US Market Entry

The Appleton Greene Corporate Training Program (CTP) for US Market Entry is provided by Mr. Worrell Certified Learning Provider (CLP). Program Specifications: Monthly cost USD$2,500.00; Monthly Workshops 6 hours; Monthly Support 4 hours; Program Duration 12 months; Program orders subject to ongoing availability.

Personal Profile

Mr. Worrell is a serial entrepreneur in the fields of personal and mobile computing, biopharmaceutics, clinical research, drug development, and medical device management. In each of these industries, Mr. Worrell was responsible for the overall strategy, business development, and sales and marketing strategies leading to significant growth in revenue and several successful exits.

At the age of 26, when IBM introduced the first personal computer, Mr. Worrell joined a start-up technology company designing, manufacturing, and marketing data storage systems. Entering the company as a sales representative for global markets, he quickly rose to the position of Vice President, International Sales and Marketing. In just 5 years, Mr. Worrell developed a global network of 19 distributors, 6 joint ventures, and a technology transfer agreement to manufacture and sell tape drives in India. Revenues from international markets reached nearly $65MM, 45% of total revenue before the company was acquired by an industry leader.

Leveraging his extensive global contacts, Mr. Worrell then founded an IT distribution company. He worked with clients in Europe, Asia, India, Australia, and the Middle East, giving him a strong understanding of cultural differences and global business practices. This company grew into one of the largest computer systems distribution and integration organizations in the Midwest and was sold in 2011.

Immediately following that success, Mr. Worrell again leveraged his global contacts and founded a Sales/Business Development company helping foreign drug development companies successfully enter the US market. Combined sales of all clients exceeded $600MM over a 12-year period.

More recently, Mr. Worrell acquired a medical device service company serving the US healthcare industry. In 5 years, the company grew from 1 location in Florida to 8 locations nationwide, and revenue grew by 800%.

The combined sales revenues of Mr. Worrell’s companies over his 30-year career approach US$1B

Mr. Worrell understands the unique needs of each client, helping them navigate the nuances of the US market and develop and implement a successful sales, marketing, and distribution strategies. He is an expert in creating and simplifying the right sales message and value propositions and implementing effective communication strategies to a targeted set of prospects in America.

Mr. Worrell also understands the combination of: e-commerce, distribution, sales management, team building, compensation, real estate, human resources, and integrating these elements for success in the US market. He helps clients build relationships with trusted resources in the US.

He is currently a board member of the company he acquired in 2015, and serves as a board member for several non-profit organizations in Colorado. He has 2 adult sons and currently resides in Boulder, Colorado with his wife, Marion. He enjoys hiking, tennis, and gardening.

To request further information about Mr. Worrell through Appleton Greene, please Click Here.

(CLP) Programs

Appleton Greene corporate training programs are all process-driven. They are used as vehicles to implement tangible business processes within clients’ organizations, together with training, support and facilitation during the use of these processes. Corporate training programs are therefore implemented over a sustainable period of time, that is to say, between 1 year (incorporating 12 monthly workshops), and 4 years (incorporating 48 monthly workshops). Your program information guide will specify how long each program takes to complete. Each monthly workshop takes 6 hours to implement and can be undertaken either on the client’s premises, an Appleton Greene serviced office, or online via the internet. This enables clients to implement each part of their business process, before moving onto the next stage of the program and enables employees to plan their study time around their current work commitments. The result is far greater program benefit, over a more sustainable period of time and a significantly improved return on investment.

Appleton Greene uses standard and bespoke corporate training programs as vessels to transfer business process improvement knowledge into the heart of our clients’ organizations. Each individual program focuses upon the implementation of a specific business process, which enables clients to easily quantify their return on investment. There are hundreds of established Appleton Greene corporate training products now available to clients within customer services, e-business, finance, globalization, human resources, information technology, legal, management, marketing and production. It does not matter whether a client’s employees are located within one office, or an unlimited number of international offices, we can still bring them together to learn and implement specific business processes collectively. Our approach to global localization enables us to provide clients with a truly international service with that all important personal touch. Appleton Greene corporate training programs can be provided virtually or locally and they are all unique in that they individually focus upon a specific business function. All (CLP) programs are implemented over a sustainable period of time, usually between 1-4 years, incorporating 12-48 monthly workshops and professional support is consistently provided during this time by qualified learning providers and where appropriate, by Accredited Consultants.

Executive summary

US Market Entry

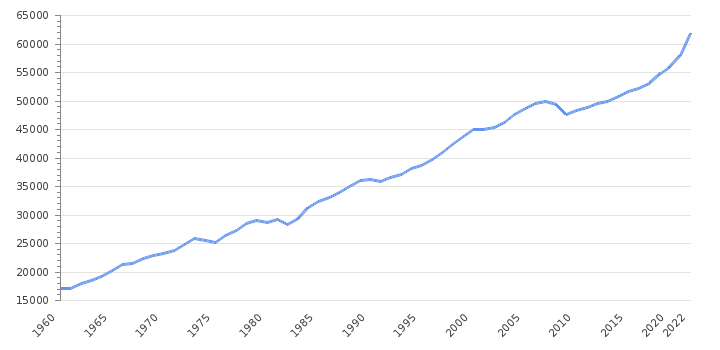

With a GDP of nearly $25 trillion, the US represents the largest single market in the world. California alone has a GDP larger than most countries. If California was a country, its $3.5 trillion GDP would make it the 7th largest market in the world.

GDP of the United States, $25,000,000,000

Many fortunes are won and lost in this large, dynamic, and somewhat mysterious market. A few examples help make this point:

A German manufacturer of high-end woodworking equipment was losing significant money every month despite investing heavily in the US with a distribution facility and national sales staff. The root of the problem? Their product was simply too good for the US market. Their sales and marketing message focused on product quality and German engineering. They were proud of the fact that their $200,000 machines had a life expectancy of 20+ years. American buyers, however, have a different mentality. With the speed of technological change and its impact on worker productivity, American manufacturers want to buy new machines at a significantly lower price every 5-6 years.

On the other hand, a Clinical Research Organization (CRO) in Switzerland positioned their company as the fastest route to completion of Phase One studies. They invested in exhibiting at US trade shows, hired a B2B sales company, and customized their marketing materials and approach to the market. Their CEO also made sales trips to the US each year, meeting with large multinational drug companies like Pfizer, GSK, and small and medium-sized biotech. They generated millions of dollars in US revenue. Their company was later acquired by a UK company for $29MM.

