Acquisitive Growth – Workshop 1 (Business Assessment)

The Appleton Greene Corporate Training Program (CTP) for Acquisitive Growth is provided by Mr. Chicles Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 24 months; Program orders subject to ongoing availability.

If you would like to view the Client Information Hub (CIH) for this program, please Click Here

Learning Provider Profile

Mr Chicles is an approved Certified Learning Provider (CLP) at Appleton Greene who is a business leader and strategist with broad experience in the global multi-industrial, aerospace and defense sectors. He is a seasoned operational leader of global industrial businesses, leading transformational strategies in highly competitive markets.

As a senior, C-suite strategist for multiple major industrial corporations he has led multiple mergers, acquisitions, divestitures and restructurings, as well as corporate break-ups and spin-offs. He has a distinguished track record of successful transformations of complex organizations in dynamic and uncertain market conditions while engendering the trust and buy-in of employees, customers, vendors, owners, corporate leadership and boards of directors.

A highly engaged leader at the personal and team level he has demonstrated the ability to engender effective senior teams and boards. He’s also an active mentor, teacher and community leader.

Mr Chicles is an active board member with AES Seals, global leader in sustainable reliability engineering, and Micro Technologies Inc, an electronics and advanced manufacturing company. He is a principal partner with ProOrbis Enterprises®, a management science consultancy with premier clients such as the US Navy and PwC, as well as the principal of Xiphos Associates™, a management and M&A advisory. Recently, he served as Board Director and Chairman of Global Business Development with Hydro Inc. the largest independent pump and flow systems engineering services provider in the world.

He was President of ITT’s Industrial Process / Goulds Pumps business segment a global manufacturer of industrial pumps, valves, monitoring and control systems, and aftermarket services for numerous industries with $1.2 billion in revenue, 3,500 employees and 34 facilities in 17 countries. Preceding this role he served as Executive Vice President of ITT Corporation overseeing the creation of a newly conceived ITT Inc. following the break-up of the former ITT Corporation to establish its strategy and corporate functions such as HR, communications, IT and M&A, building the capabilities, policies and organizations for each.

He joined ITT Corporation’s executive committee as its strategy chief in 2006 and instituted disciplined strategic planning processes and developed robust acquisition pipelines to respond to rapidly changing markets. Created successful spin-offs of 2 new public corporations Exelis Inc. and Xylem Inc. ITT Corporation was named one of “America’s Most Respected Corporations” by Forbes for exemplary management and performance during his tenure there.

Before joining ITT, Mr Chicles served as Vice President of Corporate Business Development and head of mergers and acquisitions for American Standard / Trane Companies, where he initiated and closed numerous transactions and equity restructurings globally.

Additionally, he created and led the corporate real estate function which entailed more than 275 real estate transactions around the world.

He began his career at Owens Corning rising through the ranks in various operational roles to Vice President of Corporate Development.

Recently, he taught advanced enterprise strategy at Stevens Institute of Technology as an adjunct professor and still supports start-ups through the Stevens Venture Center. He continues to be active as the Founding Board Member with several successful start-up technology businesses and non-profit organizations. A community leader, Mr Chicles has held the role of President of the Greek Orthodox Cathedral in Tenafly, N.J., He also led trips abroad to Cambodia and Costa Rica to build sustainable clean-water solutions and affordable housing.

His formal education includes earning a Masters of Business Administration from The Wharton School at the University of Pennsylvania, and a Bachelors in Finance from Miami University.

MOST Analysis

Mission Statement

Assessments can be incredibly valuable tools for organizations of all sizes. A comprehensive assessment methodology can help you evaluate your organization across multiple dimensions. But what are business assessments, what do they entail, and what are the benefits? Business assessments can help you identify areas of improvement and potential acquisitive growth. By taking a comprehensive approach, you can get an accurate picture of your organization’s strengths and weaknesses. Assessments can also help you develop actionable plans to improve your business. At their core, business assessments are all about providing clarity. When you’re feeling overwhelmed by the day-to-day details of running a business, it can be difficult to step back and get a clear picture of where your company is headed. That’s where assessments come in. By taking a comprehensive look at your company’s strengths and weaknesses, you can develop a clear road map for success. Assessments are an essential part of any business plan. By evaluating your company’s strengths and weaknesses, you can develop a roadmap for growth. Furthermore, assessments can help identify areas where your company may be at risk. By addressing these risks early on, you can avoid potential problems down the road. In addition, assessments can help you benchmark your company’s performance against others in your industry. This benchmarking process can give you valuable insights into areas where your company may need to improve. Ultimately, regular business assessments are a crucial tool for any organization that is looking to grow and thrive.

