Compliance Administration – Workshop 1 (Compliance Essentials)

The Appleton Greene Corporate Training Program (CTP) for Compliance Administration is provided by Mr. Nelson Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr. Nelson is a Certified Learning Provider (CLP) at Appleton Greene. He has executive leadership and management experience in Operation Workflow, Financial Services, Regulatory Compliance and Consulting. His academic achievements include a Bachelor of Business Administration from the University of Miami and a Master of Business Administration from Nova Southeastern University. He is a Certified Compliance Professional, dedicated to developing and implementing operational processes and workflows, integrating automated and Artificial Intelligence technology to effectively administer and manage compliance programs. Mr. Nelson maintains active membership in professional associations such as the National Society of Compliance Professionals (NSCP) and the American Society of Administrative Professionals (ASAP).

MOST Analysis

Mission Statement

Before an organization starts creating a compliance program, the first thing that it needs to know is the essential elements for the compliance program. The organization has to do some diligent research on the applicable laws and regulations. But simply communicating these regulations and standards to employees will not make them comply from day one. The company has to appoint a dedicated compliance administration team that will take care of all related activities. The team has to design and implement all the administrative processes to ensure compliance with organizational policies. They will also be responsible for updating the policies and monitoring compliance on a regular basis.

The organization will need a strong strategy for the implementation of the compliance program. The strategy has to define whether the organization will take a rigid or flexible approach to compliance, or switch between the two based on circumstances.

Training of employees to educate them about the laws, standards, and codes of conduct is essential. Without periodic training, employees cannot be expected to commit to compliance or understand its importance. Along with periodic training, monitoring and audits are equally important. Monitoring with established protocols and controls allows the organization to identify gaps in the compliance program and remediate them in time. Audits and reporting help prevent non-compliance and associated penalties.

It is also important to document and report any exceptions to compliance that may have been made. Untracked/ undocumented exceptions may be treated as non-compliance during external audits and may land the organization in trouble.

Objectives

01. Culture: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Incentives & Rewards: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Enforcement & Discipline: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

04. Accountability: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Risk Assessment: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Compliance Officers: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Policies & Procedures: departmental SWOT analysis; strategy research & development. 1 Month

08. Communication & Training: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

09. Monitoring & Auditing: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

10. Issues Management: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

11. Metrics: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Technology: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Culture: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Incentives & Rewards: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Enforcement & Discipline: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Accountability: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Risk Assessment: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Compliance Officers: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Policies & Procedures: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Communication & Training: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Monitoring & Auditing: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Issues Management: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Metrics: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Technology: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze Culture.

02. Create a task on your calendar, to be completed within the next month, to analyze Incentives & Rewards.

03. Create a task on your calendar, to be completed within the next month, to analyze Enforcement & Discipline.

04. Create a task on your calendar, to be completed within the next month, to analyze Accountability.

05. Create a task on your calendar, to be completed within the next month, to analyze Risk Assessment.

06. Create a task on your calendar, to be completed within the next month, to analyze Compliance Officers.

07. Create a task on your calendar, to be completed within the next month, to analyze Policies & Procedures.

08. Create a task on your calendar, to be completed within the next month, to analyze Communication & Training.

09. Create a task on your calendar, to be completed within the next month, to analyze Monitoring & Auditing.

10. Create a task on your calendar, to be completed within the next month, to analyze Issues Management.

11. Create a task on your calendar, to be completed within the next month, to analyze Metrics.

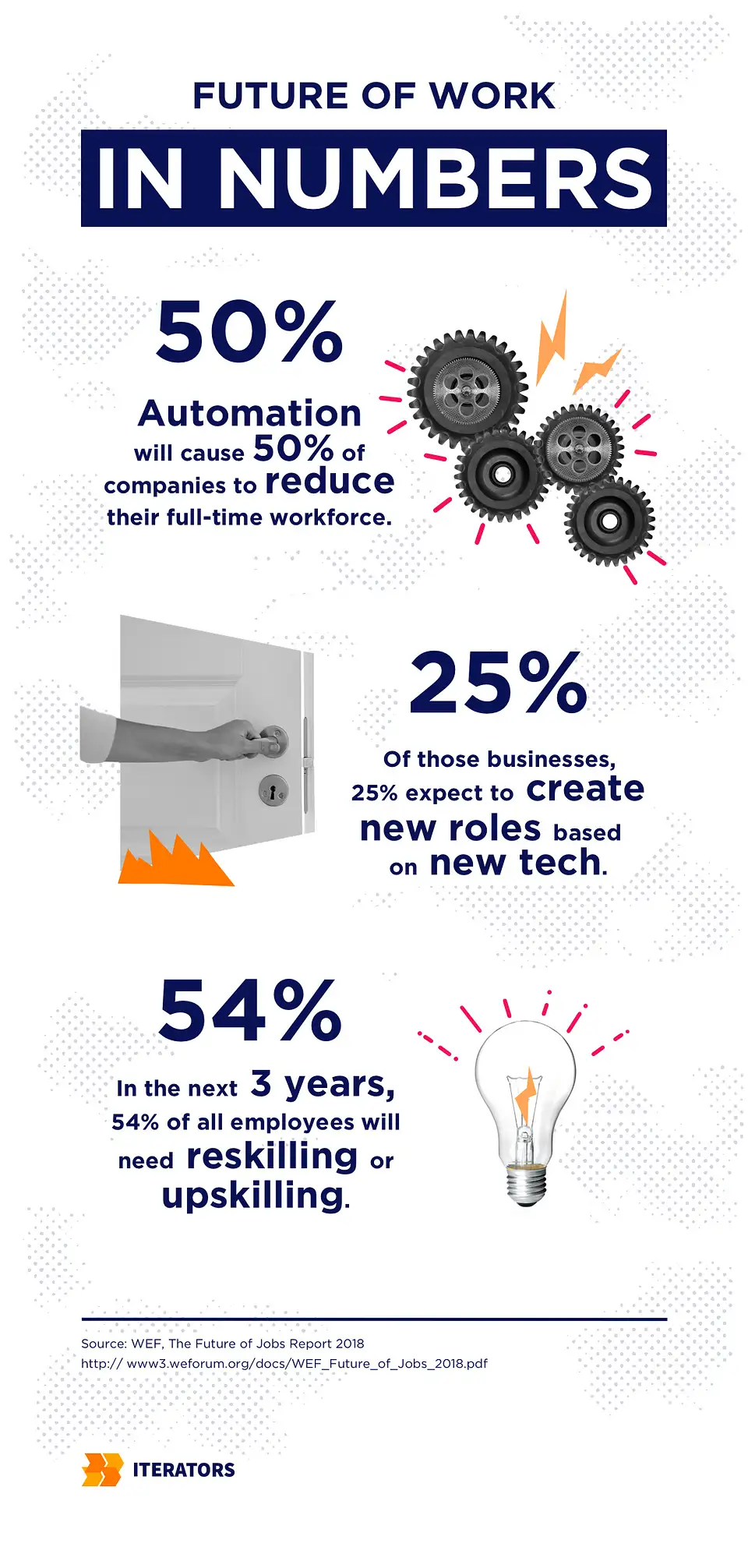

12. Create a task on your calendar, to be completed within the next month, to analyze Technology.

Introduction

Legal and regulatory compliance failures have caused major reputational and financial damage to businesses across industries. Most had what they thought were appropriate compliance procedures in place, but they didn’t seem to function. Compliance is receiving an increasing amount of corporate resources, as well as more attention in the C-suite and board room, yet anxiety remains—and rightly so. While keeping a watch on regulatory actions, legal and compliance professionals have attempted to merge their compliance processes from fragmented parts into a cohesive whole. However, we are seeing a significant shift in what important regulators are looking at and using to determine whether or not to pursue enforcement proceedings. With that backdrop in mind, and taking into account what recent experience has shown to work in the “real world,” businesses may now build extremely effective and efficient compliance procedures. Richard M. (Rick) Steinberg outlines these game-changers and provides a roadmap with 10 essential elements to get programs where management and boards need and want them to be in achieving compliance objectives in this article, which is an excerpt from his recently published white paper sponsored by IBM Open Pages.

Introduction

If you’re a CEO, director, general counsel, compliance officer, risk officer, or someone else in charge of your company’s legal and regulatory compliance, you’re undoubtedly concerned, if not alarmed. When it comes to supply chain, product liability, marketing, antitrust, mergers and acquisitions, and alliance partners (such as resellers, distributors, agents, or joint venture partners), the list appears to go on and on. You have a feeling that people in your organization are aware of wrongdoing but aren’t reporting it. You’re spending more money on your compliance program and trying harder to track results, but you’re still not convinced it’s working.

Regulatory compliance enforcement efforts have brought corporations across industries to their knees in recent years. Indeed, legal and regulatory compliance has risen to the top of the C-and suite’s boardroom’s priority list, outshining strategy, operational execution, risk management, and CEO compensation. Too much time is taken away from “running the business,” and even as compliance costs continue to grow, many organizations’ compliance strategies fall short.

Officials from the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) have spoken about their “carrot and stick” strategy, with the SEC and DOJ being more lenient when a compliance program is good and harder enforcers when it is not. Directors are cognizant of Delaware Chancery and Supreme Court decisions that highlight the board’s role in maintaining effective compliance programs. In addition, the modified federal sentencing guidelines for criminal wrongdoing, as well as company initiatives for analyzing and eliminating related risks, are discussed.

With over 2,000 pages of new regulations introduced just last year, split over six laws, financial services is bearing the brunt of additional regulation. The Dodd-Frank Act alone is likely to grow to 5,000 pages over time. Though it is becoming increasingly challenging, the financial industry is working hard to design incoming laws so that they do not excessively hinder company opportunities and the industry’s future health. However, there’s no denying that legal and regulatory compliance affects every industry, and keeping up has become more difficult.

A New Direction For Regulation

For years, the SEC and DOJ have stressed how they give corporations “credit” for having an effective compliance program in investigations and enforcement actions. Many general counsels, chief compliance officers, and others have recognized this as one of several grounds for bolstering internal processes. However, there was little direct proof until recently that the regulators’ message was backed up by action. Indeed, it appears that the emphasis was on encouraging a corporation to build an effective compliance program after a failure rather than praising them for having one before the loss. Furthermore, businesses have complained about inconsistent regulatory enforcement techniques and have urged for more transparency and uniformity. Now we’ve got a game changer, and it’s definitely worth paying attention to.

Case Study

The case involves Morgan Stanley, where compliance issues arose after Garth Peterson, a managing director, allegedly persuaded the firm to sell a real estate interest to a Chinese state-owned company; however, the company turned out to be a shell company in which Peterson had a direct interest, with cash payments to Chinese officials and himself. Peterson pleaded guilty and could face a six-figure fine and five years in prison if he is found guilty. But the true story here is what happened to Morgan Stanley, or rather what didn’t. The Department of Justice and the Securities and Exchange Commission decided not to pursue any enforcement action against the corporation. Morgan Stanley already has a robust compliance framework in place, complete with essential internal controls. It provided thorough training to its personnel, compliance reminders, annual confirmations by personnel, and constant monitoring, as well as frequently updating systems to reflect risks of misconduct. And, when evidence of wrongdoing appeared, the firm launched and completed a thorough inquiry right away.

Morgan Stanley’s reputation is actually boosted by its obvious presentation of good compliance and operational practices. The message has never been more obvious. Cover up the situation and deal with irate regulators and shareholders. If you have a good compliance system in place and do the right thing, the regulators and others will look favorably on your organization.

What Does “Effective” Mean?

Compliance officers have been bombarded with information on what makes a good compliance process and how to create and manage one. In a series of memoranda from the Justice Department, regulators have outlined what are considered as five “must haves” for an effective system, including the McNulty Memo. The Federal Sentencing Guidelines also provide guidance.

Maintaining a compliance process that follows regulators’ rules is certainly a good idea, but having a truly effective process is even more crucial. That is, organizations with successful compliance processes that avoid substantial instances of non-compliance will often evade regulators’ notice in the first place. Beyond regulatory inquiries and enforcement actions, there are corporate incentives to avoiding compliance failures.

But what if the demands of regulators were truly in line with what actually works? That would be an excellent model to follow. One regulator, the SEC’s Office of Compliance Inspections and Examinations, appears to have gotten it right (OCIE).

OCIE of SEC

If you work in the financial services business, you’re aware that the OCIE’s mandate is broad, encompassing compliance, fraud prevention, and risk management. 4 When it comes to fraud, for example, its examiners look for signs of insider trading, market manipulation, and Ponzi schemes and cooperate with the SEC’s Enforcement Division to prosecute them. When it comes to organizations subject to examination, the OCIE casts a wide net, including not only broker-dealers, transfer agents, investment advisers, and investment companies (and now, thanks to the Dodd-Frank Act, private equity and hedge funds), but also stock exchanges, clearing agencies, credit rating agencies, the Financial Industry Regulatory Authority, and the Public Company Accounting Oversight Board, among others. But, more crucially, its director, Carlo di Florio, has defined effective compliance procedures in a way that cuts across industries.

Di Florio shares essential details on how he and his team carry out the OCIE’s comprehensive goal.

