Acquisitive Growth

The Appleton Greene Corporate Training Program (CTP) for Acquisitive Growth is provided by Mr. Chicles Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 24 months; Program orders subject to ongoing availability.

Personal Profile

Mr Chicles is an approved Certified Learning Provider (CLP) at Appleton Greene who is a business leader and strategist with broad experience in the global multi-industrial, aerospace and defense sectors. He is a seasoned operational leader of global industrial businesses, leading transformational strategies in highly competitive markets.

As a senior, C-suite strategist for multiple major industrial corporations he has led multiple mergers, acquisitions, divestitures and restructurings, as well as corporate break-ups and spin-offs. He has a distinguished track record of successful transformations of complex organizations in dynamic and uncertain market conditions while engendering the trust and buy-in of employees, customers, vendors, owners, corporate leadership and boards of directors.

A highly engaged leader at the personal and team level he has demonstrated the ability to engender effective senior teams and boards. He’s also an active mentor, teacher and community leader.

Mr Chicles is an active board member with AES Seals, global leader in sustainable reliability engineering, and Micro Technologies Inc, an electronics and advanced manufacturing company. He is a principal partner with ProOrbis Enterprises®, a management science consultancy with premier clients such as the US Navy and PwC, as well as the principal of Xiphos Associates™, a management and M&A advisory. Recently, he served as Board Director and Chairman of Global Business Development with Hydro Inc. the largest independent pump and flow systems engineering services provider in the world.

He was President of ITT’s Industrial Process / Goulds Pumps business segment a global manufacturer of industrial pumps, valves, monitoring and control systems, and aftermarket services for numerous industries with $1.2 billion in revenue, 3,500 employees and 34 facilities in 17 countries. Preceding this role he served as Executive Vice President of ITT Corporation overseeing the creation of a newly conceived ITT Inc. following the break-up of the former ITT Corporation to establish its strategy and corporate functions such as HR, communications, IT and M&A, building the capabilities, policies and organizations for each.

He joined ITT Corporation’s executive committee as its strategy chief in 2006 and instituted disciplined strategic planning processes and developed robust acquisition pipelines to respond to rapidly changing markets. Created successful spin-offs of 2 new public corporations Exelis Inc. and Xylem Inc. ITT Corporation was named one of “America’s Most Respected Corporations” by Forbes for exemplary management and performance during his tenure there.

Before joining ITT, Mr Chicles served as Vice President of Corporate Business Development and head of mergers and acquisitions for American Standard / Trane Companies, where he initiated and closed numerous transactions and equity restructurings globally.

Additionally, he created and led the corporate real estate function which entailed more than 275 real estate transactions around the world.

He began his career at Owens Corning rising through the ranks in various operational roles to Vice President of Corporate Development.

Recently, he taught advanced enterprise strategy at Stevens Institute of Technology as an adjunct professor and still supports start-ups through the Stevens Venture Center. He continues to be active as the Founding Board Member with several successful start-up technology businesses and non-profit organizations. A community leader, Mr Chicles has held the role of President of the Greek Orthodox Cathedral in Tenafly, N.J., He also led trips abroad to Cambodia and Costa Rica to build sustainable clean-water solutions and affordable housing.

His formal education includes earning a Masters of Business Administration from The Wharton School at the University of Pennsylvania, and a Bachelors in Finance from Miami University.

To request further information about Mr. Chicles through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

Acquisitive Growth

In today’s context of changing markets, technologies and business models, and in conjunction with historic levels of available capital, acquisitive growth has emerged as an increasingly compelling approach to transformational growth. However, as has been empirically proven growth through acquisitions is fraught with pitfalls and inherently risky. Successfully acquisitive growth requires the confluence of many factors that go beyond the traditional phased steps of a typical process. In my experience success is a function of bringing together the elements of people, processes, and technologies into a set of capabilities that are custom-made for an organization’s particular strengths, circumstances and aspirations. Winning in today’s dynamic markets demands bold, unique and sustainable strategies. The following are the stages of such an approach that I have found to create high probability, profitable growth that stands the test of time.

Additionally, while the M&A industry has many advisors available, they tend not to be operating executives who have lived through all the elements I will lay out below. Many simplistic guidelines exist, however what its clear is that the difference between success and failure with acquisitive growth is not in rote adherence to some set of processes, rather it is found in the combination of process discipline and strong application of experiential, practical knowhow. The nature of this knowhow is to apply and allocate the elements below in a smart, efficient manner to achieve exemplary outcomes for the specific client’s unique situation and circumstances.

Strategy Development: Whether at the corporate level or in a specific business unit, clients would be taken through steps to clarify the markets and segments where they currently compete and where they want to go in the future, what differentiates them from competition, where capabilities need to be refined or built, and the various functional elements (e.g. systems, processes, structures, etc.) critical to sustain profitable growth. Approach would be a combination of review of current strategies/capabilities, interviews and facilitated discussions and structured workshops. Outcomes might be a strategy to bring a particular business into a new growth phase or to meet changing competitive environments, or at the enterprise level might entail “platform building” whereby new businesses, sectors or legs are build from the ground up through foundational initial acquisitions and subsequent organic and inorganic initiatives.

Market Focus: Where will we hunt for acquisition targets? If a company allows too-wide of a scope will find themselves suffering from expensive resource drains/distractions and/or dilute efforts. Therefore, following the alignment of enterprise/business strategies the process will seek to focus the market segments and the business criteria to qualify a company to be elevated to possible target.

Research Possible Targets: Simply put, take the descriptions and criteria from above and create lists of potential targets that might fit. Each such company is researched for available information, any currently available knowledge the client might have, etc. Output is a gross list of possible targets.

Target Approach: Utilizing a number of possible approaches, one that is appropriate for the client is determined. For example, some companies may have business development or sales teams who could participate in this stage, or on the other hand for reasons such as confidentiality, resource scarcity, etc this might need to be put into the hands of specific individuals (senior executives, dedicated M&A executives, 3rd party services, etc.). Each company is different, so this is an exercise of matching needs with capabilities. The objective is to screen the gross target list to elminate those who have “killer facts” such as big contingent liabilities, prohibitive complexity such as a company with a complex ownership structure, our any other aspects that renders a target not acceptable for the next step.

Cultivation: This is a very critical part of the overall process. The essence of this authentic, genuine and meaningful relationship-buidling which requires a combination of individuals with certain skill-sets to ‘sell’ the prospects on being acquired, patience and persistence. I have many approaches, processes and techniques that I have and continue to use to great effect in this regard. Output is a short list of interested targets who have moved to active discussions and in-person meetings.

Target Assessment: During the cultivation phase as it gets more advanced, a critical success factor for effective acquisitive growth is the ability to narrow the list with limited amounts of information. This is important because the next phase is quite intensive so any company can not practically thoroughly assess all such targets. In other words, how does a client gain the insights needed to do this? Some might consider this the ‘phase I due diligence’ whereby, prior to the engagement of expensive resources such as lawyers, accountants, etc., an overview of a target’s current status is determined. Through structured and open discussions, the client engages in discussions with the targets to learn as much as possible..

Preliminary Offer: Structuring of a term sheet or letter of intent based on finding to date. Depending on these findings, certain terms may be included to lay out a) value expectations; b) focus for due diligences and commitment to support it; and c) various legal terms typical for these agreements. This tend to be non-binding agreements meant to establish exclusivity of dealings for a period of time, high level terms that both parties agree to, and confidentiality. Given my background, I have the abilility to craft these documents with minimal legal cost.

Due Diligence: This is yet another element of acquisitions that can take several different forms. Depending on the situation and capabilities of both clients and targets, due diligence activites tend to have different scopes and approaches that match each particular circumstance. A simple example would be a private company target versus a public company. With the latter, sellers often limit potential acquirers to only publicly available information whereas private companies may have limited information at their disposal. Therefore, each approach must be designed for purpose, with the output being a customized plan for a particular target. This leads to both more efficient and cost effective processes as well as deeper insights to help with final decisions.

