Reimagining Sales

The Appleton Greene Corporate Training Program (CTP) for Reimagining Sales is provided by Mr. Dardelin Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

Mr Dardelin is a Certified Learning Provider (CLP) with Appleton Greene. He has a dual business and scientific background, with an MSc in Hospitality Management from ESSEC (Paris) and an MSc in Applied Neurosciences from King’s College (London).

He started his career in the luxury hotel and leisure industry as a sales director and then hotel director, where he acquired solid sales and customer service experience. Then, he specialized in auditing, training, and strategy consulting. He worked in international audit and consulting groups as a senior consultant and then as project director, where he carried out productivity optimization and reorganization missions for multinational companies in the USA, Europe, and Asia.

Mr Dardelin has become an expert in growth strategy, productivity optimization, customer experience, sales strategies, sales training, and disruptive management.

For over 30 years, he created and has managed a growth strategy consulting firm with large European clients. In this capacity, he led consulting projects involving sales teams ranging from 500 to 10,000 people.

Mr Dardelin has developed a unique professional training method that is playful and of remarkable efficiency. This registered method, called RUN TRAINING©, based on repetition and the acquisition of reflexes, allows all types of professionals to acquire or improve the practices that sell in a very short time.

What makes Mr Dardelin strong is helping his clients quickly and efficiently implement winning strategies that overcome operational obstacles and constraints.

Mr Dardelin is multilingual and speaks seven languages fluently.

He has commercial experience in the following countries: Belgium, Brazil, Canada, China, England, France, Germany, Kuwait, Netherlands, Spain, Singapore, Switzerland, United States.

He has industry experience in the following sectors: Automotive, Airlines, Casino and Gaming, Fast moving consumer goods, Energy, Financial Services, Food Industry, Hospitality, Insurance, Leisure, Luxury, Retail

To request further information about Mr. Dardelin through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Reimagining Sales

How To Grow In a Context of Lasting Crises?

Reimagining sales is a program that answers the strategic question many leaders ask themselves: Have an organization and sales teams that adapt and change as quickly as the market requires.

By 2030, 99% of companies face two significant challenges:

• They operate in mature or declining markets. Core target customers are decreasing; new targets have different expectations and purchasing habits.

• They are in the context of lasting crises. Wars, climate change, health, or economic crises, one crisis replaces another. Change is permanent and becomes the norm.

Companies are realigning themselves and defining new strategies to maintain or recover growth: Acquiring new business, diversification, penetrating new markets, and improving the customer experience. Whatever the chosen method, the most essential part of their implementation involves sales transformation.

Until recently, companies took little interest in their commercial organization as long as turnover grew. Investments were reserved primarily for technology and innovation, sustainability, digital transformation, and the supply chain. When a change in strategy becomes vital for a company, it is not uncommon to make the following assessment at the sales force level:

• Sales managers have become “jack-of-all-trades managers”. They are overwhelmed and spend little time meeting with their customers and salespeople.

• Salespeople have often worked in the same sector and with the same clients for many years. They know their products and customers well but have strong habits. They do not see the need to change and often need help developing an agile and aggressive commercial attitude. They are often distraught when the company asks them to conquer new markets or sell products utterly different from those they were selling.

• The company did its digital transformation without modernizing and updating sales methods and processes. Salespeople apply simplistic argumentation and negotiation techniques inherited from the industrial era. They need to be more suitable for the digital era with a customer who carries out 70% of their purchasing journey alone and only requires the salesperson for the closing.

• The more sales fall, the more indicators we put in place to measure commercial performance. Reporting becomes a full-time activity. Salespeople must collect much data that only some know how to interpret.

• Business productivity is not considered an essential element of growth. Salespeople’s tasks and productivity are not tracked. Salespeople invest much time in activities not directly related to sales that are the responsibility of other departments.

• The remuneration systems are the same as elsewhere and do not interest ambitious candidates with exceptional qualities.

• Sales coaching is not regular or non-existent. The company has yet to understand that managing a sales force is like preparing athletes to win matches or competitions. No training, no results.

• Finally, implementing the new strategy is often limited to creating one-shot sales training lasting 2 to 3 days without upstream pre-training action and post-training follow-up with downstream coaching.

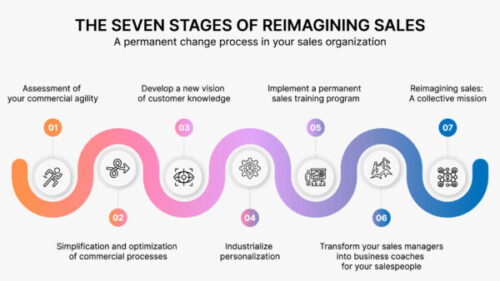

Industrialize and Personalize a Permanent Sales Transformation Process to Strengthen the Company’s Market Competitiveness.

Assessment of your commercial agility

The starting point of this 12-month program will be to help you complete an assessment of your organization and sales team. You can measure the turnover or margin you lose daily due to a sales organization that needs to be faster to integrate the changes that are a matter of survival.

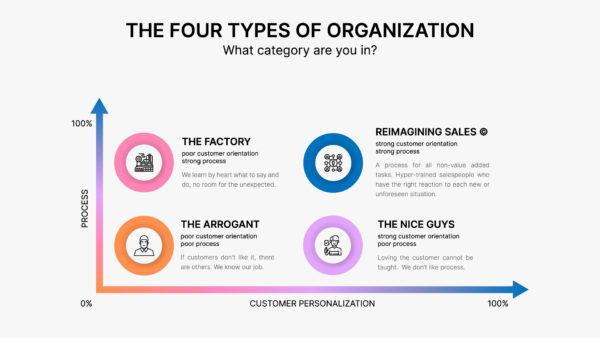

There are four types of organization in Sales Reengineering, which are the result of two dimensions:

The first dimension is process orientation. It is the ability to define and implement processes that save time, automate, and simplify commercial tasks with low added value or apply best practices that enable more sales.

The second dimension is customer orientation. Customer orientation is essential when faced with prospects or professional buyers who carry out 70% of their purchasing journey alone. The salesperson must provide value and service that the customer needs help to obtain. He no longer sells but advises the customer in his purchase. Customer orientation is also the ability to deviate from the process in the event of unforeseen events or unique customer requests not formalized in the methods.

Depending on whether your company is weak or strong on one of these two dimensions, you will belong to one of the four categories below, and we will be able to determine your work priorities during our program.

Simplification and optimization of commercial processes

Sales is initially a question of process and mathematics. It involves analysing the pre-sales, sales, and after-sales processes. The objective is to simplify and save time by removing heavy processes that have existed for years without any real impact on increasing sales.

Checking commercial mathematics means analysing whether the salesperson’s available time is allocated logically and reasonably. Do your salespeople’s customer portfolios have the right size or geographic distribution to occupy the market? Is the distribution between tasks not directly related to sales and those related to sales fair? Is your salespeople’s time and how they use it to sell measured and optimized constantly?

Concerning the processes directly linked to sales techniques and commercial behaviour, we will translate them into simple reflexes that are easily communicated and applicable daily. Sales is also about excellence, the sum of many admirably managed details.

Develop a new vision of customer knowledge.