What Makes Effective Compliance Processes?

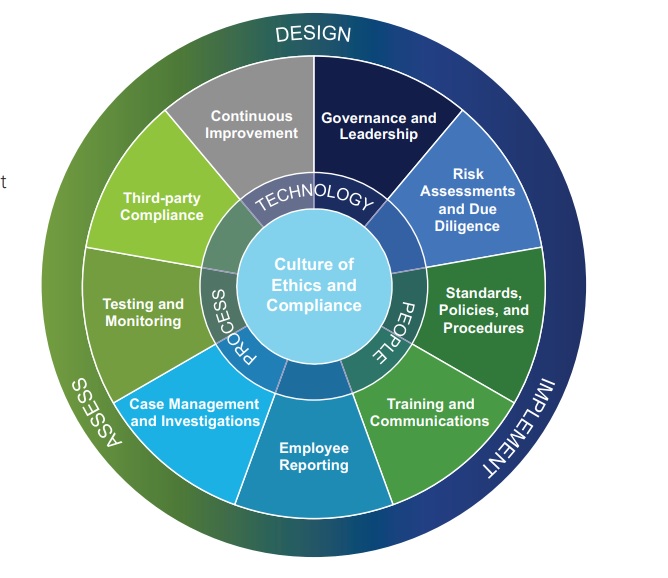

Di Florio identifies eleven components that, when combined, result in effective compliance programs (and which also, by the way, reflect the U.S. Federal Sentencing Guidelines). Here, we start with each of the parts and build on them to add knowledge gathered from years of experience witnessing organizations’ compliance programs progress from rudimentary to holistic, establishing a roadmap to achieving truly successful and efficient corporate compliance programs.

Governance

Despite the claims of certain so-called experts, compliance is the responsibility of management, not the board of directors. That said, the board has a critical role to play in overseeing compliance measures and ensuring that management has built an effective procedure. To that purpose, the board must receive regular briefings from the CEO, Chief Compliance Officer, and others on the process’ design and operation, as well as data demonstrating its efficacy (see “metrics” below). However, we’ve seen compliance programs built with the primary goal of producing reports for the board of directors, and they don’t perform very well. Effective compliance management should naturally lead to reporting, with the primary focus on assuring the mindsets and activities that drive effective compliance.

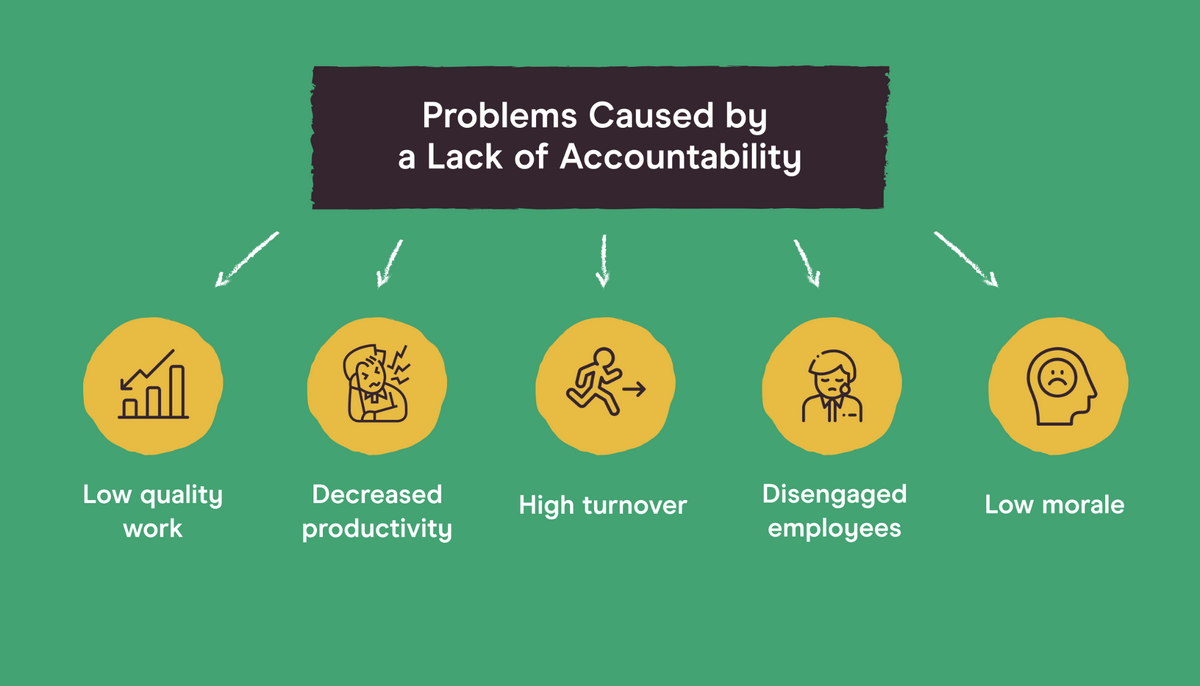

Accountability, Culture, and Values

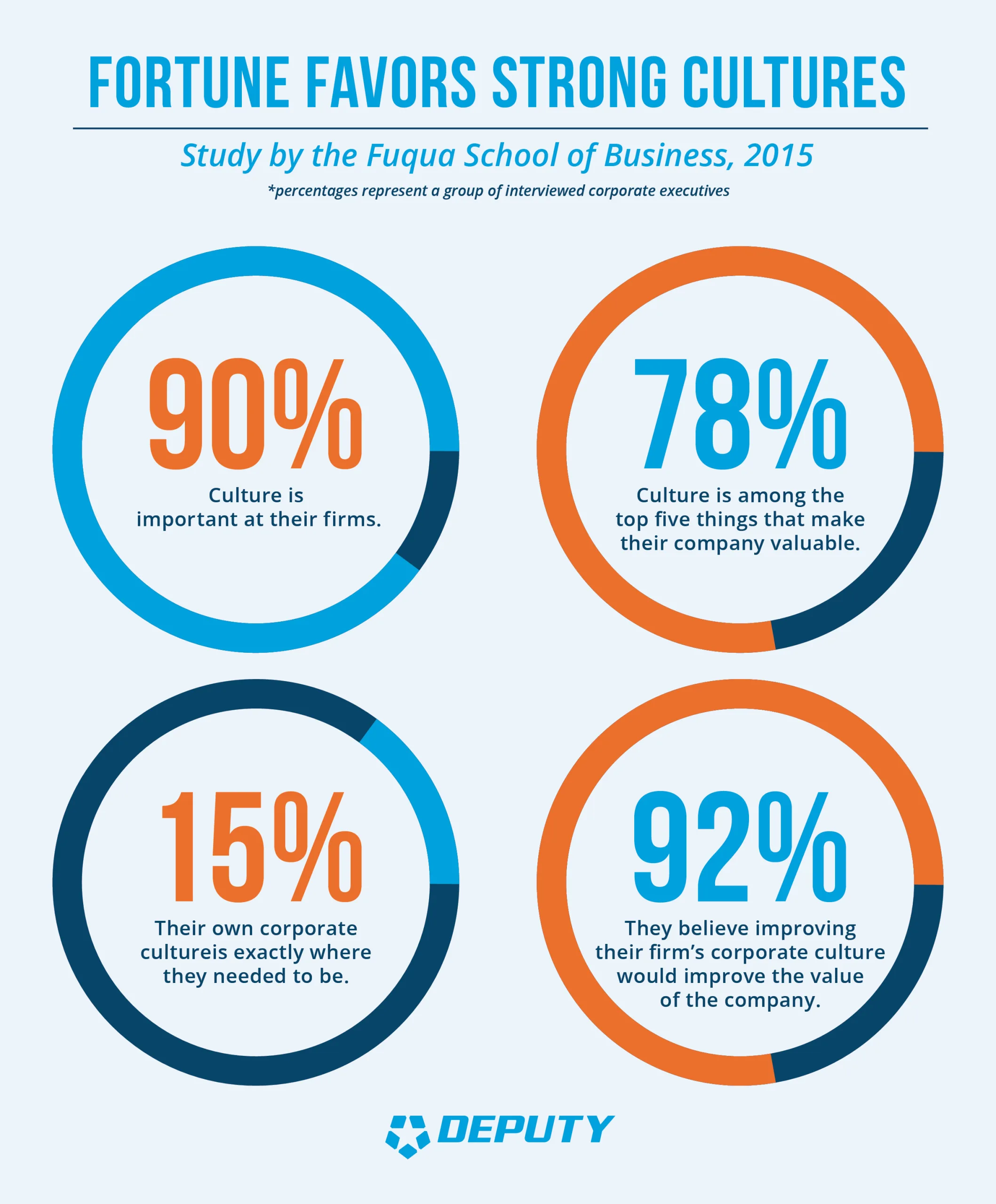

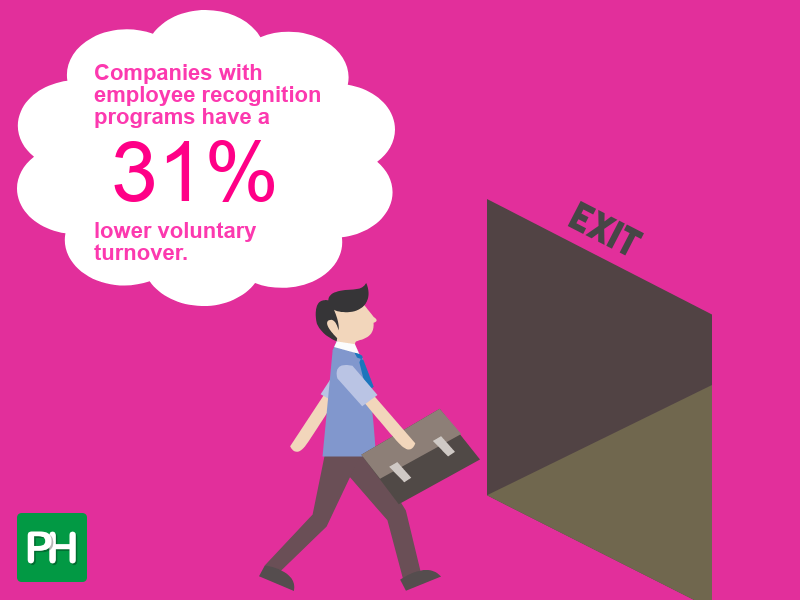

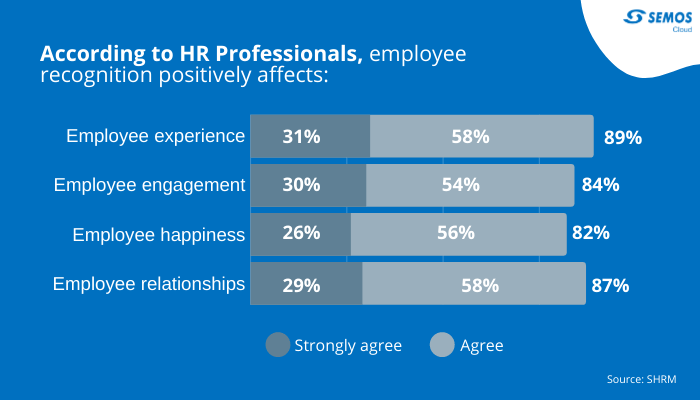

Perhaps nothing is more vital to effective compliance than an organization’s culture, which includes the tone set at the top and is founded on ethical ideals and unambiguous accountability. The actions of top management, which must be consistent with their statements, and supported by managers and supervisory workers across the organization, form the foundation of a company’s culture. A compliance program without integrity will have form but no substance, and will eventually fail to achieve its goals. Organizations that behave with integrity and ethical ideals, without a doubt, attract the best employees, customers, suppliers, alliance partners, and so on. While it’s difficult to link a positive corporate culture to financial performance, there are signs that it exists. According to the 2011 Edelman Trust Barometer, 85 percent of global respondents said they bought items or services from firms they trusted, while 73 percent said they refused to buy from organizations they didn’t trust. 5 Another company, the Ethisphere Institute, discovered a link, finding that highly ethical businesses beat competitors by seven to eight percent annually. 6 Motivators and Rewards

Having genuine incentives for ethical behavior, as well as associated rewards and corrective actions, is closely tied to responsibility. Many organizations have leaders that talk a good game but fail to incorporate compliance into their HR practices. Objective-setting, performance appraisal, and related promotion and compensation-adjustment processes must all include compliance duties. As a result, compliance is essentially the duty of each and every line and staff management in their domains of responsibility, rather than a compliance officer. Building compliance into company operations requires this strategy, which makes compliance not only more effective, but also more efficient.