Deal Making: After the due diligence phase, and with a set of terms already agreed, the negotiations begin to finalized the terms of value, liabilities and the myriad legal and busses considerations that must be addressed and finalized. Whether as chief negotiator or as a trusted advisor to the same, I would bring my experience and talent to bear on this phase as well as some structured approaches/guidelines.

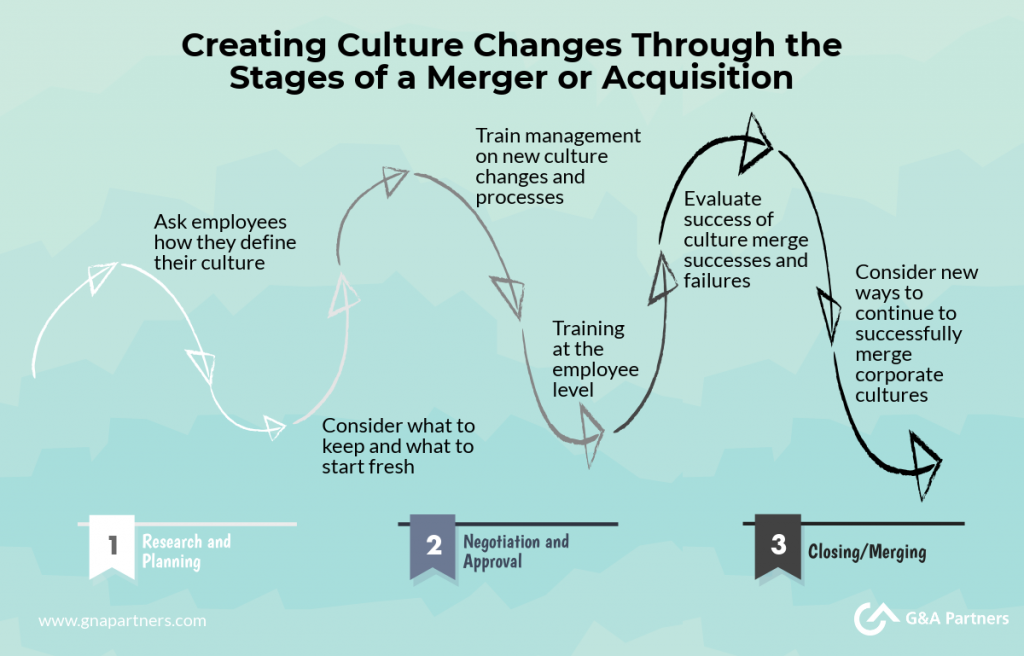

Integration Planning: Concurrent with the commencement of due diligence, full attention is required to determine the structure, resources, plans and teams for post-closing integration. Specific approaches and processes would be employed here to ensure that a proper integration leader is named (critical), robust but prioritized integration plans (e.g. IT and Finance integration might be a first priority for some companies), organizational and assimilation plans, and specific actions in several other area. Among the more difficult and critical elements of integration is culture. While culture is a key consideration in the pre-offer phases, it tends to be among the more challenging aspects to successful acquisitions and an area where experience from a career of hands-on accountability of acquisitions brings valuable insights. Several pro-active approaches can be introduced to the clients to determine which is best to employ with any particular integration.

Execution: From plans to execution requires much more than a roadmap. While such roadmaps are critical, it is the confluence of leadership and human capital, prioritized focused actions to achieve specific results, and finally sustainable integration to bring into the client’s company the full potential of the value creation possible. Tools exist and can be created to provide structure and management support to achieve this consistently.

Important And Strategic Elements Of A Growth By Acquisition Approach

This program has thus far concentrated on the role that acquisition strategies play in driving growth.

However, this assumes that the acquisitions are carried out properly on its own. Experience has shown that acquisitions may both produce and destroy value, with the execution of the transaction typically making the difference.

The following are crucial and strategic elements that support successful acquisitions:

• Considering strategic fit: Purchasing merely for the sake of purchasing is little more than management hubris. The target businesses should in some manner meet the needs of the buyer’s company strategy (i.e. product or service line, geographic reach, etc.).

• Addressing culture fit: Due to cultural mismatches between the two merging organizations, some of the largest mergers in history have failed. It is important to take into account a company’s culture because it directly affects how it creates value.

• Doing thorough due diligence: This guarantees that the buyer “looks beneath the hood” of the company they are buying and that the price they are looking to pay for the company reflects its intrinsic value.

• Integration: Even when the share purchase agreement’s ink dries, the deal is not finalized. The two businesses must now start an integration process to ensure that they grow into something greater than the sum of their individual parts.

Advantages Of Growth Acquisition

10 advantages of expanding your company through acquisition

If you’re deciding whether to enter into an acquisition contract, you might wish to take into account the following list of acquisition benefits:

1. Strengthens a failing business

The company you work for might be going through a period of underperformance, and an acquisition might be the answer. The ability to work together as a team rather than alone may be a key factor in the business’ success. As you get to share resources with the company you’re merging with, this can assist keep the business from failing.

2. Secure financing for growth

By making an acquisition, a company might gain access to money or other important assets that it might not otherwise have at its disposal. You can easily acquire these assets with the aid of an acquisition. The firm and its employees may benefit from collaborating with a company that has sufficient resources because the development of the enterprise is the ultimate objective.

