Building Equity Value

The Appleton Greene Corporate Training Program (CTP) for Building Equity Value is provided by Mr. Bray Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 48 months; Program orders subject to ongoing availability.

Personal Profile

Mr Bray has experience in strategy, implementation performance and mergers and acquisitions. He is a Chartered Management Accountant, Graduate member of the Institute of Export, Certified Exit Planner, and holds a diploma in company direction from the Charted Institute of Directors.

He has served as Chair, Board Director, CEO, COO, and as Partner for several organizations. He has managed staff and assignments in over 34 countries, with 26 nationalities speaking 22 languages and has run organizations and businesses in finance, service delivery, IT, support, and new product and services development as well as working in various roles in finance, manufacturing, domestic and international logistics, and services delivery.

Mr Bray’s personal achievements include creating and developing new businesses up to $200 million in revenue, launching new countries and service lines in consulting, coaching, and mergers and acquisitions sectors. He has helped clients leverage and transform undervalued assets, improve their value and attractiveness, implement ERP, digital transformation, launch new service lines, change culture, and post-merger integration.

He has worked across many industries with concentrations in professional services, technology, manufacturing, logistics, consumer goods, financial services, construction, oil, and gas.

Mr Bray’s service skills include: equity vision and strategy; growth strategy; business consulting; business coaching; exit planning and preparation; process improvement; change management and project and program management.

To request further information about Mr. Bray through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Building Equity Value

Background

Whether the owners of a business want to transfer to family members, to their employees and management, or simply are looking to sell, many exit options provide limited returns for the current ownership at the time of transfer. Most businesses are built as lifestyle businesses, built to support the owners lifestyle, but expect the business to be worth the same as businesses that have been built to create equity value. This course aims to inform Owners and other leaders in private businesses how to transition from lifestyle to creating equity value. This course is aimed at those that want to create a business of value and a business that is ready to be transferred to the new owners whether that is through internal transfer, to family members, or sale to a third party. This course should be attended by Business Owners, and private Leaders / Business Management.

According to surveys and information provided by the M&A profession in terms of those businesses that go to market, only 30% – 40% of businesses with revenues above $10 million sell, with only 20% of smaller businesses sell. The business is often the owner’s life work, their main income source. It is often between 60% and 90% of their wealth, and any transfer is expected to fund their retirement. There are several reasons why businesses don’t sell: the business is overpriced, its relative value cannot be demonstrated, the value is dependent on the owner’s specific skills or knowledge, or possibly fundamental flaws in the business model or infrastructure.

Lifestyle organizations can be transformed into equity value creators if the owner and management team are prepared to make the necessary changes whether they are planning to transfer to family, employees and management, or hope to sell.

There are multiple forms of valuation for specific purposes such as tax filing, gifting, selling equity to a key employee. Looking at the business from both a financial and strategic buyers perspective gives a measure of a business’ health and sustainability. Independent of the current owner’s succession plans, this course helps business owners, its leaders, and managers to understand what drives an organizations sustainable health (equity value), what doesn’t, and what specifically drives down the value. Why some businesses are more desirable to buyers as well what is required to ensure that the business is transition ready and its value drivers understood and can be demonstrated.

Organizations typically enroll on this course for the following reasons:

• They want to know what drives the valuation multiple and how to maximize the business’ value.

• They want to understand ways to de-risk the economic sustainability of their business.

• They have had a failed M&A deal and want to know why.

• They want to reduce the chances of leaving money on the table from M&A activities.

• They want to be fully informed and prepared ahead of a future deal.

• They want to understand buyer’s perspective.

• They want to reduce the risk of not being able to find a future buyer.

• They want to know what makes a business attractive or not to buyers.

The structure of a deal has much to do with how well prepared the organization is to operate without the owners pulling the strings. Many organizations have been wooed by buyers with a fantastic price on paper, only for the terms to feel oppressive because the business wasn’t ready, or the buyers pull their deal at the last minute because they discover more operational risk than expected.

Valuation Scale

There are several ways to value a business that focus on specific needs and size. Main Street businesses have a valuation linked to an owner’s discretionary earnings. Often Fair Market Value is used as a hypothetical value that is the form that many governments favor. For new innovations often a Discounted Cash Flow is used. If the business is looking to be sold to a Financial or a Strategic buyer, the valuation often follows the format of Adjusted Profit or Income Multiplied by a Multiple, referred to as:

V = P x M

This is a measure of the value and expected income impact in the eye of the buyer also known as the business’ ability to be sustainable and thrive.

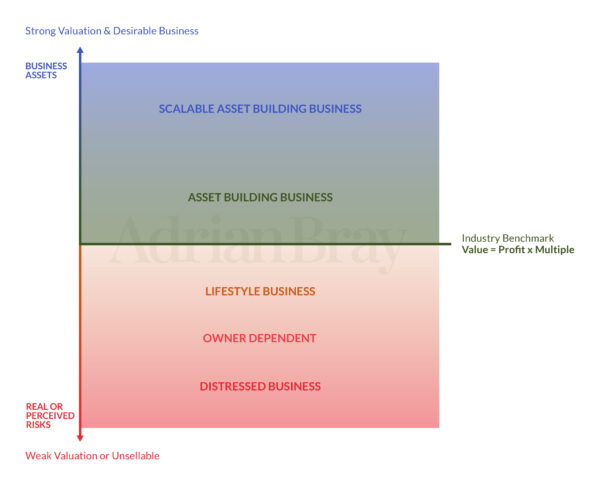

Figure A. below shows how the value ranges for companies in the same industry with the same income. This is driven by quality and buyer readiness of the business to be transitioned to new owners. The Industry Benchmark (Average) is subject to go up and down depending on the economic cycle and availability and price of capital – for example in high interest rates the Industry Benchmark goes down as it does in a recession or economic uncertainty.

Figure A. Range of value of a business from the Buyers Perspective

[Alt a vertical scale of value at the bottom being a distressed business, the lower middle being lifestyle and owner reliant. The middle is the average or benchmark, above the middle are businesses that are businesses that are building the assets that drive future revenues and at the top the most valuable businesses are those that are scalable and have the capability to continue scaling]

The typical risk profile of a founder tends to be higher than that of a future buyer, after all, without the willingness of the founder to roll the dice and make things work the business would never have got to this stage. However, the buyers of the business do not necessarily have the same risk tolerance. In Figure A. above the red section illustrates the lower range of a multiple through to where a business is not sellable as an entity. Often Lifestyle and owner dependent businesses believe that they are somewhere in the higher green section if not the blue. From the eye of the buyer the business is full of risk and the more reliant on the owner or outgoing management this risk is more significant – after all what are they really buying?

