Growth Strategy

The Appleton Greene Corporate Training Program (CTP) for Growth Strategy is provided by Mr. Ardila Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 27 months; Program orders subject to ongoing availability.

Personal Profile

Mr Ardila is the co-founder of The Hawksbill Group, a business consulting and investment firm advising medium and large clients in the public and private sectors. Mr. Ardila is also a member of the Board of Directors of Accenture, Goldman Sachs BDCs, Nexa Resources and Ola Electric Mobility. Prior to his current activities, he was Executive Vice President of General Motors and CEO of Latin America from 2010-2016 (March). In his 30-year career with GM, he held several important positions, including country CEO in Ecuador, Colombia, Argentina and Brazil, as well as CFO of Latin America, Africa and the Middle East. He also worked as an investment banker for the Rothschild Group from 1996-1998 and Secretary General at the Ministry of Industry and Trade in Colombia (1983-84).

Mr. Ardila is a graduate of the London School of Economics where he obtained a MSc. Degree in Economics. He has lived in 10 countries and speaks English, Spanish, Portuguese and German.

To request further information about Mr. Ardila through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Growth Strategy

Importance of Growth Strategy

Growth strategies are crucial because they enable a firm to reach the necessary scale to be cost competitive and maximize the business opportunity while concentrating on its other goals, and then specify all the necessary steps to reach them.

According to the Bureau of Labor Statistics, less than 20% of new enterprises survive past their first two years of operation. Even worse, only 45% of businesses that do survive over the two-year milestone will remain in business for five years. Growth is obviously necessary for businesses to succeed and avoid becoming just another statistic.

When executed properly, any of the growth strategies can help a disciplined firm experience sustainable growth that would not be achievable without this option. The long-term survival of a corporation depends largely on growth. It facilitates asset acquisition, talent attraction, and investment financing. Profit and corporate performance are also fueled by it.

For a variety of reasons, corporate growth can be beneficial. For instance, it might enable you to:

• Benefit from fresh opportunities

• Increase the scope of your products or services

• Draw in additional clients

• Boost sales

• Increase staffing

Additionally, it might assist you in meeting consumer demand, boosting your market share, and leveraging your expanding brand. It frequently encourages creativity, assisting you in standing out in the market and fending off competition.

Growth can also improve your company’s reputation, increase your bargaining power in supplier negotiations and give you more supplier options, as well as boost stability and revenue. But for growth to be effective and long-lasting, it must be deliberate and motivated by the appropriate factors.

Reasons for business growth

The majority of firms expand in order to grow larger, possibly by growing revenue or market share, but size isn’t the sole factor. Numerous more advantages spur firm expansion. For instance:

• A market that is more resilient or sustainable.

• Cost savings as a result of economies of scale.

• Increased market dominance.

• More purchasing and negotiating power.

• The capacity to reduce business risks, for instance by diversification.

• The capacity to lessen the threat posed by competition.

• The capacity to withstand changes in the market and downturns.

• The capacity to recruit top talent.

For certain firms, growth may not be practicable or feasible beyond a certain point (think of a Business Development Company governed by the 1940 Act), but in most circumstances, stagnation is more likely to result in missed opportunities or even inability to survive an increasingly competitive environment.

Who Stands to Gain?

Any kind of growth strategy can help an organization reach new hights, no matter what stage of development it is in, if it is well planned and executed .

Startups

The most obvious candidates to implement a growth plan are startups, particularly if they are funded by venture capital or investors who don’t mind waiting a while to see a return on their investment to prioritize growth. In fact, most of the big success stories in the technology sector started as VC funded start-ups that grew in the early stages while burning through significant cash, and required several rounds of private capital raising before they became public through and IPO or a SPAC (Special Purpuse Acquisition Company) reverse merger. In many cases, even after becoming public some of them didn’t pay dividends for many years to prioritize growth, and investors relied exclusively on the stock price increase to obtain a return.

Startups are frequently seen utilizing product development growth strategies as they are typically at the forefront of product offerings with cutting-edge items and tenacious teams wanting to make a difference in the world.

Smaller companies

The majority of the time, small firms are wonderful instances of organic growth in action. Being an established company rather than a startup has helped them to continue operating past the scary 2- year failure mark that we previously stated. They must, however, be frugal with their spending because they lack the huge funds of a business.

As a result, it’s possible that you’ll see tiny enterprises employing a market penetration approach and competing on price or quality with lots of loyal clients.

Corporations

No matter how big a company gets, there’s always room for expansion.

Because large companies typically have a lot of cash and internal resources that can readily accommodate additional teams or business divisions, corporations often adopt a mergers and acquisitions model. However, they might also use any of the other growth techniques given their substantial internal resources and talent pools.

Types of Business Growth

The primary goal of the majority of organizations is growth. Keeping this in mind, business decisions are frequently focused on what would support the company’s ongoing development and success as a whole. We’ll go over some of the strategies that can help growth in more detail below.

You can build your firm in a number of ways. These categories can be used to categorize business growth:

1. Organic

With organic growth, a business achieves scale by using its own internal resources and internal activities, as opposed to having to look for outside resources to support expansion.

Making production more effective so you can produce more in a shorter amount of time, which results in increased revenue, is an example of organic growth. Utilizing organic growth has the advantage of relying on self-sufficiency and preventing debt if it can be funded from the operating cash flow of the business. Furthermore, the greater revenue brought about by organic growth might eventually be used to finance more strategic growth strategies. We’ll go over that afterwards.

2. Strategic

Creating strategies for long-term corporate growth is part of strategic growth. Creating a new product or creating a marketing plan to appeal to a new market are two examples of strategic growth.

In contrast to spontaneous growth, these initiatives frequently need a large investment of time and money. In order to raise the necessary funds for future strategic expansion initiatives, businesses frequently start with an organic strategy before they consider M&A opportunities.

3. Internal

Internal business process optimization is the goal of an internal growth strategy. This technique is dependent on businesses utilizing their own internal resources, much like organic growth. The key to any internal growth strategy is making the best use of the resources already at hand.

Cutting excessive spending and running a leaner organization by automating some of its activities instead of recruiting new personnel could be examples of internal growth enablers. Internal growth is often more difficult, since it pushes businesses to consider how their operations can be enhanced and made more effective rather than concentrating on external variables like expanding into new markets.

4. Acquisitions, Partnerships, and Mergers

Although mergers, partnerships, and acquisitions are riskier than the other growth categories, they can also yield substantial profits. There is strength in numbers, and a properly performed merger, partnership, or acquisition can assist your company in entering a new market, growing its clientele, or increasing the range of goods and services it provides.

An expansion strategy enables businesses to grow. Expanding a product range, opening new locations, or investing in customer acquisition are all ways to accomplish growth. The industry and target market of a firm have an impact on the growth methods it will select.

Plan strategically, think about your possibilities, and incorporate some of them into your business strategy. Depending on the type of business you’re starting, your growth strategy can involve things like:

• Adding new locations

• Investing in customer acquisition

• Franchising opportunities

• Product line expansions

• Selling products online across multiple platforms

Your particular industry and target market will influence your decisions, but it’s almost universally true that new customer acquisition will play a sizable role.

