Strategic Optimization

The Appleton Greene Corporate Training Program (CTP) for Strategic Optimization is provided by Mr. Vinck Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

TO BE ADVISED

To request further information about Mr. Vinck through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Strategic Optimization

The Importance of Strategic Optimization and Why It’s Needed

Business optimization is the process of improving the efficiency, productivity and performance of an organization. This can apply both to internal operations and external products.

The following are immediate advantages of strategic optimization:

• Improved productivity

• Less waste

• Lower costs

• Increased profitability

Other benefits include the establishment of an excellence culture, enhanced morale, and the reduction of organizational silos that obstruct corporate operations, resulting in greater organizational focus.

The cumulative impacts of business optimization result in a more efficient business. In this context, it’s important to remember the Kaizen philosophy of continuous improvement, which states that business optimization is a continual process that becomes part of the organization’s culture, rather than a one-time initiative. As a result, the company will continue to grow, remain sustainable, and outperform competitors.

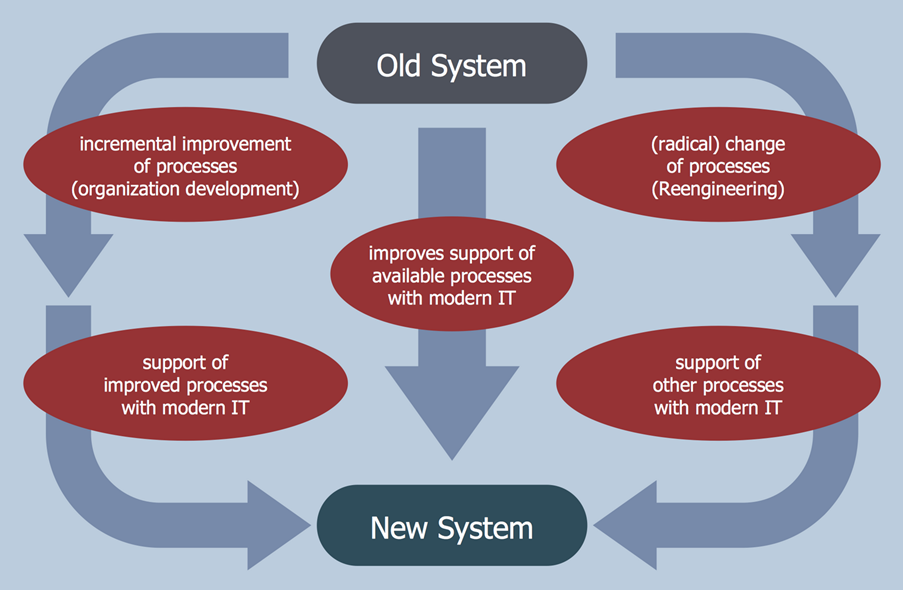

Source: conceptdraw.com

Strategic optimization: Key advantages for your company

Your business processes are much more than how you manage your company’s day-to-day responsibilities. While many of these procedures may appear insignificant or irrelevant, business process optimization is critical to your company’s long-term success and competitiveness. Your team will never be able to spend time to the work that matters most if their hours are filled with accomplished tasks that might be handled automatically or rectifying errors.

Implementing strategic process optimization software is a terrific method to bring your business into the twenty-first century and acquire a competitive advantage. Here are five significant benefits that using this program will bring to your company.

1. Improved Efficiency

The first and most evident advantage of business process optimization is that it can improve the efficiency of your firm. Many companies continue to use inefficient technologies or even need manual input for operations that should be automated. This wastes time and money, reducing your capacity to make a profit and putting excessive stress on your personnel. Employee happiness suffers as a result, and your business processes are slowed by preventable errors and other issues. Business process optimization allows your team to work more efficiently and devote more time to projects that will help your company expand by automating some operations and streamlining others.

2. Reliable Information

For your business to succeed, you need accurate and current data. Providing your staff with timely and accurate information can help them avoid costly mistakes, stay compliant with industry and federal requirements, and even boost their own performance. Your staff will have piece of mind knowing that they are receiving correct, trustworthy data thanks to automated data input and distribution. Business process optimization guarantees that everyone on your team has access to the information they need to keep your company running smoothly. Better yet, many process optimization softwares use authorization and permissions systems to ensure that access to higher-level information is only allowed to those who genuinely need it.

3. Greater Adaptability

Your team will be able to react rapidly in the face of shifting marketplaces, unanticipated setbacks, or fresh breakthroughs if your business processing system is streamlined. It assists you in identifying opportunities and difficulties that your company may face, allowing you to take quick action to stay ahead of the competition. Staying ahead of the competition and avoiding circumstances that could harm your organization requires the flexibility to effectively implement change in an ever-changing business climate.

4. Accountability and Performance Monitoring

When performance is tracked, it improves, and you can be confident that this will yield significant rewards for your business. Business process optimization makes it much easier for your team to monitor their performance and demonstrate accountability by sharing and tracking information across departments. Monitoring and reporting technologies can help you spot issues like human error, strategy flaws, and even fraud that could be holding your organization back. Your team will be better able to spot performance concerns and take steps to assure continuous improvement if you provide complete transparency from beginning to end.

5. Higher-quality outcomes

At the end of the day, business process optimization is all about improving the quality of your company’s output. Whether it’s simplifying your order fulfillment process or minimizing human error in internal reporting, an optimized solution can help you deliver higher-quality outcomes to your consumers by addressing critical internal issues. As a result, your company’s reputation will improve, allowing you to retain current clients while also attracting new ones. You can increase profit margins by lowering operational costs by assuring consistent and efficient internal processes.

6. You can better assist your consumers

It’s all about providing the greatest possible service to the consumer. You may improve your organization’s effectiveness by optimizing processes. You can react more quickly and be more adaptable to consumer demands. You have more full and accurate information when you employ the correct software solutions, which allows you to better assist the consumer. Naturally, better customer service leads to happier consumers, which is in the best interests of the entire company.

7. There is more transparency

Lack of clarity causes a lot of inefficiencies in procedures. Who is in charge of what? What kind of information should be recorded? What kind of job did my colleague in the other department do? You can make rapid progress by closely examining this. Confusion and issues are avoided by making explicit agreements and talking openly with one another. And if something goes wrong, you’ll know where it happened and who was to blame.

8. You better comply with laws and regulations

Of course, your business operations must adhere to all applicable rules and regulations. Where most procedures are obviously well-organized, there will almost certainly be opportunity for improvement. What about separating responsibilities? Has the VAT rate changed? Or what about payroll management? Consider safety precautions. Is every workplace safe, and has all equipment been properly examined and certified?

9. Improving and growing gets simpler

Continuous improvement is built on the foundation of well-organized and well-documented processes. Innovation, new ideas, and constant progress thrive in a well-organized work environment. It also facilitates collaboration with other departments and the sharing of best practices.

It takes time to document, analyze, and optimize business processes. However, it pays to do so thoroughly and to assess whether the procedures are still optimal on a frequent basis. Process optimization relies heavily on automation; with the correct software, you can make many procedures easy, quick, and error-free.