Perhaps one of the most well-known retailers in the world, UK-based TESCO, failed with their initial entry into the US market. A short summary of their experience can be found here as a case study by Harvard Business Review.

History

Being successful in the US market

Success in the US market can be a reality for any company from any country that is willing to invest the time, money, and executive resources to make it happen. But there are certainly right and wrong ways to go about it.

The right way speeds up market penetration, sales revenue, and profits. The wrong way takes much longer, costs more money, and generates little if any, net profit. It is also fraught with mistakes and missteps that can drain a company’s budget and enthusiasm for the program.

Success in America helps guide ex-US companies down the right path. We begin with the proper evaluation of your executive team and your current global sales & distribution program. We explore what product and service sales, marketing, and distribution strategy, then adding the legal, human resources, and support activities, any company can win in this market.

History (the travel, analog and paper economy)

Obviously, the growth of the digital economy changed the game completely. Looking back, being successful in the US market required much more time, money, and executive resources than it does now.

Determining the competitive landscape in the US market for your products or services required multiple trips to the US, where executives would attend trade shows and collect data about competitors, products, services, and pricing. Visiting potential customers was a common way to gather information about customers’ requirements and how these requirements were being met. This would consume weeks of time and multiple thousands of dollars in travel, hotels, car rental, and entertainment expenses.

Industry magazines were another source of gathering market intelligence. Articles were often written by industry professionals describing product attributes and applications. One successful method used by overseas companies interested in the US market was to contact the editors of these magazines, describing your product or service and asking for their advice on the best approach to the US market. Sometimes they would share their contacts with you; sometimes, they would not. In any case, an executive first had to acquire the magazine from the US, take the time to find and read the right articles, and then decide what actions to take.

Industry associations, which still exist today, were another great resource for industry information. To gain access to their members (distributors, retailers, jobbers, and customers) often meant spending several thousand dollars to become a member of the association. You then had the task of contacting those companies via phone or whatever technology existed at the time.

Depending on how far back you want to look, communication was often the determining factor in how fast you could get the required information to make informed decisions. Let’s not go as far as the global mail system, which was the only option for receiving paper brochures or industry reports.

Although the telephone has been universally in place since the 1950s, the cost was incredibly high, and the connections were often poor. However, this was the best way to verbally communicate one’s requests, whether to make an appointment or request information via mail. From a sales perspective, this was the primary tool used to make appointments or introduce yourself to a prospect. This was then followed up by an in-person appointment which was usually welcomed by the prospect due to the product knowledge of the sales rep.

From a global communication perspective, some will remember the Telex machine (circa 1980) which required the user to type his/her message in a QWERTY keyboard resulting in a long-punched tape that was then fed into the Telex machine, and a hard copy was printed on the other end. Certainly, easier, and faster than the mail, but both parties had to have a telex machine which was not always the case. And although you could communicate via telex, sending product brochures, purchase orders, or nicely written proposals via telex was impossible.

The fax machine, often associated with the industry term G1, dramatically improved communications with customers and suppliers. One still had to use a typewriter (or if you were lucky to have a primitive word processor), creating a paper document which was then fed into the fax machine and transmitted to your customer or supplier. Printed documents such as product brochures, price lists, and purchase orders could then be fed into the fax machine and transmitted. This was a real benefit from a sales communication perspective as brochures (with pictures!) and proposals could be sent directly to the customer’s fax machine.

It wasn’t until the global adoption of e-mail around 1997 that communication started to improve globally. Not everyone had an email address, of course, so for a few years this was a “hit and miss”. It was common to ask, “do you have an email address?” which today would be unheard of. Now the sales and marketing process is as easy as including an attachment to an email, sending a video message, or promoting a product on LinkedIn, Facebook, or Amazon.

Finally, the internet erupted in the 1990s, and companies began developing what they called a “Home Page”, which, of course, grew into a website. When Google made its debut in 1997, it was possible to search for customers, suppliers, distributors, or salespeople. From a sales perspective, this was a game changer. Until this point, the salesperson was the primary source of information about a product or service. Hence, they were often welcomed by purchasing agents and prospects.

Once “search” became common, information about products or services was much easier, and buyers could educate themselves without needing a sales rep to visit them. Once the sales rep was successful in getting an appointment, the buyer was already knowledgeable about the company’s products and competition. The salesperson’s job shifted from providing information to providing value compared to the competition.

Fortunately, things have changed for the better.

Current Position (the digital economy)

Everyone reading this is very familiar with current business practices of email, websites, search engines, and the various platforms that go along with them. Researching potential customers, suppliers, and distributors or hiring a US sales team is as close as your keyboard no matter what country you are in.

And globalism is in full swing. Various platforms like Amazon, Etsy, or e-Bay have made it very easy for ex-US companies to sell their products in the US market. One simply needs a reasonably good feeling for design and a decent command of the English language to reach a large part of the US market. Of course, these e-commerce platforms also provide the same promotional language in Spanish, German, French and a host of other languages to reach these specific niche markets in the US.

Although having a distributor of your products in the US is often required to provide fast fulfillment to your US customers, FedEx and UPS provide ex-US companies with fast international shipments to anywhere in the US.

If you are familiar with Moore’s law, you know that the power of integrated circuits (ICs) is doubling about every two years. This dramatic improvement in the speed and reduced size of ICs has led to technological advances that were not even thought of just 5-10 years ago. Your mobile phone has more technology and power than was on the Apollo mission when it landed on the moon in 1969. These technological changes have dramatically impacted how goods and services are marketed and sold in the US and around the world. Now communication with customers, suppliers, and sales reps is taken for granted. Identifying potential distributors or customers is a matter of selecting from the multitude of “results” from a Google search. And the options to sell your products in the US market are numerous.

This ultra-convenience, however easy, brings with it a set of new problems. Now there are too many options to choose from, and the information overload demands careful analysis to make the correct business decisions. Ex-US companies can select from a wide variety of US companies to approach to help them with their US sales and distribution. Most of these companies, whether it is distributors, sales companies, or retailers, have a specific niche in the market. Each of these market niches can be worth millions of dollars, of course, so partnering with the right one is especially important and often difficult. These niche companies are very particular about the products/services they accept to continue being attractive to their chosen customers.

This “options overload” extends beyond the research and outreach to help a company enter, market, and sell in the US market. Savvy US companies are using these new technologies to compete in the market more effectively. Geo-targeting, GPS tracking, re-marketing, and cookie-tracking via e-commerce are a few of the basic technologies used by companies to gain market share. Now add Artificial Intelligence (AI), quantum computing (QM), virtual and augmented reality (AR / VR), and machine learning, and you can see how difficult it is to compete in today’s digital economy.