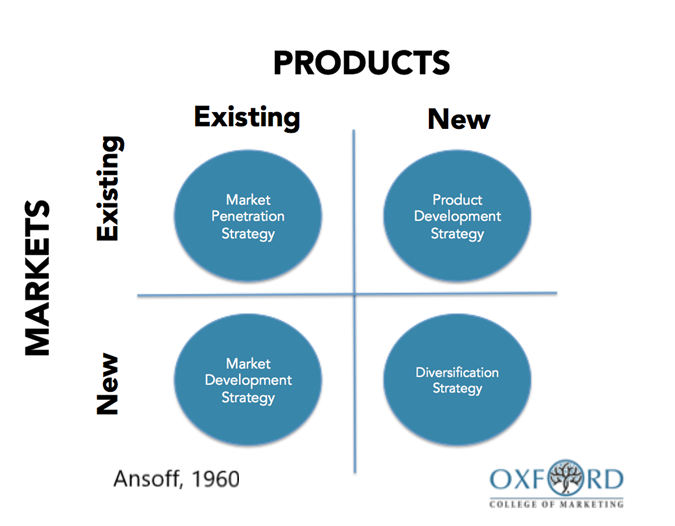

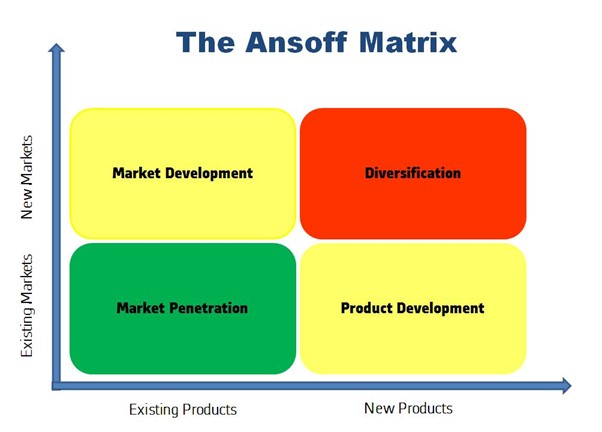

The Ansoff Matrix

Four high-level company growth strategies used by firms are outlined in the so-called Ansoff Matrix. Let’s take a quick look at each of these strategies now before going into more detail about them in the methodology section.

• Market Penetration: In the Ansoff Matrix, growing market share in an established market is the goal of a market penetration strategy. In order to increase client awareness of your services, common strategies include cutting pricing or adopting strategies like direct marketing.

• Market Development: The goal of the market development approach is to expand into new markets with already-available goods. A new market might relate to a new geographic area (for instance, international expansion), a new consumer demographic, or a new method of customer contact, such as the addition of an online store to supplement your physical presence.

• Product Development: This technique entails developing new items for already-existing markets. This can involve anything as straightforward as an ice cream store adding a new flavor or something as sophisticated as launching a completely new product line, such as if the ice cream shop started selling sandwiches.

• Diversification: The riskiest growth strategy in terms of potential failure is diversification. When a company develops novel items for untapped markets, it is a trailblazer. Because of this, it can be difficult to succeed, even though the benefits are greater if you do.

Since the objective is to expand the entire organization, you’ll probably use certain business development principles regardless of the growth strategy you choose.

Successful Growth Strategy Examples From Real-World Companies

Let’s look at some real-world examples to better grasp how various growth tactics operate.

1. Facebook

Even though Facebook is widely used today, it wasn’t the only social media network available in 2004. At the time, MySpace dominated the social media landscape. Thus, how did Facebook seize control?

The business adopted a market penetration growth strategy.

It began by concentrating on a small target consumer base, then progressively expanded. What Facebook did was as follows.

• Start small: Mark Zuckerberg founded Facebook in his dorm room at Harvard. Consequently, Harvard undergraduates made up the bulk of the first clientele.

• Expand gradually: After gaining popularity at Harvard, Facebook gradually spread to other universities. This made it possible for the business to expand using the same success paradigm as Harvard.

• Increase growth when you’re ready: After reaching colleges, Facebook started accepting non-students. Facebook was able to concentrate on modifying the product to meet the needs of each new client segment because to its methodical expansion. As a result, it did not experience the growth problems that caused MySpace’s demise.

2. Amazon

In 1995, Amazon started to rule the retail world. Consumers back then weren’t accustomed to online shopping. Despite this, Amazon increased its annual revenues to billions of dollars. What promoted Amazon’s expansion?

A diversification growth strategy is the answer.

One of the first online merchants was Amazon, which provided customers with the option to make purchases online (a novel idea at the time) in a brand-new market: the internet. Here is how Amazon approached its growth plan.

• Offer an improved customer experience: a better customer experience: It began by giving customers access to a wider variety of books than those found in traditional bookshops. Because it was online, Amazon was not constrained by shelf space. Customers may also check the website to see if a book was in stock and find out right away. Amazon was able to outcompete more established brick and mortar bookshops thanks to this convenience.

• Rinse and repeat: After proving its viability in the book business, Amazon subsequently branched out into related industries like DVD and electronics sales. As it expanded its operations, it eventually entered the grocery and even the healthcare industries.

3. Dollar Shave Club

According to Entrepreneur magazine, Gillette had a commanding hold of roughly 70% of the U.S. market when Dollar Shave Club started its razor company in 2012.

According to a CNBC report, Gillette’s market share had decreased to roughly 53% in 2019. Unilever purchased Dollar Shave Club for $1 billion as a result of the company’s expansion. How was Dollar Shave Club able to defeat a much bigger rival?

It employed a market development growth strategy.

Dollar Shave Club’s ability to sell directly to customers, which at the time was a new market for razors, allowed it to provide a more affordable alternative to the market leader.

• Identify a new market: Retail stores were where Gilette’s items were sold. By using the internet and a direct-to-consumer business strategy, Dollar Shave Club was able to offer razors for as little as $1.

• Offer an improved customer experience: To create razors without any markup from a middleman, Dollar Shave Club collaborated with Asian producers. The customers that flocked to its low-priced offering could benefit from these expense savings.

4. Google

Google is well-known for its well-known search engine, but its enormous revenue is what gave rise to the holding company that is now known as Alphabet, which comprises its numerous business initiatives. How was it done by Google?

It used a product development growth strategy.

Initially, Google was a business-to-consumer (B2C) organization that provided a search engine. However, it required a means of funding. It created a new product called AdWords, targeted at companies who had to pay for advertising, in order to generate that revenue.

• Make the product customer-specific: Converting a business-to-business (B2B) product from a business-to-consumer (B2C) offering required a new set of capabilities created for its B2B audience.

• The new product should enhance old ones: Google made sure that the new AdWords product integrated flawlessly with its B2C product. It delivered text ads that loaded rapidly and had the same appearance as the other search engine results because it had to protect the speed of its search engine. This ensured that the user experience was not compromised by advertising, encouraging users to keep using the search engine.

Curriculum

Growth Strategy – Part 1 – Year 1

- Part 1 Month 1 Why Grow?