Curriculum

Strategic Optimization – Part 1- Year 1

- Part 1 Month 1 Growth Concept

- Part 1 Month 2 Growth Roles

- Part 1 Month 3 Growth DNA

- Part 1 Month 4 Firm’s Margin

- Part 1 Month 5 Firm’s Cash

- Part 1 Month 6 Firm’s Velocity

- Part 1 Month 7 Firm’s ROA

- Part 1 Month 8 Industry

- Part 1 Month 9 Competition

- Part 1 Month 10 Growth Vision

- Part 1 Month 11 Vision Targets

- Part 1 Month 12 Delivery Mechanism

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Strategic Optimization corporate training program.

Strategic Optimization – Part 1- Year 1

- Part 1 Month 1 Growth Concept – When a company reaches the point where it needs to expand and is looking for new ways to increase profits, a business growth concept is born. The business lifecycle, industry growth patterns, and the owners’ ambition for equity value generation all influence firm growth. All scale-up-minded businesses require business expansion funding. Because no two businesses are alike, selecting the correct company growth finance requires skill and market knowledge. When you make the right decisions, your growth accelerates. It could be disastrous if you make a poor decision. Rather of fitting your capital needs into an existing structure, clever businesses create their own to reduce risk. Business expansion is a result of resource availability and frequently necessitates an initial investment. It pays to be conservative when estimating profits over time, whether it’s an acquisition or a company venture. The amount of the capital raise, the cost of money, the flexibility of capital, and the term structure of capital are all factors to consider when choosing the correct company growth financing. A business that is expanding in one or more ways is said to be growing. There isn’t a single metric for measuring growth. Instead, a company’s growth might be demonstrated by highlighting multiple data points. These include revenue, sales, company worth, earnings, employee count, and client count.

- Part 1 Month 2 Growth Roles – Most of the time, your major objectives will be to see, create, and maintain manageable growth. That is, you must consider growth roles. A growth manager can assist you with this. Consider them a mix of partial marketers and product developers working to extend your client base. When it comes to client acquisition and retention, a growth manager should be brought in to assess the situation and implement growth-oriented activities. A growth manager must be able to define what growth means to the firm, develop and implement strategies to achieve that growth, and optimize those plans to achieve maximum growth. A growth manager must first and foremost understand data. It’d be like driving a lorry blindfolded without knowing where growth is feasible and how to progress beyond your current level if they didn’t have that. Growth teams can include a wide range of employees, from engineers to analysts to marketers, but you should start with a manager. A growth team will collaborate with sales and product teams to gain a thorough understanding of the market and to fit in well with the rest of the organization. They can be thought of as a bridge between the two in certain aspects. Although the CEO and directors should answer to all of your teams, having points of contact amongst them is always a smart idea. You may need to bring in copywriters, product engineers, and other specialized roles from outside the core growth team to brief and support the team as needed. These should be brought in from other parts of the company, as they are usually too specialized to be useful in the growth team on a daily basis.

- Part 1 Month 3 Growth DNA – Human DNA determines our hair, complexion, eye color, body type, and disease predisposition, as well as our aptitude or capacity to master a skill and the extent to which one’s personality traits can be developed. Each strand of our DNA has a specific role. Our bodies’ ability to accomplish different functions while working together is what permits them to function efficiently, effectively, and productively today and in the future as specific DNA is passed down from generation to generation. Businesses are no exception. Marketing, sales, operations, leadership, finances, human resources, technology, systems, and processes are all important components for a firm to run. Each component is critical to the success and growth of the company. If one of these systems fails, the organization’s ability to function, and therefor grow, is severely jeopardized. The organization is no longer productive, effective, or efficient. The DNA Model of business differs from human DNA in one very crucial way. Humans get their DNA from their parents. Future generations of a family firm will inherit business DNA as well, but you may control how that DNA is constructed at the beginning. If you notice that your present business growth DNA isn’t conducive to success, for example, if it’s deficient in one area or weak in another, you can improve it by assembling a dream team. In addition to ensuring that all “bases” are covered, you can construct a DNA structure that assures that these entities are tightly synchronized. You may construct the structure that tells your company who it is and how to operate by changing its growth DNA. This is vital in any company setting, but it is especially important in the challenging and change-filled business environments we’ve recently seen. Businesses that follow the growth DNA Model are unbreakable and immutable at their core. Whatever challenges are faced, the DNA Model provides company direction, harmony, and inspiration to those who are currently participating, as well as future generations.

- Part 1 Month 4 Firm’s Margin – Knowing how to calculate margins in different company settings will help you become more efficient and profitable. Calculating the appropriate margins can have a direct impact on current and future financial decisions, regardless of the business circumstances. Calculating and understanding margins is an important ability, but it takes time and effort to master. We will explore what margins are in commercial commerce, financial accounting, and investment in this post. The profit margin of a corporation is a commonly used profitability statistic for determining how efficient the company is at producing a profit. This formula is critical for all for-profit businesses, as it can provide managers and entrepreneurs with a precise indicator of their company’s potential to keep business expenses low while increasing overall sales to maximize profit. Business owners and managers can use margins to determine how many items or services they need to sell in order to generate a large profit. Low-margin products can be profitable if they sell in large quantities, but high-margin products can be profitable even if they sell in small quantities. If a seller is unable to raise their sales volume, they will most likely seek out ways to manufacture and sell higher-margin items and services.

- Part 1 Month 5 Firm’s Cash – While market conditions fluctuate throughout time, one thing stays true for all businesses: cash is essential. Businesses can be profitable on paper but still face bankruptcy if they can’t pay their debts if they don’t optimize their cash flow. Because businesses are prone to erratic cash flows and limited liquidity, it’s critical to keep a careful eye on working capital and put mechanisms in place to manage it before problems develop, such as a pandemic. Even while COVID-19 did not have the same impact on every industry, the uncertainty it created made working capital a major priority for many business owners. Making a structured approach to cash flow management and ensuring that it is fully optimized is a smart starting step. This will not only offer enough liquidity to sustain operations and support expansion during good times, but it will also provide a layer of stability during bad times, obviating or decreasing the need for further funding. Short-term cash flow estimates, such as weekly or monthly projections, and longer-term projections, such as those that look at a company’s growth over one year, three years, or even five years, are critical in establishing a company’s present cash situation. This is especially true if a company is growing quickly or going through a difficult period. Savvy business owners examine previous cash flow statements to gain insight into past decision-making and trade-offs, as well as other noticeable trends, in order to generate more accurate estimates and extract as much cash as possible from their balance sheets.

- Part 1 Month 6 Firm’s Velocity – In business, velocity refers to the time it takes a corporation to reach particular milestones, which can be measured in days, hours, or minutes. It refers to the amount of work performed in a particular amount of time. Additionally, velocity may be found in many company areas, including product or service development, sales, and marketing. In times of business expansion, it’s critical to consider velocity rather than just spinning wheels and achieving nothing. It makes it easy to analyze the efficiency of newly implemented tactics, as velocity will decline, increase, or stay constant, demonstrating how the change effects the business’s performance. By regularly diagnosing, planning, implementing, monitoring, and correcting, you may stay on track with milestones rather than losing focus during rapid development. Ascertaining that the firm is progressing in the proper way.

