Strategic Success

The Appleton Greene Corporate Training Program (CTP) for Strategic Success is provided by Mr. Huebner Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 24 months; Program orders subject to ongoing availability.

Personal Profile

Mr. Huebner is an approved Certified Learning Provider (CLP) at Appleton Greene who is a business strategist and technology executive with broad experience in strategic consulting and technology management. He works with clients in the following sectors: banking, financial services, healthcare, non-profit organizations, and market leading companies. Mr. Huebner helps his clients successfully create, plan, and implement new business strategies and technology capabilities that leverage their strengths to increase competitiveness, agility, and profitable growth.

As a consultant, strategist, and board of directors’ member for a community banking client from 2009 – 2018, Mr. Huebner was responsible for strategic planning, and audit and technology oversight. During his board tenure the bank experienced consistent, profitable growth. The bank’s success led to its acquisition by a larger regional bank which resulted in an excellent return on investment for owners and career opportunities for employees. Mr. Huebner has continued working with banks on strategy, technology selection and banking as a service.

Mr. Huebner was the strategy consultant and interim IT director for a market leading business coaching company client from 2018 – 2020, where he assisted the executive team and owner with transforming his client’s business operations and service delivery to increase service quality and profitability. The company’s transformation project facilitated by Mr. Huebner resulted in a 30% increase in profit margins and significant improvements in coaching quality.

As the strategic projects and technology leader for a market leading, fast growing private surgical hospital and clinical practice client from 2010 – 2017, Mr. Huebner helped his organization establish a strategic planning process and upgraded technology to navigate implementation of Affordable Care Act technology standards, a new clinical EMR system, cyber-security systems, and clinical technology projects.

As senior vice president of e-Business and chief information officer (CIO) for a fast growing, billion dollar insurance and financial services company from 2000 – 2008, Mr. Huebner led an organization of over 200 technology professionals in support of life insurance, retirement plans, a financial broker dealer, mutual fund company, market leading dental insurance and bank divisions. He and his team established the company’s online business presence and capabilities and managed a major IT merger integration with another insurance company.

Prior to his roles described above, Mr. Huebner was an IBM Global Services consultant and practice executive for IBM Global Services for six years, as a business process consultant and later a consulting practice executive, leading a consulting practice that served financial services, insurance, banking, distribution, and mid-sized manufacturing clients. The consulting practice he led grew rapidly and profitably from 12 to 130 consultants and programmers within three (3) years. Prior to his consulting career, Mr. Huebner worked in sales and sales management for IBM for 12 years.

Mr. and Mrs. Huebner reside in Lincoln, NE, have four grown children, four grandchildren, and are active supporters of several community organizations. Mr. Huebner is a past board member of the First National Bank of Northfield, MN, and the Foundation for Lincoln Public Schools of Lincoln, NE. Paul is a 1982 graduate of St. Olaf College, where he majored in political science, with concentrations in economics and history.

To request further information about Mr. Huebner through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Strategic Success

All organizations, like people, go through stages of growth and maturity. Many of these stages are familiar, such as: idea and feasibility, start up, initial operations, expansion, next level operations, competitive advantage, etc. During each of these stages, and the transitions between them, organizations learn and adapt to succeed in the present and long term. However, as they advance from one stage of success to another, many organizations, even the best, struggle with opportunities and/or solving critical challenges. This is because their products and services, people and systems (i.e. policies, processes, technology) often “tip out of sync” with what these organizations need to succeed during a new stage.

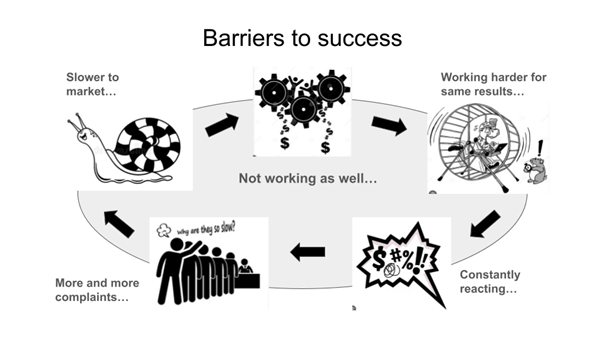

These barriers to success frequently show up looking like, “things don’t work as well as they used to, we’re working harder and harder to just to keep up”, or “our expenses are increasing as fast or faster than revenues” or, “we always seem to be reacting to opportunities, problems and threats”, or “product and customer service quality is eroding, customers are complaining and starting to leave”, or “we are no longer creating the new products and services needed to win with customers and against competitors”, or “we’re not attracting and retaining the talented people we need”, or “it seems like our managers and employees are no longer “rowing’ in the same direction.” Do these barriers and issues sound familiar?

Strategic success means the ability to consistently achieve organization goals, smoothly transition to next level performance and achieve extraordinary results, when necessary, through normal operations. The purpose of this two (2) year strategic success training program (SSTP or Program) is to help your organization achieve sustained strategic success by using a proven strategic success process (SSP) to eliminate strategic barriers, deliver expected results, and continuously improve your competitiveness and agility. Throughout this Program, your leaders and teams will “learn by DOING” how to establish an agreed strategic direction, facilitate strategic decisions, solve key issues, and create and execute adaptive strategic success plans. As a result, your organization will be prepared to succeed and thrive during any stage of growth and maturity, and in between.

Back in 2007, Starbucks, Inc., the world’s largest coffee company, with FY 2024 revenues of $36.53B, faced declining business performance and growth. Starbucks had just completed a rapid, multi-year, global store expansion, resulting in 12,400 outlets worldwide by the end of 2006. However, even though the company’s revenues were still growing, the pace of profitable growth had been slowing for several years. Most key performance indicators (e.g. per store growth, customer experience, operating margins, productivity, stock price, etc.) were declining. Howard Schultz, former CEO, returned to the company to lead a necessary and strategic course correction. Over the next several years, Schultz and his team led Starbucks through a successful strategic transformation guided by a clear strategic direction and framework consisting of three (3) strategic themes; strengthen its core (coffee and partners), elevate experiences (customer by customer, store by store), and invest and grow (for the long term). These themes were implemented through seven (7) big moves (a.k.a. critical success factors), including: undisputed coffee authority, engage and inspire partners, emotional attachment with customers, expand while making each store the heart of its neighborhood, lead ethical sourcing and environmental impact, create growth platforms, and a sustainable economic model. Implementation of this long term, transformational strategic plan has enabled Starbucks to sustain its success ever since as the world’s largest, most successful coffee company. Starbucks transformation underscores the importance and benefits of establishing a clear, long term strategic success process.

A market leading business coaching company established and used this strategic success process (SSP) to transform their business model over several years to increase internal coaching capacity, resulting in improved coaching outcomes and client retention, increasing operating margins by 30-40%. A market leading surgical hospital established and used their SSP to strategically track and manage significant and profitable surgical volume growth over several years. This process has enabled its surgeons and staff to continue to offer the highest quality surgical experience for patients, at lower costs than other local hospitals.

Imagine the confidence, energy, teamwork and peace of mind your leaders and teams will experience knowing your organization’s strategic direction, priorities and results are clear and on track, and that a proven, adaptable process is in place to facilitate annual and long term success.