- Part 1 Month 2 Market Opportunity

- Part 1 Month 3 Competitive Environment

- Part 1 Month 4 Regulatory Environment

- Part 1 Month 5 The Ecosystem

- Part 1 Month 6 Supply Chain

- Part 1 Month 7 Technology Differentiation

- Part 1 Month 8 Customer Profile

- Part 1 Month 9 Product Definition

- Part 1 Month 10 Marketing & Distribution

- Part 1 Month 11 Capital & Talent

- Part 1 Month 12 Price Positioning

Growth Strategy – Part 2 – Year 2

- Part 2 Month 1 Revenue Projections

- Part 2 Month 2 Cost Structure

- Part 2 Month 3 Profit & Cash

- Part 2 Month 4 Shareholder Return

- Part 2 Month 5 Other Stakeholders

- Part 2 Month 6 Geographic Focus

- Part 2 Month 7 Entry Barriers

- Part 2 Month 8 Business Plan

- Part 2 Month 9 Financing Options

- Part 2 Month 10 Automotive Growth

- Part 2 Month 11 Mining Growth

- Part 2 Month 12 Technology Growth

Growth Strategy – Part 3- Year 3

- Part 3 Month 1 Financial Services Growth

- Part 3 Month 2 Growth Process

- Part 3 Month 3 Growth Model

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Growth Strategy corporate training program.

Growth Strategy – Part 1 – Year 1

- Part 1 Month 1 Why Grow? – The long-term survival of a corporation depends on growth. It facilitates asset acquisition, talent attraction, and investment financing. Profit and corporate performance are also fueled by it. For a variety of reasons, corporate growth can be beneficial. For instance, it might enable you to seize fresh chances, broaden your offerings, draw in more clients, boost sales, and hire additional personnel. Additionally, it might assist you in meeting consumer demand, boosting your market share, and leveraging your expanding brand. It frequently encourages creativity, assisting you in standing out in the market and fending off competition. Growth can also improve your company’s reputation, give you more options for suppliers, and boost stability and revenue. But for growth to be effective and long-lasting, it must be deliberate and motivated by the appropriate factors. The majority of firms expand in order to grow larger, possibly by growing revenue or market share, but size isn’t the sole factor. Numerous more advantages spur firm expansion. For instance: More market sustainability or resilience, lower costs as a result of economies of scale, greater market dominance, greater purchasing and negotiating power, the capacity to mitigate commercial risks, such as through diversification, the capacity to lessen the threat of competition, the capacity to withstand market fluctuations and downturns, and the capacity to draw in the best talent and employees. For certain firms, growth may not be practicable or feasible, but in most circumstances, stagnation is more likely to result in missed opportunities. In the technology sector, growth often leads to the so-called network effects, where the more you grow your customer base, the greater the value added to your customers, which in turn leads to faster growth. Think of social platforms, where the greater the number of users, the more attractive

it becomes to users. - Part 1 Month 2 Market Opportunity – Simply described, a market opportunity is a gap in the market. Something, someone, or some place that isn’t being serviced by other businesses that you may take advantage of and exploit to expand your company swiftly. However, it is simpler said than done. Everyone is striving for the same spot and searching for that extra, unheard-of thing to put them ahead of the competition. How therefore can you identify a promising market opportunity before your rivals do? And once you have one, how do you go about creating an effective business growth strategy? Four crucial factors come into play when determining a promising market potential for your company: What do consumers want or need? What, more crucially, is your competition NOT doing? How does your product address a specific issue? or strengthen an existing remedy? What is the market like right now? Following the completion of these inquiries, you ought to be in a better position to comprehend your target market, spot product flaws, and ultimately find untapped markets. At the end of the exercise, you also need to understand the profit potential of the opportunity, which normally is arrived at by estimating the gross margin over a period of time.

- Part 1 Month 3 Competitive Environment – A system where numerous businesses compete with one another utilizing diverse marketing channels, advertising strategies, pricing approaches, etc. is referred to as a competitive environment. Businesses should abide by the rules contained in this system. Your business and your decisions may be directly impacted by your rivals. Consider two rival online clothes retailers who compete with one another for customers and financial gain. Before Christmas, one of them decides to hold a flash sale where buyers may get 40% off anything on the website. The competing store will also need to develop a compelling offer to draw leads and consumers, boost sales, move off-brand merchandise, and ultimately increase profits. Similar to this, if a coffee firm releases a new product, its rival will need to think about growth hacking. Therefore, competition can be advantageous because it spurs businesses to improve themselves and their goods. Customers benefit from a competitive environment as well. Businesses frequently provide premium products at competitive prices to attract customers. Additionally, corporations must innovate in order to release their products. However, competition can occasionally make it more difficult for a business to survive. Consider two businesses that are housed in the same place. It will be challenging for the second company to compete if one of them sets low prices and discounts. It’s time to move on to the many sorts of competition that define the relationships between and among sellers and customers now that you understand how a competitive environment affects your business and customers.

- Part 1 Month 4 Regulatory Environment – A broad regulatory environment document covers the laws and ordinances that control the activities of your organization in various jurisdictions as well as the penalties for breaking them. A document that lists the important regulators who control the regulatory frameworks that have an impact on your business. Additionally, it lists any past or present decisions or projects that have been or may be impacted by the regulatory environment, as well as any potential effects on your business. These laws, which vary by business, industry, and location, control the financial, operational, technological, and legal facets of your organization. Thus, technology firms may be faced with strict privacy laws and regulations if they handle people’s personal data. Regulation in financial services firms aims to protect the money and investments of individuals and firms. In the mining industry, regulation is more geared towards the potential environmental impact. And in manufacturing health and safety issues may be the main focus for regulatory agencies. They may be decided upon by relevant industry bodies, public organizations, or federal, state, or other governmental bodies. Why is today’s corporate environment subject to general regulations? A general regulatory environment document enables your business to: Assess the risks and legal liabilities of non-compliance with regulations to your business; evaluate the financial and operational costs of complying with various regulations; and evaluate the impact of local regulations on your operational performance and growth potential.

- Part 1 Month 5 The Ecosystem – A business ecosystem is a group of organizations that participate in the delivery of a certain good or service through both competition and collaboration, such as distributors, suppliers, customers, competitors, government agencies, and so forth. According to the theory, each component of the ecosystem influences and is influenced by the others, resulting in a dynamic interaction that requires flexibility and adaptability for each component to exist, just like in a biological ecosystem. Ecosystems impose significant barriers to entry for new competitors because they require would-be competitors to not only imitate or improve upon the network’s main product but also to compete with its complete ecosystem of independent complementary firms and suppliers. Being a part of a business ecosystem offers ways to take use of technology, attain excellence in research and business acumen, and successfully compete with rival businesses. A business ecosystem’s objectives may also include fostering new partnerships to address pressing social and environmental issues, utilizing creativity and innovation to reduce production costs or enable participants to reach out to new markets, accelerating the learning process to efficiently collaborate and share insights, skills, expertise, and knowledge, and developing novel approaches to meet basic human needs and desires. For these reasons, in the quickly evolving business world of today, a company develops its own ecosystem or finds a means to integrate into an already-existing ecosystem by offering a benefit that is currently lacking in that ecosystem.