- Part 1 Month 7 Firm’s ROA – Return on assets (ROA) is a financial statistic that measures a company’s profitability in relation to its total assets. ROA can be used by executives, analysts, and investors to measure how well a company uses its assets to generate profit. Using a company’s net income and average assets, the metric is often stated as a percentage. A higher return on investment (ROI) implies that a corporation is more effective and productive in managing its balance sheet to generate profits, whilst a lower ROA suggests that there is space for development. Businesses are all about productivity. Comparing earnings to revenue is a valuable operational statistic, but comparing them to the resources a company utilized to earn them shows the company’s viability. The simplest of these corporate value-for-money measurements is return on assets. It informs you of the earnings earned by your assets or invested capital. The return on investment (ROI) number tells investors how well a company converts its investments into profit. The higher the return on investment (ROI), the better, because the company may earn more money with less investment. Simply said, a higher ROA indicates greater asset efficiency.

- Part 1 Month 8 Industry – In this workshop, we will discuss the importance of gaining clarity on where your industry is today, its capacity and pricing power, consolidation, digitization, what trends and pressures the industry is facing today, what trends and pressures will likely emerge tomorrow, and how one makes money today and tomorrow. Answering these questions will help you figure out where your industry falls short in terms of strategic optimization and where it excels. Then you’ll be able to concentrate on the areas where your industry is underperforming.

- Part 1 Month 9 Competition – Organizations find it challenging to assess competitive rivalry, partly because they lack a process to help them evaluate all of the aspects where competition is present. It’s good to borrow a phrase from hockey legend Wayne Gretzky when determining where customer demand should lead your company. “I skate to where the puck is going to go, not where it has been,” he remarked when asked how he does so effectively against opponents. That same notion applies not only in business, but is critical to success in strategic planning. Strategic planning must involve an understanding of competitive rivalry, regardless of the technique chosen. The external environment of the firm must be thoroughly understood in terms of who the rivals are, what strategies they employ, and what works and what does not. We need to know how the market is changing. In order to comprehend the impact of suppliers on our strategy, we must also assess and plan for them. Even the best-laid strategic plans are jeopardized if this competitive rivalry dimension of planning is overlooked.

- Part 1 Month 10 Growth Vision – Based on your goals and desires, a growth vision is a vivid mental image of what you want your firm to be in the future. Having a clear vision for your company will help you avoid going in the wrong way. It’s important to redefine your corporate vision now that your firm is established and growing. A company vision statement explains where you want to take your business, but not how you’ll get there. It’s a concept that should pique your interest and inspire you. The finest vision statements are succinct, easy to comprehend, and contain enough excitement and drive to push your people and company forward. Keep the following elements in mind while you write your vision statement: Make grandiose plans. Concentrate on the achievement you want to accomplish in the next five to ten years; become enthused. To increase the motivational aspect, add some emotional language to your vision statement; involve employees in the process. Inquire about employees’ suggestions for the company’s future. This will assist your employees take ownership of the goal and engage them as future ambassadors. Be clear. Keep your vision straightforward and unambiguous by avoiding buzzwords and business language; communicate consistently. You may unify your company’s vision and let employees feel like they are expressing it by utilizing inclusive phrases like “we,” “us,” and “our.” Keep employees informed about the company’s progress toward its goals. Maintain a vision that is compatible with the company’s underlying principles.

- Part 1 Month 11 Vision Targets – Many leaders make promises to deliver growth, but only a small percentage of them follow through. This is because many people mismanage the growth gap, which is the difference between their development aspirations and the capabilities of their base company. To close the gap, either new products or acquisitions are required. That’s where the problem begins: it’s easy to be duped by attractive assumptions that, when rigorously examined, turn out to be unworkable. Unrealistic sales estimates or assumptions about how much growth you’ll actually receive can cost you your job. Investor confidence is shattered by misses, which can result in huge stock price drops and investors waving metaphorical pitchforks. Every company must define firm-specific goals for success, but how do you choose the proper goals for your company? It begins with you identifying the overall direction of your organization, selecting where you want it to go, and documenting it in a simple strategy summary. This document should be reviewed by your team throughout the year to ensure you’re on pace to meet milestones and achieve your objectives.

- Part 1 Month 12 Delivery Mechanism – It is your obligation to create an atmosphere that allows the team to deliver efficiently now that they are completely committed to the vision and business value. Just like in any sporting event, when a team reaches a stage where everyone on the team understands their roles and there is a high level of trust among the members, the team produces excellent outcomes. To ensure that team efficiency thrives, you must serve the team and remove any impediments in their way. The team will respond with incentive to succeed if an executive promotes a project environment that focuses on delivering value to the business.

Methodology

Strategic Optimization

Processes should always operate at maximum efficiency, no matter what. The productivity of personnel who use these processes is directly affected by efficiency. Consider that for a moment. What happens if an employee has malfunctioning equipment and the IT team takes two days to respond? The employee is compelled to work only part of the time. Companies that have been around for a long time don’t have the luxury of scraping everything off and starting over. These businesses get comprehensive processes right the first time and stick with them for a long time. Constantly optimizing processes is the simplest and best choice.

Process optimization is the art of fine-tuning a process to optimize a set of parameters while adhering to a few limitations. The most common objectives are to reduce costs while increasing throughput and/or efficiency. This is one of the most important quantitative instruments in industrial decision-making.

The practice of enhancing processes to increase organizational efficiency is known as business process optimization. Processes that are optimized lead to business goals that are optimized.

Business Optimization Techniques

While the ultimate goal is to develop and implement a Strategic Optimization Plan for a business that is:

• Data-based

• Immediately actionable

• Has the enthusiastic buy-in of the leadership team

• Becomes a part of the senior management culture,

implementing a business optimization project is the initial stage. As part of the first step, the company must explicitly identify objectives and specify its targets and ambitions. This is a crucial stage in any optimization modeling strategy.

It is vital to appoint a qualified staff to conduct the process, as well as executive assistance. For a variety of reasons, it is preferable to build an internal team that understands the business than than rely on outside consultants. This does not rule out the possibility of hiring an outside company optimization specialist to oversee the process and provide useful input.

It is advantageous to have a business optimization framework that describes the program and sets precise targets, particularly those that influence personnel. It’s vital not to neglect the potential impact on employees and to take steps to allay fears and obtain support.

Because early results promote confidence, most optimization techniques start with low-hanging fruit, or modifications that are straightforward to detect and apply. A deeper investigation is necessary to find and solve more difficult optimization problems.

Workplace silos hamper business optimization

Internal competition between departments is practically inescapable because most firms are organized around functional expertise. When it comes to equipment maintenance, for example, production and maintenance usually clash. Maintenance prefers to shut down equipment for routine maintenance, but production requires that they remain operational in order to meet production targets. Another example is a production manager who, despite the obvious benefits, rejects efforts to shift production to other lines.

Internal competition is the root cause of organizational silos, in which each silo’s and the organization’s goals are unique. When each silo strives to improve functional performance, steps to optimize particular silos may conflict with other activities aimed at improving overall organizational performance. If internal departmental efficiencies are placed over organizational adaptability, business optimization efforts might be considerably disturbed.

How to achieve strategic optimization

1. Create a comprehensive analytics platform

Any well-thought-out strategic optimization project requires precise data on the company. Companies wanting to optimize must not only have the capabilities to collect data at the strategic, tactical, and operational levels, but also the skills to parse that data into useful information.