Management of Risk

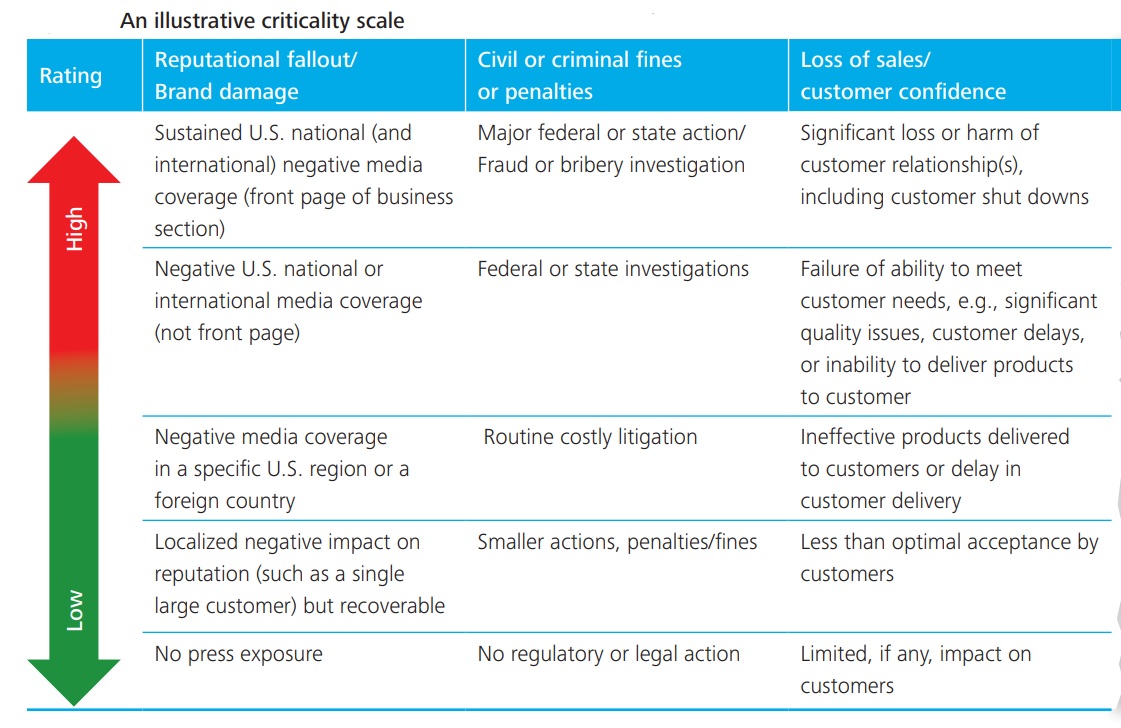

To manage potential exposure, business processes must reflect relevant compliance-related risks, with policies and protocols developed inside the business process. Risks must be defined in terms of where and how noncompliance can occur, the possibility of it occurring, and the impact on the company if it does, as well as the speed with which such an event can occur. When risks and needs are determined, resources can be directed to where they will be most effective, lowering risks to tolerable levels.

Procedures and Policies

Written policies are the foundation of what defines appropriate activities and behavior, so policy administration has become an art unto itself. We’ve seen policies written in legalese with a jumble of elements and formats, all of which are in various stages of completion or modification and are difficult to find when needed. As a result, employees find it difficult, if not impossible, to recognize what acts are and are not appropriate in everyday situations. Policies should follow a consistent framework, be risk-based, relevant, transparent, and easy to understand and access, and be trusted so that employees know they have been approved and can be trusted. The policy lifecycle should be maintained, with libraries based on the most recent legislation and regulations, version control, and modifications tracked, reviewed, and approved, as well as links to specific business operations and amended duties.

Training and communication

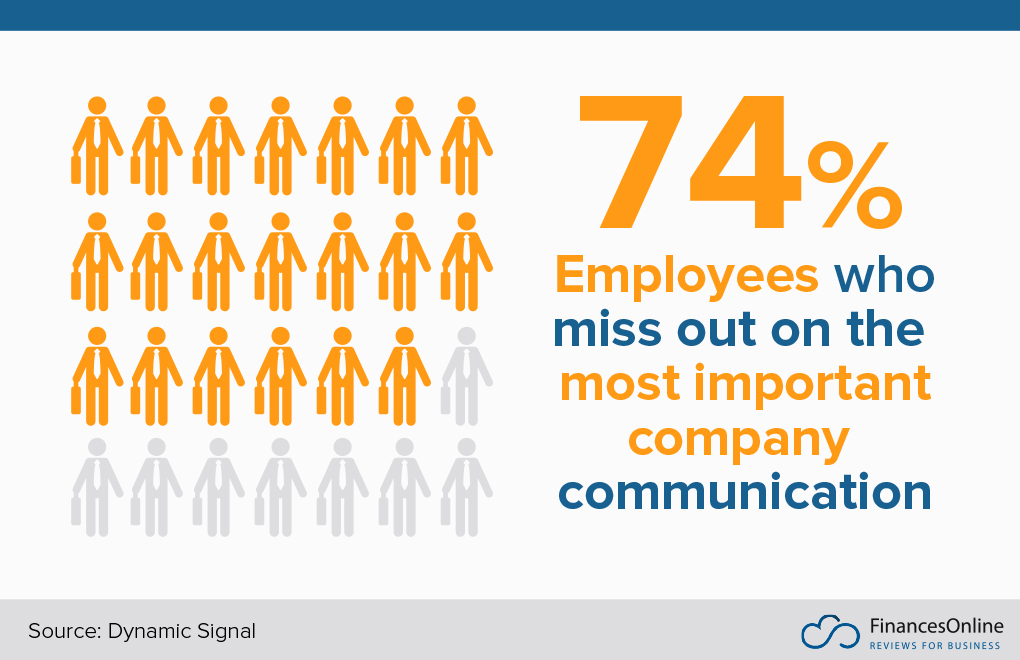

Each employee in a company must understand what is required of them and why doing so is in their best interests as well as the organization’s. Employees must comprehend the rationale behind the regulations in order to benefit the company, its employees, customers, and others. Employees who don’t understand why they’re required to accomplish something will, at best, go through the motions with a checklist mentality. Clear communication from the top of the organization is required, proving that senior management is in charge of compliance programs. Classroom and computer-based educational programs, as well as on-the-job reinforcement by unit leaders, should be in place not just upon hire, but on a continuous basis. We understand the value of having open, accessible, and successful internal or outsourced whistleblower channels, and we also recognize that valuable information can be gleaned through social networking sites, exit interviews, and internal audit findings.

Reporting and Monitoring

These aspects are critical and should be incorporated into the business and management operations. When supervisory and management staff closest to the action are aware of actions and monitor them in the usual course of business, compliance is most successful. Upstream reporting is crucial, but it should not be the foundation of fundamental compliance process design, as previously stated. Rather, reporting should be integrated with information flows inside management processes, with a compliance office monitoring to ensure timely and effective communication of important information. Additionally, in the normal course of running a business unit, hands-on managers can test processes and information flows, with extra, focused testing performed by the internal audit function in cooperation with the compliance office and business unit leadership.

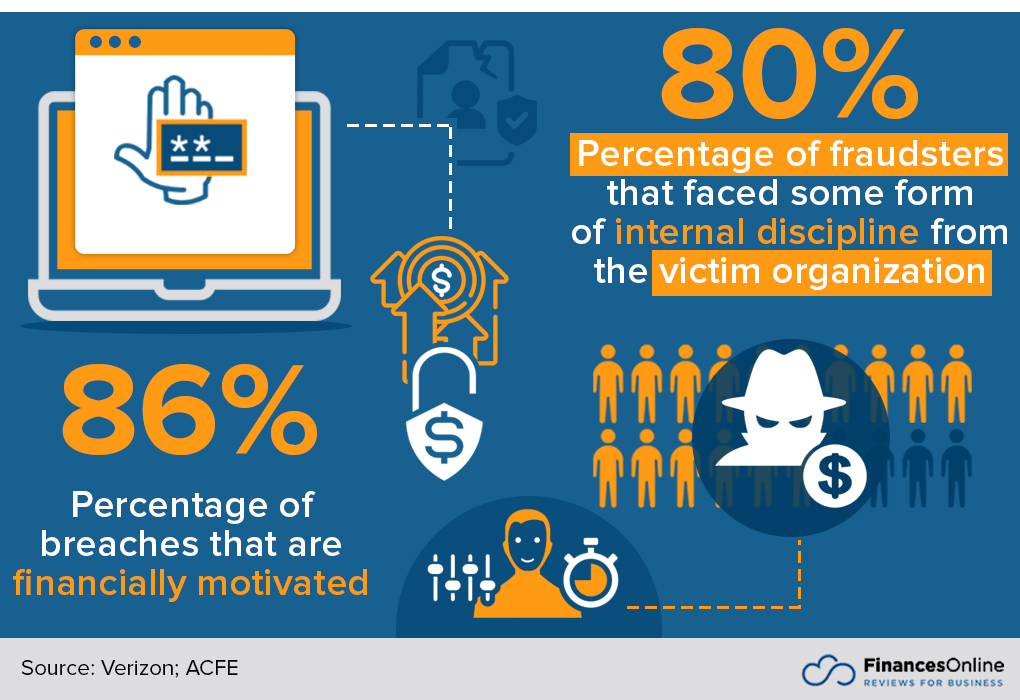

Discipline, Investigation, and Escalation

Employees must feel at ease and understand the necessity of reporting problems in a private and anonymous manner if requested. Employees are usually comfortable reporting potential misbehavior through their customary reporting procedures, which can be beneficial in firms with the correct culture and ethical norms. Simultaneously, it’s vital to have an alternate channel in place—a hot line or whistleblower channel—that can be relied on and used when necessary. Such confidence entails a firm belief that not only will there be no reprisal, but that those who report would be praised. Employees being informed of actions made as a result of their reports is a make-or-break issue, according to experience.

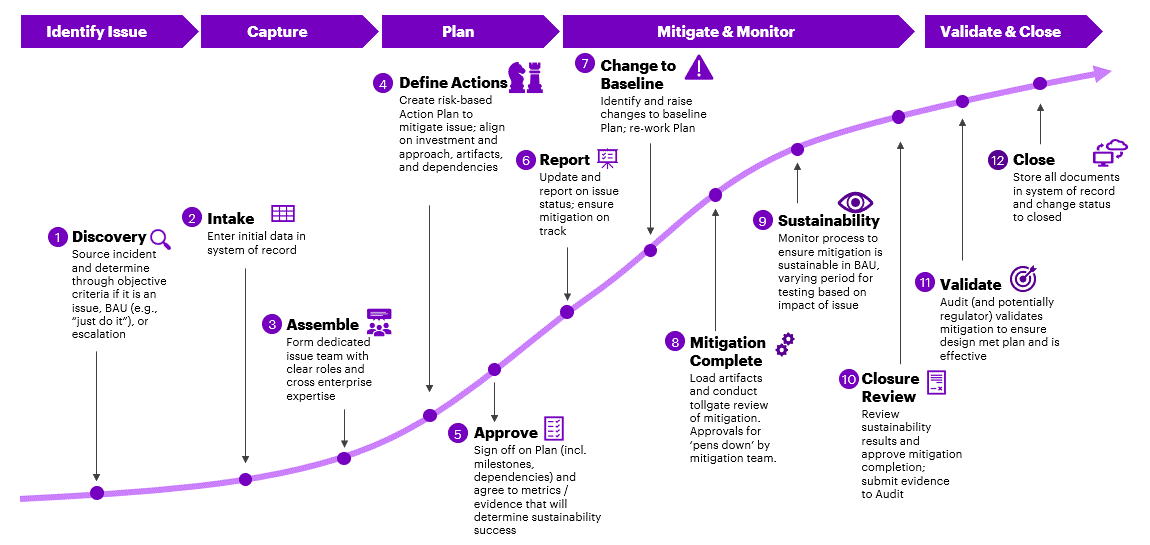

Management of Problems

When a compliance issue arises, action must be taken to determine what happened, the severity and consequences of the occurrence, and the repair steps required. Internal reporting should be escalated up the management ranks and, if warranted, to the board, with external reporting given due consideration. If the matter is sufficiently serious, an investigation should be conducted, with the assistance of outside legal or other consultants as needed. Understanding why the compliance process enabled the incident to happen, reassessing the associated risks, and identifying what systemic corrective action, such as improving processes, procedures, controls, or other components of the compliance process, may be required are also crucial.

An Ongoing Process of Improvement

Circumstances and practices evolve, much like other aspects of the business process, and management should stay on top of new developments. New rules and regulations, as well as pertinent legal cases, emerge, technology progresses, and experience shapes leading practices. The legal counsel should be in charge of tracking new mandates and requirements and alerting the relevant business units and compliance office of their ramifications, according to experience. Legal and compliance departments work with business units to decide what enhancements to policies that apply to everyone. Typically, business units are most qualified to assess what modifications to procedures and standards in business processes should be made, with compliance office approval.

Additional Thoughts

In addition to the ten criteria listed above, there are several other factors to consider when developing a successful compliance program.