- Part 1 Month 6 Supply Chain -At first glance, procurement—the efficient acquisition of raw materials, components, office supplies, and professional services—and logistics—the planning of the transfer of those goods—might not appear to be as crucial as sales, marketing, R&D, or finance. But failing to take them into consideration can be a significant growth inhibitor, and supply chain problems have been a major role in the failure of numerous startups and even bring down large established businesses. Whether a company is expanding domestically or internationally, supply chain management is a critical component, and its complexity depends on the industry and the ecosystem the company operates. For example, a car manufacturer that has most of its main suppliers in the same area where plants are located will face very different supply chain challenges from those incurred by a competitor that has a large international supplier network located in different parts of the world. The fastest-growing firms aggressively prioritize the customer by providing them with better products or customer experiences, yet customer service is doomed to failure without a strong supply chain. Any expanding business needs personnel to estimate demand, create or obtain the products needed to satisfy that need, and supply those products swiftly and reliably to customers while only maintaining the bare minimum amount of inventory. The disruption in supply chains caused by Covid 19 has served as a clear demonstration of the paramount importance of the supply chain in an integrated world.

- Part 1 Month 7 Technology Differentiation – Can your technology keep up with the expansion of your company? Can you adjust the scale on demand? Even though the digital landscape is evolving quickly, over a third of businesses are unable to stay up and are falling behind more agile ones. The IT industry has entered a digital era where new technologies can offer a compelling foundation for expansion, innovation, and differentiation. Digital business will disrupt every industry by 2025, thus it is crucial to use current technologies to become flexible and expand more successfully. When used properly, technology may help your business grow and succeed in addition to being necessary for day-to-day operations. With the appropriate tools, you can deliver high-quality customer service, adapt to changing business needs, lower operating expenses, and increase revenue. Improved decision-making, enhanced productivity, higher profits, and improved agility are further advantages. It’s not an exaggeration to say that every business is a digital business.

- Part 1 Month 8 Customer Profile – If you want to efficiently serve your consumers and meet their expectations, understanding customer profiles is essential. Customer profiles involve socio-demographic patterns, culture and idiosyncratic characteristics, income levels, life styles and preferences. It is obvious why this is important: You must comprehend and get to know your clients in order to effectively market to, sell to, and provide assistance to them. By implementing a system for producing and auditing client profiles, you may accomplish this efficiently. A thorough overview of your present clients is contained in a customer profile, also known as a consumer profile. In order to target customers that have comparable buying habits and pain areas in your sales and marketing activities, you would define these characteristics in a customer profile. Without creating customer profiles, you run the danger of marketing to an uninteresting audience, which can waste time and result in lost opportunities. You may learn more about the characteristics and buying habits of the clients whose business you’ve already secured by defining your ideal customers. The development of customer profiles is essential if you want to expand your company. Your entire business, from your sales staff to your service department, will profit from its advantages.

- Part 1 Month 9 Product Definition – The success of your business depends heavily on the success of the goods or services you are providing, regardless of where you are in the life cycle of your enterprise. You could believe you understand what your firm does if you’re just starting to expand. What’s more crucial, though, is being able to communicate your product’s vision to others. Clarity is crucial when it comes to your product or service. The success of your sales and marketing initiatives is strongly related to how well you define what you do. The ability to distinguish your offering in the market, which is essential for revenue growth, will come from having a clear definition of the goods or services you offer. A model created for scalability is defined clearly. It gives you direction so you can understand how the good or service sells and where the right market fit is. Being able to describe who you are and what you do gives you the opportunity to also specify what you do not do. This ability is an excellent time focus filter or decision-making tool. Spending too much time and money on consumers who don’t mesh well with their main product offering causes firms to frequently lose money. When the company may be better providing a more ideal fit, extra time and resources are spent on the sale and customer care for those clients. The ability to say “no” and concentrate on providing for the needs of your target audience come from clarity. The product development process varies widely by industry. Engineering and design skills are key in the manufacturing industry; mining products are mostly commodities where differentiation comes from the grade of the ore concentrate; in technology software development is often critical; and financial services require deep understanding of financial market workings and innovativeness for the creation of more sophisticated offerings that meets the needs of increasingly knowledgeable investors.

- Part 1 Month 10 Marketing & Distribution – The distribution channel and the marketing channel work together seamlessly. In essence, the marketing channel would not exist without the distribution route or procedure. All businesses involved in creating and transporting commodities up until they reach end users are considered part of the distribution channel. Every business involved in this process uses a different marketing channel. Since it enables companies to link their goods and services to consumers, distribution marketing is a crucial factor for marketers to take into account. Companies can accomplish marketing objectives like increasing brand recognition and revenues by making this relationship. Marketing professionals may choose the finest solutions for their businesses by understanding distribution marketing and distribution channels. Technology has created the possibility of merging marketing and distribution as an integrated customer experience online for many industries, whereas some still require physical distribution through retail outlets owned by the company or contrated through a franchised distribution network as is the case in the automotive industry.

- Part 1 Month 11 Capital & Talent – Prior to developing and putting a growth strategy into execution, companies need to ensure they have the resources available. In particular, significant capital and human talent are required for a growth strategy, in proportions that will vary by industry and company. Corporate personnel strategies must be properly aligned with their business ambitions as they aggressively search for new methods to boost top line development. Human capital and corporate growth must be seen as two sides of the same coin in the modern workplace. The risk profile of the economy of our country will rise if American firms continue to ignore this important and urgent fact. If a company’s success actually depends on its employees, it is time for businesses to identify underutilized potential inside their own ranks. Learn more effective ways to use your talent pool to support business growth before you start spending money on new products and advertising efforts that take years to generate the required ROI may be the answer for many companies. Capital needs to be secured through equity or various forms of debt when the internal cash flow generated by the business is not enough to fund growth.

- Part 1 Month 12 Price Positioning – Setting a price for a given good or service within a certain price range is known as price positioning. The pricing positioning reveals how a product is positioned in relation to its rivals in a specific market and in the eyes of the consumer. With price positioning, you may determine if a product is perceived as being inexpensive (lowpriced) or costly (high-priced). Businesses that want to sway clients to buy a particular product or service must consider price positioning. In the majority of markets, price placement significantly affects how consumers view the brand. Because their brand’s promise is unclear, some companies underprice or overprice their products because they are unsure of what message they are sending to their customers. In the end, it all comes down to how consumers view the brand and their willingness to spend both now and in the future. However, monitoring the alterations in customers’ willingness to pay over time is necessary while working on branding and positioning every three or six months, as an illustration. In essence, a company has the option to price at the low end of the spectrum if it wants to position itself as a high volume low margin brand; conversely, it may choose to prioritize product quality and service and position itself as a premium or luxury brand commanding higher margins, and possibly lower volumes.