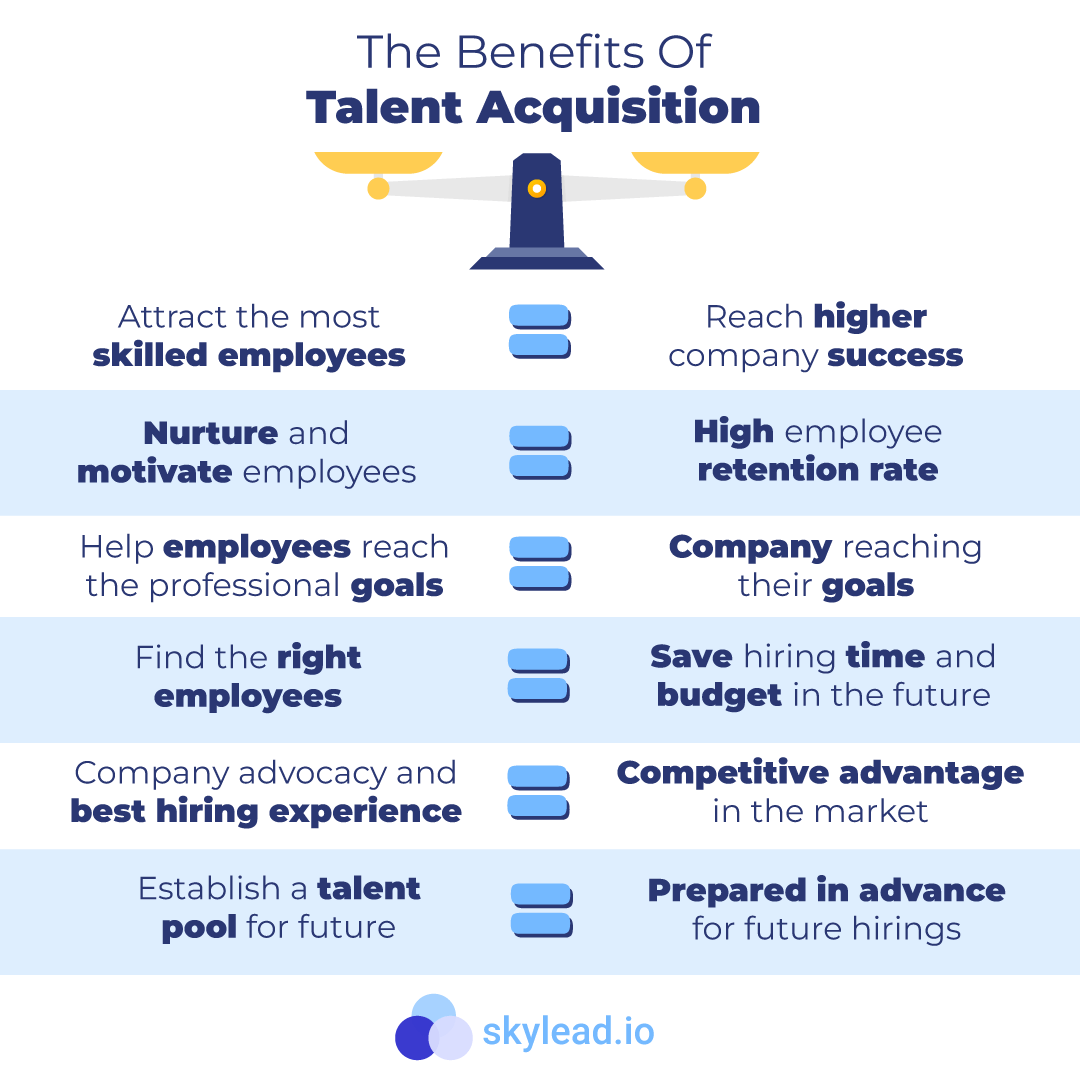

3. Have access to skilled personnel of high caliber

An acquisition can aid in boosting both the amount and quality of employees who are knowledgeable about the demands of the company. The experienced staff often stays on the firm payroll after an acquisition is completed so they can integrate. Their business acumen contributes to the companies’ success after the merger.

4. Expand the company’s market.

The corporation may diversify its offerings of goods and services as a result of the acquisition. You can make a variety of goods and distribute them to various target consumers. An acquisition often aids in a company’s development and growth.

5. Increase market influence

When you enter a new market, making an acquisition might help you combine market forces and exercise control. The synergy it offers increases your market presence and market share. If you plan to establish branches or subsidiary businesses, an acquisition may assist you lessen competition and preserve market dominance.

6. Make sure more capital is available.

Because the company is now larger after an acquisition, access to cash is improved. Higher cash and funds are available and accessible as a result of the arrangement. Amountable capital may be extended to both companies according on the agreement the companies come to when making the purchase.

7. A decrease in training expenses

Through an acquisition, your company may be able to cut internal training costs by using resources from the other acquired company. The cost of employee training is not necessary if the acquired firm develops its resources. You can use the company’s resources, depending on their state of development, to train other employees so they can develop their skill set.

8. Boost the competitiveness of your business

A purchase can take care of the requirement to adhere to higher standards as a result of the development in technical advancements. By joining forces with a smaller company that possesses the required technologies, a larger corporation can maintain its competitive position. Long-term gains from this may accrue to both businesses.

9. Lower production expenses

If you can use another company’s production facilities, facilities, and storage space, merging with them can save your production expenses. Building these kinds of facilities can be expensive, but if the business expands, it might be necessary. Sharing resources could significantly affect the budget and production costs.

10. Enable you to fulfill stakeholder expectations

Stakeholders could have expectations for the company’s growth, and making an acquisition is an effective strategy to achieve such expectations. An purchase increases the likelihood of investment returns, which may gratify the stakeholders. The pressure from the stakeholders can be handled more easily by making an acquisition, and you can even surpass their expectations.

What To Watch Out For During The Entire Acquisition Growth Process

Investigating less evident problems within the target company is the goal of the due diligence procedure.

This ranges from contracts with sizable clients that are about to expire to potential legal proceedings resulting from past business decisions.

But there are a few things that the buyer should watch out for on a more strategic level.

They consist of the following:

• Culture: Even if this phrase keeps coming up, it is crucial to the success of M&As. The culture of the target company should be thoroughly researched by prospective buyers in order to have a sense of what they are getting into.

• Competitive Edge: Is the target company “plain vanilla” or does it engage in any activities that offer it a competitive advantage (which we’ll define as the capacity to produce above-market value over the long term)?

• Leadership: Would the target company’s leadership complement your own leadership team in a positive way? Spend some time with them while conducting your research to see whether this might be the case.

• Possibilities: Are there any prospects that the target firm can take advantage of that your business won’t be able to in the near future? Let’s say it’s because of a service or product line they offer that is expected to see rapid expansion.

• Synergies: Where do your two companies’ synergies lie? Are they really complementary, or does purchasing the target company actually run the danger of causing some of your company’s income streams to be cannibalized?

Curriculum

Acquisitive Growth – Part 1- Year 1

- Part 1 Month 1 Business Assessment

- Part 1 Month 2 Strategic Aspiration

- Part 1 Month 3 Segment Focus

- Part 1 Month 4 Targeted Offerings

- Part 1 Month 5 Target Pool

- Part 1 Month 6 Target Identification

- Part 1 Month 7 Target Approach

- Part 1 Month 8 Deal Approach

- Part 1 Month 9 Cultivation

- Part 1 Month 10 Cultivation

- Part 1 Month 11 Confirm Target

- Part 1 Month 12 Talent Assessment

Acquisitive Growth – Part 2- Year 2

- Part 2 Month 1 Talent Strategy

- Part 2 Month 2 Integration Strategy

- Part 2 Month 3 Business Plan

- Part 2 Month 4 First 90-Day Plan

- Part 2 Month 5 Valuation

- Part 2 Month 6 Synergy Analysis

- Part 2 Month 7 Due Diligence

- Part 2 Month 8 Due Diligence

- Part 2 Month 9 Deal-Making

- Part 2 Month 10 Deal-Making

- Part 2 Month 11 Documentation

- Part 2 Month 12 Communications

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene Acquisitive Growth corporate training program.

Acquisitive Growth – Part 1- Year 1

- Part 1 Month 1 Business Assessment – Assessments can be incredibly valuable tools for organizations of all sizes. A comprehensive assessment methodology can help you evaluate your organization across multiple dimensions. But what are business assessments, what do they entail, and what are the benefits? Business assessments can help you identify areas of improvement and potential acquisitive growth. By taking a comprehensive approach, you can get an accurate picture of your organization’s strengths and weaknesses. Assessments can also help you develop actionable plans to improve your business. At their core, business assessments are all about providing clarity. When you’re feeling overwhelmed by the day-to-day details of running a business, it can be difficult to step back and get a clear picture of where your company is headed. That’s where assessments come in. By taking a comprehensive look at your company’s strengths and weaknesses, you can develop a clear road map for success. Assessments are an essential part of any business plan. By evaluating your company’s strengths and weaknesses, you can develop a roadmap for growth. Furthermore, assessments can help identify areas where your company may be at risk. By addressing these risks early on, you can avoid potential problems down the road. In addition, assessments can help you benchmark your company’s performance against others in your industry. This benchmarking process can give you valuable insights into areas where your company may need to improve. Ultimately, regular business assessments are a crucial tool for any organization that is looking to grow and thrive.

- Part 1 Month 2 Strategic Aspiration – A Winning Aspiration defines the purpose of your enterprise, its guiding mission and aspiration, in strategic terms. The first choice of the strategic choice cascade is winning aspirations. Here we ask, “what is our winning aspiration.” Strategically, our winning aspiration defines our purpose. Aspirations are a view of the future. Qualified with “winning,” it is the ideal future that we strive to achieve. Unless you deliberately set out to win, it is impossible to do so. A business that only wants to participate rather than succeed will invariably fall short of making the difficult decisions and large investments necessary to succeed. Aspirations that are too modest rather than lofty are much more harmful. Most businesses fail because they have low expectations.