If you can’t arrange a wall of numbers into something helpful, it’s useless.

2. Determine the most important performance indicators

When you have the numbers in front of you, you must decide which ones are important. While many markers of success are universal, others will be specific to your industry, your business model, and the objectives you choose to pursue. This may necessitate unique research, or you may discover that significant research on the subject exists for your industry, business model, or other factors. What matters is that you focus on the numbers that really matter rather than the ones that appear to matter.

3. Establish short and long-term business objectives

Firm, testable short- and long-term goals are required for strategic optimization. You can’t make the thoughtful, deliberate improvements your company needs to reach its full potential unless you have precise goals to monitor progress toward. Short-term goals should support long-term goals, and long-term goals should be resistant to the need for change; if a single movement in the industry renders your long-term goals worthless, you should reevaluate optimizing your firm to that end.

4. Refocus the project to achieve its objectives

Many companies embark on projects with a startling lack of awareness. Consider how many of the present projects consuming corporate resources, time, consumer goodwill, and so on support your long-term or even short-term objectives. When viewed in its entirety, a project that appears to be a “good concept” in isolation may be a waste of time. The elimination of these false wastes of effort is at the heart of high-level strategic optimization. Similarly, projects that promise to get your firm closer to its long-term goals should be prioritized inside the organization—not every project needs to be solely useful in the long run, but you should be more careful with your assets.

5. Adjust approaches based on facts and long-term goals

You’ll want to start looking at the methods you’re using within projects and efforts as you optimize at the strategic level. How do you plan utility infrastructure, manage labor, and so on? Do you think about the implications of your decisions at this level on the strategic and operational levels of your company? You should be able to make confident, educated tactical decisions if you have a solid foundation of data collection and analytics. Don’t be hesitant to switch methods if necessary—the it’s nature of this line of business that the optimum solution shifts frequently, without jeopardizing strategic or operational efforts.

6. Improve operations

The sheer flexibility a firm faces in things such as cash management, scheduling policies, and so on, generates significant openings for inefficiency and big potential for clever planning, thus operations should ideally be enhanced in line with your other business optimization. You’ll achieve considerably more optimal operations and assist your organization achieve its short and long term goals if you approach operations as a component of the broader total rather than as an afterthought.

A holistic, data-driven approach to business improvement will always yield superior results.

7. Be adaptable, but not overly so

While certain areas of your organization should not be optimized around current events, you should be aware of market movements and make whatever changes are necessary to be effective and efficient without jeopardizing your long-term objectives. It’s not worth it to make a hasty decision that would harm your business in the long run. Major adjustments can wait for hard data, but you won’t have to wait long if you use the correct analytics tools.

Here are ten more steps to achieve strategic optimization:

1. Compile data analytics

You may need to look at current data and previous yearly reports to gather insights. This could involve the following, depending on your industry:

• Website analytics reveal how much traffic and engagement a company’s website receives.

• Social media analytics: This form of analysis displays a company’s social media accounts’ followers and interaction.

• Production analytics depicts the input and output of various production levels.

• Operational analytics: This form of analysis demonstrates how productive a company is overall.

These analytics can provide crucial information for a company to decide where it needs to improve in order to realize its full potential.

2. Evaluate performance and return on investment

Business analytics can assist you in evaluating a company’s performance and return on investment. Examining these essential aspects of your company’s current and historical operations is critical for identifying areas where improvement can be beneficial. For instance, a company may manage efficient manufacturing but optimize to increase sales.

3. Prioritize and organize

For organizations to make educated decisions, optimization necessitates the utilization of data and information. Organizing and prioritizing this data can assist firms in quickly locating critical information. For example, if you want to fact-check something during the optimization process, having your data prepared ahead of time may save you time.

It’s also critical to concentrate on specific areas in need of development. If you have a specific focus, such as customer relations, you may get better outcomes because the optimization process can be tailored to improve client connections. Making checklists and setting deadlines are two methods for prioritizing.

4. Audit applications

When it comes to business optimization, it’s critical to identify and audit all of the programs that your company needs to run its operations. For example, if an audit reveals that a company is utilizing two programs for time tracking, the company can alter its procedures to use only one application. This method can help businesses work and budget more effectively.

5. Establish objectives

Because goals give businesses with tasks to focus on and work toward, they can help lead optimization. Current and previous performance reports, as well as where you’d like the ROI to be, should all be considered when creating business goals. The following are some steps to developing business goals:

• Define the goals’ objectives and needs.

• Decide how you’ll track your progress.

• Consider your objectives realistically.

• To fulfill your objectives, set a timeframe.

These four phases might assist you in developing unique, personalized goals for maximizing the potential of your company.

6. Create plans to attain your objectives

Analyzing data and defining goals might assist you in developing plans to reach your objectives. Many tactics and multistep processes for producing business plans might be beneficial in keeping everyone informed and on track. These are some instances of these steps:

• Write down your goals.

• Determine what resources are useful.

• Plan your strategy.

• Make a list of actionable steps for your strategy.

• Make a checklist to keep track of your progress.

7. Put your strategy into action

Implementing and using business optimization strategies as a guide can help you get started. It may be helpful to refer to your plan and checklist when first implementing your strategy to ensure that operations and adjustments are completed on time. Depending on your optimization strategy, you may want to take it one step at a time to make the process more progressive.

8. Keep track of your strategy

Monitoring your strategy might assist you in identifying prospective business adjustments or upgrades. Referencing your strategy and checklist can also help you keep track of the process and see if your objectives are being accomplished. It’s also a good idea to keep track of your progress each day to make sure you’re on pace to accomplish your objectives.

9. Make changes to your strategy

During the optimization phase, you may need to make changes to your plans. Depending on your needs, revising your plan may entail updating a specific section or the entire plan. If, for example, the plan is assisting your company in improving customer interactions but you’re having trouble meeting sales targets, you may adjust your strategy to focus on how to better meet sales targets. The following are some revision steps:

• Determine a region that isn’t reaching its objectives.

• Examine operations and data to see why it isn’t achieving its objectives.

• Consider many options.

• Make a decision about how to proceed with your plan.

10. Be patient and manage your time

It is critical to effectively manage your time and to be patient and adaptable. Throughout the optimization process, managing your time can help you be more productive, stay focused, and achieve your objectives. It’s also crucial to keep in mind that reaching your objectives may take some time. Setting daily goals and prioritizing work to focus on the areas that are most important to your business are two techniques to help you manage your time.

Industries

This service is primarily available to the following industry sectors:

Manufacturing

Manufacturing is the process of converting raw materials or parts into completed things using tools, human labor, machinery, and chemical processing.

Manufacturing enables companies to sell completed goods for more than the cost of the raw materials required. Large-scale manufacturing enables the mass production of items employing assembly line procedures and innovative technology as primary assets. Manufacturers can take advantage of economies of scale by using efficient manufacturing techniques to produce more units for less money.

Manufacturing is a vital and significant component of the economy. It entails the transformation of raw materials like ore, wood, and foodstuffs into finished commodities like metal goods, furniture, and processed foods.

Adding value by converting these raw materials into something more valuable. The price of finished goods rises as a result of this additional value, making manufacturing a particularly profitable portion of the business chain. Some people specialize in the abilities needed to make items, while others supply the finances needed for enterprises to buy the tools and materials they need.