Future Outlook: The “merging technologies” and data economy

Where is all this going? Great question! One thing we know for sure is that things are not slowing down.

We know e-commerce is a vital part of any company’s sales and marketing efforts in the US market. Selecting the right platform and managing it correctly are basic to a successful product or service. The amazing data analytics available to marketers makes this an even more important segment of your business.

We know that providing sales and marketing information and access via a mobile device is critical to a current and future marketing strategy. US consumers, like consumers everywhere, are married to mobile phones and expect their chosen vendors, suppliers, and sales reps to offer information, access, and updates via their mobile devices. US customers, whether it’s B2B or B2C, expect to be able to review products or services, place orders, and be kept up to date on the status of their order via their mobile devices – their phones, tablets, and now their smart-watch.

Marketing and advertising options are exploding across the digital landscape and will only become more and more prevalent. Advertising on a mobile device or on a “smart speaker” such as Amazon’s Alexa or Apple’s Siri, brings your message right into a consumer’s home and as close as their voice.

When these devices are combined with detailed consumer analytics (names, birthdates, addresses, hobbies, friends, interests, etc.), marketers can now target their message to groups of specific consumers. Now, combine these data analytics and smart devices with artificial intelligence and automation, and the business world becomes more competitive and faster and offers smart marketers multiple options to compete in the world’s largest markets.

Certainly, the growing number of wearable devices will be a major part of future sales and marketing. Many products and services, especially in the healthcare industry, are making wearables an integral part of their products and services. From diabetes to fall detection, from heart rate monitoring via a smartwatch to activity tracking (Fitbit, Garmin, and Apple, for example), wearables will be an important part of the company’s offerings.

Sensor technology has come a long way and is now embedded in many products and services sold in the US market. As described above, sensors are a major part of the wearable market but are also embedded in industrial machines to detect upcoming failures. Sensors are now incorporated into all new automobiles, motorcycles, and traffic-monitoring devices. Sensors track vibration, temperature, humidity, weather patterns, sound, bacteria, and other variables. Indeed, these will become more and more common in all products sold in the US and worldwide.

Another important area is the growing popularity of 3D printing. What used to take weeks or months can now be accomplished in a matter of hours. Smart companies must understand their products can now be designed, developed, and prototyped “onsite”. The impact on industrial design and manufacturing will be amazing, and companies will need to modify their product offering to accommodate these new customer expectations.

Augmented Reality (AR) and Virtual Reality (VR) are nascent technologies that will explode in the coming years. The Metaverse, the much-discussed future of the internet, will be a reality and will grow to include every aspect of consumer purchasing behavior.

Consumers will have “digital twins” online who will visit virtual stores, — try on clothing, sit in new cars, and walk around digital showrooms. This will be an integral part of e-commerce. Companies will have a metaverse site and a website, allowing customers to select how they want to engage with a company via their mobile device, laptop, or AR/VR headset.

And when this new technology is combined with industrial equipment, from healthcare to manufacturing, architecture, building and construction, maintenance, and design, the limits are too far out to see.

It will be an amazing future, and successful companies will need to embrace it if they want to compete successfully in the global market.

Curriculum

US Market Entry – Part 1 – Year 1

- Part 1 Month 1 Understanding America

- Part 1 Month 2 Internal Review

- Part 1 Month 3 External Review

- Part 1 Month 4 US Marketing 1

- Part 1 Month 5 US Marketing 2

- Part 1 Month 6 US Sales Strategy

- Part 1 Month 7 US Sales Preparation

- Part 1 Month 8 Market Entry

- Part 1 Month 9 Monitor & Pivot

- Part 1 Month 10 Market Expansion

- Part 1 Month 11 Problem Resolution

- Part 1 Month 12 Continuous Growth

Program Objectives

The following list represents the Key Program Objectives (KPO) for the Appleton Greene US Market Entry corporate training program.

US Market Entry – Part 1 – Year 1

Part 1, Month 1: Understanding America

To be successful in any market requires a solid, foundational understanding of the “3’C’s”: the country, the culture, and the consumer. To be successful in the world’s largest market requires an in-depth knowledge of all aspects of American business culture, business models, distribution networks, regional markets, and consumer behavior.

We begin with an overview of the geography and related “micro-markets”, which many newcomers to the market have largely misunderstood. For example, if the state of California were a country, it would be the 7th largest economy in the world.

Each area of the US has its own culture, differences, and business practices. We will examine how successful companies sell products in the US market, using salaried or “commission-only” sales representatives (unique to America).

As many foreign companies rely on distributors to help them gain market share, they are severely disappointed with low sales after years of investment. That is because distributors in the US have different business models than distributors in other countries. We will examine how US distributors work (and don’t work) to sell your products.

Many companies entering the US market fail to fully understand the legal requirements of doing business in the US. This often leads to significant costs, slower growth, and excessive management time dealing with these issues. This module will also help you understand the legal requirements to do business in America to keep you out of trouble with the US authorities. We teach you how the government works on a city, county, state, and federal level, and what you must do to be compliant as you hire staff, rent real estate, or sell products in each market.

We will also examine in-depth how US buyers “think and act” when making purchasing decisions. It’s likely much different than in other markets. You will learn the importance of providing value to US customers and the necessity to build trusting relationships. You’ll understand how American consumers generally perceive cold-calling techniques and sales techniques.

At the conclusion of this course, the client will have a deep understanding of how to approach the market with the smallest investment and the greatest outcome. This foundational knowledge will play a pivotal role in the decisions the client makes in the next workshops.

Video 1: Tax Attorney

Video 2: HR professional

Video 3: Real estate professional

Part 1, Month 2: Internal Review

The objective of this module is to help clients take a “deep dive” into their own business to understand if they are prepared to enter, compete, and succeed in the world’s largest market.

We help clients focus on the most important elements of their business:

– Corporate Objectives

• Products: What products will be sold and what are the objectives

• Markets: Same markets as other countries or different?

• Channels: Distribution? Direct Sales? Indirect sales?

– Financial Objectives

• Sales

• Profit

• GM

• Net margins

– Executive Resources

– Product Strategy

– Market strategy

All too often we have seen companies enter the US market with the goal of “$10MM in sales” without a good business plan behind it. This module is not about making the plan (we’ll cover that later), it’s about understanding the capabilities of your company, the products and services most likely to succeed in the US market, the financial resources needed to “stay the course” and the executive resources needed to drive, monitor, and manage the business.