- Part 1 Month 3 Segment Focus – Every company aspires to grow. But, in a market where competition is fierce, inorganic business growth requires insight and innovation. Segmenting the market and customers is among the most effective techniques to promote acquisitive growth. Yet as numerous businesses have shown, artful segmentation can result in a significant competitive advantage. The purpose of segmentation is to inform your marketing approach. Using this method, it is feasible to recognize and categorize groups of potential clients based on their shared preferences, needs, and interests. This method effectively identifies the demographics most likely to value a specific good or service you provide. Furthermore, it may assist you in positioning that service so that it outperforms that of your rivals.

- Part 1 Month 4 Targeted Offerings – Everything the market offers, be it products or services or any experience, is known as a market offering. Market offerings are also divided among themselves based on the nature of the offering. Read along to understand the role and value of market offerings. Individuals within a market have different wants and needs. As a result, businesses in the market offer various products and services. The ultimate aim of businesses is to fulfill all the varying wants and needs of the population. Providing better target offerings and standing out in the market will eventually lead to more loyal customers and a broader customer base. People expect businesses to add value to their lives in various ways, precisely the purpose of market offerings – satisfying customer needs.

- Part 1 Month 5 Target Pool – The purpose of this workshop is to map out the offerings that one wants to develop or enhance for the focus segments defined by WDP3. A target pool is at the intersection of Targeted Offerings and Focused Segments. For example, if your strategy is focused on growing a currently manufactured product beyond your existing markets, you’ll want to know all the players who make these products in the markets where you don’t currently play but aspire to. In this simple case, the target pool would be derived by researching the current suppliers in these focus segments and profiling them for certain things such as size, channels to market, etc. The approach of this workshop is to take the Targeted Offerings and in a way and ‘map’ them with the Segment Focus areas we developed previously. In reality you might only need to do one or few of these approaches, but the workshop can develop the understanding and skills to do this work, which is in essence synthesizing the ‘strategic play’ associated with any acquisitive growth program.

- Part 1 Month 6 Target Identification – Target identification in acquisitive growth is the process of identifying potential companies or assets that align with the strategic objectives of the acquiring company. It involves conducting comprehensive research, market analysis, and due diligence to evaluate various factors such as financial performance, growth potential, synergies, industry trends, competitive landscape, and cultural fit. The goal is to identify targets that offer strategic value and can contribute to the acquirer’s growth, profitability, market position, or diversification objectives. This process requires careful evaluation, consideration of risks, and alignment with the acquiring company’s overall M&A strategy to ensure successful integration and value creation.

- Part 1 Month 7 Target Approach – All business investors are “financial” investors – the real question is how “strategic” is their ability to leverage the assets of the target. Providing practical guidance on approaching a business target and conducting initial due diligence depends on the investor’s criterion, competencies, and execution bandwidth. At this point, you will have identified a target or group of targets and you are attempting to learn enough about the target to determine whether to proceed with developing a meaningful indication of interest. Of course, an active seller is likely prepared for the sale process and represented by an advisor who is postured to provide the financial and operating information necessary for investors to quickly determine the suitability of a deal (i.e., a pitchbook and defined protocols for communication and information access). However, many desirable targets may not be seeking a sale because business conditions are favorable, and their businesses have been managed to provide options to the owners regarding continued independence and turn-key ownership and management succession. If the former, you, as a prospective buyer may have already pinged on the radar of the seller, and if the later, you have mined for target opportunities and are ready for the next step to accomplish an acquisition.

- Part 1 Month 8 Deal Approach – The M&A landscape is becoming increasingly competitive and the balance of power is shifting further in favour of buyers. For attractive businesses, however, sellers may wish to make divestments through an auction process which is designed to elicit competitive bidding among interested parties to facilitate the sale of a business or stake in a company at the highest price and on the best possible terms. Not all transactions require collaboration between the buyer and the seller, however. In many instances, an auction is still a better approach than a negotiation. The trick is in knowing which process to use when. To make that choice, you need to clearly understand your potential buyers, the characteristics of the asset in question, your own priorities, and the relative importance of speed and transparency to obtaining the best price.

- Part 1 Month 9 Cultivation – (non-auction)

- Part 1 Month 10 Cultivation – (organized process)

- Part 1 Month 11 Confirm Target – Assuming initial contact and conversations go well, the acquirer asks the target company to provide substantial information (current financials, etc.) that will enable the acquirer to further evaluate the target, both as a business on its own and as a suitable acquisition target. After producing several valuation models of the target company, the acquirer should have sufficient information to enable it to construct a reasonable offer; Once the initial offer has been presented, the two companies can negotiate terms in more detail.

- Part 1 Month 12 Talent Assessment – Talent decisions can be made with less precision, discipline, and data but frequently require more complexity than other integration decisions (such as decisions about goods, markets, or customers). M&A leaders must “up their game” in talent assessment if they want to succeed. In the end, the acquirer must decide if current employees from the target (the acquired company) are the most qualified to carry out the goals of the new organization.

Acquisitive Growth – Part 2- Year 2

- Part 2 Month 1 Talent Strategy – There are numerous tactics available for talent acquisition. But not every organization benefits from every method or strategy. When developing your strategy, consider the following factors: industry, size, development trajectory, types of positions, leadership, and more.

- Part 2 Month 2 Integration Strategy – The process of integrating a buyer and seller to the extent required to realize the anticipated benefits from a merger or acquisition is known as an M&A integration. An M&A integration plan outlines the merger’s goals, top priorities, performance indicators, non-negotiables, and scope.Getting agreement among your leaders on the integration strategy is the first stage in an M&A integration. At least two to three months before the deal closes, they should make it clear.

- Part 2 Month 3 Business Plan – Lack of a business strategy before an acquisition is one of the main mistakes that many M&A practitioners make. When considering an M&A, the business strategy is a vital resource. It provides comfort to those funding the deal that the reasoning behind it is sound and that the decision to acquire is not being made on a whim, as well as a roadmap for what you’re looking for in a business acquisition.

- Part 2 Month 4 First 90-Day Plan – HR must be quick and efficient when acquisition is at the core of a company’s growth strategy. The first 90 days are crucial for the organisation’s long-term performance as well as for the retention of individual employees. We can win hearts and minds by day 90 and have a better probability of them becoming productive team members if we have a robust acquisition plan.

- Part 2 Month 5 Valuation – One of the biggest challenges in negotiating a business acquisition is typically price haggling. The intricacy of business valuation makes this more challenging because a fair value cannot be determined without thoroughly examining the company’s financial data, sales trends, customer and supplier base, and many other factors.

- Part 2 Month 6 Synergy Analysis – A significant driver of value in M&A transactions is the potential for establishing synergies. A synergy is the idea that two businesses might be valued more highly when united than when valued separately. Knowing the possible synergies in an M&A transaction is crucial to any agreement, for both the buyer and the seller.

- Part 2 Month 7 Due Diligence (Foundational – Foundational due diligence is an organization’s baseline due diligence requirements that they must have on file for every vendor relationship, regardless of risk level, in order to do business with them. With origins in the private-sector world of business and finance, the term “due diligence” refers to the process through which an investor (or funder) researches an organization’s financial and organizational health to guide an investment (or grantmaking) decision. The decision to fund or not to fund is based upon a balance of objective data analysis, insight into the general state of organizational health and stability, and intuition. A sound and thorough due diligence review is the process through which all the factors that make up that equation are uncovered and understood. It is the process in which a program officer seeks the “truth” about an organization. Foundation program officers are faced with multiple challenges in assessing whether to recommend a grant to their board or decision-making committee. First, they must ascertain whether and to what extent the proposed activity coincides with the foundation’s guidelines and priorities. Next, they must assess the worth of the proposed activity itself — does it advance the fi eld, provide needed services or generate new learning? If the proposal survives this initial scrutiny, it must then be weighed for its relative merits beside many other worthy proposals. This process requires a great deal of skill and sensitivity. Due diligence protects a foundation’s investments and reputation and advances its mission and overall strategy.