Objectives

01. Current State: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

02. Analysis Tools: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

03. Identify Stakeholders: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

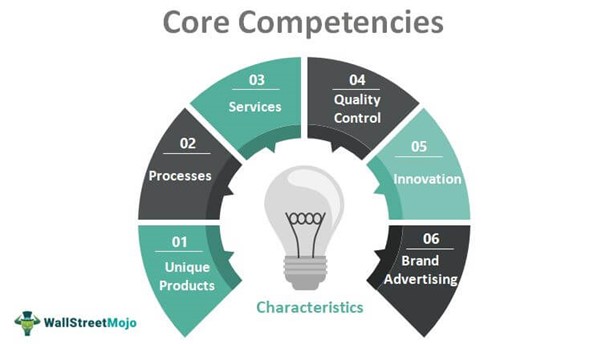

04. Core Competencies: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

05. Market Differentiation: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

06. Mission/Vision Statement: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

07. Mapping Future State: departmental SWOT analysis; strategy research & development. 1 Month

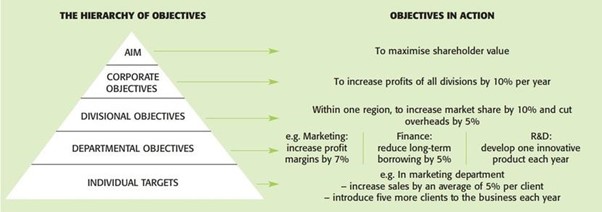

08. Set Department Objectives: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

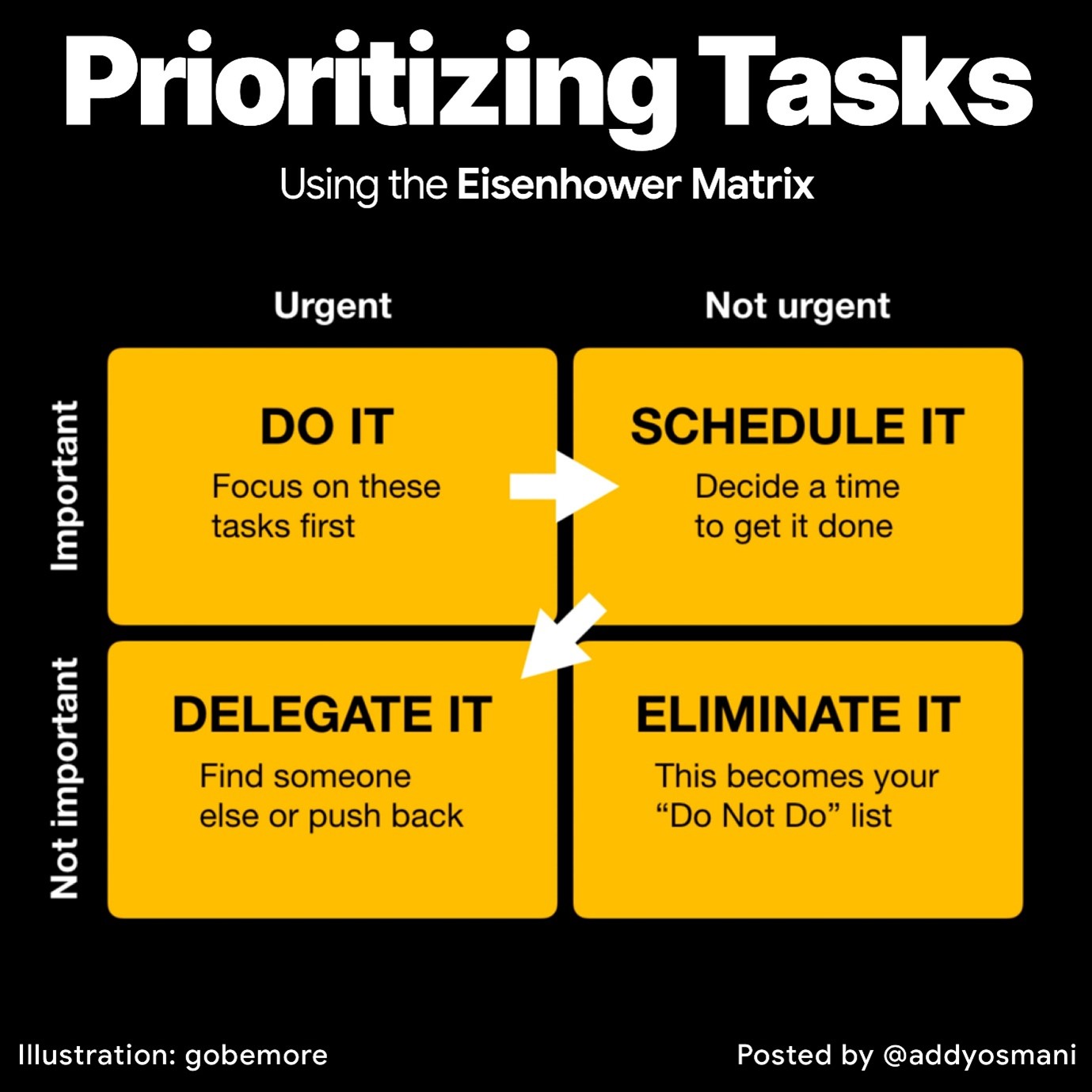

09. Prioritizing Tasks : departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

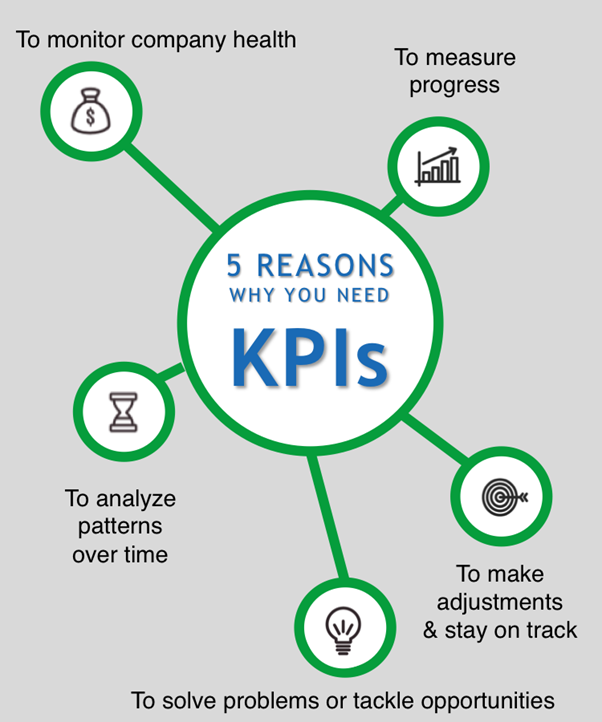

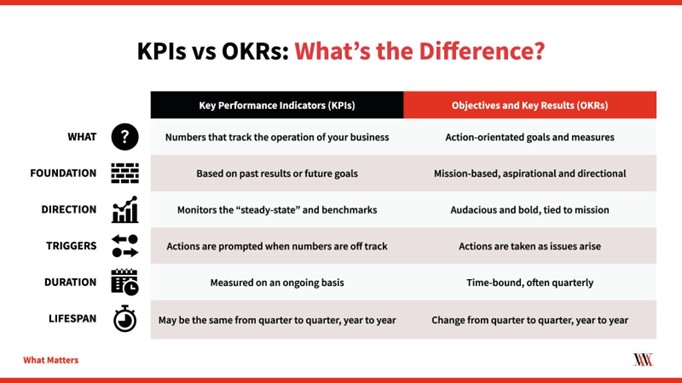

10. Set KPIs: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

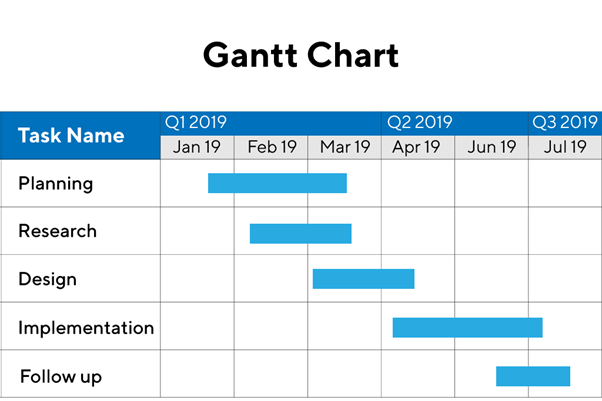

11. Create a Project Schedule: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

12. Monitor Data over Time: departmental SWOT analysis; strategy research & development. Time Allocated: 1 Month

Strategies

01. Current State: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

02. Analysis Tools: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

03. Identify Stakeholders: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

04. Core Competencies: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

05. Market Differentiation: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

06. Mission/Vision Statement: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

07. Mapping Future State: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

08. Set Department Objectives: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

09. Prioritizing Tasks: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

10. Set KPIs: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

11. Create a Project Schedule: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

12. Monitor Data over Time: Each individual department head to undertake departmental SWOT analysis; strategy research & development.

Tasks

01. Create a task on your calendar, to be completed within the next month, to analyze Current State.

02. Create a task on your calendar, to be completed within the next month, to analyze Analysis Tools.

03. Create a task on your calendar, to be completed within the next month, to analyze Identify Stakeholders.

04. Create a task on your calendar, to be completed within the next month, to analyze Core Competencies.

05. Create a task on your calendar, to be completed within the next month, to analyze Market Differentiation.

06. Create a task on your calendar, to be completed within the next month, to analyze Mission/Vision Statement.

07. Create a task on your calendar, to be completed within the next month, to analyze Mapping Future State.

08. Create a task on your calendar, to be completed within the next month, to analyze Set Department Objectives.

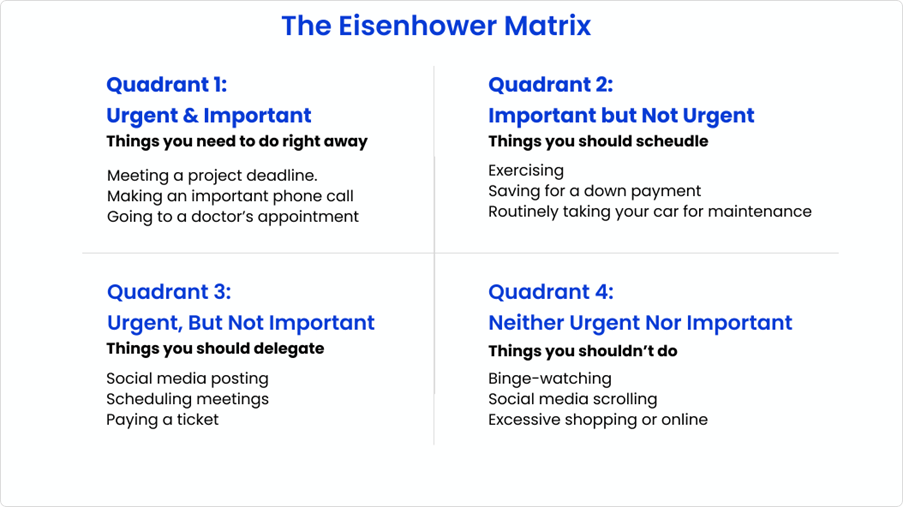

09. Create a task on your calendar, to be completed within the next month, to analyze Prioritizing Tasks.

10. Create a task on your calendar, to be completed within the next month, to analyze Set KPIs.

11. Create a task on your calendar, to be completed within the next month, to analyze Create a Project Schedule.

12. Create a task on your calendar, to be completed within the next month, to analyze Monitor Data over Time.

Introduction

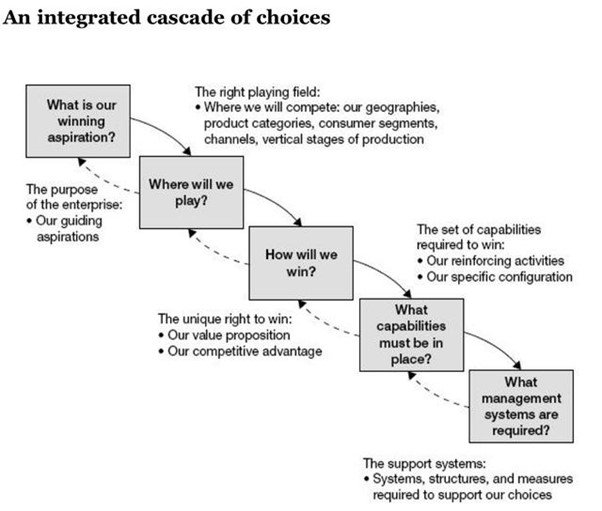

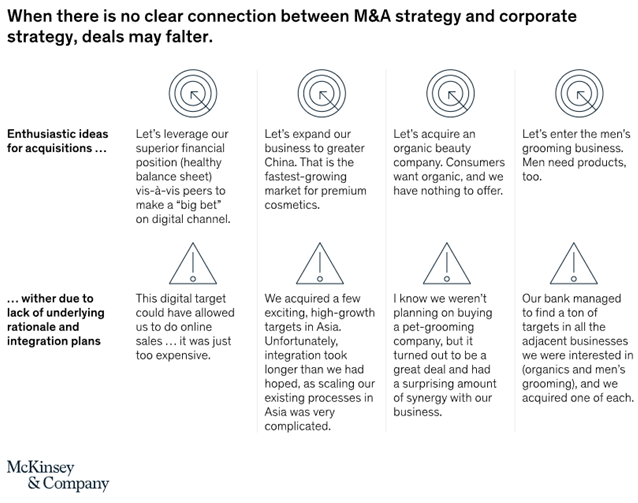

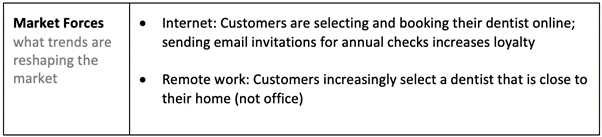

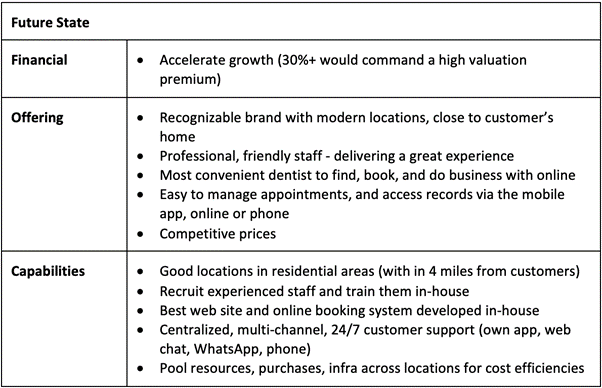

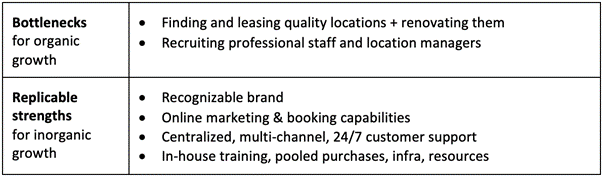

Referring to the original application and executive summary in the ‘Acquisitive Growth’ Client Information Hub, the first order of business is the “Strategy Development” phase. This is meant to be a self-assessment and evaluation of current strategic context and situation from which to determine if and where acquisitions fit and support a business’s aspirations. A very effective methodology that I may have shared with you prior is to use AJ Laffley’s book “Playing to Win” whereby a company assesses “Where they play” ( the products, markets and segments), “How the win” (the competitive differentiation and value proposition they offer), “Capabilities” (what combinations of people, process and technologies are required) and “Systems” (those foundational elements that a business stands on such as footprint, IT Systems, management systems, talent processes, etc.). By evaluating these elements, a company can then perform a gap analysis and create a strategy to get from current state to the future state they wish to achieve. For example, if a company was successful in the US making differentiated products for a certain set of endmarkets and wanted to grow, they would evaluate first if they could achieve their goals organically. If they cannot, then the likely reason would be a lack in one of these elements such as: a) Need to access new market segments or geographies, or b) need leverage their particular capabilities in new markets or develop new capabilities and so on.