Business models and practices vary by country and the US market is no exception. What products or services have successfully sold in other European or Asian markets is no guarantee they will be accepted in the US market. Even worse, it may backfire, costing you hundreds of thousands of dollars in expenses and wasting months or years of market entry. It is therefore imperative that you understand how you will enter the market and how your company will support that effort, both financially and internal resources

One major objective is understanding your ideal US customers by looking at your current customers. We will explain various models used to profile your customers based on various attributes of the company. Then compare these to the business structures in the US markets to begin formulating your ideal customer profile.

Current product/service offerings and their overall contribution to your company. Our templates help guide you through your most profitable products and those that have the shortest sales cycle. We help you examine the types of customers that are buying your products and services and the most effective sales channels. Remember that even a small market in America can generate millions of dollars in sales revenues and profits, so it is necessary to define your market niche very carefully and be sure your products & services provide value to that niche.

We then present templates to help you analyze the prices, margins, and distribution costs of each product or service to understand if it can be competitive in the US market.

Of course, finances will ultimately drive the business and be a major factor in the success or failure of your enterprise. Our budget templates help you identify and quantify all the possible expenses you will face as you market, sell, distribute, and support your products in the US.

Part 1: Month 3. External Review

The objective of this module is to understand how your products or services will compete in the US market — the specific markets you will address and how you will address them.

Market Review is all about research… collecting information and data about your chosen market, competitors and their strengths and weaknesses, sales channels, distributors, trade associations, and more. Too many companies fail to take this important step and never fully understand why their sales are not meeting their stated objectives.

This module has much to do with knowing and understanding your competition in your selected markets. You must know how you will approach the market and, more specifically, what sub-markets you can address, allowing you to have less competition and develop your own “niche.” Other modules will discuss your strategies and tactics to convince prospects that your products or services are superior to the competition.

All this data will be used in future modules to help you develop your sales and marketing strategy, budgets, and execution plans.

Part 1: Month 4: US Marketing 1

Nothing is as important to competing in the US as an effective marketing program. Your marketing program impacts your products, sales channels, sales reps, distributors, retailers, packaging, and even your logistics program.

Competing in the US market requires strategic thinking about how you will approach each of your selected markets and more specifically, how you will position and promote each product and service you want to sell in the US. This module will walk you through this process.

Too many companies enter the US market without a comprehensive marketing plan, whether that plan involves how to support a distributor with “pull-through” strategies or supporting a sales team with the tools they need to approach prospects, provide meaningful information, and close deals.

This module helps the client understand the many options available to him/her to help them develop the marketing tools that the sales team or distributor will require to successfully sell into the US market. Many trusted referrals are provided.

This module uses much of the information gathered in previous modules but will take the next step to put that data to use in specific marketing messaging and tools that resonate with your target market. This includes the critical components of the brand promise, value propositions, case studies, product positioning, effective differentiation, and concise pricing strategies. We will help the client organize the many options into effective strategies in the market.

Templates are also provided to help the client build marketing budgets so they clearly understand the financial impact of their decisions.

Part 1, Month 5: US Marketing 2

This module aims to build on the previous modules to develop the marketing plan into a 30-60-90-120+ day plan, with a long-term view of succeeding in the US market.

Rather than “make it up as you go”, it is important to identify and engage with the right marketing partners and resources to help you implement. The process involves combining the data from previous modules regarding your target markets and competition with the value propositions and brand promises developed in month 4.

We will use these when making decisions about media spends and placements, trade show reservations, search engine optimization and digital marketing strategies, and the specific tools to develop for the sales team.

If you choose to use distributors or sales reps o sell your products or services, we will build the marketing plan around product launches, pilot programs, e-mail campaigns, training programs, webinars, and lead-generation programs.

At the conclusion of this module, the client will have a fully developed, time-based go-to-market plan complete with selected vendors, messaging strategies, and budgets.

All this together provides the confidence and roadmap to ensure success in the US market. We will put this aside for the time being, then combine it with the sales strategies we develop in the next modules. The result will be the “operational program” to make it all happen.

Part 1, Month 6: US Sales Strategy

As the saying goes: “Nothing happens until a sale is made.” You may have the best products, the best service, a fantastic (and expensive) marketing plan, and ambitious goals. But until a sale is made, there is no revenue and no profits.

Clients may find the expense of a salesperson or a sales team is the most expensive part of US market entry. This module will help the client decide which sales strategy is best for their product or service and how to make the most sales in the shortest amount of time.

Many ex-US companies entering the US market will select a distributor to represent and (hopefully) sell their products or services. The common thinking is “problem solved.” Unfortunately, when engaging with a US distributor, the client’s problems are just beginning. The role distributors play in the US market is quite different from distributors in other world markets. This module will help the client understand these differences and plan accordingly.

Decisions regarding sales strategy can be based on geographic market, product line, product category, budget, or all the above. The process of making these decisions requires research, interviews, and of course, budget. This module will walk the client through all the options available to them and provide the advantages and disadvantages of each option.

Of course, hiring a sales team or even independent reps has a list of legal, ethical, and monetary considerations. This lesson discusses compensation strategies, hiring and firing regulations, and how to handle payroll, commissions, company vehicles, and taxes. All of these are addressed and made clear in this overview.

We also develop plans to manage the American sales team, including ideas on the type of reports and communication strategies to effectively manage a US sales rep or distributor.

At the end of this lesson, clients will have developed a custom-fit go-to-market sales strategy for their product or service and understand the many challenges and solutions needed to help the US sales team generate the highest sales in the shortest time.

Part 1, Month 7: US Sales Preparation

Once the strategic decision has been made regarding the sales program, clients must then prepare the salesperson, sales team, or distributor to begin the sales campaign. That is the objective of this lesson.

Various sales tools are required at different stages of the sales cycle, and the sales team or the distributor must have access to them and be trained on how and when to use them. This lesson reviews all the options available to the client, provides templates and scripts, and advice on customizing them for each client.

The lesson presents a list of powerful tools US sales personnel use to contact and engage with potential customers. Detailed templates are provided to help the client quickly and easily develop powerful introductory letters, follow-up letters, closing letters, brochures, and videos. The lesson includes examples of sales scripts written in effective business English to motivate even the most sensitive prospect.

Sales training is also a critically important element that is often not given enough attention. Sales representatives or distributors must have the sufficient product knowledge to effectively compete in the market by explaining the product or service’s value proposition, differentiation, and benefits. If they do not have this information, they must know how and where to get it – quickly and easily.