You cannot say you know your client simply because they expressed their expectations and answered a few standardized questions during a 20 to 30-minute briefing. Reimagining sales involves a new vision of customer knowledge—a vision from neuroscience. When the salesperson meets his customer, he speaks to his brain. With around 85 billion neurons and numerous cognitive functions such as perception, attention, memory, language and decision-making, the client’s brain and decision process are much more complex than it seems.

Customer knowledge is about understanding the two systems of thought: automatic thinking and reflective thinking. The brain, which consumes 50 to 60% of body energy, prefers to decide quickly and switch to automatic mode to save energy. The downside of intuitive thinking is that you must take the time to think. More than 50% of our decisions are errors of judgment or cognitive biases. Understanding how the brain works knowing how to detect cognitive biases and how to respond to them is the basis of the salesperson who signs more deals than those who apply simplistic and rigid methods inherited from the industrial era.

Industrialize personalization

The personalization of the purchasing process and customer relations has become one of the significant challenges. It may seem contradictory to want to industrialize what must remain unique and adapted to each situation and each client. The digitalization of prospecting methods has saved salespeople valuable time but resulted in an almost anonymous relationship where the first contact with the prospecting company is an email with just a name without a telephone number.

The level of personalization is so low that it is possible to industrialize numerous personalization actions regardless of the sales channel used: telephone, email, web, in-person, or video conference.

Implement a permanent sales training program.

Establishing an ongoing sales training program is one of the essential elements of having a sales organization and sales teams capable of changing as quickly as necessary.

The sales world has become so complex, multi-decision-making, multi-channel, and multi-skilled that every salesperson can only sustainably develop sales if supported, trained, and coached daily, just like top-level athletes do. Sales has become a high-level sport, and salespeople must train regularly.

Based on the reasonably available time the commercial can invest in training, you will implement regular and rapid training actions lasting less than 10 minutes, independent of distance, location, and material conditions in which the salesperson finds himself.

Transform your sales managers into business coaches for your salespeople.

Sales Managers are the actual relays for implementing within your organisation a culture and practices of questioning and permanent improvement of commercial performance. 50% of the sales manager’s time must be devoted to supporting, training, and coaching their salespeople in sales situations.

We will provide you with proven techniques that allow you to train and coach your salespeople quickly, anywhere and without needing a room, support or training equipment.

Reimagining sales: A collective mission

Sales transformation can only be achieved with the help of other support departments. The marketing department will be essential to help the sales team be always present in the customer’s mind and without needing the salesperson’s presence.

The Human Resources department will help the Sales Department to innovate to recruit and integrate candidates with varied profiles different from the competition while having the essential soft skills in line with this culture of permanent transformation.

Ultimately, the Finance Department can measure the value of permanent sales transformation. His help will be necessary to avoid false successes. The percentage increase in turnover linked to transformation only makes sense if it is higher than the average of market competitors.

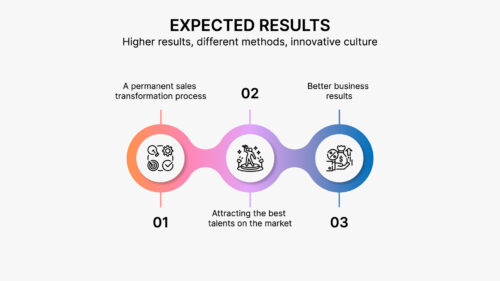

Expected Results

You will get three main results from this program:

A permanent sales transformation process

You will have completely changed your vision of what a sales organization is. Most companies have an attitude of reaction to difficulties and only ask themselves questions during the decline phase. You will develop a mindset of anticipation, and instead of redefining your sales strategy every 3 to 5 years with each market sneeze, your strategy will be permanent and fluid. The results will no longer result from profound reorganizational changes but from a permanent change process in your organization and sales team. You will no longer need to recruit a consultant to make the changes; you can take stock, define your objectives, and implement the transformations.

Attracting the best talents on the market

Because your results will be higher, your methods will be different, and your culture will be innovative, your model will attract the best talents in the market. You will not only be a company with the best human orientation, but you will have become an obligatory point of passage for any candidate wanting to make a career in your sector.

Better business results

Making changes to improve your business results can take a long time. Competitors often move faster than the time required to transform.

Because you will have perfectly integrated and will know how to balance customer orientation and process orientation according to the market situation, the time it will take you to integrate each new change will be less than that which will be necessary for your competitors. You will thus be able to overcome crises and challenges much better without hurting your margins, productivity, and commercial results.

Curriculum

Reimagining Sales – Part 1 – Year 1

- Part 1 Month 1 Turnover Killers

- Part 1 Month 2 Review Practices

- Part 1 Month 3 Simplify Processes

- Part 1 Month 4 Update Know-How

- Part 1 Month 5 Intensive Program

- Part 1 Month 6 Reflex Training I

- Part 1 Month 7 Reflex Training II

- Part 1 Month 8 Customer Knowledge

- Part 1 Month 9 Customer Brain

- Part 1 Month 10 Transform Sales Team

- Part 1 Month 11 Transform Sales Managers

- Part 1 Month 12 Permanent Transformation

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Reimagining Sales corporate training program.

Reimagining Sales – Part 1 – Year 1

- Part 1 Month 1 Turnover Killers – At the end of this workshop, you will have carried out in less than 30 days a laser assessment of your overall commercial approach, including your methods, management, team and IT tools and technologies. You will know what data to collect from your end customers, distributors, competitors, sales team and internal departments. You will have conducted in-depth qualitative interviews with experts who matter and know your business perfectly (customers/managers/salespeople/others). You will have identified and calculated your turnover killers. The turnover killers are summed up by the accumulation of methods, decisions, and actions resulting from your previous successes but never called into question and unsuitable for future challenges. You can sort through all the data collected to focus only on essential ones. You will have analysed your decision-making habits and know why specific projects or strategies failed. You will have all the necessary evidence to present the need for transformation to all stakeholders concerned: Unsatisfied or lost customers, daily loss of income, productivity losses, lost talents, organizational obstacles.

- Part 1 Month 2 Review Practices – At the end of this workshop, you will be able to organize, observe and compare the current practices of your salespeople with those that are essential for success. You will have defined clear observation objectives: What practices to observe? With how many salespeople? In what customer situations? Who will be the most qualified observers? You will have previously tested the easiest, most reliable and ethical observation methods: Listening to sales interviews over the telephone or remotely, accompanying the customer, audio and video recording of interviews with prior consent, and sample letters or emails addressed to customers. You will be able to design an observation grid with the factual skills and behaviour to observe. You will respect the confidentiality rules as well as the laws in force concerning privacy and work control. You will be able to put salespeople at ease and observe them in a non-fussy manner and without interacting. You will analyze individual observations and be able to identify trends common to all of your salespeople in terms of strengths or areas for improvement. You will carry out mystery shoppers to compare the level of practices of your salespeople with those of your competitors. You will be able to prepare and present to all the decision-makers involved the strengths, weaknesses and professional development opportunities for your sales team.