It is through this work that a company focuses their acquisitive growth strategies to in essence fill the strategic gaps they have which practically cannot be filled organically. For example, if a US-Based industrial product company had developed a set of unique products and services that are winning in their existing markets, but found that as their share grows and the markets cycle they have challenges achieving sustainable growth. Suppose then through their strategy work that they identify a new geography/market where they would be able to take their competitive advantage and grow a whole new area of revenues. This methodology or approach would help them Identify this opportunity and to focus on what they need to acquire – new products, channels to market, brand recognition, technical capabilities, etc. In this example, it might be to acquire a similar business into which they instill their capabilities. Or it might be a matter of just acquiring distribution channels that meet certain criteria that would enable them to enter and win in the new market by flowing their existing products through them. Another example might be that in order to penetrate this new market, new products might be needed which in turn could be the focus of acquisitions.

So as you can see, the upfront Business Assessment part of this program is internally focused to determine the acquisition strategy as opposed to externally focused on targets once the strategy is articulated.

In this workshop, you will learn how to carry out a successful business assessment which will in turn, prepare your organization for acquiring growth through an acquisition or merger. It is an in-depth process which will highlight your business’ strengths and weaknesses and highlight areas where inorganic growth may be more effective and fruitful compared to trying to grow organically.

Playing to Win: How Strategy Really Works

How Strategy Really Works is a book about strategy, written by A.G. Lafley, former CEO of Procter & Gamble, and Roger Martin, dean of the Rotman School of Management. The book covers the “transformation” of P&G under Lafley and the approach to strategy that informed it.

This method evolved from Monitor Company’s strategic practice and then became P& G’s standard operating procedure. Throughout their professional lives, they strove to create a solid framework for their strategic approach, a means of imparting the ideas to others, and a process for putting it into practice in an organization. At the end of the day, this is a tale of choices, including the decision to establish a discipline of strategic practice and thinking within an organization. Having a strategic mentality can only help you in the business evaluation phase of acquisitive growth since it enables you to spot change chances and equips you with the skills and knowledge you need to seize them. This, in turn, increases market share and profitability, and makes your business more durable. Knowing where to focus acquisitive growth is vital. A business assessment will highlight which areas and departments would benefit most from this kind of growth, as organic growth may not have been enough for your organization to grow at the rate in which you desired.

The “Playing To Win” Methodology

A corporation will invariably fall short of making the difficult decisions and substantial investments that would make winning even a remote possibility when it sets out to participate rather than win.

But if you play to win, you risk being in error.

The Playbook

A winning aspiration, where to play, how to win, core capabilities, and management systems are the five options listed by the author as a coordinated and integrated set of five alternatives. The strategic decision cascade, the cornerstone of strategy work, and the focus of this book are the five options.

Specifically, the answers to these five interconnected problems are found in strategy:

1. What winning goals do you have? The goal of your business and what makes it inspiring.

2. Where do you plan to play? A field of play where you can realize that goal.

3. How will you succeed? how you’ll triumph on the selected field of play.

4. What requirements must be met? the combination and arrangement of skills necessary to triumph in the selected manner.

5. What management techniques are necessary? systems and policies that support and empower capabilities and choices.

Later in the course, we’ll go into more detail on these ideas and demonstrate how to use them in your business evaluation procedure. The foundation for effective acquisitive growth is laid by this process, which can be used to any business or project and which identifies areas where your company might gain from M&A to remain competitive and fill a niche you might find difficult to fill on your own.

As you can imagine, in small organizations a single choice cascade might exist, whereas in large organizations multiple “levels of choices and interconnected cascades.” Nested cascades means that choice happens at almost every level in the organization.

Winning Aspirations

Statements concerning the ideal future are known as aspirations. Later on in the process of acquisitive growth, a corporation attaches certain precise benchmarks that track progress toward those goals to those ideals. Over time, aspirations can be adjusted and changed. Though they exist to consistently align business actions, aspirations shouldn’t vary day to day and should be made to persist for a while. Future mergers and acquisitions should support these goals.

M&A Failure: Daimler-Benz and Chrysler (1998)

MBA programmes frequently highlight the Daimler-Benz and Chrysler merger as the classic case study of how cultural differences would always result in a deal’s failure.

Some people have claimed that the two civilizations are too dissimilar to ever be combined.

Daimler-Benz made methodical decisions; Chrysler made creative, unstructured decisions. Daimler-Benz salaries were conservative; Chrysler salaries were much less so. And finally, there was the flat hierarchy that existed at Chrysler as opposed to the top-down structure at Daimler-Benz.

The result?

Within ten years, Daimler sold Cerberus Capital Management 80% of Chrysler for $7 billion, giving the cultural relativists a US$20 billion kick in the pants.

This M&A disaster is a prime illustration of how business disagreements may be disastrous. Always look to merge with or buy businesses that share your goals and beliefs in order to ensure a smooth and ultimately successful purchase.

Where to Play

Where to play and how to win define the precise actions of the organization—what the business will do, where it will do it, and how it will do it—in order to fulfill its goals. The winning aspiration broadly defines the scope of the firm’s operations.

The set of options that limit the field of competition is represented as where to play. The questions that need to be posed center on the markets, clients, consumers, channels, product categories, and vertical stage(s) of the industry in question where the company will compete. For instance, during your business evaluation, you might find that expanding through an acquisition or merger may enable you to enter the geographic regions needed for accelerated growth.

How to Win

The playing field is determined by where you play; the options for winning on that field are determined by how you play. It is the key to success in the targeted demographics, markets, channels, and so on. The decision of where to play is closely related to the decision of how to win. Keep in mind that the focus is on winning within the chosen where-to-play areas, not on winning overall.

A company must decide what will allow it to produce distinctive value and sustainably deliver that value to clients in a way that is different from the firm’s competitors in order to determine how to win during the business assessment phase. The exact way a company uses its advantages to provide higher value for a consumer or client, and as a result, superior returns for the firm, is what Michael Porter referred to as competitive advantage.

Excellent plans enable for a certain fit between where to play and how to win decisions that strengthens the business.

Core Capabilities

Two inquiries stem from and bolster the core of strategy: What competences must be there in order to succeed, and what management systems must be in place in order to support the strategic decisions?

Management Systems

The cascade’s last strategic decision is centered on management systems. These are the frameworks that encourage, underpin, and evaluate the approach. They must be specifically created to support the options and capabilities if they are to be truly effective.

Summing Up

During the phase of your business assessment, strategy is an iterative process in which all of the moving pieces impact one another.

Lafley and Martin claim that choosing where to play and working out how to win there is the essence of strategy.

What business are you in?

When asked what industry they are in, the majority of businesses would either describe their product line or the services they provide. For instance, many producers of mobile devices might claim to be in the business of producing smartphones. They probably wouldn’t claim to be in the business of facilitating communication at all times and all places. However, that is their actual line of work, and using a smartphone is merely one method.

Procter & Gamble’s Acquisition of Gillette

P&G announced its largest acquisition ever on January 28, 2005, when it agreed to pay $57 billion to acquire Gillette. A number of the top brands in the world were united in the deal. The biggest manufacturer of consumer goods in the world was P&G. P&G offered everything from Head & Shoulders shampoo to Crest toothpaste. Among Gillette’s top offerings were its renowned razors, Duracell batteries, Braun, and Oral-B dental care items.

The largest consumer goods corporation in the world was created as a result of the merger. The agreement provided P&G additional control over shelf space at supermarkets and other shops around the country as well as expensive real estate. In addition to more than 300 consumer brands like Ivory soap, Head & Shoulders shampoo, Pringles, Crest toothpaste, and Bounty paper towels, P&G has added Duracell batteries, Right Guard deodorant, and Gillette razors. For every share of Gillette common stock, P&G paid 0.975 shares of its own common stock. The acquisition valued Gillette at around $54 per share, or an 18% premium over its closing price, based on the stock’s closing price of $55.32 on January 28, 2005. After acquiring Gillette, P&G had 12 billion-dollar brands in the baby, family, and household divisions and 10 billion-dollar brands in the beauty and health categories. In markets and with clients where P&G brands are not yet completely entrenched, such as home improvement channels, P&G took advantage of Gillette’s robust in-store presence.

In the shorter time frame period, the cumulative returns were negative, but in the longer time window period, they were positive. From 10.7% in the pre-merger period to 13.6% in the post-merger period, the average net earnings margin increased.

The Business Assessment Phase

Organizations of all sizes can benefit greatly from doing business assessments. You can examine your organization across a number of dimensions with the use of a thorough assessment approach. But what exactly are business analyses, what do they entail, and what are the advantages?

What are Business Assessments?

You can use business assessments to find opportunities for organic or acquired growth as well as areas that need improvement. You may accurately determine the strengths and weaknesses of your firm by adopting a thorough strategy. You may create concrete plans to improve your firm with the aid of assessments.

Business assessments are really about giving clarity. It might be challenging to take a step back and obtain a clear image of where your organization is headed when you’re feeling overburdened by the day-to-day details of running a business. The assessments play a role in that. You may create a clear road map for success and identify areas where a merger or acquisition may be able to assist your business grow by conducting a thorough inventory of your company’s strengths and limitations.

