn. In other words, we are enabling students to do things for themselves. The benefits of distance learning via facilitation are considerable and are much more sustainable in the long-term than traditional short-term knowledge sharing programs. Consequently, you should learn how and when to use tutorial support so that you can maximize the benefits from your learning experience with Appleton Greene. This guide describes the purpose of each training function and how to use them and how to use tutorial support in relation to each aspect of the training program. It also provides useful tips and guidance with regard to best practice.

Tutorial Support Tips