This lesson also presents options and instructions regarding the use of CRM (Customer Relationship Management) software and how to customize it for maximum efficiency. A strong CRM program can be used to manage the sales team and generate meaningful reports for management even 5000 miles away.

By the end of this lesson, clients will have all the tools needed to ensure success in the US market, each one easily customized to fit their products and/or services.

Part 1, Month 8: Market Entry

With a solid understanding of the country, the culture, the competition in each market(s), and well-developed sales and marketing programs, it’s time to make it all work together.

This lesson aims to help clients weave it all together and begin implementation. This type of detailed planning and control gives management the confidence that their entry into the US market will be a success.

The process involved in market entry is one of timing. Of course, the products and services must be ready for distribution and sale in the US market. All the legal requirements must be satisfied. Sales teams or distributors must be hired, trained, and managed and clearly understand and accept the objectives set by management.

This module provides examples of the road map others have used to successfully enter the US market. Templates are provided to help management identify potential pitfalls or problems. Calendars are aligned, and reporting structures are clearly identified and operational.

Customer Service resources must be activated in the US market, corporate headquarters, or outsourced.

Sales order and purchase order processes are in place and operational.

Once the sales team or distributors begin making their first calls, the team must be ready. This module gets them there.

Part 1, Month 9: Monitor & Pivot

Good businessmen and women in any country understand that markets are dynamic. Consumer tastes change. Trends come and trends go. Learning how to adapt your business strategy and approach is fundamental to success in any market.

The objective of this lesson is to give the client the tools and reports needed to monitor market activity in real-time and make the necessary adjustments to minimize expenses and maximize revenue and profits.

Examples of Key Performance Indicators (KPIs) are included in this module as well as reports showing the effectiveness of the sales and marketing programs.

Although each company and each industry are unique, the ability to pivot quickly based on market dynamics is critical to a company’s success. This module shows you how.

Part 1, Month 10: Market Expansion

Many companies enter the US market with a limited number of products or services, perhaps a limited budget, and likely addressing one market or one geographic area.

A successful launch of this product, satisfied customers who re-order time and time again, and a clear operation program will give management the confidence to expand.

This module aims to give management ideas and options on the most common expansion strategies used in the US market. This may involve expanding into new geographies, adding more product lines, or adding a sales team or distributors. More products may need to be warehoused in different parts of the country to address these new markets or improve delivery times to customers. Sales offices may need to be opened. Real estate may need to be purchased or leased. Many options are available to the innovative company that has tasted success and wants to expand and conquer the US market.

This module helps management understand their options and helps develop a profitable roadmap to greater success in the US markets.

Part 1, Month 11: Problem Resolution

Every businessperson knows that good business brings lots of problems. Effectively managing these problems on a day-to-day basis, or handling larger problems as they occur, is the key to ongoing success.

The objective of this lesson is to prepare management for some of the most common problems that may occur and provide a framework and resources for fast, efficient, and low-cost resolution of these problems.

Here we present in detail the most common problems related to employee complaints, compensation, taxation, regulations regarding employee benefits, insurance, real estate contracts, and so forth.

Interviews with American businessmen and women are shown, each detailing how they handled certain situations.

Referrals to assistance dealing with Human Resources, tax advice, and real estate assistance are provided to give the client fast access to trusted American resources.

Part 1, Month 12: Continuous Growth

Once again, success has its own way of demanding innovative solutions and activities to manage the many opportunities presented by continued success in the US market.

In this module, we present business at a higher level than was previously discussed. Cash management, banking relationships, owning and developing real estate, employee visas, and long-term residency in the US are explored, discussed, and understood.

Case studies are presented and discussed to help management see how other foreign companies have managed successfully in the US market.

Alternate marketing and product development strategies are presented and discussed. These may include merger & acquisition strategies, private label deals, corporate partnerships, co-branding opportunities, distribution strategies, and more.

Clients who reach this milestone have excelled in the US market. This module helps prepare them for possible success, and the many opportunities and resources available to help them take their business to the next level.

Methodology

US Market Entry

The methodology used to in Success America is designed to educate, inform, and provide a structured program that can be followed and implemented by any company dedicated to the task.

The program is essentially broken down into distinct phases:

Phase 1: Months 1 – 3: Total Understanding.

In this phase, clients are guided through a process of understanding the 3-C’s of the United States market: Country – Culture – Consumers. The most important element of this phase is to help the client feel “immersed” in the US market… to “think like an American” and to understand the various components that will ensure success in the US market.

To aid in this understanding, we guide the client through a series of charts, maps, and videos, each selected to present an important element of the US market. Rather than simply relying on the expertise and experience of Mr. Worrell, the client is presented with testimonials and informational videos from US distribution managers, Regional Sales Managers, Human Resource directors, lawyers, and real estate executives. Each of these individuals presents an overview of their respective areas of expertise. Several of them invite the client to contact them via email with questions, further aiding the broad experience of the program.

One fundamental “mindset” of this phase is to give the client the confidence that he/she will need as they approach the US market. As they say, “Knowledge is Power”, and this “Total Understanding” phase provides the client with as much knowledge of the US market and consumers as possible.

After the client understands their own capabilities and the products or services they will sell in America, we present interviews with actual VPs of Procurement / Purchasing from various healthcare companies. These are titled “How I Buy” and help the client better understand the purchasing criteria, the decision-making process, and the mindset of the buyers.

Phase 2: Months 4 – 7: Detailed Preparation

Once the client has a complete understanding of the US culture, their internal capabilities and product/service selection, and the challenges and opportunities of the market, they are ready to develop detailed sales and marketing plans to guide their journey. Phase 2 provides this guide.

In this phase, the client is presented with detailed templates to help them develop a strategic marketing plan, a sales plan, logistics and distribution plans, and a customer service/product support plan.

This effort is delivered with the participation of Mr. Worrell as he works one-on-one with key executives in the client’s company, helping them formulate a strategy and gather a solid understanding of the risks and rewards of a well-developed sales and marketing plan.

Phase 2 also helps the client develop a financial plan to ensure the company truly understands the financial implications of entering the US market. Budget templates are presented and discussed in both a group setting and one-on-one with the CEO or CFO of the client company. Plenty of time is allocated to questions and answers, and US resources are presented to the client for their possible collaboration.

This phase helps the Sales / Business Development effort understand the best way to approach US prospects. One-on-one and group sessions are held with the sales team to ensure they understand the sales process and the “do’s and don’ts” when working with US buyers. Proven sales scripts are provided for the sales team to use. This includes cold-calling scripts, e-mail introductory scripts, follow-up scripts, presentation outlines, and more. The objective is to give the sales team all the tools needed to shorten the sales cycle and win as much business as possible.