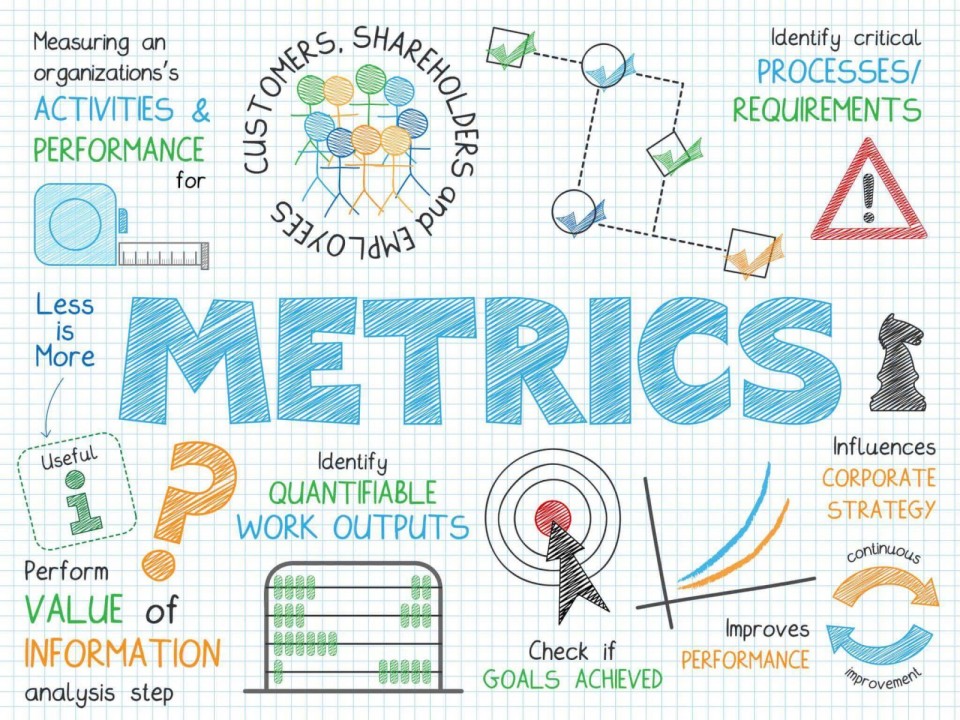

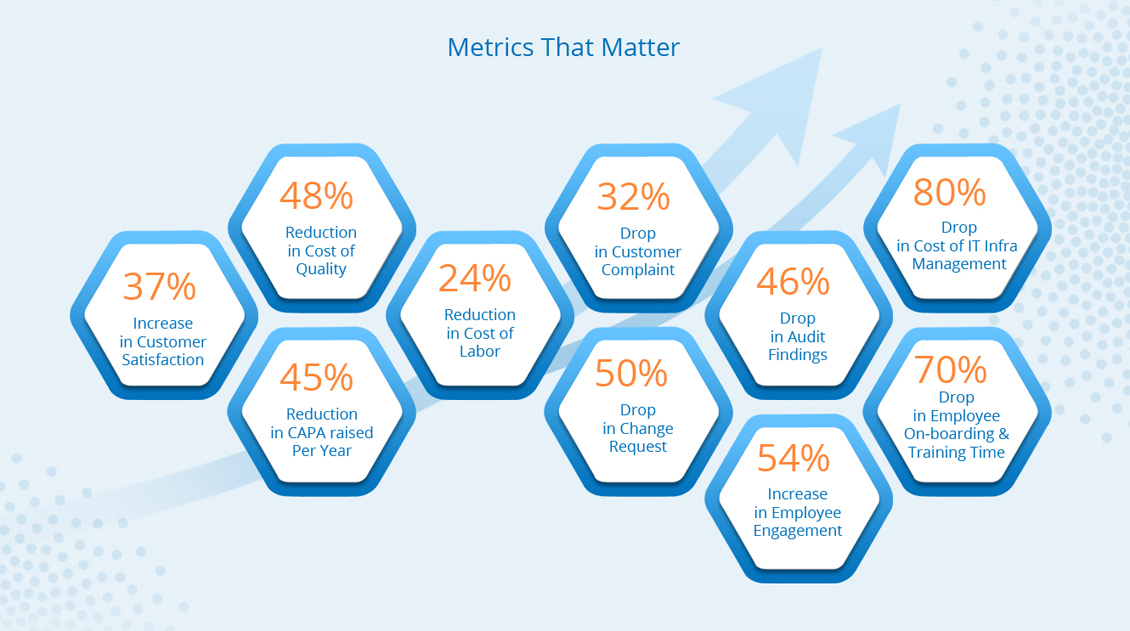

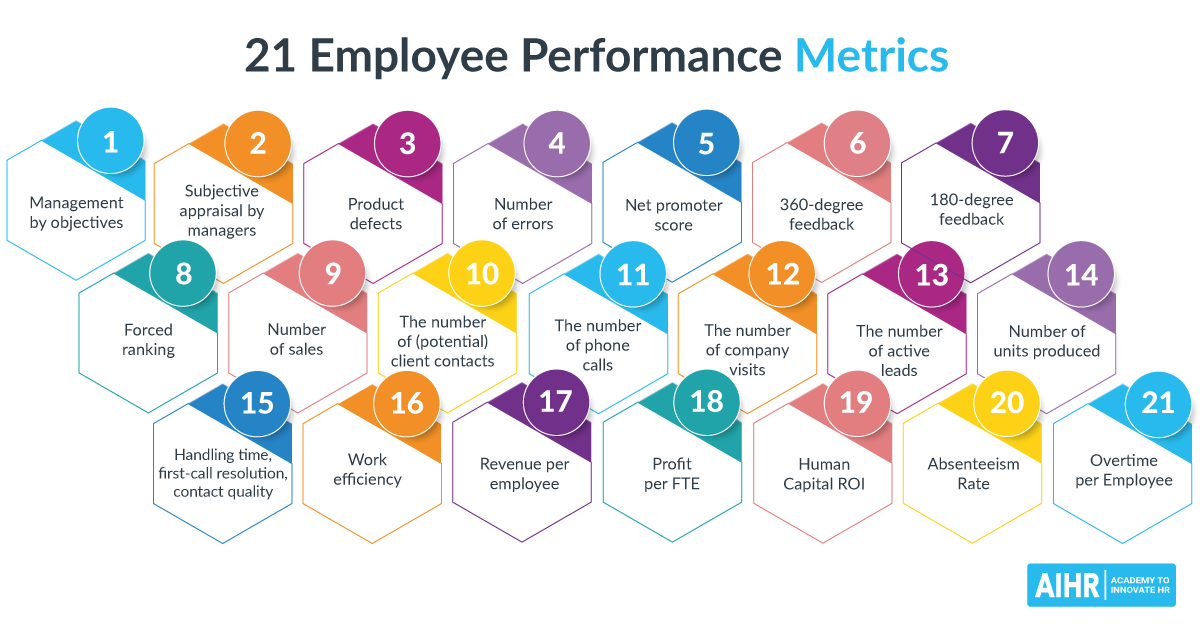

Metrics

Compliance departments have long tried to assess the efficacy of the company’s compliance program, whether motivated by a desire to demonstrate and improve performance, or by CEOs, boards, regulators, or business partners. Many have looked at metrics like the number and type of non-compliance issues, as well as the number of calls to the company’s hotline or whistleblower channel, for years. Over time, it became clear that such measurements did not adequately address the inherent dangers or the company’s people’s mindset. Few cases of misconduct did not imply that the risks were minimal, and few calls to the hotline did not signal that there were few issues—in fact, a lack of calls could simply indicate that individuals do not trust the system. Some businesses have accumulated statistics on ethics and compliance training, as well as staff certificates for knowledge and adherence to the code of conduct, but these efforts have been deemed insufficient.

Compliance measurements have gotten more insightful in recent years. Some businesses use a simple metric to determine which areas of their online code of conduct are receiving traffic, indicating where problems may arise. Some organizations keep track of the quantity and types of reports received via standard management channels versus the hotline. Others are concerned with the nature and types of complaints presented, internal sources, and whether calls are anonymous or caller-identified. Some companies follow up with people who file reports to see how comfortable they are with the process. Real-time dashboards show where dangers or occurrences require immediate attention, with metrics connected to key performance indicators and critical risk indicators. And a growing number of businesses are monitoring social media sites for signs of wrongdoing and seeking out and following up on reports of potential wrongdoing from third parties with whom they do business. Internal compliance audits can also reveal more about wrongdoing and related concerns.

Internal surveys, often known as culture surveys or risk culture surveys, are one of the most critical indicators any firm can have. When done effectively, they can reveal a lot about an organization’s ethics and integrity, communication efficacy, observations of misconduct, and other things. People’s main worries are whether or not they trust their coworkers and managers, as well as how comfortable they are with peer and management behavior and reporting signs of wrongdoing upstream. The surveys are usually conducted twice a year or once a year, and while the raw data are valuable, especially when evaluated by business unit or other category, trend lines over time are even more relevant.

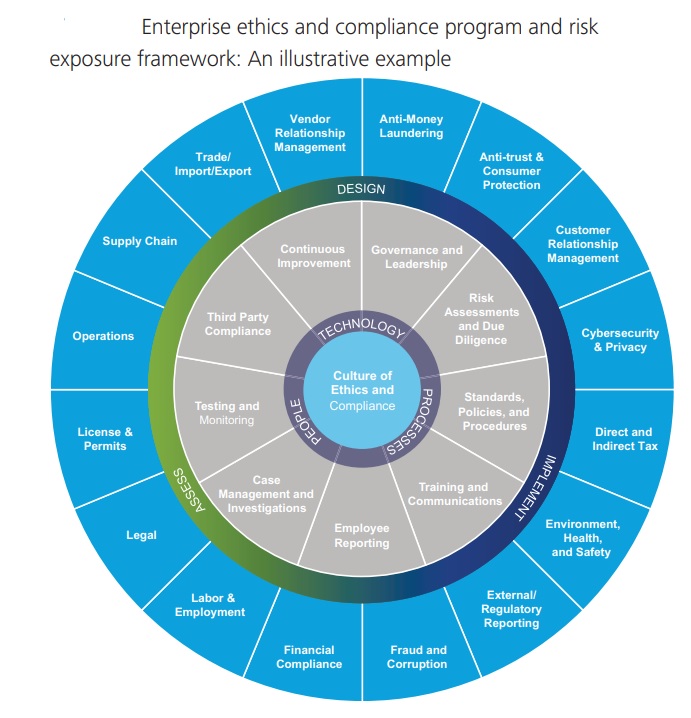

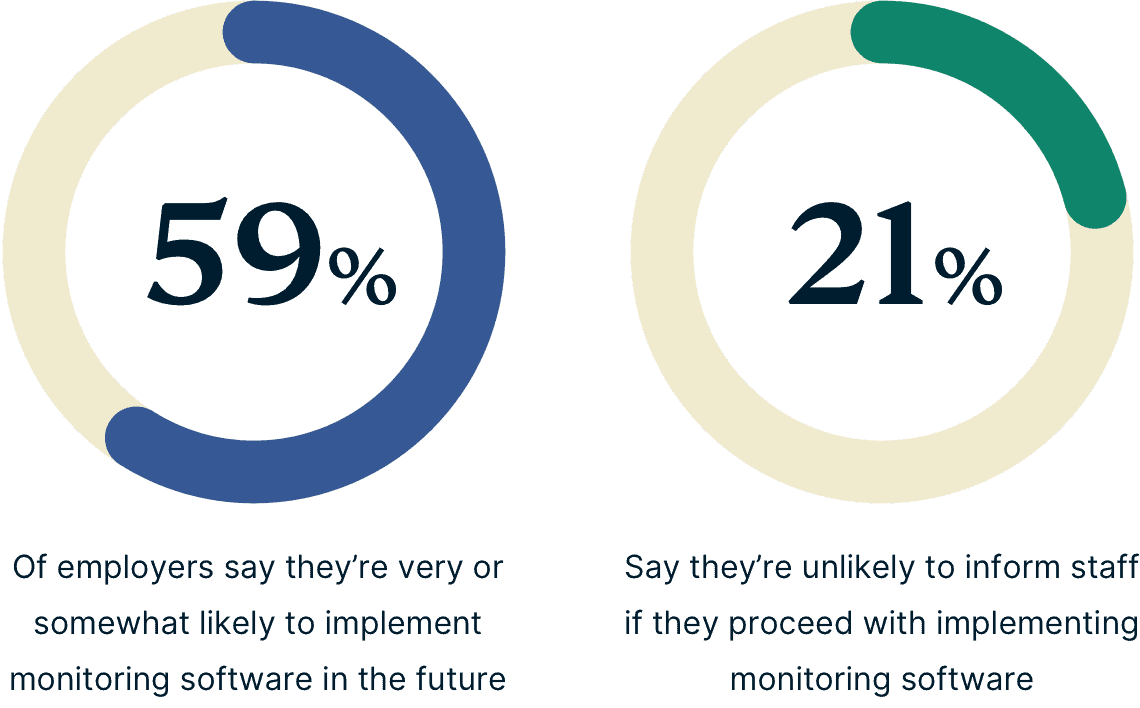

Technological Companies have access to and employ a wide range of technology solutions to assist compliance program objectives. However, research shows that many firms’ tools are simple and stand-alone, resulting in a “siloed” strategy that impedes cross-organizational collaboration and effectiveness. According to one research, the majority of compliance function operations employ basic desk-top tools, while integrated IT solutions provided by major software manufacturers are used by a minority of respondents. “A fragmented approach to GRC—the dreaded’silos’ of data and compliance activities, which can stymie compliance executives trying to acquire a holistic perspective of corporate risk,” according to the survey.

