Crisis Management

The Appleton Greene Corporate Training Program (CTP) for Crisis Management is provided by Ms. Miller Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

Ms. Miller is a risk/crisis management executive with 25+ years of global security leadership experience in the FBI and the private industry. Ms. Miller has led multiple crises over her career. Ms. Miller was a certified crisis negotiator for the FBI for over 20 years. She worked on several kidnappings and hostage takings of American citizens both domestically and internationally during her career. She received the National Intelligence Meritorious Unit Citation as a member of the hostage support team for her meritorious service in the safe return of an American citizen held captive abroad. As an FBI leader, she led the FBI’s response to terrorist attacks against US interests abroad including the attack on the US Consulate in Karachi, Pakistan in 2006, and a terrorist attack at a restaurant in Islamabad, Pakistan in 2008 where several victims were US citizens. Ms. Miller served as the Crisis Management and Counterterrorism leader for the FBI during two National Special Security Events, the Papal visit and the Democratic National Convention in Philadelphia in 2015 and 2016, respectively. Ms. Miller served as the on-scene commander for the FBI during several crises, to include the Amtrack train derailment in Philadelphia in 2015, the manhunt and capture of a violent fugitive who killed a Pennsylvania State Trooper in 2014, and the attempted killing of a Philadelphia police officer in 2016.

In 2006, Ms. Miller received the FBI Director’s award for Investigative Excellence for her leadership in both the US Consulate bombing in Karachi, Pakistan and for the safe release of an American girl kidnapped overseas. The Attorney General’s award for Distinguished Service was awarded to Ms. Miller for her role in a foreign terrorist operation leading to his prosecution in the US.

Upon her retirement from the FBI, Ms. Miller joined the National Football League as the first international security director where she led security operations, to include a crisis management plan, for the London and Mexico City games. Ms. Miller joined TIME as the Director of Global Security where she built and implemented a global security

infrastructure to include cybersecurity, travel security, workplace safety, crisis management, due diligence, and event security. Ms. Miller implemented key security and safety best practices for journalists traveling to hostile working environments including the Ukraine/Russia war.

Ms. Miller’s real-world experience in crisis response and management, building security programs and managing risk provides her with a unique perspective of the complexities and challenges companies face in today’s threat environment.

To request further information about Ms. Miller through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Crisis Management

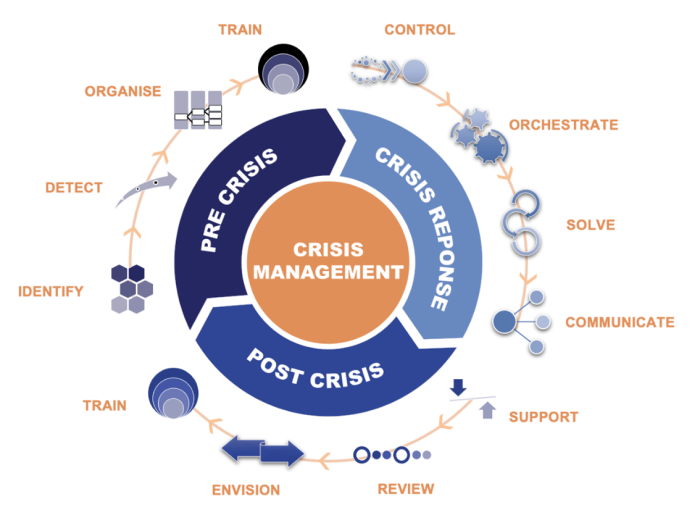

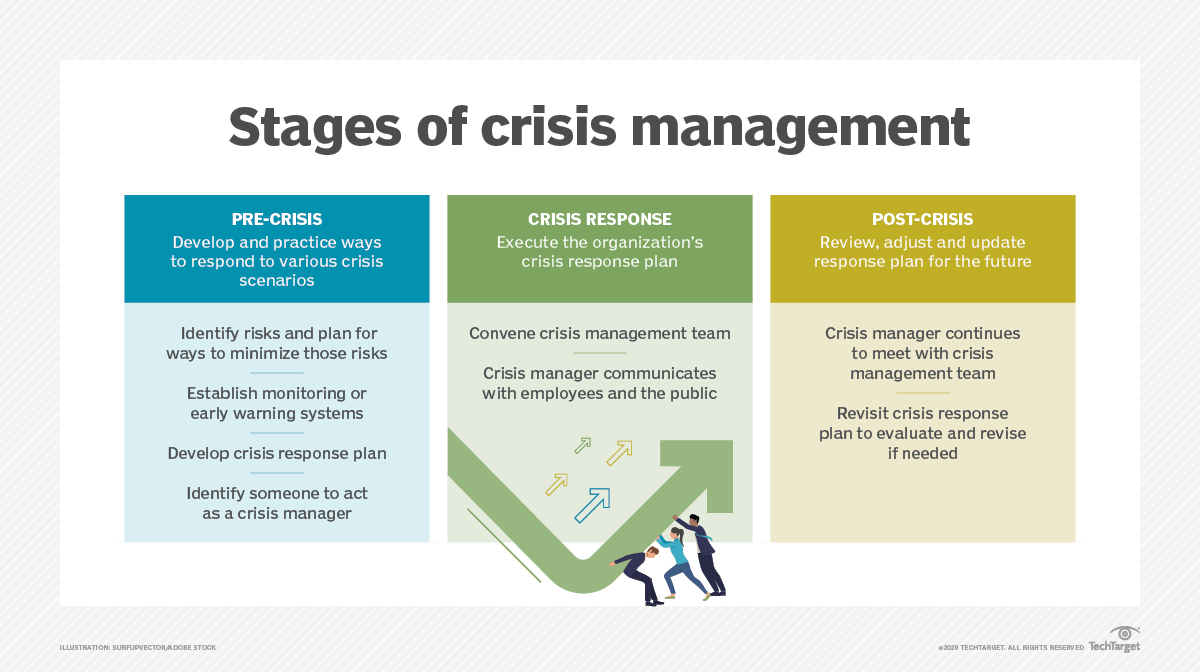

Crisis management, a vital discipline within organizational leadership and public relations, is designed to protect and preserve an entity’s reputation, operations, and sustainability during periods of significant disruption or threat. The importance of crisis management cannot be overstated, as it is the key to navigating unexpected and often sudden events that pose a substantial risk to an organization’s stakeholders, assets, or ability to continue functioning. Effective crisis management involves a series of pre-emptive, strategic, and responsive actions essential for mitigating such events’ adverse impacts.

The scope of crisis management extends across various crises, including natural disasters, financial downturns, cyber-attacks, pandemics, product recalls, and public relations scandals. Every crisis presents unique challenges, requiring tailored strategies and actions to address them. The unpredictable nature of crises makes preparation and agility crucial. Organizations must have well-developed crisis management plans outlining the procedures and responsibilities to be enacted in the event of a crisis.

A robust crisis management plan typically includes several key components: risk assessment, crisis communication strategies, business continuity planning, and post-crisis analysis. Risk assessment involves identifying potential threats and vulnerabilities within an organization, allowing for the development of strategies to either prevent or mitigate these risks. Crisis communication is another critical component, focusing on how an organization communicates with its stakeholders during a crisis. Clear, timely, and transparent communication is not just a strategy, but a reassurance to maintain trust and credibility with customers, employees, investors, and the public, making you feel confident and reassured.