We will also discuss how to work with distributors that service specific market areas. Conference calls with US Distribution Product Managers can be scheduled to enforce the learning process. Detailed product introduction plans will be developed along with a timeline for implementation.

We provide examples of how to properly exhibit at US trade shows, and not make the “10 Big Mistakes” many first-time companies make when coming to the US trade shows for the first time. Resources for graphic design, trade show booths, signs, logistics, etc will be shared with the client to ensure a successful trade show.

Phase 3: Months 8 – 9: Market Entry, Review, and Growth

This phase focuses on execution and follow-up to ensure the client is doing the right things at the right time with the right people.

The emphasis of this phase is timely market feedback and fast responses to sales and marketing data.

The client is “hand-held” during this phase and discussions are held with the company’s key stakeholders, including the Finance staff, Sales staff, and Executive staff. We will review the metrics and KPIs established during Phase 2 and make decisions on the best way to proceed.

A successful market entry takes time, and many ex-US companies have unrealistic expectations regarding the time required to win sales and contracts in the US market. We will examine the data and engage with the sales team and the US distributors (if utilized) to better understand what is happening, why it is happening, and the best next steps to take.

Often this involves a slight “pivot” to the initial strategy. Products/services offered may be enlarged or decreased depending on market feedback. Sales scripts and presentations may need to be modified to be more effective. Marketing strategies or the marketing “message” may need to be changed depending on competition and changes in the marketplace.

Joint conference calls with key stakeholders, even current customers and distributors can be held with Mr. Worrell as the moderator to make sure nothing is lost in translation, and everyone is on the same strategic page.

Different strategies are needed at different stages of market entry, and we will have group and one-on-one sessions devoted to growth strategies based on the data presented. Some markets will be easily penetrated, while others present various challenges. These markets will be reviewed, and strategic decisions will be made based on a variety of data points.

Long-term success in the US market requires long-term thinking. Success will not happen overnight, or even in the first year or two. But lessons will be learned, and products and services will be modified. Packaging and distribution will be reviewed and optimized, and sales will grow.

Industries

This service is primarily available to the following industry sectors:

Healthcare, Pharmaceutical & Biotechnology

History

To face the challenges ahead, it is important to understand the past.

The sense of health has evolved depending on the historical moment, cultures, social systems, and level of knowledge at the time.

In the first years of history, primitive thinking (magical-religious) was maintained for a long period, based on the belief that illness was some kind of divine punishment. Unfortunately, this attitude is still maintained in some peoples of Africa, Asia, Australia, and America.

The Egyptian and Mesopotamian civilizations initiated the first conceptual change, going from the magical/religious sense to personal and public hygiene development.

In ancient Hebrew civilization, the Mosaic Law contains one of the first sanitary codes of humanity: it prescribes strict regulations on personal hygiene, nutrition, sexual behavior, and prophylaxis of communicable diseases, some of them still in force.

The word hygiene, as well as the current Hippocratic oath, finds its origin in Greek culture, inspired by mythology, Higea, “goddess of health,” and Hippocrates “father of medicine”.

The Roman people applied their knowledge of urban planning to public health, building large aqueducts for the provision of water as well as for the removal of waste substances, a great work was the “Sewer Maximum”, a work admired today.

In the Middle Ages, when monastic schools appeared, Hippocratic medicine was taught. A volume was produced containing numerous pieces of advice on personal hygiene. This hygienic sense of health has been maintained until a few decades ago.

The splendor of the Renaissance also has its manifestation in health promotion, introducing innovative ideas that motivated great advances in health.

The most important conceptual change took place in 1946 when the World Health Organization in its Magna Carta, defined health as a “Complete state of physical, mental and social well-being.”

Experience from the past is a vital tool in the formulation of health policy. Understanding the evolution and context of those challenges and innovative ideas can help us navigate the public health world of today and the future.

Current Position

The healthcare industry and its related drug development fields are changing rapidly. Successful companies must recognize and adapt to these changes to succeed in a competitive market.

From the recent decoding of the human genome to nuclear medicine used to treat various diseases, technology is driving healthcare, medicines, and therapies, to new heights. The recent COVID pandemic brought about advances in vaccines and new technologies to develop drugs faster and with greater efficacy. Remote surgery, sometimes using Augmented Reality (AR) is one example of the incredible advances in recent years.

These advances also drove clinical research and its related industries into new areas. Remote communications, telehealth, and faster data processing brought about by the Internet of Things (IoT) and 5G technology created massive opportunities for astute companies.

The healthcare industry now recognizes six different types of health: Physical health, Mental health, Emotional health, Social Health, Environmental Health, and Spiritual Health.

Each of these areas has generated entire multi-billion-dollar industries. The educational infrastructure to support these industries ensures capable professionals will drive multi-billion-dollar growth and bring opportunity and challenge to today’s healthcare companies. The needed support systems, from staffing to technology, real estate, manufacturing, support, legal, and regulatory, are driving incredible growth for astute and assertive companies.

1. Physical Health

Physical health refers to the state of your physical body and how well it is operating. It is influenced by levels of physical activity, adequate nutrition, rest, environments, etc.

Physical health consists of many components, but a brief list of the key areas are given below:

– Physical activity – includes strength, flexibility, and endurance.

– Nutrition and diet – include nutrient intake, fluid intake, and healthy digestion.

– Alcohol and drugs – include the abstinence from or reduced consumption of these substances.

– Medical self-care – includes addressing minor ailments or injuries and seeking emergency care as necessary.

Rest and sleep – include periodic rest, relaxation, and high-quality sleep.

2. Mental Health

Mental health is a level of psychological well-being or an absence of mental illness. It is the psychological state of someone who is functioning at a satisfactory level of emotional and behavioral adjustment.

Good mental health doesn’t just mean if you don’t have a mental illness. It’s about having a sense of purpose, getting involved with things, coping with stress and setbacks, forming close relationships, and being in touch with your own thoughts and emotions. To maintain mental health, we have to be confident and accept ourselves.

3. Emotional Health

Emotional health refers to a person’s feelings which encompasses everything about the individual. It governs decisions, mood, and personality.

4. Social Health

Social health is how an individual gets along with others, which involves forming satisfying interpersonal relationships with others. It also relates to the ability to adapt comfortably to different social situations and act appropriately in a variety of settings.

5. Environmental Health

Environmental Health is the field of science that studies how the environment influences human health and disease. “Environment,” in this context, means things in the natural environment like air, water, and soil, and all our surroundings’ physical, chemical, biological, and social features.