Curriculum

Strategic Success – Part 1- Year 1

- Part 1 Month 1 Program Planning

- Part 1 Month 2 Program Kickoff

- Part 1 Month 3 Prepare Visioning

- Part 1 Month 4 Strategic Situation

- Part 1 Month 5 Strategic Direction

- Part 1 Month 6 Transfer Direction

- Part 1 Month 7 Organize Planning

- Part 1 Month 8 Planning Part 1

- Part 1 Month 9 Planning Part 2

- Part 1 Month 10 Executive Approval

- Part 1 Month 11 Board Approval

- Part 1 Month 12 Kickoff 1st Year Plans

Strategic Success – Part 2- Year 2

- Part 2 Month 1 Checkpoint Planning

- Part 2 Month 2 Success Tracking

- Part 2 Month 3 Progress Report

- Part 2 Month 4 Facilitation Training

- Part 2 Month 5 Review and Preparation

- Part 2 Month 6 Checkpoint Visioning

- Part 2 Month 7 Transfer Updates

- Part 2 Month 8 Checkpoint Planning

- Part 2 Month 9 Finalize Plans

- Part 2 Month 10 Checkpoint Approval

- Part 2 Month 11 Board Approval

- Part 2 Month 12 Kickoff 2nd Year Plans

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Strategic Success corporate training program.

Strategic Success – Part 1- Year 1

- Part 1 Month 1 Program Planning – The objective of this workshop is to introduce, organize and plan your organization’s Year 1 Program and SSP Team. During this workshop your Team will learn why and how your SSP will help your organization achieve sustained strategic success. They will also be introduced to facilitation techniques by identifying and prioritizing your organization’s strategic drivers. Finally, the Team will define the Year 1 Program plan and calendar and assign Year 1 Program roles for Team members. The results of this workshop will be documented during the workshop by your SSP Team in a “Year 1 Program Initiation Report” to be used in the upcoming Month 2 workshop.

- Part 1 Month 2 Program Kickoff – The objectives of this workshop are to 1) finish organizing your SSP Team, 2) finalize and approve your Year 1 Program and calendar, 3) finish Team assignments, and 4) kickoff the Program. During this workshop, your SSP Team will complete open tasks from the previous workshop, and learn about the strategic success visioning and planning phases of your SSP. The Team will learn facilitation techniques while 1) identifying and prioritizing your organization’s strategic drivers, 2) assessing your existing strategic planning and management process(s), and 3) identifying strategic assumptions. The results of this workshop will be documented during the workshop by your SSP Team in a “Year 1 SSTP Plan Report” to be used in the upcoming Month 3 workshop.

- Part 1 Month 3 Prepare Visioning – The objective of this workshop is to prepare for your organization’s upcoming strategic visioning workshops. During this workshop, your Team will create a prioritized list of strategic success assumptions (Assumptions) for your organization consisting of 1) strategic drivers and issues, 2) a preliminary SWOT analysis, and 3) a high-level competitive assessment. Next, the Team will identify its confidence level for these Assumptions, and research high priority, low confidence Assumptions. The results of this workshop will be documented during the workshop by your SSP Team in a “Strategic Visioning Pre-Read Report” to be used in the upcoming Month 4 workshop.

- Part 1 Month 4 Strategic Situation – The objective of this workshop is to create a clear consensus among your Board and CEO (and optionally, other executives) about your organization’s current strategic situation, including internal and external factors that are likely to promote, constrain and/or add risk to achieving sustained strategic success. External factors include stakeholders, customers, strategic drivers, SWOT, competition, regulatory risks, trends, technology, etc. Internal factors include clarity of strategic goals, SWOT, operational alignment, risks and constraints, strategic positioning, talent, management, etc. During this workshop your SSP Team Sponsor and Manager will use the “Strategic Visioning Pre-Read Report” completed during the previous workshop, to facilitate discussion and create strategic consensus amongst your Board, CEO and executives regarding your organization’s external and internal strategic situation. This consensus will enable your Board and CEO to establish your organization’s strategic direction, goals, priorities and expectations for your organization. The results of this workshop will be documented during the workshop by your SSP Team in a “Strategic Situation Report” to be used in the upcoming Month 5 workshop.

- Part 1 Month 5 Strategic Direction – The objective of this workshop is to help your organization’s Board and CEO (and optionally, other executives) clarify and agree on your organization’s long-term strategic direction (including your purpose, mission, vision, core values, goals, risks), and on short and long-term priorities and expectations. During this session, your SSP Team will learn to use strategic visioning and planning techniques to help your Board and CEO define, discuss and reach agreement. The results of this workshop will provide your CEO and management with the guidance needed to complete your organization’s strategic success planning. The workshop will be documented during the workshop by your SSP Team in a “Strategic Direction and Priorities Report” to be used in the upcoming Month 6 and future Year 1 workshops.

- Part 1 Month 6 Transfer Direction – The objectives of this workshop are to 1) transfer the results in the “Strategic Direction and Priorities Report” to your SSP Team, executives and selected managers, and 2) start organizing your strategic success planning. During this session, your SSP Team learn to use the “Strategic Direction and Priorities Report” and facilitation techniques to 1) explain and transfer this strategic guidance to the Team and selected managers, 2) identify a preliminary list of your organization’s critical success factors (CSF’s) and 3) configure and schedule your organization’s Strategic Success Process (SSP, Process). This workshop, and the upcoming Month 7 workshop, will prepare your Team to develop, gain approval of and implement your organization’s 1st Year Plans for the coming year. The results of this workshop will be documented during the workshop by your SSP Team in a “Strategic Planning Guidance Report” to be used in the upcoming Month 7 and remaining Year 1 workshops.

- Part 1 Month 7 Organize Planning – The objective of this workshop is to finish organizing your strategic planning. During this session, your SSP Team and selected managers will learn to use your organization’s SSP and facilitation techniques to organize planning, confirm and quantify your critical success factors (CSFs), learn additional strategic planning and facilitation techniques, and define, assign, schedule and coordinate your strategic planning activities. The results of this workshop will be documented during the workshop by your SSP Team in a “SSP Planning Report and Calendar” to be used in the remaining Year 1 workshops.

- Part 1 Month 8 Planning Part 1 – The objectives of this workshop are to 1) outline your organization’s new 3 Year Strategic Success Plan and 1st Year Strategic Annual Plan and Budget (collectively, 1st Year Plans), and 2) complete planning according to the “SSP Planning Report and Calendar”. During this session your SSP Team and management will learn to use SSP best practices and Year 1 Program results so far to identify and prioritize long term strategies, goals and initiatives. The Team and selected managers will learn to assess and prioritize critical success factors (CSFs) and identify your organization’s Thematic Goal (the most important thing) for the coming year. Given this context, using SSP best practices and facilitation techniques, your Team will learn to define and prioritize long and short term strategies and initiatives, identify plan dependencies, and to organize, outline and timeline draft plans. The results of this workshop will be documented during the workshop by your SSP Team in a “1st Year Plans Outline Report” to be used in the remaining Year 1 workshops.

- Part 1 Month 9 Planning Part 2 – The objectives of this workshop are to 1) complete final drafts of your organization’s new 3 Year Strategic Success Plan and 1st Year Strategic Annual Plan and Budget (collectively, 1st Year Plans), 2) integrate these draft plans with your organization’s annual budget planning, and 3) storyboard the presentations for CEO and Board approval, and organization kickoff. During this workshop your SSP Team and management will learn to use SSP best practices to integrate your planning results so far with your organization’s annual budgeting and learn to storyboard and finalize the executive and Board presentations noted above. Next, the Team will use facilitation techniques to resolve remaining planning issues, and to make necessary adjustments and decisions needed to complete your organization’s 1st Year Plans. The Team will wrap up the workshop by completing the remaining activities necessary for executive team approval. The deliverables of this workshop are the finalized 1st Year Plans and Presentations listed above, ready for executive review and approval. The results of this workshop will be documented during the workshop by your SSP Team in an updated “1st Year Status Report” to be used in the remaining Year 1 workshops.