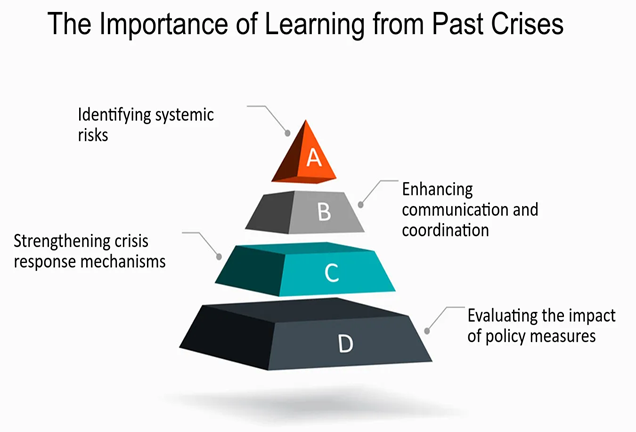

Business continuity planning ensures that essential operations can continue or be quickly restored following a disruption. This may involve creating backup systems, cross-training employees, and developing alternative processes. Once the immediate crisis is managed, organizations must conduct a post-crisis analysis. This analysis is not just a formality, but a crucial step to evaluate the effectiveness of their response and to learn from the experience. It helps to refine crisis management plans and improve preparedness for future crises, making you feel that lessons are learned and improvements are made.

In an increasingly interconnected and complex world, crisis management’s importance cannot be overstated. Organizations that fail to manage crises effectively may suffer severe reputational damage, financial loss, and operational setbacks. In contrast, those who excel in crisis management can emerge stronger, more resilient, and more trusted by their stakeholders. Thus, crisis management is about surviving disruptions and seizing opportunities to strengthen the organization’s foundations and enhance its long-term viability.

Resilience in Action: The Strategic Benefits of Crisis Management for Organizations

Crisis management is an indispensable component of organizational strategy, offering numerous benefits beyond merely surviving a crisis. By proactively managing potential threats, organizations can safeguard their reputation, ensure business continuity, and even emerge more substantial after a crisis. The benefits of crisis management are multifaceted, providing value across various aspects of an organization’s operations and stakeholder relationships. These benefits underscore the strategic importance of crisis management in today’s business landscape.

One of the most significant benefits of crisis management is preserving and protecting an organization’s reputation. Public perception can make or break a business in today’s interconnected world. Effective crisis management involves transparent and timely communication with stakeholders, which helps to maintain trust and credibility. By managing the narrative during a crisis, organizations can prevent misinformation, address concerns promptly, and demonstrate their commitment to resolving the issue. This approach minimizes reputational damage and can enhance an organization’s image as responsible and capable under pressure.

Another critical benefit is the continuity of business operations. A well-prepared crisis management plan includes business continuity strategies that ensure essential functions can continue or be quickly restored after a disruption. This readiness minimizes downtime and the associated financial losses, allowing the organization to maintain service levels, protect revenue streams, and uphold customer satisfaction. By having contingency plans, organizations can respond more effectively to disruptions, reducing the impact on day-to-day operations and maintaining a competitive edge.

Crisis management plays a crucial role in risk mitigation. Through risk assessment, organizations identify potential vulnerabilities and implement measures to prevent or reduce the likelihood of a crisis. This proactive approach is a key aspect of crisis management, helping to avoid costly disruptions and preparing the organization to respond swiftly and efficiently when a situation does arise. Moreover, by regularly reviewing and updating their crisis management plans, organizations can adapt to changing risks and environments, ensuring they remain resilient in the face of new challenges.

Strong crisis management practices also positively impact employee morale and engagement. When employees see that their organization is prepared and has a clear plan for handling crises, it boosts their confidence and sense of security. This reassurance can lead to higher engagement and productivity, even during challenging times. Additionally, involving employees in crisis management planning fosters a culture of preparedness and responsibility, which can further strengthen the organization’s overall resilience.

Finally, organizations that excel in crisis management often find opportunities for growth and improvement. By conducting post-crisis analysis, they can identify weaknesses in their operations and make necessary adjustments, leading to more robust systems and processes. This continuous improvement mindset prepares the organization for future crises and can drive innovation and efficiency across the board.

Overcoming Challenges: How Crisis Management Addresses Key Organizational Pain Points

Organizations often face challenges or “pain points” that effective crisis management can help address. Here are ten key pain points:

1. Reputation Damage:

Reputation is one of the most valuable assets an organization possesses. An organization’s public image can suffer significant damage in a crisis, such as a product recall, scandal, or adverse publicity. This damage can lead to a loss of trust among customers, investors, and the general public, potentially resulting in long-term financial harm. Crisis management is crucial in mitigating this damage by implementing clear, consistent, and transparent communication strategies. By promptly addressing concerns, providing accurate information, and showing accountability, organizations can protect their reputation and enhance their image by demonstrating effective leadership during challenging times.

2. Operational Disruptions:

Crises, whether natural disasters, technical failures, or other unforeseen events, can abruptly halt or severely disrupt business operations. These disruptions can lead to significant productivity, service delivery, and revenue losses. Crisis management is essential for ensuring business continuity, which involves developing and executing plans to keep critical functions running or quickly restoring them after a disruption. This proactive approach minimizes downtime, ensures that the organization can continue to serve its customers, and reduces the long-term impact of the crisis on its operations.

3. Financial Losses:

Financial impacts are often one of a crisis’s most immediate and severe consequences. Organizations may face revenue loss due to operational disruptions, increased costs associated with crisis response, or the fallout from reputational damage. Effective crisis management helps mitigate these financial losses by enabling organizations to respond swiftly and strategically to crises. Organizations can better absorb the economic shock and manage cash flow during and after a crisis by having contingency plans, insurance coverage, and financial reserves.

4. Legal and Regulatory Compliance Issues:

Organizations may find themselves exposed to legal liabilities during a crisis, such as lawsuits, fines, or sanctions, mainly if the crisis results from non-compliance with regulations or negligence. Crisis management includes legal preparedness, ensuring the organization’s response complies with relevant laws and regulations. This preparedness helps avoid or minimize legal penalties and protects the organization’s legal standing, thereby preventing further damage to its reputation and financial health.

5. Employee Safety and Morale:

Crises can put employee safety at risk and significantly impact morale, leading to decreased productivity and engagement. For example, during a pandemic, ensuring the health and safety of employees becomes a critical concern. Crisis management plans often include protocols for protecting employees, such as health and safety measures, clear communication about risks, and support systems for those affected by the crisis. Organizations can maintain morale, retain talent, and ensure a motivated and productive workforce, even in challenging circumstances, by prioritizing employee well-being.

6. Supply Chain Disruptions:

Many organizations rely on intricate and interdependent supply chains, vulnerable to disruptions from natural disasters, geopolitical issues, or other crises. These disruptions can lead to delays, increased costs, and an inability to meet customer demands. Crisis management involves developing contingency plans that include alternative suppliers, stockpiling essential materials, and diversifying the supply chain. These measures help maintain supply chain integrity, reduce the risk of bottlenecks, and ensure the organization can continue to deliver products and services to its customers.