Information, communication, reporting, and monitoring are all more efficiently achieved across the company when companies use more sophisticated technology tools. Compliance risks are recognized, and procedures, controls, and accountability are established, resulting in an integrated compliance process. As a result, policy lifecycle management may generate, approve, maintain, save, monitor, and automate tasks using these technologies. They provide policy training and awareness, as well as surveys and test feedback. They provide automatic workflows and allow for the assignment of tasks for required actions by managers or monitors, as well as the tracking of activities and the ability to query senior officials. Control testing, surveys, certification, and regulatory reporting are among the procedures and information retrieval that they automate. They assist with issue remediation, incident tracking, key performance indicators, and regulatory engagements. They enable real-time messaging and reporting to disseminate information to all levels of management and the compliance function, as well as customized dashboards and drill-down capabilities to zero in on specific issues. They also present information to senior management and the board of directors on topics like the reasons of compliance failures, the financial effect, and mitigating actions.

A Comprehensive Approach

We’ve mentioned it before, but it bears repeating. When compliance programs are made up of separate parts, they rarely work successfully. That’s the truth. They must have all of the right pieces weaved together to make an integrated, well-coordinated whole to be genuinely effective. This is a basic principle that is difficult to implement in the reality of a large, complex, global business.

We know that good compliance systems are built on cultures of integrity and ethical ideals, guided by the chief executive’s words and deeds and overseen by the board of directors. All of the other essential elements flow from there.

The Benefits

Compliance costs are rising, non-compliance incidents are increasing, and the possibility of a catastrophic failure is all too real for most businesses. It is possible to have a really effective and efficient compliance process. Some businesses have already arrived, recognizing the accompanying commercial benefits and focusing on process and people to achieve corporate success. It requires focus and attention, but it is possible.

Executive Summary

Chapter 1: Culture

Why Is It Important To Create A Compliance Culture, And How Can You Accomplish It?

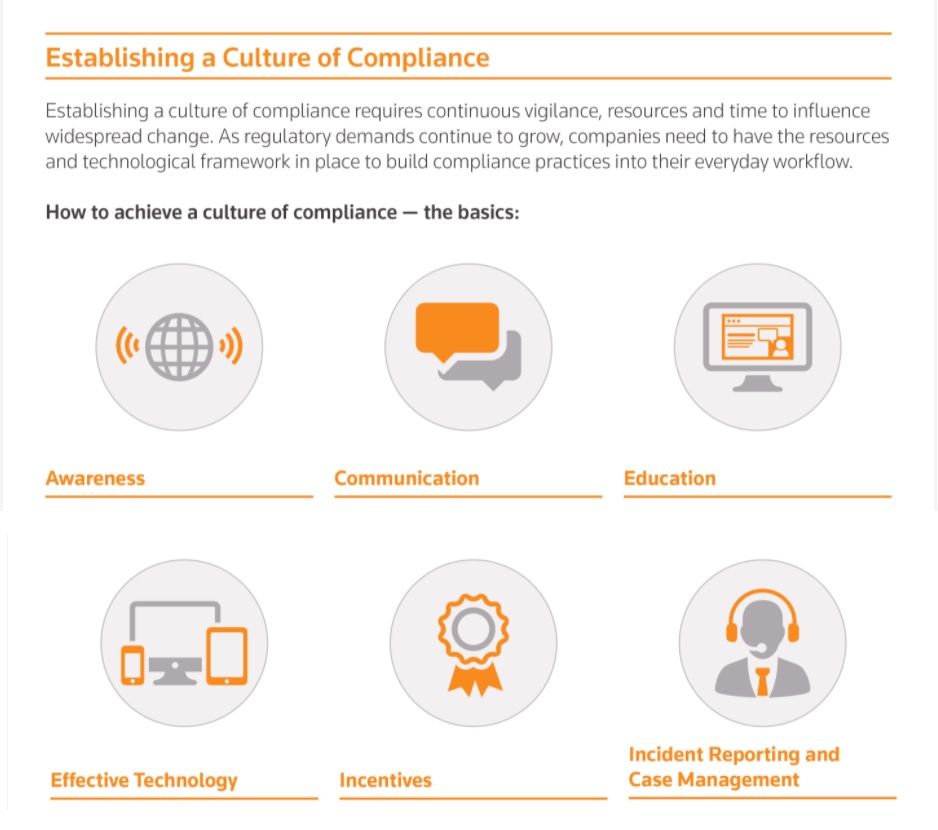

The variety of compliance difficulties encountered by organizations and employees today is vast, ranging from internal policies to regulatory obligations to criminal law requirements. It is critical to have rules and procedures in place to meet those difficulties, yet it is frequently insufficient. Compliance is most easily achieved when it is ingrained in a company’s culture.

Compliance is crucial to every employee of a company, from the top to the bottom. A compliance culture means that everyone of those employees is aware of the regulations and is committed to ensuring that they are followed.

A breach of export rules, for example, can occur in the post room just as easily as it can in the boardroom. Employees who understand the rules and are committed to enforcing them can also stop a breach of export restrictions that started in the boardroom in its tracks in the post room.

Why Should Businesses Be Concerned About Their Culture And Compliance?

Before looking at how to create a compliance culture, it’s worth contemplating why compliance, and a company’s culture in general, is so important.

The possibility of regulatory and legal fines is perhaps the most evident motivation for businesses to take compliance seriously. The reputational damage that compliance failures can cause to an organization or an individual is often just as costly. Investors are becoming more aware of a company’s environmental, social, and governance characteristics, making companies that can demonstrate that they take their compliance requirements seriously a more appealing possibility.

Similarly, a company with a bad reputation for improper workplace conduct, such as harassment and discrimination, may have difficulty attracting and maintaining top personnel. In contrast, a company with a healthy and compliant workplace culture may find it easier to attract and retain top employees.

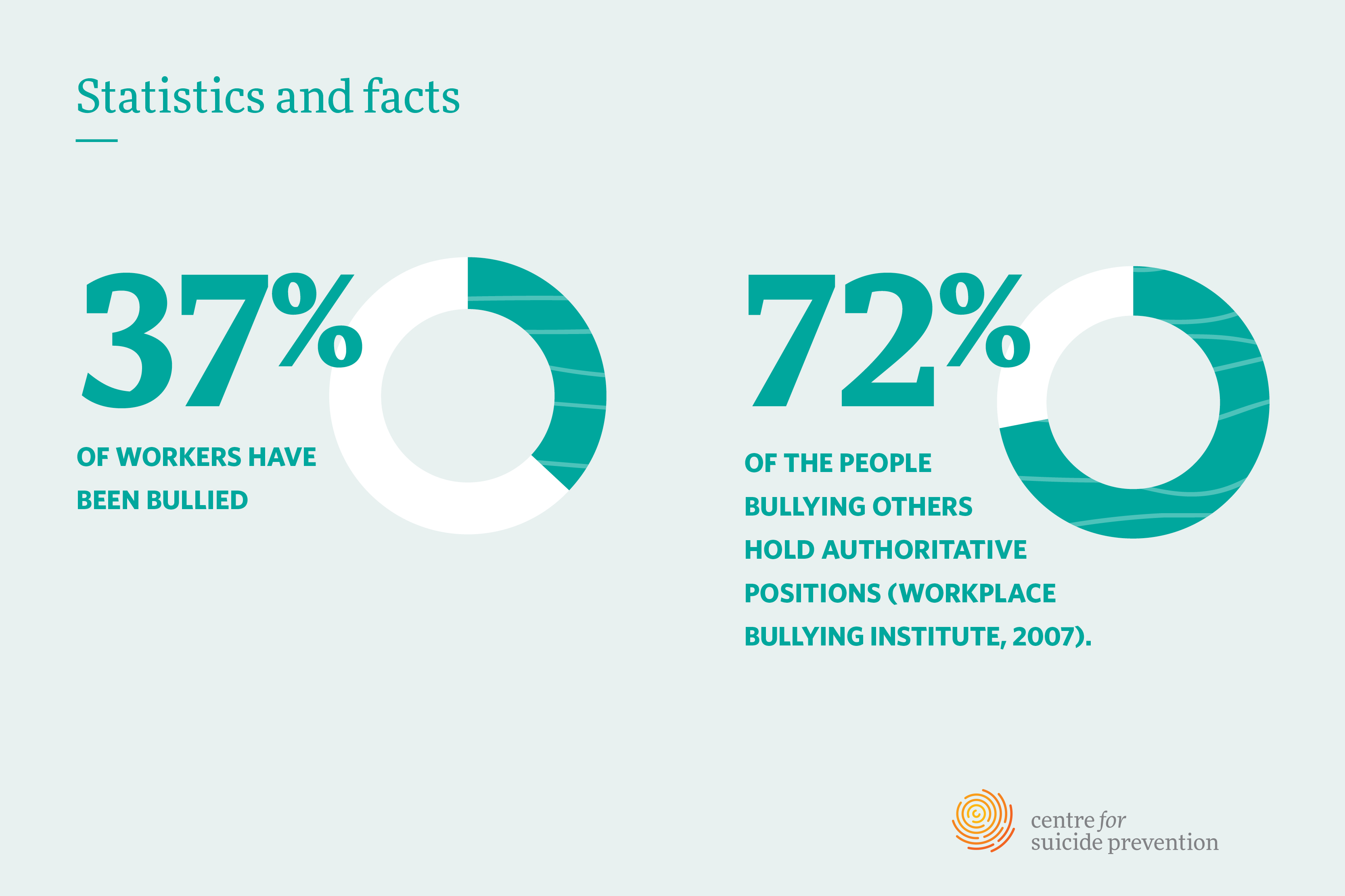

Culture is increasingly becoming a compliance issue in and of itself. A safe culture, according to the FCA, is “an environment in which employees feel comfortable to express their opinions and, crucially, are listened to when they do”. The FCA made it clear in a “Dear CEO…” letter sent in January 2020 that senior executives who fail to address non-financial misconduct such as discrimination, harassment, victimization, and bullying, which it views as indicative of a firm’s culture, may not be considered fit and proper by the regulator.

Creating A Compliance Culture

As previously said, a culture of compliance means that employees from the top to the bottom of a company understand and value their role in compliance. The establishment of a compliance culture must begin at the top. One of the most effective methods for a company to demonstrate how seriously it takes compliance is to assign responsibility for compliance to a senior executive, as a separate job role if appropriate. This is not only an important step in fostering a compliance culture, but it also has real-world implications in terms of ensuring that compliance issues are discussed and addressed at the highest levels. To be effective, all senior members of a firm must set and uphold a high standard of behaviour for the rest of the firm in a transparent and consistent manner. Setting KPIs for compliance and designing performance appraisal forms and processes with a portion devoted to evidence of compliance as part of the annual review are two ways to ensure that employees’ attitudes toward compliance are monitored and evaluated.

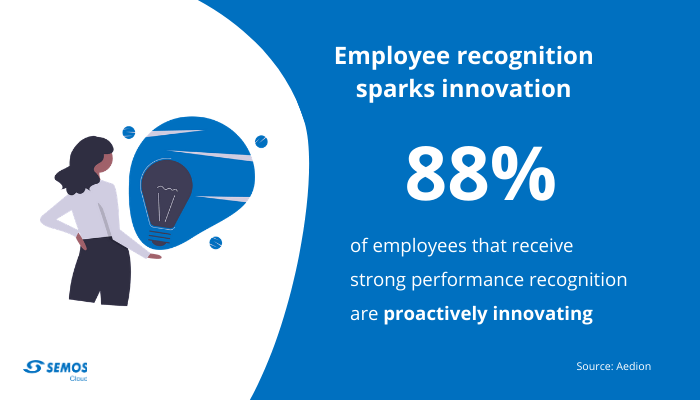

Chapter 2: Incentives & Rewards

“In addition to examining the design and implementation of a compliance program throughout a company, enforcement of that program is crucial to its efficacy,” according to the FCPA Guide. No one should be exempt from a compliance program, which should apply from the boardroom to the supply room. When enforcing a compliance program, the DOJ and SEC will assess whether a corporation has appropriate and clear disciplinary procedures in place, whether those procedures are followed consistently and promptly, and whether they are proportionate to the breach. Many businesses have discovered that making disciplinary actions public, if permitted by local law, can have a powerful deterrent effect, indicating that unethical and illegal behavior has rapid and certain repercussions.”

This implies you’ll need incentives for doing business in accordance with your Code of Conduct and following your compliance policies and processes. Immediate incentives (such as monetary bonuses or other awards) or long-term incentives (such as promotion within an organization). Recent research suggests that a kind word or two for a job well done in an ethical manner can go a long way toward promoting not only similar ethical behavior, but also compliance.

You can implement some generic incentive concepts because compliance incentives do not have to be costly or groundbreaking. Even simple incentives can be effective provided they are delivered regularly, the rewards are apparent, and your compliance incentives can be implemented at all levels of your firm.

Chapter 3: Enforcement & Discipline

The enforcement and discipline aspects of building a compliance program are sometimes overlooked or overlooked. Violations of the facility’s code of conduct, policies, and procedures must have consequences, just like any other effective program. Consider the parent who threatens and threatens without actually following through and enforcing the house rules. As a result, There’s a house for sale!