- Part 1 Month 10 Executive Approval – The objective of this workshop is to gain CEO and executive team approval of your organization’s new 3 Year Strategic Success Plan and 1st Year Strategic Annual Plan and Budget (collectively, 1st Year Plans), and of Board Approval and Organization Kickoff presentations (Presentations). During this workshop, your SSP Sponsor and Team Manager will learn to walk through 1st Year Plans, and the Presentations. Next, they will learn to facilitate discussion and gain CEO approval of these proposed 1st Year Plans and Presentations. The deliverables of this workshop will consist of CEO approved 1st Year Plans and Presentations. The results of this workshop will be documented during the workshop by your SSP Team in a “1st Year Plans Status Report” to be used in the upcoming Month 12 workshop.

- Part 1 Month 11 Board Approval – The objective of this is to gain Board approval of your organization’s new 3 Year Strategic Success Plan and 1st Year Strategic Annual Plan and Budget (collectively, 1st Year Plans). During this workshop, your CEO, SSP Sponsor and Team Manager will learn to present and discuss your 1st Year Plans with your Board during a Board meeting. Your CEO will conclude by requesting your Board approve the organization’s 1st Year Plans as proposed or approve with contingencies and/or request revisions. Your CEO and SSP Team will strive to eliminate contingencies and/or complete Board requests by the end of this workshop and/or as soon as practicable. The results of this workshop will be documented during the workshop in the “1st Year Plans Approval Report”.

- Part 1 Month 12 Kickoff 1st Year Plans – The objective of this workshop is present and kickoff implementation of your organizations approved 1st Year Plans. During this workshop your SSP Team Sponsor and CEO learn to and conduct the SSP Kickoff for managers and employees throughout your organization. Next, your SPP Team Sponsor and Manager will answer questions, and explain major milestones, assignments, dependencies, and the implementation timeline for your 1st Year Plans. This workshop will create clarity, alignment and inspire successful implementation of these plans. Results of this workshop will be documented during the workshop by your SSP Team in a “1st Year Plans Kickoff Report”.

Introduction: Strategic success means the ability to consistently achieve organization goals, smoothly transition to next level performance and achieve extraordinary results, when necessary, through normal operations. The purpose of this two (2) year strategic success training program (SSTP or Program) is to help your organization achieve sustained strategic success by implementing a proven strategic success process (SSP or Process) to eliminate strategic barriers, deliver expected results, and continuously improve its competitiveness and agility. Throughout this Program, your leaders and teams will “learn by DOING” how to establish an agreed strategic direction, facilitate strategic decisions, solve key issues, and create and execute adaptive strategic success plans. As a result, your organization will be prepared to succeed and thrive during any stage of growth and maturity, and in between.

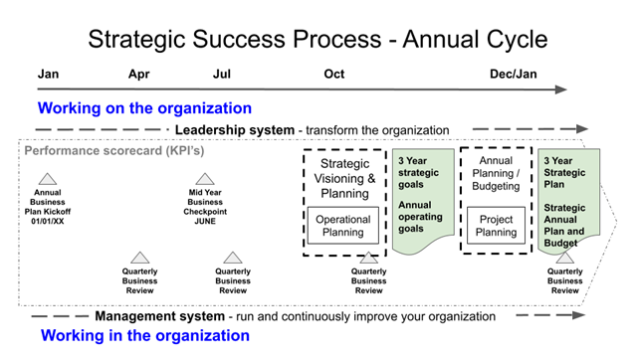

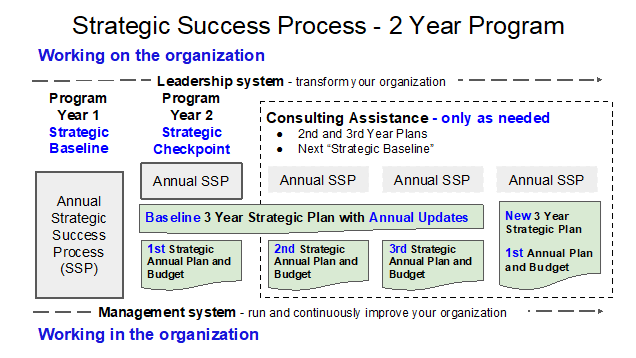

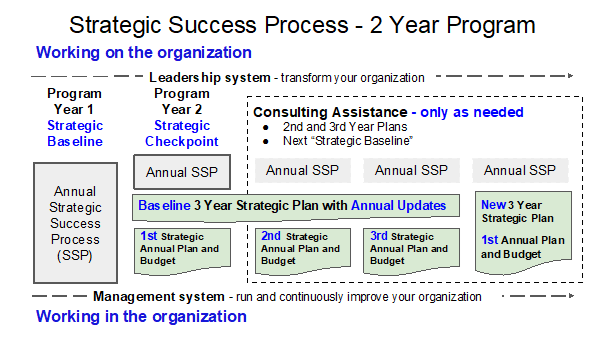

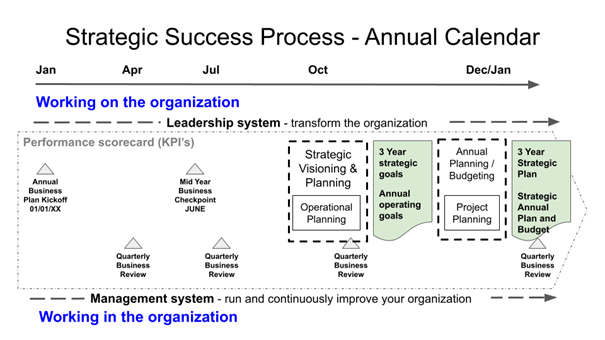

The Strategic Success Process (SSP) runs on a two (2) year annual planning cycle. The following pictures illustrate the SSP and its annual cycle.

Year 1 – Strategic Success Baseline

Strategic Visioning

Introduction: Strategic visioning is the phase of your strategic success process (SSP, Process) during which the organization’s Board of Directors (Board), CEO and selected executives use their combined “experience, insights and strategic thinking” to define, clarify and reach consensus on the strategic direction (i.e. purpose, scope, focus, mission, vision, strategic goals, core values, top priorities, etc.) of your organization. This strategic direction, along with the Board’s annual guidance for management (goals, priorities, and performance expectations, etc.) will provide the strategic context and annual guidance necessary for your CEO and management, facilitated by your SSP Team, to develop a three (3) year strategic success plan implemented through strategic annual plans and budgets (collectively, 1st Year Plans). These 1st Year Plans will help management align and inspire your people, allocate resources, mitigate risks, and execute to achieve sustained strategic success.

Strategic Planning

Introduction: Strategic success planning is the phase of your Strategic Success Process (SSP, Process) during which your team (i.e. CEO, executive team, SSP Team and selected managers), guided by your Board’s annual “Strategic Direction and Priorities Report”, will develop your organization’s new, three (3) year strategic success plan, which will be implemented through strategic annual plans and budgets (collectively, 1st Year Plans). These 1st Year Plans, once approved, funded and implemented successfully, will help your organization achieve sustained strategic success over the next 3 years and beyond.

Strategic Success – Part 2- Year 2

- Part 2 Month 1 Checkpoint Planning – The objective of this workshop is to orient, organize and train your SSP Team (Team) how to configure, plan and schedule your Year 2 SSTP (Program). During this workshop your SSP Sponsor and Team Manager will welcome your SSP Team and review the importance of your organization’s Strategic Success Process (SSP) and this Year 2 work. Objectives, SSP activities and calendar for Year 2 of your Program will be presented, including an overview of strategic success management processes and Checkpoint Planning. SSP Team roles, planning tasks and pre-reads for the next workshop will be assigned to Team members. The results of this workshop will be documented during the workshop by your SSP Team in a “Year 2 Strategic Checkpoint Plan Report” to be used during the remaining Year 2 workshops.