- Part 1 Month 3 Simplify Processes – By the end of this workshop, you will know how to continuously improve your sales team’s workflow and simplify sales processes. You will have understood that any commercial development is not initially a question of skills but of the number of salespeople and the available time devoted to sales. You will be able to simplify the workflow of your salespeople by identifying the tasks that directly contribute to sales and those that do not. You will have simplified your commercial reporting regarding the number of indicators and time spent collecting and interpreting data. You can communicate the results translated into immediately applicable actions to develop sales or reduce gaps. You will have reduced by 30% the number of meetings and participants linked to the coordination of your commercial activity.

You will have reduced the number of daily internal emails by 50%. You will have implemented a mode of monitoring commercial performance based primarily on the time spent selling, eliminating everything superfluous and non-essential. You will have established a list of tasks that need to be automated so that your salespeople can focus on what creates the most value in the eyes of your customers. - Part 1 Month 4 Update Know-How – By the end of this workshop, you will have translated all your commercial knowledge into simple, immediately applicable reflexes with an immediate effect on increasing sales and customer satisfaction. You will have understood that the difference between a salesperson who sells more and one who sells less is a question of words. Sales is like a foreign language; there are words which are understood by the customer, and which sell and those which kill the sale. You will have prepared a project for new commercial know-how based on observing current practices, mystery shoppers carried out with your competitors and your strategic needs. You will have written a commercial know-how project intended to be applied by your salespeople in an actual sales situation over the telephone, face-to-face, remotely, orally or in writing. You will have tested and timed your commercial know-how project in an actual sales situation with a representative sample of salespeople and customers. You will have new commercial know-how, allowing your salespeople to get to the point, sell quickly and well and be more innovative than your competitors’ salespeople.

- Part 1 Month 5 Intensive Program – By the end of this workshop, you will have defined with your sales team and your human resources department all the actions necessary to train your salespeople regularly. You will have understood that the sustainable increase in sales is the consequence of the skills of your salespeople. You will know that there are no good or bad salespeople but only salespeople who are highly, moderately, weakly trained or left to their own devices. You will have defined with your sales managers who will be responsible for constantly training and coaching your salespeople. You will have broken down all of your sales know-how into 5–10-minute micro training sessions. You will have prepared training programs adapted to three sales profiles: junior, senior, expert. You will have prepared training sheets allowing each manager to train your salespeople in any location and professional situation. You will be able to set up a motivating training program based on individual effort and surpassing oneself.

- Part 1 Month 6 Reflex Training I – By the end of this workshop, you will have gotten rid of all the politically correct false beliefs about training and sales coaching. You will limit the content of your training because you will know that it is not the number of techniques but only what your salespeople can memorize. You will have learned how the different memories in our brain work: working memory, episodic conscious memory, semantic conscious memory, long-term unconscious memory. You will know how, with the proper training method, your salespeople can memorize 80% of information or techniques in a few minutes. You will have started to practice the unique RUN TRAINING© sales training method developed by Olivier Dardelin. You can lead micro-training sessions of 15 to 30 minutes with groups of 1 to 8 salespeople without a room and training equipment in any workplace.

- Part 1 Month 7 Reflex Training II – By the end of this workshop, you will master all the intensive sales training techniques necessary to perfect your salespeople throughout the year. You will lead training sessions based on exercise and repetition of reflexes that sell. You will know that you should say petite and let your sales reps rehearse and practice 90% of the time. You will train your salespeople standing, all together in groups of 8 maximum, without PowerPoint, without taking notes. You will know how to train your salespeople in situations that are more difficult than reality. You will use exercises that will develop the concentration, questioning skills and response speed of your salespeople. You will have developed the attitude of the sales coach: factual, demanding, customer and results oriented.

- Part 1 Month 8 Customer Knowledge – By the end of this workshop, you will realize why, in the era of the digital economy and artificial intelligence, a deep knowledge of each customer is strategic. You will know by what means which customer data to collect: Simple data with low added value using the WEB, strategic data through your salespeople. You will have understood that with approximately 86 billion neurons that make up their brain, each customer is a unique, complex being. Wanting to put them into ready-made profiles is the quickest method to miss the sale. You will no longer use methods of categorizing customer profiles with no scientific evidence. You will acknowledge that in an economy where the customer does 70% of his purchasing journey alone, he has already formed an opinion before knowing you. Every salesperson or sales method must be more robust to change customer opinion quickly. You will be able to train your salespeople to use an innovative customer knowledge method that breaks with all traditional sales methods. You will save time and convert more sales by moving from a sales strategy with the same marketing arguments for everyone to sales arguments based on the values, opinions and deep motivations of the customer.

- Part 1 Month 9 Customer Brain – By the end of this workshop, you will understand that the new paradigm for transforming more sales is to understand how our brain decides. You will throw away most of the methods of argumentation which come from the industrial era and need to be more modern. You will know that the brain works and decides in two ways: Automatic thinking and reflective thinking, which requires cognitive effort. You will understand the psychological, biological and emotional reasons why the client decides too quickly and makes judgment errors in 50% of his decisions. You will realize why you missed sales when you were technically and commercially the best. Your salespeople will be able to outwit and use to their advantage the principal errors of judgment encountered in sales situations.

- Part 1 Month 10 Transform Sales Team – By the end of this workshop, you will know which coaching or training actions to choose to obtain maximum efficiency for a fair budget. You will have understood that faced with constant changes in the market and your customers, your salespeople cannot improve alone. You will take stock of the time spent by your sales managers monitoring and coaching their teams. You will redefine the priorities of your sales managers so that 50% of their time is devoted to coaching their teams. You will be able to set up a monthly and annual coaching plan for your sales team with the main actions and expected results. You will set coaching objectives with your sales managers. You will have prepared the training content intended to transform all your sales managers into sales coaches.

- Part 1 Month 11 Transform Sales Managers – By the end of this workshop, your sales managers will be able to: Apply the techniques that sell, correct the smallest detail and push each salesperson to give the best of themselves. Prepare quickly and well for each sales coaching session. Get the salesperson to talk about his progress and difficulties observed since the last coaching. Observe the salesperson in an actual sales situation and note everything that is said and done by the salesperson and the customer. Focus as a priority on the obligatory reflexes which contribute the most to increasing turnover. Carry out a debriefing of the observed sales situation in 10 minutes flat. Agree and encourage the salesperson to propose the priority practice to improve. Prioritize correcting practices that have a direct influence on increasing sales. Immediately after coaching, improve salespeople on unlearned practices. Check within 3 to 10 days after coaching that the salesperson’s results are progressing. Adopt factual and demanding coaching behaviour. Handle difficult coaching situations brilliantly.

- Part 1 Month 12 Permanent Transformation – By the end of this workshop, you will be able to: Define common objectives between the sales department and key functional departments: Marketing, Finance, HR. Take stock of the help and tools provided by the support departments to the sales department. Determine the actions that require input from both the sales department and another support department to achieve the objectives. Evaluate what data and KPIs should be shared by the sales department and support departments, how to use and interpret them. Encourage all departments involved to focus on keeping a customer-centric approach. Establish action priorities and tools to change or improve by marketing, HR and finance so that sales transformation is a permanent process.

Methodology

Reimagining Sales

Program planning

Accept the transformation and change vision of sales management.