7. Cybersecurity Threats:

Cybersecurity threats such as data breaches, ransomware attacks, and system outages are increasingly common in the digital age. These threats can cause significant operational disruptions, financial loss, and reputational damage. Crisis management includes robust cybersecurity measures designed to prevent such attacks and to respond effectively if they occur. This includes regular security audits, employee training, incident response plans, and partnerships with cybersecurity experts. Organizations can protect sensitive information, maintain operational continuity, and safeguard their reputation by preparing for and responding to cybersecurity threats.

8. Customer Trust and Retention:

Customer trust is crucial for any organization, and a poorly managed crisis can significantly lose that trust, driving customers to competitors. Effective crisis management focuses on maintaining customer trust through timely and transparent communication and ensuring service continuity. Organizations can retain customer loyalty and strengthen customer relationships during a crisis by addressing customer concerns, offering solutions, and demonstrating a commitment to their well-being.

9. Leadership and Decision-Making Under Pressure:

Crises often create high-pressure situations where leaders must make quick, high-stakes decisions. Poor decision-making during a crisis can exacerbate the problem, leading to more significant losses and damage. Crisis management frameworks provide leaders with the tools, protocols, and support to make informed and timely decisions. This includes clear lines of communication, access to real-time data, and predefined roles and responsibilities. By supporting effective decision-making, crisis management ensures that the organization can respond to crises in a coordinated and effective manner.

10. Media and Public Scrutiny:

In today’s digital and social media-driven world, crises are often magnified by intense media coverage and public scrutiny. Missteps handling the situation can lead to widespread negative attention, further damaging the organization’s reputation. Crisis management involves media training for key spokespeople, developing a clear and consistent message, and managing public relations effectively. By controlling the narrative, engaging with the media proactively, and responding to public concerns, organizations can navigate media scrutiny, protect their reputation, and maintain public trust.

The Crisis Management program empowers organizations to effectively navigate disruptions by preserving their reputation, ensuring business continuity, and mitigating risks. Through comprehensive strategies including risk assessment, crisis communication, and post-crisis analysis, the program enhances organizational resilience, boosts employee morale, and identifies opportunities for growth. By preparing your organization to respond swiftly and strategically to crises, this program not only helps you survive disruptions but also positions you to emerge stronger and more trusted by your stakeholders.

Case Study: Johnson & Johnson’s Tylenol Crisis (1982)

In 1982, Johnson & Johnson faced a severe crisis when seven people in the Chicago area died after taking Tylenol capsules that had been laced with cyanide. At the time, Tylenol was the company’s most successful product, accounting for a significant portion of its profits. The incident triggered a nationwide panic and could have destroyed the brand.

Crisis Management Strategy: Johnson & Johnson’s handling of the crisis is widely regarded as a textbook example of effective crisis management. The company immediately acted with transparency and concern for public safety, prioritizing consumer trust over short-term financial losses. Key elements of their strategy included:

1. Immediate Response: Johnson & Johnson quickly issued warnings to the public through the media, advising people to stop consuming all Tylenol products. This swift action helped to prevent further harm and demonstrated the company’s commitment to consumer safety.

2. Product Recall: Despite the significant cost, Johnson & Johnson voluntarily recalled approximately 31 million bottles of Tylenol from store shelves across the United States. This move showed that the company placed consumer safety above its profits, reinforcing public trust.

3. Communication: The company maintained open and honest communication with the public, providing regular updates about the situation and the steps they were taking to address it. This transparency helped to maintain credibility during the crisis.

4. Rebranding and Relaunch: Johnson & Johnson introduced tamper-resistant packaging for Tylenol and offered coupons for the new product to encourage consumers to return to the brand. This innovation not only restored public confidence in Tylenol but also set new industry standards for product safety.

Outcome: Thanks to their decisive and consumer-focused crisis management, Johnson & Johnson successfully regained the trust of the public. Within a year, Tylenol had regained its market share, and the company’s reputation was stronger than ever. The case is often cited in business schools and corporate training programs as a model for how to manage a crisis effectively.

Key Takeaways: Johnson & Johnson’s handling of the Tylenol crisis underscores the importance of transparency, swift action, and prioritizing stakeholder trust in crisis management. Their ability to turn a potentially devastating situation into a long-term success story highlights the value of having a well-prepared crisis management plan.

Curriculum

Crisis Management – Part 1- Year 1

- Part 1 Month 1 Understanding Crisis Management

- Part 1 Month 2 Risk Assessment and Identification

- Part 1 Month 3 Leadership Foundation

- Part 1 Month 4 Business Continuity

- Part 1 Month 5 Decision Making

- Part 1 Month 6 Communication Techniques

- Part 1 Month 7 Crisis Management Team (CMT)

- Part 1 Month 8 Crisis Management Plan (CMP)

- Part 1 Month 9 Crisis Response

- Part 1 Month 10 Psychological Impact of Crises

- Part 1 Month 11 Training

- Part 1 Month 12 After-Action Review

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Crisis Management corporate training program.

Crisis Management – Part 1- Year 1

- Part 1 Month 1 Understanding Crisis Management – There are generally three common elements to a crisis. A threat, surprise and a short decision time. A crisis could be a major or minor, could cause reputational harm as well as physical harm, and could be internal or external. Understanding what a crisis is before it occurs is essential to creating a crisis management plan for business. Understanding the difference between crisis management, risk management, and business continuity is important. A crisis management plan prepares an organization for potential crises that may arise at any given time. Crisis planning helps your company to become more resilient and more capable of making effective decisions in the short and long term. A business continuity plan involves the processes and procedures a business should put in place to ensure mission critical business functions can still operate during the crisis and after.

- Part 1 Month 2 Risk Assessment and Identification – Organizations should understand the risks and vulnerabilities they could face and be able to identify any potential crisis triggers. Once there is an understanding of the potential risks and vulnerabilities to the company, organizations should learn to develop a crisis risk mapping.

- Part 1 Month 3 Leadership Foundation – Leading during a crisis might seem daunting. Your ability as a leader will be tested. Learn to build a foundation that will help you lead and manage in a crisis. Learn to build effective partnerships and foster empathy, both of which are crucial assets to have.

- Part 1 Month 4 Business Continuity – Learn how to carry out mission-critical business functions during a crisis. Learn how to build an effective business continuity plan so your organization can resume normal operations as quickly as possible in the event of a crisis.

- Part 1 Month 5 Decision Making – Effective decision making is key during a crisis. Yet many leaders fail to make decisions when needed. Displaying leadership requires you to remain focused, stay calm, and act decisively all while managing expectations and working well with others on the team. CEOs hold significant responsibility in leading their organization through crises. One of their key responsibilities is to provide clarity and direction for the organization. Learn how to make effective decisions under pressure and develop a resilient organizational culture.

- Part 1 Month 6 Communication Techniques – How and what you communicate during a crisis is crucial. One of the key elements of leading during a crisis is clear and trustworthy communication. Learn to foster open communication, transparency, and mutal understanding. Learn how to build internal and external communication plans.