We all know that we are only as strong as our weakest link, so it’s critical for employees to understand that there are consequences and that this program is more than just “checking a box.”

The following are important components of an efficient enforcement and disciplinary system:

• Be fair in your discipline. Failure to comply must also be held accountable by corporate executives, managers, and supervisors. Managers and supervisors must also understand that they are responsible for disciplining employees consistently and responsibly.

• Consider disciplinary action on an individual basis. A reprimand with more training, a demotion, or termination may all be appropriate disciplinary actions. The reward or disciplinary punishment should be commensurate to the behavior in order to be successful. Ascertain that your organization’s procedures for dealing with disciplinary issues are defined, as well as who will be responsible for taking necessary action.

• Observe them doing something correct. The program should go beyond punishment; positive reinforcement goes a long way toward improving behavior. Rewarding them when they express legitimate concerns, recognizing great service quality, and rewarding helpful comments for improving the compliance program and/or its implementation are all possible incentives.

• Make a quick decision. It’s critical that the compliance officer or other management investigate complaints right away to see if there’s been a violation of the compliance program and, if so, what efforts have been made to fix the problem. Staff will be hesitant to report if they feel unheard or if management is unresponsive because “no one will do anything anyway.” Make a point of emphasizing the facility’s zero-tolerance policy.

• Reroute: Pay close attention to your systems as problems develop. We all know that “stuff” happens in long-term care; nonetheless, the rules state that a “recurrence of comparable wrongdoing raises doubt about whether the organization took reasonable steps to” develop an effective program (Guidelines, 8B2.1 Commentary App. Note 2[D]). To figure out why anything happened, you need to take appropriate corrective action and evaluate the root cause. This could range from penalizing the person who committed the wrongdoing to changing the compliance program.

• Employee screening: We must take reasonable steps to ensure that our workers have not engaged in illegal activities or acted in a manner that is inconsistent with the compliance program. As a result, we must create employment screening methods to check a person’s past and criminal history as an institution. This would entail background checks, licensure checks, and following up with prior employers and references (more on that later).

• Documentation, documentation, documentation

Chapter 4: Accountability

Organizations are increasingly adopting a multi-layered approach to their action plans, with a specified emphasis area established at the organizational level and responsibility for team or department level action held at the appropriate level. This frequently prompts HR to ask, “How do we ensure that our workers will act?”

People, in our experience, often act on criticism because they are innately motivated to ‘better their lot,’ but a lack of tools, expertise, or ideas can be a roadblock to action. The approach should be one of empowerment: putting data and tools in the hands of those who are best suited to effect change and action. Many times, the people who should be in charge are not in HR or at the executive table. Many of us, regardless of seniority, experience, or job title, require additional support when making behavioral changes. This is where we may apply the principles of positive psychology and expert coaching to find the most effective forms of accountability assistance.

It’s crucial to note that no piece of software can keep someone accountable or push them to take ownership. What technology can do is:

• Help us exchange experiences about what works

• Provide access to shared ideas that others acting on comparable focuses have found success with • Make the process of taking action more clear

• Set an individual or team up for success by tracking, nudge, and reminding us about action

Some Useful Information About Accountability

Accountability is defined as accepting and taking responsibility for one’s actions. This indicates that words and actions are in sync. People have the power when they choose to keep themselves accountable while also appreciating the assistance of others who can help them reach their goals. A good coach will always assign a job or activity for their clients to complete before the following session. The client chooses an action that they want and agree to take, and that they believe will help them achieve their desired end goal or behavior. Given these three factors (desire, agreement, and belief), as well as the awareness that their coach will inquire about their progress toward their goals in a follow-up session, they will feel responsible for the desired adjustments and activities.

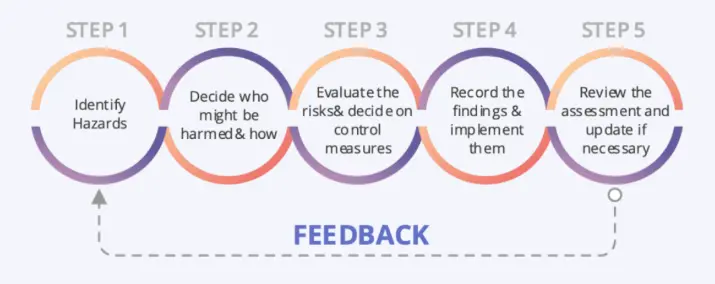

Chapter 5: Risk Assessment

Why Should Risk Assessments Be Conducted?

Compliance procedures must be tailored to each company’s specific needs and challenges, as well as thorough enough to address all of the risks identified.

In the event of a company misconduct inquiry, having a strong compliance program could lead to more leniency from authorities. In fact, the Criminal Division of the United States Department of Justice amended its guidance document for prosecutors on how to evaluate company compliance programs in the context of conducting corporate investigations in April 2019. Prosecutors should assess whether the compliance program is “structured to detect the particular sorts of misbehavior most likely to occur in a given corporation’s line of business” and “complex regulatory environment,” according to DOJ advice.

An successful risk assessment should start with a complete picture of your company’s compliance environment. Answer the following two questions:

1) where are you doing business, and

2) what restrictions apply to businesses like yours.

Are you attempting to work with customers in the healthcare industry, for example? If that’s the case, you’ll need to ensure sure your patient-data-handling systems can meet HIPAA security criteria. GDPR must be followed if you collect, store, transfer, or process personal data of EU residents. If you engage with third parties on a regular basis, such as suppliers and subcontractors, ensure sure they have adequate compliance policies in place to handle information security, privacy, and fraud threats.

The most important thing to remember is that your compliance efforts should be focused on the risks that are most significant to your company.

A thorough risk assessment must also include a detailed description of your company’s operations. To put it another way, you’ll need to know the “who, what, where, when, and how” of your company’s day-to-day operations.

However, this should not be confined to a business code of conduct and should apply to all of the company’s actions. Bribery, corruption, and accounting practices should all be covered by policies and processes that are clear, practical, and accessible.

Third parties, whether as a supplier or a customer, should be included. Policies and procedures are only effective if they are kept up to date and conveyed on a regular basis, especially when changes occur.

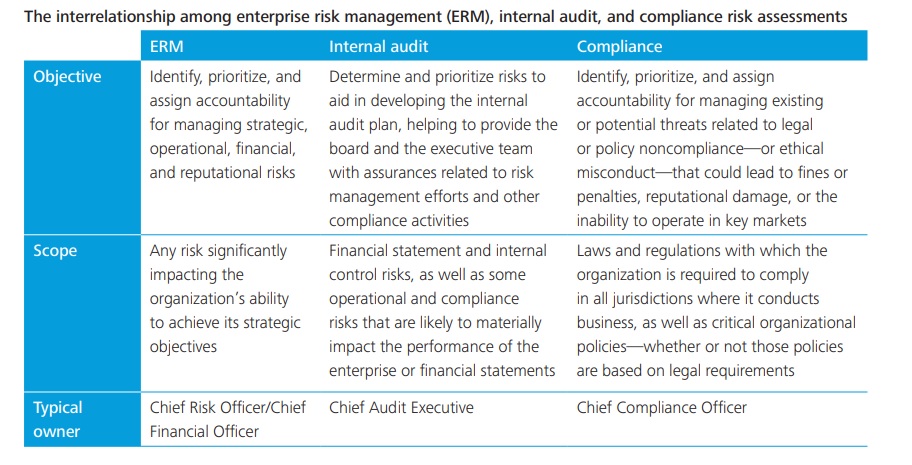

Ethics and compliance risk assessments are about recognizing the hazards that a company confronts, not just the method. The risk assessment helps the board and senior management focus on the most important risks facing the company, and it serves as the foundation for defining the measures needed to avoid, minimize, or remediate those risks.

Chapter 6: Compliance Officers

The Office of Inspector General (OIG) of the Department of Health and Human Services recommends appointing a Compliance Officer and other relevant oversight bodies, such as a compliance committee and a Board of Directors’ subcommittee, to manage and oversee the Compliance Program. The Compliance Officer is in charge of overseeing the Compliance Program’s day-to-day operations and ensuring that a program is in place to prevent, detect, and rectify violations of the Code of Conduct, the organization’s policies and procedures, and federal and state laws and regulations.

The Appointment Of An External Compliance Officer

When firms need to fill a Compliance Officer position, they typically have to search outside the organization for appropriate candidates. The search for a qualified applicant can take anywhere from a few months to a year or more in many cases. Organizations, on the other hand, cannot afford to go that long without a Compliance Officer. Many corporations seek to outside firms with expertise in health care compliance, practical experience, and an understanding of the industry to fill the function during this interim period.

In specific cases where someone needs to step into the role, the OIG indicates in their compliance program guideline documents1 that “the compliance function could be outsourced to an expert in compliance.” As a result, firms should consider outsourcing or appointing an external compliance specialist to fill the Compliance Officer function, whether temporarily or permanently.

A Compliance Officer’s Job Description

Compliance officers must have an instinctive understanding of a company’s aims and culture, as well as a broad understanding of the industry and conventional business law…

A compliance officer, sometimes known as a compliance manager, ensures that a firm is operating in complete compliance with all national and international laws and regulations that apply to its industry, as well as professional standards, acceptable business practices, and internal standards.

Compliance has an ethical as well as a practical component, and it plays a critical role in helping firms manage risk, preserve a positive reputation, and prevent lawsuits.

Compliance officers must have a natural and intuitive understanding of the company’s objectives and culture, as well as the larger industry and standard business legislation. They are responsible for not only maintaining a firm’s commercial dealings ethical and lawful, but also for training the entire company and implementing processes that will ensure the highest degree of compliance possible.

“The most effective line of defense a corporation can implement against federal prosecution, including both civil and criminal enforcement, is an efficient and effective compliance program. An efficient and effective compliance program is not attainable without the right compliance officer,” says Robert Moseman, manager of Robert Walters’ compliance section in New York.

The Quintessential Compliance Officer Personality

A compliance officer’s work includes conveying compliance-related issues to employees across the organization’s divisions. It may be necessary to comprehend complicated or abstract rules or ethics, as well as determine how to build and incorporate best practices. A compliance officer must consequently have excellent interpersonal skills and be able to communicate and collaborate with employees at all levels of the organization, as well as a thorough understanding of the business.

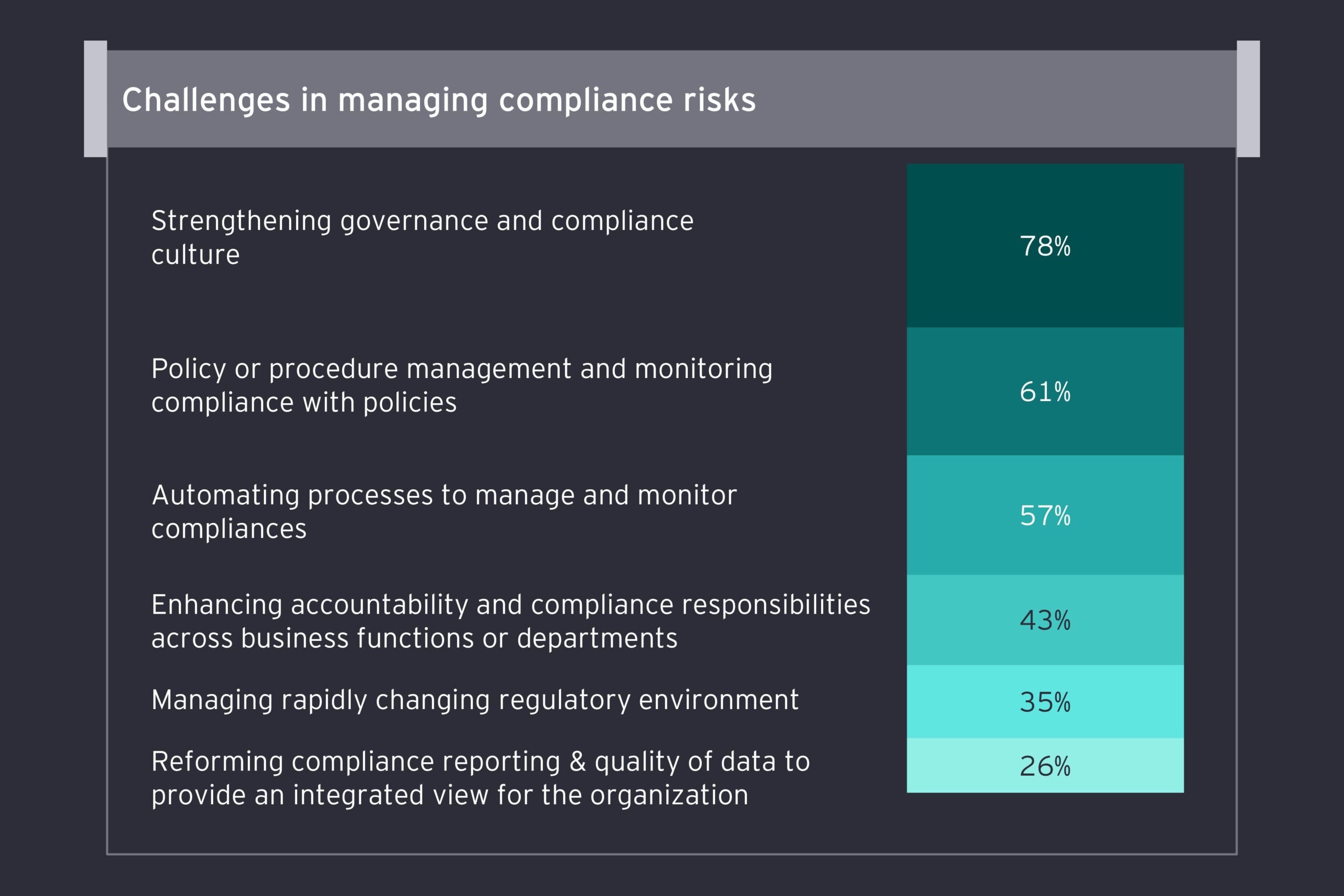

Chapter 7: Policies & Procedures

The foundation of any compliance program, both in terms of organization and management, is its policy and procedure documentation. These documents also make it easier for high-risk operational regions to comply with applicable laws, rules, and standards. A single policy development costs around $5,000 on average. This is true whether the development is done by an outside contractor or legal firm or by an internal committee within the company. You should also think about the time and effort it took to thoroughly study and approve the policy document. This can take a long time and be time and effort consuming.