What Do Business Assessments Entail?

Business evaluations generally focus on four important areas: operational efficiency, customer happiness, staff satisfaction, and financial health. You may find areas for development and implement the adjustments required to advance your company by carefully examining each of these areas.

Evaluations may be carried either internally or externally. Employees typically do internal assessments, whereas outside consultants typically conduct external assessments. Although external exams are frequently more thorough and offer an unbiased viewpoint, both kinds of assessments can be helpful.

Benefits of Business Assessments

A business evaluation is similar to a physical for your firm. It’s an opportunity to take a step back, assess the organization as a whole, and pinpoint any problematic areas that might be contributing to bottlenecks and stifling progress.

Like you wouldn’t wait years to visit the doctor, you shouldn’t wait years to get a company evaluation. Here are a few of the numerous advantages of this significant exercise:

1. Improved decision-making: When you have all the facts and figures in front of you, it’s easier to make informed decisions about where to invest your time and resources, and where you may benefit form M&A.

2. Greater clarity: A business assessment can help you to see your company more clearly, highlighting areas of strength and weakness that you may not have been aware of previously.

3. Improved Prioritization: Once you know where your company needs to improve, you can develop strategies for moving forward and achieving your goals.

4. Stronger relationships: Assessing your business can also help to strengthen relationships with employees, customers, and other key stakeholders. By openly discussing areas of concern, you can build trust and create a shared commitment to finding solutions.

5. Increased success: Ultimately, undergoing a business assessment can help you to achieve greater success. By taking a proactive approach to identifying and addressing problems, you can set your company on the path to long-term growth via acquisition or merger if you cannot solve these problems organically.

How Can Business Assessments Help My Organization Grow inorganically?

Every company plan must have assessments. You can create a roadmap for organic, or in this case, acquisitive growth by analyzing the strengths and limitations of your business. Assessments can also aid in locating potential risk areas for your business. You can prevent future issues by addressing these hazards right away.

Additionally, assessments can assist you in comparing the success of your business to that of others in your sector. This benchmarking technique might help you gain important insights into potential improvement areas for your business. In the end, regular business assessments are an essential tool for every company seeking to expand and prosper.

How Can I Make the Most of My Assessment Findings?

There isn’t a one-size-fits-all approach to company. Because every business is different, what works for one may not be effective for another. For this reason, it’s crucial to have a thorough evaluation of your company before making any significant choices regarding inorganic expansion. Every area of your organization, from your sales process to your customer experience activities, will be closely examined in a good business assessment. You will receive the data you require to make wise judgements from it.

How then can you maximize the results of your assessment? First, spend some time going over all of the assessment results. Don’t simply concentrate on the aspects of your organization that require improvement; also pay attention to the sections that are presently functioning well. This will serve as a fantastic springboard for transformation.

Make a plan of action based on your findings in the second place. Be clear about your goals and the path you’ll take to reach them.

Finally, put your plan into action and monitor your results. Review your results frequently, and correct as necessary. You can make sure your assessment is a beneficial tool for expanding your business by following these steps.

Business analyses can be quite helpful for businesses of all sizes. You may maximize the results of your evaluation and experience considerable growth for your business with proper planning and implementation.

Internal Analysis

An in-depth investigation of a company’s internal elements, including its resources, assets, and processes is known as an internal analysis. To develop a workable business strategy or business plan, firm decision-makers use internal analysis to precisely pinpoint areas for development or correction. In order to have a complete view of how the firm operates both as an independent unit and as a component of the larger competitive industry, individuals developing the company’s business plan frequently combine an internal analysis with an external study.

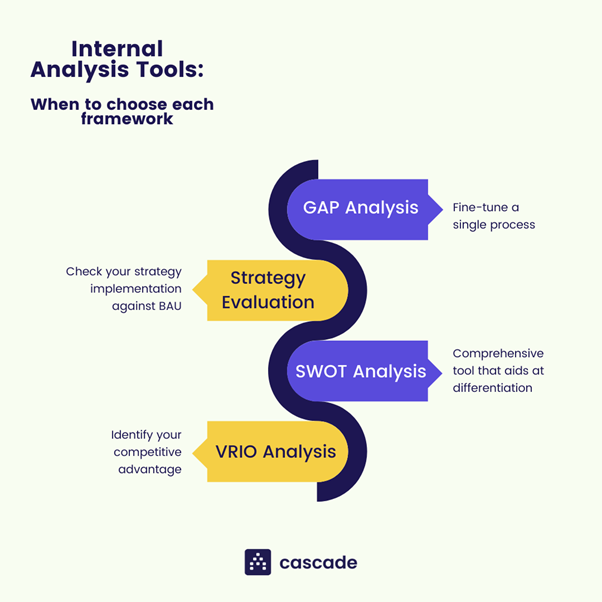

Before deciding on growth through acquisition, businesses can pick from a number of models for performing an internal analysis. To find out important details about the internal business processes, resources, and structures, each employs slightly different techniques, strategies, and objectives. The following are a few of the most typical illustrations of internal analytical frameworks:

● Gap analysis: A gap analysis identifies the gap between a business goal and the current state of operations. Companies use gap analyses when they need to identify weaknesses in the business.

● Strategy evaluation: A strategy evaluation is an ongoing internal assessment tool used at regular intervals to establish if a company is meeting its objectives as outlined in a business strategy or plan.

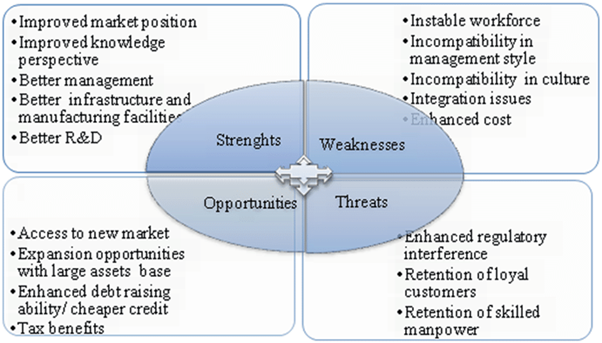

● SWOT analysis: A SWOT (Strengths, Weaknesses, Opportunities and Threats) analysis helps to give companies a broad overview of all internal functions. SWOT analyses are ideal for evaluating the full range of a company’s abilities.

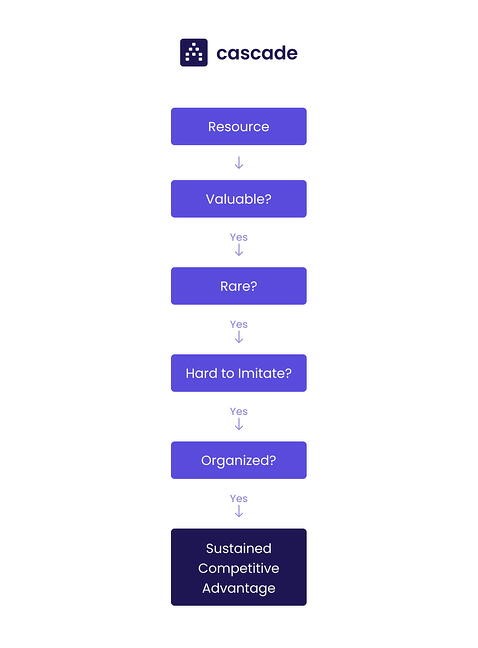

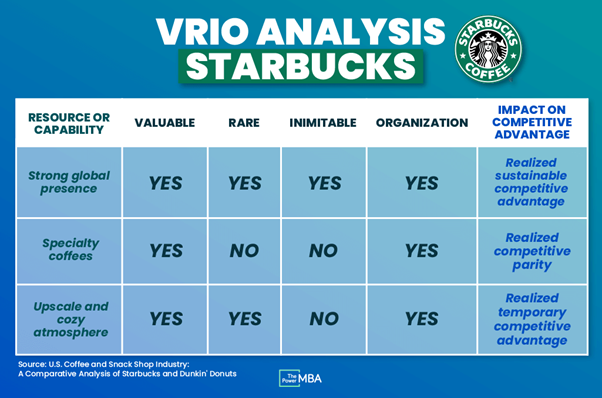

● VRIO analysis: A VRIO (Valuable, Rare, Inimitable and Organized) analysis helps organize business resources. It is ideal for assessing and categorizing a company’s resources.

● OCAT: An OCAT (Organizational Capacity Assessment Tool) assesses internal performance in a variety of specific dimensions. Companies can use the OCAT to establish specific areas of strength or growth.

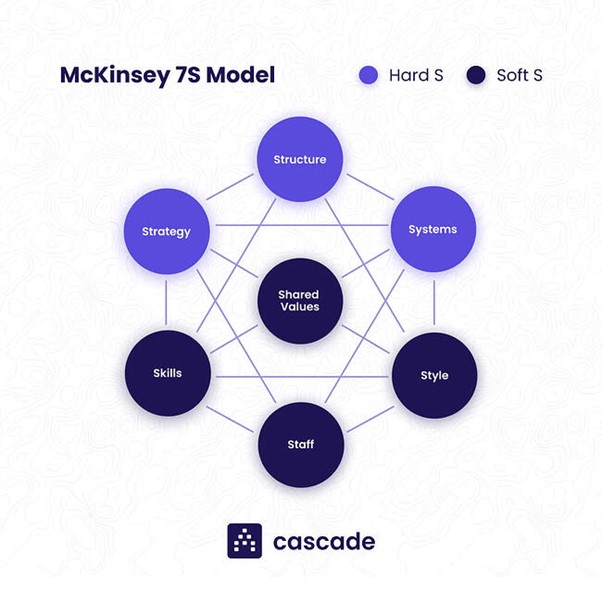

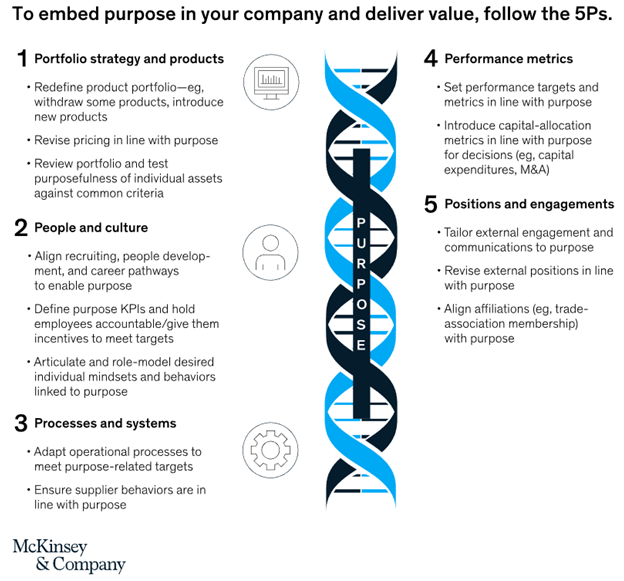

● McKinsey 7S framework: The seven S’s are strategy, structure, systems, shared values, skills, style and staff. The McKinsey 7S framework ensures that businesses align these seven elements for maximum success.