- Part 1 Month 7 Crisis Management Team (CMT) – Identify key stakeholders such as human resources, legal, IT, executive team, security who can make decisions during a crisis. The purpose of the CMT is to work together during a crisis, have clear chain of command responsibilities, and ensure reporting mechanisms

- Part 1 Month 8 Crisis Management Plan (CMP) – Build/ review your crisis management plan. The crisis management leader is responsible for developing the CMP along with members of the CMT. The CMP should include an organisation chart with chain of command, the type of risks, a response plan to those risks, internal and external communications, and an after-action plan.

- Part 1 Month 9 Crisis Response – Once the CMP is in place, learn how to respond to a crisis. Learn how to activate the CMP, understand chain of command, communicate internally and externally, develop action protocols.

- Part 1 Month 10 Psychological Impact of Crises – The psychological impact of going through a crisis can impact employees and victims in various ways. It’s important for organisations to recognise signs of stress and trauma, communicate effectively in stressful situations, and provide emotional support to individuals and teams.

- Part 1 Month 11 Training – Develop a training programme for the CMT, and other employees. The purpose is to understand and walk through different scenarios that may arise, so employees understand their role in a crisis. Training prepares the CMT to be ready to act, creating muscle memory for their role crisis response.

- Part 1 Month 12 After-Action Review – Organisations should analyze how they performed during the crisis response. Collecting data and lessons learned can help businesses recover, help leaders identify and prioritize areas for improvement. After reviewing their performance, organizations should update their CMP as necessary.

Methodology

Crisis Management

Crisis management is a structured discipline that plays a crucial role in helping organizations navigate and recover from unforeseen events. It encompasses various business processes, methodologies, and standardized practices to ensure organizations can effectively manage crises, minimize their impact, and emerge stronger. Below, we explore the critical business processes, common methodologies, and standard methods of effective crisis management.

Risk Assessment and Analysis

One of the foundational elements of crisis management is risk assessment and analysis. This process involves identifying and evaluating potential risks that could lead to a crisis. Standard methodologies include using a risk matrix, which assesses the probability and impact of potential crises, and SWOT analysis, which evaluates the strengths, weaknesses, opportunities, and threats related to these risks. Scenario planning is another crucial technique, allowing organizations to develop and analyze hypothetical crisis scenarios to better understand potential impacts and necessary responses.

Crisis Management Planning

A comprehensive crisis management plan is essential for addressing and managing crises. This plan outlines the organization’s strategy, including roles, responsibilities, communication strategies, and recovery steps. Business continuity planning (BCP) ensures critical business functions can continue during and after a crisis. The Incident Command System (ICS), widely used in emergency management, provides a standardized, on-scene, all-hazard incident management approach integral to effective crisis response.

Crisis Communication

Effective communication is critical during a crisis. Managing the flow of information to internal and external stakeholders is an essential process for crisis management. Developing a crisis communication plan (CCP) helps ensure timely, transparent, and consistent communication. Stakeholder analysis identifies vital stakeholders and tailors communication strategies to their specific needs. Message mapping is another valuable technique that helps organizations develop concise, clear, and consistent messages for different audiences during a crisis.

Training and Simulation

Preparation is vital to effective crisis management, and training and simulation are essential components of this preparation. Tabletop exercises and discussion-based sessions simulating crisis scenarios help test the crisis management plan and improve readiness. Mock drills provide practical experience by simulating real-life crises, testing response protocols, and coordination. Crisis simulation software allows organizations to simulate crises in a controlled virtual environment, enhancing preparedness.

Response and Recovery

Executing the crisis management plan is critical when a crisis occurs. The response and recovery process involves managing the crisis and restoring normal operations. This includes implementing an emergency response plan (ERP) for immediate actions to protect people, assets, and the environment. Continuity of operations planning (COOP) ensures that essential functions can continue during and after a crisis. Disaster recovery planning (DRP) focuses on restoring IT systems and data, particularly in the case of cyber-attacks or data breaches.

Crisis Evaluation and Learning

Once a crisis has been managed, it is essential to review the response to identify lessons learned and improve future preparedness. The after-action review (AAR) is a structured process that evaluates what happened, why, and how the crisis was managed. Root cause analysis (RCA) is used to identify the underlying causes of the crisis, helping to prevent recurrence. Documenting lessons learned is crucial for refining crisis management plans and enhancing the organization’s resilience.

Governance and Compliance

A critical aspect of crisis management is ensuring that crisis management processes comply with legal, regulatory, and organizational standards. Standards like ISO 22301, which focuses on business continuity management systems (BCMS), and ISO 31000, a standard for risk management, provide guidelines that organizations can follow. Regular regulatory compliance audits are also necessary to ensure that crisis management plans adhere to industry regulations and standards.

Stakeholder Engagement and Relationship Management

Building and maintaining relationships with key stakeholders is essential for ensuring their cooperation during a crisis. Stakeholder mapping helps organizations identify and prioritize stakeholders based on their influence and interest in crisis outcomes. A well-developed public relations strategy is crucial for managing relationships with the media, the public, and other stakeholders. Developing partnerships with external entities, such as emergency services and government agencies, is vital for coordinated crisis response.

Crisis Leadership and Decision-Making

Leadership is pivotal during a crisis, and effective decision-making under pressure is essential. Decision-making models like the OODA Loop (Observe, Orient, Decide, Act) and the DECIDE Model (Detect, Estimate, Choose, Identify, Do, Evaluate) guide leaders in making informed and timely decisions during crises. Leadership training and ethical decision-making frameworks ensure leaders can navigate crises effectively while upholding the organization’s values and ethics.

Documentation and Reporting

Maintaining detailed records of crisis management activities is essential for accountability and continuous improvement. Incident logs provide thorough documentation of actions taken during a crisis, including decisions, communications, and outcomes. Comprehensive crisis management reports are developed post-crisis to evaluate the response, capture lessons learned, and suggest improvements. Regulatory reporting is also necessary to ensure compliance with legal requirements for reporting incidents, particularly in highly regulated industries.

By integrating these methodologies and processes, organizations can enhance their ability to respond swiftly and effectively to crises, protect their stakeholders, and ensure long-term resilience. Crisis management is not just about surviving difficult times; it’s about emerging more robust and better prepared for future challenges.

Industries

This service is primarily available to the following industry sectors:

Government

While not a traditional sector like manufacturing or finance, the government-industry plays a crucial role in society by providing essential services, regulatory oversight, and governance. Over the past few decades, the government sector has evolved significantly, driven by technological advancements, changing public expectations, and shifts in revenue models. This evolution reflects the need to adapt to a more complex and interconnected world, where government functions are increasingly intertwined with the private sector and digital technologies.

Historically, the government-industry was primarily focused on providing essential public services, such as national defense, law enforcement, education, infrastructure, and public health. Governments operate through a structured system of legislative, executive, and judicial branches, each responsible for different aspects of governance. Funding for these activities traditionally came from taxation, supplemented by borrowing and revenue from public assets.

In the 21st century, the digital transformation of the government-industry accelerated. E-governance initiatives became widespread, enabling governments to provide services online, streamline bureaucratic processes, and increase transparency. Citizens began interacting with their governments through digital platforms, applying for permits, paying taxes, and accessing public records online. This shift improved government operations’ efficiency and made services more accessible to the public.