Growth Strategy – Part 2 – Year 2

- Part 2 Month 1 Revenue Projections – Revenue forecasts show how much money a company expects to make over a specific period of time. Revenue estimates for sales companies refer to the sales revenue produced from the goods or services they offer. The ability to project revenue helps firms avoid risks that could lead their operations to fail. Gross revenue, or the amount at the top of a balance sheet, is the money made once the full extent of the service is rendered. Revenue projects forecast how much money will be made over the course of a fiscal year or another defined time period. Executives in well-established companies may take into account revenue for the most recent quarter or year, as well as pipeline created, market pressures, and any changes in the size of the sales team. Since there is less historical data available for younger companies, generating realistic revenue projections is more difficult. Any organization’s ultimate objective is to finish the quarter or the year within a small margin of error of the revenue prediction made at the beginning of the quarter. Overstating revenue projections has been a common feature in many start-ups looking to become public companies, which has led to a loss of market confidence in projections that are not supported by real bookings or clear client commitments.

- Part 2 Month 2 Cost Structure – The totality of the many fixed and variable cost kinds that go into a business’ overall expenses is known as its cost structure. Cost structures are used by businesses to determine profit potential and pricing, as well as pinpoint areas where costs might be cut. Finance executives need to control costs in a way that doesn’t limit future development possibilities. Will the finance choices you make now promote effective growth or damage your business’s reputation in the market? Effective corporate executives concentrate on choosing the best strategies for cost-cutting and capital allocation. They devote more money to innovation and larger, riskier growth risks. Businesses are managed for asset efficiency rather than just profit and loss. They carefully consider potential merger and collaboration prospects. In general, material cost and logistics impact gross margins and help identify the size of the business opportunity, whereas sales, marketing, administrative and other general expenses determine operating income and help identify whether the company is best positioned to take advantage of the growth opportunity.

- Part 2 Month 3 Profit & Cash – In any industry, knowing the difference between profit and cash is crucial. Profit is calculated as revenue less all costs incurred by a business over a specific time period, whereas cash flow is the amount of money coming into and leaving a business over that time period. Increasingly, businesses and investors have shifted their focus toward cash generation as the ultimate measure of success. However, cash is critical to maintain and successfully run the firm on a daily basis, profit is also a key measure of overall business performance from an accounting and business perspective. At any rate, profit is the basis for cash generation and a lack of profitability has a detrimental effect on the company’s cash flow.

- Part 2 Month 4 Shareholder Return – As a shareholder, you have two earning options. Capital expansion is the first approach. This happens if the share’s value rises between the time you buy and sell it. Another way to profit is the fact that some businesses use the profit they make to reward shareholders for their investment by paying dividends. Total shareholder return is the result of adding capital growth and dividends together. The profit or loss from the change in the net share price plus any dividends that were paid during the time period equals the total shareholder return. When a public company generates cash beyond what is required to fund operations and growth, it may choose to pay a dividend, repurchase its own shares to boost the share price, or a combination of the two. The pre-tax shareholder return assumes that all dividends are reinvested. Reinvesting dividends entails using all or a portion of the dividend amount to purchase additional company shares. You can also do this to simply to raise the number of shares you own in the business or to pay your top management in stock. Companies ultimate goal is to maximize total shareholder return. According to a conventional share price valuation model, high rates of return for a stock can drive down its average stock price and diminish the company’s overall shareholder return.

- Part 2 Month 5 Other Stakeholders – A stakeholder is a party with an interest in a business who has the potential to influence or be affected by it. A typical corporation’s investors, employees, clients, and suppliers make up its main stakeholders. However, the idea has been broadened to encompass communities, governments, and trade groups as a result of the growing focus on corporate social responsibility. An organization’s stakeholders may be internal or external. Internal stakeholders are those who have a direct interest in a firm, such as through employment, ownership, or investment. External stakeholders are those who don’t work for a company directly but are still impacted by its decisions and results. Suppliers, borrowers, and government agencies are all regarded as external stakeholders. Stakeholders are vital to the development of the company. Prioritizing stakeholder needs may help organizations meet the expectations that different people may have of them. Therefore, it’s critical to comprehend not just who your stakeholders are but also how much they may be impacted by your growth plans.

- Part 2 Month 6 Geographic Focus – Segmenting your audience according to the area in which they reside or work entails using a geographic focus. Customers can be categorized in a variety of ways, including by their nation of residence, or by more specific geographic divisions, such as city, region, or even postal code. Even if geographic segmentation is the easiest type of market segmentation to understand, there are still many applications for it that businesses never consider. Depending on your needs as a firm, the area you target should have a different size. Generally speaking, the locations you’ll be targeting will be larger the larger the firm. After all, it won’t be economical to target each postcode individually with a larger potential audience. Geographic segmentation can be done using six different variables, including location (country, state, city, ZIP code), timezone, climate and season, cultural preferences, language, population type, and density (urban, suburban, exurban or rural).

- Part 2 Month 7 Entry Barriers – A startup is prevented from entering a certain market by entry barriers. They make up one of the five forces that influence how fiercely a market is competitive (the others are industry rivalry, the bargaining power of buyers, the bargaining power of suppliers and the threat of substitutes). The attractiveness of a market is determined by the level of competition in a certain industry (that is, low intensity means that the market is attractive). Innocent or purposeful factors might operate as entrance barriers, such as the dominant company’s unbeatable cost advantage (for example, high spending on advertising by incumbents makes it very expensive for new firms to enter the market). While some entrance obstacles are the result of government action, others arise naturally in a free market. Companies frequently ask the government to create new entry barriers. This is ostensibly done to safeguard the integrity of the sector and stop new entrants from flooding the market with subpar goods. Sectors with high entry barriers, either because of capital, technology or talent requirements, or simply because of government regulations, normally offer higher profit opportunities.

- Part 2 Month 8 Business Plan – – Company expansion requires a thorough, wellthought-out business plan. You will never encounter a more difficult writing assignment than the creation of a business plan, regardless of whether you are starting a new company, seeking additional funding for existing product lines, or suggesting a new activity in a corporate division. Only a well-conceived and well-packaged plan can win the necessary investment and support for your idea. It must include a clear and appealing description of the business or prospective endeavor. The plan must describe the company’s or the project’s current condition, current demands, and anticipated future even though its subject is a moving goal. You must logically and persuasively articulate and defend ongoing and changing resource requirements, marketing choices, financial projections, production demands, and people needs.

- Part 2 Month 9 Financing Options – Any strategy for corporate expansion must start with sound financial planning. The first thing you should do is figure out how much money you’ll need to finance the project, when you’ll need it, when it’ll be available, and when you’ll be able to pay it back. It’s crucial to include all the expenses required to launch your growth choice and contrast them with the expected revenues. When establishing goals for business expansion, you must be pragmatic and reasonable. A thorough cash flow projection is crucial, not least since expenses will almost definitely rise earlier and more quickly than income. To keep your main business operating, you need to have adequate cash on hand. Since these kinds of projects frequently go over budget, it’s a good idea to include some extra money as well. You might also need to create precise estimates for sales, working capital, and sources of seed investment or any further funding, in addition to cash flow. As indicated, internal cash flow generation, various forms of debt, and equity issuance, are the main alternatives to fund growth.