Businesses that have eliminated and actively mitigate the risks that occur as a business grows are able to focus on building the Business Assets that will generate future income. Organizations that have a proven track record and are systematically building the Business Assets to generate and sustain income growth – this gives the buyer return on their purchase.

Companies that have developed further and are now systematically scaling, learning, de-risking and have built the proven playbook can make the step change into the blue where they are in the upper zone of value.

Once grounded in the why and the what, the course then focuses on the how, and then the implementation and integration approaches to support the desired impact within the attendee’s business.

Empowering the Privately Held Business Owner and Management

We propose a framework and tool set to give business owners, leaders, and managers the opportunity to develop the skills to understand the investors perspective, or buyers view. on their business and what makes them highly desirable and what they need to do. Why does one business get a higher valuation than another, and how does one thrive in a VUCA (Volatile, Uncertain, Complex and Ambiguous) environment?

Understanding the Transition Options

Only around 35% of business owners know all their transition options. Acquisition specialists and investors know their exit options for each investment or acquisition they make in a privately held business. Understanding the viable exit options for their business enables the ownership and management team to determine what investments are required to set up their business for the desired transition and be prepared for them. Many businesses continue to do what worked in the past unaware that they this erodes their value for the next generation of ownership. Having an exit strategy is good business strategy and will give context to both the strategic and operational decisions.

Cycles and Timing

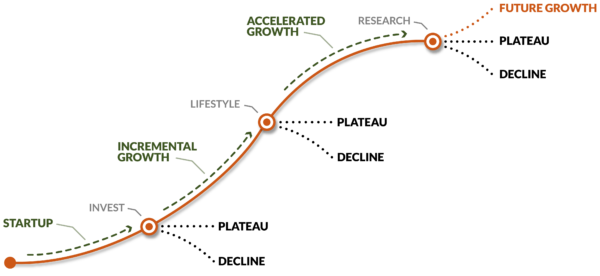

There are three cycles that the business owner is subjected to. They are Economic cycle, Industry cycle and their individual business cycle. Most business owners are unaware of the cycle of their specific business and when they synchronize and when they do not. The choices made at each phase determine whether a business stalls, declines, or continues to grow (see figure B. below).

Simplified Business Cycle Figure B

[Alt: A curve going from the bottom left-hand side to the top right hand side with 4 phases, Startup, Incremental growth, Accelerated Growth and Future Growth. In between these phases are tipping points. The tipping point between Startup and Incremental growth is investment, The next tipping point between Incremental and Advanced growth is the lifestyle, and the tipping point between Accelerated and Future Growth is the Research point. Each tipping point is a gateway to three different paths. (i) to continue to the next phase, (ii) to stall and plateau, or (iii) to decline]

There are two points in a business’s cycle that best points to transition ownership (not shown) that can feel counter intuitive to the owners and management. Armed with this knowledge and what is required to arrive at these points the management team can manage the execution of the appropriate strategy.

In Figure B above there are three stall points that any privately held business goes through. The decisions made in these points determine whether the business keeps growing, plateau’s or starts to decline.

Timing

Some owners have been lucky and have managed to do their transition when all three cycles have synchronized at the top of economic desirability. However, many have still left much on the table because the business wasn’t fully ready and had earnouts linked to future performance when the external cycles moved into decline.

In addition to the Economic, Industry, and Business cycles, there is also two additional cycles linked to ownership transitions. The first is the cycle liked to the owner readiness and the energy they have and can expend into the business as it transitions to the new ownership.

Growth or Efficiency Platforms

There are six growth strategies and many efficiency platforms. Continuous growth requires significant capital to achieve, and any business will outgrow its ability to service the growth and enter a business specific stall. Understanding when to focus on business asset growth and when to focus on business asset efficiency is a core business management skill.

Most organizations do not know the financial capacity of their business, how well they utilize it, and what is preventing them to achieve the optimum run rate within this capacity and what the triggers are to grow or to focus on filling up this capacity.

Understanding the relationship between risk, growth, efficiency, the company’s financial capacity, and the journey it creates is seldom understood. The choices made generate the feelings and mood within the ownership, management, and employees. These choices determine how quickly an organization progresses through the stages and phases of the business cycle and where it gets stuck.

Every organization goes through phases growth whether fast or slow, and stalls. These stalls often happen when the ability to grow a business is constrained by having too little financial capacity or when there are large excesses of financial capacity to support the existing revenue.

Management Capability

There are many courses, books, and articles about Leadership and Management. Very little has been written about in relation to the impact of valuation, the organizational and business sustainability, and what makes a quality management team from the buyer’s perspective.

Often when a privately held business looks to transition to new ownership, the management team have a great track record for what they have achieved. However, they often do not know what is required for the growth to achieve the vision and apply strategies that worked when the organization was smaller. Many organizations back fill roles without where the job has everything that others don’t want to do, without truly assessing whether these tasks still or should be done. Forward hiring capable resources also has its challenges from hiring people that have only experienced operations with more infrastructure of brand equity that prepositioned them very differently than a growing enterprise.

We introduce a scoring and management approach that identifies specific capabilities that demonstrate operational excellence and strategic capabilities. Understanding and determining the appropriate balance between having depth or width of these capabilities. Whether looking to sell internally, externally or pass on to family members systematically managing the capability scores is foundational to being able to sustain growth and having an asset that has longevity to the future owners.

These capabilities sit across four categories:

• Revenue Generation

• Structure and productivity

• Asset build

• People and Culture

Being able to align and execute operationally and strategically makes the difference on its value and the terms of that transition or exit.

Income follows Asset Build

For most businesses, especially those that are not asset heavy, approximately 80% of a company’s value is based on intangible assets. These are generated by the management and operational capabilities of the business. Many business owners realize too late that they need to refresh or rebuild these business assets as they grow. This causes them to stall, decline or slip back to a former point. There are many stories of organizations rapidly growing to a point, having flat revenue, and watching their profits erode as they try all the previously successful strategies to regain traction. The issue is often that they have outgrown the capabilities of the organization or the business asset’s capacity.

Building the assets to the right level, at the right time, with the right capabilities allows organizations to maximize their valuation and still leave enough on the table for the future owners to benefit and then build further business assets and capabilities.