- Part 2 Month 8 Due Diligence (Business Plan) – When you receive a proposal on your desk, the first step of proposal review is generally a consideration of the alignment of the applicant organization and proposed project with your foundation’s guidelines and interests. If this initial review is positive, due diligence typically commences with broad research and information gathering to provide a good understanding of the organization, how it fits into the field and the way in which this project will advance your foundation’s strategy. You might also contact colleagues for their view of the organization and its work. Then, you move on to get to know the applicant on a deeper level, including interviews with some combination of the executive director, board chair, other board members and staff members key to the proposed project. Each of these activities is covered in depth in this tool.

- Part 2 Month 9 Deal-Making (Direct Negotiation) – Direct negotiations are a deal making process in which an agency may contact a single contractor of its choice to submit a quote or tender without having first gone through a genuine competitive process.

A variation to an existing contract can also be a direct negotiation. Bargaining between buyer and contractor is a critical element of the process. The objective is to reach agreement on all terms and conditions and to obtain the goods and services at a price that is fair and reasonable to both the contractor and the agency. Direct negotiations are not intended to avoid competition or to discriminate against any organization and must be conducted in a manner consistent with the standards of behavior and requirements. A suitable assessment, based on comprehensive knowledge gained through specific market research, will need to be made to justify direct negotiation. - Part 2 Month 10 Deal-Making (Auctions) – Many (if not most) complex deals between buyers and sellers—from home sales to purchasing auctions to corporate mergers—qualify as auction deal making. Deal making (auctions) give sellers the opportunity to avoid making the difficult tradeoffs of traditional negotiations or auctions— competition versus value creation, for example, or many versus few bidders. In fact, sellers can take the best of both worlds— negotiations and auctions—to ensure they get a great deal. Auction deals have the following features: 1. One-on-one negotiations. At some stage of the deal making process, the seller engages one or more buyers in private discussions about the asset on the table. 2. One or more rounds of bidding. The seller also pits potential buyers against one another in an auction. 3. Several, but not too many, potential buyers. Deal making at auctions need enough parties to spark an auction but not so many that one-on-one negotiation would be difficult for the seller to manage. 4. Process ambiguity. In a traditional auction, the seller determines the process (whether there will be a single round of bidding or multiple rounds, for instance), and buyers are passive participants. In auction deal making, by contrast, the process is up for grabs. Buyers can try to shape the process to their advantage, as in the case of an auction contestant who approaches a seller about negotiating privately to move beyond the single issue of price. In general, whether you are the process setter or a bidder in an auction that has features of a negotiation, don’t assume that the rules are set in stone. Instead, change the game by thinking about how you can influence the rules, parties, and assets to your advantage.

- Part 2 Month 11 Documentation – The paperwork phase of a merger or acquisition is crucial. It might be regarded as the merger and acquisition process’s soul. With due diligence complete, parties make the final decisions on moving forward to execute the transaction. For legal teams, this comes with several responsibilities. Corporate or pre-clearance filings must be made in advance of the closing date. These include merger filings, amendments, ordering of good standings, or issuance of bring-down letters.

- Part 2 Month 12 Communications – An increase in M&A activity indicates a potential deal for entrepreneurs, business owners, and C-suite executives. In the event that a tempting deal is successful, it would be advisable to view an employee communication plan as a crucial component.

Methodology

Acquisitive Growth

It’s challenging to make this kind of acquisition successful. Seven fundamental operating principles are used by profitable corporate and financial purchasers, according to research. Almost all phases of the acquisition process, from the selection of candidates through post-merger management, are impacted by these ideas.

• Insist on cutting-edge operating tactics.

• If you can’t identify the leader, don’t make the deal.

• Provide top executives with significant incentives.

• Connect pay to variations in cash flow.

• Accelerate the rate of change.

• Encourage lively interactions between the board, managers, and owners.

• Employ the top acquirers.

Insist On Cutting-Edge Operating Tactics

High-profile leveraged buyouts like those of Duracell International, Uniroyal, and RJR Nabisco have garnered a lot of attention since the early 1980s. Prices, clever financial arrangements, and bargaining strategies have received a lot of attention. However, the other 2,200+ buyouts that took place during that time period and the fundamental changes in operational procedures that led to profitable outcomes for many of those businesses have received little attention. Although many observers think that LBO enterprises find hidden treasures in the market, more often than not, they only concentrate on enhancing operations.

Two acquisitions, Sunglass Hut International and Snapple Beverage Corporation, show that operating performance—rather than financial leverage, market timing, or industry selection—is the main driver of value creation in successful acquisitions.

Desai Capital focused on accelerating sales growth and developed a new strategy to achieve so when it acquired Sunglass Hut. By acquiring smaller stores in turn and introducing a new store model, Sunglass Hut has expanded from 150 locations to more than 800 since the initial acquisition in 1988. This growth has led to an astounding 37% yearly return. The business introduced a broad product selection rather than depending on two or three popular lines, replaced clerks with limited knowledge of sunglasses with educated customer-service specialists, and implemented a low-cost regional approach.

Another illustration of operating improvements is the 1992 purchase of Snapple by renowned financial acquirer Thomas H. Lee Company. Snapple launched an aggressive growth strategy based on quick global expansion and product range extensions shortly after the takeover. The business immediately established its production and distribution network since it anticipated that rivals will soon release their own natural teas and fruit juices. It entered into contractual agreements with bottling and distribution businesses that had excess production capacity, allowing it to launch its product one year before major rivals like Fruitopia (from the Minute Maid division of Coca-Cola Company) and achieve a competitive advantage.

As the Snapple case demonstrates, innovative operating methods help acquirers succeed in fiercely competitive markets like the American food and beverage sector. The takeaway: Don’t limit your search for success to high-growing industries.

If You Can’t Identify The Leader, Don’t Make The Deal

Acquirers make sure they have the correct managers by employing three different strategies: they assess their current executives, search within the firm for managers who are not yet in leadership roles, and engage outside industry experts.

85% of preacquisition managers are retained in their roles. Other times, successful acquirers have discovered leaders elsewhere in the organization—leaders who hadn’t yet had the chance to put their vision into action. Middle management at General Instrument was where Forstmann Little & Company found strong leaders, who went on to add more than $3 billion in value over the last three years.

Successful acquirers frequently discover excellent performers at major firms when they search for outside industry expertise. For instance, after Wassall acquired General Cable Corporation in 1994, Stephen Rabinowitz, who had a strong track record as president of General Electric Lighting and later as vice president of AlliedSignal Braking Systems, was brought in to bring the company around. A supplier of copper wire cables, General Cable had drawn the attention of numerous prospective buyers, but few understood how to turn a profit. Wassall staked his money on Rabinowitz’s ability to turn around General Cable by purchasing the company. After the acquisition, Rabinowitz drastically lowered working capital, revamped the company’s numerous computer systems, and slashed more than 30% of its product offerings. The gamble paid off within 18 months.

However, effective acquirers don’t think twice about replacing managers when financial goals aren’t attained. The patience of financial buyers is lower than that of corporate acquirers. Three years after the acquisition by financial buyers in 32% of the cases, one or more top-level managers had been removed. Less than 10% of managers in corporate acquisitions were removed within three years. Why are corporate and financial buyers treated differently? It can be due to the greater obstacles put in place by financial bidders or the unwillingness of corporate acquirers to remove managers and upend a company’s culture.

People who are hesitant to fire managers might learn something from Thomas H. Lee. In 1988, the business orchestrated the management buyout of Diet Center. Former managing director Steven Segal, who is currently the managing director of J.W. Childs Associates, recalls, “We recognized management was inadequate, but we thought we could repair it. Jenny Craig was primarily an Australian food firm at the time of the Diet Center acquisition, and Nutri-System was recently coming out of bankruptcy. At first, neither posed a significant threat to Diet Center, but they quickly developed into formidable rivals. Diet Center’s managers stumbled when the going became tough.