- Part 2 Month 10 Automotive Growth – By 2030, it is anticipated that the global automotive market would reach slightly under nine trillion dollars. It is expected that around 38% of this amount will come from sales of new cars. In terms of revenue, Volkswagen Group and Toyota Motor are the top two automakers globally. Volkswagen made slightly more than 245 billion dollars in sales in 2020 compared to the Japanese car giant’s revenue of about 250 billion dollars. The brand with the biggest brand value growth globally across industries in 2021 is Tesla, which is situated in the United States. Battery electric and plug-in hybrid vehicles have become more and more popular in recent years, with their use rising by more than three times between 2016 and 2019. Global initiatives like the Paris Agreement have prompted numerous nations to set higher emissions regulations for new vehicle models. As a result, automakers are starting to diversify their company into the field of electric mobility. By 2025, it’s expected that every third new car sold will be powered or assisted by an electric battery. Mobility services and autonomous vehicles are expected to spark a new automotive revolution over the course of the ensuing ten years. By 2040, China is anticipated to dominate the market, selling 14.5 million autonomous vehicles. The workshop will focus on the technology changes in the industry, the transition to electric vehicles and the disruption autonomous vehicles are likely to trigger when they become a commercial alternative.

- Part 2 Month 11 Mining Growth – Since the growth of the mining industries frequently regulates the capacity for resource acquisition and the economic growth of the countries, the mining industry is one of the most important sources of income for many different countries. Around the world, many sectors rely on the subsurface supply of mineral products. Coal, on the other hand, is still one of the world’s top energy sources, despite the dependence of numerous hightech businesses on rare earths. As a result, the mining industry is crucial to the global economy. The top 40 mining corporations in the world, which make up the great majority of the sector, generated about 656 billion dollars in revenue in 2020. In the mining sector, the net profit margin dropped from 25% in 2010 to 11% in 2020. The focus of the workshop will be on the impact of the energy transition to clean sources and the electrification of transportation on the mining industry, which plays a pivotal role in this transition.

- Part 2 Month 12 Technology Growth – Without a doubt, there is a great deal of investment opportunities in the technology sector. It has overtaken all other market segments in the last ten years, including the financial and industrial ones, to become the biggest one. Technology is today more than ever connected with invention and innovation, and it is now incorporated into all other existing industries, whether they be in the fields of manufacturing, finance, real estate, or health. Global spending on technology reached $3,360 billion in 2019, according to Statista data. Additionally, the Internet, the foundational element of the digital age, is connected to the expansion of the technology sector. Additionally, the statistics indicates that there are 4.4 billion active internet users worldwide. And if you still don’t find these figures remarkable, you should know that they represent over 58 percent of the world’s population. Having said that, in today’s digital age, investing in technology just makes sense. The focus of the workshop will be on the new technologies, the commercial opportunities they offer and the impact they are likely to have on business and the economy in general.

Growth Strategy – Part 3 – Year 3

- Part 3 Month 1 Financial Services Growth – The primary engine of a country’s economy is the financial services industry. It allows for the free flow of capital and market liquidity. The economy expands and businesses in this area are better able to manage risk when the sector is robust. The prosperity of a nation’s populace also depends on the health of its financial services industry. Consumers typically earn more money when the economy and sector are robust. Their confidence and purchasing power are boosted as a result. They turn to the financial services industry for borrowing when they require access to credit for significant purchases. But if the financial services industry falters, it could hurt an entire nation’s economy. The result could be a recession. The economy starts to suffer when the financial system begins to collapse. As lenders restrict lending, capital starts to dry up. Increased unemployment and possibly declining wages cause customers to cut back on their spending. Central banks adjust by lowering interest rates in an effort to spur economic expansion. During the financial crisis that precipitated the Great Recession, this was basically what took place. The focus of the workshop will be on the growth possibilities in the industry, determined by technology, evolving customer needs and regulation.

- Part 3 Month 2 Growth Process – Every business aspires to expand, whether it’s through aiming to boost profitability, expand its market share, or hire more employees. To do this, one must navigate difficult obstacles and come up with novel solutions as the firm grows. The stages of growth that businesses go through vary depending on who you ask. A growth cycle with five stages—existence, survival, success, takeoff, and resource maturity—is advocated by some. Others contend that there are four stages: initiation, development, maturation, and renewal/decline. All of these cycles exhibit a generalized pattern of how businesses expand, which unites them. They also offer helpful insights for managers and owners of businesses, who may utilize the theories to learn more about the possibilities and challenges their company may be about to face. To assist companies in preparing for the future, this can be utilized in conjunction with metrics for corporate growth. The focus of the workshop will be on the process a company must follow to develop a growth strategy with a high chance of success.

- Part 3 Month 3 Growth Model – In the early phases of a business, the founder’s philosophy, mission, and practices are typically passed down as growth drivers. At this point, your staff is small, your goals are clear, and your growth strategy is based on straightforward business decisions that increase your profits. Future expansion becomes complex and necessitates more structure when your firm reaches a more developed stage in its lifetime. This framework is developed by creating a strategic growth map that supports your business strategy. It is crucial that this growth strategy adopts a scientific approach both internally and externally, taking into account your available resources and competitive landscape. Changes to your company’s organizational structure, joint ventures, or the exclusive usage of marketing tools can all be part of your strategy. Your growth model need to be a combination of tactics that support your objectives and vision. The maturity, resources, and planned rate of growth all influence how many strategies are included in the model. Depending on the size, sector, and capabilities of your organization, you should expand at the rate that is appropriate. Your company should seek out cost-effective strategies including distinctive products, niche markets, a memorable brand, and novel marketing channels the smaller it is. You should be more cautious as your company grows and you have more options open to you. Greater risk is associated with the larger, more aggressive growth levers, therefore appropriate planning and research are advised. Building a growth model, which is a success factor, takes time and involves a multi-layered approach to strategic planning Ultimately, your business model is aimed at maximizing profit and shareholder return while addressing the needs and expectations of all stakeholders.

Methodology

Growth Strategy

As previously discussed, there are numerous strategies for business growth. The path you take in terms of growth is mostly determined by your ambition, your motivations, and the possibilities and resources at hand. There are, however, two important considerations when selecting a growth plan. As follows:

• Products, including those you already offer and those you hope to in the future.

• Markets – your present and desired future sales locations.

Strategic tools, such as the Ansoff matrix, offer four primary types of business growth plans based on these variables.

What are the four major growth strategies?

You try to sell more of the same products to the same market when you try to penetrate the market. As you concentrate on expanding your present market share with the things you already have, the risks are typically minimal.

You introduce a new product into your current market through product development. You’re essentially offering a new product to the same client, running a higher risk.

Market development is an alternative, when you attempt to sell an existing product in a completely untapped market. For instance, you might want to target a whole other geographic location or segment your current market or reposition your product inside it.

Finally, diversification entails selling entirely different products or services to entirely different clients. This is often the riskiest choice because it necessitates the establishment of both a product and a market.