As previously said, industrial efficiency can lead to increased productivity and cost savings. Manufacturers will be able to do this if they can:

• Cut redundancies

• Improve job quality

• Update equipment and processes

• Set realistic objectives

• Make the intake, supply chain, and distribution channels more efficient.

Modern Manufacturing History

Before the Industrial Revolution, handcrafted goods ruled the market. During this time, the industrial process began, with raw materials being transformed into final products in large quantities. Companies were able to use machines in the manufacturing process thanks to the development of steam engines and subsequent technology. This lowered the requirement for human capital while boosting the total amount of commodities produced.

By minimizing the requirement for part customisation, mass production and assembly line manufacturing enabled enterprises to design parts that could be used interchangeably and finished products to be produced quickly. In the early twentieth century, Ford pioneered mass-production techniques. Companies have been able to pioneer high-tech manufacturing methods because to computers and precision electronic equipment. These companies charge a greater premium, but they also demand more specialist staff and a larger capital investment.

Over time, the abilities needed to run machinery and establish production processes have changed dramatically. Because labor in developing countries is cheaper, many low-skill manufacturing employment have transferred from industrialized to developing countries. As a result, high-end products requiring precision and skilled manufacturing are usually made in developed economies.

Manufacturing has become more efficient, and employees have been more productive, thanks to technological advancements. While the quantity and variety of commodities produced have expanded, the number of people required has decreased.

Economic Measurement of Manufacturing

When measuring the contribution of manufacturing in the economy, economists and government statisticians utilize a variety of ratios. Manufacturing value added (MVA), for example, is a measure of an economy’s manufacturing production in relation to its overall size. This figure is calculated as a proportion of gross domestic product (GDP).

Manufacturing enterprises are surveyed by the Institute for Supply Management (ISM) to estimate employment, inventories, and new orders. Each month, the ISM releases the ISM Manufacturing Report, which summarizes its results. This report is anticipated by financial analysts and researchers as a possible early predictor of the economy’s health as well as a sign of where the stock market may be headed.

Professional Services

Professional services organizations provide services across a wide range of industries, including banking, legal, marketing, and almost any type of consultant you can imagine.

Professional services companies sell information and expertise, whereas other businesses sell tangible goods.

This knowledge and skills may appeal to business owners who cannot be specialists in all areas. They may be at ease dealing with management, sales, and marketing issues, but they lack the necessary training. They aren’t even practitioners. They also did not attend law school or pass the Certified Public Accounting test. Their area of competence is their commercial speciality, not the collateral challenges that have arisen around it.

These companies have something else that many business owners are in short supply of: time.

Time is on the side of professional services firms.

One of the most common reasons that business owners use professional service organizations is a lack of time. Running a business is a full-time job that leaves little, if any, quality time to solve the financial, legal, and marketing challenges that come across their desk.

In almost every study of business owners, “short of time” is consistently listed as one of the top ten concerns or challenges. For example, Guidant Financial polled over 2,600 business owners across the US, and they responded that managing their time was their third-largest concern, after cash flow and marketing/advertising issues:

• Entrepreneurs are constantly interrupted by emails, phone calls, and text messages. They also have to cope with tight meeting schedules, last-minute deadlines, and the need to do several tasks. That is why time is so important.

If this scenario sounds familiar, wait till you hear the fourth most common issue mentioned by the same business owners: administrative duties, such as bookkeeping and payroll:

• Administrative work is a significant challenge for many small businesses.

You can see how this “perfect storm” might come together: The professional services firm is located there, presumably with an arsenal of skill and knowledge ready to be unleashed. And there’s the small-business owner, working late again again, unsure of which hat to put on next as he shifts from one assignment to the next.

According to The Business Research Company’s professional services industry analysis, the worldwide professional services market rose at a compound annual growth rate (CAGR) of 7% from $5.03 trillion in 2020 to $5.43 trillion in 2021. Companies are reorganizing their operations and recuperating from the COVID-19 impact, which had previously resulted in tight containment measures such as social distancing, remote working, and the shutdown of commercial activities, all of which created operational issues. At a CAGR of 7%, the market is estimated to reach $7.06 trillion in 2025.

The top opportunities in the professional services market segmented by type will arise in the design, research, promotional, and consulting services segment, which will gain $1,602.0 million of global annual sales by 2025, and the top opportunities within this segment will arise in the architectural, engineering consultants, and related services segment, which will gain $437.0 million of global annual sales by 2025, according to TBRC’s professional services industry outlook.

The B2B legal services category, which will account for $104.3 million of worldwide annual sales by 2025, will offer the best prospects in the legal services market classified by type. The bookkeeping, financial auditing, and other accounting services sector, which will account for $149.1 million of worldwide annual sales by 2025, will present the best prospects in the accounting services market split by type.

Top prospects in the other professional, scientific, and technical services market will emerge in the other professional, scientific, and technical services segment, which will acquire $38.5 million in global annual sales by 2025.

At $449.1 million, the professional services sector will grow the greatest in the United States.

The research Professional Services Market – Opportunities And Strategies – Global Forecast by the Business Research Company Professional services market share by company, professional services manufacturers, professional services market size, and professional services market projections are all covered up to 2022. The global professional services industry and its segments are also covered in the report.

Technology

Industry Structure

Companies that create, manufacture, or distribute electronic devices like computers, computer-related equipment, computer services and software, scientific instruments, and electronic components and goods make up the technology industry. Consumers and businesses may prosper in a digital world thanks to technology.

This industry is unlike most others in that it requires an extremely large investment in research and development due to the rapid pace of innovation. As a result, compared to other industries, the industry employs a substantially higher number of engineers and other highly trained technical personnel, especially since product creation necessitates creativity, competence, and precision. The technology business also employs a sizable sales and marketing team, as the success of a new or enhanced product is primarily reliant on consumers being aware of and interested in it. While industrialized countries account for the majority of sales, the majority of computer hardware is produced in emerging countries, where manufacturing and assembly costs are lower.

History

The technological business is still relatively new, dating back to the invention of the two-element electron tube in 1904. The transistor, integrated circuits, and analog devices all followed in the 1950s and 1960s, respectively. Military research was responsible for several of these innovations. The creation of the integrated circuit board in the 1970s, followed by the development of microprocessors, made home and personal computers a reality in succeeding years. Computers, on the other hand, were not extremely popular until the internet became widely available. When the internet became widely accessible in the 1990s, the use of personal computers skyrocketed. Entrepreneurs like Bill Gates and Steve Jobs became household names as a result of this surge. Customers sought multi-tasking computers that could handle a variety of photo, video, and audio applications in the early part of 2000, but the market turned around in 2003 and 2004 as consumers sought multi-tasking computers that could handle a variety of photo, video, and audio applications. Since then, the technology has evolved to include mobile phones and tablets that provide all of the functions of a traditional desktop computer. As a result of cloud computing’s revolution in data storage, gadgets are becoming smaller and more powerful.

Leaders

Microsoft Corp., IBM, Google, and Oracle Corp. are the leaders in the software industry. Consumer electronics products have recently been integrating with computer sector products, for example, phones now have Internet connectivity, as do game consoles, PDAs, and many other devices. As a result of this convergence, businesses should expect more competition from previously unrelated industries. By providing both hardware and software, companies like Apple have grown to be giants in their own right. Other companies that had previously focused solely on software have now expanded into the hardware manufacturing industry as a result of this business strategy.