Many people use shortcuts to save money, such as adopting pre-made policy templates. Some organizations make their policies available for download online. When employing this method, be careful when copying and pasting documents from other organizations. There may be considerable differences in how policies and procedures are organized and managed, making adaptation difficult. There’s also the matter of whether the other company followed applicable laws and regulations appropriately and consistently. There are other genuine providers that can help you write policy documents quickly, effectively, and affordably. Whether you’re writing rules from scratch or using templates, the following will help you understand what’s needed, why it’s needed, and how to do it correctly.

Policies and procedures that establish the framework under which an organization operates are required. However, this should not be confined to a business code of conduct and should apply to all of the company’s actions. Bribery, corruption, and accounting practices should all be covered by policies and processes that are clear, practical, and accessible.

Third parties, whether as a supplier or a customer, should be included. Policies and procedures are only effective if they are kept up to date and conveyed on a regular basis, especially when changes occur.

Chapter 8: Communication & Training

Even if you have the best product in the world, if no one knows about it, it will not sell. To get the word out, you’ll need to spend in the right promotional channels. The compliance program of an organization follows the same principle.

You’ve put in a lot of effort to develop a detailed compliance plan for your organization; now it’s time to spread the news. This entails informing staff about the plan on a regular basis and giving frequent training.

But where do you even begin?

Here are some suggestions for getting your compliance plan across to your staff.

Understand Your Target Market And How They Communicate

How do your staff learn about the company? Do your staff frequently access the intranet? Do they communicate via email or another method? If your company has monitors in its lobby or halls, for example, you could show slides on them. You may also develop a landing page that varies monthly or weekly if your employees predominantly use the intranet. It could include weekly or monthly messages as well as links to ethics documents, rules of conduct, and other resources.

Sync Up Your Internal Messaging

Know when and from which departments internal communications are sent. Is there a monthly internal newsletter from your HR department or marketing/public relations department? If this is the case, request that they supply some compliance information.

Examine Your Resources And Choose Stuff That Is Relevant

Your communication strategy will suffer if you don’t have enough people or the correct material. Because every company’s tone and culture are unique, make sure your material reflects yours while generating it.

Employees Are Polled

Get input from your staff on both the compliance program and the communications that go along with it. Allowing anonymous survey responses from employees might assist design your program and future communications. Employee surveys can also provide useful information on where and how they like to receive program information.

If employees aren’t aware of the program or don’t know what they need to do to participate effectively, it’s ineffective. Following the advice above will help you effectively convey your compliance program inside your company.

A strong training program is required for effective execution of compliance program policies and procedures. Regulators want a company to have a comprehensive training strategy in place that properly explains employees’ compliance duties, especially for those in high-risk positions or locations.

Traditional live training is still valuable, but it may be complemented and reinforced with e-Learning platforms, remote training via video conferencing, online assessment, and other tools that make training more accessible and affordable. Employees should get compliance training as part of their introduction, and this training should be renewed on a regular basis.

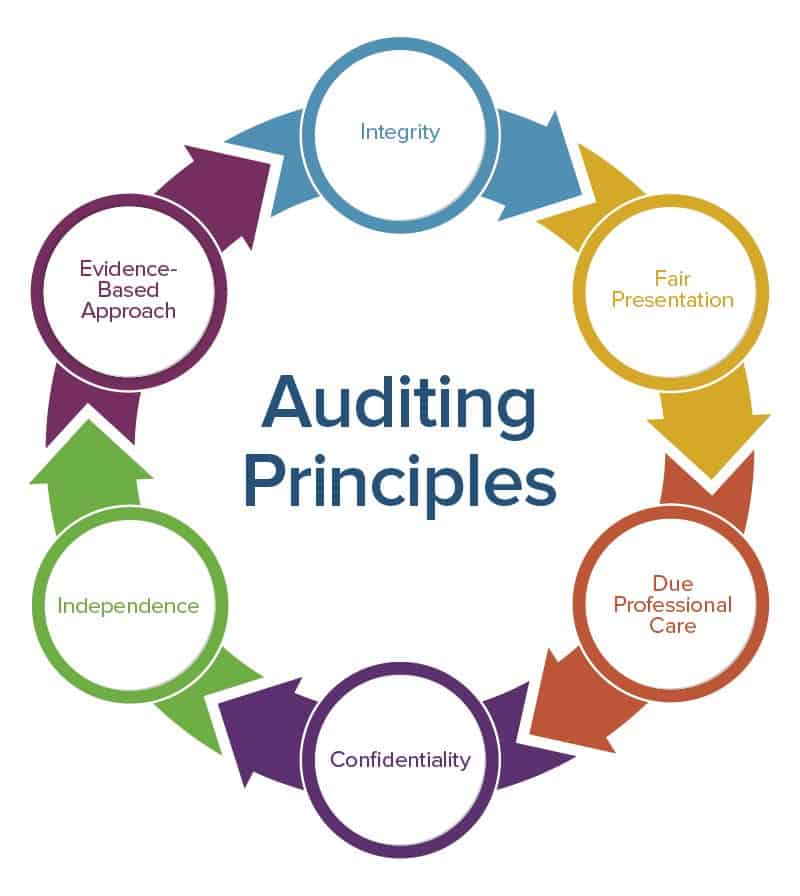

Chapter 9: Monitoring & Auditing

Putting in place monitoring and auditing controls is an important part of any compliance framework since it ensures that the organization has control over its compliance program and that workers follow it. To identify and address concerns, an organization should implement a frequent monitoring system. Effective monitoring entails using a standardized set of processes, inspections, and controls that are suited to the risks in order to detect and correct compliance issues on a continuous basis.

If a compliance breach is discovered, the organization should conduct an early investigation to determine how the breach occurred and put steps in place to prevent it from happening again. Compliance reports should show how the organization adheres to regulatory bodies’ and government agencies’ rules, norms, laws, and regulations, and these assessments should be presented to senior management, the board of directors, and the audit committee. Businesses that fail to comply face regulatory consequences, including fines and jail.

A thorough testing and monitoring program can aid in the effective operation of the control environment. The process begins with the implementation of appropriate controls, which should be tested, followed by regular monitoring and auditing.

Auditing and monitoring are the mechanics of running a compliance program once the previous steps have been completed. A successful compliance program involves a continuous evaluation process.

A successful compliance program, according to the OIG compliance program guidance, requires constant evaluation. Furthermore, according to the OIG, all Corporate Integrity Agreements (CIA) are monitored at least once a year.

All areas of facility operations are audited and monitored, and the compliance program is taken into account. Detecting illegal conduct and errors is an important part of a good compliance program, according to the federal Sentencing Guidelines.

The following areas of potential exposure should be addressed as potential risk areas in the Compliance Plan and the Auditing and Monitoring Plan:

• Self-referral and anti-kickback issues

• Credit balances

• Bad debts

• Claim preparation and submission

• Record retention

• Cost reporting

• Marketing

• Compliance program processes

• National background checks

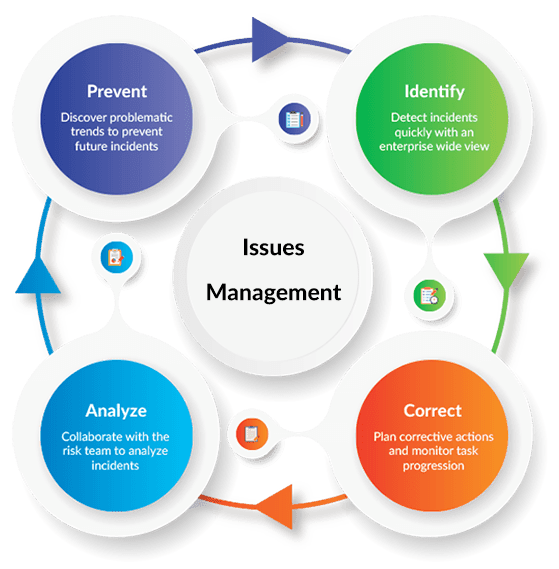

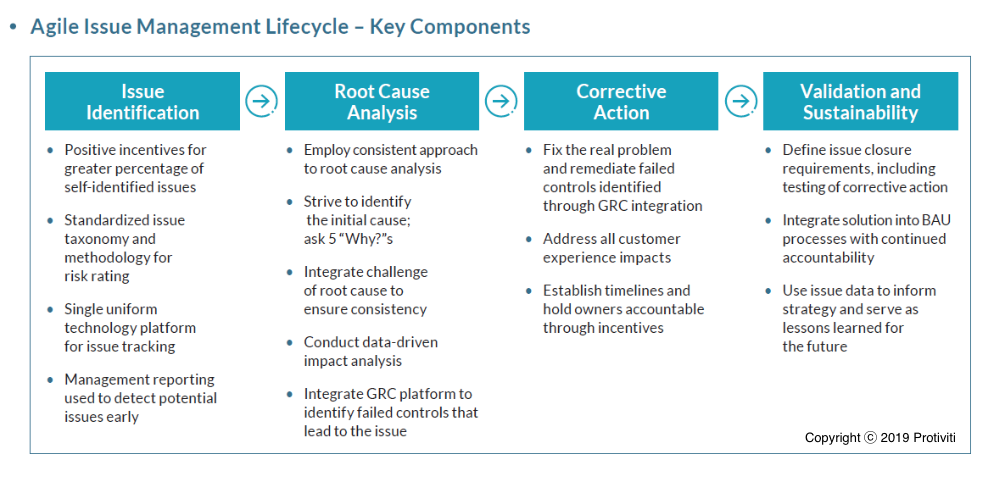

Chapter 10: Issues Management

Leading Issue Management Techniques

Issue management is becoming a more essential priority for businesses. Issue repositories, which are frequently large and compartmentalized, can reveal a range of flaws, shortcomings, and gaps that might hinder a company’s profitability and operational effectiveness. Firms that efficiently manage risk using problem data will unlock value and gain a competitive advantage.

While there are numerous advantages to building and implementing an efficient problem management framework, there are also several common obstacles. Among them are:

• Manual activities that are error-prone and time-consuming

• Inconsistent and/or inappropriate categorization of issues impacting reporting

• Rudimentary reporting that does not provide qualitative context

• A lack of a risk-based approach to issue prioritization and closure

• Weak practices for managing regulatory findings remediation

Low and medium-severity concerns receive insufficient attention, resulting in a lack of awareness into the systemic impact of issues across the business.

To capitalize on increasingly extensive issue-management datasets, there is a lack of personnel recruitment and retention.

Benefits

Companies that design and implement effective issue management systems get a range of benefits. They can, for example, more easily support strong reporting methods like aggregating problem data across functional units and drilling into summarized issue data to understand the characteristics of each detected issue. Developing strong issue management methods creates a thorough understanding of issues across the enterprise and often exposes critical risk themes for senior management to address, such as the health of functional units, prevalent pain points, and common causes of inadequacies. Furthermore, a greater understanding of concerns aids in the development and implementation of stronger controls, as well as assisting the firm in determining the level of risk it is willing to tolerate, all of which help the firm reduce losses and achieve its business objectives.

Issue Management in the Future

Issue management is becoming increasingly important to financial institutions. Issues are no longer managed in silos, with inadequate information technology resources and a lack of awareness about their interconnectivity, by those with more developed issue-management frameworks. Integrated systems that take advantage of centralized technological solutions and standardized processes to provide an enterprisewide perspective of issues and their associated risks are replacing fragmented issue-management frameworks in today’s competitive landscape. Companies that match their issue-management frameworks with best practices can use them to develop their company and strategy. Furthermore, as the volume and complexity of issue-management data acquired by organizations grows, the adoption of advanced analytics — such as cognitive models — to comprehend the data will deliver a higher positive return on investment.