- Part 2 Month 2 Success Tracking – The objective of this workshop is to configure the success tracking and reporting process for your organization’s 1st Year Plans. During this session, your SSP Team (Team) will learn to confirm your organization’s critical success factors (CSF’s), define your key performance indicators (KPI’s) and metrics, and your progress tracking and reporting process. This process will enable your Team to measure, track and report the status of your 1st Year Plan results, quality and teamwork. The results of this workshop will be documented during the workshop by your SSP Team in a “Strategic Success Tracking Report” to be used in the upcoming Month 3 workshop.

- Part 2 Month 3 Progress Report – The objective of this workshop is to develop and approve your Strategic Success Scorecard (Scorecard) and Strategic Success Process Progress Report (SSP Progress Report). During this workshop, your SSP Team will learn to configure and populate your Scorecard with data and prepare a Progress Report for CEO and Board review of your organization’s 1st Year Plans. Your Team will learn to compare and map your organization’s existing performance tracking process with this new process. Gaps will be identified and resolved so your new Scorecard and SSP Progress Report meet CEO and Board expectations. This workshop concludes with your SSP Team populating your Scorecard with available data and preparing the first SSP Progress Report. The results of this workshop will be documented during the workshop by your SSP Team in the SSP Progress Report, which will be used to conduct your organization’s first strategic success review during the Month 5 workshop, and then quarterly thereafter.

- Part 2 Month 4 Facilitation Training – The objective of this workshop is to increase your organization’s SSP capabilities by training your SSP Team to use a variety of planning and facilitation tools and techniques. During this workshop, your Team will learn to lead groups of people to successfully brainstorm, judge and prioritize ideas, rapidly generate data and assess feedback, facilitate consensus, identify and agree on priorities, facilitate issue resolution, and enjoy the process. The results of this workshop will be documented during the workshop by your SSP Team in your organization’s “SSP Facilitation Guide”. This guide will serve as a reference and training resource for your SSP Team(s) over time.

- Part 2 Month 5 Review and Preparation – The objectives of this two (2) part workshop are to 1) conduct a success review of your organization’s 1st Year Plans with your CEO and Board, and 2) prepare for Checkpoint Planning. During Part 1 of this workshop your SSP Team will learn to update the “Strategic Success Progress Report” (Progress Report) developed during your Month 3 workshop with the latest available data. Next, your SSP Sponsor, Team Manager and CEO will learn to use the SSP Progress Report to 1) conduct a progress review with your Board, and 2) gather Board and CEO input about the key strategic issues and priorities facing your organization over the next eighteen (18) months. During Part 2 of this workshop, your SSP Team will learn to prepare for Checkpoint Planning by completing pre-planning and research activities for the upcoming Month 6 workshop. The results of this two (2) part workshop will be documented during the workshop by your SSP Team in a “Checkpoint Planning Status Report.

- Part 2 Month 6 Checkpoint Visioning – The objective of this workshop is to identify and develop CEO and Board guidance on key issues, priorities and expectations for the upcoming year. During this session, SSP Sponsor and Team Manager will learn to facilitate your CEO and Board’s assessment of 1st Year Plans, changes to strategic assumptions, identification of goals, priorities and expectations for your organization’s strategic success next year. The results of this workshop will be documented during the workshop by your SSP Team in a “Strategic Direction and Priorities Report”, which will guide your remaining Year 2 workshops.

- Part 2 Month 7 Transfer Updates – The objectives for this two (2) part workshop are to 1) conduct a review of your organization’s 1st Year Plans with your CEO and Board, and 2) outline your 2nd Year Strategic Annual Plan and Budget (2nd Year Plans). During Part 1 of this workshop, your SSP Team will update your SSP Progress Report with the latest results, and then your SSP Sponsor, Team Manager and CEO will conduct a quarterly success review with your Board. During Part 2 of this workshop, your CEO and SSP Sponsor will review and transfer the strategic direction and priorities of your CEO and Board to your SSP Team using the “Strategic Direction and Priorities Report” (Report) developed in the previous workshop. Using this guidance, your SSP Team will learn to update your 3 Year Baseline Strategic Success Plan and draft your 2nd Year Strategic Annual Plan and Budget (collectively, 2nd Year Plans). The results of this session will be documented during this workshop by your SSP Team in a “Checkpoint Planning Status Report” that will guide your Team’s work during your upcoming Month 8 workshop.

- Part 2 Month 8 Checkpoint Planning – The objective of this workshop is to help ensure your organization’s 2nd Year Plans are updated, completed and ready to approve on time. During this workshop your SSP Team will learn to assess the status of your organization’s SSP planning activities according to your planning calendar. Next, your Team will develop budget and resource estimates for your 2nd Year Plans, in sync with your organization’s annual budgeting process. Planning issues and barriers will be resolved and/or assigned for resolution using facilitation and project management best practices. The results of this workshop will be documented during this workshop by your SSP Team in a “Checkpoint Status Report” and in draft 2nd Year Plans to be used in your remaining Year 2 workshops.

- Part 2 Month 9 Finalize Plans – The objectives of this session are to 1) complete final drafts of your 2nd Year Plans and 2) prepare for CEO and Board approval. During this workshop, your SSP Team will learn to use planning and project best practices, and SSP templates from your Year 1 Program to define, organize, sequence and timeline your organization’s 2nd Year Plans. Next, the Team will draft Board Approval and Organization Kickoff presentations (Presentations). The results of this workshop will be documented during the workshop by your SSP Team in a “Checkpoint Plans Status Report” and in your organization’s 2nd Year Plans and Presentations.

- Part 2 Month 10 Checkpoint Approval – The objective of this workshop is to gain CEO and executive team approval of your organization’s updated 3 Year Strategic Success Plan and 2nd Year Strategic Annual Plan and Budget (collectively, 2nd Year Plans), and of Board Approval and 2nd Year Kickoff Presentation (Presentations). During this workshop, your SSP Sponsor and Team Manager will learn to walk through 2nd Year Plans and Presentations. Next, they will learn to facilitate discussion and gain CEO approval of these proposed 2nd Year Plans and Presentations. The deliverables of this workshop will consist of approved 2nd Year Plans and Presentations. The results of this workshop will be documented during the workshop by your SSP Team in a “Checkpoint Plans Status Report”, 2nd Year Plans and Presentations for the upcoming Board Approval workshop.

- Part 2 Month 11 Board Approval – The objective of this workshop is to gain Board approval of your organization’s updated 3 Year Strategic Success Plan and 2nd Year Strategic Annual Plan and Budget (collectively, 2nd Year Plans). During this workshop, your CEO, SSP Sponsor and Team Manager will present and discuss your 2nd Year Plans with your Board. Your CEO will conclude by requesting your Board approve your 2nd Year Plans as proposed or approve with contingencies and/or request revisions. Your CEO and SSP Team will strive to eliminate contingencies and/or complete Board requests by the end of this workshop and/or as soon as practicable. The results of this workshop will be documented during the workshop in the “SSP Checkpoint Approval Report”.

- Part 2 Month 12 Kickoff 2nd Year Plans – The objective of this workshop is kickoff implementation of your organizations approved 2nd Year Plans. During this workshop your SSP Team Sponsor and CEO learn to and conduct the 2nd Year SSP Kickoff for managers and employees throughout your organization. Next, your SPP Team Sponsor and Manager will answer questions, and explain major milestones, assignments, dependencies, and the implementation timeline for your 2nd Year Plans. This workshop will create clarity, alignment and inspire successful implementation of these plans. Results of this workshop will be documented during the workshop by your SSP Team in the “2nd Year SSP Kickoff Report”.