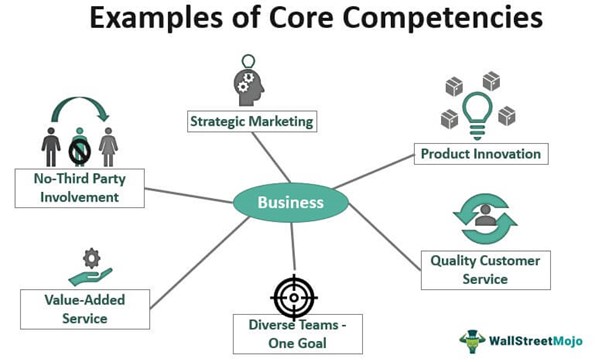

● Core competencies analysis: The core competencies analysis identifies the unique combination of qualities that separates the business from competitors. It’s best used when determining ways to improve business operations over a direct competitor.

Why is an internal analysis important?

Internal analyses help business leaders identify ways in which they can improve company functions. A few of the most important reasons to conduct an internal analysis include identifying:

● Company strengths

● Structural weaknesses

● Business opportunities

● Possible threats

● Viability in the marketplace

Company strengths

The caliber of the workforce, the accessibility of critical resources, or customer brand familiarity are examples of strengths. Companies can boost their overall success and viability by focusing on their strengths, which can be found utilizing an internal study.

Structural weaknesses

A company’s deficiencies may include things like ineffective training, outdated technology, or inadequate interdepartmental communication, which can be discovered through internal analysis. Weaknesses may have modest effects on the business, such impeding the flow of internal information, or serious ones, like financial losses.

Business opportunities

The ability to spot business prospects is another advantage of conducting an internal study. Opportunities for expansion on both an internal and external level typically exist for businesses. Examples can be bringing a new product to market or modernizing the computer system.

Possible threats

Threats frequently originate from outside sources. However, detecting external risks as part of an internal analysis can assist businesses in preparing for them by maximizing operational strengths, strengthening operational weaknesses, and generating fresh growth prospects.

Viability in the marketplace

The ability to distinguish the business from rivals by identifying a specific niche within the bigger market is one of the most beneficial outcomes of an internal study. This is frequently the long-term objective of performing an internal analysis.

How to conduct an internal analysis

To conduct a successful internal analysis and enhance business functionality, follow these steps:

1. Set your objective

2. Choose a framework

3. Conduct research

4. Follow the framework

5. Set your priorities

6. Apply the findings

1. Set your objective

Establish a purpose or justification for conducting an internal analysis before you begin. For instance, one goal would be to look for fresh, innovative company prospects. Another option would be to cut internal costs. By deciding what you intend to learn from the internal study before you start, you should be able to collect the most relevant data and, as a result, determine which departments would gain from an acquisition or merger.

2. Choose a framework

Pick a framework for internal analysis to apply. While some frameworks concentrate on the growth of the business or its internal structures, others are better at uncovering internal flaws. Look over the available frameworks and pick one that best suits the demands of your business and will enable you to achieve your goal.

3. Conduct research

Obtain information on resources, skills, and potential growth areas from all internal sources. Employee interviews, an examination of the company’s finances, and equipment evaluations may all be included in the research process.

4. Follow the framework

To parse the data, employ the chosen framework. If you’re utilizing a SWOT analysis, for instance, make four distinct lists with each of the SWOT elements serving as the headline. List your research’s strengths, shortcomings, opportunities, and threats in a logical manner.

5. Set your priorities

Review the finished framework and contrast your conclusions with the goal you set out to achieve. Find information that will enable you to decide how to accomplish your goal. If, for instance, you wanted to improve technological capabilities, you may look at what equipment needs to be updated, what employees believe would be more useful for their employment, and what resources are available to meet those demands.

6. Apply the findings

Utilize the results to put a plan in place to achieve the goal. Put new machinery in place of the outdated equipment, using the same example as step 5. To guarantee that staff use the new asset properly and to its fullest potential, provide training.

We will discuss these points in more detail later in the workshop.

Executive Summary

Chapter 1: Current State

Without a better understanding of your own current state, you risk a catastrophic failure with the potential to threaten the existence of both the acquirer and the target—and the financial safety of clients. Do you have the time, resources, people, and infrastructures in place to handle such a move? What are you offering your current clients that potential clients aren’t receiving? Do these offerings have the ability to scale if you bring over more accounts?

You need to determine the feasibility of maintaining your current level of service while also managing newly acquired clients, since they will most likely expect those same services. By taking a closer look at your own business, you are more likely to identify any potential issues before they arise, which puts you in a better position to decide if pursuing an acquisition is the right move.

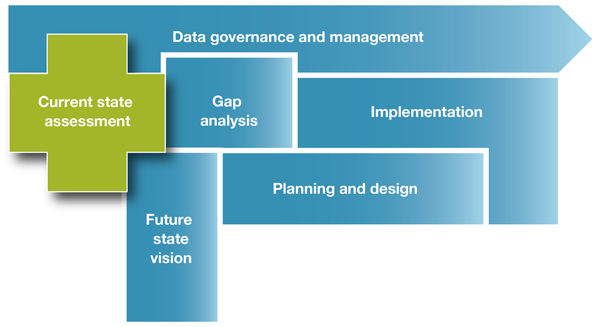

Researching and evaluating the internal and external elements that have an impact on the firm are necessary for developing an effective business growth strategy. Businesses can identify prospects for growth and competitive advantage by doing an internal review of their current situation. An detailed understanding of the internal workings of the business is necessary to conduct an internal analysis. In this course manual, we define a current state analysis, discuss its significance, and demonstrate how to conduct one.

What is current state analysis?

The management technique of current state analysis, also known as as-is process analysis, is used to identify and assess a company’s processes and workflows. As-is diagrams, which describe an organization’s current procedures, are also used in these assessments. By assessing your current functions for effectiveness, efficiency, dependability, and customer satisfaction, as-is procedures assist you figure out how to improve your company duties. The goal is to determine the advantages, disadvantages, opportunities, and threats of each process. You can then evaluate where a merger or acquisition might help speed growth after these have been identified.

Either the entire organization or a single team procedure is the focus of a present status analysis. The secret is to perform data-driven, observational, and analytical research. Additionally, measurements allow you to assess how well a company is fulfilling its obligations and what modifications are necessary.

Process analysis of current and future states

While the as-is processes analysis depicts the state of your operations at the moment, the future state processes analysis demonstrates the organization’s potential. A tool for enhancing the current procedure is future analysis. Starting with an analysis of what is happening in the organization right now and ending with how you want it to look in the future, the process management strategy is composed. You must take into account business objectives, the interactions between your processes, and stakeholder relations when performing these studies.

You utilize the as-is diagram in these discussions to suggest changes to the business’s present procedures. You can determine whether problems within particular processes have an impact on other sections of the business by understanding how processes interact.

As-is process analysis advantages

An organization’s operations can be built on a solid foundation thanks to a present state process analysis, which also adds to management strategies and enhances workflow. You might provide remedies for problems identified through the process analysis of the situation as-is if you want to show that you have great management and leadership skills. To establish your priorities, you might assess the company’s state and contrast it with your objectives. You can also talk about problems with your managers or superiors. Think about creating a to-be diagram that illustrates the potential of your future workflows. You can choose which departments can develop organically and which would benefit from acquisition-driven expansion by identifying the company’s vulnerabilities.

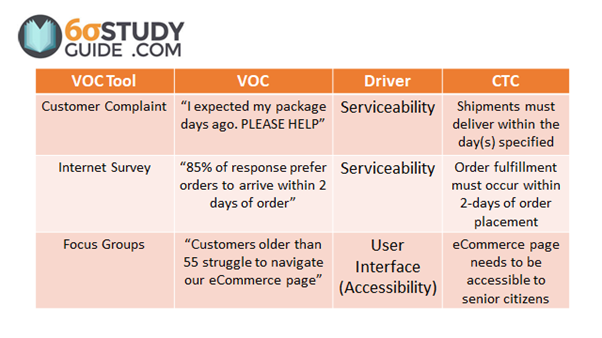

Chapter 2: Analysis Tools

To identify the key details about the organization’s structure, resources, and processes, growing enterprises and companies employ a variety of analysis methods, strategies, objectives, and frameworks. These methods can be used to identify weak spots or problem areas in your company where inorganic development can be advantageous. The following are some of the key internal analysis tools:

Gap Analysis

The gap analysis, as the name suggests, identifies the discrepancy between the company’s current activities and its ambitions. Gap analyses are performed in order to identify the weak areas of the business. However, it enables management to assess if the organization is operating at peak efficiency by identifying underperforming areas like production, planning, and resource allocation.

Strategy Evaluation

The results and application of strategic plans are covered in the strategy review. Regular strategy appraisal during or after execution is important for the company. For instance, you can assess your company’s success every quarter, every six months, and every year, or after implementation. It involves looking at the company’s objectives and determining whether they have been met or not.