Provide Top Executives With Significant Incentives

Since it’s crucial to hire and retain the best management, many successful acquirers provide senior executives sizeable ownership stakes (often 10% to 20%). Those managers could become billionaires if everything goes according to plan. Why are the carrots so large? “Managers are more dedicated to undertaking the onerous work of restructuring, growing, and otherwise correcting an acquisition when some or all of their net worth is on the line,” said B. Charles Ames, a partner at Clayton, Dubilier & Rice. It takes a lot of dedication and work to generate annual returns above 35%, as these managers must.

When hiring new managers for a company, incentives are extremely crucial. In that circumstance, there frequently needs to be a large upside potential to lure top executives away from secure and low-risk positions. According to prior research on buyouts, CEOs of acquired companies typically control 6.4% of their unit’s equity, compared to only.25% for the typical CEO of a publicly traded company.

In the majority of the situation, CEOs are required to buy enough stock to make up a sizable portion of their net worth. These substantial investments are frequently referred to as “pain equity” as a means of guaranteeing that managers cannot afford to fail. Acquirers may provide a loan or a discount if an executive is unable to purchase the shares.

Some managers are required to put a sizeable portion of their wealth at risk. “Pain equity” refers to this.

The question of whether public corporations ought to adhere to these policies has sparked a significant debate. Some claim that because shareholders monitor executive pay to ensure that it is “reasonable,” public companies cannot offer large ownership stakes to individual managers. However, the best acquirers in our aren’t afraid to make top managers wealthy if their companies generate outstanding returns. In fact, approximately 60% of corporate acquirers give managers the opportunity to amass wealth unmatched by anyone in their sector. Such acquirers are cunning, though, and only give up as much stock as necessary to entice the greatest talent.

Of course, managers are motivated by more than just equity stakes. To make the challenges and unpredictability valuable for managers, additional rewards are also required, such as exposure in the public eye and potential progression (within major corporate parents). At public corporations, where CEOs with the best performance records are rewarded in a variety of ways, nonmonetary types of pay are particularly common.

Connect Pay To Variations In Cash Flow

Successful acquirers not only reward executives with stock up front but also with well crafted incentive plans linked to variations in cash flow. Such incentive pay satisfies two goals. It serves as a reward for recent efforts and serves as a pat on the back. Second, and perhaps more importantly, it gives managers and owners a common language to communicate with, encouraging managers to consider cash flow when making operational choices on a daily basis.

Many acquirers pay managers a base wage that is close to the industry standard. They do, however, connect a sizeable portion of total compensation to yearly performance indicators. They assess which metrics are crucial for generating operating cash flow, after which they set challenging goals. In general, variables that affect longer-term cash flows, such as return on new capital investment and market share gains, are used combined with variables that effect current cash flow, such as inventory on hand, accounts receivable, and unit growth. These measures, which have clear numerical targets established for each variable, are derived from overarching business targets and frequently included in senior managers’ employment contracts. Bonus payments often vary from 50% to 100% of base pay or more. Specific performance targets are challenging, and the size of the prize reflects this.

Kirkland Messina, a Los Angeles-based buyout firm, understood it had to address a serious lack of communication among Selmer’s departments when it acquired the musical instrument manufacturer in 1993. For instance, it found that the production team’s inventory requirements were not being appropriately communicated to it by the sales team. Due to the uncertainty, the business missed crucial delivery dates for trumpets for professional musicians, which had the largest margins.

As CEO Dana Messina puts it, “The company was run in fiefdoms.” All of that was altered by Kirkland Messina: “We put in place measures that forced cooperation between functional sectors. Both margin and revenue targets are set for sales managers, and customer delivery and working capital targets are set for manufacturing managers. As a result, in the two years following the acquisition, cash flow has increased by 50% and manager cash pay has doubled.

Accelerate The Rate Of Change

The vice president of development and technology at Emerson Electric, Charlie Peters, asserts that “time is essential when it comes to discovering opportunities.” “The majority of measures necessary to build value are conducted in the first two years following the conclusion of the deal.” Both public and private acquirers concur that accelerating change focuses goals and disciplines managers. It creates a sense of challenge and urgency among employees in the organization. For instance, in late 1992, Emerson purchased Fisher Controls International, a producer of machinery for manufacturing process control. A number of operational adjustments, such as factory consolidations, modified procurement procedures, inventory management initiatives, and sales force alignments, allowed for both profit and cash flows to exceed the initial acquisition prediction in addition to meeting aggressive two-year plans. Grand Metropolitan also expedites change, so Emerson is not alone. After acquiring PET in February 1995, the business moved swiftly to shut down facilities, cut expenses at the corporate office, and alter its branding strategy.

Operating income at WESCO, a buyout by Clayton, Dubilier & Rice, increased from virtually nil earnings to profits of about $55 million in just two years. Wesco occasionally sold items at a loss since the previous owner, Westinghouse Electric Corporation, had aimed to maximize earnings by maintaining a high factory utilization rate. After the acquisition, the company’s new management team declared that it was no longer in business to sell the most merchandise possible. Instead, it had created a new sales incentive program that rewarded the sales force for increasing gross margins rather than emphasizing volume. By charging the branch managers 1% per month for inventory stored under two months and 2% for inventory held over two months, procurement and inventory control were enhanced.

Encourage Lively Interactions Between The Board, Managers, And Owners

The degree of contact between managers, directors, and shareholders is a key distinction between successful acquirers and the majority of firms. Successful acquirers build flat organizations rather than a multi-tier, bureaucratic structure. For instance, Sara Lee has a decentralized management structure that separates the company into several profit centers, each of which is run by an executive with significant authority and responsibility for the success of that business.

Sara Lee has decided to use a decentralized organizational structure that separates the business into distinct profit centers.

Other profitable acquirers maintain acquired firms apart from other operating units, despite the fact that this policy prevents them from taking advantage of possible synergies. They think it’s crucial to give acquired businesses a lot of freedom.

The structure of Thermo Electron serves as an example. Thermo Electron has purchased 30 businesses in the environmental, energy, healthcare, and medical equipment sectors over the last ten years. Between 50% and 80% of the equity of its operating units are owned by it; the remaining 20% are held by the general public. By doing so, CEO George Hatsopoulos has been able to offer equity holdings to a wide range of managers while yet maintaining control over the company by having key officers report to Thermo Electron and formal contractual agreements that outline operating strategy. Each operational firm must, for instance, deposit its money into a central cash management system under Thermo Electron’s control, adhere to internal control and accounting protocols, submit annual and five-year plans, and inform Thermo Electron’s senior executives of any deviations from the plan. In other words, the operating units have the control and reporting connections that are typical of corporate subsidiaries along with the independence of public businesses.

Operating units at Thermo Electron have the independence of publicly traded corporations and subsidiary-like reporting arrangements.

As long as financial goals are met, more than 80% of the successful acquirers under study give top-level managers the last say in all operational decisions. Major operational choices are collectively made by the others. Despite holding majority stock holdings, financial purchasers in particular rarely override the choices made by higher management. We have the same authority as corporate parents, but we are less ready to utilize it, as one of their representatives put it.

The finest corporate and financial purchasers frequently designate a gatekeeper to act as the point of contact between the owner and the operating unit manager. By serving as a sounding board for management, this person becomes deeply involved in the operational choices made by the acquired firm, especially in the first six to eighteen months following the acquisition. According to Thomas Weld, general director of financial buyer Three Cities Research, “We talk monthly after the first few months, until considerable change has occurred.”