The government industry is unique in its revenue model, primarily relying on taxation to fund its activities. Taxes on income, sales, property, and corporate profits constitute the bulk of government revenue. In addition to taxes, governments generate revenue through various other means, such as service fees, fines, and duties on imports and exports.

In 2023, the combined revenue of all levels of government globally was estimated to exceed $30 trillion. The largest portion of this revenue comes from income taxes, followed by value-added taxes (VAT) and corporate taxes. In the United States alone, federal government revenue was around $4.5 trillion in 2022, with individual income taxes accounting for nearly half of this amount.

Governments also raise revenue through borrowing and issuing bonds that investors buy. This allows them to finance large projects or cover deficits when expenditures exceed revenue. Public debt is a common feature of modern economies, with many governments using it to manage economic cycles and fund long-term investments.

In recent years, governments have increasingly turned to alternative revenue streams, such as public-private partnerships and privatization of certain public services. These approaches help governments manage costs and generate revenue without relying solely on taxation. For example, toll roads operated by private companies under government contracts generate income shared with the public sector.

The government-industry faces several challenges in the modern era. One of the most significant is balancing fiscal responsibility with the growing demand for public services. As populations grow and age, governments must find ways to fund healthcare, pensions, and other social services without overburdening taxpayers or accumulating unsustainable debt.

Another challenge is maintaining public trust and transparency. The rise of digital technology has made government operations more visible to the public and increased the potential for cyber threats and data breaches. Governments must invest in cybersecurity and data protection to safeguard sensitive information and maintain public confidence.

Despite these challenges, the evolution of the government-industry presents numerous opportunities. The continued integration of technology into government operations offers the potential for further improvements in efficiency, service delivery, and citizen engagement. Big data, artificial intelligence (AI), and blockchain technology are being explored as tools to enhance decision-making, reduce fraud, and improve the transparency of government transactions.

Another opportunity is the shift towards more participatory governance. Digital platforms enable citizens to engage more directly with their governments, providing feedback, participating in consultations, and even co-creating policies. This trend towards “Gov 2.0” transforms the relationship between governments and their citizens, making governance more collaborative and responsive.

The government-industry has evolved from a traditional, bureaucratic model to a more dynamic and interconnected system that leverages technology and partnerships to meet the public’s needs. As the industry continues to adapt to the demands of a rapidly changing world, the focus will likely be on enhancing transparency, improving service delivery, and maintaining fiscal sustainability.

The ongoing digital transformation will shape the future of the government-industry, the increasing importance of data-driven decision-making, and the need to address global challenges such as climate change, economic inequality, and public health crises. Governments will need to continue innovating and collaborating with the private sector and civil society to build resilient, efficient, and inclusive systems that serve the needs of all citizens.

With global government revenue projected to grow as economies expand, governments’ ability to effectively manage resources, adopt new technologies, and engage with citizens will be crucial to their success in the coming decades.

Sports

The sports industry has undergone significant evolution over the past few decades, driven by technological advancements, shifting consumer behaviors, and changes in revenue models. From the traditional in-stadium experience and television broadcasts to the rise of digital platforms, social media, and esports, the sports industry continues to adapt to a rapidly changing landscape.

Historically, the sports industry was primarily centered around live events, where fans would attend games and matches in person. This experience was complemented by television and radio broadcasts, which brought the action to a broader audience. Advertising, sponsorships, and ticket sales were the primary revenue streams, with broadcasting rights becoming increasingly valuable as viewership grew.

The advent of the internet and the rise of digital platforms in the early 21st century marked a significant turning point for the sports industry. Online streaming services, social media, and mobile apps have transformed how fans engage with their favorite sports, teams, and athletes. Fans now have access to live streams, highlights, behind-the-scenes content, and real-time statistics at their fingertips, which has further fueled the global growth of the sports industry.

The sports industry is a massive global business, generating substantial revenue across various segments. As of 2023, the global sports market is estimated to be worth over $600 billion, with revenue streams coming from broadcasting rights, sponsorships, merchandising, ticket sales, and digital media.

Broadcasting Rights: Broadcasting rights remain one of the most lucrative revenue streams in the sports industry. Major leagues and tournaments, such as the NFL, NBA, FIFA World Cup, and the Olympic Games, command billions of dollars for exclusive broadcasting deals. For example, the NFL secured over $110 billion in revenue from broadcasting rights agreements with major networks in the United States through 2033.

Sponsorships: Sponsorship deals are another critical revenue stream for the sports industry. Companies invest heavily in sports sponsorships to increase brand visibility and associate themselves with the passion and loyalty of sports fans. Sponsorship spending in sports is estimated to surpass $65 billion globally, with major brands like Nike, Adidas, Coca-Cola, and Emirates leading the way.

Merchandising: Merchandising, including the sale of jerseys, apparel, and other branded merchandise, also contributes significantly to the industry’s revenue. For example, the global sports apparel market alone was valued at over $180 billion in 2023, driven by fan demand for team-branded products and the popularity of athlete-endorsed lines.

Ticket Sales and Live Events: Although digital consumption has grown, live events and ticket sales remain a significant revenue source. Major sports events like the Super Bowl, UEFA Champions League, and the Olympics attract millions of fans in-person and generate billions in ticket sales, hospitality, and associated spending.

Digital Media and Streaming: The rise of digital media has opened up new revenue opportunities for the sports industry. Streaming services, social media platforms, and mobile apps have become essential tools for reaching global audiences, especially among younger fans. Digital streaming rights are becoming increasingly valuable, with platforms like Amazon, DAZN, and ESPN+ investing heavily in exclusive sports content. Additionally, social media platforms like Instagram, Twitter, and TikTok offer athletes and teams new avenues for monetization through sponsorships and fan engagement.

Despite its growth, the sports industry faces several challenges. The competition for viewer attention is intense, with a plethora of entertainment options available.

The rise of esports is both a challenge and an opportunity for the traditional sports industry. Esports has rapidly grown into a multi-billion-dollar industry, attracting millions of viewers and new sponsors. Traditional sports organizations are increasingly investing in esports to tap into younger audiences and diversify their revenue streams.

Technological advancements, such as virtual reality (VR) and augmented reality (AR), present new opportunities for fan engagement. These technologies offer immersive experiences that can bring fans closer to the action, whether they’re watching from home or in a stadium.

The sports industry has evolved from a predominantly live and broadcast-based model to a dynamic ecosystem characterized by diverse content distribution channels and revenue streams. As the industry continues to adapt to technological changes and shifting consumer preferences, sports organizations must innovate to stay competitive.

The future of the sports industry will likely be defined by the continued integration of technology, the rise of new sports formats like esports, and the ongoing efforts to enhance fan engagement both in-person and digitally. With the global sports market projected to reach $700 billion by 2026, the industry’s ability to innovate and adapt will be crucial to sustaining its growth and relevance in a rapidly evolving landscape.

Media

The media industry has undergone a dramatic evolution over the past few decades, shaped by technological advancements, shifting consumer behaviors, and changes in revenue models. From the dominance of traditional print and broadcast media to the rise of digital platforms and social media, the industry has been continuously adapting to the demands of a rapidly changing landscape.