Case Study 1 – O2 Acquisition by Telefonica

Four years after O2 a cell phone operator was struggling to increase its share price. The executive team believed it to be significantly undervalued. The challenge that O2 had was that it didn’t stand out compared to its competitors and looked much the same. Its share price was trading between GBP 1.10 and GBP 1.20.

Once the leadership understood the drivers of rerating a share price from analysts, they set about being acquired by changing their business model and repositioning their business from product focus to relationship focus. Prior to this they followed the industry standard of giving incentives to those that changed carrier from one to another and most organizations sold their service through coverage, price, and incentive through independent retailers.

The business model choice was to flip the business model to one that rewarded loyalty and customer experience. O2 opened over 100 stores across the UK and launched an extensive advertisement campaign with a well-known start explaining how a subscriber could earn rewards by staying with after the expiry of their contract as well as getting their family and friends onto the same platform. This pushed O2 to become a star performer in the sector, as they reached number one in customer satisfaction in the sector, mainly due to these benefits.

Telefonica paid GBP 2.00 a greater than 50% prior to the brand repositioning adding a 22% purchase premium on the trading price just prior to the sale. Telefonica wanted to enter the UK market and strengthen its European holdings after building its holding in Latin America. O2 was an attractive acquisition with Telefonica not requiring the same level of monopoly or unfair competition security as it did not operate in the UK and the other O2 operations in Ireland, Holland, and Germany. Telefonica also agreed to continue using the O2 brand in an endorsed way.

Sources: FTSE, BBC news archives, O2, and private research

Case Study 2 – Amazon

Amazon is known from starting as an online bookstore to becoming the largest online retailer. It is the go-to place when searching for a product replacing traditional search engines. It has done this by having a business model that is customer centric. This seamless and convenient shopping experience has led to a loyal customer base that are willing to buy from the many categories of product it now sells.

From 1994 through to 2006 Amazon built out its product categories and making the customer buying experience simple and expanding into key European markets. In 2006 Amazon launched Amazon Web Services providing cloud computing and infrastructure services using lessons learned from its own expansion. It continued to expand geographically.

Amazon has continued to wrap services around the customer, providing a variety of differently formatted recommendations as well as capturing the data to provide predictability of customer buying patterns and increasing products and services. These have included Amazon Prime 2-day delivery service, Fresh, Music and audio books, Kindle online book reading, purchasing and rental, video including its own productions, online marketplace, care, and pharmacy services. It has acquired several companies to support these plans from audible, Zappos, GoodReads, twitch, Whole Foods, and MGM. Amazon retail operations had a major increase in sales during COVID.

Amazon has built and continued to invest in its supply chain including automated warehousing, last mile delivery, air fleet, and is now moving into displacing first and middle market shipping.

Amazon’s success is characterized by its relentless focus on a customer experience and driving loyalty business model supported by rapid expansion into new markets and new services to provide them. They have cemented themselves as the leading online retailer in large parts of the world, built an industry-leading cloud computing business, and established itself as a major player in digital media and consumer technology.

Sources: HBR, HBS, internet various case studies and private research

Future Outlook

Increasing numbers of business owners are going for an exit such as a sale or transition of their business. Many of these privately held businesses are OK, a smaller percentage are excellent and warrant a price premium. The Building Equity Value approach is ideal for organizations that want to generate value and growth as well as those that are considering an exit or transition in 5 years.

It empowers business leaders to take a buyer’s perspective about their business adapting how they manage their business strategically. Implementing throughout the organization to the required depth both de-risks it as well as enabling the income generating assets to produce income at their optimum.

Understanding how the value levers impact the organization and how each person’s role enables goals can be aligned, achieved and impact on the organization’s value.

Curriculum

Building Equity Value – Part 1- Year 1

- Part 1 Month 1 Cycles

- Part 1 Month 2 Managing Value

- Part 1 Month 3 Exit and Transition Options

- Part 1 Month 4 Exit/Transition Vision

- Part 1 Month 5 Financial Capacity

- Part 1 Month 6 Building a Capacity Plan

- Part 1 Month 7 Management Systems and Organizational Capability

- Part 1 Month 8 Asset Allocation

- Part 1 Month 9 Purposeful Culture Design and Management

- Part 1 Month 10 Change Management

- Part 1 Month 11 Market Positioning

- Part 1 Month 12 Application

Building Equity Value – Part 2- Year 2

- Part 2 Month 1 Product Architecture

- Part 2 Month 2 Channels to Markets

- Part 2 Month 3 Organic Versus Acquisitive Growth

- Part 2 Month 4 Leading in Context

- Part 2 Month 5 Creating Effective Relationships

- Part 2 Month 6 Risk Leadership

- Part 2 Month 7 Culture and Change Coaching Depth

- Part 2 Month 8 Boards

- Part 2 Month 9 Designing Internal Succession

- Part 2 Month 10 Introduction to Designing Scale

- Part 2 Month 11 M&A Sell-Side Process

- Part 2 Month 12 Application

Building Equity Value – Part 3- Year 3

- Part 3 Month 1 Enabling Others to Act

- Part 3 Month 2 Managing from Source and Outcome

- Part 3 Month 3 Training Managers & Leaders to Coach

- Part 3 Month 4 Navigating Growth Stalls

- Part 3 Month 5 Navigating Sprints and Strolls

- Part 3 Month 6 Strategic Partnerships and Joint Ventures

- Part 3 Month 7 Pricing, Packaging and Profit Models

- Part 3 Month 8 Potential Buyer Personas

- Part 3 Month 9 Capturing and Telling the Story

- Part 3 Month 10 Building Relationships with Potential Buyers Ahead of Time

- Part 3 Month 11 Best or Worst Times to Say Yes or No to Inbound Interest

- Part 3 Month 12 Application

Building Equity Value – Part 4- Year 4

- Part 4 Month 1 When to Separate, Spin Off or Shut Down an Asset

- Part 4 Month 2 Benchmarking

- Part 4 Month 3 Managing, Reviewing and Evolving the Culture

- Part 4 Month 4 Upskilling Ahead of a Transition

- Part 4 Month 5 Incentives Review

- Part 4 Month 6 Preparing for Due Diligence

- Part 4 Month 7 Preparing for Family Transition

- Part 4 Month 8 Preparing for Internal Transition

- Part 4 Month 9 Integration Preparation Review

- Part 4 Month 10 Personal Transition Readiness Review

- Part 4 Month 11 Next Steps

- Part 4 Month 12 Application

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Building Equity Value corporate training program.