Chapter 11: Metrics

Effective compliance metrics paint a clear image of a company’s compliance program, as well as the risks and controls that come with it. Precision and meaningful metrics assist a company in identifying its core risks and root causes, allowing resources to be applied where they are most needed. Furthermore, metrics derived from data from many lines of business can provide a more accurate picture of compliance risk that might otherwise go unnoticed.

Organizations must assess and identify key metrics that can provide insight into the success of their compliance program, allowing for more effective prevention, detection, and reaction to current and future compliance problems. These indicators can assist compliance professionals identify holes in their programs and implement stronger controls, allowing the company to be more risk-aware and get more value out of its compliance program.

Compliance officers, on the other hand, find it difficult to report on compliance indicators. While some struggle to come up with the right measures and get access to the data they need, others face difficulties dealing with market dynamics and complexity.

Here are some metrics that help compliance officers improve their program:

• Violations of applicable rules and regulations

• Customer or employee complaints

• Significant compliance investigations, audit or quality assurance findings

• Key risk indicators (“KRIs”)

• Risk Tolerance Statements

• Employee and stakeholder culture surveys

Evaluation of a compliance program – tracking target achievement

This is a measure of how well the compliance program is achieving its programmatic goals, such as program acceptability and collaboration from various business lines. It’s an excellent statistic for assessing the compliance program’s success. Some firms examine business area performance reviews to see if managers follow the central compliance function’s compliance standards and guidance/recommendations. This evaluation aids in determining how different areas of business are implementing compliance suggestions.

While it is vital to define and evaluate these indicators, it is evident that this is not a one-time task. Organizations should review and improve their compliance metrics on a regular basis to better manage their evolving compliance risks, stay current with market and regulatory changes, and ensure that the metrics remain linked to the organization’s most significant risks.

Chapter 12: Technology

How To Make A More Meaningful Compliance Program With Technology

Running an effective program requires time and effort, but using new, emerging technology allows you to swiftly put together an effective program. Control testing, tracking, monitoring, and resolving issues, and scanning the environment for changes to regulations and standards that could affect your firm can all be made easier with technology.

Organizations may better track what they are required to comply to, which controls are in place, and how deeply their obligations and controls are entrenched into their business processes by leveraging technology to create a single source of truth for all of their compliance risks. Compliance managers and risk teams can use this type of enablement to better identify where their organization’s shortcomings are, which can help them develop a business case for more resources to address them.

Curriculum

Compliance Administration – Workshop 1 – Compliance Essentials

- Culture

- Incentives & Rewards

- Enforcement & Discipline

- Accountability

- Risk Assessment

- Compliance Officers

- Policies & Procedures

- Communication & Training

- Monitoring & Auditing

- Issues Management

- Metrics

- Technology

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Compliance Administration corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment

You will need to locate a quiet and private place to study, preferably a room where you can easily be isolated from external disturbances or distractions. Make sure the room is well-lit and incorporates a relaxed, pleasant feel. If you can spoil yourself within your study environment, you will have much more of a chance to ensure that you are always in the right frame of mind when you do devote time to study. For example, a nice fire, the ability to play soft soothing background music, soft but effective lighting, perhaps a nice view if possible and a good size desk with a comfortable chair. Make sure that your family know when you are studying and understand your study rules. Your study environment is very important. The ideal situation, if at all possible, is to have a separate study, which can be devoted to you. If this is not possible then you will need to pay a lot more attention to developing and managing your study schedule, because it will affect other people as well as yourself. The better your study environment, the more productive you will be.

Study tools & rules

Try and make sure that your study tools are sufficient and in good working order. You will need to have access to a computer, scanner and printer, with access to the internet. You will need a very comfortable chair, which supports your lower back, and you will need a good filing system. It can be very frustrating if you are spending valuable study time trying to fix study tools that are unreliable, or unsuitable for the task. Make sure that your study tools are up to date. You will also need to consider some study rules. Some of these rules will apply to you and will be intended to help you to be more disciplined about when and how you study. This distance-learning guide will help you and after you have read it you can put some thought into what your study rules should be. You will also need to negotiate some study rules for your family, friends or anyone who lives with you. They too will need to be disciplined in order to ensure that they can support you while you study. It is important to ensure that your family and friends are an integral part of your study team. Having their support and encouragement can prove to be a crucial contribution to your successful completion of the program. Involve them in as much as you can.

Successful distance-learning

Distance-learners are freed from the necessity of attending regular classes or workshops, since they can study in their own way, at their own pace and for their own purposes. But unlike traditional internal training courses, it is the student’s responsibility, with a distance-learning program, to ensure that they manage their own study contribution. This requires strong self-discipline and self-motivation skills and there must be a clear will to succeed. Those students who are used to managing themselves, are good at managing others and who enjoy working in isolation, are more likely to be good distance-learners. It is also important to be aware of the main reasons why you are studying and of the main objectives that you are hoping to achieve as a result. You will need to remind yourself of these objectives at times when you need to motivate yourself. Never lose sight of your long-term goals and your short-term objectives. There is nobody available here to pamper you, or to look after you, or to spoon-feed you with information, so you will need to find ways to encourage and appreciate yourself while you are studying. Make sure that you chart your study progress, so that you can be sure of your achievements and re-evaluate your goals and objectives regularly.

Self-assessment

Appleton Greene training programs are in all cases post-graduate programs. Consequently, you should already have obtained a business-related degree and be an experienced learner. You should therefore already be aware of your study strengths and weaknesses. For example, which time of the day are you at your most productive? Are you a lark or an owl? What study methods do you respond to the most? Are you a consistent learner? How do you discipline yourself? How do you ensure that you enjoy yourself while studying? It is important to understand yourself as a learner and so some self-assessment early on will be necessary if you are to apply yourself correctly. Perform a SWOT analysis on yourself as a student. List your internal strengths and weaknesses as a student and your external opportunities and threats. This will help you later on when you are creating a study plan. You can then incorporate features within your study plan that can ensure that you are playing to your strengths, while compensating for your weaknesses. You can also ensure that you make the most of your opportunities, while avoiding the potential threats to your success.

Accepting responsibility as a student

Training programs invariably require a significant investment, both in terms of what they cost and in the time that you need to contribute to study and the responsibility for successful completion of training programs rests entirely with the student. This is never more apparent than when a student is learning via distance-learning. Accepting responsibility as a student is an important step towards ensuring that you can successfully complete your training program. It is easy to instantly blame other people or factors when things go wrong. But the fact of the matter is that if a failure is your failure, then you have the power to do something about it, it is entirely in your own hands. If it is always someone else’s failure, then you are powerless to do anything about it. All students study in entirely different ways, this is because we are all individuals and what is right for one student, is not necessarily right for another. In order to succeed, you will have to accept personal responsibility for finding a way to plan, implement and manage a personal study plan that works for you. If you do not succeed, you only have yourself to blame.

Planning

By far the most critical contribution to stress, is the feeling of not being in control. In the absence of planning we tend to be reactive and can stumble from pillar to post in the hope that things will turn out fine in the end. Invariably they don’t! In order to be in control, we need to have firm ideas about how and when we want to do things. We also need to consider as many possible eventualities as we can, so that we are prepared for them when they happen. Prescriptive Change, is far easier to manage and control, than Emergent Change. The same is true with distance-learning. It is much easier and much more enjoyable, if you feel that you are in control and that things are going to plan. Even when things do go wrong, you are prepared for them and can act accordingly without any unnecessary stress. It is important therefore that you do take time to plan your studies properly.

Management

Once you have developed a clear study plan, it is of equal importance to ensure that you manage the implementation of it. Most of us usually enjoy planning, but it is usually during implementation when things go wrong. Targets are not met and we do not understand why. Sometimes we do not even know if targets are being met. It is not enough for us to conclude that the study plan just failed. If it is failing, you will need to understand what you can do about it. Similarly if your study plan is succeeding, it is still important to understand why, so that you can improve upon your success. You therefore need to have guidelines for self-assessment so that you can be consistent with performance improvement throughout the program. If you manage things correctly, then your performance should constantly improve throughout the program.

Study objectives & tasks

The first place to start is developing your program objectives. These should feature your reasons for undertaking the training program in order of priority. Keep them succinct and to the point in order to avoid confusion. Do not just write the first things that come into your head because they are likely to be too similar to each other. Make a list of possible departmental headings, such as: Customer Service; E-business; Finance; Globalization; Human Resources; Technology; Legal; Management; Marketing and Production. Then brainstorm for ideas by listing as many things that you want to achieve under each heading and later re-arrange these things in order of priority. Finally, select the top item from each department heading and choose these as your program objectives. Try and restrict yourself to five because it will enable you to focus clearly. It is likely that the other things that you listed will be achieved if each of the top objectives are achieved. If this does not prove to be the case, then simply work through the process again.

Study forecast

As a guide, the Appleton Greene Compliance Administration corporate training program should take 12-18 months to complete, depending upon your availability and current commitments. The reason why there is such a variance in time estimates is because every student is an individual, with differing productivity levels and different commitments. These differentiations are then exaggerated by the fact that this is a distance-learning program, which incorporates the practical integration of academic theory as an as a part of the training program. Consequently all of the project studies are real, which means that important decisions and compromises need to be made. You will want to get things right and will need to be patient with your expectations in order to ensure that they are. We would always recommend that you are prudent with your own task and time forecasts, but you still need to develop them and have a clear indication of what are realistic expectations in your case. With reference to your time planning: consider the time that you can realistically dedicate towards study with the program every week; calculate how long it should take you to complete the program, using the guidelines featured here; then break the program down into logical modules and allocate a suitable proportion of time to each of them, these will be your milestones; you can create a time plan by using a spreadsheet on your computer, or a personal organizer such as MS Outlook, you could also use a financial forecasting software; break your time forecasts down into manageable chunks of time, the more specific you can be, the more productive and accurate your time management will be; finally, use formulas where possible to do your time calculations for you, because this will help later on when your forecasts need to change in line with actual performance. With reference to your task planning: refer to your list of tasks that need to be undertaken in order to achieve your program objectives; with reference to your time plan, calculate when each task should be implemented; remember that you are not estimating when your objectives will be achieved, but when you will need to focus upon implementing the corresponding tasks; you also need to ensure that each task is implemented in conjunction with the associated training modules which are relevant; then break each single task down into a list of specific to do’s, say approximately ten to do’s for each task and enter these into your study plan; once again you could use MS Outlook to incorporate both your time and task planning and this could constitute your study plan; you could also use a project management software like MS Project. You should now have a clear and realistic forecast detailing when you can expect to be able to do something about undertaking the tasks to achieve your program objectives.

Performance management

It is one thing to develop your study forecast, it is quite another to monitor your progress. Ultimately it is less important whether you achieve your original study forecast and more important that you update it so that it constantly remains realistic in line with your performance. As you begin to work through the program, you will begin to have more of an idea about your own personal performance and productivity levels as a distance-learner. Once you have completed your first study module, you should re-evaluate your study forecast for both time and tasks, so that they reflect your actual performance level achieved. In order to achieve this you must first time yourself while training by using an alarm clock. Set the alarm for hourly intervals and make a note of how far you have come within that time. You can then make a note of your actual performance on your study plan and then compare your performance against your forecast. Then consider the reasons that have contributed towards your performance level, whether they are positive or negative and make a considered adjustment to your future forecasts as a result. Given time, you should start achieving your forecasts regularly.

With reference to time management: time yourself while you are studying and make a note of the actual time taken in your study plan; consider your successes with time-efficiency and the reasons for the success in each case and take this into consideration when reviewing future time planning; consider your failures with time-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future time planning; re-evaluate your study forecast in relation to time planning for the remainder of your training program to ensure that you continue to be realistic about your time expectations. You need to be consistent with your time management, otherwise you will never complete your studies. This will either be because you are not contributing enough time to your studies, or you will become less efficient with the time that you do allocate to your studies. Remember, if you are not in control of your studies, they can just become yet another cause of stress for you.

With reference to your task management: time yourself while you are studying and make a note of the actual tasks that you have undertaken in your study plan; consider your successes with task-efficiency and the reasons for the success in each case; take this into consideration when reviewing future task planning; consider your failures with task-efficiency and the reasons for the failures in each case and take this into consideration when reviewing future task planning; re-evaluate your study forecast in relation to task planning for the remainder of your training program to ensure that you continue to be realistic about your task expectations. You need to be consistent with your task management, otherwise you will never know whether you are achieving your program objectives or not.

Keeping in touch

You will have access to qualified and experienced professors and tutors who are responsible for providing tutorial support for your particular training program. So don’t be shy about letting them know how you are getting on. We keep electronic records of all tutorial support emails so that professors and tutors can review previous correspondence before considering an individual response. It also means that there is a record of all communications between you and your professors and tutors and this helps to avoid any unnecessary duplication, misunderstanding, or misinterpretation. If you have a problem relating to the program, share it with them via email. It is likely that they have come across the same problem before and are usually able to make helpful suggestions and steer you in the right direction. To learn more about when and how to use tutorial support, please refer to the Tutorial Support section of this student information guide. This will help you to ensure that you are making the most of tutorial support that is available to you and will ultimately contribute towards your success and enjoyment with your training program.

Work colleagues and family