The digital transformation of the media industry has not only changed how content is delivered but also how it is monetized. Advertising remains a key revenue stream, but the dynamics have shifted. In the digital era, companies like Google and Facebook have come to dominate the advertising market, capturing the majority of digital ad spending due to their vast user data and targeted advertising capabilities. This has created challenges for traditional media companies, which now compete with tech giants for advertising dollars.

The global media industry generates substantial revenue. As of 2023, the industry is estimated to be worth over $2.5 trillion, with digital media, including online advertising, streaming services, and digital subscriptions, contributing significantly to this figure. Digital advertising alone accounts for over $600 billion globally, with companies like Google and Facebook (Meta) controlling a significant share. Streaming services have also become a major revenue driver, with platforms like Netflix, which generated over $30 billion in revenue in 2022, leading the charge. The broader entertainment and media sector, including film, television, music, and video games, has seen robust growth, driven by increasing consumer spending on digital content.

Subscription models have become increasingly important in the digital age. Many news organizations have introduced paywalls, requiring readers to subscribe to access premium content. Streaming services also rely heavily on subscription fees, with companies like Netflix generating billions in revenue from monthly subscribers. This shift towards subscription-based models is seen as a way to build stable, recurring revenue streams in a landscape where advertising revenue can be volatile. The subscription video-on-demand (SVOD) market, for example, is expected to surpass $100 billion in revenue by 2025, highlighting the growing consumer appetite for on-demand content.

Content monetization has also expanded into new areas, such as sponsored content, branded partnerships, and influencer marketing. Social media platforms, where influencers have large followings, have become lucrative channels for brands to reach audiences, further diversifying revenue streams within the media industry. Influencer marketing alone is projected to become a $20 billion industry by 2024, demonstrating its growing significance as a revenue stream.

Despite these advancements, the media industry faces several challenges. The competition for consumer attention is fierce, with a plethora of content available across various platforms. Traditional media companies must continually innovate to stay relevant, whether by investing in new technologies like artificial intelligence and data analytics or by exploring new content formats, such as podcasts and short-form videos. Podcasts, for example, have become a significant revenue generator, with the global podcasting market expected to exceed $4 billion by 2024.

The issue of misinformation and declining trust in media is also a significant concern. The rise of fake news and the spread of disinformation on social media platforms have eroded public trust in the media. This has prompted media organizations to invest in fact-checking and editorial integrity to rebuild credibility with their audiences.

On the other hand, the evolution of the media industry presents new opportunities. The demand for high-quality, niche content is growing, enabling media companies to cater to specific audiences with tailored content. Moreover, globalization and digital distribution have allowed media companies to reach international audiences, opening new markets and revenue streams. For example, the global video game industry, a key segment of the broader media landscape, has seen explosive growth, with revenues surpassing $180 billion in 2021, driven by the popularity of online gaming and esports.

The media industry has evolved from a predominantly print and broadcast-based model to a complex digital ecosystem characterized by diverse content distribution channels and revenue streams. As the industry continues to adapt to technological changes and shifting consumer preferences, media companies must innovate and diversify their revenue models to thrive in a highly competitive and rapidly changing environment. The future of the media industry will likely be defined by the continued integration of technology, the rise of new content formats, and the ongoing battle for consumer attention and trust. With the global media and entertainment market projected to reach $3 trillion by 2026, the industry’s ability to innovate and adapt will be crucial to sustaining its growth and relevance.

Oil and Gas

The oil and gas industry has long been a cornerstone of global economic stability and growth, playing a pivotal role in energy production, geopolitical dynamics, and commercial enterprises. Understanding its economic and commercial landscape requires an analysis of its recent history, current position, and future outlook.

The oil and gas industry has experienced significant volatility over the past decade, largely driven by geopolitical tensions, technological advancements, and shifting market dynamics. In the early 2010s, the industry saw a boom in production, particularly in the United States, due to the shale revolution. Hydraulic fracturing and horizontal drilling unlocked vast reserves of oil and natural gas, making the U.S. one of the world’s leading producers. This surge in supply led to a period of lower oil prices, causing economic strain on traditional oil-producing nations like Saudi Arabia, Russia, and Venezuela, which rely heavily on oil revenues.

However, the industry faced a dramatic downturn in 2014-2015 when oil prices plummeted from over $100 per barrel to below $40. This decline was precipitated by a combination of oversupply, weaker global demand growth, and OPEC’s decision to maintain high production levels to defend market share against the burgeoning U.S. shale industry. The result was widespread financial distress in the sector, leading to bankruptcies, mergers, and a sharp reduction in capital expenditure.

The industry began to recover in 2016, as OPEC and non-OPEC producers agreed to production cuts to stabilize prices. However, the COVID-19 pandemic in 2020 dealt another blow to the industry, as global lockdowns led to an unprecedented collapse in oil demand. Prices briefly turned negative in April 2020, forcing producers to cut output and rethink their strategies.

As of 2024, the oil and gas industry is navigating a complex landscape shaped by the dual challenges of energy transition and geopolitical uncertainty. On one hand, the industry continues to recover from the pandemic-induced downturn, with oil prices stabilizing around $70-$80 per barrel, supported by a cautious approach to production increases by OPEC+ and robust demand recovery, particularly in Asia.

On the other hand, the sector faces mounting pressure to decarbonize and adapt to a world increasingly focused on sustainability and climate change. The push for renewable energy sources, coupled with regulatory changes and investor activism, has forced oil and gas companies to diversify their portfolios and invest in cleaner technologies. Major players like BP, Shell, and TotalEnergies are rebranding themselves as energy companies, with significant investments in wind, solar, hydrogen, and carbon capture projects.

Commercially, the industry is also witnessing a shift in investment strategies. There is a growing focus on capital discipline, cost efficiency, and technological innovation. Digitalization, artificial intelligence, and automation are being increasingly adopted to enhance operational efficiency, reduce costs, and improve safety. Moreover, the rise of Environmental, Social, and Governance (ESG) criteria is reshaping how companies operate and report their performance.

Looking ahead, the oil and gas industry faces a challenging yet opportunity-rich future. The global energy transition is set to accelerate, with governments, corporations, and consumers increasingly committing to net-zero emissions targets. This shift will likely result in a gradual decline in oil demand, particularly in developed markets, as electric vehicles, renewable energy, and energy efficiency measures gain traction.

However, oil and gas are expected to remain critical components of the global energy mix for the foreseeable future, particularly in developing regions where energy demand continues to grow. Natural gas, in particular, is seen as a key transition fuel, bridging the gap between coal and renewables.

In the commercial arena, the industry will likely see continued consolidation, with companies focusing on core assets and divesting from non-core operations. The emphasis on low-cost production, portfolio optimization, and technological advancement will be crucial for maintaining competitiveness. Additionally, the sector’s ability to adapt to changing regulatory environments and consumer preferences will determine its long-term viability.

Locations

This service is primarily available within the following locations:

Miami, FL

Miami’s economy is a vibrant and dynamic ecosystem that reflects its unique position as a global gateway, not just for the United States, but for Latin America and beyond. The city’s Gross Domestic Product (GDP) is heavily influenced by its diverse economic sectors, with international trade, finance, tourism, real estate, and a growing technology sector making significant contributions.