Building Equity Value – Part 1- Year 1

- Part 1 Month 1 Cycles – The course approach is relevant and pertinent to all manner of enterprise and organization and adaptable to the teams size and complexity, from single locations and small teams to fortune 50 multi-nationals, the course focuses on businesses up to 10,000 staff. As organizational and geographic complexity increases, it is necessary to break down the overall cycle into individual manageable units and how the individual cycles impact a company’s growth strategy, commercial performance, employee behavior, and organizational culture. The business cycle and its phases can be grouped into four zones: Startup / Next Start, Incremental Growth, Accelerated Growth, and Future Growth, and the tipping points or gates that allow a business to move to the next phase or stagnate. The business cycle and the company’s maturity within their current cycle iteration have both connection and independence with the economic and industry cycles depending on their preparedness. The module continues with the goal with the participants learning how to better assess business cycles impact on culture, behavior, customer/ client relationships, supplier relationships, departments, relationships, careers, internal breakdowns, the company’s value, and desirability. The participants will bring this to life by assessing their organization and where it is on the cycle. The participants next explore what is ahead and what they can do to successfully navigate the future stages within the zones and phases of the cycle. The participants will build an outline strategy for their organization and key personnel and how deeply they wish to implement the tool, including which units they need to fast forward and the likely commercial and cultural upsides and downsides to manage. Each cycle stage is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 2 Managing Value – Building from Month 1, the participants explore the proposed 12-level valuation framework in business language, the six issues that drive down valuation, and the six business assets that improve valuation beyond the benchmark average multiple from the valuation formula Valuation = Profit x Multiple. a buyer’s eye, the participants will understand what a buyer would diligence beyond legal and accounts either directly or indirectly to determine whether the risks are fully managed and that the business assets have any worth. The participants continue to explore how they would use the model to buy the example business, what to test, and determine the integrity of each valuation level, their parts, transferability into their business, and impact. The participants will use the model to set the leadership equity value vision, their current level, and what they can realistically achieve without raising additional capital or extending a planned exit timeline. Then, compare to what the ‘number’ is for the owners to accomplish the mechanism to understand the potential wealth gap and the cycle of business phase gap. The participants also review the potential profit gap for a set revenue compared to the best in class for the industry using the example case study that the participants work through individually and in groups.

- Part 1 Month 3 Exit and Transition Options – This module covers the different types of succession and exit paths, how to determine the most desired, and how to navigate the 4 categories: internal, external, closure, or pass to family. Within these four categories, there are a variety of specific forms, as well as hybrid solutions, to be explored. Each transition form has pros and cons that must be assessed and aligned with the valuation vision from Part 1, Month 2. Planning the transition (exit of the existing owners and leadership team) is good business planning and growth strategy and can add value to a business. Depending on the laws of a country, some of the specific forms vary, and their related pros and cons change as well. Many business owners don’t always pick their exit, whether through Death, Divorce, Disability, Disagreement, or externally generated Distress. The participants will explore the benefits of being ready to transition on planned or unplanned terms and the downsides of either. The third objective of the module is to take the participants through what it means to be transition-ready personally and in business. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 4 Exit/Transition Vision – This module aims to map out a winning transition vision, combining the first three modules into a vision (the why) that will attract the next ownership phase. The participants go through a series of challenges to the vision, whether it inspires, is too modest, is unbelievable, and what are the impacts on commercial operations, culture, and the organization’s purpose. The participants explore whether it motivates the leadership and owners and engenders a connection to it. The participants discuss the continuum between the internal and external expression of the vision, testing the likelihood of customers, suppliers, and the community connecting to it and why. The module’s next goal is aligning the vision to one that will motivate the successive layers of management and the workforce that do not participate in any valuation impact. Understanding that workforce, and further exploring what is in it for them which reveals what will be required to connect them with the vision. The participants explore the resistance internally and externally. The participants assess where the business is today and, compared to the future, where the risks are and their severity. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 5 Financial Capacity – Every company aspires to grow, and their vision usually ties some revenue growth element to the impact they expect on the shareholders, community, industry, or workforce. In this module, the participants design the journey to achieve the vision and explore what it means to go through it. Understanding whether it is intended to generate stress, force sprints, or require patience and endurance for a marathon. The participants explore the relationship between budgeting and capacity management and the common mistakes management teams make when they do not understand the journey or their decisions. The participants explore how the impact of everyone trying to increase sales and service can have the opposite effect and how the traditional budgetary process of requests to invest in plant or personnel or facilities that the annual budget process has unintended consequences. A further goal for the participants is to understand where and why a growing organization can stall for several years. The participants go on to explore sequences of growth and efficiency, the activities behind them, the impact of the six growth strategies, and the organizational inefficiency they create. They then explore what to grow, when to grow, when not, and when to focus on efficiency and the capital needs this creates. The next goal is how to recognize when the organization’s financial capacity is or will become stressed because it is too full or too empty and how risk profiles play a part. The participants then map the capacity journey top-down, the sequence of investments, the journey it creates, and the context it provides for the operational and capital budgetary processes. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, albeit fictional that the participants work through individually and in groups.

- Part 1 Month 6 Building a Capacity Plan – This framework takes the top-down capacity strategy and builds the bottom-up plan and what issues this uncovers. Then, they work through the resources required, timing, dependencies, conflicts, constraints, and alternatives to be able to both build the capacity and fill it up. They break down the plans into individual business functions and the impact overall where budgets can look good but spell trouble ahead and what can be done to resolve it. The bottom-up plans specify the resources required to fulfill them over one or more years. Scenario testing such as how would the sales and marketing strategy impact the organization or the plan, and which areas are likely to have problems. The participants explore how delays can impact financial needs and explore the question of whether it makes sense to raise debt or equity capital as well as what expectations need to be set rather than running out of cash in the middle of a build and then need to raise it on unfavorable terms. The next part of the process is focused on aligning the organizational Key Performance Indicators to measure its capacity, current run rate (how full it is), and trend and understanding the impact of the capacity journey and the potential impact on the valuation. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, albeit fictional that the participants work through individually and in groups.