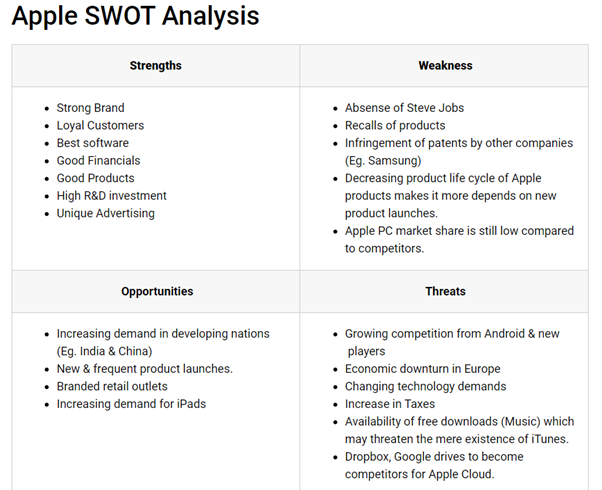

Swot Analysis

A well-known and popular method for doing business analyses, the SWOT analysis provides both internal and external examination of the company. The four primary components of a swot analysis are strengths, weaknesses, opportunities, and threats.

You can use a swot analysis to identify possible market possibilities and learn how to take advantage of them. Additionally, it enables you to identify and eliminate internal flaws to lessen the likelihood of an attack.

Swot analysis, for instance, enables you to identify your company’s advantages, such as its organizational strengths and talented workforce. Its dependence on limited raw materials and troubled supply chains is a drawback. For instance, while Amazon’s expansion threatens your company, it also gives you a chance to take advantage of the low loan rate environment.

VRIO Analysis

An excellent method for examining an organization’s internal environment is VRIO analysis. Here, you examine numerous internal resources of the business and classify each one according to how it benefits the business.

For instance, you should think about employing the VRIO analysis tool if you intend to develop a strategy to get a competitive edge.

McKinsey 7S Framework

A well-known technique for businesses planning to synchronize their departments and procedures is the McKinsey 7S framework. This framework can be used to calculate the difference between the present situation and the one that is being suggested for the future. It enables you to research seven internal company factors that you may use to help the business reach its objectives. The list is as follows:

● Staff

● Style

● Skill

● Shared values

● System

● Structure

● Strategy

Core Competency Analysis

The core competence analysis tool aids organizations in formulating a plan to obtain a competitive edge. It enables you to identify your core capabilities, such as abilities, expertise, and resources, which are bringing distinctive value to the consumers. Following that, you can create a strategy based on the major areas where your business excels and the products and services it provides to clients.

What distinguishes internal from external analyses?

The area of focus is what distinguishes internal analysis from external analysis. The focus of external analysis is on how external factors such in advantages of outside analysis

A corporation can gain a lot by doing an external analysis. Here are a few typical advantages:

1. Promotes expansion of businesses into new markets

External analyses help firms by motivating them to take initiative in how they run their businesses. For instance, a retail shop may opt to expand its business model to include the sale of free trade products if it notices a public trend toward free trade clothes.

2. Aids in preparing for and adjusting to change

Businesses can adapt to industry changes that might help them survive with the aid of external analysis. For instance, a catering business modifies how it stores its food goods to conform to new FDA guidelines. They can continue to operate as a catering service thanks to this.

3. Offers chances to beat out the competition

Businesses might find operational aspects they could change or enhance to differentiate themselves from rivals in their industry by doing an external analysis. A staffing solutions company, for instance, notes that they offer the same staffing solutions as their rivals: marketing, business management, and IT industry trends have an impact on a business and its success.

In course manual 2, these analytical tools will be covered in greater detail.

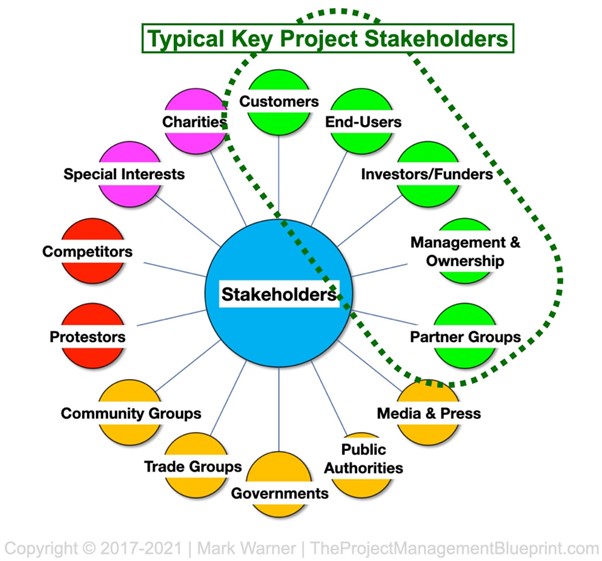

Chapter 3: Identify Stakeholders

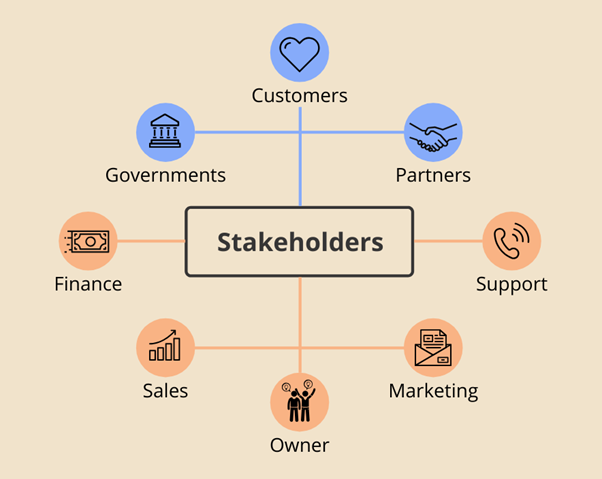

A significant stakeholder is crucial in the business evaluation phase since they are crucial to a company’s long-term development. A company’s key stakeholders can aid in decision-making, risk management, and business expansion. Knowing who your main stakeholders are and how to identify them is crucial. In this course manual, we go through the definition of important stakeholders, how to spot them, and the advantages they might provide to your company as you perhaps gear up for acquisition expansion.

Who are a company’s major stakeholders?

The most important stakeholders in a specific firm are the primary stakeholders in a corporation. Any professional who is impacted by a company’s operations, initiatives, and successes is a stakeholder. The kind and degree of interest that stakeholders have in a company varies.

One of the most crucial stakeholders for a firm is a major stakeholder.

Since they are most impacted by a company’s operations, key stakeholders are keenly interested in its success. Similar to this, a company’s success and expansion frequently depend on its major stakeholders.

What functions do major stakeholders play in a company?

The function of a major stakeholder inside a company is dependent on a variety of variables. The duties of important parties may include:

• Providing financial support to your business

• Helping with business initiatives or assignments

• Asking for updates on your business’s current projects or recent developments

• Contributing during planning or company leadership meetings

The precise relationship a stakeholder has with your company is one of the important elements that defines whether or not they are a critical stakeholder. Customers, staff members, investors, managers, and other people with an interest in the success of your firm can all be stakeholders.

Participants in M&As and the Parts They Play

The M&A process demands that the proper people be in the right places at the right times, just like any significant production. Veteran deal makers are aware that involving the appropriate stakeholders at the right time can significantly affect the M&A process and perhaps even the deal’s final worth.

Determining who should do what and when can be a difficult task for small and medium organizations that don’t usually engage in merger and acquisition activities. But it’s important to get this step of the process perfect from the beginning. Fortunately, SMBs can benefit from deal makers’ prior expertise to better understand what to do and when.

It’s crucial to realize that no two negotiations are the same before we begin. There is no magic solution that can guarantee that your transaction will go through smoothly and according to schedule. The M&A process will be impacted by your sector, the economy as a whole, the type and complexity of the deal, and other factors. Although it is not a guarantee, putting the relevant stakeholders in the proper place can assist ensure your deal is completed smoothly.

Chapter 4: Core Competencies

A company’s competitive edge in the market is derived from its core capabilities, which set it apart from its rivals. Instead of physical or monetary assets, a company’s set of abilities or knowledge in a particular field is typically referred to as its core competency. The strategic strength of an organization is its core competency. Honda’s engine and propulsion systems, for instance, are a key strategic advantage. Sony’s primary area of expertise is miniaturization. The areas of logistics and customer support are fundamental competencies for Federal Express.

To identify a core skill, one can use the following three tests:

• A core competency can lead to the development of new products and services and must provide potential access to a wide variety of markets.

• It must make a significant contribution to the perceived benefits of the end product.

• It should be difficult for competitors to imitate. In many industries, such competencies are likely to be unique.

The management industry helped to develop the idea of core competencies. In “The Core Competence of the Corporation,” a 1990 Harvard Business Review article, C.K. Prahalad and Gary Hamel proposed the idea. A core competency is defined as “an area of specialized expertise that is the result of harmonizing complex streams of technology and work activity.” according to what they wrote. They used Honda as an illustration, pointing out how its skill in engines allowed it to create a number of highly appreciated items, including lawn mowers, snowblowers, and cars.

The long-term competitive advantage of your business is maintained in part by identifying and growing your core talents. Concentrating on your advantages can make your deficiencies more apparent and help you identify areas where a merger or acquisition could speed up your growth.

Determine the underlying knowledge, expertise, experience, technology, or method that enables your business to offer its distinct range of goods and services when defining the core competences of your organization. Analyze how your company’s key competencies can be used to build strategic responsiveness and create a competitive advantage. High-performing businesses improve their current core skills and create new ones to penetrate upcoming markets. When a business is operating at this level, it understands the requirements and desires of its clients in present and emerging markets and builds the skills required to satisfy those desires.