According to the National Institute of Environmental Health Science, The social environment encompasses lifestyle factors like diet and exercise, socioeconomic status, and other societal influences that may affect health.

6. Spiritual Health

Spiritual health refers to possessing meaning and purpose in life; having a clear set of beliefs and living in accordance with morals, values, and ethics. Essentially, it means understanding and clearly defining right and wrong and living according to this understanding.

Industry Notations:

Encompassing all the healthcare segmentations is the insurance industry’s impact, the aging of the “Baby Boomers” and the consolidation of the healthcare industry in general.

Healthcare insurance in the United States was mandated by “Obamacare” and the Affordable Care Act, which provided health insurance to a much larger percentage of Americans and penalized companies for failing to provide insurance for their employees.

Additionally, as the post-WW2 “Baby Boomers” generation ages, the US healthcare industry in experiencing a surge in mergers and acquisitions. Healthcare providers like Kaiser-Permanente and United Healthcare are vertically integrating from “cradle to grave” as they acquire home care, clinics, hospice, long-term care, and skilled nursing facilities.

Future Outlook

The future of the healthcare industry is tied closely to the future of technology and the aging of the American population.

IMAGE 9: PROJECTED AGING OF AMERICA GRAPH NEEDS TO BE LARGER AND CLEARER

New therapies and business models are emerging as the industry deals with COVID-19. Vaccine discovery was fast-tracked. Patients were pushed out of the hospital to their homes. Healthcare workers were quitting by the thousands as they were forced to work endless hours in risky environments.

Many of these market dynamics pushed the adoption of “wearables” in the market, incorporating sensors to identify insulin levels in the blood, heart rate, fall detection, and more, and allowing healthcare professional to monitor their patients from afar. The medical device companies manufacturing the wearables, and the technology, labor, and distribution companies supporting them, are all multi-million-dollar opportunities.

All these Internet-connected devices are bringing new opportunities for companies to develop products and technologies to capture, transmit, and report disease states and patient care.

Artificial Intelligence will also play a major role in healthcare as it “learns” from the terabytes of data given to it by multiple medical devices, sensors, and Internet-connected devices. AI will, of course, also play a major role in drug development as increased computer power allows scientists to process data in ways not previously possible.

We must not overlook the coming “digital therapies” being driven by a combination of Virtual Reality (VR) and Augmented Reality (AR), or the combined industry known as “XR”. These devices are now being used to treat depression, anxiety, COPD, pain management, and generally educate patients and caregivers on how to live with and treat various diseases.

All of these new products and processes must be approved by the FDA, creating opportunities for consulting companies, clinical research organizations, patient-recruitment companies, and data processing companies, and the like.

With more seniors preferring to stay at home, CMS (Center for Medicare and Medicaid Services) has instituted “Hospital@Home”, giving healthcare providers access to government Medicare and Medicaid remuneration usually exclusive to care provided in a hospital setting. This alone is driving a significant shift to provide healthcare services via remote links such as computers, tablets, and smartphones.

‘HOSPITAL AT HOME’ IMAGE NEEDS TO BE CLEARER

New companies are emerging to take advantage of this tectonic shift in home-based care.

Home care is one of the fastest-growing segments of the healthcare industry. Companies now provide both skilled nursing resources for acutely ill patients, to “caregivers” who visit the elderly in their homes, aiding with medications, dressing, food preparation, light housekeeping, and general companionship.

Homecare companies like Lincare and AdaptHealth are becoming a major force in Homecare as they acquire hundreds of smaller health providers, especially in the areas of respiratory, diabetes, home infusion, and wound care. These companies are also investing heavily in sensor-based technology, allowing them to monitor their patients’ health and report that data to physicians and family members/caregivers.

All these factors, and much more too numerous to discuss, will drive improvements in healthcare, prolong patients’ lives, improve their quality of life, and create massive opportunities for companies to succeed and thrive in today’s market.

Locations

This service is primarily available within the following locations:

London, UK

London’s economy is largely dominated by service industries, with financial and professional services playing a major role in the global economy. Approximately 85% of the employed population works in the service industries. Another half-million residents of Greater London work in manufacturing and construction.

Greater London has a GDP of over L500B, and according to the Brookings Institute, has the 5th largest metropolitan economy in the world. The greater London metro area generates approximately 22% of the total UK’s GDP.

Many of the world’s largest corporations are either located in greater London or have officers there. Over 100 of Europe’s 500 largest companies are headquartered in central London, and 75% of the Fortune 500 companies have offices in London. According to Deloitte, “London has the most internationally diverse executive community in the world, attracting business leaders from 95 nationalities and with alumni working in 135+ countries.”

When the UK pulled out of the EU, there were significant fears over what would happen to the L550B of trade with the countries in the EU, its largest trading partner. Although there was an initial decline in exports to the EU, but post-COVID trade volumes have recovered to pre-pandemic levels. However, new import restrictions and the related paperwork have slowed trade as many companies are still adjusting to the “new normal” and overall, trade with the EU has fallen relative to the size of the UK economy.

Munich, Germany

Located in Bavaria, Munich is the third largest city in Germany behind Berlin and Hamburg and the 11th largest city in the EU. It is well known as the European Center of arts, technology, finance, science, architecture, and tourism. In 2018, Munich was rated as the “world’s most livable city” by Monocle’s Quality of Life Survey.

Munich is also considered one of the most prosperous and fastest-growing cities in Germany and is home to more than 530,000 people of foreign backgrounds, making up about 40% of its population.

As the largest city in Bavaria, Munich is considered the “gateway to Europe’s healthcare market.”2 In fact, Germany’s largest life science campus is in greater Munich, where you will find some of the largest healthcare companies in the world, including Roche Diagnostics, Sandoz, Amgen, Novartis, GSK, and a host of other multinational biopharma companies. These companies have spawned an ecosystem of research institutions, biotech start-ups, and medical device companies.

Munich is also home to some of Europe’s finest technical universities and attracts world-renowned scientists. Among them are two elite universities, Ludwig-Maximilian University (LMU) and Technical University of Munich (TUM), with TUM having the distinction of being Europe’s #1 center for innovation and business creation.2

Munich boasts a wide variety of industries that are recognized around the world for innovation and quality. These include Automotive and Mobility, Big Data and IT, Aerospace, Insurance, Banking, Life Sciences, and Logistics.

Overall, Munich is a vibrant city located in the innovation-rich state of Bavaria, with a population of over 13MM proud and productive residents.