- Part 1 Month 7 Management Systems and Organizational Capability – The next step focuses on assessing the organization’s capability and what is required to deliver its vision. It starts with determining the company’s management capability today, and then compared to the vision, the capacity strategy, and its detailed capacity plan. It allows the leadership to understand the individual and the organization’s capability gaps, dependencies, and vulnerabilities. Every organization has its own capability strengths and weaknesses, often generated by successfully growing the business and believing that the prior work and experience should still be good enough. This belief can be either valid or misplaced. Knowing what capabilities are weak, what is needed, where the opportunities are, and their respective priority makes a difference between best in class or just an OK management team. The participants will further assess the organization’s management attractiveness and transition readiness and how a sale or an internal succession may differ and go on to explore the triggers for capability change and how the capacity journey, management capability changes, and natural organizational stalls relate. The participants then determine the appropriate organizational capability strategy, including the need to hire in capability or to develop internally. The participants explore when the vision requires the capability strategy to be built across many areas or focus by going deep into two or three areas when it makes sense to get ahead, and what happens if the capability is too far ahead of the business—the capability strategy and assessment tool integration into their management systems and compared to their peers and competition. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 8 Asset Allocation – In this module, the participants take a top-down approach to organizational structure and the resources within a company and understand where the assets are allocated relative to staff, expenses, and the ratios within the organization. They then explore whether the organization has got the correct number of people ‘on the bus,’ where it might be too lean, too heavy, or just right. The participants review the asset allocations across revenue generation, structural infrastructure, and future asset build and the allocations and impact of the prior module decisions. The participants then explore how the allocations change as the organization grows and progresses through its current cycle and where there is danger to just throw resources at a problem or to get through capacity constraints. Once the business has the correct number of people, the participants explore whether these resources are doing the right things and the critical responsibilities for the key roles. The participants explore a scenario if the business with the current revenue was created today, how it would differ, in what areas, why, and where technology can make more significant impacts, and understand how investors and buyers assess this element of their business. They then explore where newer organizations within the industry are doing and whether they outperform those who have been around for a while. The final aspect of this module focuses on whether the organizational resources have the right skills to do the role and whether time is lost because of out-of-date or redundant approaches or where an inadequate supply of human resources or resources is abundant. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 9 Purposeful Culture Design and Management – Every organization has a culture. During an organization’s lifecycle, the culture often needs nurturing and, at specific points, a redesign. The participants first assess organizational culture and its values and then explore the difference between operationally, reactively, or strategically managing it. The participants consider whether the culture supports the vision and what are the behavioral norms and signals being provided to determine if it helps or hinders the brand of the business, whether its health is robust or weak, what type of employees it attracts, and whether there is different culture between layers divisions, departments, or geographical locations, and the industry norm. The participants then design the culture and what is required to manage it. The strategy may need to be created, redesigned, leveraged, rebuilt, or aligned. The participants explore how this strategy impacts an organization’s underpinning values, culture, and management. The participants will develop and design the culture as an asset strategy and the expected commercial and behavioral outcomes. The participants then explore how the culture aligns with the organization’s intent and develop the vision’s cultural aspects, the implementation approach, and the expected challenges, inhibitors, and resistance to successfully implementing the design, aligning it, and integrating it with the existing management systems. The participants will explore how they can assess the culture of other organizations. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, and nevertheless fictional that the participants work through individually and in groups.

- Part 1 Month 10 Change Management – This framework focuses on the use of coaching to support the management of change sustainably. The participants explore the five ways change can be implemented and how coaching fits into these. Coaching has become more acceptable and prevalent in organizations of all sizes. Some organizations use coaching to fix performance issues; others use it to get an individual to perform at their best. It is all change of some form. Participants will develop specific coaching skills that will support those with existing coaching skills or if they are new to coaching. The participants will also understand how to use coaching to support change and how it fits in with the other management techniques required to implement a management-led organizational change—understanding what makes a credible change leader and coach and what does not. The participants explore how coaching for change differs and its intent to align the organization’s vision, demonstrate value-based leadership and credibility. The practical skills and coaching frameworks include building a safe environment, setting the change, and coaching agenda, asking the right questions at the right time, identifying source issues, listening for context through the content, the coaching energy and change curves, no verbal cues, understand blockers and fears to change, directive and non-directive coaching, when coaching feels like manipulation to the other party, along with coaching with integrity. Coaching in the VUCA (Volatility, Uncertainty, Complexity and Ambiguity) environment and the drama triangle. The difference between group and coaching individually and the pitfalls. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individual role-play and in groups.

- Part 1 Month 11 Market Positioning – In this module the focus is positioning from a business model perspective and then setting the context that the brand occupies within the minds of its customers and investors. There are four business contextual levers that an organization can choose to lead in, and it can only lead in one; the remaining three must align. For most businesses the problem is that they often don’t, and significant resources are wasted on the brand, branding, and marketing. Once the business model is understood the participants explore the brand architecture, that will be or has been deployed underneath, additionally their alignment to the culture and cultural values, and what triggers a re-evaluation of the organization’s positioning and brand architectures. The participants continue to explore the impact of aligned and misaligned positioning strategies, valuation impacts, and resulting operational performance. The participants then analyze competitor positioning and concentration relative to their organization, where the opportunities are, and whether the organization could move in a single change, or it requires a multi-step implementation. They continue to analyze whether the organization’s positioning has moved unconsciously as the organization has grown from the official positioning, brand, branding. Further analysis to the impact on the management capability, organizational culture, and vision builds the fact find picture to allow the participants to move into the strategic design phase of this module, they then develop what is required to align the positioning, where the customer relationship is focused with the business, and what type of brand connects into their market – Is it a logical brand, a feeling, or a gut instinct brand and the five contextual implementation strategies required to deliver the desired impact. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 1 Month 12 Application – This module is focused on solidifying the learning of the prior 11 modules. The goal is for the participants to demonstrate understanding and competent application of what has been learned previously, using a real-world case study. The participants will work together in groups and build on the learning and case studies from the prior sessions and present their collective strategic approach to other the participant groups acting as “the Board.” The second goal is to provide individual self-reflected learning journeys for the participants, covering the areas they have struggled with and need more information, have applied within their business along with any implementation challenges experienced, what was straightforward, and why. The participants also provide a forward-looking plan for their areas that commit to driving depth and what disciplines they have or need to adopt to drive their company’s enterprise value.