Year 2 – Strategic Checkpoint

Introduction: The objectives for Year 2 of this Strategic Success Training Program (SSTP or Program) are to 1) train your Strategic Success Process team (SSP Team or Team) to implement, run, track and report on the progress of your organization’s 1st Year Plans, and 2) complete the following Year 2 SSP checkpoint planning activities: success tracking, project management, success reviews and change management, and SSP checkpoint planning (Checkpoint Planning) to develop your 2nd Year Plans. Similar to Year 1, your Team will “learn by DOING” how to use SSP planning, project management, issue resolution and facilitation tools to implement and run your SSP, and complete Checkpoint Planning. Monthly workshops help ensure your organization’s approved 1st Year Plans are executed successfully (meaning on time, as agreed and on budget), and your Checkpoint Planning is completed successfully. The expected results of this Year 2 Program are: 1) 1st Year Plan objectives are achieved, 2) your organization’s updated 3 Year Baseline Strategic Success Plan and 2nd Year Strategic Annual Plan and Budget (collectively, 2nd Year Plans) are approved and funded, and 3) your SSP Team learns to lead your SSP into the future with minimal assistance.

Planning and Training

Success Review

Strategic Checkpoint

Methodology

Strategic Success

Introduction

Strategic success means the ability to consistently achieve organization goals, smoothly transition to next level performance and achieve extraordinary results, when necessary, through normal operations. The purpose of this strategic success training program (SSTP or Program) is to help your organization achieve sustained strategic success by using a proven strategic success process (SSP) to eliminate strategic barriers, deliver expected results, and continuously improve your competitiveness and agility. Throughout this two (2) year Program, your leaders and teams will be trained to establish an agreed strategic direction, facilitate strategic decisions, solve key issues, and create and execute adaptive strategic success plans. This Program uses “learn by DOING” training methods throughout and is intended for organizations of 50 employees or more.

During Year 1 of this Program, participants are trained to use the SSP to produce their organization’s “strategic baseline” consisting of an approved three (3) year strategic plan, and a strategic annual plan and budget (collectively, 1st Year Strategic Success Plans) ready to implement in the upcoming year. During Year 2 of this Program, called “strategic checkpoint”, participants are trained to monitor, modify, and improve their organization’s SSP and Strategic Success Plans as needed to achieve success in the current and upcoming years.

The strategic success process (SSP) consists of the following major steps: initiate the process; create a clear strategic direction, assumptions and priorities; conduct look ahead research as necessary; identify, define and sequence organization critical success factors; strategic planning; integrate with operational plans; prioritize goals; develop, approve and manage strategic plans and annual budgets; assign, communicate and roll out strategies and plans; monitor progress; conduct regular status and performance reviews; and modify and improve the SSP based on results and circumstances.

The SSP is implemented and improved through annual planning cycles. The following pictures illustrate the SSP’s 2 Year Program and Annual Calendar.

The SSP depends on the following process critical success factors (CSF’s): simplify by using strategic assumptions; separate generation and judging ideas; consistently achieve goals and results on time; adopt a “working in and on” mindset; assign sufficient resources and talent; require results-driven, end to end accountability; improve continuously; anticipate and adapt to changing circumstances; communicate effectively. These CSFs are learned and used by participants throughout this Program.

Advantages of implementing a SSP to achieve strategic success include: clear strategic direction, priorities and decisions; strategic alignment across the organization – everyone “rowing in the same direction”; a repeatable and flexible way to capitalize on expected, and respond to unexpected, strategic opportunities and solve challenges; resources allocated and staff assigned to working on the most important priorities; the ability to systematically prioritize, adapt and strengthen your organization’s successful way of doing business; and built-in accountability for performance, projects and results across the organization.

Year 1 – Strategic Success Baseline

The purpose of Year 1 of this Strategic Success Training Program (SSTP, Program) is to train its participants (the SSP Team) to implement and run their organization’s Strategic Success Process (SSP) version 1.0, in order to establish a “strategic success baseline” to implement. During twelve (12) monthly sessions, the SSP Team is trained to use planning, facilitation, and process and project management tools and techniques to: 1) organize and initiate the SSP Team, 2) clarify and agree on the organization’s competitive situation, strategic direction, strategic assumptions, critical success factors (CSF’s) and strategic priorities, and 3) develop and approve a baseline Three (3) Year Strategic Plan, and 1st Year Strategic Annual Plan and Budget (collectively, Baseline Strategic Success Plans or 1st Year Plans), ready to roll out and implement during Year 2 of the Program and going forward.

Year 2 – Strategic Checkpoint

The purpose of Year 2 of this Program is to train the SSP Team to implement and run their first “strategic checkpoint” cycle. During 12 monthly sessions, the SSP Team learns to use performance management, project and process management, issue resolution and facilitation tools and techniques to 1) regularly track and review progress of your organization’s 1st Year Plans to achieve expected strategic results, and 2) develop, approve and kickoff your organization’s updated Three (3) Strategic Success Plan, and 2nd Year Strategic Annual Plan and budget (collectively, 2nd Year Plans) during the upcoming year and additional strategic success plans in future years.

Industries

This service is primarily available to the following industry sectors:

Banking

The 2008 financial crisis (Crisis) triggered a period of upheaval in the US banking industry. This period can be broadly divided into three phases: crisis, reform, and cautious recovery.

It is now generally acknowledged that the Crisis was caused by federal policies and bank lobbying that drove successive US federal administrations to simultaneously 1) broaden the scope of the CRA (Community Reinvestment Act) of 1977 far beyond its original mandate of providing access to credit for homeownership for LMI (low and middle income) families and individuals, and 2) eliminate depression era Glass Steagall banking law that prohibited banks from trading stocks and securities. One result of these policies was a massive increase in risky (subprime) mortgage loans issued during the early 2000’s to borrowers with poor creditworthiness. Seeing a big profit opportunity, banks and Wall Street investment firms mixed risky mortgage loans with higher quality mortgages creating derivative investments called “mortgage-backed securities”, which they then sold as “high quality” investments, with a stamp of approval from regulators and investment rating firms like A.M. Best and Standard and Poors. The dirty little secret at the time was these investments depended on ever increasing housing demand and prices. When these risky borrowers could no longer pay their mortgages, housing prices plummeted and nearly two trillion dollars of these securities became worthless, triggering a panic that crippled major financial institutions worldwide and caused tens of thousands of people in the US to eventually lose their homes. Public confidence in banks, Wall Street and the federal government plummeted, leading to increased scrutiny and calls for reform.

In response to the Crisis, between 2008 and 2012, the US Federal Deposit Insurance Corporation (FDIC) closed a staggering 465 banks, compared to just 10 in the previous five years, and the federal government injected trillions of dollars into the banking system through bailouts and stimulus packages. In addition, the Crisis and public sentiment drove Congress to enact significant reforms intended to strengthen the banking system and prevent future meltdowns, including the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (a.k.a. Dodd-Frank). This landmark legislation aimed to increase financial stability by regulating derivatives, establishing the Consumer Financial Protection Bureau (CFPB), and imposing stricter capital requirements and increased regulation of banks. The Crisis also triggered a wave of mergers and acquisitions as stronger banks absorbed weaker ones. This trend has continued for over a decade, resulting in a more concentrated banking industry and very few new bank formations.

In the sixteen years since the crisis, the banking industry has gradually recovered. However, the road has been bumpy, with ongoing challenges and uncertainties. The Federal Reserve kept interest rates historically low for over a decade to stimulate economic growth. This has squeezed bank profits as they rely on the spread between interest paid on deposits and interest earned on loans. In the meantime, federal regulators have encouraged a dual regulatory regime favoring the formation and dramatic expansion of non-profit credit unions, enabling them to offer lower interest on loans and pay higher interest rates for deposits than banks. As a result, credit unions have gone on to dominate significant lending segments such as automobiles and residential mortgages and have even begun to acquire banks. As a result, regional and community banks have continued to lose lending market share and sources of liquidity. Finally, a major focus on cyber security and compliance to protect customer data, prevent money laundering, on-line theft and fraud has been required across all banks.