The commercial department is the strategic department of any company. The main obstacle to growth is that many management committees need an updated vision of managing a sales force. How often have we heard from management or sales committees, “We generally do this”. Statement to which we respond: “Would you agree to be a passenger on a plane in which the pilot tells you «Usually I land?” The mediocrity of the recruitment system, integration, weaknesses in remuneration, insufficient investments, lack of ongoing training, and lack of management time and coaching dedicated to salespeople are the situations commonly observed in many companies. The sales department is always the one that must do with few resources. The Management Committee will quickly decide to invest millions in a new IT development requested by the IT or Finance department or in recruiting ten people for the marketing department. Still, when the Sales Director requests a new tool for his salespeople, he will be refused or told to deal with marketing.

The critical element of the success of this program is based on the ability of the company’s executive committee to abandon at the start of the project its current paradigm of the organization and management of a sales force and adopt a new one:

• The commercial department is the strategic department of the company.

• The mode of operation must move from “generally we do it to systematically we do it.”

• Recruit, integrate and train ambitious, intelligent salespeople and pay them very well.

• Have a training and management system designed in such a way that salespeople devote 90% of their time to customers and winning over.

Finally, we will help the company adopt a mode of operation and decision-making from the world of aeronautics to predict disasters: Fail-Safe & Safe-Fail. The goal of Fail-Safe is to ensure that nothing will go wrong. The safe-fail policy accepts that errors are inevitable and seeks methods and responses to overcome the obstacle when mistakes occur. Thanks to this new mode of operation and decision, we can quickly increase sales by 10 to 15%. There is no increase in turnover; we recover the sales we lose every day due to an unsuitable and non-rigorous method: The Turnover Killers.

Program Development

Simplify as much as possible

Over the years, companies have implemented processes and methods to analyse results, automate specific tasks, share information, make faster decisions or control quality. Each time the company implements a new technique or procedure, it adds to existing ones with the consequences of complicating instead of simplifying, creating duplicate tasks and slowing down execution to make it more fluid. We call it the mille-feuille procedure compared to the cake of the same name, where we add one layer of dough to the others. Therefore, we arrive in situations where sales teams create their visit preparation tool on an Excel grid because no internal database contains all the information helpful in preparing their sales visits. It is not uncommon for the company to have defined and measured so many Key Performance Indicators that we spend more time measuring sales that we have not made than selling. It is common to note that many salespeople devote at least 40% of their monthly time to tasks not directly related to sales.

The maximum simplification of all commercial activity tasks and processes will benefit salespeople’s productivity and ensure that 90% of sales time is devoted to customer knowledge and sales. An accurate surgical operation will be carried out within your organization to eliminate, simplify, and automate meetings, reports, procedures, and rituals without adding value and slowing down commercial conquest.

Program implementation

Leave nothing to chance.

The updating and formalization of commercial best practices at each stage of the customer journey must be as precise as the technical guides given to the cadet to obtain their pilot’s license. Most commercial know-how books are too synthetic and develop sales and negotiation methods from the industrial era. We put customers in socio-professional categories with the same arguments for everyone. The objective is to build exhaustive and rigorous know-how so that your salespeople save time and have all the answers to 70% of recurring commercial situations. We translate the know-how into reflexes that are easily communicated and memorized in a training session of less than 10 minutes. Several pages don’t define excellent know-how. The salespeople’s ability to memorize it and apply it in real-life situations makes it excellent.

Change your vision of customer knowledge.

In the era of hyper-personalization, each customer is unique, and that is what he asks for. All sales and negotiation methods need to be updated because they have minimal effect on the conversion rate. Specific pseudo-scientific methods such as the DISC method or emotional intelligence have no scientific basis, and no scientific study or meta-analysis has been able to demonstrate and reproduce what they put forward. With 85 billion neurons, the client’s brain is complex. To please him and make him buy more, we must understand the psychological, biological, and cognitive foundations of the customer’s brain. How does the customer remember information? What are the different memories it uses, and how? When to request them. When and for what reasons can the customer enjoy the purchase? How does the natural reward system work? How do you request it during the commercial process? What is a mental map? Can we understand the customer’s mental patterns when purchasing? How the customer evaluates an offer, a product, or a price in his brain. Where does he make errors in judgment? How do we recognize and use all clients’ main mistakes of judgment? The objective of this phase is to abandon all sales techniques and move on to commercial reaction techniques in response to customer behaviour resulting from recent discoveries in neuroscience.

Train your sales teams like high-level athletes.

Success is not a question of knowledge but of tireless and daily repetition of the techniques and behaviour that sell, just as top athletes practice to win a competition. Sales teams need more training to perfect or learn new practices in line with customer or market needs.

Often, the HR department sets up training for sales teams when results are dangerously declining. A “one shoot” panic training prepared too quickly, and which will be followed by little effect.

Like high-level sports, for sales to reach peaks, salespeople must continually train and improve to be better than competitors’ salespeople or have the best responses and behaviours when faced with complex or unforeseen customer situations.

We implement a permanent training system based on repetition in the form of micro-sessions of less than 5 to 10 minutes of face-to-face training on the phone or via Teams. The main messages to remember are reminded weekly by email or text message. The primary tool used is the salespeople’s smartphone. The objective is to encode the unconscious memory in the long term through repetition for each essential technique to be applied naturally and fluidly in a real-life situation. There are no good or bad salespeople; only salespeople are hyper-trained or left to their own devices, and your results depend on the intensity and regularity of their training.

Program review

We will evaluate and improve the program as follows:

Key Performance indicators

We jointly set three types of KPIs at the start of the program.

1. Quantitative KPIs to measure increased sales and improved sales productivity.

2. Performance improvement KPIs intended to measure the improvement of processes resulting from training (reduction in prospecting time, increase in the number of customer requests, updating of customer files in the CRM).

3. Quality KPIs such as an increase in the number of active customer references, NPS score or other.

Assessment of the impact on participants:

We are establishing a questionnaire given to each participant in the program and intended to assess how the program is adapted to their concerns. This impact questionnaire allows, after administration, to adjust the program and the objectives or improve the support provided to each person.

Evaluation of learning:

The objective is to verify no gap between the training content and the application after the training. After each workshop, we evaluate what each person understands and how they apply it daily.

Evaluation of the results:

We evaluate the results by pre- and post-program measurement of the above KPI performance indicators.

Industries

This service is primarily available to the following industry sectors:

Automotive

History of Automotive

The word automobile means that it moves by itself. According to historians, the first machine that meets this definition is that of Ferdinand Verbiest, manufactured in 1668 for the Emperor of China.

With the age of steam, the first road vehicles appeared in England around 1800 but were abandoned for the railways. The state of the roads at the time was not suitable for this type of vehicle. The invention of the first internal combustion engine by the Belgian Etienne Lenoir in 1860 allowed him to replace the boiler used to move cars with its engine. The automobile, in its modern form, was born. Gottlieb Daimler and Nikolaus Otto were the first to imagine an internal combustion engine 1885 for mass production. They founded the Daimler company to equip all types of vehicles: automobiles, boats, and aeroplanes.

Then come inventions that will eliminate the difficulties that automobile owners face. Michelin then Dunlop invented the first tires in 1890, reducing rolling resistance and providing better stability and grip. The first gasoline pump was born in 1901.

The first manufacturers, some brands of which still exist today, were created between 1890 and 1910. The country we find the most is France with Peugeot, Renault, Panhard & Levassor. Aperson produced the first American cars. Other events that will transform a machine into a legend will then occur.