Building Equity Value – Part 2- Year 2

- Part 2 Month 1 Product Architecture – Product architecture is the foundation to support growth and valued asset. The concept explores that product is the foundation of the business and is the foundation for many strategic decisions across the business. Having more than one product (i.e., a product portfolio) allows a business to grow its customer base and potentially reach new markets. The participants explore the concept of aligned product portfolio versus seemingly independent products as an approach to expansion and how a well-designed product extension strategy is one of the key pillars of growth for a business. The participants go on to the impact of the product and the markets and how the product is packaged to meet their needs and make it easier to buy, as well as how it is positioned in the customer’s mind. Products can be tangible, such as items you create or distribute, or they can be a service that is provided, specifically professional services where the client buys the expertise in a particular area (e.g., design, accounting, legal services etc.). The participants continue by exploring product portfolio planning including the why and when including situations such as new technology created new possibilities to deliver the product, products have been opportunistically added rather than a planned product expansion, industry cycle changes, impact on product to enter new markets or geographies. The participants further explore the impact of expanding the product portfolio into their respective markets, and strategic drivers as well as the choices of how product is obtained (developed, bought, or acquired) along with the benefits of each, challenges, and mistakes frequently in implementing these strategic choices. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 2 Channels to Markets – Builds from product architecture and brings the lens of what the channels and underpinning channel currently and required to distribute the product portfolio to the market. Participants first explore the concept that channels are about relationships with the channel and how managing these relationships is different to managing the relationship with the end customer. They flip the question to who are and what are the sources of customers and the five reasons why a channel will distribute your product as well as the five reasons why they won’t whether a tangible product or a service. The participants then explore the impact of planning the expansion or reduction of channels, markets and geographies for the existing product portfolio and the relationship with the positioning as well as product architecture. The participants then explore the impact of aligned and misaligned channels, the channel cycle, and the impact of societal changes. The participants then explore whether having a narrow or a wide channel architecture is best for them and the impact of entering new markets and new geographies or exiting them and how managing the channel mix, into their respective markets, and the underlying strategic drivers can be achieved (developed, bought, sold, or acquired) along with the benefits of each, challenges, and mistakes frequently in implementing these strategic choices. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 3 Organic Versus Acquisitive Growth – This module develops from the prior two modules and explains the benefits of growing, whether through acquisition or organically. Participants will use the 12-level framework initially introduced in Part 1 – Month 2 as to explore the why and where it could make sense to acquire other businesses or grow organically, what are the risks of doing so and when do they outweigh the benefits. The participants will explore a basic acquisition process and they will assess how ready the acquiring business is to grow through acquisition and then to build an acquisition thesis relevant to the current Mergers and Acquisitions market conditions including why would targets be interested in being acquired, commercial and cultural alignment, synergies expected, necessities, nice to haves, and what is the outline integration strategy from run independently through to fully integrated along with the complexity of the risks and benefits the range of integration strategies. The participants then explore how the business vision, strategies and execution plans would change or evolve including and the impact on financial and management resources to be successful. The participants will then work through understanding what diligence is required to find out the real picture of the target acquisition. They will go onto explore the internal and external capabilities required to pull off the strategy. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, and nevertheless fictional that the participants work through individually and in groups.

- Part 2 Month 4 Leading in Context – This module focuses on leading in context as well as outcome or content. The participants explore each part of the business from a contextual viewpoint and the difference between managing from outcome only, managing from context or from both. They then explore the scenarios of the impact in what they do in their business, how decisions are generally made, what is not working, causing frustration or stress in their business, what is working and well, how are decisions made to fix what is not working as desired and how are they dealing with them enabling the participants to understand how to understand how to uncover root cause of issues and also successes. The participants explore the impact of making strategic decisions at the context or outcome / content layers and how that influences the results in culture and behavior as well as the commercial. The participants go onto defining Key Performance Indicators (KPIs) at the different levels and how KPIs can align and uncover source issues, how to determine when KPIs are misaligned, and the consequences of misalignment. Misaligned KPIs create frustration and stress at the company level, and if left unfixed, at the departmental level. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 5 Creating Effective Relationships – This module focuses on leading through creating effective relationships. The participants start by exploring the difference between managers and leaders, and the difference between leading and managing They then explore how this impacts internal relationships, and then focus on communication and the differing styles. Some styles prefer details and data, some prefer the story, and others prefer few words to the point. The participants explore organizational and individual preferred styles, and how this impacts relationships, culture, and interpretation of communications as well as where conflicts occur and how to avoid them. The participants further explore how these styles impact customer relationships at the point of sale, and at the business relationship level: servicing and managing and supplier relationships. The participants then explore how individual relationship concerns outweigh any benefits that leaders or managers may present and how the communication styles can support relationships. They go onto explore how to run meetings, and how to effectively communicate through both written and verbal communications, to embrace all three styles and achieve unity and connection. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 6 Risk Leadership – This module focuses on understanding risk appetites, managing risk, reducing risk, or quitting an activity that unfolds to have too much risk. To start a business requires a certain level and risk appetite or comfort. The participants will explore how risk appetites impact business strategy and implementation decisions. Where risk appetites create conflicts, trust issues and control behavior across functions and through the organizational layers within the business. The participants review risk-based behavior and how it impacts culture, profitability, and valuation moving into how attitudes to current investments and risk appetites lead to undesired results. The participants then consider the business growth investments and the functions of their business from the context of a portfolio of risk and the overall appetitive level, as well as the appearance to a prospective buyer or investor. The participants explore their interpretation of the risk levels of their competitors, the behavior their competitors demonstrate in the marketplace, and how both customers and prospects perceive risk. The participants then go on to explore their risk appetite in acquiring other businesses and why and how it might differ to the expectations they have investors or buyers to theirs. The participants then explore how risk appetite impacts willingness or resistance for change whether that is created by growth, buying a company, selling a company or change in external conditions. The process is illustrated with a realistic example, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 7 Culture and Change Coaching Depth – This module focuses on driving depth in the concepts in Part 1 Module 10 and focuses on practical application. Some of the participant businesses will experience have faced change since they started the course. The module starts with a review of the key concepts from the prior modules, introduction of developing coaching and change management, and the use of transition plans including when and when not to use them. The participants explore the difference between coaching on a one-on-one basis and coaching a group. They then focus on listening for the source issues that are preventing desired change. The participants will learn to identify when someone is choosing not to be coachable and then focus on practical application through role play, group work, and experiments. This will allow participants to achieve impactful breakthroughs with feedback support and make mistakes in a safe environment. The process uses specific change scenarios inspired by real cases.