Additional ways to grow your company

Every company is unique. Some of the proposed tactics might need to be modified to fit your specific situation. For instance, you might wish to explore:

• Acquisitions

• Franchising

• Strategic partnerships

• Improving efficiency in your business

You might also wish to create your own special concoction of tactics.

The strategy that best fits your overarching strategic plan will typically be the best strategy. Look for a solution that could produce the most outcomes with the least amount of risk and work.

Remember that a purposeful growth strategy is necessary for success. A significant amount of study and careful planning for business expansion are necessary for success.

Growth Strategy

As previously discussed, there are numerous strategies for business growth. The path you take in terms of growth is mostly determined by your ambition, your motivations, and the possibilities and resources at hand. There are, however, two important considerations when selecting a growth plan.

As follows:

• Products, including those you already offer and those you hope to in the future.

• Markets – your present and desired future sales locations.

Strategic tools, such as the Ansoff matrix, offer four primary types of business growth plans based on these variables.

What are the four major growth strategies?

You try to sell more of the same products to the same market when you try to penetrate the market. As you concentrate on expanding your present market share with the things you already have, the risks are typically minimal.

You introduce a new product into your current market through product development. You’re essentially offering a new product to the same client, running a higher risk.

Market development is an alternative, when you attempt to sell an existing product in a completely untapped market. For instance, you might want to target a whole other geographic location or segment your current market or reposition your product inside it.

Finally, diversification entails selling entirely different products or services to entirely different clients. This is often the riskiest choice because it necessitates the establishment of both a product and a market.

Additional ways to grow your company

Every company is unique. Some of the proposed tactics might need to be modified to fit your specific situation. For instance, you might wish to explore:

• Acquisitions

• Franchising

• Strategic partnerships

• Improving efficiency in your business

You might also wish to create your own special concoction of tactics. The strategy that best fits your overarching strategic plan will typically be the best strategy. Look for a solution that could produce the most outcomes with the least amount of risk and work.

Remember that a purposeful growth strategy is necessary for success. A significant amount of study and careful planning for business expansion are necessary for success.

Growth strategy process

Here are the steps you can take to create an effective growth strategy for your business:

1. Identify your value proposition.

Identifying your competitive advantage is the first step in developing a growth strategy. Think about the reasons why people use your company when they require a service or product similar to what you provide. Consider what makes you unique compared to your competition and what keeps you relevant. Determine the reasons why potential clients should choose your company using the answers to these questions.

2. Determine who your target market is.

You must first comprehend who you now serve in order to comprehend how you wish to expand. Start by taking a look at your current clientele. Consider which of your consumers generates the most revenue or is the most valuable to your organization. Also consider what makes them unique.

3. Understand your current revenue streams.

Finding all of your present revenue sources is the next stage. Take into account whether there are any additional revenue sources you may introduce to increase the profitability of your business. Examine the sustainability of these new revenue sources. Also, notice whether you have any ideas or goods that don’t have any sources of income.

4. Look at your competition.

Take a look at firms that are directly competing with you as well as similar ones that are expanding in different ways. Think about the reasons behind the decisions those companies made and whether they are in a unique position. What adjustments may your company do to better position itself to gain market share?

5. Choose an area of growth.

Understanding where you wish to grow is necessary for development. Among the most popular growth efforts are:

• Increasing employees

• Increasing profits and revenue

• Launching an online store

• Selling in new stores

• Adding additional products and services

• Adding new branches or locations

• Increasing your warehouse or retail space

6. Conduct market research.

You must conduct market research to ensure that your strategy is workable after deciding how to expand your company. You might want to think about conducting surveys or looking at previous studies in your field. Your budget for the growth strategy, your schedule, and your final objective can all be decided upon using the information you gather at this step of the process.

7. Set goals.

The next step is to decide how much you plan to develop after you’ve identified whatever area of the business you are expanding. What you want your company to become should inform the goals you set. However, it’s also crucial to make sure your objectives are manageable and attainable, which is why the market research step is so crucial.

8. Create a plan.

The next stage is to create a thorough growth plan. Your plan should include a thorough description of the tasks that your team must do, the individuals who are in charge of each work, and the completion dates for each task. A list of the resources you will require to reach your growth target should also be included.

9. Consider investing in more employees.

You could need to add staff, depending on the size of your current team and your long-term growth goals. Employing talented people who are driven by your company’s value proposition is vital since they will typically work harder and feel more committed in the company. This is because many of your employees will likely have direct contact with your consumers.

10. Determine requirements for growth.

The last stage before implementing your growth strategy is to see whether there are any particular resources that will make it simpler for you to achieve your growth objectives. Tools for growth include, for instance:

• Software and technology: Think about any technological resources that you might need to expedite the growth process.

• Services: Consider whether there are any consultants or designers who could help you execute your plan more effectively.

• Funding: You may want to consider looking for funding to successfully execute your growth strategy.

Market penetration strategy

One of the four primary business growth techniques is market penetration. It entails concentrating on selling your current goods or services into your current markets in an effort to increase your market share.

Since this method has the lowest risk according to the Ansoff matrix, the majority of organizations will at some time take it into consideration. It can be especially beneficial when a business is first getting started.

Methods for entering new markets

You need a profitable product and thorough market understanding to create an effective market penetration plan. Additionally, you need to fully comprehend your rivals.

There are typically four approaches to penetrate the market. One can:

• Increase the market share of current products

• Increase usage by existing customers

• Dominate growth markets

• Drive out competitors from a saturated market

You can use a variety of strategies to improve the market share of your current items, such as:

• Price adjustments

• Sale promotions

• Targeted advertising

• Opening of new distribution channels, such as online sales

To identify a new demographic for your goods, such as a different age group, you can also segment your consumer base. For the purpose of attracting and converting certain demographic groups in their markets, businesses frequently rely on marketing and advertising.

If your market is already saturated, you might need to come up with another strategy to push away rivals. For instance, adjusting your prices and aggressively pushing your goods can make the market unattractive or unattainable for smaller rivals.

If you can compete on pricing and offering, you might consider measures to encourage repeat business from current clients. For example, you can add value to the current product or service to encourage more regular use, keep and expand your clientele, and develop loyalty programs. The market penetration strategy won’t be effective for all items or all business models. To achieve and sustain growth, you might need to apply a variety of business growth tactics. For instance, market expansion, product development, or diversity.

How to evaluate market share.

Knowing the extent of your market penetration can help you gauge how well your product is selling and how consumers perceive it in contrast to other goods or services.

Market penetration is measured using a percentage. You may figure it out by multiplying the current sales volume by 100 and subtracting the sum of all sales volumes of comparable products, including those offered by rival companies.

Product development strategy

A product development strategy involves creating new items or altering old ones to make them appear brand-new, then introducing those products to existing or emerging markets. When carried out effectively, it can result in increases in sales and market share.

Typically, organizations would consider product creation if they have exhausted all potential markets or avenues for expansion for their current product, or when they identify an opportunity in products that offer synergies with existing products (for example, same distribution channel).

Development of new products for growth.

A business often has one of three options when it comes to product creation. One can:

• Develop a brand-new product

• Improve your current product for the market it serves

• Improve your current product to reach new markets

Thorough research and development, an in-depth analysis of client needs, product design and analysis, design documentation, prototyping, and production are likely to be steps taken to produce a new product or improve an existing one.