International trade is a crucial driver of Miami’s GDP. The Port of Miami plays a central role in this, being one of the busiest cargo ports in the United States. In 2023, the port contributed significantly to the city’s GDP, with international trade accounting for approximately $43 billion. The port’s activity, which includes both cargo and cruise operations, underscores Miami’s role as the “Gateway to the Americas,” facilitating robust trade links with Latin America and the Caribbean. This trade activity not only boosts Miami’s GDP but also supports thousands of jobs in the city.

Miami’s financial sector is another substantial contributor to its GDP, particularly through its international banking and financial services. The city’s financial district, centered around Brickell Avenue, is home to the highest concentration of international banks in the United States, which collectively manage billions of dollars in assets. In 2022, the finance and insurance sectors contributed over $45 billion to Miami’s GDP. The city’s financial institutions are crucial in facilitating international trade and investment, particularly for clients from Latin America, and play a key role in the overall economic health of the region.

Tourism is a cornerstone of Miami’s economy, significantly impacting the city’s GDP. In 2023, Miami-Dade County welcomed over 24 million visitors, contributing nearly $18 billion directly to the local economy. The tourism and hospitality sector, which includes hotels, restaurants, and entertainment venues, is vital for employment and GDP growth. Iconic areas like South Beach and cultural events such as Art Basel Miami Beach draw international attention and tourism dollars, further boosting the city’s economic output.

The real estate and construction sectors are pivotal to Miami’s GDP, driven by both domestic and international demand. In 2022, real estate, rental, and leasing activities contributed around $35 billion to the city’s GDP. The demand for luxury condominiums and commercial properties, especially from international investors, has led to a surge in construction activity. This sector not only enhances Miami’s skyline but also significantly adds to the city’s economic output, supporting a wide range of jobs and industries.

Although still emerging, Miami’s technology sector is increasingly contributing to the city’s GDP. The city’s efforts to position itself as a tech hub have started to pay off, with the technology sector contributing approximately $6 billion to Miami’s GDP in 2023. Initiatives like eMerge Americas and the rise of tech startups have attracted venture capital and innovation to the city. This growing sector is seen as a key part of Miami’s strategy to diversify its economy and sustain long-term economic growth.

Miami’s economy is multifaceted, with each sector making significant contributions to its overall GDP. The city’s strong foundations in international trade, finance, tourism, and real estate, complemented by its growing technology sector, ensure that Miami remains a vital economic player both nationally and internationally. As Miami continues to grow and diversify, its GDP is expected to rise, reflecting the city’s economic resilience and dynamism.

New York, NY

New York City, often regarded as the financial capital of the world, has one of the most diverse and robust economies globally. The city’s Gross Domestic Product (GDP) exceeds $1.8 trillion, making it not only the largest city economy in the United States but also one of the largest globally. New York’s economy is driven by various sectors, including finance, real estate, media, technology, healthcare, and tourism.

The financial services sector is the backbone of New York City’s economy. Wall Street, located in the Financial District of Lower Manhattan, is synonymous with the American financial industry. The New York Stock Exchange (NYSE) and NASDAQ, two of the largest stock exchanges in the world, are based in the city. The financial services sector alone contributes approximately $429 billion annually to the city’s GDP. Major global banks, investment firms, hedge funds, and insurance companies have their headquarters or significant operations in New York, making it a central hub for global finance. This sector not only drives a substantial portion of the city’s GDP but also influences global financial markets.

New York’s real estate sector is another major contributor to the city’s economy. The city’s skyline, known for its iconic skyscrapers, is continually evolving with new developments. The real estate market in New York is one of the most expensive and active in the world, with both residential and commercial properties commanding high prices. In 2023, the real estate, rental, and leasing sector contributed over $250 billion to the city’s GDP. The construction industry, closely tied to real estate, also plays a significant role, with ongoing developments across the five boroughs. High-profile projects such as Hudson Yards and the revitalization of Lower Manhattan post-9/11 have underscored the importance of real estate to the city’s economy.

New York City is a global center for media, entertainment, and the arts, contributing significantly to the local economy. The city is home to major media conglomerates such as NBCUniversal, CBS, and The New York Times Company, which influence global news and entertainment. The media and entertainment industry contributes around $150 billion annually to New York’s GDP. Broadway, with its theater productions, is a key component of this sector, attracting millions of visitors and generating billions in revenue each year. Additionally, the city is a hub for advertising, publishing, and digital media, further bolstering its economic output.

In recent years, New York has emerged as a significant player in the technology sector, earning the nickname “Silicon Alley.” The tech industry in New York is rapidly growing, with contributions to the city’s GDP exceeding $50 billion annually. Startups and established tech companies alike are drawn to the city for its access to capital, diverse talent pool, and proximity to industries such as finance and media. Major tech firms like Google, Facebook, and Amazon have expanded their presence in New York, further solidifying the city’s status as a technology hub.

The healthcare and life sciences sectors are crucial to New York’s economy, contributing over $250 billion to the city’s GDP. New York is home to some of the world’s leading hospitals and research institutions, such as NewYork-Presbyterian Hospital, NYU Langone Health, and the Memorial Sloan Kettering Cancer Center. The city’s healthcare sector not only provides critical services to its residents but also leads in medical research, education, and innovation.

Tourism is another vital component of New York’s economy. The city attracts over 60 million visitors annually, contributing more than $80 billion to the local economy. Iconic landmarks like Times Square, Central Park, the Statue of Liberty, and cultural institutions like the Metropolitan Museum of Art and the Broadway theater district draw tourists from around the world. The hospitality industry, including hotels, restaurants, and entertainment venues, thrives on this steady influx of visitors, supporting jobs and businesses across the city.

New York City’s economy is a complex and multifaceted ecosystem driven by key sectors such as finance, real estate, media, technology, healthcare, and tourism. Each of these sectors makes significant contributions to the city’s GDP, reflecting New York’s status as a global economic powerhouse. As the city continues to evolve, its diverse economy ensures resilience and sustained growth, making New York not only a key player in the national economy but also a critical center of global commerce and innovation.

Los Angeles, CA

Los Angeles, the second-largest city in the United States, is not just a city, but a global economic powerhouse. Its dynamic and diverse economy ranks among the largest in the world, with a Gross Domestic Product (GDP) exceeding $1 trillion. This makes Los Angeles a critical economic hub for California and the entire nation. The city’s economy is a testament to its global influence, with major contributions from the entertainment industry, international trade, technology, aerospace, tourism, and manufacturing.

The entertainment industry is perhaps Los Angeles’ economy’s most iconic and globally recognized component. Often referred to as the “Entertainment Capital of the World,” Los Angeles is home to Hollywood, the epicenter of the global film and television industry. The city’s entertainment sector, including film, television, music, and digital media, contributes approximately $150 billion annually to the local economy. Major studios like Warner Bros., Paramount Pictures, Universal Studios, and countless independent production companies drive this industry. The entertainment sector fuels significant economic activity and supports a vast network of jobs in areas like production, post-production, distribution, and marketing.