The boards of directors of acquired companies are likewise meticulously crafted by successful acquirers, with a maximum of five to seven members. The boards normally include one to three managers from the acquired business, one or two subject-matter specialists, and two or three ownership group representatives. Financial buyers frequently include outsiders on their boards to offer an unbiased viewpoint. While owners are normally represented by the group head or holding company president in the case of corporate acquirers, industry specialists are frequently the CEOs of other operating units in relevant business sectors. A majority of the board members should be held by equity owners, according to preference of both corporate and financial acquirers (managers and investors).

Employ The Top Acquirers

The choice of the deal makers is one acquisitions factor that is sometimes disregarded. These people render decisions that are frequently crucial to whether the transaction is successful or unsuccessful. Here, the distinctions between corporate acquirers and financial buyers may result in some variations in value generation.

Financial buyers employ highly qualified individuals with exceptional academic and professional credentials. 45% of the specialists in our sample of nine buyout firms and more than 100 individuals had prior deal-making expertise at either an investment bank or another sizable investing business. 35% more of the group had extensive operating or consulting experience. Investment professionals appear to be chosen from a select group based on their educational backgrounds. In the study, more than 75% of the associates and partners had advanced degrees in business or law, and more than 90% of them were from prestigious U.S. universities.

The very finest and brightest are not inexpensive. Starting salaries for associates may exceed $100,000 annually, and they may surpass $500,000 within five years. The ability for associates to affect managers’ decisions at acquired companies also provides them with a significant non-financial motivator: a high sense of impact. The financial benefits are substantial at a higher level. Successful businesses’ partners typically make more than $1 million a year in management fees, incentive (“override”) payments from realized investments, and stock capital gains.

Building their acquisition teams is a varied approach taken by corporate acquirers. They tend to hire individuals with less deal-making expertise than financial buyers, preferring to nurture their own potential. Corporate investing specialists typically have less advanced degrees and graduated from less reputable institutions. Compared to their peers in financial institutions, they are paid much less. Corporate purchasers often delegate these decisions to senior executives, unlike financial buyers who consider both senior and junior personnel when determining if an acquisition is desirable. The deal’s structure, negotiation, and resolution of any legal or accounting concerns are the sole responsibilities of staff associates. Corporate investment experts are more driven by the possibility of rapid promotion than by the decision-making freedom and financial benefits provided by financial buyers. Does it hurt corporate acquirers in any way that they don’t employ the same individuals as finance buyers do? Although this theory cannot be directly evaluated, research of the acquisition strategies and returns of the two groups implies that they do.

Industries

This service is primarily available to the following industry sectors:

Industrial

Economic experts divide the economy into sectors to understand how different industries function and to track certain data points. The industrial sector is one of these broad sectors that composes most of what’s known as the secondary sector.

Understanding how the industrial sector functions and relates to the other major sectors can help you better understand how your job supports the overall economy. In this article, we explain what the industrial sector is, describe what makes up the industrial sector and list the other primary economic sectors.

The industrial sector is a segment of the economy made up of businesses that aid other businesses in manufacturing, shipping or producing their products. The industrial sector is what’s known as a secondary sector because the products and services this sector offers to go to other businesses rather than directly to consumers. Supply and demand in other sectors often drive the growth or minimization of the industrial sector, since it’s reliant on purchasing from businesses in other sectors.

Global M&A activity has slowed in 2022 as companies across the industrial manufacturing and automotive (IM&A) sectors are facing growing uncertainty. Headwinds likensupply chain disruption, commodity price increases, skilled labour shortages and the global semiconductor shortage—have all intensified and may create both challenges and opportunities for dealmakers in the second half of the year.

Lockdowns related to COVID-19 in a number of Chinese cities have reduced manufacturing output and disrupted exports from the Asia Pacific region. At the same time, the Russia–Ukraine conflict is exacerbating already stressed supply chains, and corporates’ actions to exit from Russian operations or deal with sanctions are inevitably diverting management focus from other strategic priorities, including M&A. We expect this to continue, at least in the short term.

Volatile and high energy and commodity prices continue to disrupt industrial manufacturing and automotive sectors, both of which are large consumers of energy and raw materials. Other sectors, such as business services and aerospace and defence, appear to be less impacted by the current headwinds. As a result, we expect the latter to remain attractive sectors for M&A activity.

Business leaders across all IM&A sectors who see technology as central to gaining a competitive advantage will continue to engage in M&A. IM&A companies have long been buyers of technology assets, and we are now seeing more examples of greater convergence across sectors. For example, the automotive and energy sectors are working closely together to develop technologies focused on e-mobility, including electric, hydrogen-powered and autonomous vehicles, batteries, and charging stations. As business leaders continue to look to technology to transform their business models, we expect further tech-related deals in the areas of automation, digitalisation, next-generation materials and production powered by renewable energy sources.

Aerospace

In the aerospace and defense industry, mergers and acquisitions (M&A) as we know them have recently changed. Instead of megamergers for the purpose of cost savings and synergies, current aerospace and defense M&A activity focuses on acquisitions that deliver new products and offer expansion into markets such as Asia, the Middle East, and beyond.

While this is good news for the industry, aerospace and defense companies must understand the nuances of this change and prepare for the challenges and opportunities that result in executing a merger or an acquisition. For example, acquiring companies or investors must consider how to value a company that has a short financial track record, or has few competitors, or is in a country in which they have not previously operated. Integrating overseas has its own hurdles, potentially resulting in inefficient operations and failure to realize acquisition benefits.

Pursuing growth via acquisition

Consolidation among original equipment manufacturers has given rise to several major players with the resources to pursue an aggressive and expansive M&A strategy. Aerospace and defense company investment in emerging technologies has introduced competition from adjacent industries, such as software.

Evolving customer relationships, regulatory changes, and potential tax reforms likewise complicate deal making. Once an acquisition deal is closed, integration should focus on how to scale the acquired assets and capabilities while considering cultural attributes and differences. Notwithstanding these challenges, M&A activity remains high.

M&A activity in the ADS sector in Q3 2022 was predominantly led by deals ranging from $10 to $100 million, with six deals overall. There was one mega deal in Q3 2022, whereas Q2 2022 saw no mega deals. All regions except China reported a quarter-on-quarter (QoQ) decrease in deal value in Q3 2022. The aerospace, defense and security industry M&A report analyzes the disruptive themes that have driven M&A activity in Q3 2022 in the aerospace, defense, and security sector. The report also offers a comparison of the aerospace, defense, and security sector deal activity by volume and value on segments such as cross-border vs domestic and public vs private.

Aerospace, Defense and Security Industry M&A Activity: Top Themes

The top themes that drove aerospace, defense, and security industry M&A activity in Q3 2022 were space systems and supply chain.

Space Systems: Eutelsat Communications and key OneWeb shareholders have signed a memorandum of understanding (MoU) to create a leading global player in connectivity.

Supply Chain: Precision Aviation Group (PAG) has entered into a definitive agreement to acquire PTB Group (PTB). The deal will expand PAG’s engine repair capabilities, allowing it to provide greater maintenance and repair coverage to the aviation industry’s components.

Energy

The energy sector is a category of stocks that relate to producing or supplying energy. The energy sector or industry includes companies involved in the exploration and development of oil or gas reserves, oil and gas drilling, and refining. The energy industry also includes integrated power utility companies such as renewable energy and coal.

The energy sector is a large and all-encompassing term that describes a complex and interrelated network of companies, directly and indirectly involved in the production and distribution of energy needed to power the economy and facilitate the means of production and transportation.

M&A activity in the energy and natural resources industry remained sluggish in 2021, rebounding only around 20% from 2020 and not yet recovering to prepandemic levels. Partly, this was the result of companies looking for demand to stabilize. Then, as stabilization largely took place, a second factor came into play: Companies began sharpening their capital discipline, which slowed dealmaking as fewer deals met their higher hurdle rates.