Apple’s process for creating products makes it special. With the iPod, Apple merged the features of MP3 players and jukebox software, which can both organize and store a huge number of music in an easy-to-use format. The iPod’s groundbreaking design and shift in customer expectations were largely attributed to its simplicity.

Leadership in the company should be mindful that even the most effective strategies will eventually fall short if they are not regularly reviewed and updated to reflect shifting market conditions.

Greater financial stability results from mergers and acquisitions for both participating businesses. A higher market share, more sway over consumers, and a lessened danger from competitors can all result from having more economic power. Larger businesses typically present more difficult competition.

Chapter 5: Market Differentiation

Trying to fit in with the crowd should be your last priority when conducting business. Your company has to stand out in a fiercely competitive market. Because of this, differentiation in business is essential for expansion.

Business differentiation definition

In essence, differentiation in business relates to the idea of distinguishing your business from the competitors by a particular feature, such your distribution system or pricing point. It offers your clients a higher level of value and aids in the market differentiation of your business. Any differentiation strategy’s primary goal is to boost your company’s competitive advantage as a result.

The value of differentiation in the corporate world

Differentiation is crucial to business success because it enables organizations to carve out distinctive niches in cutthroat markets or industries. It’s a common goal of business leaders to build organizations that mean everything to everyone, yet this is almost unattainable. Instead, developing a more concentrated path for your company can be quite advantageous and offer the following advantages:

• Compete without lowering prices – Differentiation strategies in business can give you a way to compete against other firms without getting into a price war. Whether you’re making a commitment to ethical business practices or focusing on high-quality products that are built to last, you’ll have a USP that other companies won’t that doesn’t simply involve lowering your prices until you’re dealing with unsustainable, razor-thin margins.

• Develop unique products – In addition, differentiation in business can help you build a unique product/service, even if there isn’t much to distinguish your products from your competitors. For example, bottled water companies (which largely produce the same product), can distinguish themselves from the competition and develop brand loyalists through differentiation strategies, such as focusing on a lower price-point, advertising the fact that the business is family owned, and so on.

• Increase customer loyalty – The importance of differentiation in business also extends to customer loyalty. By improving the perceived quality of your products, you can increase brand loyalty even at a higher price-point, which can help your business to prosper.

Chapter 6: Mission/Vision Statement

Successful Acquisitions Align With a Company’s Mission and Vision

The transaction itself does not mark the beginning and finish of a business purchase. Planning is the first step in creating a successful mergers and acquisitions (M&A) strategy, and planning should take place well before any conversations with possible targets. Additionally, the planning process must be exhaustive and entirely truthful.

Any planning done for the purpose of a potential purchase should be in line with your company’s strategic plan if one exists. If it doesn’t, you should either modify your strategic strategy accordingly, or if you are unable or unable to do so, you should reevaluate the acquisition concept altogether. Do your company’s mission and vision statements exist as well? If so, go back and check to see if they still appropriately reflect your growth goals. Create your purpose and vision statements right away if you don’t already have them. Let’s examine both.

Mission Statement

Your company’s mission statement outlines what it does and explains why it exists. You and your leadership team can decide whether a potential acquisition could further that larger goal and how that might happen by having a thorough understanding of it. The effects of such a purchase could be far-reaching—and typically detrimental—if it caused your business to stray from its goals.

Vision Statement

What you intend to be in the future as the acquiring firm must be reflected in your vision statement. It should concentrate on your company’s long-term goals. You won’t truly know what kind of acquisition is necessary (if any) without a vision statement.

You (the owner), your management team, and your advisors will have the necessary background information and resources to start reviewing target companies and assessing the degree to which they complement your company in relation to these statements once your company’s mission and vision statements have been developed or refined.

This leads to the creation of a Target Value Statement, the following step in the M&A strategy process.

You and your team will do some basic investigation once you’ve chosen a possible target firm. It’s alright. However, the value proposition of the target to your company (i.e., the acquirer) must be identified and articulated before due diligence is started, before the economics of a transaction are discussed internally or between the parties, and certainly before a letter of intent (LOI) is drafted (let alone signed).

You and your team must respond to a few fundamental inquiries, such as, but not limited to:

• What value will the transaction bring to your company?

• Will it expand your footprint?

• Will it help you sell new products to your existing customers/clients?

• Does the target company have a loyal base of its own existing customers/clients?

• To what extent would the acquisition open new channels or markets to your company—assuming such opportunities represent appropriate fits?

• How would you qualitatively characterize the target company’s culture? Do you envision a smooth transition post-acquisition, and how well do you really believe each company’s culture will mesh?

The target value statement is built on the responses to these and other crucial questions. You and your team must then ask the most crucial question after it has been finalized in writing (it might be a statement, a summary, a list of value points, or whatever format best suits your approach).

Does this value statement support the mission and vision statements of your business?

If so, greater thought should be given to the target company. If it doesn’t, you should end your investigation into that company and go on to find another acceptable target.

There are several reasons why businesses explore acquisitions. It makes sense to at least investigate a strategic or financial acquisition if it creates new growth opportunities or opens doors to potentially important customers/clients, especially given the current low cost of capital and the rapidly accelerating speed of technical innovation.

Your first order of business must be assessing prospects in relation to your company’s purpose and vision statements, regardless of the factors that may be important to you and your team. Does the objective match the target? Will it assist you in realizing your goals? You must respond to these queries right away. This is the starting point for all further inquiries, actions, and choices.

Chapter 7: Mapping Future State

When you’re trying to determine the business needs for a project or a product, or when you’re trying to sketch out a particular solution for your clients, future state process mapping is one of the most crucial activities you should be carrying out. And one of the causes.

Because it provides a visual depiction of what the future state of your customers’ environment will look like, future state process mapping is incredibly powerful. So, in essence, when you create a process map in this manner, what you’re telling your client is that in the future, you’ll have specific individuals or positions, as well as specific divisions, involved in particular types of that process.

Additionally, certain tasks must be completed in a particular order for their respective parts of the organization to function successfully. It also makes it extremely simple for them to decide once you’ve painted that kind of a picture for your customers, making choices based on their needs in terms of business.

For the requirements process, future state process mapping is crucial, which is why it should be done. Now, the majority of employers who employ business analysts may not necessarily understand the relationship between process mapping and requirements, and the majority of business analysts who engage in process mapping may not always be aware of the best way to translate their process maps into business requirements.

Chapter 8: Set Department Objectives

Setting OKR objectives must be done in a way that benefits your company. They’re not meant to be forced or overly complicated. Instead, by tying your teams to the main business objectives, employing OKRs is just a goal-setting process. Every organisation has different needs, thus each one will apply OKRs in a special and efficient way.

However, for OKRs to function properly, a few fundamental principles must be followed. Setting goals exclusively at the individual level will not promote the attainment of top-level objectives because they are meant to achieve company-wide alignment. Because of this, many executives believe that the best way to use OKRs is to first establish corporate objectives. This promotes alignment at all levels.

Setting team and department-level objectives.

Keep in mind that not every top business OKR needs to be reflected in every objective when developing goals for your team or department. However, team and department OKRs should in some way, shape, or form contribute to the primary corporate objectives. During the business assessment stage of acquisitive expansion, team leaders should get together to discuss goals before starting to set departmental OKRs. Keep in mind the major business priorities and enquire:

● Are the team or departmental objectives somehow connected with our top company goals?

● Do the team or departmental OKRs make it more likely that the company will achieve its overarching goals?

● Are there more than 3-5 objectives listed here?

OKRs should not simply list all of the tasks that teams will do during the quarter since they are not meant to serve as a checklist. Teams will be forced to concentrate on tasks rather than what the firm wants to accomplish if OKRs are approached as a to-do list. Instead, let the team’s desired outcome be guided by the objectives. The best way to achieve the goals can then be decided by the teams themselves.

Examples of team and departmental objectives.

Here are just a few team or departmental objectives for reference:

● Marketing: Launch the new monthly newsletter successfully

● Sales: Grow our sales in the Central region

● HR: Improve employee retention

● Engineering: Build a world-class engineering team

● Operations: Improve our IT and infrastructure

Remember that the goals listed here, like with all OKRs, should be complemented with important outcomes that adhere to SMART goal-setting standards.

Setting particular departmental goals will help you concentrate on areas that may have been neglected in the past but are essential for business expansion. If you find that you lack the manpower or resources to accomplish these goals organically, an acquisition or merger could fill the gaps and promote long-term growth.

Chapter 9: Prioritizing Tasks

Six steps to help you get organized instead of overwhelmed

When conducting your business evaluation, it might be helpful to divide large tasks into smaller, more manageable components. You may stay away from tension and procrastination by doing this. When they wait until the very last minute, those who procrastinate frequently complain that they feel overwhelmed and the task appears impossible. The work is more doable and less scary when priorities are established and the larger project is divided into smaller tasks.

Here are six suggestions for segmenting tasks:

1. Look at the big picture. Make sure you understand what the end product is supposed to look like.

2. Examine the parts of the task. Figure out step-by-step what you need to do because it’s not going to happen through magic.

3. Think about the logical order of completing the pieces. What should you do first, second, third, etc.?

4. Create a timeline for completing your tasks. Having a deadline will make you more focused for each task.

5. Have a plan to help you stay on track. Put the time you will spend on the project into your schedule so that you can set aside the time for it. Stick with this plan. A plan is only good if you see it through.

6. Complete your task early enough to have some time left for a final review.

Professionals must break down projects into discrete tasks in order to fulfill deadlines because they frequently work on multiple projects each day. When doing an internal business review, dividing down duties will assure efficiency and help you get to the point where you can decide whether acquiring new businesses will be advantageous for your company. In this course manual, we explain why it’s crucial to break projects down into tasks, demonstrate how to do it in five steps, and offer you some advice on how to accomplish it.

Why is it crucial to divide projects into separate tasks?

It may be beneficial to break your project into tasks depending on its size and complexity. Other advantages are that it:

Generates a prioritized workflow

The workflow of your jobs should be prioritized if you want to finish a project as soon as possible. The efficiency of a project can be improved at each stage of the process by identifying its major components. For instance, doing things that are more important first may give you more time to review and make changes before deciding what to do.