The first automobile races were the Gordon Bennett Cup in 1889, the French Grand Prix in 1906 and the Monte Carlo Rally in 1911. Speed records followed: Stanley Steamer exceeded 195 km at Daytona Beach on January 26, 1905.

Henry Ford’s dream was to make simple, robust automobiles for everyone. He realized his dream by producing and selling more than 16.5 million Ford Ts between 1908 and 1927, thanks to assembly line work.

The period between 1920 and 1940 is the expansion of the automobile sector. The first luxury brands and models appear. Each manufacturer competes in creativity and innovation: Bugatti, Mercedes, Cadillac, Rolls Royce, and Bentley. The first hydraulic brakes were created. The golden age of automobile development was between 1945 and 1945. World vehicle production increased from 10 million to 30 million. The first oil crisis in 1973 marked the turning point of a new era in the search for smaller cars that consumed less. The Japanese brands Toyota and Honda understood this need before others and established such commercial success that American manufacturers asked their government to limit imports of Japanese cars.

After the era of brand consolidation and globalization from the 1980s to 2000, since the 2000s, the automobile has taken two directions. The first direction is that of autonomy. We are moving from cars that park themselves to vehicles that can take us from point A to B without any human intervention. A second direction is that of the environment with the gradual abandonment of thermal engine cars in favour of hybrid or electric vehicles with low or zero CO2 emissions.

Automotive market today

The global automobile market is estimated at 2 trillion USD in 2022 and will reach 2.46 trillion by 2028, with a growth rate of 2.79%. We distinguish two activities. The first is the activity of designing, manufacturing, and selling vehicles (automotive), and the second is maintaining and repairing cars (automotive aftermarket). The automotive aftermarket industry is valued at 427 billion in 2022 and is expected to reach 828 billion in 2031.

More broadly, the global automotive market includes all industries involved in vehicle production, from suppliers of raw materials (steel, plastics, electronic components, and others) to manufacturers, automobile dealers and distributors. – repairers, distributors of spare parts, credit organizations, and fleet operators.

The top five vehicle brands in the world are Volkswagen, Toyota, Renault, Nissan Mitsubishi, General Motors, and Hyundai-Kia. The market includes four main segments: passenger cars, light commercial vehicles, heavy commercial vehicles, and two-wheelers. Manufacturers today produce cars in response to three significant expectations. The first expectation is zero CO2 emissions. Governments and consumers sensitive to climate change request it. The production of electric vehicles continues and will grow more and more. The second expectation is that of security and zero risk. Notably, 90% of road accidents are the consequences of human errors. Today, many vehicles are equipped with driving assistance and collision avoidance systems while awaiting the marketing of 100% autonomous vehicles by 2025.

The third expectation, given current fuel prices, is to continue to produce ever more economical cars with thermal or hybrid engines by using ever lighter materials or ever more economical engines for the same number of kilometres travelled.

However, this market has numerous weaknesses or threats. Electric vehicles are more expensive to produce, and the sales prices for the end user are much higher than for a car with thermal engines.

The market depends on its supply chain; COVID and the war in UKRAINE have had a negative impact, and delivery times to obtain a new vehicle have doubled. Our global situation of lasting crises affects the budget that the end consumer devotes to his car. New entrants threaten Manufacturers. They offer new vehicles through monthly subscriptions. Constant changes in regulations from different governments impact costs and sales. Ecological taxes for the purchase of the most polluting cars can double the vehicle’s selling price. However, many opportunities remain, such as exploiting emerging markets, improving electric cars, or partnerships with tech companies to produce autonomous vehicles.

Trends and strategies for the future

Several strategies are emerging by 2030 relating to the future automotive industry.

The first strategy is that of the digital car. It involves onboarding all the necessary means to connect the vehicle to the Internet and make the driver experience more pleasant or practical. This connected technology will provide access to remote diagnostics, vehicle health reports for technical aspects, or all the comfort linked to internet access for leisure trips. Google and other pure players will become the industry’s essential partners. Automotive repairers must develop their profession, training, and resources accordingly.

The second strategy is that of the development of hydrogen vehicles. The hydrogen vehicle has more advantages than the electric car while offering zero CO2 emissions. It can fuel in 5 minutes for a range of 500 km. It requires less infrastructure than electric vehicles in charging stations because they are similar to gasoline vehicles.

The third strategy is that of the second-hand market. Today’s used vehicles less than four years old with less than 100,000 kilometres are reliable, often like new and much less expensive. Many distributors are entering the pre-owned/used car market.

The fourth strategy is that of digital sales. More and more manufacturers or distributors are offering customers the opportunity to buy their vehicles online without going to the showroom. Distributors must equip themselves with virtual demonstration technology. Does this mean that the sales teams of manufacturers and distributors will disappear? Disappear, indeed, not transform yes. In terms of Business-to-consumer sales, the end customer no longer needs a salesperson to buy their car; they will, however, need advisors to get the most out of the use of their vehicle, whether for financing or insurance. , its daily use, and its repairs, but to date, this point is the fundamental weakness of all automobile distributors where the sale of financing is more an opportunity to make more margin by offering credits at exorbitant rates rather than offering a solution that will satisfy and retain the customer.

In terms of Business-to-Business sales involving salespeople from all players in the industry, from those who sell raw materials to those who sell spare parts, the contribution of technology to all stages of the chain will involve exceptional technical advice and sustained relationships without which none of the players will be able to respond to market transformations.

Will the automotive market become like that of smartphones, where the important thing is not the brand of phone but the applications we can download? Will there only be one brand that will stand out, like Apple, and the others that will follow?

Fast Moving Consumer Goods

History

The history of the consumer goods market and humanity are linked. The difference between this market and all others is that we are both consumers and producers. It started in prehistory, where the first products were food, then tools or weapons. In those ancient times, producers made products only for immediate and personal use. With time and improved living conditions throughout the ages, producers began to produce more than they needed. Still, they realized they could only produce some of what they needed.

Producers, therefore, began to get closer to each other by exchanging the products they produced for other products. With this system of barter and producers’ interdependence among themselves, economies were born. However, from the 19th century, the industrial era made it possible to mass produce products that only the middle class living in the cities could afford to buy. After the end of the First World War, human beings became consumers. Reducing worker’s working hours was the primary trigger, allowing everyone to have free time to buy. A society with new values was born; Happiness linked to desire with money and consumption to satisfy this desire.

The deprivations and injuries of the Second World War caused consumption to explode. The appearance of new forms of sales makes it possible to arouse consumer desire: Propaganda, which has become advertising. The appearance of television in every family increases the impact of advertising on purchasing and consumption. Human beings no longer buy products out of necessity but out of desire. The science of marketing appears based on certain discoveries of cognitive psychology, such as the mere exposure effect, where the more we are exposed to a message or a stimulus, the more it influences our perception (positive) and our behaviour (purchase).

The scarcity of resources, the increase in the world population, which rose from 4 to 8 billion between 1974 and 2020, and the ecological emergency are now calling consumption into question. The logic of endless growth is no longer a positive model among the youngest generations. Humanity is moving towards thoughtful, equitable, and sustainable consumption.