- Part 2 Month 8 Boards – This module focuses on setting up and managing a board, the different types of boards, different board cultures, their behaviors, roles, and impact on a private business. The participants explore beyond the minimum legal requirements related to their formation/incorporation with the reasons both to have a more active form of board, the reasons against an active form of board, their high-level formal responsibilities in different types of boards, and interaction with the executive members of the organization. They will then go onto explore the different types including advisory, governing, management/executive, working, policy, family based, independent, and competency board and the pros and cons of each board type. Next participants will go onto exploring board culture, personality, mandate, and relationship with the organizations leadership and management including board personalities and their impact on the organization, including changes to risk appetite and organizational resilience. They will then go onto explore board mandates and what makes an effective member, an effective board and separation of roles. They then explore the challenge of time-based mandates compared to phase and time-based mandates, and triggers to rejuvenating a board’s charter and its membership. This requires considering what the board represents, where the board has been or where it is going, and whether the underpinning values that drive its policies are still relevant. Finally, the participants discuss the organizational impact of introducing a board as well as prospective buyers’ perspective. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 9 Designing Internal Succession – Internal succession is a term that is often used to cover a range of activities from transitioning the business to a new internal owner to career development from the lowest level. The participants start the module exploring what the benefits to invest in, and what is succession planning, exploring, and evaluating the different journeys from top down: owner exit, owner/partner from employee, leader from manager, becoming a manager, and competency levels. From this the participants explore four strategic approaches and choosing the appropriate strategy to build the architecture of a proactive internal succession methodology that meets the business to where it is going rather than where it has been and the planned commercial and cultural impacts. Participants explore what is the entry points for new employees, what are the criteria and methods to identify internal prospects, what skills can be done via internal or external training, on the job training, self-directed projects, mentoring and learning activities. The participants then explore integrating succession planning into the employee evaluation process as well as the myths and common mistakes made by organizations implementing internal succession planning. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 10 Introduction to Designing Scale – Many privately held organizations attempt to design or redesign their organization as they grow. This often involves trial and error when the organization is trying to design, build, and cross the bridge simultaneously. This module is not about designing a unicorn but recognizing that every time an organization doubles its complexity factor increases significantly and even reactive small organizational changes have impacts on the customer experience, communications, decision making, processes, roles, culture, inefficiency, management distraction, unexpected risks, and revenue stalls. The participants bring in the capacity lessons from Part 1 Modules 5 and 6 and focus on the organizational elements exploring from the top down what the organization could look like, where are the likely blockages and bottleneck like to deliver the vision and the change phases to get there, what triggers planned change as well as what external factors force a significant organizational pivot. The participants explore how different sizes, architectures, and phases of organization impose different requirements and emphasis on its architecture. They go onto exploring implementation triggers and the importance of timing, too early and the company will be sluggish, too late and the company stalls or declines. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 11 M&A Sell-Side Process – This module focuses on understanding the process of selling a business and what it takes to be prepared for the process from both a business and personal basis. Many privately businesses that successfully sell don’t sell at the expected time and respond to an unexpected approach during a buying season. Understanding the process, what it needs, and how to prepare is key to minimizing distraction and frustration and reducing the chance of an unsuccessful sale. The sale of a closely held business can be very emotional for the owners and leadership team. The participants will explore what it takes to be prepared for this journey and managing expectations, distraction, time, and energy expended to manage the process internally while still running the business without the organization knowing. The participants build a plan identifying who will be focused on the initiative and the impact of on day-to-day operations. They will then explore key phases, their objectives, expectations, and information needed during the process including selecting the representative team, what company documentation is required for what phase and levels of diligence, timing for the advisor to build an auction and what type, bid management process through to the letters of intent. Selection criteria and selecting the most appropriate bid, deeper diligence, the agreement and the close. The participants will determine how organizational processes can reduce the time to have access to all the requested information in a timely manner and give buyers confidence in the business they wish to buy. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 2 Month 12 Application – This module is focused on solidifying the learning of the prior 11 modules. The goal is for the participants to demonstrate understanding and competent application of what has been learned previously, using a real-world case study. The participants will work together in groups and build on the learning and case studies from the prior sessions and present their collective strategic approach to other the participant groups acting as “the Board.” The second goal is to provide individual self-reflected learning journeys for the participants, covering the areas they have struggled with and need more information, have applied within their business along with any implementation challenges experienced, what was straightforward, and why. The participants also provide a forward-looking plan for their areas that commit to driving depth and what disciplines they have or need to adopt to drive their company’s enterprise value.