Trends

The technology industry is continually changing and evolving by its very nature. Mergers and acquisitions are typical practice at the business level because they allow organizations to pool their resources and knowledge in a highly competitive environment. As technologies become increasingly integrated in numerous multipurpose devices, computer businesses must compete with companies in the consumer electronics and telecommunications markets.

To increase profits, secure market share, and gain access to low-wage workers, technology companies frequently expand internationally. As a result, corporations must manage a global workforce, currency risks, technology transfers, and a global supply chain while also responding to governments and authorities in this borderless economy. Aside from global technology supply, global demand for technical items is also expanding. International sales account for a significant portion of hardware sales, particularly in India, Japan, China, and other Asian regions.

Companies in the IT business are concerned about a number of challenges. There’s a huge opportunity to sell items that are built to work with or on the new operating system, as well as products that need to be upgraded since they’re incompatible with the new, more advanced OS. Piracy is the second key worry of computer software firms. Estimates put the percentage of counterfeit software in use in the United States at roughly 20%. Depending on the country, this percentage can be substantially higher. The third point is safety. The sector must deal with security challenges such as system failure, security breaches, intellectual property abuse, and reputational damage from social media as a result of the entrustment of personal information and data.

Future Outlook

The technology industry presents a significant challenge for firms; success is dependent on innovation, which can come and go at any time. Data breaches can jeopardize a company’s entire reputation, therefore it’s critical that they construct secure networks and develop solid risk management procedures. The retirement of baby boomers, shifting talent pools, increased technical skill needs, and regulations will all be challenges for this industry.

The industry, on the other hand, is well positioned for expansion in both emerging and developed countries. Cloud computing, mobile devices, and social media have all proved the importance of disruptive innovation in the sector. These are relatively new trends that will help organizations modify their plans in order to speed product development, operations, and strategy, among other things. Technology firms should also concentrate on developing more user-friendly software. Mobile device and tablet expansion is critical as more individuals keep portable devices and seek out simple applications.

Healthcare

In most wealthy countries, healthcare takes more than 10% of GDP. In reality, by the end of 2019, this percentage for the United States was close to 18 percent. This isn’t surprising given that healthcare is the largest employer in the United States. In fact, the United States spends far more on healthcare than the rest of the globe.

As we can see from current statistics, healthcare is one of the world’s largest and fastest-growing sectors. So, which other countries invest heavily in health care? And how much is the global healthcare sector worth? What does the future hold for it?

Healthcare Statistics to Know

• In 2018, the global health industry was valued at $8.45 trillion.

• By 2023, global healthcare spending could exceed $10 trillion.

• The United States spends the most on healthcare, at $10,224 per capita.

• The United States spends twice as much on healthcare as other countries.

• The US healthcare industry employs 784,626 people.

• McKesson is the largest healthcare corporation in the United States, with $208.3 billion in yearly revenue.

• The internet of things (IoT) has the potential to save $100 billion per year in operational and clinical inefficiencies.

• Sixty-four percent of physicians feel the Internet of Things can help nurses and doctors work more efficiently.

• China has the greatest percentage of people using linked health devices in the world, at 28%.

In the global health industry, the old adage “what goes up must come down” does not appear to apply. According to research, global citizens spend more on healthcare each year. Why is this the case? Which countries spend the most per capita on health? The United States spends the most per person on health care, followed by Switzerland and Germany.

According to the latest health statistics, the United States spends a disproportionate amount of money on health compared to its wealth. While the United States spends $10,224 per capita on healthcare, Switzerland and Germany spend $8,009 and $5,728 per capita, respectively. Sweden ($5,511) and Austria ($5,440) are the other top health-spending countries.

According to research, the healthcare sector would be worth $10.059 trillion by the end of 2022. Global healthcare expenses will continue to rise due to aging and rising populations, higher incidence of chronic health disorders, and exponential yet costly developments in digital technologies.

Growth in the Health Care Industry

According to latest healthcare industry statistics, the global health industry is developing at an astounding rate. This industry was worth $8.45 trillion in 2018, up 7.3 percent year over year since 2014.

The healthcare business is likely to continue to expand. According to the latest predictions, the market in the United States grew to $808 billion in 2021. The booming health insurance business, as well as rising healthcare costs, are major contributors.

The Healthcare Industry’s Future

According to the report, 98 percent of pharmaceutical and life science executives anticipate increased digital investment in clinical trials in the coming years. Around 75% of healthcare facilities, such as clinics and hospitals, were found to be unprepared to respond to cyber-attacks, indicating that this is an area that will need to be improved in the future. Nearly 96 percent of respondents believe that cyber-attacks on hospital software and infrastructure have escalated, putting healthcare facilities at danger.

Perspectives on Healthcare

The coronavirus epidemic has exposed the healthcare system, with revenues in the United States alone falling by about 50%. Fitch now rates around 2/3 of issuers with a stable outlook, 17% with a negative outlook, and 10% with a positive outlook. According to DataBridge Industry Research, the health insurance market is estimated to reach $2,259,670.09 million by 2027, rising at a CAGR of 4.4 percent.

Global Healthcare

92 percent of healthcare solution suppliers advocate for the adoption of digitization in healthcare facilities. This makes it an excellent moment to invest in digital healthcare. Experts expect that digital technology in healthcare will accelerate dramatically, including cloud computing, data security, and other technologies.

Premiums for life and health insurance will increase by 2.9 percent to over $4 trillion, but will rebound to around 3% growth by the beginning of next year. The recovery will be fueled by heightened health risk awareness and improving financial market circumstances.

Business Services

Industry Structure

The business services industry is a fairly large industry that includes many different types of businesses that all provide non-financial services to other businesses. Advertising, marketing, consultation, logistics (including travel and facilities services), waste disposal, staffing services, shipping, administration, and security services are just a few of the services available. Almost every firm in existence need at least one of the various types of services provided by the industry.

• Marketing firms are in charge of helping a client company increase revenue by attracting new customers and retaining existing ones.

• Legal services are required to handle business transactions as well as litigation.

• Logistics and shipping companies collect, store, transport, and distribute products in order to connect businesses with other businesses or consumers.

• Staffing firms connect job seekers with employers seeking suitable staff, whether temporary or permanent.

• Leasing companies meet a client’s need for particular things without requiring them to be purchased outright.

• Security firms are in charge of keeping a company’s assets safe.

• Consulting companies are in the business of fulfilling needs for expertise that clients cannot fulfill themselves. These firms may provide professional, scientific, or technical advice, management or strategy advice, or human resource advice.

Leaders

The advertising and marketing area underwent a lot of consolidation and mergers among enterprises, primarily due to rising fragmentation of advertising media (more TV channels, the internet, etc.), until the global recession of 2008 slowed the pace a bit. Now the industry is heating up, with a few companies like Omnicrom Group and WPP Group, who provide a comprehensive range of services, leading the pack. Most other marketing firms serve a specific market rather than competing directly. In the consulting field, corporations are classified into two groups; the industry elite and smaller, more specialized firms. The industry elite include companies like Accenture, the world’s largest consulting business, or IBM, which can provide knowledge in a variety of sectors. Some of the specialized consulting organizations include Cornerstone Research, Gartner, and PRTM. United Parcel Service, YRC, and FedEx are the market leaders in shipping and logistics, offering “intermodal” transportation. Hay Group and Mercer Human Resource Consulting are big names in human resources and facilities management, respectively, and The Brinks Company is a leading security firm. The best solid waste disposal business is Waste Management.