Fast moving consumer good today

The fast-moving consumer market is a huge one. It is valued at 11.32 trillion USD in 2022 with an average growth rate of 5.03%. The forecast is 15.2 trillion USD by 2028. This market is quite challenging to define because it is very heterogeneous regarding products ranging from cosmetics, food and beverage, and cleaning products to small electronics or tobacco. Today’s market is divided into four segments: Food and beverages, personal care, health care and home care. There are four categories of products: perishable and non-perishable products for food and durable and non-durable products for non-food.

The characteristics of this market are the sale of very high-volume products at low margins with high inventory turnover. The benefits to the consumer are inexpensive products that he purchases effortlessly for immediate or short-term use. Large, internationally known brands make up this market. The top 10 are Nestlé, Procter & Gamble, PepsiCo, Unilever, AB InBev, JBS, Tyson Foods, Coca-Cola, L’Oréal, Philip Morris.

Although this market is highly competitive, many factors favour its development:

1. Global population growth will increase by more than 2 billion people between 2023 and 2050.

2. There is an increase in average disposable income per individual, mainly in developed countries.

3. The migration of populations to urban centres increased the consumption of FMCG products.

4. Finally, the explosion of e-commerce platforms makes purchasing these products easier.

However, past business models do not guarantee future success. Consumer expectations reinforced by government policies have dictated changes or innovations from many players.

The tobacco market has a poor reputation among consumers and public health organizations. Tobacco taxes have been doubled in many countries; PHILIP MORRIS was forced to innovate by creating an electronic cigarette without combustion to reduce the effects of nicotine.

The food and beverage market has been impacted by consumers’ desire to lead a healthy lifestyle. Brands must imagine foods without sugar, fat, and chemicals like nitrites. The edible oils market is losing momentum; Generation Z, or millennials, are not cooking anymore and using less oils.

Major cosmetics brands like L’OREAL are being attacked by newcomers who offer cosmetic products without synthetic preservatives, parabens, silicones, and mineral oils. New applications make it possible to read the composition of cosmetics immediately to alert the consumer whether the product is natural or organic (Yuka, Incibeauty). Biodegradable packaging is becoming a selling point or at least a concern for all market players.

In less than 50 years, the FMCG market has gone from a market where almost everything was manufactured and sold to uninformed and passive consumers to a context where those who want to continue to develop must work and innovate with and for the customer.

Trends and strategies for the future

Ecology and sustainable development

Respecting consumer aspirations for a healthier life and preserving the planet’s resources is no longer an option. Consumers expect brands to adapt products to their lifestyles, and this translates into organic, vegan or locally made products with a low carbon impact.

Packaging must be adapted to these expectations with plant-based and recyclable packaging, display of components or deposit of containers.

Customer experience as a key differentiator

This market has really changed because the consumer is becoming a customer again. Brands realize that they can only succeed by developing an authentic customer experience.

75% of consumers prefer to buy products from a brand that knows their name and purchase history. 76% of them think that brands absolutely must understand their expectations and needs.

The customer wants to avoid being inundated with promotional emails or leaflets. He wants to know the offers that suit him rather than randomly. The customer wants to be interviewed intelligently, not so that we sell them more but so that they can better buy the products that suit them at the time they want.

Brands must combine all customer data from physical stores with digital platforms to respond to this challenge and thus move on from Mass Marketing or Smart Marketing.

Become the business coach for Hypermarkets and Supermarkets.

The FMCG market has always been closely linked to its distribution channels. Supermarkets and hypermarkets constitute the most crucial channel. The latter are facing a change in business model and an evolution in the behaviour and expectations of end customers in stores. The increase in gasoline prices in almost all countries makes consumers hesitate to take their cars often to the supermarket, located 20 kilometres from their homes. The average time spent in store is decreasing. Department managers are overwhelmed because they are often understaffed. Visits by brand salespeople in supermarkets are done standing up and should last 15 to 20 minutes.

These changes mean that brands’ wholesale salespeople are still selling using the commercial approaches and techniques of the past and are struggling to change. The ability of brands to transform their commercial strategy is essential. Their sales teams are now in more than just stores to sell; they are also there to help the store team develop their full potential and go beyond store penetration.

Insurance

History of insurance

Psychology and stress have been the foundations of the development of insurance since antiquity. The perception of stress linked to unpredictable risks (life, health, loss or destruction of property) motivated the human race to imagine insurance. Two conditions make the need for insurance products possible. The first is the frequency of the event, which creates the necessity, and the second is the unpredictable side, which makes the event impossible to control. Buying insurance is a coping strategy to reduce a significant perceived stressor.

We found the first forms of insurance in 1750 B.C. with the code of Hammurabi. Merchants could then pawn a ship’s cargo for a loan. The insured was not required to repay the loan if the ship sank. The insurance and a loan were linked. It was in the 14th century that the first insurance contracts separate from loans appeared in Genoa, with the calculation of a premium based on risks.

The first life insurance appeared in 1583 in England and then in France. This first attempt was unsuccessful, as insurers needed more risk assessment methods. We had to wait for the work of Blaise Pascal in 1654, which opened the way to calculating probabilities to assess risks. At the same time, Edmund Halley’s research on births and mortalities made it possible to calculate the price of life annuities and the use of mortality tables. This work is at the origin of underwriting techniques for risk assessment and calculation of insurance premiums. This innovation established the foundations of insurance as we know it today.

Insurance products then emerged for almost everything. The first fire insurance policies were invented in 1680 in England by the economist and physicist Nicholas Barbon in response to the Great Fire of London of 1666, which destroyed nearly 13,000 houses.

Insurance then slowly migrated to the new world, where investors financed and insured the journey of the first settlers by signing at the bottom of the ship’s manifest, ready to leave in exchange for a share of the fruits of their labour once they arrived in America: The Tobacco harvest.

The history of insurance is too long to be told in a few lines; what we must remember is the incredible creativity that was implemented both to make insurance a profitable business and its positive impact on society by protecting companies and individuals and allowing them to realize their dreams of conquest over time.

Insurance today

The global insurance market is estimated at $6.7 trillion in 2022. Insurance comprises two main areas: life insurance products (41% of turnover) and non-life insurance products (59% of turnover). The USA occupies first place with 44% market share, followed by China (10.3%) and the United Kingdom with 5.3%. The leading players in the market are:

• ALLIANZ was founded in 1890, is present in 70 countries and is based in Munich, Germany.

• AIA Group Limited was established in Shanghai in 1919 and is a leader in the Asia-Pacific region. AIA is one of the largest life insurance companies in the world.

• AIG (American International Group), founded in 1919 and based in New York, represented in 80 countries; AIG is known for its three main orientations, which are general insurance, life insurance and retirement

• AXA, created in 1816, is based in Paris and is present in 57 countries. AXA dominates life and savings, property and casualty, and asset management.

Despite an uncertain global economy that impacts profits, the solvency of insurers, and the revaluation of insurance premiums, growth prospects could reach 7.5 billion in 2027, with an average growth ratio of 4.4% between 2023 and 2027.

Three elements fuel these forecasts. Number one is the increase in disposable income per capita in developed and developing countries, thus creating opportunities to insure what is not yet covered or develop life insurance: number two is the urbanization of the world population. More and more people are migrating to cities. They will need all the insurance products to cover their new lives (home insurance, accidents, theft, natural disasters). Number three, technology with artificial intelligence, blockchain and extensive data analysis will make it possible to attract new customers by reducing costs and offering a better customer experience.