Promotes better performance

By breaking projects down into smaller jobs, professionals can avoid getting tired and keep motivated. A business assessment can be completed more quickly and successfully if you break up the work into manageable chunks. This will allow you to take breaks and unwind as you go.

Helps team collaboration

Allocating each assignment to a different team member or colleague can help professionals fulfill deadlines more successfully when working on a huge project, such as an internal assessment. A team leader might, for instance, designate a teammate to a particular project phase where they may have more expertise than another team member. This can assure good quality while enabling each team member to use their skills to the fullest.

Chapter 10: Set KPIs

Effective KPIs are crucial measures to use to make sure you can achieve any business goal. To improve corporate performance, the value of effective KPIs cannot be overstated.

The most frequent error businesses make when beginning to measure their KPIs is attempting to measure too much. The issue with this strategy is that you can’t tell whether you’re making progress if you don’t know which KPI to assess. You can never determine if you’re successful or failing if you don’t know what you’re attempting to accomplish.

KPIs are more than just the numbers and measurements you share on a weekly basis; they give you insight into the performance and overall health of your company, allowing you to make crucial changes to your execution in order to meet your strategic objectives. You can get outcomes more quickly and determine which areas of your business will benefit from an acquisition or merger by knowing and measuring the proper KPIs. A key performance indicator is a quantifiable number that shows how well a business is doing in relation to its major business objectives, quarterly goals, and business objectives, as well as the development of your 3-5 year plan for acquisition-led growth.

The Importance of KPIs

KPIs to Monitor Company Health

KPIs serve as an indicator of a company’s health. To monitor the vital indicators of your business, you only need a small number of KPIs. Only measure the things you wish to alter so you can direct your energy in the right directions. We’ve discovered that it’s crucial to track a few KPIs for each of the four areas of revenue, processes, customers, and employees. These are covered by the business strategy, customer satisfaction, business processes, and human resources disciplines. Make sure you select the appropriate KPIs for your company before worrying about who will be responsible for them (leadership accountability.)

KPIs to Measure Progress Over Time

An organization’s key performance indicator (KPI) is any measurable outcome that shows whether it is accomplishing its goals. It could be anything, including revenue, gross margin, the number of sites and staff, customer satisfaction, the calibre of the product, employee productivity, and more. Each quarter, you establish these KPIs for your team and yourself so that you can assess your progress. After then, you keep tabs on them once a week to check if they’re heading in the right way. If not, change your course of action accordingly, and let other departments know if you veer off course.

KPIs to Make Adjustments and Stay on Track

You should track your leading indicator KPIs in addition to your present performance to determine how near you are to attaining your objectives. You can determine whether you are on pace to achieve your goals using these measurements. Then, you can modify your plan as necessary. For instance, you can opt to prioritise marketing initiatives over product development if you see a decline in sales. Leading indicators have the ability to be measured and are subject to direct control. They are useful KPIs to have on your dashboard to maintain the progress of your projects.

KPIs to Solve Problems or Tackle Opportunities

Utilize a dashboard that combines KPIs so that you have the necessary data at hand to address issues or seize opportunities. Say your sales are suffering. Choose a few KPIs that can assist you change the situation (perhaps the number of outgoing calls, appointments kept, or trade shows attended). Put them on a dashboard and keep an eye on them each week to see whether you’ve discovered the appropriate lever to increase your sales predictability. Or, let’s say you have a fantastic concept for a brand-new item. Before launching it on a big scale, you may test it out with a small number of clients and use KPIs to validate your business model. You might track the number of interested consumers, funding for the new product, NPS score, implementation time, number of defects, etc.

KPIs to Analyze Patterns Over Time

You can start to see trends in your data if you measure the same KPIs from quarter to quarter. These patterns can benefit your business in a plethora of ways. Perhaps you can anticipate when business will be slow and use that period to implement a system update or company-wide training programme. Perhaps it is obvious to you that your sales manager consistently predicts that you will close 5 deals either above or below where you typically do at the end of the quarter. If you can identify team members who consistently perform below or above average on their KPIs, you may utilise this information to discuss any negative or positive repercussions.

The balanced scorecard is followed by a variety of KPIs on an effective KPI dashboard. To track your company’s progress toward its crucial goals and objectives, you must make sure that you are covering all the vital parts of your organisation. Since each of the following categories has at least two KPIs (including one leading indicator KPI), the top companies always have them:

● Financial Perspective

– Net Profit

– Net Profit Margin

– Revenue

● Internal Business Perspective (Operational KPIs)

– Revenue Per Employee

– Capacity Utilization

● Customer Perspective

– NPS (Net Promoter Score)

– Repeat Customers

● Employee Perspective

– Employee NPS

– Turnover Rate

Chapter 11: Create a Project Schedule

When deadlines and objectives are clearly in your line of sight, it is harder to forget about them. Your project tasks are mapped on a timetable by project schedules, so you always know what follows next. We’ll go over the seven phases to making a project schedule in this course manual and provide some templates to help you get started.

At work, a possible M&A project frequently heralds the start of a new journey replete with participants, deadlines, deliverables, and tools. However, you’ll need a project plan to get you there whether your project is a new product launch, a vendor event, the annual editorial calendar, or even employee onboarding.

To keep your team on track, understand who is responsible for what by when, and see how everything fits together, you must have the authority to design a project calendar with precise plans, procedures, and responsibilities. A well-written project schedule will improve efficiency, accountability, and clarity even though it could take some time initially. And everyone loves hearing those three words. Additionally, you’ll be able to reduce the use of tools that are meant to make project management easier but really make it tougher.

What is a project schedule?

A project schedule gives you a broad overview of your project, outlining the timetable, tasks, dependencies, and team members that will be working on it. In essence, a project schedule ought to be able to inform you of all the information you require about your project at a look. You can track project progress in real-time and make sure you’re on the right track for success by describing all the major components and high-level specifics of your project.

Connecting the dots of your project schedule

A work breakdown structure (WBS) is frequently used by project managers to give the project schedule life. Work breakdown frameworks make it easier to organise and distribute work among team members. The WBS is a visual structure of your task list that shows the dependencies between each task so you can see how they relate to one another. The parent task will be at the top level, followed by dependent tasks at the following level, and so forth.

Chapter 12: Monitor Data Over Time

The Importance of Business Monitoring and Reporting

Many businesses must maintain consistent business reporting and monitoring since the board may insist on seeing weekly, monthly, quarterly, or annual reports to understand how the company is doing. Business monitoring and reporting can save time and money in a variety of business sectors, including eCommerce and the service sector. In the long run, these reviews can also improve your processes.

Management Insight

Business reports compile a lot of data about your organisation, which can give managers vital data. There will also be insights on growth, spending, and earnings that may be used to make budgets, marketing strategies, and projections for the future.

Business reports will also be used by management to monitor expansion and the development of the company, spot patterns, and pinpoint any abnormalities that may need further investigation. If you have a complete and trustworthy set of data about your company, you may routinely consult it and provide it to possible investors, for instance.

Identify Problems

Regular reporting and monitoring should assist you identify any potential problems in your company before they have a chance to get worse. If your firm simply generates an annual report, then issues and anomalies may be easily overlooked and may be costing your company money and time without your knowing. Monitoring a problematic location and comparing data gathered over time should help identify any causes or the origins of any problems. This can then be utilised to offer a fix or suggest methods to improve, such as buying a company that has expertise effectively resolving the problems you’ve found challenging to resolve naturally.

Highlight Opportunities

Monitoring and reporting over time might spot potential expansion chances in addition to revealing issues inside the company. Reports are a useful tool for keeping track of previous activity and instances where expansion has been successful. These can be used to identify potential areas for future growth, as well as what has already worked effectively and what needs to be improved. Regularly observing and analysing competitors might also help with this.

Transparency

Many publicly traded firms are required by law to submit an annual report in order to disclose financial information and ownership details to stockholders, the government, and other parties. More frequent reporting can provide more openness throughout the year, potentially improving the company’s appeal to investors. It makes it simple to compare companies operating in the same industry and compare their performance to one another.

Set Goals

Reporting on business performance makes it possible to compare performance over various time periods. The reporting goals should be in line with the KPIs because these can show if the reporting goals have been fulfilled, surpassed, or not. Whatever the outcomes, recognising performance trends and the state of the business can subsequently be utilised to define new objectives. This could be for making broad decisions about budgets or coming up with future strategies for acquisitive expansion.

Monitor Partners

In addition to your own company, it’s critical to track and evaluate the performance of any business partners you rely on to make sure they’re making the most use of your time and money. To give customers responsibility and transparency, online retailers and eCommerce companies frequently use parcel tracking systems. However, businesses can also employ parcel monitoring to evaluate and review the performance of their delivery partners.

Curriculum

Acquisitive Growth – Workshop 1 – Business Assessment

- Current State

- Analysis Tools

- Identify Stakeholders

- Core Competencies

- Market Differentiation

- Mission/Vision Statement

- Mapping Future State

- Set Department Objectives

- Prioritizing Tasks

- Set KPIs

- Create a Project Schedule

- Monitor Data over Time

Distance Learning

Introduction

Welcome to Appleton Greene and thank you for enrolling on the Acquisitive Growth corporate training program. You will be learning through our unique facilitation via distance-learning method, which will enable you to practically implement everything that you learn academically. The methods and materials used in your program have been designed and developed to ensure that you derive the maximum benefits and enjoyment possible. We hope that you find the program challenging and fun to do. However, if you have never been a distance-learner before, you may be experiencing some trepidation at the task before you. So we will get you started by giving you some basic information and guidance on how you can make the best use of the modules, how you should manage the materials and what you should be doing as you work through them. This guide is designed to point you in the right direction and help you to become an effective distance-learner. Take a few hours or so to study this guide and your guide to tutorial support for students, while making notes, before you start to study in earnest.

Study environment