Looking ahead, increased regulation, increased competition from credit unions and on-line financial technology (Fintech) companies, challenges finding talent and lower net interest margins will continue to drive consolidation, as banks seek economies of scale to remain competitive and profitable. Furthermore, the current, major decline in the value of commercial real estate, due to work from home trends, has increased the risk of loan defaults across this major asset class held by almost all banks. Excluding US megabanks, regional and community banks will need to rely on their deep knowledge of local markets, close and enduring customer relationships, technology savviness and partnerships, finding new ways (such as embedded financial services) to increase fee income, strong loan underwriting and OREO management, and niche opportunities to remain relevant and win new customers.

Insurance

The US life insurance industry, unlike banking, weathered the 2008 financial crisis relatively well. However, the economic downturn that followed in 2009 – 2012 and changing demographics resulted in a period of cautious innovation and adaptation.

Life insurance companies, due to their state mandated conservative investment strategies and regulation, and focus on long-term liabilities, were largely shielded from the immediate fallout of the crisis. However, the economic uncertainty did impact the industry in a few ways. Consumer confidence dipped, leading to a temporary decline in life insurance sales. The Federal Reserve’s low-interest-rate policy squeezed investment returns for life insurers, negatively impacting product pricing and profitability. However, life insurers remained financially sound due to prudent risk management practices and diversified investment portfolios. Insurers also responded to low-interest rates by developing new products with features like indexed universal life and variable life insurance, which ties policy benefits and returns to market indices.

Over the past ten years, the life insurance industry has faced several key trends, including the aging US population creating a growing demand for life insurance products, particularly long-term care solutions. Insurers are also leveraging technology to streamline operations, improve risk assessment through data analytics, and offer more accessible products online. In particular, Millennials and Gen Zers are showing a preference for simpler, more customizable life insurance products with lower premiums.

Key responses by the industry to the trends cited above include the launch of InsurTech (insurance technology) startups offering new distribution channels and streamlined life insurance products for younger demographics, and a wider range of products that cater to diverse customer needs and risk tolerances. Many insurers are also integrating wellness programs and health tracking features into their policies, promoting healthy lifestyles, and potentially lowering mortality rates. Also, the Department of Labor’s fiduciary rule (later revoked) aimed to raise the bar for life insurance salespeople, potentially impacting sales practices. Online platforms and partnerships with non-traditional sales channels are expanding access to life insurance, particularly for younger generations.

Overall, the US life insurance industry has exhibited resilience and a capacity for moderate innovation in the face of economic challenges and demographic shifts. Looking ahead, the US life insurance industry is expected to continue its steady growth in the coming years, by relying on their proven insurance distribution systems to distribute increasingly popular, low cost term life insurance products, and variable life and annuities, to younger customers. While several challenges remain, including rising interest rates, economic uncertainty, the complexity of state regulation and competition from technology startups, most life insurers are very well capitalized, protected by regulation and well positioned with innovative products to serve the changing needs of current and future generations.

Healthcare

The US healthcare industry has undergone a period of significant change since the 2008 financial crisis. Fueled by rising costs, access concerns, and technological advancements, the industry has seen a wave of reform, innovation, and ongoing debate.

The most impactful event affecting access to, costs of and delivery of healthcare of the past sixteen years undoubtedly the passage of the Affordable Care Act (ACA) in 2010. The ACA aimed to expand health insurance coverage through the creation of health insurance marketplaces (exchanges), Medicaid expansion, and subsidies for low- and middle-income individuals. It also included preventive care mandates and reforms to insurance practices, leading to a historic decline in the uninsured rate among low income Americans. At the same time, however, insurance deductibles sky-rocketed for the 180 million Americans with employer provided coverage, individual health insurance became unaffordable for self-employed people, and people are locked into narrow, geographically based coverage networks and can no longer choose their doctors. These negative effects are a direct result of ACA’s elimination of coverage exclusions and charges for pre-existing conditions and lifestyle behaviors. The result being the transfer of coverage to 10 million plus low income Americans via Medicaid expansion, unaffordable, reduced coverage for about 10 million self-employed people, and the spending of hundreds of billions since 2020 to subsidize inferior coverage for the middle class, which has driven up the federal budget deficit, inflation and interest rates.

In addition to the dramatic changes to access to medical care, the ACA has on balance hurt the productivity and quality of healthcare. ACA reporting and technology mandates for systems such as electronic medical records (EMR’s), underwritten by nearly fifty billion dollars of federal automation grants from 2010 to 2014, did not achieve their goals of streamlining and improving healthcare delivery and quality for patients or physicians and nurses. Instead, on balance, physician productivity and time with patients decreased because of data entry and increased paperwork, while requiring patients to still have to repeatedly re-enter medical information at each venue of care they visit. In addition, much of this automation, especially on the medical and diagnostic equipment side, has dramatically increased the risks of cyber security, data theft and ransomware attacks. These unintended consequences of the ACA led to physician burnout, early retirements and shortages, lower quality care, and large increases in medical costs, without achieving the original ACA goals of improving physician care, streamlining systems and patient care experiences.

Unrelated to the ACA, thanks to continuing research and dramatic advances in the biotechnology of medical treatments such as genomic immunotherapy, surgical robotics, telehealth, CRISPR gene editing, new drug therapies and many others, the chances for curing life threatening and quality of life limiting diseases have improved dramatically. Due to these advances, when combined with recent innovation and affordable access to AI (artificial intelligence) systems, there are now real opportunities for breakthroughs in medical cures, productivity and patient care. The key challenge facing healthcare is to integrate and implement these new advances in ways that improve medical outcomes, patient care and provider productivity. The key challenge for public health and governmental programs is to reverse the negative consequences and high costs of the ACA, while preserving the healthcare access the law created for low and middle income Americans. This is the major opportunity and challenge for healthcare in the years ahead.

Non-Profit & Charities

The past sixteen years have presented a unique set of challenges and opportunities for the US non-profit and charitable sector. The 2008 financial crisis, coupled with evolving donor preferences and technological advancements, have reshaped the landscape in several keyways. The economic downturn of 2008-2012 and the COVID pandemic (Pandemic) significantly impacted the non-profit sector. Nonprofits providing essential services like food banks, homeless shelters, and job training programs saw a surge in demand due to rising unemployment and poverty. During the financial crisis put traditional fundraising channels like individual donations and corporate donations under pressure as donors tightened their belts. By contrast, due to the limiting public health protections during the Pandemic, many healthy nonprofits saw their fundraising surge to historic highs as a result of donors having more money to spend on charitable causes.

Overlaying these major impacts has been a shift in donor behavior and preferences. Donors have become more mission driven, and self-satisfaction focused. Instead of donating for the common good, today’s donors want their resources to go to causes that give them personal satisfaction of the difference their donations are making. Also, there are fewer organizations and individuals giving larger gifts to fewer organizations. This makes building enduring relationships with donors more important than ever. Online giving has increased exponentially, and both complicates this critical relationship building process and facilitates it. Today’s technology enables donors to receive more frequent, timely and better information about the impact of their gifts. Finally, tax enabled donor advised funds have placed investment intermediaries in between nonprofits and their donors, created the need for nonprofits to establish more institutional relationships and easy, technology enabled ways for donors to direct their money to chosen charities. Once established, these “wired” relationships offer nonprofits better funding predictability for their programs. However, loss of these “stickier” connections can disrupt funding at greater levels.

Looking ahead, nonprofit organizations have a historic opportunity to leverage information and technology to cement their “wired” relationships through artificial intelligence enabled, personalized relationships with donors that can increase the “share of wallet” high performing nonprofits receive from their donors. Overall, the US non-profit and charitable sector has demonstrated remarkable resilience and adaptability in the face of economic downturns and evolving donor preferences. By embracing technology, focusing on measurable impact, and fostering deeper relationships with donors, non-profits will continue to play a vital role in addressing some of the most pressing social challenges facing America.