However, insurers have new challenges. Insurers must be agile and creative to attract and retain new customers rather than simply offering and insure historical risks. In response to the new expectations of customers who demand more and more flexibility in their insurance products, new players are offering innovative products such as usage-based insurance, insurance on demand and insurance equals. An example is Rideshare insurance, which guarantees the risks of those who use their car to be a UBER driver.

Another challenge is finding the balance between clients’ need to insure against the risks of natural disasters or climate change while maintaining an optimal level of profitability.

Cyber risks have become a genuine concern. Insurers must offer innovative products to protect their business and individual customers from digital risks while protecting themselves from these threats.

Faced with all the threats that have emerged over the last fifty years (wars, epidemics, economic crises, natural disasters, terrorism), insurance companies can no longer cover all risks alone without states or other financial organizations sharing these risks.

Trends and strategies for the future

Customers, customers, and customers

Gone are the days when the insurer signed an insurance policy, played golf with its main clients, and kept them twenty to thirty years without any follow-up other than the insurance premium renewal. Innovation and customer experience will be the keywords for success in the business or individual market. In this context, the insurance agent, which produces around 45% of the turnover generated by insurance companies, is a strategic channel. The insurance agent is a real asset by having daily contact with customers, whether on the telephone or in an agency. The relationship and support given by the insurance company must bring about a real revolution. Until now, insurance companies were content to offer products to agents, giving them ready-made marketing arguments in terms rarely understandable by the end customer and putting pressure on agents regarding turnover, loss ratio and net contribution.

The profession has become so complex and requires so much time that the insurance agent must benefit from different support from his company. It must no longer only offer products to sell but also help the agent to sell simple products quickly and well to the end customer and better manage its employees because they are the ones who sell and provide the tools so that the agent knows how to develop its business network without wasting too much time. The insurance company must adopt a new posture and become the business coach of each of its agents.

Business-to-business orientation

Initially, the insurance market focused primarily on where the most volume was to be made: the individual market. To grow, insurers will have to adopt a much sharper B2B development strategy, especially as this market is much easier to develop. Entrepreneurs are much easier to convince when purchasing insurance products, with risks and amounts being much more significant than in the individual market. Productivity gains are much more important; a single entrepreneur does not take more time to convince and can generate much more turnover than an individual. The net contribution is 3 to 4 times higher, a single company having many risks to insure.

The difficulty for insurance companies in implementing this strategy will lie in their ability to innovate and offer products in response to the problems of each profession as well as to train their internal resources and their sales teams in contact with brokers, agents and end customers to see insurance not as an insurer but as an entrepreneur.

Aviation

History

The history of aviation is linked to man’s dream of flying. We distinguish two periods. The first period went from 1783 to 1888, when inventors flew machines lighter than air: hot, gas, or dirigible balloons. The second period of heavier-than-air began in 1888 when Gottlieb Daimler, thanks to its Daimler gas engine with two propellers, achieved the first powered flight in history.

Wilbur Wright realized in 1908 the first passenger flight. He flew 2,000 feet above Kitty Hawk Beach in North Carolina with Charles Furnas. The first commercial flights started in 1914 with a line between St Petersburg and Tampa in Florida. Even if this adventure only lasted a few months, it made many entrepreneurs want to develop this new form of passenger transport at a time when maritime transport dominated, and rail was in development.

As the planes were not pressurized, flight altitudes were low, and turbulence was frequent. The inside of the cabin was noisy, and it was cold. Many passengers suffered from anxiety and airsickness. It was not until 1935 and the entry into service of the first DC3 that the development of air transport improved. Faster and more efficient, this aircraft could transport 32 passengers with a range of 2,400 kilometres.

The entry into service of jet planes after the Second World War increased the number of passengers transported worldwide from ½ million in 1934 to 108 million in 1960. Although passengers no longer suffered the discomfort of aircraft at that time, only wealthy passengers could afford commercial flights. It was in 1966 that an English entrepreneur, Freddy Laker, had the idea of creating a low-cost, no-frills airline. This new business model democratized air transport and transformed it into mass transport. Aeronautical engineers then developed aircraft based on two different concepts.

Larger aircraft with the incredible success of the Boeing 747 allowed, depending on the version, to transport up to 660 passengers in a single class and faster aircraft with supersonic flight and the commissioning of the Concorde to connect Paris to New York in 03:30. Too expensive, too polluting, the Concorde was a commercial failure and disappeared in 2003. The deregulation of air transport initiated by the USA in 1978 made it possible to reduce the price of plane tickets by more than 50% in less than 30 years. This deregulation forced airlines to merge and regroup. Twenty companies now control 70% of global air traffic. This grouping goes hand in hand with airports that aim to capture passenger flows by offering airlines cost optimization and commercial leisure areas for passengers. Twenty-five airports alone attract 80% of global passenger traffic.

Since September 11, 2001, air transport has suffered numerous disasters: Terrorist acts, the eruption of the Eyjafjöll volcano in 2010 leading to the closure of airspace in many countries, the COVID crisis and recently, the war in UKRAINE. Despite these tragedies, air transport plans to double by 2050, carrying nearly 16 billion passengers.

Passengers’ aviation today

Whether for tourism or business, Passenger aviation has become the industry of freedom. It made it possible to transport more than 4.2 billion passengers in 2023 and achieve 35% of international trade value by impacting many other sectors. IATA counts over 5,000 airline codes worldwide, with around 800 operating regularly. The turnover achieved in 2023 is 642 billion and exceeds that of 2019 before the COVID period, which was 607 billion. The cumulative losses of the COVID period between 2020 and 2022 amount to 180 billion. Experts conclude that, depending on the country, it will take more than twenty years to absorb these losses.

In passenger aviation, there are two different areas of activity.

1. Airlines are divided into full-service carriers (FSCs) and low-cost carriers, each meeting different customer needs.

2. Airports and all associated services are inseparable partners of airlines, whether for optimizing routes or contributing to the customer experience during travel.

The market rebounded positively following the COVID period for the following reasons:

• Air travel is the preferred means of travel. The increase in disposable income of the middle classes, particularly in developing countries, is boosting demand. The Asia/Pacific region should add around 2.5 billion passenger journeys per year by 2040.

• There has been an increase in the number of low-cost airline routes. This segment has become extremely popular by making air transport accessible to many destinations.

However, the sector faces numerous constraints. The volatility of fuel prices is a headache for airlines, resulting in an impact on margins and an almost permanent reassessment of budgets. Cybersecurity is becoming a prominent concern. The increase in technology, whether for operating aircraft or developing the customer experience, makes airlines easy prey for hacking and data theft.

The global geopolitical context of wars and economic crises plunges airlines into a context of lasting crises and the threat of overnight reduced demand.

There is inequality between airlines and airports. On the one hand, companies must constantly adjust their prices downwards and strategies in the face of competition and the crisis context. On the other hand, airports are almost all in a quasi-monopoly situation and are increasing their fees. For example, airport charges per passenger have practically doubled in Europe in less than ten years, while airline revenues have fallen by 11%.