Trends

It is only natural to anticipate that the business service industry will follow the enterprises wherever they go. The business service industry is following the creation of enterprises in rising markets like China and India.

There is a growing demand for complete solutions that combine warehousing, transportation, and other logistics functions in business-to-business shipping. This includes value-added services like sorting bulk goods into customized lots, packaging goods, controlling and managing inventory, order entry and fulfillment, labeling, light assembly, and price marking, all of which have helped manufacturers and customers improve the efficiency of their relationships.

To speed up the distribution of goods, businesses rely on innovative technologies and process coordination.

To eliminate errors and boost productivity, voice control software allows a computer to coordinate workers via auditory orders.

Incoming and departing shipments are tracked and managed using radio frequency identification devices.

Just-in-time shipping is a method of delivering items only when they are required, saving recipients money by eliminating the need for extensive stockpiles.

The development of internet job boards like monster.com, theladders.com, and jobs.com has revolutionized the personnel staffing industry substantially, removing the necessity for traditional personnel staffing firms.

What are the most pressing issues confronting the business services industry?

While there is currently a steady need for business services, companies’ resources and margins are being squeezed, limiting their capacity to supply that demand. Skills shortages, for example, are beginning to limit their ability to expand, while increased expenses continue to squeeze profit margins. Brexit may bring new obstacles, such as the depreciation of the pound, influencing import prices and limiting access to talent, but it may also provide new opportunities.

Future Outlook

Because of the wide range of companies and services that make up this industry, forecasting trends for the entire industry is extremely difficult. As a result, just a few segments of the sector are highlighted.

Demand for technology-based security systems is shifting, particularly for those with wireless monitoring capabilities and connection with other automation needs such as fire alarms and closed-circuit television systems. Over the recent year, an increase in corporate activity, such as mergers and acquisitions, has signaled a growing demand for legal services in many different industries. The breadth of globalization and the maturation of a technology-based workplace are expected to increase demand for consulting services, a service that is extremely beneficial because experts are well-trained and stay current on the latest technologies, government regulations, and management and production techniques. Companies are learning that hiring specialists early on is preferable to waiting until they run into serious difficulties later. Finally, notwithstanding the challenges posed by cost pressures, rising demand for air shipping will benefit logistics and shipping firms.

Locations

This service is primarily available within the following locations:

Dallas-Fort Worth

Fort Worth is the fifth largest city in Texas and the thirteenth largest city in the United States. Tarrant County covers about 350 square miles (910 km2) and is bordered by four other counties: Denton, Parker, Wise, and Johnson. Fort Worth has a population of 958,692 people according to a United States census estimate from 2022 and is the second-largest city of the Dallas–Fort Worth–Arlington metropolitan area, which is the United States’ fourth-largest metropolitan area.

Fort Worth was founded as an army station on a hill overlooking the Trinity River in 1849. The Texas Longhorn cattle trade has long been centered in Fort Worth and it maintains its Western roots, as well as traditional architecture and style. The USS Fort Worth (LCS-3) is the United States Navy’s first ship named after the city and despite the fact that nearby Dallas has had a population majority for as long as records have been maintained, Fort Worth has become one of the fastest-growing cities in the United States in recent years, notably in the twenty-first century, nearly tripling its population since 2000.

Texas Christian University, Texas Wesleyan University, University of North Texas Health Science Center, and Texas A&M University School of Law are all located in Fort Worth. Fort Worth is home to a number of international firms, including Bell Textron, American Airlines, BNSF Railway, and Chip 1 Exchange.

Fort Worth was founded on the Chisholm Trail, which was used for livestock runs. Until the Civil War, millions of cattle were moved north to market along this road, and Fort Worth became the center of cattle drives and later ranching. Fort Worth’s population declined as a result of shortages during the Civil War. General stores, banks, and “Hell’s Half-Acre,” a vast concentration of saloons and dance halls that expanded economic and criminal activity in the city, helped it recover during the Reconstruction Era. The military utilized martial law to control Hell’s Half-bartenders Acre’s and prostitutes by the early twentieth century.

Several large corporations have had their headquarters in Fort Worth since the late twentieth century. The John Peter Smith Hospital, Pier 1 Imports, Chip 1 Exchange, RadioShack, Pioneer Corporation, Cash America International, GM Financial, Budget Host, the BNSF Railway, and Bell Textron are among them. Bank of America, Wells Fargo, Lockheed Martin, GE Transportation, and AT&T, a Dallas-based telecommunications corporation, all have large presences in the city. T-Mobile Metro is also well-known throughout the city.

Forbes placed Fort Worth–Arlington 15th among the “Best Places for Business and Careers” in 2013. Fort Worth was awarded the 18th best city for Hispanic entrepreneurs by Fortune magazine in 2018. The Dallas–Fort Worth metroplex was placed 18th among the “125 Best Places to Live in the USA” by U.S. News & World Report in 2018.

Fort Worth was at the center of the wheeling and dealing when oil began to flow in West Texas in the early twentieth century, and again in the late 1970s. Many people received royalty cheques for their mineral rights after breakthroughs in horizontal drilling technology made massive natural gas deposits in the Barnett Shale available directly under the city in July 2007. Today, the city of Fort Worth and many people are coping with the advantages and disadvantages of subsurface natural-gas reserves.

Between 2000 and 2006, Fort Worth was the fastest-growing metropolitan city in the United States, and it was named one of “America’s Most Livable Communities.” Fort Worth’s mayor announced in 2020 that the city would continue to grow at a rate of 20.78 percent. Between 2014 and 2018, the city began to diversify, according to the US Census Bureau. From 2001 through 2020. Its GDP is estimated to be 477.02 billion dollars in 2020.

Phoenix

With 1,608,139 residents as of 2020, Phoenix is the capital and most populous city in the American state of Arizona. Along with Austin, it is the sixth most populous city in the United States and one of only two state capitals with a population of over one million people.

The Phoenix metropolitan region, commonly known as the Valley of the Sun, is located in the Salt River Valley. With roughly 4.85 million people as of 2020, the metropolitan area is the 11th most populous in the United States. Phoenix, the county capital of Maricopa County, is the state’s largest metropolis, with 517.9 square miles (1,341 km2) and is one of the country’s largest cities. It is the largest urban area in the Arizona Sun Corridor megaregion, both in terms of population and area.

Phoenix was founded as an agricultural town near the junction of the Salt and Gila Rivers in 1867, and it became a city in 1881. In 1889, it was designated as the capital of Arizona Territory. It is located in the Sonoran Desert’s northeastern reaches and has a scorching desert environment. Despite this, the canal system created a prosperous farming community, with crops such as alfalfa, cotton, citrus, and hay being key aspects of the Phoenix economy for decades. The “Five C’s” that anchored Phoenix’s economy were cotton, cattle, citrus, climate, and copper. Until after World War II, when high-tech industries began to pour into the valley and air conditioning made Phoenix’s scorching summers more bearable, these remained the city’s driving forces.