Technology

The US information technology (IT) industry has undergone a period of phenomenal growth and transformation since the 2008 financial crisis. Fueled by the rise of mobile computing, cloud technology, and artificial intelligence (AI), the industry has reshaped communication, business operations, and even daily life. While the 2008 financial crisis adversely impacted some technology sectors, it also sparked innovation in others, such as cloud computing with the emergence of platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform gaining traction, offering businesses on-demand computing resources and scalability. The rise of mobility, especially smartphones and tablets, and their associated “apps” have redefined how users interact with technology.

More recently, artificial general intelligence has emerged as a huge sustaining innovation for almost any company or organization, regardless of industry or sector. Like the advent of the internet, general A.I. (GAI) is going to lead to unprecedented productivity improvements and information access for the global economy. In particular, GAI is going to enable people and institutions to grasp and act on volumes of data heretofore impossible for humans to understand. A significant example of this is Google’s “Alphafold” project that solved a fifty (50) year “protein folding” problem in biology in just over a year, revolutionizing the tools available for drug discovery and testing. Thousands of use cases like this are awaiting the training of GAI models to tackle. Likewise, in the hands of international bad actors and nation states, these technologies will continue to threaten the privacy and security of people, organizations and nations, such that equally strong cybersecurity protections must be established and upgraded.

Looking forward, with the widespread adoption of GAI, technology providers and customers will be able to increase the speed, productivity and value of their products and services for the benefit of their customers and society in general. The rapid advance and adoption of gAI and similar technology is and will create tremendous pressure to deal with the economic, career and social “dislocations” that are likely to occur, just as the last fifty (50) of the information technology revolution caused. This is the new, seismic evolution in technology and its implications for society.

Consultancy

The 2008 financial crisis sent shockwaves through the US consultancy industry, forcing a period of adaptation and reshaping its priorities. Since then, several driving forces have reshaped the professional services industry.

During the 2008 – 2012 economic downturn that followed the crisis, corporate spending on professional services decreased significantly, causing a decrease in demand for traditional consulting services like strategy and cost-reduction. Consulting firms adapted by shifting their focus to helping clients restructure, manage risk, and improve operational efficiency. Public anger toward the financial sector spilled over to consulting firms perceived as contributing to pre-crisis risks. These factors led to mergers between weaker consultancies and closures resulting in a more concentrated industry dominated by major players like McKinsey, Bain & Company, and BCG. Demand rose for consultants with expertise in crisis management, restructuring, and regulatory compliance.

The next five years saw the explosive rise of digital technologies like cloud computing, mobile, big data, and social media, which created a demand for digital transformation consulting services. Consulting firms began helping clients develop digital strategies, implement new technologies, and enhance customer experiences.

Consulting firms became more specialized, building expertise in areas like cybersecurity, data analytics, digital customer experience, and artificial intelligence (AI). As a result of this major shift, digital consulting emerged as a major driver of industry growth, attracting both established firms and new entrants. The demand for technical, digitally skilled consultants intensified competition for top talent in areas like data science and engineering.

For the past six years, technology giants like Accenture and IBM expanded their consulting offerings, posing a significant challenge to traditional players. As clients sought quicker results, consulting firms emphasized agility, value-based pricing, and data-driven insights. The emergence of online, freelance consulting platforms and niche consulting firms utilizing technology for project delivery challenged traditional, labor based consulting models. The shift towards data driven, measurable client outcomes, and Return on Investment (ROI) for services has also accelerated.

.

The future of the US consultancy industry will likely be shaped most by several key trends, including: growing pressure on businesses to address environmental, social, and governance (ESG) issues are driving demand for sustainability consulting. As automation and AI rise, consulting firms will likely offer expertise in human capital management and workforce reskilling. AI-powered tools will automate many tasks currently performed by consultants, impacting project and workforce structures.

Overall, the US consultancy industry has gone through a period of significant change since 2008. The industry has adapted to economic downturns, embraced digital transformation, and is now facing disruption from AI and technology companies creating new delivery models. Consultancies must master these new, automated delivery models in order to compete and grow in the years to come.

Locations

This service is primarily available within the following locations:

Lincoln and Omaha, Nebraska

Nebraska entered the Union in 1867, has approximately two (2) million residents, and is one of the most successful states in the country in terms of quality of life and education, cost of living, civic progress and business environment. It is the only state in the union governed by a non-partisan, unicameral legislature, which has enabled a very efficient, lower cost governing system. Omaha and Lincoln, the state capital, are its largest cities and home to about half of the state’s residents. Nebraska has always been one of the country’s leading agricultural states for the past century. Beyond agriculture, Nebraska based businesses have been innovators and leaders that have generated robust economic growth, civic development and jobs for its citizens, including: Mutual of Omaha, Berkshire Hathaway, Union Pacific railroad, Kiewit engineering and construction, Level 3 communications, Valmont irrigation, Fiserv banking software, FDR payments processing, West Communications, Hudl software, Pegler food services, Werner and Crete Carrier transportation, Duncan general aviation, to name just a few. In the 1950’s, Nebraska was selected as the home for the U.S. Strategic Air Command because of its geographic and telecommunications capacity.

Nebraska’s economy has supported one the nation’s lowest unemployment rates for over the past twenty (20) years. Looking forward, Nebraska is uniquely positioned to grow opportunities in the following areas: agriculture, software development, renewable energy and biofuels, financial services, transportation, national defense, large data center technology, and medicine. The regulatory environment and tax system is well suited to promote business formation and growth. In Omaha and Lincoln specifically, there is ample capital available to make significant investments in start-up and growth companies, especially in specialty software development and cancer research and treatment. In partnership with the University of Nebraska, many businesses have access to leading technology and project management talent through its technical, engineering, medical and business development programs.

Minneapolis, MN

Beginning in the 1680’s, European settlers and French fur traders began settling around the area of today’s state of Minnesota where the Minnesota River merges with the Mississippi River. During the 17th into the 19th centuries, these European settlers traded with the Sioux and Ojibwe peoples the area. In 1872, Minneapolis as we know it today was formed on the west bank of the Mississippi River when the towns St. Anthony and Minneapolis merged.

Situated at the north end of the Mississippi River, it became a major grain transportation, milling and food processing hub. Companies such as General Mills, Pillsbury, Cargill and others took advantage of its unique geographic location to make Minneapolis a leading city in the production and distribution of agricultural commodities, including becoming the nation’s largest flour producer. Minnesota also industrialized, helped by discovery of large iron ore deposits in northern Minnesota and by innovation from companies like 3M (Minnesota Mining and Manufacturing), etc. Minneapolis, has been and is also a leading hub of major retail and financial services sectors, including home to Dayton Hudson, Ameriprise, Target and Best-Buy, and a cultural center with Orchestra Hall and the Guthrie Theatre. Downtown Minneapolis has one of the country’s largest networks of skyways, that help people who work and live downtown navigate and stay warm during cold Minnesota winters.

Minneapolis is experiencing a mixed business climate. While sectors like healthcare, construction, and hospitality are thriving, the office market faces challenges due to declining demand. The economy is projected for moderate growth, supported by a state budget surplus and a stabilizing housing market. However, affordability remains a concern. Looking ahead, Minneapolis’s focus on innovation in healthcare, financial services, food processing and distribution, human capital development, and emerging industries will be crucial. Addressing workforce challenges and attracting new businesses will be key for long-term growth and prosperity.