Trends and strategies for the future

The sector plans to double by 2050, going from 4.2 billion in 2023 to 9 billion in 2050. This increase can only take place by planning the answers to specific points.

Carbon footprint and sustainable development

Air transport contributes 2% to human-made CO2 emissions, adding to this the instability of fuel prices; the different players must innovate. IATA’s objective is to eliminate net CO2 emissions by 2050. The first idea is optimizing current aircraft’s carbon signature by making them lighter and cleaner and consuming less per kilometre per passenger. The second idea is to find new means: Solar planes, electric planes, hydrogen, or synthetic fuels. In any case, and in view of current technical advances, it isn’t easy to imagine transporting 500 passengers within 20 years with solar or electric motor devices. The alternative fuel route seems a much better option.

Ready to fly passengers

The current and future trend is to reduce the time and all the constraints and control of the passenger during their trip. This objective is based on two elements. The first is to invest in automation and digitalization: Creating and verifying a digital identity for the passenger using their smartphone and boarding pass with biometric identification.

The second element to consider is airports’ ability to streamline passenger traffic. Airports today are often crowded, and delayed flights are frequent; even with improved infrastructure, this situation cannot only be resolved in the short term.

Staff shortage

The industry faces two challenges regarding staff shortages. It must rebuild following the loss of jobs during the COVID period and anticipate future recruitment linked to increased air traffic. In terms of recruitment, training, and integration, this implies imagining new ways to ensure that the time needed to find resources is most required to fill positions. This policy can only be achieved with the help of governments. To deal with the shortage of pilots, the American government, for example, offers a visa with a residence permit to all foreign pilots who want to come and work in the USA.

Customer satisfaction

Many dimensions of the service influence the passenger’s decision to choose one airline or another—the ease of booking, the price, comfort in the cabin, schedules, and service personalization. Companies and airports must continually invest in better infrastructure, services, and amenities to stand out from the competition. This permanent update will require heavy investments, which will impact profitability. The different players will have to balance their commercial strategy between the level of service offered to satisfy the customer and the investment to achieve this. Air Berlin, a low-cost airline, is leading the way in this search for more service while maintaining margins and, to stand out from the competition, offers a 24-hour telephone assistance centre and a loyalty program popular with their customers.

Retail

History of Retail

Retail is one of the very first forms of commerce, which appeared with the creation of writing, currency, and the emergence of the first urban centres. Since ancient times when farmers sold their products directly to city residents in marketplaces, Retail has evolved and taken on completely different forms in line with demographic, economic and technological developments.

From antiquity to the 18th century, Retail was mainly independent businesses often run by families where you could find everything from groceries to fabrics, remedies, or all types of tools and materials.

With the appearance of machines and the first industrial revolution, new retail points of sale appeared: department stores. Machines then made it possible to manufacture large quantities of everything previously made by hand. Factories are being set up in or near cities and need employees mainly from the countryside. The demographic evolution of cities combined with the capacity of factories to mass produce favours the creation of Department Stores, whether Harrods (London), Macy’s (New York), Galeries Lafayette, Bon Marché, Printemps (Paris) or KaDeWe (Berlin).

Telegraph and radio of the second industrial revolution shortened distances. Stores can stay open longer thanks to well-equipped electricity networks. The development of rail networks makes it possible to distribute products more quickly and further from a single production location. Everything is ready to imagine new store models that can develop nationally. Chain stores and supermarkets appeared between 1920 and 1930.

The first shopping centres or shopping malls then appeared around 1950. With the expansion of the suburbs and the possibility of having their car, the consumer was quick to take their car and drive tens of kilometres to go to a shopping centre, which brings together all the stores rather than walking in town.

According to the economist Jérémy Rivkin, industrial revolutions result from an association between energy sources, means of transport and communications. The scarcity of energy, the ecological emergency and the emergence of the Internet accelerated the end of the industrial era, giving rise to the need for a profound transformation of the third industrial revolution in the 1990s/2000s. Information technologies and the Internet have made possible what would never have been imaginable since antiquity: stores without stores and salespeople, AMAZON and pure players were born.

Retail today

With 27.3 trillion turnover achieved in 2022 and 213 million companies, Retail today represents 20% of all global companies. Although global sales fell by almost 3% in 2020 due to the COVID crisis, the sector recorded record sales in 2021 (+9.7%). Retail is a sector that is doing well, mainly thanks to online sales, and currently benefits from an average growth rate of 4.8% (CAGR). The USA mainly dominates the market. Seven of the world’s largest companies are American (Walmart, Amazon, Costco, Home Depot, etc.)

Retail today is very far from the General Store before the industrial era. The sector, products and customer targets are broad. Segments should adapt decisions and action models. There are three main ways to segment Retail. The first is by channel, differentiating between online and offline; the second is by type of products sold (food and beverage, clothing and apparel, electronics, home and furniture, beauty and personal care); and the last is by geographic region.

Retail is one of the few sectors of activity that have experienced so many transformations in just a few years. The digital revolution gives power back to the customer who has become KING. Almost all of the companies that did not anticipate this change disappeared or were absorbed during and after the COVID crisis.

Digital has transformed the customer into a professional buyer. He can now buy 24 hours a day, seven days a week. All the information and marketplaces on the WEB allow him to make his discovery and compare products and offers for his most significant benefit. The physical store is no longer the only step in their purchasing journey but a step where they come to touch, try and get the personalized advice they cannot get on the WEB.

In reality, and even if omnichannel has become the standard, few brands have successfully transformed their physical stores so that the customer experience is perfectly fluid in the purchasing journey. There are only a few powerful brands like APPLE or NIKE for which the WEB to STORE and STORE to WEB experience is perfectly integrated.

The real weakness lies in offline sales for the rest of the market. The customer who comes to a store looking for a hyper-personalized experience finds nothing better than buying alone and online. The reception, personalization and quality of advice are heterogeneous. The customer knows more about current products or promotional offers than the salespeople. The new customer arrives unknown and leaves anonymous. The products he came to try are not in stock.

Many brands still need to resolve the paradox that we are moving towards dual flow. On average, six days a week from 10:00 a.m. to 7:00 p.m., the stores achieve 70% of their turnover in just 3 to 4 hours per day, resulting in salespeople running around at peak time and being absent from the sales area at off-peak hours.

Trends and strategies for the future

Retail has become a complex profession where retailers will require more than a simple sense of commerce and customer service to develop and succeed by 2030 and beyond. They will need to integrate:

Sustainability and ethical consumption

How products are manufactured, recycling, carbon footprint, and preserving our planet’s resources have become purchasing criteria for Generation Z or millennials. To continue to develop, brands must now imagine how to sell their products and set up their resale channels. Brands such as VESTIAIRE COLLECTIVE, based on the sale of second-hand products, are flourishing. The buyback of its products becomes a selling point (Apple, NorthFace, Timberland, etc.).

Retail Data Analytics

Companies must set up Data Analytics experts or departments capable of collecting and analysing the millions of data generated daily that marketing departments alone can no longer manage. Data Analytics will become the central aid available to General Management to understand why certain products sell more than others, predict how many products to sell to whom, and at what price or hyper-personalized offers products according to the customer.

Integrate numerous technologies to offer each customer a seamless shopping experience.