International trade is not just a cornerstone, but a strategic pillar of Los Angeles’ economy. The Port of Los Angeles, along with the adjacent Port of Long Beach, forms the largest port complex in the Western Hemisphere. Together, these ports handle more than 40% of the nation’s containerized cargo, making Los Angeles a critical gateway for goods entering and leaving the United States. The trade sector in Los Angeles contributes approximately $400 billion to the city’s GDP. The port’s activity supports a vast logistics and transportation network, including trucking, rail, and warehousing, which in turn drives economic growth and job creation across Southern California.

Los Angeles has not just emerged, but solidified its position as a significant player in the technology sector. Particularly in areas like digital media, e-commerce, and biotechnology, the city is a force to be reckoned with. Often referred to as “Silicon Beach” due to the concentration of tech companies in areas like Santa Monica, Venice, and Playa Vista, Los Angeles is making a name for itself. Major companies like Google, Snap Inc., and Hulu have established significant operations in Los Angeles, contributing to the city’s growing reputation as a tech hub. The technology sector in Los Angeles is valued at over $100 billion, and its growth has been fueled by the city’s creative talent, access to venture capital, and proximity to the entertainment industry.

Los Angeles has a long history in aerospace and manufacturing, which remains vital to its economy. The city is home to major aerospace companies like Northrop Grumman, Boeing, and SpaceX, which drive innovation in defense and commercial space exploration. The aerospace sector contributes approximately $60 billion to the local economy and provides high-paying jobs in engineering, manufacturing, research, and development. Also, Los Angeles maintains a solid manufacturing base, producing goods ranging from apparel to electronics, further diversifying the city’s economic portfolio.

Tourism significantly contributes to Los Angeles’ economy, attracting millions yearly visitors. Los Angeles is renowned for its cultural landmarks, beaches, and entertainment attractions like Disneyland, Universal Studios, and the Hollywood Walk of Fame. The tourism and hospitality sector generates more than $50 billion annually for the local economy. The city’s warm climate, diverse cultural scene, and status as a global entertainment capital make it a top destination for domestic and international travelers. This influx of tourists supports many businesses, including hotels, restaurants, and retail outlets, creating thousands of jobs.

Los Angeles’ economy is one of the most diverse and robust in the world, driven by its leading entertainment industry, strategic role in international trade, growing technology sector, and historic strengths in aerospace and manufacturing. The city’s tourism industry further enhances its economic profile, making Los Angeles a global city with a significant national and international impact. As Los Angeles continues to innovate and diversify, its economy is expected to grow even more vital, maintaining its position as a critical economic powerhouse in the United States.

London, UK

London is one of the most important economic centers in the world. Its diverse and highly developed economy plays a crucial role not only in the United Kingdom but also on the global stage. The city’s Gross Domestic Product (GDP) exceeds £500 billion, making it Europe’s most significant urban economy. A mix of finance, professional services, technology, media, tourism, and a burgeoning creative sector drives London’s economy.

The financial services sector is the cornerstone of London’s economy, contributing around £140 billion annually to the city’s GDP. The City of London, often called the “Square Mile,” is one of the world’s leading financial districts, home to central banks, insurance companies, hedge funds, and financial markets. The London Stock Exchange (LSE) is one of the largest and most influential stock exchanges globally, and the city is a pivotal hub for international finance. Institutions like the Bank of England, Lloyd’s of London, and numerous multinational financial firms reinforce London’s status as a global financial powerhouse. Additionally, the financial sector supports many jobs in related fields such as law, accounting, and consulting.

London is also a global leader in professional services, particularly law, consulting, and accounting. The city hosts the headquarters of many of the world’s leading professional services firms, including the “Big Four” accounting firms—Deloitte, PwC, EY, and KPMG. These firms provide services integral to businesses worldwide, including auditing, tax advisory, management consulting, and corporate finance. The professional services sector in London contributes over £100 billion to the city’s GDP, underscoring its critical role in the economy.

In recent years, London has emerged as a central hub for technology and innovation. The city’s “Tech City,” also known as Silicon Roundabout, located in the Shoreditch area, has become a center for startups and tech companies. The technology sector in London is now worth over £60 billion, with significant contributions from fintech, artificial intelligence, and digital media. London is also a leading destination for venture capital investment in Europe, attracting billions in funding for tech startups. This growth has been fueled by the city’s diverse talent pool, world-class universities, and a robust entrepreneurial ecosystem.

London is a global center for media, publishing, advertising, and the creative industries. The city is home to major international media organizations like the BBC, The Guardian, and Reuters. The creative industries, which include film, television, music, and fashion, contribute approximately £40 billion annually to London’s economy. The West End, London’s entertainment district, is famous for its theaters, which attract millions of visitors each year and generate significant economic activity. London Fashion Week and the British music scene have also made the city a global trendsetter in arts and culture.

Tourism is vital to London’s economy, attracting over 30 million visitors annually. Iconic landmarks such as the Tower of London, Buckingham Palace, the British Museum, and the London Eye draw tourists worldwide. The tourism and hospitality sector contributes more than £25 billion to the city’s GDP and supports many businesses, including hotels, restaurants, and retail. London’s rich history, cultural diversity, and status as a global city make it one of the most popular tourist destinations in the world.

London’s real estate market is one of the most valuable and active in the world, contributing significantly to the city’s economy. The high demand for residential and commercial properties drives constant development and investment. In 2023, the real estate sector contributed over £50 billion to London’s GDP. The city’s construction industry is also robust, with ongoing projects ranging from luxury apartments to significant infrastructure developments like Crossrail, critical to supporting London’s growing population and economic activity.

London’s economy is a complex and diverse ecosystem driven by its financial services, professional services, technology, media, tourism, and real estate sectors. London plays a pivotal role in international finance, commerce, and culture as a global city. Despite challenges like Brexit and economic uncertainties, London continues to thrive as a leading global financial center, supported by its ability to adapt, innovate, and attract talent and investment worldwide. The city’s economic resilience and diversity ensure that it remains a critical player on the global stage, contributing significantly to the UK’s overall financial health.

Program Benefits

Human Resources

- Employee Safety

- Crisis Communication

- Morale Maintenance

- Policy Compliance

- Resource Allocation

- Workforce Stability

- Talent Retention

- Stress Management

- Contingency Planning

- Legal Protection

Operations

- Downtime Reduction

- Supply Chain Stability

- Process Continuity

- Resource Optimization

- Risk Mitigation

- Service Consistency

- Asset Protection

- Cost Control

- Operational Resilience

- Recovery Speed

Information Technology

- Data Protection

- Cybersecurity

- System Uptime

- Disaster Recovery

- Business Continuity

- Threat Detection

- Incident Response

- Network Resilience

- Infrastructure Stability

- Service Reliability

Testimonials

Testimonial 1

Content here…

Testimonial 2

Content here…

Testimonial 3

Content here…

Testimonial 4

Content here…

Testimonial 5

Content here…

More detailed achievements, references and testimonials are confidentially available to clients upon request.

Client Telephone Conference (CTC)

If you have any questions or if you would like to arrange a Client Telephone Conference (CTC) to discuss this particular Unique Consulting Service Proposition (UCSP) in more detail, please CLICK HERE.