Chicago, IL

Chicago has a long history as America’s second largest city, built by meatpacking, railroad hub and great lakes shipping port. Post is famous 1877 fire that destroyed much of the cities wooden building landscape, it became a major manufacturing, distribution, insurance and commodities trading city. Fast forward through the 1930’s and the notorious prohibition period, saw Chicago become a major destination for the “great migration” of black Americans from the Jim Crow south. Also famous for its ethnic neighborhoods, the dynamism of Chicago’s economy and growth through the 1970’s made it a growth engine of the Midwest economy. In more recent decades, however, the city’s economic vitality has suffered from taxation and social policies that have increased crime and hampered opportunity for businesses and its citizens.

Today, Chicago has diverse economy powered by several key industries: banking, insurance, life sciences, health care, finance and fintech, transportation and logistics, warehousing and distribution, food and beverage, and professional services like accounting and management consulting. Chicago is also a major entertainment and convention hub. Chicago’s O’Hare International Airport, proximity to major interstate highways and port facilities on Lake Michigan, continue make the city a transportation and logistics leader. These sectors contribute to Chicago’s economic vitality and position it for future growth.

Looking ahead, however, Chicago’s economic and cultural outlook is uncertain, with people and corporations leaving the city, and Illinois, because of high taxes, unaffordable cost of living, crime, declining schools and neighborhoods. Addressing these persistent issues will be crucial for the city’s long-term success.

Washington, D.C. Metro

The social and political culture of Washington D.C. (D.C.) has always existed in its dual reality as a “city in the South”, while being the seat of government for our entire nation. The dual, local and federal, governance of D.C. creates unusual political dynamics that complicate the ability of businesses to operate in the city and the risks they face. For the last eighty years or so, as the scope and size of the Federal government has expanded, so has the economy and wealth of the D.C. metropolitan area. Every year trillions of tax dollars flow into and are allocated via our federal system. As a result, defense, legal, lobbying, associations, regulatory and federal contractor sectors have flourished. These huge revenue inflows, along with a somewhat constricted geographic area, have driven the cost of living much higher than in similar sized cities around the country. In particular the communities of southern Maryland of Bethesda and Rockville and Alexandria, McClean, Tyson and Dulles in northern Virginia have growth exponentially. The city of Washington D.C. proper has also gentrified in the areas around Capitol Hill and the National Mall into the northwest and down by the Navy Pier. Due to the COVID pandemic, however, the Federal government allowed its employees to permanently work from home, undercutting many downtown businesses and creating vast empty offices.

Finally, a summary of the business environment and quality of life in Washington D.C. would be incomplete without mentioning the dramatic increases in crime the city has experienced due to failures of local government policies and policing. This has created a situation where poor people in the city are suffering the most from violence and the lack of economic opportunities.

Going forward, the Federal government work location policies will continue to have a major impact on the economic health and vitality of D.C. On the other hand, given ever increasing federal spending will continue to create tremendous opportunities for people in the current industries mentioned above. It remains uncertain whether poorer residents of Washington D.C. will ever benefit from these opportunities.

Dallas – Fort Worth, Texas

Dallas symbolizes the modern example of a “wild west” city of opportunity. Founded as a trading outpost and livestock slaughterhouse center in the south, the Dallas – Fort Worth metroplex (DFW Metroplex), as it has come to be known, has become a favorite, new destination for corporate headquarters thanks to its business friend regulatory environment, low cost, ample land for development and at the crossroads of several major interstate highways. Key industries, including technology, finance, aviation, healthcare, and logistics are thriving, comprised of both established corporations and startups. Texas Christian and Southern Methodist universities anchor the area’s advanced education opportunities, attracting talented students from across the country. Culturally, Dallas and Fort Worth, once known as a “Jim Crow communities” in the South, have transformed their culture into cities of opportunity for anyone.

The Metroplex continues to be a dynamic economic powerhouse. Fueled by a robust job market, low taxes, and a business-friendly environment, the region has experienced substantial growth in recent years. Key industries including information technology, finance, aerospace and defense, aviation, transportation and logistics are thriving, attracting both established corporations and startups. Given its proximity to major energy resources, the region also continues to play a crucial role in the energy sector, including oil and gas exploration.

The future outlook for the DFW Metroplex remains optimistic and well-positioned for growth. Ongoing infrastructure investments, such as expanded airport capacity and improved transportation networks, will enhance the region’s competitiveness. However, challenges like housing affordability and traffic congestion need to be addressed to sustain long-term growth. Additionally, diversifying the economy beyond traditional sectors will be crucial for future prosperity.

Program Benefits

Management

- Strategic focus

- Strategic metrics

- Clear accountability

- Performance clarity

- Competitive advantage

- Customer relationships

- Employee engagement

- Higher margins

- Improved performance

- Predictability

Operations

- Operational clarity

- Operational control

- Faster innovation

- Process innovation

- Customer satisfaction

- Employee empowerment

- Talent retention

- Resilient operations

- Higher productivity

- Strategic flexibility

Finance

- Investment priorities

- Transparency

- Effective budgeting

- Resource allocation

- Financial control

- Higher margins

- Lower costs

- Increased profits

- Improved financials

- Lower risk

Achievements

Community Bank

During the nine (9) years of planning, execution and oversight using this strategic success program (program), this Minnesota community bank was able to accelerate its return to normal operations following the financial crisis by twelve (12) months. The book value of the bank doubled, profits and assets grew 50%. The bank’s local market share grew by 15% in an “over banked” environment. New markets were opened for commercial lending in the nearby Minneapolis – St. Paul metropolitan area. The bank’s overhead was reduced 20%. Net interest margin stayed steady despite historically low interest rates, while the bank’s loan portfolio, security controls and technology were consistently rated top tier by regulators.

Bank employees where highly engaged even as headcount was carefully managed because of the culture of clarity, trust, innovation and teamwork built through this program. When this bank’s shareholders decided to sell to a larger, competing regional bank in 2018, the bank was well positioned for an acquisition, which resulted in a two (2) times book purchase price – one of the highest prices paid for a bank in the country at that time.

Physician Owned Hospital

This surgical hospital used this strategic success program (program) over a six (6) year period to transition from a smaller facility and organization into one of the leading physician owned, for profit hospitals in the country in terms of number of surgeries performed annually, quality of patient outcomes and experience, and physician satisfaction. During this period, the hospital doubled the number of its operating rooms and in-patient beds to accommodate a 100% increase in in-patient surgeries performed annually. The hospital’s out-patient surgeries increased significantly to 10,000 annually.

Using the strategic roadmap and strategic management process that included quarterly performance reviews developed by this program, the hospital successfully navigated and implemented the mandates from the affordable care act (ACA) for patient privacy, electronic medical records technology and patient care standards, all while offering physicians and their patients the highest quality, lowest cost surgery in the region.

Coaching Company

Over the four (4) years this market leading coaching company implemented this strategic success program, the company was able to transform its business and service delivery model to grow its client base by 20%. The company rigorously identified and relied on its nine (9) critical success factors to prioritize its business transformation initiatives annually and measure their success through consistent monitoring of key performance indicators (KPI’s). The company’s sales and coaching technology platform was also upgraded significantly to support more efficient, sustainable growth. Coach and client satisfaction and coaching program profitability improved by 40%.

Large Non-Profit

A large non-profit used this strategic success program (program) for four (5) years to establish, launch and run its new, on-line communications and fundraising subsidiary. The program enabled the founders and board of this new organization map out, execute, monitor and quickly adjust its early business plans and technology investments according to the many unexpected and changing business circumstances of its startup, including branding, target audience, messaging, donation processing, website design, build and maintenance, and financial budgeting. This implementation of the program underscored its usefulness in establishing a new, startup subsidiary.

More detailed achievements, references and testimonials are confidentially available to clients upon request.

Client Telephone Conference (CTC)

If you have any questions or if you would like to arrange a Client Telephone Conference (CTC) to discuss this particular Unique Consulting Service Proposition (UCSP) in more detail, please CLICK HERE.