Building Equity Value – Part 3- Year 3

- Part 3 Month 1 Enabling Others to Act – Part 3 commences with developing managers: exploring the difference between a manager’s and a leader’s behavior, the specific roles, and the continuum between them. The participants then explore the combination of skill and will and how it impacts delegation, development, empowerment, and control. They then explore the difference between delegation and dumping, development and empowerment and when to and when not to initiate these enablement approaches. The participants will experiment with the IDEALS delegation framework and the nature and forms of feedback, resistance, and development. They go onto explore the Johari windowpanes of the open self, the hidden self, the blind self, the undiscovered self, and how building on their own self-awareness can help other become self-aware and how this impacts the willingness to receive feedback. The delegates go onto explore the different types of feedback and the different approaches to give the type of feedback as well as creating a supportive feedback environment. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 2 Managing from Source and Outcome – Module 2 focuses on implementing both source and outcome KPIs as defined in Part 2 Module 4 throughout the organization. The participants explore how KPI’s can cascade down into the management roles and their focus on managing resources, processes, things, and risk. The participants build on the traditional output focused KPIs at this level and add in where source based KPIs can be added. They continue to explore how performance linked reward systems would need to change. The focus then moves to training the leader on how to train their management team. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 3 Training Managers & Leaders to Coach – This module focuses on training the participants to be able to train coaching skills in their organization as part of implementing both a coaching culture and a culture of continuous learning, to better support the growth of the business and attraction of talent. The participants build on their own coaching abilities developed in prior modules skills that had a focus on supporting organizational change to that of coaching as a management skill and with practical skills including building a safe coaching environment, when to coach, when not to, the introduction of TGROW (Topic/Theme, Goal, Reality, Options, Will/Way forward), directive and non-directive coaching, and when and how to use each approach. Then on how to form appropriate questions, bad questions, good questions, question sequence, identifying source issues, listening for context through the content, the coaching energy curves, nonverbal cues, blockers, and fears of coaching and being coached. The participants explore the appropriateness of implementing an internal code of ethics and mechanisms to manage this and the differences between coaching by internal or external coaches. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 4 Navigating Growth Stalls – There are certain phases of a business growth when it stalls. In this module the participants explore the reasons why at certain tipping points businesses naturally stall, the type of stalls and what can be done to minimize the impact, and how to get out when in a stall. They go on to discover why some business get stuck for many years, why some businesses enter a stall as though it ran into a wall, some fall back into a stall, and others creep into them, often not initially aware that they are one. The participants explore the impact on the company’s valuation, attractiveness, and typical shareholder and leadership behaviors when stuck within a stall. The participants then explore the mistakes that are made when trying to get out of a stall that exacerbates the stall, increases the severity, and increases the duration. The participants go on to design strategies to manage the stalls proactively to ensure the minimum amount of time is spent within them. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 5 Navigating Sprints and Strolls – There are certain phases during which the relative revenue of the business grows rapidly, and other phases where the relative revenue grows slowly. In this module the participants explore the reasons behind these phenomena and when this leads to a stall as covered in Part 3 Month 4. The participants explore the top down and bottom-up approaches and their impact on speed and resources, as well as the mistakes often made. The participants explore the design of the strategies and tactics required within each of the phases to keep revenue momentum and the infrastructure required to support it, the unintended consequences of buying one or more businesses, adding product lines, and geographic expansion on the pace of growth. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 6 Strategic Partnerships and Joint Ventures – This module explores the impact of having a hero or strategic partnership leading to opening new markets, geographies, and products, and the effects on both revenue and valuation. The participants explore the forms of partnering such as alliances, complimentary partnering, licensing, franchising, innovation, and supply chain. The participants understand the benefits, challenges, and often unspoken expectations of strategic partner. The participants then explore what is required to set up the partner relationship for success and the differences with a channel versus a product relationship including expectations, control, and resources. The participants also review the mistakes often made in managing these relationships. The participants then explore the impact of these partnerships becoming some a joint venture. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 7 Pricing, Packaging, and Profit Models – This module explores pricing psychology and the impact on revenue and valuation. The participants will explore pricing approaches and models such as bundled, unbundled, financing, flexible, forced scarcity, membership, licensing, premium, subscription, risk sharing, and value based. The participants explore, following industry norms, disruption, and the pros and cons of each. The participants then go on to explore the perspective of profit first, and in which ways can redesigning the pricing and profit model can give one a fiscal advantage compared to the competition. Participants explore the fears and resistance that often occurs when looking at these changes, going to explore what is required to successfully make the different pricing models work. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 8 Potential Buyer Personas – This module explores the concept of buyer personas. Participants explore the traits of the ideal buyers. The concept is that if their ideal buyer (third party, employee, or family) does not see the business as ideal target, they will ignore it when it comes time to transition. The participants go onto explore why would their idea buyer want to own the business including what problems would owning the business solve, and why the business is the best option for them. The elements of the buyer persona include obvious buyer choices, communities, likely location, likely goals, what would their top factors in making the decisions on the options in front of them, what culture would align, which competitors might be on the market at the same time, and what do they offer that the business does not. Once the potential buyer personas is defined, the participants will review the business model and what might need to be changed or tuned. The participants then explore what makes a poor buyer for their business, culturally or organizationally. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 9 Capturing and Telling the Story – Building from Part 3 – Month 8 the participants move on to develop storyboards for internal and external communications and explore how, when the business is ready to go to market, it will support the Sell-Side process and demonstrate to prospective buyers why the opportunity is worth investing time and resources in. The participants explore what messaging themes can support this objective, including how the messaging differs from customer focused marketing, communication contamination, awards, public relations, and industry reputation. The participants then explore how these align to prior communications, implement internal communications to ensure consistency between external and internal communications, leadership behavior, and organizational culture. The participants determine how this long-term communication campaign is managed and refreshed, and keep watch for any competitor response it might engender. Finally, they explore the often-asked question of when you are going to sell? The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 10 Building Relationships with Potential Buyers Ahead of Time – Prospective buyers and their representatives continually reach out to business owners to start building a relationship with prospective sellers. Industry specialists and buy-side representatives keep in contact with potential sellers, even when they do not have a current mandate. In this module the participants explore what information is readily available to buyers, what the intentions are, what privileged information is sought to build a picture of the company to qualify its immediate or long-term appropriateness, and at times to have information to compare to a purchase they could be making of a competitor. The participants go onto understand the mistakes made by business owners, in both leadership and relationship matters. They understand what information to give and know what happens to it. The participants also go on to explore conflicts inherent with certain third parties, the ability to turn the tables and where it makes sense to build knowledge of buyers prior to considering a sale, internal or family transition. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 11 Best and Worst Times to Say Yes or No to Inbound Interest – Many business owners say yes to inbound interest at the worst time. In this module the participants explore why deals fail and the distraction it can cause. The participants explore the consequences of not being ready for a sale and the difference between not being ready versus selling early. The participants also explore the best times to say yes to inbound interest and what to do when in that situation. They explore the timing and impact of industry, economic and individual business cycles w, the impact of being unremarkable versus being best in class, and when it makes sense to consider a partial sale and multiple partial sales as the company grows. They participants go onto explore the reasons why saying no can be a mistake if their exit strategy is that of a third-party sale. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.

- Part 3 Month 12 Application – This module is focused on solidifying the learning of the prior 11 modules. The goal is for the participants to demonstrate understanding and competent application of what has been learned previously, using a real-world case study. The participants will work together in groups and build on the learning and case studies from the prior sessions and present their collective strategic approach to other the participant groups acting as “the Board.” The second goal is to provide individual self-reflected learning journeys for the participants, covering the areas they have struggled with and need more information in and the areas they have applied within their business along with any implementation challenges experienced, and why. The participants also provide a forward-looking plan for their areas that commit to driving depth and what disciplines they have or need to adopt to drive their company’s enterprise value.

Building Equity Value – Part 4- Year 4

- Part 4 Month 1 When to Separate, Spin Off, or Shut Down an Asset – This module allows the participants to address the discussion about separating out, selling off or just shutting down a business or asset. Participants explore the impact of risk profiles, sunk costs, stop loss strategies and why it is significant harder to implement them and walk away. They go onto to explore how sacred cows can drain the company of resources and why. The participants also explore the situation where the joined businesses are unlikely to be of interest to the same buyer, and the complication it creates. The participants go onto to explore the impact of trying to sell these combined assets and separating them out during the sale process and the additional diligence that a buyer will conduct. The process is illustrated with realistic examples, freely inspired by several real cases in different industries, that the participants work through individually and in groups.