From the mid-1960s until the mid-2000s, the city saw a yearly population growth rate of 4% on average. During the Great Recession of 2007–09, this rate of growth slowed and has only slowly recovered. The state of Arizona’s cultural center is Phoenix.

Agriculture and natural resources dominated Phoenix’s early economy, particularly the “5Cs” of copper, cattle, climate, cotton, and citrus. The city became more accessible with the building of the Southern Pacific train line in 1926, the opening of Union Station in 1923, and the creation of Sky Harbor airport by the end of the decade. Phoenix was devastated by the Great Depression, but the city’s economy was diverse, and by 1934, it had begun to recover. When World War II ended, many men who had completed their military training at facilities in and around Phoenix returned with their families, boosting the valley’s economy. The building sector grew even more as the city grew, thanks to the establishment of Sun City. When it opened in 1960, it became the model for postwar suburban development, and Sun City became the model for retirement communities. Between the mid-1960s and the mid-2000s, the city grew at a four percent yearly rate on average.

Construction in Phoenix fell as the national financial crisis of 2007–10 began, and property prices plummeted. From peak to trough, Arizona jobs fell by 11.8 percent; in 2007, Phoenix employed 1,918,100 people; by 2010, that number had dropped by 226,500 to 1,691,600. Phoenix’s employment rate had climbed to 1.97 million by the end of 2015, finally recovering pre-recession levels, with job growth occurring across the board.

The Phoenix MSA’s Gross Domestic Product (GDP) was little under $243 billion in 2017. Real estate ($41.96), finance and insurance ($19.71), manufacturing ($19.91), retail trade ($18.64), and health care ($19.78) were the top five industries. If government (federal, state, and municipal) had been a commercial company, it would have placed second, with $23.37 billion in revenue.

The electronics manufacturer Avnet, the mining company Freeport-McMoRan, the store PetSmart, and the garbage transporter Republic Services all have headquarters in Phoenix. Honeywell’s Aerospace division is based in Phoenix, and many of the company’s avionics and mechanical facilities are located there. Intel has one of their major operations in the area, with around 12,000 employees, making it the country’s second largest Intel location. U-HAUL International, Best Western, and Apollo Group, the parent company of the University of Phoenix, all have headquarters in Phoenix. At Phoenix’s Sky Harbor International Airport, US Air/American Airlines is the largest carrier. Phoenix is home to Mesa Air Group, a small airline company.

With Luke Air Force Base in the western suburbs, the military maintains a strong presence in Phoenix. The sub-prime mortgage crisis had a significant impact on the city. Phoenix, on the other hand, has regained 83 percent of the employment lost during the recession.

The federal budget sequester, a reduction in US military commitments, and a sluggish economic recovery all contributed to a $1.7 billion drop in defense contracts issued in Arizona between 2012 and 2013. According to the GPEC Aerospace and Military report, Greater Phoenix plays a significant part in the national defense footprint, with federal defense funding accounting for 5.2 percent of the state’s GDP and Arizona ranking among the top 10 states for defense contracts.

In 2017, the Phoenix Metropolitan Area’s (AZ) GDP per capita was $44,534. Since the statistic in 2001, the Phoenix Metro Area (AZ) has grown at an average rate of 0.03 percent. If current trends continue, GDP per capita will be $44,592 in 2022.

San Diego

San Diego is a city in California, United States, located on the Pacific Ocean’s coast and close to the Mexican border. San Diego is the ninth most populous city in the United States and the second most populous in California, with a population of 1,386,932 (after Los Angeles). With 3,338,330 projected population as of 2019, the city is the county headquarters of San Diego County, the seventh most populous county in the United States. The city is noted for its pleasant climate all year, natural deep-water harbor, wide beaches and parks, long relationship with the US Navy and Marine Corps, and recent emergence as a healthcare and biotechnology development center.

San Diego, which was once home to the Kumeyaay people, is sometimes referred to as the “Birthplace of California,” as it was the first European settlement on what is now the United States’ West Coast.

Juan Rodrguez Cabrillo claimed the territory for Spain after landing in San Diego Bay in 1542, laying the groundwork for the establishment of Alta California 200 years later. The Presidio and Mission San Diego de Alcalá were the first European settlements in what is now California, erected in 1769. San Diego joined the newly founded Mexican Empire in 1821, which reorganized two years later as the First Mexican Republic. Following the Mexican–American War, California joined the United States in 1848 and was admitted to the union as a state in 1850.

The city is the economic hub of the San Diego–Tijuana conurbation, the western hemisphere’s second most populous transborder metropolitan area (after Detroit–Windsor), with an estimated population of 4,922,723 people as of 2012. The San Ysidro Port of Entry, which connects San Diego with Tijuana, is the world’s busiest international land border crossing outside of Asia (fourth-busiest overall). San Diego International Airport, the city’s major airport, is the world’s busiest single-runway airport. Droughts across California have exacerbated San Diego’s water security since 2010.

Defense/military, tourism, international trade, and research/manufacturing are the most important sectors of San Diego’s economy. San Diego was named the greatest city in the US to establish a small business or startup company by a Forbes contributor in 2014. In 2018, the median household income in San Diego was $79,646, up 3.89 percent from $76,662 in 2017.

San Diego is home to numerous significant wireless cellular technology manufacturers. Qualcomm is one of San Diego’s major private-sector employers and was founded and is based in the city. Nokia, LG Electronics, Kyocera International, Cricket Communications, and Novatel Cellular are among the other wireless sector companies with headquarters here. The Slovakian security firm ESET maintains its US headquarters in San Diego. San Diego has been recognized as an iHub Innovation Center for future wireless and health sciences collaboration.

San Diego’s innovation economy companies generated over $63 billion in sales, employed over 164,000 people, and paid out over $21 billion in wages in 2019. San Diego’s direct economic contribution is more than $33 billion, accounting for more than 13% of the regional economy’s gross domestic product (GDP). The San Diego innovation economy generates about $61 billion in indirect and induced benefits, accounting for 24% of the city’s projected total GDP. The multiplier effect on jobs, including indirect and induced jobs, is 2.66, which means that for every technological job, another 2.66 jobs are dependant or generated.

Denver

Denver’s economy (Denver is the most populous city in the Rocky Mountain region) is heavily dependent on its location. Denver is the largest urban area in the region (the nearest metro area of comparable size is the Kansas City Metropolitan Area about 600 miles east). Denver serves the Rocky Mountain States with federal, high-tech, educational, commercial, financial, cultural, tourism, storage, and distribution services. Several large firms in the central United States have their headquarters in the city.

Denver is the capital and most populous city of Colorado, as well as the state’s consolidated city and county. At the time of the 2020 United States census, its population was 715,522, up 19.22% from the 2010 census. It is the United States’ 19th most populated city and the fifth most populous state capitol. It is the first city of the Front Range Urban Corridor and the principal city of the Denver–Aurora–Lakewood, CO Metropolitan Statistical Area. Its metropolitan region is the most populous within a 560-mile (900-km) radius and the Mountain West’s second most populous city after Phoenix, Arizona. U.S. News & World Report ranked it the greatest location to live in the United States in 2016.