Each business has a unique strategy for product creation. Some companies purchase an existing product to market under their own brand while outsourcing the product creation process. Others purchase the rights to market someone else’s creation or collaborate with another company to create brand-new goods.

Continuous research and on-going client needs analysis are essential to the development of new products.

Tactics for brand extension.

A good strategy for product development is brand stretching, often known as brand extension. It entails applying your recognized brand name to a novel good or novel product category.

There are numerous strategies to grow your brand, including:

• Offering the original product in a new form

• Combining two well-known products into one

• Applying the existing brand to a different product category

• Creating complementary products

Because it is typically simpler to accomplish than developing wholly new items, brand extension is a common method in product development.

It enables you to capitalize on your reputation and the success of an existing product to introduce a brand-new one. Additionally, the costs are typically cheaper than they would be for the launch of a new product with no established brand.

However, for the brand extension to be effective, there needs to be a logical connection between the old product and the new one. Brand dilution can occur if there is a mismatch or if the new product forges a bad association.

Remember that one of the four main corporate growth techniques is product development. Along with other choices like market penetration, market development, and diversification, you should think about it.

Market development strategy

Selling your current goods or services to a new clientele is part of the market development growth plan. Market research is the first step, in which you:

• Do a market segmentation analysis of your current clientele

• Make a list of the market segments you think you should focus on

Simply put, a segment is a smaller subgroup within a larger population. When choosing a target market segment, consider the following elements:

• New geographical areas

• New demographic segments

• New customer needs

• Customer preferences, interests and lifestyle

Consider clients who are generally served by your rivals or those who aren’t being supplied by anyone right now. You should develop a promotional strategy and look for strategies to draw in and close sales from customers inside the target category once you’ve done so.

Common market development strategies.

Key market expansion techniques to think about are:

• Pricing – To charge a higher price, you could offer a product that is more valuable than the competition’s or implement competitive price structures with offers and discounts.

• Distribution – If you presently just have a physical and mortar store, you could create additional channels to sell online in order to reach your target audience.

• Branding – For products intending to reach a target market or a certain customer sector, a new brand could be created.

• Promotion – You might think about creating customized promotional messaging to entice clients with deals, discounts, loyalty programs, etc.

• Sales – To generate new leads and prospects, you could target a different demographic group or kind of customer.

• Product development – You may create a new product or modify an existing one to target an unexplored market.

Market development considers increasing revenue through new or alternative uses for your goods in addition to bringing in new clients. Consider fresh ways you might encourage your existing customers to use your product. A well-known illustration of a multipurpose product is WD-40.

Market development vs market penetration.

Market development aims to expand market potential, which is the main distinction between it and market penetration. By growing into undeveloped market sectors, it achieves this. Market penetration fixes the size of the market, allowing the approach to concentrate on maximizing the potential of an already-existing market.

Business growth through diversification

A growth strategy known as diversification is expanding your business into a new market or industry while also developing a new product specifically for that market.

Different types of diversification strategies

There are numerous types of diversification, including:

• Horizontal diversification is the process of acquiring or creating new goods or services that complement your main line of business and are appealing to your existing clientele. One example is when an ice cream shop expands its assortment of confections. To diversify in this way, you could need new technologies, abilities, or marketing strategies.

• Concentric diversification entails the addition of new items that complement existing product lines or industries technologically or commercially while also attracting new clients. As an illustration, a PC company may begin making laptops. You might be able to use the technologies, resources, and marketing you already have to diversify in this way.

• Conglomerate diversification takes place when you introduce new goods or services that are completely unconnected to and distinct from your main line of business. Take the establishment of an entertainment park by a movie company. The risks are substantial because this strategy needs you to sell to a new customer base in addition to entering a new market.

• When you extend in a backward or forward manner along the production chain of your product, this is known as vertical diversification or integration. With this strategy, you may have control over many supply chain stages. A movie distributor might create its own material, or a tech company might start its own retail location.

Deciding how and when to diversify will require:

• Detailed market research for the new product or service

• A thorough assessment of customer needs

• A clear product development strategy and market testing

• Sales, marketing and supply chain operations able to cope with the added demands

Advantages and disadvantages of diversification:

Each of the many diversification techniques has advantages and disadvantages. You can benefit from successful diversification by:

• Increase sales and revenue

• Grow market share

• Find new revenue streams

• Achieve higher margins compared to existing products

• Limit the impact of changes in the market

However, diversification will cost more in terms of development, sales, and marketing. Additionally, it will need for more managerial abilities, operational resources, and skill sets. Diversification might put your company at risk if these needs are greater than the potential revenue and profit improvements. For instance:

• Limiting potential growth in your company’s core business sectors by investing money and resources on diversification.

• Lack of knowledge or expertise in the new industry or markets may lead to costly delays or mistakes.

• Diversifying too quickly may cause you to lose track or dilute your core products or services.

• If you overextend your resources, you can find it difficult to deliver a consistent level of service, which could result in client resentment and loss of business.

In general, diversifying your business by offering comparable goods and services to your current clientele is less hazardous than undertaking business expansion tactics like developing a product for an entirely new market. Business stability can often be maintained by diversification. It enables you to diversify your bets so that if one of your markets or goods falters, you have a backup plan to keep you going until you get back on track.

Business growth through acquisition, mergers and partnerships

You can expand your firm both organically and through partnering with or acquisition of another company. There may be obvious benefits even if this may lead to concerns with decision-making and potential management and personnel problems. A good post acquisition or merger strategy is often the most important part of an inorganic growth strategy.

Advantages of business collaboration.

Successful commercial partnerships can deliver:

• More assets

• Distribution of the managerial workload and lower costs

• Increased talent and skill base

• A larger network of contacts

• Expansion of markets

• Organic growth and diversification with more resources

• Less business risk

Consider carefully the kind of collaboration you intend to pursue to ensure the best possibilities of success. The perfect partner should compliment your primary brand and business development goals.

Joint ventures and partnerships

Partnerships and joint ventures can provide both parties with a variety of advantages, such as the ability to pool resources like personnel, tools, and clientele. You might be able to expand into new markets or enhance your offering to current ones through a partnership or joint venture with a complementary, non-competitive company.

You should be very selective about who you associate with. The parameters of the partnership or joint venture must be spelled out in a written agreement or contract, and further legal protection is advised.

Collaboration should benefit both parties in the long run. Typically, companies with comparable activities or abilities are the best prospects. A group of solo proprietors, such as a carpenter, a builder, and a gas installer/electrician, might establish a corporation to:

• Boost their stature in the construction industry

• Enable them to submit larger contract bids

• Entice clients seeking a “one-stop shop” service

Mergers and acquisitions.

Acquisition or merger growth is a popular strategy used to achieve market positioning and diversification. It can help:

• Increase market share

• expand the workforce

• Expand the current service or product lineup

• Boost sales

• Achieve economies of scale and reduce costs

• Save expenses by utilizing shared spending plans and increased purchasing power