(2) Invest in Bavaria

Singapore

With a population of approximately 5.7 million and a GDP of US$560 billion, Singapore is ranked as 1st among 39 countries in the Asia-pacific region, and its overall score on the index of Economic Freedom is above the regional and world averages.

Although the Singapore economy contracted in 2020, its free-market economy has maintained its standing as one of the world’s most prosperous nations. This is due in large part to its open and corruption-free business environment, prudent monetary and fiscal policies, and transparent legal framework. Entrepreneurship and innovation are highly promoted via well-secured property rights and freedom to trade.

Singapore’s business-friendly legal and tax structure, reliable infrastructure, and very dependable regulatory processes provide a positive commercial environment.

Singapore is a global location for international companies to develop and produce biomedical products to meet the healthcare needs of greater Asia and the world. Singapore is also recognized for its best-in-class manufacturing plants where industry leaders like Pfizer. Sanofi, Amgen, and Novartis have global manufacturing hubs. In fact, 8 of the top 10 pharmaceutical companies have facilities in Singapore, producing four of the top ten drugs by global revenue.

As expected, there is a broad ecosystem of companies related to the biopharma industries, including API, biologics, medical devices, and all kinds of related companies providing support to the dynamic industry.

Other companies proliferate and energize Singapore’s industrial base. These include world-class companies in the field of Aerospace, Energy & Chemicals, Engineering, Electronics and IT, Medical technology, and of course Professional Services. Many of these companies thrive by exporting their products to Asia, Europe, and North America. In fact, the United States is Singapore’s 3rd largest trading partner behind China and Hong Kong/China, with exports to America averaging $US$40 billion per year.

Program Benefits

Marketing

- Less risk

- Faster penetration

- Higher revenues

- Higher profits

- Lower costs

- More satisfied customers

- Less loss

Operations

- Effective programs

- Clear strategy

- Better training

- More control

- Concise reporting

- Actionable data

- Dynamic tools

- Market leadership

Management

- More confidence

- Managed risk

- Market growth

- Faster returns

- Higher ROI

- Informed decisions

- Growing value

Testimonials

SIS International, Singapore/Hong Kong

“I have had the opportunity and pleasure of working with Mr. Worrell on various companies for the past 30 years. Early on, he was instrumental in helping grow SIS International into one of Asia’s largest IT distribution companies. Mr. Worrell is dedicated, personable, honest, creative, innovative, and smart. His approach to the marketplace and understanding of customer needs is second-to-none.” – Mr. KH LIM, Chairman

Swiss Pharma Contract

“Mr. Worrell was the guiding light and the primary reason for our success in the US market. I met Mr. Worrell at a trade show and immediately bonded with him as a person and a colleague. His dedication, creativity, and work ethic helped grow my company’s business in the US market, achieving millions of dollars in revenue. In addition, I was able to sell my company to one of the largest CROs in the industry due in part to Mr. Worrell’s services in the US market.” – Dr. Rolf Pokorny, CEO

Market Enhancement Group

“I have had the pleasure to work with Mr. Worrell on several challenging projects, all success stories. One of the things that strike me about Mr. Worrell is that most people have sight, but few have the vision, Mr. Worrell has the tactical and strategic vision to make sure his global clients maximize their success and avoid the pitfalls of the markets. Highly recommended. An excellent resource.” – Barry Quarles, President at Market Enhancement Group, Inc.

Homes by Polaris

“Regardless of how much Mr. Worrell may have on his plate he will always find the time to discuss and resolve the issues of others.

His concern for people, in general, is amplified when it comes to the best interest of his clients. His level of intensity coupled with his out of box thinking has made many of his clients extremely wealthy over the years. Although the marketplace, economy, and service offerings have changed he stays ahead of the curve by remaining true to his passion and work ethic.

It has been my pleasure to benefit from his diligence and participate in his success story.” – Joseph Gater, CEO and Founder, Homes by Polaris

Dr. Katharina Kettner, Change Management

“Mr. Worrell is an innovative, agile leader who processes immense knowledge about markets and industries through sharp business instincts. At the same time he is considerate and honest, sharing information and insights. Working with Mr. Worrell was a pleasure and a great learning curve.”

Payer, Provider & Government Solutions at IQVIA

“In 2008 GenericsWeb sought to engage a partner to assist with the growth of its business in North American markets. We chose Ameristart due to their track record in assisting similar companies to become established in the USA and their expertise in recruiting and incentivizing new staff for this purpose.

With only a small amount of existing business and a limited amount of brand awareness to build on, Ameristart was able to assist in successfully establishing the GenericsWeb business against all odds. Only three months after signing contracts, in the middle of the worst financial crisis of decades, Ameristart assisted GenericsWeb in landing its biggest single contract with a new customer for a new product in a new market segment. This was shortly followed by signing up the largest US company in our major market segment as a regular customer, as a direct result of Ameristart’s pharmaceutical industry presence and experience.

A seemingly endless injection of ideas and enthusiasm coupled with the ability to look at products and markets from a different perspective meant that Ameristart was always challenging the status quo and looking for ways for GenericsWeb to improve the way it offered its product range for the North American markets.

In this way, GenericsWeb has found itself not only growing its revenues in America but more than recouping establishment and ongoing costs in the region after little more than 12 months of operations.

I have personally learned a great deal from working with Ameristart and, based on our experience, I would not hesitate in recommending Ameristart to any company looking to grow their business in America.” – Leighton Howard, Senior Director

Solution Sales Specialist at IQVIA Solution

I worked with Mr. Worrell and Pharma Services Network/AmeriStart for well over a year. During this time, I found his expertise in the U.S. pharmaceutical industry to be exceptional.

“Mr. Worrell is very well-connected within the pharmaceutical industry and has been very gracious in making personal introductions for me within his network. Mr. Worrell personally referred me to one of his colleagues that ultimately helped me land one of my biggest clients to date. I can’t thank him enough! I worked with Mr. Worrell and Pharma Services Network/AmeriStart for well over a year. During this time, I found his expertise of the U.S. pharmaceutical industry to be exceptional. Mr. Worrell is very well connected within the pharmaceutical industry and has been very gracious in making personal introductions for me within his network. Mr. Worrell personally referred me to one of his colleagues that ultimately helped me land one of my biggest clients to date. I can’t thank him enough!”

More detailed achievements, references and testimonials are confidentially available to clients upon request.

Client Telephone Conference (CTC)

If you have any questions or if you would like to arrange a Client Telephone Conference (CTC) to discuss this particular Unique Consulting Service Proposition (UCSP) in more detail, please CLICK HERE.