We believe that conditions are primed for an upswing propelled by a resurgence in industry consolidation and portfolio management. The oil and gas industry is still highly fragmented in many sectors, and multiples remain depressed, setting the stage for consolidation to unlock new levels of efficiency. The conflict in Ukraine adds more complexity to the market, with many companies actively reviewing their portfolio and some exiting their Russian positions as BP has done.

Meanwhile, there will be growing opportunities for portfolio management across energy and natural resources, especially in chemicals. Over the years, companies have expanded their portfolios to the point that there’s now a lack of natural synergies among assets and a high degree of complexity.

Above all, though, companies will turn to M&A to make more progress on the monumental journey of moving the world closer to a lower-carbon, sustainable future while also keeping their current businesses running. Many large companies have already pursued deals that accelerate their participation in the energy transition that, at its heart, requires all companies to reinvent themselves.

In 2021, energy transition deals accounted for about 20% of all energy-sector deals greater than $1 billion.

Engineering Services

The engineering services market consists of the sale of engineering services. Engineering services’ companies apply physical laws and principles of engineering in the design, development, and utilization of machines, materials, instruments, structures, processes, and systems. Engineering services include the technical application of engineering in product designing, innovations, and others in industries such as building construction, mining, power and energy, transportation, manufacturing, and others.

The main types of engineering services are civil engineering services, electrical engineering services, mechanical engineering services, other engineering services. Civil engineering services encompass a wide range of activities, including the planning, design, and construction of commercial and residential structures, transportation infrastructure, such as roads, bridges, and railways, water distribution systems, such as dams, sewers, and sewage treatment, environmental infrastructure, such as landscaping, urban planning, and parks, industrial infrastructure construction management, construction technology, and more. The various engineering disciplines include civil, mechanical, electrical, piping and structural engineering, other engineering disciplines. The services are used by automotive, industrial manufacturing, construction, aerospace, telecommunications, information technology, energy & utilities, other end users.

The global engineering services market is expected to grow from $1,038.83 billion in 2021 to $1,110.20 billion in 2022 at a compound annual growth rate (CAGR) of 6.9%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $1,271.62 billion in 2026 at a CAGR of 3.5%.

The engineering services market is expected to benefit from steady economic growth in developed and developing countries. The International Monetary Fund (IMF) predicts that the global real GDP growth will be 3.7% over 2019, 2020, and 3.6% from 2021 to 2023. This trend will be mainly driven by regions of Asia and Africa. According to the report, Asia will represent 66% of the global middle-class population by 2030. For instance, the Indian IT-BPM industry grew by 7.7% in FY 2017, with software products and engineering services reaching US$ 25 billion. Going forward, the Asia Pacific and Middle Eastern regions are expected to be the fastest-growing markets in the engineering services, design, animation, and graphic designing industries. Developing countries such as India and China have started attracting foreign investments to improve their infrastructure. This was mainly due to an increase in internet penetration, growth in population, and increasing economic activity.

Mergers and acquisitions (M&A) frequently drive growth in the engineering-and-construction (E&C) sector. In fact, M&A growth usually outpaces organic growth, except in some niche sectors. But even though E&C companies frequently acquire other companies, many companies, surprisingly, face significant integration challenges, particularly compared with other industries.

A smooth, successful merger is challenging in any industry, but some challenges are intensified in an E&C context, in which serial acquisitions are becoming more common. For example, integrating two companies into one common operating model is itself a significant hurdle. But it is particularly complex in E&C because the frequency of mergers means many companies are attempting to integrate multiple operating models at the same time.

The hurdles created by frequent mergers are exacerbated by their relative size. Recent years have seen more consolidation of large, multinational companies, as compared with the acquisition of smaller, more boutique companies. It has become increasingly common for a company to acquire a company of comparable size and reach. For a $12 billion E&C company, integrating a small, localized operation of 80 to 100 engineers is relatively simple; integrating a $6 billion operation with a staff of 20,000 across three regions is exponentially harder.

M&A has proved to be a sustained growth source for E&C companies. But for true capture of promised value, companies must conduct every integration with rigor, focus, talent, and a comprehensive approach to rapid value capture. Any E&C company aspiring to use M&A as a growth driver must create strong internal capabilities, recognize and deploy best practices, and profit from lessons learned in past integrations to achieve operational success.

Environmental

The environment sector is extremely diverse. It covers hands-on roles in conservation, wildlife and forestry management. There are also scientific roles in air/water quality, ecology and renewable energy. Plus, there are specialist areas in environmental law/policy, engineering and education. You also have environmental consultancy which could encompass everything.

Sustainability is a growth area. Larger employers will now have environmental managers and departments to cover energy efficiency, waste management etc. Corporate Social Responsibility is another area linked to this.

The environmental sector consists of companies and organisations which carry out economic activities aimed at protecting the environment and managing natural resources. Environmental protection activities include for instance the measurement, prevention and correction of environmental damage caused by air, water and soil pollution. Other examples are waste management, waste water treatment, limiting noise nuisance and protection of ecosystems.

Management of natural resources includes production of cleaner technologies, products and services, such as the production of renewable energy, electrical transport, and energy-saving activities such as insulation work. In addition, activities such as water management and recycling of materials are classified under natural resource management.

Analysis of the key themes driving M&A activity reveals that environmental sustainability accounted for 288 power deals announced in Q3 2022, worth a total value of $18.1bn, according to GlobalData’s Deals Database. The $1.7bn acquisition of Hitachi Energy by Hitachi was the industry’s largest disclosed deal.

In value terms, environmental sustainability-related deal activity increased by 3% in Q3 2022 compared with the previous quarter’s total of $17.5bn and rose by 710% as compared to Q3 2021. Related deal volume increased by 22% in Q3 2022 versus the previous quarter and was 1152% higher than in Q3 2021.

As reported by Reuters, Pandemic recovery fuels deal craze as 3rd quarter M&A breaks all records, M&A for the environmental industry also hit record high levels, with buyers deciding it was an opportune time to acquire strategic growth through M&A, and sellers deciding the time was right for an external ownership transition. The result pushed valuations to unprecedented levels, as evidenced in publicly available deal valuations, several which reached 20x multiples on EBITDA.

The investment community’s commitment to incorporate ESG principles into their financial reporting also drove up M&A deal activity and valuations. As reported by EY Global, ESGrelated acquisitions drive sector activity, private equity deal volume of environmental, social and governance related M&A transactions in the first half of 2021 jumped more than 60% from the prior two years and ESG is increasingly becoming an integral part of PE investment decisions.

With the approved $1 trillion U.S. Infrastructure Bill, significant funding for Climate Change and Renewable Energy, and a continued strong economy in North America, M&A interest in the environmental industry shows no signs of letting up.

Locations

This service is primarily available within the following locations:

New York

The economy of the State of New York is reflected in its gross state product in 2022-Q2 of $US2.0 trillion, ranking third in size behind the larger states of California and Texas. If New York State were an independent nation, it would rank as the 10th largest economy in the world. However, in 2019, the multi-state, New York City-centered metropolitan statistical area produced a gross metropolitan product (GMP) of $US2.0 trillion, ranking first nationally by a wide margin and behind the GDP of only nine nations.

The state has a large manufacturing sector, which includes printing and publishing and the production of garments, furs, railroad rolling stock, and bus line vehicles. Some industries are concentrated in upstate locations also, such as ceramics and glass (the southern tier of counties), microchips and nanotechnology (Albany) and the Greater Capital District, and photographic equipment (Rochester). New York’s agricultural outputs comprise dairy products, cattle and other livestock, vegetables, nursery stock, and apples. In April 2021, GlobalFoundries, a company specializing in the semiconductor industry, moved its headquarters from Silicon Valley, California to its most advanced semiconductor-chip manufacturing facility in Saratoga County near a section of the Adirondack Northway, in Malta, New York.